Hd Hyundai Mipo Bundle

Can HD Hyundai Mipo Maintain Its Shipbuilding Dominance?

HD Hyundai Mipo, a titan in the Hd Hyundai Mipo SWOT Analysis, has carved a significant niche in the shipbuilding industry, particularly in mid-sized vessels. Founded in 1975, the company has grown from ship repair to become a global leader, boasting a substantial market share. This success story begs the question: what's next for this industry giant?

This analysis delves into the Growth Strategy and Future Prospects of Hd Hyundai Mipo, examining its strategic initiatives and technological advancements. We'll explore how the company plans to navigate the evolving Maritime Sector, focusing on its commitment to eco-friendly designs and digital transformation. Understanding Hd Hyundai Mipo's Business Development strategies is crucial for anyone seeking insights into the Shipbuilding Industry.

How Is Hd Hyundai Mipo Expanding Its Reach?

HD Hyundai Mipo is strategically expanding its operations to capitalize on the evolving demands of the shipbuilding industry. This expansion is primarily focused on increasing shipbuilding capacity and diversifying its product offerings. These initiatives are designed to strengthen its market position and meet the growing global demand for eco-friendly vessels.

A significant component of this growth strategy involves the expansion of its subsidiary, HD Hyundai Vietnam Shipbuilding (HD HVS). The company plans to enlarge its shipyard in Khanh Hoa Province, Vietnam. This expansion is expected to boost HD HVS's annual shipbuilding capacity, aligning with a robust three-year order backlog. The strategic focus on Vietnam underscores the importance of leveraging abundant manpower and resources to support its growth objectives.

Furthermore, HD Hyundai Mipo is investing heavily in the development and construction of next-generation, eco-friendly ships. This includes securing substantial orders for LNG bunkering vessels and LCO2 carriers, reflecting its commitment to leading the decarbonization trend in the shipbuilding industry.

HD Hyundai Vietnam Shipbuilding (HD HVS) is set to expand its shipyard in Khanh Hoa Province, Vietnam. Construction is potentially starting in 2025, with operations expected by 2026. This expansion aims to increase the annual shipbuilding capacity from 15 vessels to 20.

HD Hyundai Mipo secured a KRW 270.6 billion (approximately $197 million) contract in May 2025 for two LNG bunker vessels. Earlier in 2025, a KRW 538.3 billion ($372 million) order was secured for four LNG bunker vessels. These orders highlight the company's strategic focus on eco-friendly vessels.

HD Hyundai Mipo commenced construction on South Korea's first LCO2 carrier in August 2024. This is part of a four-vessel order from Capital Maritime Group. The vessels are designed for transporting LCO2, contributing to the CCUS value chain.

The company is developing ammonia dual-fuel carriers, with the first steel cut for a 46,000 cbm LPG carrier equipped with an ammonia dual-fuel engine in December 2024. This initiative is part of a four-ship order from EXMAR.

HD Hyundai Mipo’s expansion initiatives are focused on increasing shipbuilding capacity and diversifying its product offerings to meet the growing global demand for eco-friendly vessels. This strategy is supported by significant investments in new technologies and strategic partnerships.

- Expansion of HD HVS in Vietnam to increase shipbuilding capacity.

- Securing substantial orders for LNG bunkering vessels.

- Development and construction of LCO2 carriers to support the CCUS value chain.

- Building ammonia dual-fuel carriers to lead decarbonization efforts.

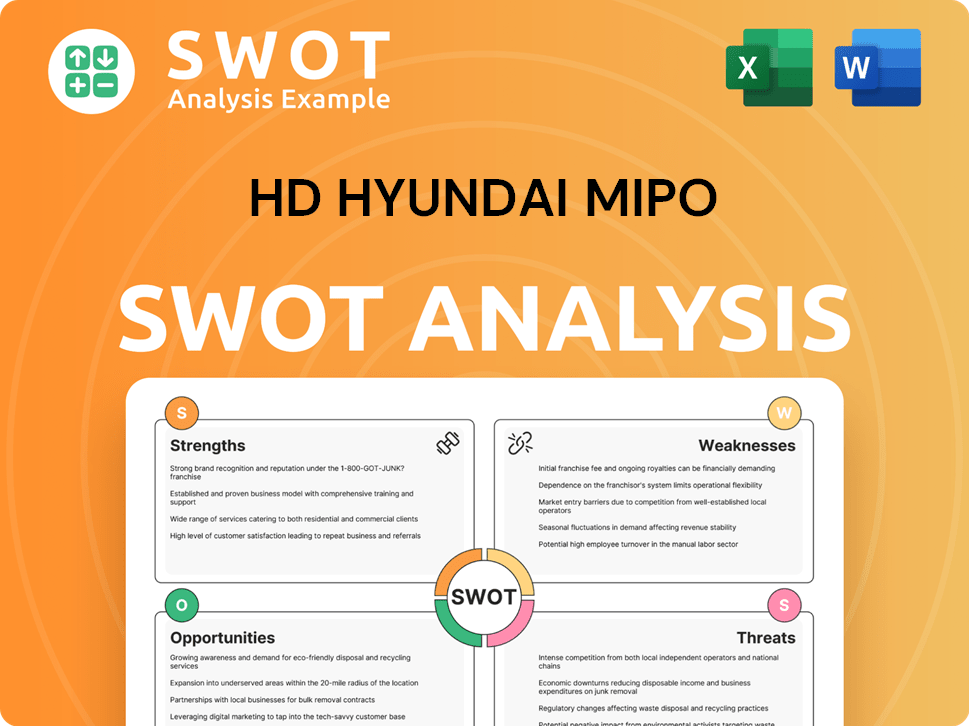

Hd Hyundai Mipo SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Hd Hyundai Mipo Invest in Innovation?

Hd Hyundai Mipo is strategically leveraging innovation and technology to secure its Growth Strategy and enhance its Future Prospects within the Shipbuilding Industry. The company's focus is on digital transformation, automation, and the development of eco-friendly vessel designs, positioning itself as a leader in the Maritime Sector. This approach supports Business Development by improving operational efficiency and meeting the evolving demands of the global market.

The integration of advanced technologies like artificial intelligence (AI), digital twins, and robotics into its smart shipyard operations is a key element of Hd Hyundai Mipo's strategy. These advancements are designed to streamline processes, improve safety, and enhance the quality of shipbuilding, contributing to the company's long-term sustainability and competitiveness. This commitment to technological advancement is crucial for navigating the complexities of the modern shipbuilding landscape.

Hd Hyundai Mipo is actively involved in collaborative projects to drive innovation. In May 2025, the company signed a joint development project (JDP) agreement with ABS to develop digital manufacturing-based automation equipment for shipyards. This project focuses on hyper-connectivity, advanced automation, and data-driven intelligence to enhance health, safety, and quality processes. A similar Memorandum of Understanding (MoU) was signed with Lloyd's Register in May 2025 to advance digital manufacturing for Type C tanks, essential for storing LNG and LCO2. This project, running from May 2025 to July 2026, aims to reduce production time and variability while increasing confidence in tank construction safety through digital twin technology and smart quality assurance systems.

Hd Hyundai Mipo's R&D investments are directed towards eco-friendly fuel solutions and advanced vessel capabilities. The company is leading the development of next-generation ships, including hybrid electric propulsion ships, liquefied carbon dioxide carriers, and liquefied hydrogen carriers.

Hd Hyundai Mipo is accelerating digital manufacturing innovation through the development of production-design integration platforms. This approach enhances efficiency and reduces the time-to-market for new ship designs.

The company has developed a concept design for a gas carrier that received Approval-in-Principle (AiP) from Det Norske Veritas (DNV) in 2024, and an 'Ammonia Leak Prevention System.' They have also received design approvals for a zero-carbon electric propulsion system based on ammonia fuel cells, an ammonia-fueled product tanker, and an ammonia-fueled feeder container ship.

The ammonia-powered feeder container ship incorporates AI technologies for autonomous navigation and video-based integrated safety control solutions, showcasing Hd Hyundai Mipo's commitment to advanced technologies.

Hd Hyundai Mipo's focus on cutting-edge technologies and sustainable initiatives demonstrates its commitment to innovation and leadership in the evolving maritime industry, ensuring its Future Prospects.

Strategic partnerships, such as the agreements with ABS and Lloyd's Register, are crucial for advancing digital manufacturing and ensuring the safety and efficiency of shipbuilding processes. These collaborations support Hd Hyundai Mipo's Growth Strategy.

Hd Hyundai Mipo is heavily investing in several key technological initiatives to maintain its competitive edge and ensure its Future Prospects. These initiatives include:

- Digital Transformation: Implementing AI, digital twins, and robotics to create smart shipyard operations.

- Eco-Friendly Vessels: Developing hybrid electric propulsion ships, liquefied carbon dioxide carriers, and liquefied hydrogen carriers.

- Advanced Manufacturing: Utilizing production-design integration platforms to enhance efficiency and reduce production times.

- Sustainable Fuels: Focusing on ammonia-fueled vessels and zero-carbon electric propulsion systems.

- Strategic Partnerships: Collaborating with industry leaders like ABS and Lloyd's Register to advance technology and ensure quality.

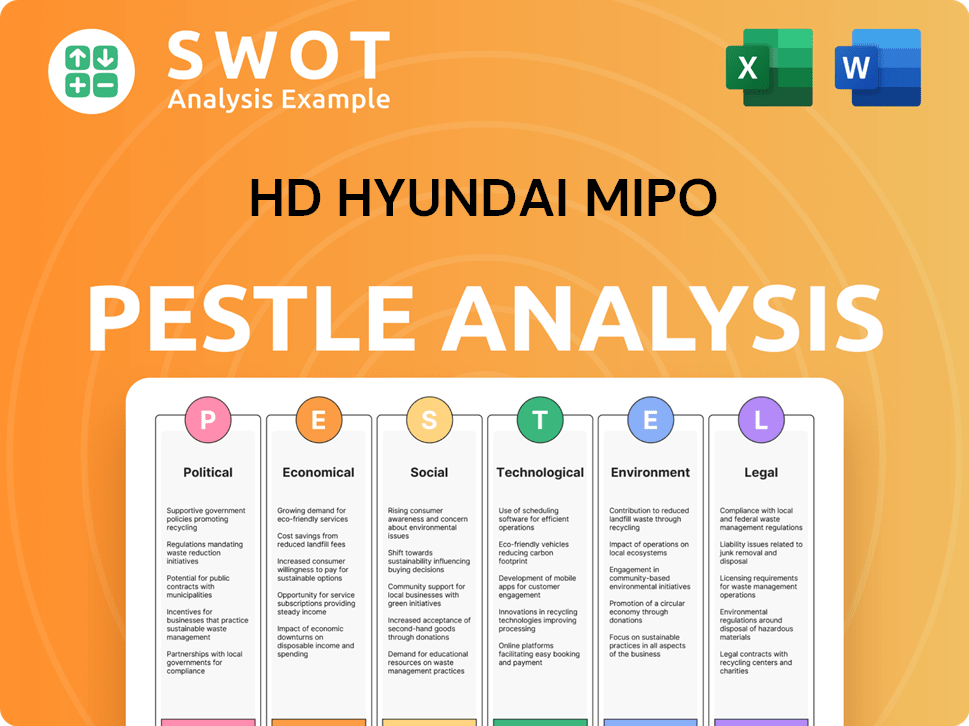

Hd Hyundai Mipo PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Hd Hyundai Mipo’s Growth Forecast?

The financial outlook for Hd Hyundai Mipo appears robust, with analysts projecting solid earnings growth. The company's performance in 4Q24 was strong, exceeding expectations due to increased working days, a favorable USD/KRW exchange rate, and improved production efficiency. These factors contributed to a notable increase in the operating profit margin.

Looking ahead, Hd Hyundai Mipo anticipates continued growth. The company's guidance for 2025 includes a standalone revenue target and a new order intake projection. The order guidance seems conservative, suggesting potential for further expansion. The company's trailing 12-month revenue as of March 31, 2025, was $3.45 billion, with a net income of $109.449 million.

The first quarter of 2025 showed positive results, with revenue up 18% from the previous year and a significant increase in net income. The profit margin also improved, driven by higher revenue. The operating profit margin for 1Q25 was particularly strong, exceeding both internal and market expectations. This positive trend is attributed to an expanded share of high-profit vessels.

In 4Q24, Hd Hyundai Mipo was expected to report revenue of W1.46 trillion, reflecting a 32.5% year-on-year increase. The operating profit reached W63.4 billion, surpassing consensus estimates. The operating profit margin improved to 4.3%.

For 2025, Hd Hyundai Mipo guided standalone revenue at W4.76 trillion. New order intake was projected at US$3.8 billion. Analysts anticipate consolidated revenue could reach W5.46 trillion, exceeding current estimates by 10.4%.

In 1Q25, Hd Hyundai Mipo reported revenue of W1.18 trillion, an 18% increase year-over-year. Net income for the quarter was W49.0 billion. The profit margin increased to 4.1% from 0.2% in 1Q24.

Analysts forecast Hd Hyundai Mipo's operating profit margin at 6.2% in 2025 and 9.7% in 2026. Further improvements are expected from 2026 due to higher-margin LNG bunkering vessel projects.

The shift towards higher-margin vessel types, such as LPG carriers, is expected to boost profitability. The share of LPG carriers is projected to rise significantly by the end of 2025, indicating a strategic move to enhance the vessel mix. The company's pretax income for the trailing twelve months ended in March 2025 was W202.716 billion, with a pretax margin of 5.05%. For more information about the company's history, you can read the Brief History of Hd Hyundai Mipo.

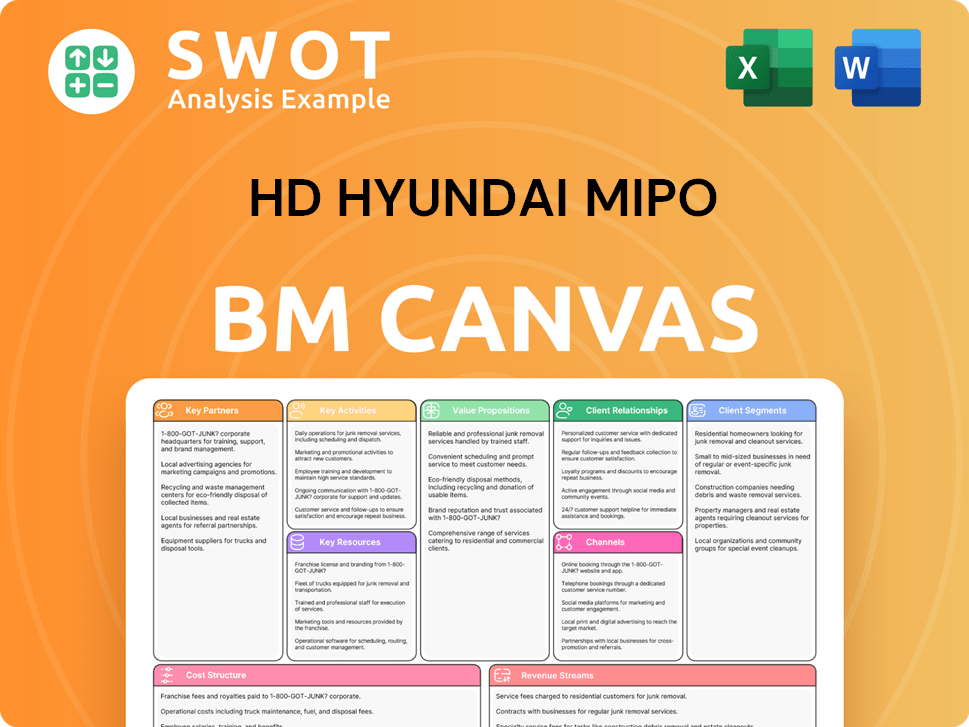

Hd Hyundai Mipo Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Hd Hyundai Mipo’s Growth?

The Hd Hyundai Mipo faces several risks that could impact its Growth Strategy and Future Prospects. The Shipbuilding Industry is highly competitive, with significant challenges from major players. Furthermore, the company must navigate evolving regulations and technological advancements to maintain its market position.

Market dynamics, regulatory changes, and technological disruptions pose potential obstacles. Internal resource constraints and the need for continuous order replenishment also present challenges. Addressing these risks is crucial for the company's long-term success and sustainable Business Development.

To understand the challenges, consider the market share of China in 2024, which was approximately 70% of the global shipbuilding market. This dominance underscores the need for Hd Hyundai Mipo to focus on high-value vessels and strategic order intake. The company's ability to innovate and adapt will be key to overcoming these hurdles.

Competition from Chinese shipbuilders is a major risk. Hd Hyundai Mipo needs to differentiate itself through technology and specialization. The strategy must focus on high-value, eco-friendly vessels.

Evolving environmental regulations and decarbonization efforts present both challenges and opportunities. Transitioning to alternative fuels requires significant investment and infrastructure adjustments. Compliance is essential.

Rapid advancements in AI, robotics, and digital technologies pose risks. Hd Hyundai Mipo must invest in new technologies and a skilled workforce. Successful implementation is vital.

Supply chain issues can impact production timelines and costs. The company must ensure a resilient supply chain. This requires careful management and planning.

Securing land for expansion and other resources can be a hurdle. Strategic planning is necessary for growth initiatives. Efficient resource allocation is key.

Maintaining a strong order book is essential for stable revenue. Hd Hyundai Mipo needs to continuously secure new orders. This ensures financial stability.

Hd Hyundai Mipo addresses these risks through strategic diversification. The company focuses on high-value vessels and continuous technological innovation. They also aim to enhance production efficiency and reduce costs. This helps them stay competitive in the Maritime Sector.

Collaboration with classification societies supports risk management. Partnerships with organizations like ABS and Lloyd's Register enhance quality. These partnerships are crucial for maintaining standards.

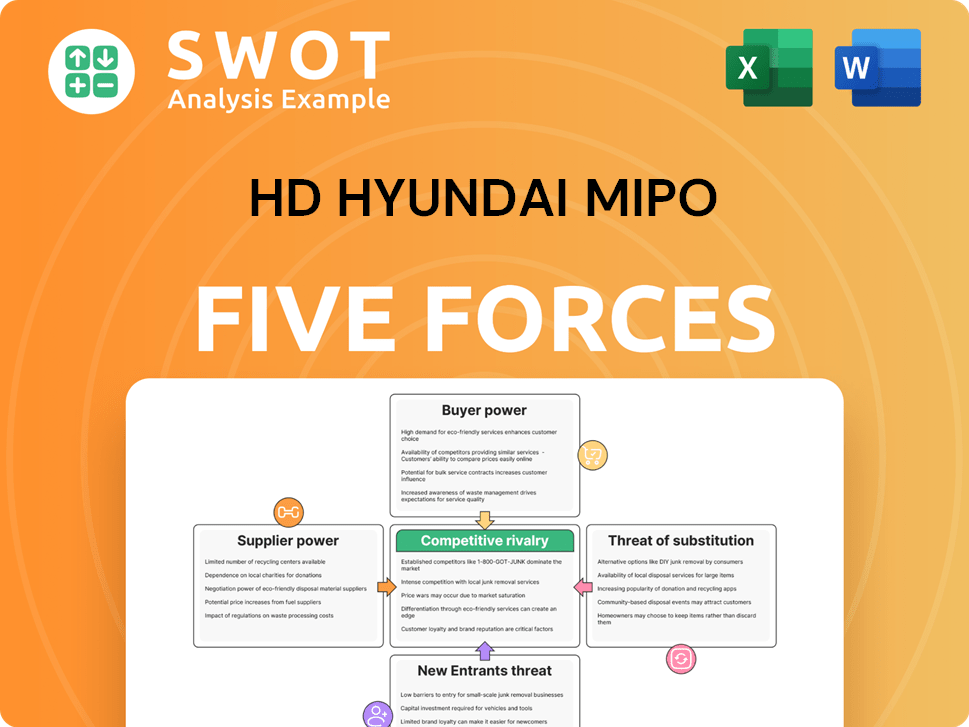

Hd Hyundai Mipo Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hd Hyundai Mipo Company?

- What is Competitive Landscape of Hd Hyundai Mipo Company?

- How Does Hd Hyundai Mipo Company Work?

- What is Sales and Marketing Strategy of Hd Hyundai Mipo Company?

- What is Brief History of Hd Hyundai Mipo Company?

- Who Owns Hd Hyundai Mipo Company?

- What is Customer Demographics and Target Market of Hd Hyundai Mipo Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.