Karex Bundle

Can Karex Continue Its Dominance in the Global Condom Market?

Karex Berhad, the world's leading condom manufacturer, has built a formidable presence, but what's next for this industry giant? Founded in 1988, Karex has captured approximately 20% of the global market share, serving over 130 countries. This Karex SWOT Analysis will explore the dynamic landscape of the sexual wellness industry and the company's strategic moves.

This in-depth exploration of Karex's Karex growth strategy and Karex future prospects delves into its journey from a family business to a global leader. We will examine Karex company analysis, including its expansion strategies, financial performance, and response to evolving consumer preferences, providing actionable insights for investors and industry observers alike. The analysis will also cover the company's competitive advantages in the condom industry and its potential for growth in the US market.

How Is Karex Expanding Its Reach?

The Karex growth strategy centers on significant expansion initiatives designed to strengthen its market position and diversify revenue streams within the condom market and broader sexual wellness industry. These initiatives are crucial for achieving sustainable growth and capitalizing on emerging opportunities. A thorough Karex company analysis reveals a strategic focus on both product innovation and geographical expansion to meet evolving consumer demands.

One of the key drivers of Karex's future prospects is its strategic focus on synthetic condoms, which offer higher profit margins compared to traditional products. The company is actively scaling up production capacity to meet growing demand, especially in key markets. This expansion is supported by strategic partnerships and product diversification, positioning Karex for sustained growth in a competitive market.

The company's strategic initiatives are geared towards enhancing its market share and profitability. These initiatives include expanding production capacity, forming strategic partnerships, and broadening its product offerings. The company's commitment to innovation and market expansion is expected to drive its financial performance and solidify its position as a market leader.

Karex is significantly increasing its synthetic condom production capacity at its Hat Yai plant in Thailand. The company plans to expand to 16 production lines by the end of 2025. This expansion will boost annual capacity to 400 million pieces, representing approximately 6.7% of its total production.

The company has established a two-year exclusive partnership with a prominent OEM client, a global market leader, to promote and distribute its synthetic condoms. Initial shipments have been sent to key European markets, including France, Belgium, Germany, the Netherlands, and Luxembourg. Shipments to the United States are anticipated around April 2025.

By the end of 2025, Karex will have clearance to sell its patented synthetic product under its own brand name. This will create additional revenue streams within the premium segment, with an expected competitive price point of around RM60 for 10 pieces. This strategic move is designed to enhance brand recognition and market penetration.

Karex is actively expanding its offerings in the personal lubricant segment, which has demonstrated significant growth. The lubricant segment accounted for 17% of total sales in 1QFY25, up from 15% in FY24, driven by increased private label orders and growing awareness of lubricant usage. The company is also benefiting from the US FDA's reclassification of personal lubricants as medical devices.

Karex plans to expand its product offerings to include synthetic, silicone, and hybrid lubricants. This expansion aims to capitalize on the growing market, which is projected to reach USD2.2 billion by 2028, with a CAGR of 8.7%. The company seeks to leverage its strong market presence to boost its lubricant segment, potentially matching the revenue of its condom business in the future. For more insights into the company's structure, consider reading about Owners & Shareholders of Karex.

- Focus on synthetic condom production to capitalize on high gross profit margins.

- Exclusive partnerships to expand market reach and distribution.

- Product diversification within the personal lubricant segment to capture market growth.

- Leveraging market presence to boost lubricant segment revenue.

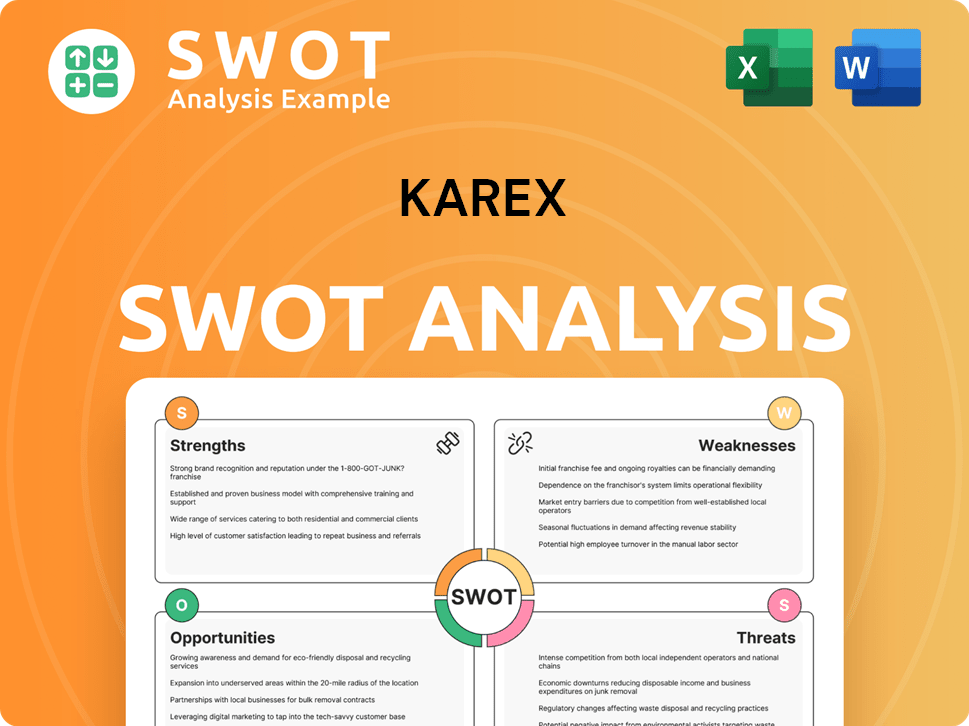

Karex SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Karex Invest in Innovation?

The Karex growth strategy heavily relies on innovation and technological advancements, particularly in developing new, high-margin products. This approach allows the company to maintain a competitive edge in the dynamic condom market. By focusing on cutting-edge technologies and sustainable practices, Karex aims to secure its future prospects and drive sustained growth.

Investing in research and development (R&D) is a cornerstone of Karex's company analysis. This commitment is evident in the creation of new products, such as the innovative synthetic condom. This strategic focus on innovation is designed to meet evolving consumer needs and preferences, positioning Karex for long-term success in the sexual wellness industry.

The company’s focus on innovation and technology is crucial for its Karex future prospects and overall Karex growth strategy. These initiatives are expected to significantly impact the company's Karex financial performance and market position.

The development of a new synthetic condom is a key innovation. This product, made from a synthetic rubber material, offers several advantages over traditional products. It is soft, stretchy, thinner, allergen-free, more durable, and resistant to chemicals.

The new synthetic condom has secured regulatory approvals from the US Food and Drug Administration (FDA) and CE. Karex has also filed patents for its manufacturing process in the US, China, Europe, France, Korea, and Canada, protecting its intellectual property.

The synthetic condom is expected to disrupt the global condom market. This innovation is poised to be a significant driver of future earnings growth for Karex, enhancing its Karex financial performance.

Automation plays a crucial role in enhancing operational efficiencies. Automated electronic testing machines in the plants in Thailand and Klang can test over 200 pieces per minute, significantly improving over the manual testing rate of 40 pieces per minute.

Automation helps Karex handle standardized client orders more efficiently. This leads to improved production speed and reduced operational costs, contributing to the company's overall Karex growth strategy.

Karex is investing in sustainability through initiatives like a planned 2.5-megawatt solar installation at its Thai plant. This installation will cover 45% of the plant's energy needs and is expected to reduce energy bills by 30% to 50% over the long term.

These advancements contribute to Karex's growth objectives by improving product quality, increasing production efficiency, and reducing operational costs. The integration of technology and sustainability is central to Karex's strategic approach.

- Focus on new product development, such as the synthetic condom, to meet evolving consumer needs.

- Implementation of automation to enhance production efficiency and reduce costs.

- Investment in sustainability initiatives to reduce environmental impact and operational expenses.

- Strategic patent filings to protect intellectual property and maintain a competitive edge.

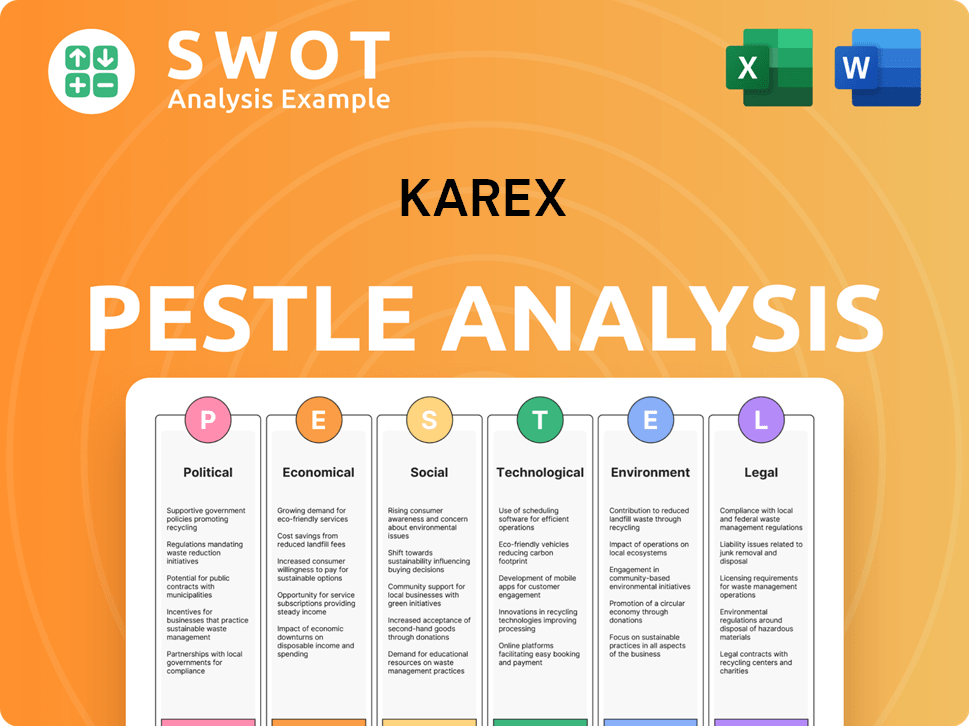

Karex PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Karex’s Growth Forecast?

The financial outlook for Karex Berhad indicates substantial growth, mainly driven by its strategic focus on high-margin products and geographical expansion. AmInvestment Bank Bhd projects a compounded annual growth rate (CAGR) of 42.4% for Karex's core net profit from 2024 to 2027. This positive trajectory is expected to be supported by increasing revenue from both its original equipment manufacturing (OEM) and original brand manufacturing (OBM) segments.

Despite a weaker-than-expected performance in the first half of fiscal year 2025, analysts remain optimistic about the company's medium-term prospects. Kenanga Investment Bank Berhad adjusted its FY25-26F net profit forecasts downward, but maintained an 'OUTPERFORM' call with a target price of RM1.07 as of February 28, 2025. This reflects Karex's strong market position and growth potential.

Karex's revenue is forecasted to grow by 1.1% year-on-year to RM513.5 million in FY25F and 9.5% year-on-year to RM562.2 million in FY26F. Strategic initiatives, rising global population, and the venture into the new synthetic condom market are key drivers. The company's healthy balance sheet, with a net gearing ratio of 0.16 times as of FY24, provides headroom for future expansion.

For the third quarter ended March 31, 2025, sales increased to MYR 135.72 million, up from MYR 127.05 million a year ago. Net income for the same period was MYR 5.09 million, down from MYR 6.02 million. This was primarily due to increased costs. The Mission, Vision & Core Values of Karex company continue to drive its financial strategies.

For the nine months ended March 31, 2025, sales were MYR 377.63 million compared to MYR 383.93 million a year ago, with net income at MYR 9.67 million, down from MYR 18.6 million in the prior year. Despite short-term fluctuations, the long-term financial narrative is positive. The company is focusing on high-margin products.

Karex's growth strategy centers on high-margin products. This includes the new synthetic condom. Focus is also on expansion in key markets. The company is leveraging its strong industry reputation.

Future prospects are positive, with earnings expected to grow significantly. This growth is driven by the shift towards higher-margin products. Market recovery is also a key factor.

The company's financial performance shows resilience despite short-term challenges. Revenue is expected to increase in FY25F and FY26F. The balance sheet is healthy, supporting future growth.

Karex is expanding its presence in the US and Asian markets. Premium brands like ONE are driving OBM growth. The company aims to secure high-value orders.

Product innovation is a key driver for OEM growth. The new synthetic condom is a key product. Karex is focused on a diverse product range.

Karex has a dominant market position. The company has strong growth prospects. It leverages regulatory expertise and industry reputation.

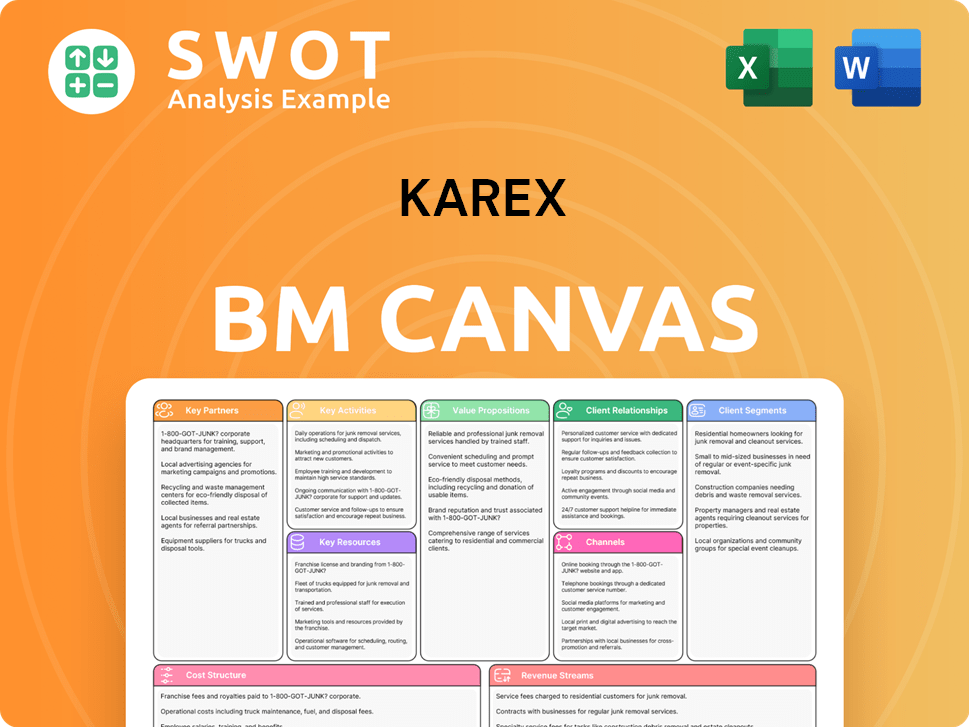

Karex Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Karex’s Growth?

The Karex company analysis reveals that while the company has ambitious growth plans, it faces several potential risks and obstacles. These challenges could impact the company's financial performance and its ability to achieve its strategic goals in the condom market and the broader sexual wellness industry. Understanding these risks is crucial for evaluating Karex's future prospects.

One of the primary concerns is the potential for reduced government spending on birth control programs, which could negatively affect sales in the tender market. Additionally, the acceptance rate of its new synthetic rubber condoms is a crucial factor, as lower-than-expected adoption could hinder projected growth. Supply chain disruptions and currency fluctuations also pose significant threats to Karex's operations and profitability.

Karex's growth strategy and financial performance are also vulnerable to market dynamics. The company's ability to maintain profit margins in a competitive environment is crucial, and any failure to raise prices could impact its financial results. The success of Karex's expansion plans and strategies depends on effectively mitigating these risks and capitalizing on opportunities within the global condom market.

Reduced government spending on birth control could significantly impact sales in the tender market. This segment has historically been a key contributor to Karex's turnover. Further declines are expected due to reduced funding for humanitarian aid agencies like USAID.

Lower-than-expected consumer adoption of new synthetic rubber condoms could hinder projected growth. These products offer higher margins, but their success depends on market acceptance. This is a critical factor in Karex's future prospects.

A less favorable product mix and the inability to raise prices could affect profit margins. Karex operates in a competitive market, making it challenging to maintain pricing power. This impacts Karex's financial performance.

Supply chain vulnerabilities and foreign exchange volatility pose threats to Karex. Foreign exchange volatility pressured margins in 1QFY25, weakening the gross profit margin to 30.6% compared to 33% a year prior. Increased logistics costs also affected profitability.

Karex's minimal involvement in rubber glove production has been affected by broader market issues. Despite a glove manufacturing facility with a capacity of 2.5 billion pieces, the company has faced setbacks. The company does not anticipate further impairment provisions related to its glove business.

Climate change poses physical risks, such as flooding at manufacturing facilities. Karex is committed to improving data collection and reporting for enhanced climate change disclosures. This impacts Karex's strategies for sustainable growth.

Karex is focusing on high-margin segments like commercial and Original Brand Manufacturing (OBM). This diversification aims to mitigate the impact of market volatility and changing consumer preferences. This strategy is central to Karex's expansion plans and strategies.

Karex leverages its strong industry reputation and regulatory expertise to secure high-value orders. This provides a competitive advantage in the condom market. This approach supports Karex's competitive advantages in the condom industry.

Karex's in-house engineering and research and development teams offer a competitive advantage. They are expected to help the company navigate technological disruptions and market changes. This supports Karex's product innovation and development.

Karex actively monitors and addresses broader risks, including climate change. This includes improving data collection and reporting for enhanced climate change disclosures. This demonstrates Karex's strategies for sustainable growth.

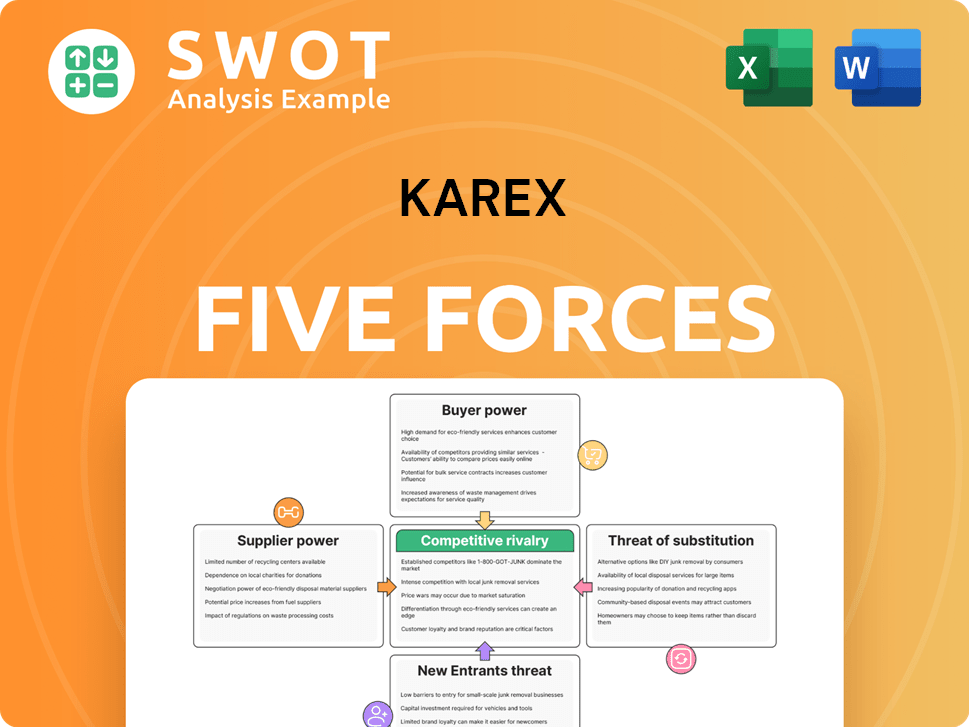

Karex Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Karex Company?

- What is Competitive Landscape of Karex Company?

- How Does Karex Company Work?

- What is Sales and Marketing Strategy of Karex Company?

- What is Brief History of Karex Company?

- Who Owns Karex Company?

- What is Customer Demographics and Target Market of Karex Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.