Konami Group Bundle

Can Konami Group Continue Its Winning Streak?

Konami Group, a titan in the entertainment world, has masterfully adapted to the ever-changing landscape. From its origins in 1969 to its current status as a global force, Konami's journey is a testament to strategic foresight and innovation. This exploration delves into the Konami Group SWOT Analysis, examining its growth strategy and future prospects.

Konami's impressive financial performance, particularly in its digital entertainment division, highlights its ability to capitalize on market trends. With a focus on Konami's future and Konami Business ventures, this analysis offers insights into the company's plans for Konami Expansion and its potential for sustained success. Understanding Konami's Revenue streams and growth strategies is key to appreciating its position in the global market.

How Is Konami Group Expanding Its Reach?

Konami Group's expansion initiatives are designed to foster growth and maintain a competitive edge in the dynamic entertainment industry. The company's strategy involves penetrating new markets and diversifying revenue streams across its various business segments. This approach is crucial for adapting to evolving consumer preferences and technological advancements.

A key element of Konami's growth strategy is international expansion, particularly in the gaming and systems business. The company is focusing on strategic investments and partnerships to strengthen its global presence. This includes leveraging its established brand and developing innovative products to attract a broader audience.

Konami's commitment to innovation and strategic partnerships is evident in its recent ventures and future plans. The company's ability to adapt and evolve will be critical to its long-term success and its ability to capitalize on emerging opportunities in the global market. For a deeper look into their marketing strategies, see the Marketing Strategy of Konami Group.

Konami Gaming, Inc. is a key driver of international expansion, with a significant presence in North America, Europe, Latin America, and Australasia. The company holds 325 licenses across the US and North America for its gaming machines and casino management systems. In 2025, the focus is on growth in European markets, building on successful expansions in North America and Latin America in 2024. Omnichannel distribution is central to this growth strategy.

Konami continues to develop new titles that blend classic gameplay with cutting-edge technology. Recent successes include the Silent Hill 2 remake, which sold over two million copies since its October 2024 release, and Professional Baseball Spirits 2024-2025. The company is working on anticipated projects like Metal Gear Solid Delta: Snake Eater and plans for 'completely new titles' within the Silent Hill series. In the sports segment, Konami is expanding its 'Pilates Mirror' studio brand, focusing on an asset-light business model.

Konami is exploring collaborations with other industry giants and emerging technology firms to leverage synergies for growth and innovation. This includes a new VLT partnership in Illinois and a gaming tie-up with Portugal's largest iGaming operator for its SYNKROS casino management system. The company emphasizes cross-platform development, allowing titles to be enjoyed across various devices.

Konami is actively involved in esports, recognizing the growing popularity and potential of competitive gaming. The company is investing in tournaments, leagues, and content creation to engage with esports audiences. These initiatives aim to enhance brand visibility and generate additional revenue streams.

Konami's growth strategy involves a multi-faceted approach, including international expansion, product innovation, and strategic partnerships. The company aims to penetrate new markets and diversify its revenue streams. This strategy is crucial for adapting to the changing market and maintaining a competitive edge.

- Focus on European markets in 2025 after successful expansions in North America and Latin America.

- Development of new titles, including Silent Hill 2 remake, which sold over two million copies since October 2024.

- Strategic partnerships, such as VLT partnership in Illinois and gaming tie-up with Portugal's largest iGaming operator.

- Emphasis on cross-platform development and esports initiatives to engage with broader audiences.

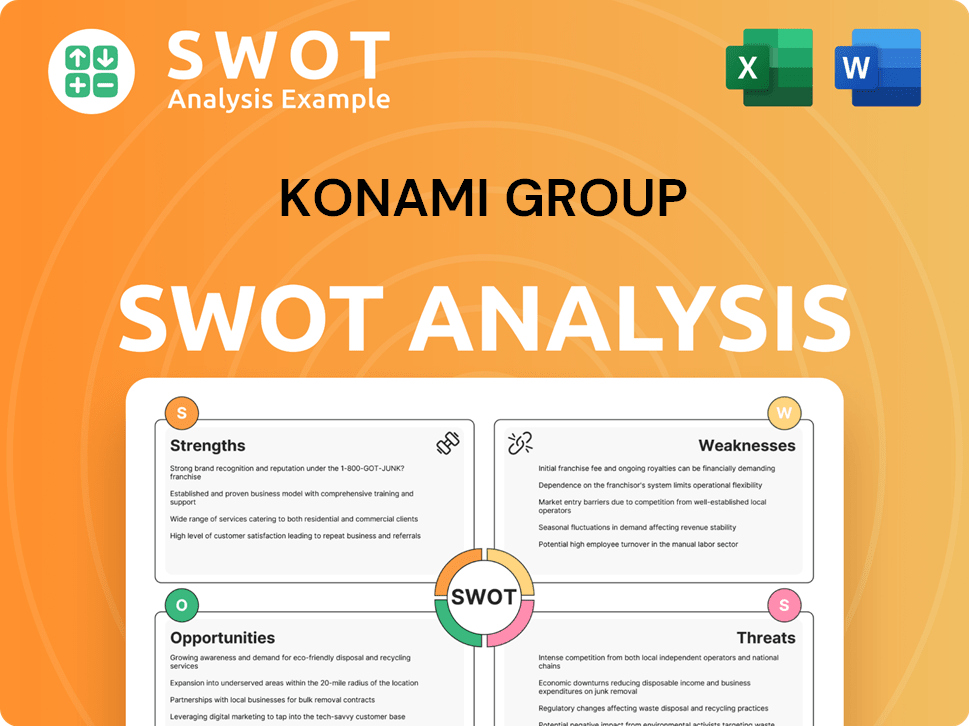

Konami Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Konami Group Invest in Innovation?

Konami Group's innovation and technology strategy is central to its Konami Business growth and future prospects. The company consistently invests in research and development, focusing on both hardware and software advancements. This commitment allows Konami to stay at the forefront of the entertainment industry, driving expansion across its various segments.

A key element of Konami's approach is the in-house development of cutting-edge technologies. This strategy enables the company to create unique products and solutions tailored to its specific needs, fostering a competitive edge. Strategic collaborations further enhance its capabilities, allowing Konami to integrate external expertise and accelerate innovation cycles.

Konami's innovation strategy is evident in its casino gaming sector, with the DIMENSION cabinet series being a prime example. The DIMENSION 49, DIMENSION 27, and DIMENSION 43x3 cabinets have seen steady sales increases in FY 2024/25 due to their advanced features. These include ultra-high-definition displays and unique configurations, which enhance the player experience and drive revenue growth.

The DIMENSION cabinet series features ultra-high-definition displays and unique configurations.

These cabinets have contributed to steady sales increases in FY 2024/25.

SYNKROS redefines connectivity in the gaming space.

It is inspired by banking and national defense industries for exceptional reliability.

SYNK Vision Tables use biometric innovation powered by privacy-preserving facial recognition AI.

This technology enhances player recognition and supports responsible gaming.

Konami is utilizing Web3.0, NFTs, AI, VR/AR, and 5G/6G.

These technologies are being explored for new businesses and content development.

The eFootball series has over 800 million global downloads.

It exemplifies success in network-based entertainment and cross-platform development.

The SYNKROS Drink System enables drink orders directly from slot machines.

It was installed at multiple new properties, including Ocean Casino Resort in New Jersey.

The SYNKROS casino management system exemplifies Konami's technological leadership. Inspired by the architecture of the banking and national defense industries, SYNKROS offers exceptional reliability. In FY 2024/25, SYNKROS was enhanced with features like the SYNKROS Drink System, enabling drink orders directly from slot machines. It was also installed at several new properties, including Ocean Casino Resort in New Jersey, demonstrating its continued expansion and adoption within the industry.

Konami is at the forefront of digital transformation, embracing cutting-edge technologies to enhance its offerings and enter new markets. The company actively explores technologies such as Web3.0, non-fungible tokens (NFTs), artificial intelligence (AI), virtual and augmented reality (VR/AR), and fifth- and sixth-generation mobile communications (5G/6G) to develop new businesses and content.

- SYNK Vision Tables: At G2E Asia 2025, Konami, in partnership with Xailient Inc., is debuting SYNK Vision Tables, a biometric innovation powered by privacy-preserving facial recognition AI, integrated into the SYNKROS system. This technology extends the success of SYNK Vision Slots to live table games, enhancing player experience and supporting responsible gaming and anti-money laundering efforts.

- eFootball Series: The eFootball series, which has over 800 million global downloads, showcases Konami's success in leveraging network-based entertainment and cross-platform development. This highlights the company's ability to create engaging content that resonates with a global audience.

- R&D Investments: Konami continues to allocate significant resources to research and development, ensuring it remains at the forefront of technological advancements in the gaming and entertainment industries. These investments support the development of innovative products and services that drive growth and enhance the player experience.

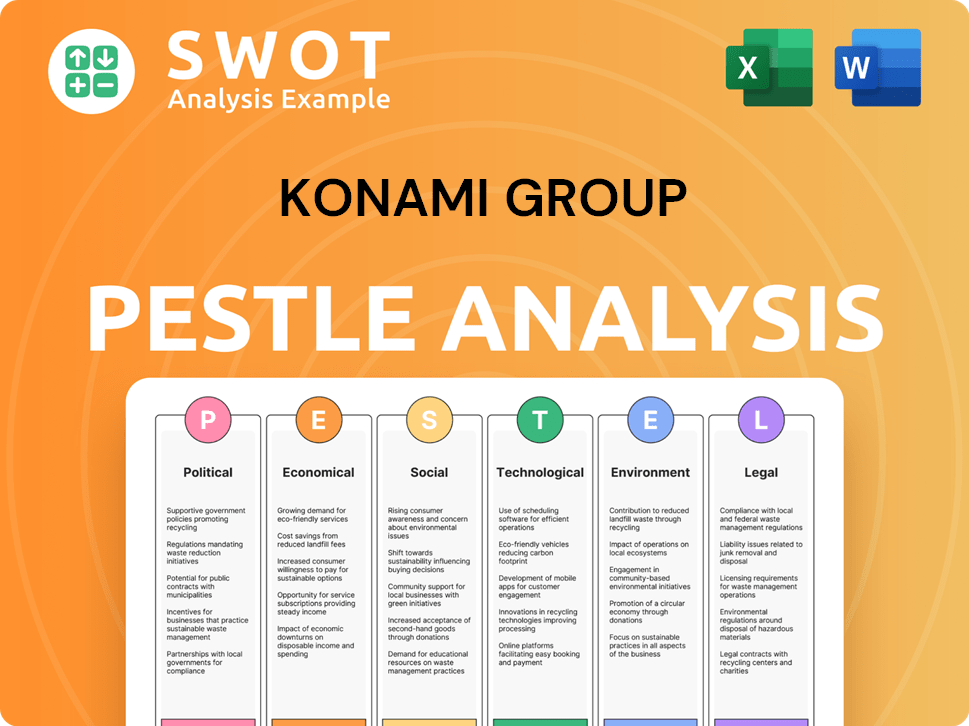

Konami Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Konami Group’s Growth Forecast?

The financial outlook for Konami Group Corporation is positive, with substantial growth in fiscal year 2025. The company demonstrated strong financial performance, with increases across all key financial metrics. This positive trend is expected to continue, driven by strategic initiatives and expansion in key business segments. For a deeper understanding, you can explore the Brief History of Konami Group.

In the fiscal year ending March 31, 2025, Konami reported a total revenue of ¥421,602 million, marking a 17.0% year-on-year increase. Business profit reached ¥109,117 million, up 23.7%, and profit attributable to owners of the parent was ¥74,692 million, a 26.2% increase. The Digital Entertainment segment was the primary driver of this growth, contributing approximately 74% of the total revenue.

Looking ahead, Konami anticipates further growth in fiscal year 2026. The company projects total revenue of ¥430,000 million, a 2% increase year-on-year, and business profit of ¥114,000 million, up 4.5%. The Digital Entertainment business is expected to generate ¥310,000 million in revenue and ¥103,000 million in business profit, reflecting continued expansion and strategic investments.

Konami's revenue increased by 17.0% year-on-year to ¥421,602 million in fiscal year 2025. Business profit grew by 23.7% to ¥109,117 million. Profit attributable to owners of the parent rose by 26.2% to ¥74,692 million, indicating strong financial health and effective operational strategies.

The Digital Entertainment segment was the primary revenue driver, generating ¥305.2 billion, or approximately $2.1 billion. This segment accounted for nearly 74% of Konami's total revenue. The segment's strong performance highlights the importance of digital entertainment in Konami's overall business strategy.

For fiscal year 2026, Konami forecasts total revenue to reach ¥430,000 million, reflecting a 2% year-on-year increase. The Digital Entertainment business is expected to generate ¥310,000 million in revenue, indicating continued growth in this key area. These projections highlight Konami's optimistic outlook.

Konami's gross profit margin for fiscal year 2025 reached 47.2%, a 6.2% increase from the previous year. The company maintains a consolidated payout ratio of over 30% for dividends. The year-end dividend for fiscal year 2025 is projected to be ¥99.50, reflecting the company's commitment to shareholder returns.

Konami Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Konami Group’s Growth?

The path of Konami Group towards its Growth Strategy is not without potential hurdles. The entertainment and technology sectors are dynamic, and this brings inherent strategic and operational risks. The company must navigate these challenges to achieve its ambitious growth targets.

Market competition remains a significant challenge, especially with the fast-paced introduction of new products and rapid technological advancements. Konami's operations span highly competitive markets across its Digital Entertainment, Amusement, Gaming & Systems, and Sports businesses. Furthermore, regulatory changes and geopolitical risks could also present obstacles.

The company's future success depends on its ability to manage risks effectively and adapt to changing market conditions. This requires proactive strategies and continuous innovation across all business segments.

Konami Group faces intense competition in all its sectors. The digital entertainment market is particularly competitive, with new products constantly emerging. The company must continuously innovate to stay ahead of its rivals.

Changes in regulations and geopolitical events could disrupt Konami's operations. Fluctuations in currency exchange rates, particularly involving the Japanese yen, US dollar, and Euro, can also affect financial performance. The global economic outlook adds to the uncertainty.

Rapid technological advancements, such as AI and quantum computing, pose significant challenges. Konami must stay at the forefront of these technologies to maintain its competitive edge. The company is exploring technologies like Web3.0, NFTs, AI, and VR/AR.

Supply chain disruptions, as seen during the pandemic, can impact operations. Konami Gaming is addressing this by shifting from a sole-source to a multi-source and multi-geographical strategy. This involves onboarding hundreds of new suppliers globally to ensure resilience.

Attracting and retaining human capital is crucial for Konami's long-term growth. The company is focused on strengthening investments in human capital and health management. This is key to supporting its Konami Business.

Fluctuations in foreign exchange rates, particularly involving the Japanese yen, US dollar, and Euro, can significantly impact Konami's Revenue. The company must manage these risks to protect its financial performance.

Konami manages these risks through diversification across its four main business segments: Digital Entertainment, Amusement, Gaming & Systems, and Sports. This diversified portfolio helps the company weather market fluctuations and invest in innovation and Konami Expansion. The company's approach is also detailed in Revenue Streams & Business Model of Konami Group.

Konami maintains strong investor relations, holding over 400 IR meetings in FY2025. Top management participates in quarterly financial results briefings and overseas IR roadshows. This transparent communication helps maintain investor confidence and support future growth initiatives.

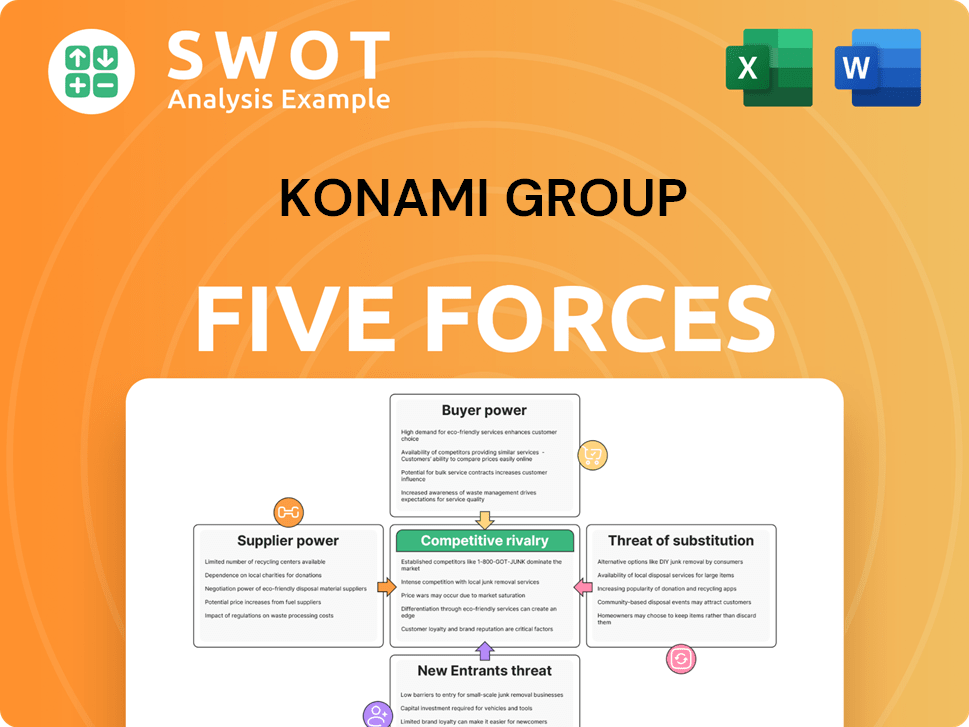

Konami Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Konami Group Company?

- What is Competitive Landscape of Konami Group Company?

- How Does Konami Group Company Work?

- What is Sales and Marketing Strategy of Konami Group Company?

- What is Brief History of Konami Group Company?

- Who Owns Konami Group Company?

- What is Customer Demographics and Target Market of Konami Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.