Horizon Robotics Bundle

Can Horizon Robotics Continue Its Ascent in the Autonomous Driving Revolution?

Horizon Robotics, a frontrunner in AI chip technology, is rapidly transforming the automotive landscape. With a commanding presence in the Chinese ADAS market and a successful IPO under its belt, the company is strategically positioned for expansive growth. This analysis delves into Horizon Robotics' Horizon Robotics SWOT Analysis, examining its innovative growth strategy and future prospects in the burgeoning field of self-driving cars.

Horizon Robotics' remarkable journey, marked by strategic partnerships and technological advancements in ADAS technology, sets the stage for a deeper exploration. This report will dissect the company's market share analysis, financial performance, and competitive landscape, providing insights into how Horizon Robotics is revolutionizing autonomous driving. We'll also explore the impact of Horizon Robotics on the automotive industry, considering its growth strategy for 2024 and beyond, including the latest news and updates on investment opportunities.

How Is Horizon Robotics Expanding Its Reach?

Horizon Robotics is aggressively pursuing expansion initiatives to strengthen its position in the autonomous driving market. The company aims to capitalize on the increasing demand for intelligent driving solutions by entering new markets and introducing innovative products. This strategic approach is designed to broaden the accessibility of advanced driver-assistance systems (ADAS) and autonomous driving (AD) technologies.

A key component of Horizon Robotics' growth strategy involves democratizing intelligent driving. This includes integrating AD technology into entry-level vehicle models, starting in early 2025. This initiative is supported by their latest AD solution for highway NOA, powered by the Journey 6E and Journey 6M processing hardware. This solution has been selected by several original equipment manufacturers (OEMs) for mass-market adoption.

Product launches and pipeline development are central to Horizon Robotics' expansion. The company unveiled its next-generation full-scenario AD solution, Horizon SuperDrive (HSD), in April 2024. HSD is designed for urban, highway, and parking scenarios. Mass production of HSD is expected to commence in the third quarter of 2025, with multiple leading OEM brands already planning to integrate it into their strategic models. The Journey 6 series processing hardware, introduced in 2024, began production in February 2025 and has been widely adopted by over 20 OEM brands. Horizon Robotics anticipates cumulative shipments of its Journey series processing hardware to surpass 10 million units in 2025, a significant milestone for the company.

Horizon Robotics is focused on expanding into new markets and product categories. They are working on making advanced AD capabilities accessible to a broader market, including integrating AD technology into entry-level vehicle models, starting in early 2025. This strategy is supported by their latest AD solution for highway NOA, powered by the Journey 6E and Journey 6M processing hardware.

The company's product pipeline is robust. In April 2024, Horizon Robotics unveiled Horizon SuperDrive (HSD), designed for various driving scenarios. Mass production of HSD is expected to begin in Q3 2025. The Journey 6 series processing hardware, launched in 2024, began production in February 2025 and is adopted by over 20 OEM brands.

Horizon Robotics has formed strategic alliances with key players in the automotive industry. Collaborations with Bosch, DENSO, and Volkswagen Group are aimed at accelerating innovation and expanding global reach. These partnerships are crucial for reducing R&D costs and opening doors for international growth.

Horizon Robotics continues to advance its technology. The Journey 6 series hardware is a key component of their strategy. The company expects cumulative shipments of its Journey series processing hardware to exceed 10 million units in 2025. The company is at the forefront of the AI in Automotive sector.

Partnerships are a critical element of Horizon Robotics' expansion strategy, facilitating technological advancements and market penetration. These collaborations are designed to enhance product offerings and broaden market reach. These partnerships are critical for the company's Growth Strategy.

- Bosch: In April 2025, the intensified collaboration with Bosch focuses on providing assisted driving solutions for multiple automakers. Bosch is developing new multi-purpose cameras based on Horizon Robotics' Journey 6B and its ADAS product family for the mid-segment using Journey 6E/M. The first mass-produced model from this collaboration is scheduled for launch in June 2025, with an overseas project planned for mass production in Q1 2026.

- DENSO: Announced in April 2025, the partnership with DENSO aims to co-develop competitive assisted driving solutions by integrating DENSO's sensor technologies with Horizon's Journey series processing hardware.

- Volkswagen Group: Expanded collaboration with Volkswagen Group in April 2025, integrating Horizon's HSD platform through CARIZON, their joint venture, for deployment across upcoming Volkswagen models in the Chinese market. This collaboration is a key element in the Self-Driving Cars market.

- These partnerships are essential for Horizon Robotics to maintain its competitive edge. For more insights, read Brief History of Horizon Robotics.

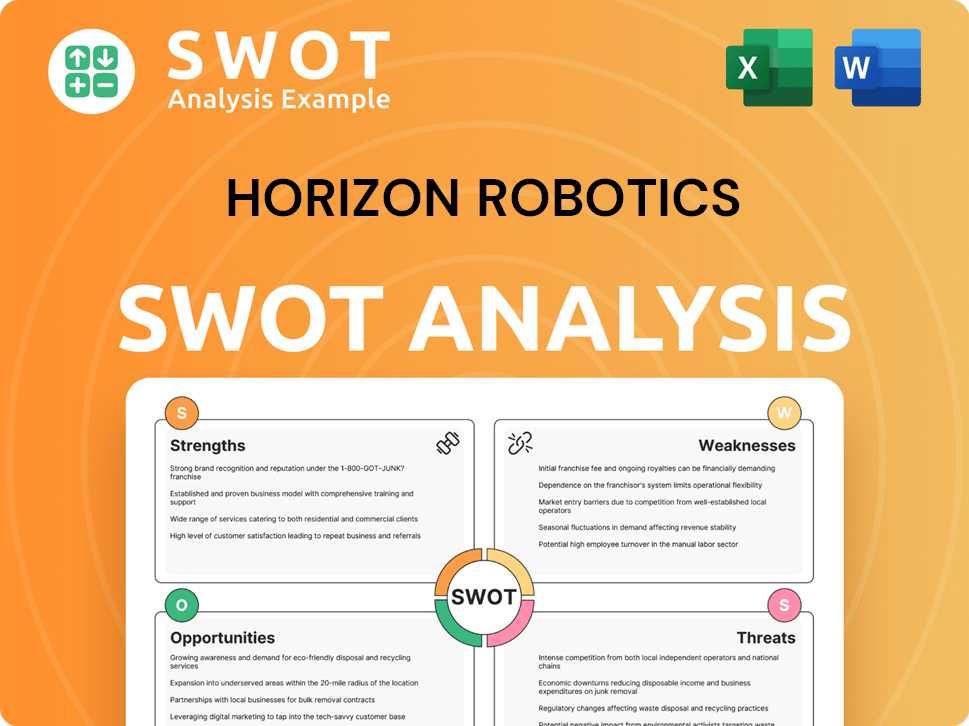

Horizon Robotics SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Horizon Robotics Invest in Innovation?

The growth strategy of Horizon Robotics is deeply rooted in its innovation and technological prowess, particularly in the field of AI for automotive applications. The company's focus on high-performance, low-power AI processors and open toolchains for edge AI computing is a key driver. This strategic direction is supported by significant investments in research and development, ensuring a competitive edge in the rapidly evolving autonomous driving market.

Horizon Robotics leverages a comprehensive approach, combining internal development with strategic collaborations. This strategy enables the company to stay at the forefront of technological advancements, delivering cutting-edge solutions for the automotive industry. Their commitment to innovation is evident in their product offerings and the continuous upgrades of their technology, positioning them as a key player in the future of mobility.

By focusing on both hardware and software, Horizon Robotics offers integrated solutions that accelerate innovation cycles for OEMs and Tier-1 suppliers. This approach not only reduces R&D costs for partners but also fosters a robust ecosystem. Their ability to provide full-stack solutions is a significant differentiator in the competitive landscape of AI in automotive.

Horizon Robotics significantly invests in research and development. In 2024, R&D investments increased by 33.4% year-on-year, reaching RMB3,156.1 million.

The Journey series of automotive-grade AI chips are central to Horizon Robotics' technological advancements. The Journey 6 series, launched in April 2024, includes six versions tailored for various intelligent driving scenarios.

The Journey 6P chip offers a computing power of 560 TOPS, designed for all-scenario intelligent driving. This high performance enables advanced autonomous driving capabilities.

Journey 6E/M chips provide 80 TOPS and 128 TOPS respectively, targeting high-speed and urban NOA applications. These chips cater to different levels of autonomous driving needs.

Production of the Journey 6 series hardware commenced in February 2025. This marks a significant milestone in bringing the new technology to market.

The Horizon SuperDrive (HSD) full-scenario AD solution was unveiled in April 2024. It is designed for smooth autonomous driving across various environments.

Horizon Robotics is at the forefront of technological advancements, particularly in autonomous driving. Their innovations include the Horizon SuperDrive (HSD) full-scenario AD solution and the Journey series AI chips. These advancements are crucial for the company's growth strategy.

- HSD Features: Transformer-based end-to-end perception and data-driven interactive predictive decision-making.

- HSD Recognition: Won the 2024 IF Design Award for its human-machine interface.

- HSD Mass Production: Scheduled to begin in the third quarter of 2025.

- Design Wins: Secured over 310 vehicle model design-wins by the end of 2024.

- Models in Production: Over 200 models are already in production.

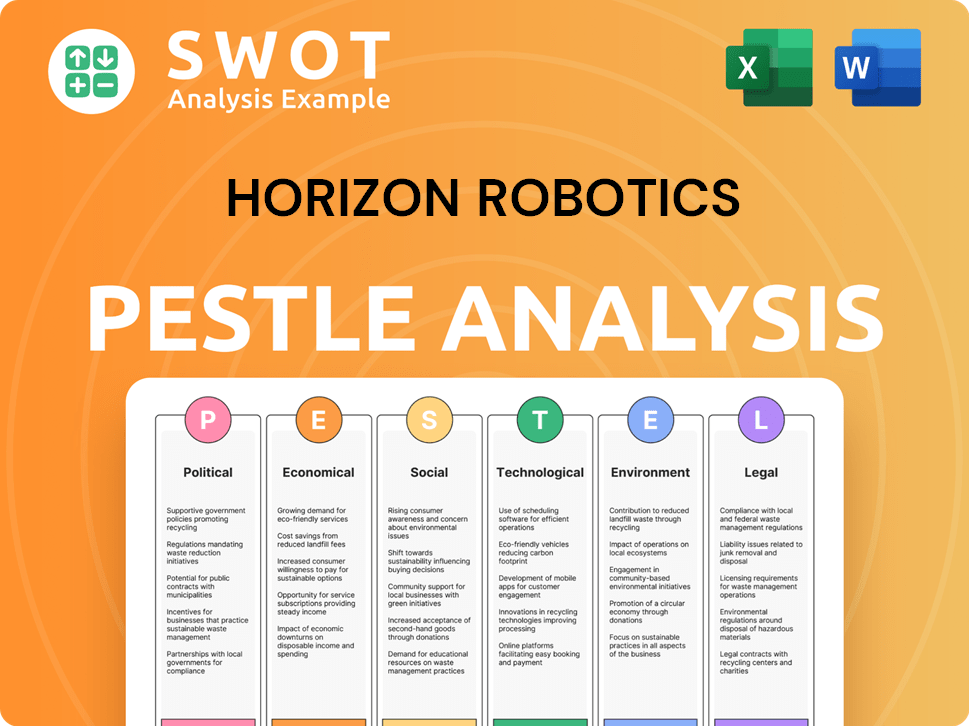

Horizon Robotics PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Horizon Robotics’s Growth Forecast?

In 2024, Horizon Robotics demonstrated robust financial performance, which is a cornerstone of its future Growth Strategy. The company's revenue reached RMB2,383.6 million, marking a substantial 53.6% year-on-year increase. This growth was primarily fueled by its automotive solutions business, which saw a 57.2% rise, indicating strong market demand for its AI in Automotive technologies.

The company's financial health is further supported by its improving gross margins. The gross profit grew by 68.3% year-on-year, reaching RMB1,841.4 million in 2024. The gross margin improved to 77.3%, up nearly 7 percentage points from 2023. This financial performance positions Horizon Robotics well for further expansion, especially in the rapidly evolving Self-Driving Cars market.

The Growth Strategy of Horizon Robotics is heavily influenced by its core automotive solutions. Revenue from product solutions increased by 31.2% to RMB664.2 million. Licensing and services revenue surged by 70.9% year-on-year to RMB1,647.5 million, reflecting the increasing adoption of its ADAS Technology.

Horizon Robotics continues to invest heavily in research and development. R&D expenses increased by 33.4% year-on-year to RMB3,156.1 million in 2024. This investment is crucial for maintaining its competitive edge in the Autonomous Driving sector and driving future innovation.

Analysts predict that revenues will reach CN¥3.61 billion in 2025, a 52% improvement compared to 2024. The company anticipates cumulative Journey series shipments to exceed 10 million units in 2025. This growth is supported by the company’s recent IPO, which raised HK$5.4 billion ($696 million).

Despite significant R&D investments, Horizon Robotics is improving its operational efficiency. The adjusted operating loss for 2024 narrowed to RMB1,495.2 million, a positive change from the RMB1,687.0 million loss in the previous year. This improvement is crucial for long-term sustainability.

Horizon Robotics' financial performance in 2024 and its projected growth for 2025 highlight its strong position in the market. The company's ability to increase revenue, improve gross margins, and manage losses while investing in R&D demonstrates a strategic approach to growth. For a deeper understanding of the competitive environment, consider exploring the Competitors Landscape of Horizon Robotics.

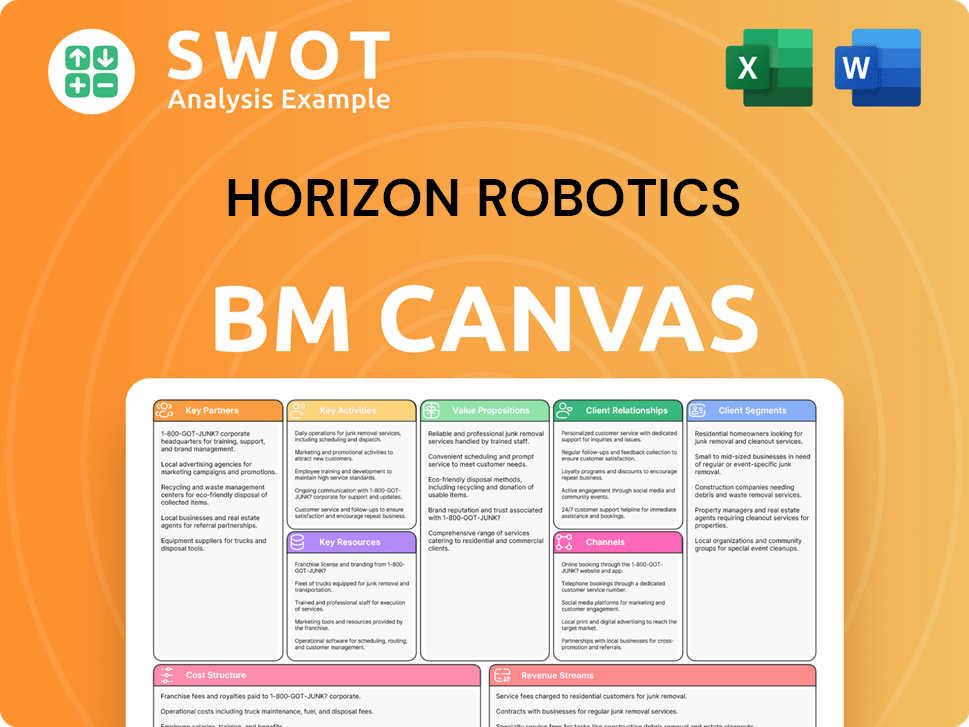

Horizon Robotics Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Horizon Robotics’s Growth?

The path for Horizon Robotics, a key player in the autonomous driving sector, is not without its challenges. Several potential risks and obstacles could impact its growth strategy and market position. Understanding these challenges is crucial for investors and stakeholders assessing the company's future prospects.

One major hurdle is the intense competition within the AI chip and autonomous driving solutions market. Horizon Robotics faces established giants and emerging startups, all vying for market share. Furthermore, rapid technological advancements and evolving regulatory landscapes add complexity to the company's strategic planning.

External factors, such as regulatory changes and geopolitical issues, also pose significant risks. These risks include potential disruptions to supply chains and the possibility of increased scrutiny, especially as Horizon Robotics expands its global footprint. These factors can significantly affect the company's ability to execute its growth strategy.

The AI chip and autonomous driving solutions market is highly competitive. Horizon Robotics competes with major players like Intel, NVIDIA, and Qualcomm. Continuous innovation is critical to stay ahead of rivals and potential in-house development by OEMs.

Regulatory changes and geopolitical issues pose significant risks. Escalating sanctions, export controls, and data privacy regulations could hinder global expansion. Geopolitical scrutiny, similar to challenges faced by other Chinese tech companies, is also a concern.

Reliance on third-party partners for chip fabrication and components creates supply chain vulnerabilities. Potential disruptions could affect production and delivery timelines. Slower-than-expected production ramp-up of new products could also impede growth.

The fast-evolving AI and autonomous driving sector carries inherent technological risks. Failure to achieve breakthroughs or adapt to rapid advancements could erode Horizon Robotics' competitive edge. The adoption rate of AD technology may also be slower than anticipated.

Acquiring and retaining top AI and robotics talent is challenging. A competitive talent market can hinder Horizon Robotics' ability to staff key roles. This could impact the company's ability to innovate and execute its growth strategy.

The pace at which self-driving cars and ADAS technology are adopted by consumers and automakers is crucial. Slower-than-expected adoption rates could impact revenue growth. This is a key factor in the Revenue Streams & Business Model of Horizon Robotics.

Horizon Robotics employs several strategies to mitigate these risks. Diversifying partnerships, such as collaborations with Bosch, DENSO, and Volkswagen, reduces reliance on a single partner. Continuous investment in R&D, which saw a 33.4% increase in 2024, aims to maintain technological leadership. A customer-centric business model, including scalable IP licensing, helps OEMs and Tier-ones accelerate innovation cycles and reduce R&D costs.

Horizon Robotics' approach to democratizing intelligent driving by making AD technology accessible to entry-level vehicles broadens its market reach. This strategy potentially mitigates risks associated with niche market fluctuations. This broader market approach is critical for long-term growth.

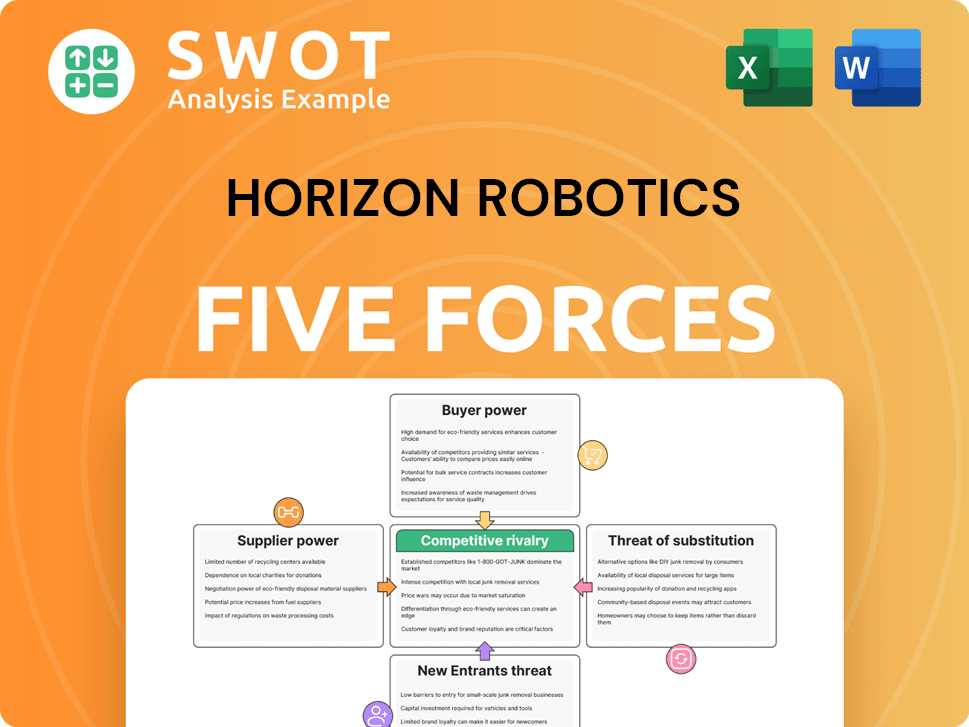

Horizon Robotics Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Horizon Robotics Company?

- What is Competitive Landscape of Horizon Robotics Company?

- How Does Horizon Robotics Company Work?

- What is Sales and Marketing Strategy of Horizon Robotics Company?

- What is Brief History of Horizon Robotics Company?

- Who Owns Horizon Robotics Company?

- What is Customer Demographics and Target Market of Horizon Robotics Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.