Kemira Bundle

Can Kemira Navigate the Future of the Chemical Industry?

Kemira, a century-old leader in the chemical industry, is strategically positioning itself for sustained growth. From its Finnish roots, the company has evolved into a global force, providing crucial products and expertise for water-intensive sectors. This Kemira SWOT Analysis delves into the company's strategic initiatives and market position.

This in-depth Kemira company analysis explores its recent strategic shifts, including the divestment of its Oil & Gas portfolio and acquisitions in sustainable solutions, highlighting its commitment to the water business. Examining Kemira's financial performance, including its 2024 revenue and market share, reveals its strong position in the pulp & paper industry and water treatment. Furthermore, we'll dissect Kemira's future prospects, focusing on its expansion plans, innovation in water treatment, and long-term growth potential within the evolving competitive landscape.

How Is Kemira Expanding Its Reach?

The expansion initiatives undertaken by Kemira are primarily focused on significant growth within its water business. This strategic direction is driven by the increasing global demand for water solutions and the tightening of environmental regulations. Kemira is actively pursuing both organic growth and strategic acquisitions to achieve its ambitious goals, reflecting a proactive approach to capitalize on market opportunities.

Kemira's commitment to sustainability is further demonstrated through its investment in renewable solutions. The company aims to generate over EUR 500 million in revenue from renewable chemistries by the end of 2030. This initiative supports the sustainability transformation in existing markets and leverages capabilities in circularity-driven markets. Kemira's strategic moves highlight its dedication to long-term growth and its responsiveness to evolving market demands.

Kemira's strategic initiatives are designed to ensure sustained growth and market leadership. The company's focus on water treatment, renewable solutions, and pulp and paper chemicals reflects a diversified approach to meet the needs of various industries. These initiatives are supported by a new operating model implemented in January 2025, which enhances customer-centricity and accelerates growth. For further insight into the financial aspects, consider reading about Revenue Streams & Business Model of Kemira.

Kemira aims to double its revenue in the water segment, responding to the growing global demand for water solutions. The company is expanding through acquisitions and organic growth. A key acquisition was Norit's UK reactivation operations in June 2024, entering the activated carbon market.

Kemira is building a leading portfolio of renewable solutions. The goal is to generate over EUR 500 million in revenue from renewable chemistries by the end of 2030. A joint venture with IFF, announced in March 2025, involves an investment of approximately EUR 130 million.

Kemira is expanding production capacity for strength chemical agents at its Wellgrow site in Thailand. This multi-million Euro investment is designed to capitalize on the rapidly growing Asian pulp and paper market. New capacity is expected by August 2026.

A new operating model, implemented in January 2025, organizes Kemira into three customer-facing business units. These units are Water Solutions, Packaging & Hygiene Solutions, and Fiber Essentials. This model aims to enhance customer-centricity and accelerate growth.

Kemira's strategic acquisitions and investments are pivotal to its growth strategy. These moves are designed to strengthen its market position and expand its product offerings. The company's focus on water treatment and renewable solutions reflects its commitment to sustainable practices and long-term value creation.

- Acquisition of Norit's UK reactivation operations in June 2024, entering the activated carbon market.

- Acquisition of Thatcher Group's iron sulfate coagulant business in the US, completed in April 2025.

- Joint venture with IFF to manufacture biobased materials, with an investment of approximately EUR 130 million.

- Expansion of production capacity for strength chemical agents at the Wellgrow site in Thailand, starting in 2026.

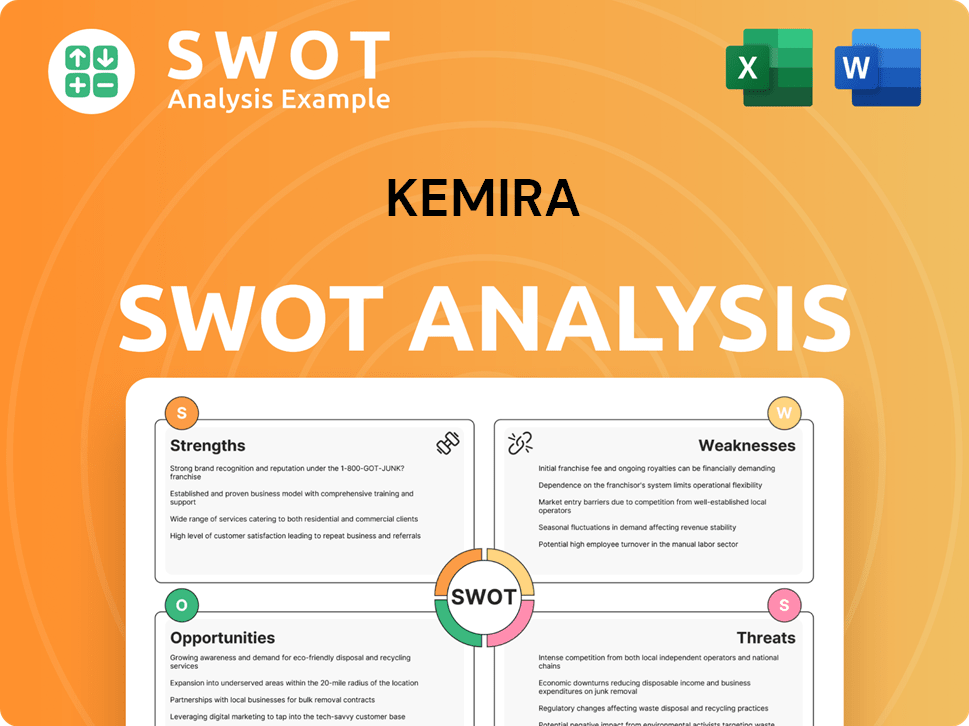

Kemira SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Kemira Invest in Innovation?

The innovation and technology strategy of the company is deeply rooted in its long-standing expertise in chemical science. This approach focuses on understanding molecules to drive research and development (R&D). The company's commitment to innovation is evident in its R&D investments, primarily focused on sustainable and renewable solutions.

A significant portion of ongoing R&D projects are conducted in collaboration with external partners, emphasizing a collaborative approach to innovation. The company leverages technology to develop new solutions, such as its innovative disinfection technology. Digital transformation is also a key aspect of the company's strategy.

The company aims to be the industry-leading provider of sustainability solutions by 2030, underscoring its commitment to leveraging technology and innovation for growth. This includes developing new technologies and digital solutions and services to meet evolving market demands and strengthen its position in the chemical industry.

The company's R&D investments are primarily focused on sustainable and renewable solutions. These investments are crucial for driving innovation and achieving its sustainability goals. This focus aligns with the growing demand for environmentally friendly products and services.

Over half of the company's ongoing R&D projects are conducted in collaboration with external partners. This collaborative approach accelerates innovation and allows the company to leverage diverse expertise. Partnerships are key to developing cutting-edge solutions.

The company actively uses technology to develop new solutions, such as its innovative disinfection technology. This technology is being applied in major projects, including the Seine Amont Wastewater Treatment Plant. This demonstrates the company's commitment to using technology for real-world impact.

Digital transformation is a key aspect of the company's strategy, including the establishment of a new Research & Innovation unit. This unit focuses on long-term research and innovation. Product development has been integrated into the new business units.

A dedicated New Ventures & Services unit has been established to explore and commercialize new market segments and digital service solutions. This unit helps the company stay competitive. This unit is crucial for exploring new market segments.

The company aims to be the industry-leading provider of sustainability solutions by 2030. This goal drives its investments in renewable solutions and sustainable practices. This commitment is central to its long-term growth.

The company's strategic initiatives focus on sustainable solutions, collaborative innovation, and digital transformation. These initiatives are designed to drive growth and maintain a competitive edge in the chemical industry. The company's approach is data-driven and focused on long-term value creation.

- Sustainable Solutions: Prioritizing renewable and sustainable products.

- Collaborative R&D: Partnering with external entities to accelerate innovation.

- Digital Transformation: Implementing new technologies and digital services.

- New Ventures: Exploring new market segments and technology platforms.

- Sustainability Leadership: Aiming to lead the industry in sustainability by 2030.

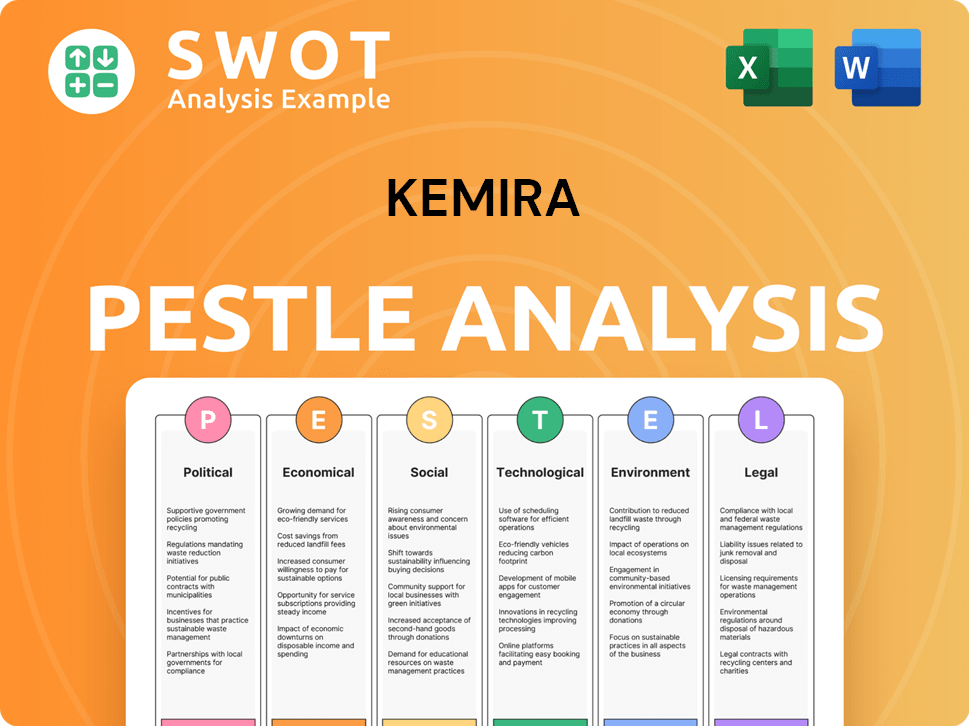

Kemira PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Kemira’s Growth Forecast?

The financial outlook for Kemira in 2025 anticipates continued revenue generation and profitability. The company's strategic focus on sustainable solutions and its strong position within the chemical industry are key drivers of its projected financial performance. This outlook is supported by ongoing investments in both organic and inorganic growth opportunities, reflecting a commitment to long-term value creation.

Kemira's 2025 financial projections include anticipated revenue between EUR 2,800 and EUR 3,200 million. The operative EBITDA is expected to be between EUR 540 and EUR 640 million. These figures demonstrate the company's resilience and strategic positioning within its core markets. The company's Brief History of Kemira provides further context to its evolution.

In the first quarter of 2025, Kemira reported a revenue decrease of 1% to EUR 708.8 million, compared to EUR 718.8 million in Q1 2024 (adjusted). The operative EBITDA decreased by 15% to EUR 135.5 million from EUR 159.2 million in Q1 2024 (adjusted). The operative EBITDA margin for Q1 2025 was 19.1%. Despite these challenges, Kemira continues to focus on its long-term growth strategy.

Kemira expects revenue between EUR 2,800 and EUR 3,200 million for 2025. This is in comparison to the EUR 2,948.1 million reported in 2024. The projections highlight the company's focus on Kemira growth strategy and market share analysis.

Operative EBITDA is projected to be between EUR 540 and EUR 640 million in 2025. This is against EUR 585.4 million in 2024. These figures are critical for understanding Kemira's financial performance and Kemira future prospects.

Q1 2025 revenue decreased by 1% to EUR 708.8 million. Operative EBITDA decreased by 15% to EUR 135.5 million. The operative EBITDA margin for Q1 2025 was 19.1%. These results are essential for Kemira company analysis.

Kemira aims for an average annual organic growth of over 4%. The operative EBITDA margin target is 18–21%. The new target for operative ROCE is above 16%. These targets drive Kemira's strategic initiatives for growth.

Kemira's financial performance is driven by several key metrics and strategic initiatives. The company's focus on sustainable solutions is a key factor in its long term growth potential. Understanding these metrics is vital for investors and stakeholders.

- Revenue Growth: Kemira's revenue growth projections are a key indicator of its market position.

- EBITDA Margin: The operative EBITDA margin reflects the company's profitability and operational efficiency.

- ROCE: The target for operative ROCE is a key measure of capital efficiency.

- Cash Flow: Cash flow from operating activities provides insights into the company's liquidity.

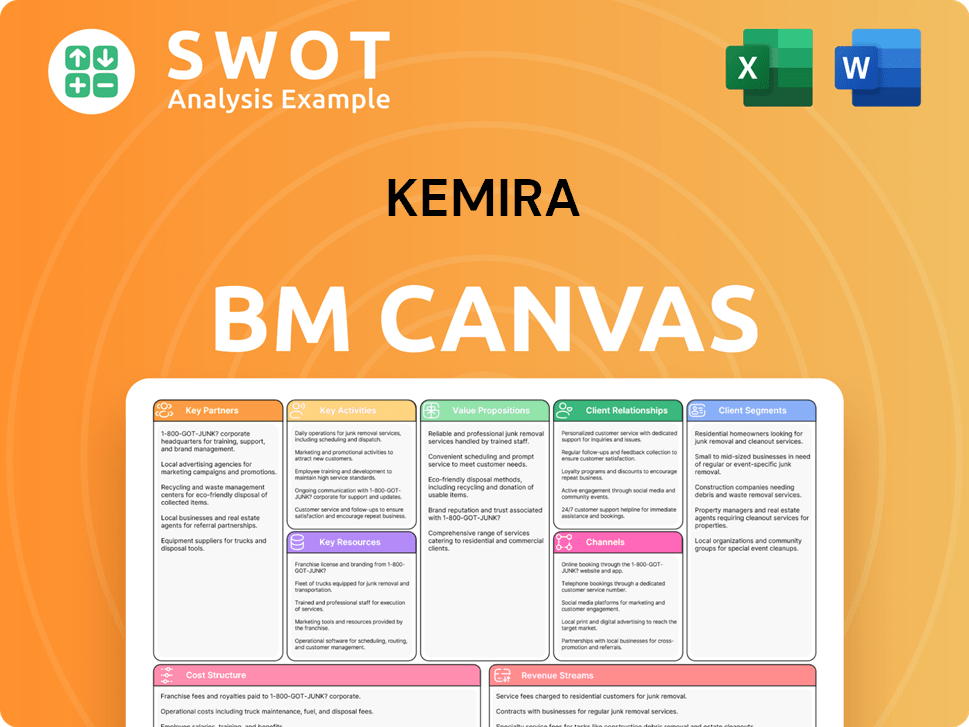

Kemira Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Kemira’s Growth?

The Kemira growth strategy faces several potential risks and obstacles that could impact its future prospects. These challenges include economic uncertainties, market competition, and regulatory changes. Effective risk management is crucial for Kemira to maintain its financial performance and achieve its strategic goals.

Global economic uncertainty presents a significant hurdle. Softer volume demand in some end-markets, especially packaging, could affect revenue. Fluctuations in raw material costs and foreign exchange rates, like a weakening US dollar, also pose financial risks. Kemira's ability to adapt to these external factors will be key.

Operational risks, such as supply chain disruptions and changes in regulations, further complicate Kemira's outlook. The company must continuously innovate and adapt to maintain its market position and capitalize on opportunities. The new operating model implemented in January 2025, aims to enhance agility and customer-centricity.

Increased global economic uncertainty is a primary risk, potentially leading to softer volume demand. This could particularly impact the packaging market. Fluctuations in raw material costs and currency exchange rates, such as a weakening US dollar, pose financial challenges for Kemira's company analysis.

Kemira operates in a competitive market, requiring continuous innovation and optimization. The company needs to maintain its leading positions, especially in water treatment and pulp & paper industries. Adapting to evolving market dynamics is essential for sustained growth and Kemira's strategic initiatives for growth.

Regulatory changes, such as tightening water treatment regulations, necessitate continuous adaptation and investment. The new Urban Wastewater Treatment Directive, approved in 2024, requires Kemira to invest in new technologies. Compliance and adaptation are critical for long-term sustainability.

Supply chain vulnerabilities and potential disruptions to manufacturing operations pose risks. The company's outlook for 2025 assumes no major disruptions in these areas. Managing these risks is critical for maintaining production and meeting customer demands.

Foreign exchange rate fluctuations, particularly a weakening US dollar, could negatively impact financial performance. Currency hedging and strategic financial planning are essential to mitigate this risk. Monitoring and adapting to exchange rate movements are crucial.

Kemira addresses these risks through portfolio diversification and a new operating model. Divestment of the Oil & Gas business and focus on water-intensive industries are key. The new operating model, implemented in January 2025, aims to enhance agility and customer-centricity.

Kemira's strong balance sheet and solid cash flow generation provide a foundation for managing obstacles and investing in future growth. The company's financial health is a key factor in its ability to navigate risks. This financial stability supports Kemira's future prospects.

The focus on sustainability solutions, including renewable chemistries and water treatment technologies, aligns with global trends. This strategy serves as a long-term risk mitigation measure. Kemira's emphasis on sustainable solutions enhances its resilience and market position.

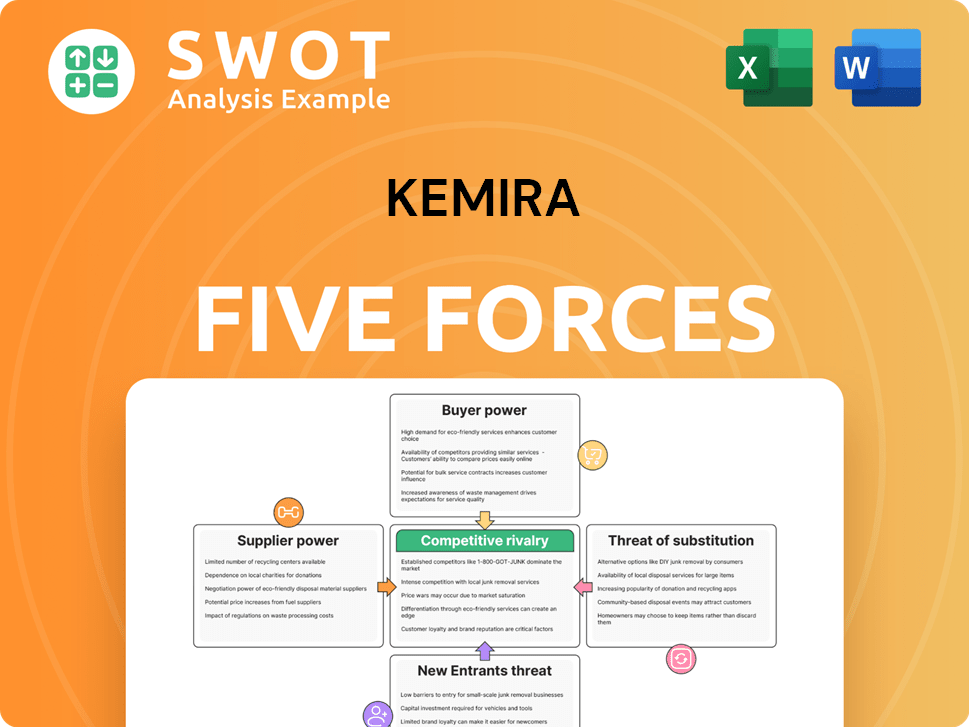

Kemira Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kemira Company?

- What is Competitive Landscape of Kemira Company?

- How Does Kemira Company Work?

- What is Sales and Marketing Strategy of Kemira Company?

- What is Brief History of Kemira Company?

- Who Owns Kemira Company?

- What is Customer Demographics and Target Market of Kemira Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.