Morgan Advanced Materials Bundle

Can Morgan Advanced Materials Maintain Its Momentum?

Morgan Advanced Materials, a titan in the advanced materials industry, is navigating a dynamic landscape where its Morgan Advanced Materials SWOT Analysis is crucial. Founded in 1856, the company has a rich history of innovation, evolving from crucible products to a global leader serving diverse sectors. This evolution sets the stage for an in-depth look at its growth strategy and future prospects.

This exploration delves into the core of Morgan Advanced Materials' strategic initiatives, examining its market position and future outlook. We'll dissect the company's approach to business development, analyzing its expansion plans and new product development strategies. Understanding Morgan Advanced Materials' competitive landscape and industry trends will be key to assessing its long-term outlook and potential investment opportunities, providing a comprehensive market analysis.

How Is Morgan Advanced Materials Expanding Its Reach?

The Owners & Shareholders of Morgan Advanced Materials are actively pursuing several expansion initiatives to strengthen their market position and diversify revenue streams. This strategy includes entering new geographical markets, especially in regions experiencing rapid industrial growth and increased demand for advanced materials. These efforts are part of their overall growth strategy.

A key focus is on expanding the product portfolio by launching new, high-performance materials and solutions. These are designed to meet evolving customer needs in sectors like electric vehicles, medical devices, and renewable energy. For instance, their focus on materials for green technologies aligns with global sustainability trends, presenting significant growth opportunities. This approach is critical for their future prospects.

Mergers and acquisitions remain a vital component of their expansion strategy, allowing them to acquire specialized technologies, expand their customer base, and gain market share. This multi-pronged approach is designed to access new customers, diversify revenue streams, and stay ahead of rapidly changing industry dynamics.

The company is targeting regions with strong industrial growth. This includes areas where there's increasing demand for advanced materials. They are focusing on markets that offer significant growth potential and opportunities for business development.

They are committed to launching new, high-performance materials and solutions. These new products are designed to meet the evolving needs of customers. The focus is on sectors like electric vehicles, medical devices, and renewable energy.

Mergers and acquisitions are a vital part of their expansion strategy. This allows them to acquire specialized technologies and expand their customer base. It also helps them gain market share and improve their competitive landscape.

The company is aligning its product development with global sustainability trends. This includes focusing on materials for green technologies. These initiatives support their long-term outlook and contribute to sustainable growth.

The company's expansion plans are primarily focused on sectors with high growth potential. This includes electric vehicles, renewable energy, and medical devices. These areas are expected to drive significant revenue growth in the coming years.

- Electric Vehicles: Increased demand for lightweight and durable materials.

- Renewable Energy: Materials for solar panels, wind turbines, and energy storage.

- Medical Devices: Advanced materials for implants and diagnostic equipment.

- Strategic Planning: Continuous innovation and market share analysis to stay ahead.

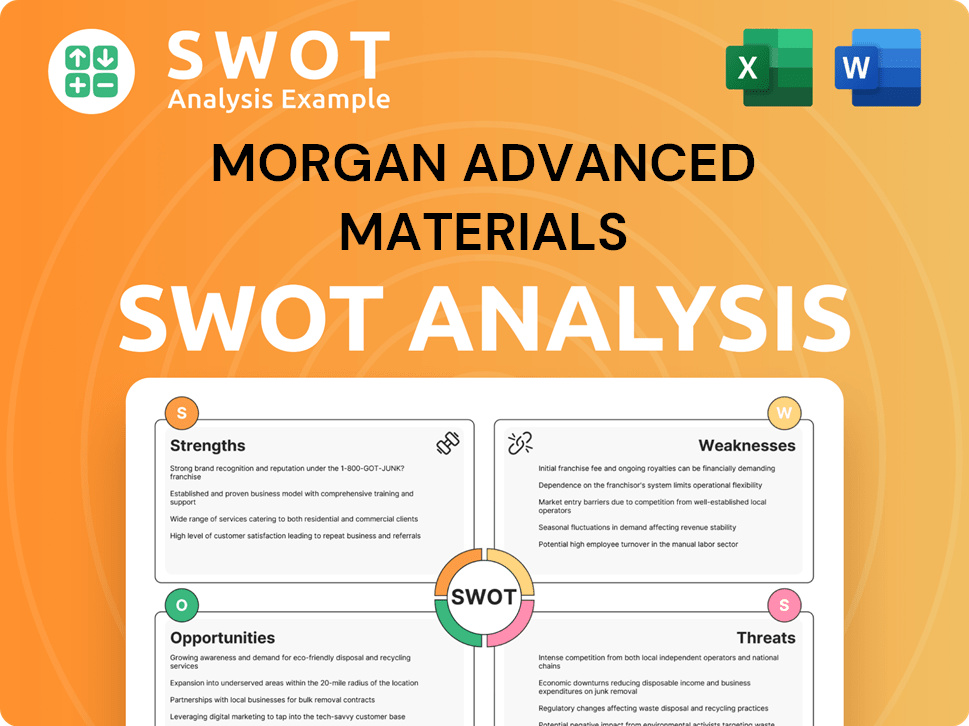

Morgan Advanced Materials SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Morgan Advanced Materials Invest in Innovation?

The innovation and technology strategy of Morgan Advanced Materials, an Advanced Materials Company, is a cornerstone of its Growth Strategy. This approach is designed to drive sustained expansion by focusing on both internal development and strategic collaborations. The company consistently invests in research and development (R&D) to enhance existing product lines and create innovative material solutions, ensuring it remains competitive in the market.

A key element of their strategy involves digital transformation. This includes integrating automation and advanced data analytics across operations to improve efficiency and accelerate product development. This commitment to technological advancement supports the company's Future Prospects by enabling it to meet evolving market demands and maintain a competitive edge. This focus on innovation is crucial for the long-term success of Morgan Advanced Materials.

Morgan Advanced Materials is increasingly exploring cutting-edge technologies like artificial intelligence (AI) and the Internet of Things (IoT) to optimize manufacturing processes and develop smart materials. Sustainability initiatives are also central to their innovation efforts, focusing on developing energy-efficient products and environmentally friendly manufacturing processes. For example, their work in advanced ceramic matrix composites contributes to lighter and more fuel-efficient aerospace components, aligning with industry trends towards sustainability.

Morgan Advanced Materials dedicates a significant portion of its resources to Research and Development. This ongoing investment is crucial for new product development and maintaining a competitive edge. The company's financial performance is directly influenced by its ability to innovate.

The company is actively integrating digital technologies, including automation and data analytics, across its operations. This enhances efficiency and accelerates the development of new products. Digital transformation is key to improving operational performance and increasing market share.

Morgan Advanced Materials is exploring the use of Artificial Intelligence (AI) and the Internet of Things (IoT). These technologies are used to optimize manufacturing and create smart materials. This helps in staying ahead of the competition.

Sustainability is a core focus, with efforts aimed at developing energy-efficient products and eco-friendly manufacturing processes. This approach aligns with global trends and enhances the company's reputation. Sustainable practices contribute to long-term growth.

The company actively engages in strategic collaborations to enhance its innovation capabilities. These partnerships provide access to new technologies and markets. Collaborations are vital for business development and expansion plans.

Significant efforts are directed towards advanced materials like ceramic matrix composites. These materials are used in sectors like aerospace to improve efficiency. This focus is important for future revenue forecast.

The technological and innovation strategies of Morgan Advanced Materials are multifaceted, encompassing significant R&D investments, digital transformation, and a focus on sustainability. These strategies are designed to drive growth and ensure a competitive edge in the advanced materials market. The company's commitment to innovation is evident in its strategic planning and expansion plans.

- R&D Investments: Morgan Advanced Materials consistently allocates a substantial portion of its revenue to research and development, focusing on both incremental improvements to existing products and the development of entirely new materials. This commitment is crucial for staying ahead of industry trends and meeting the evolving needs of its customers.

- Digital Transformation: The company is actively integrating digital technologies, including automation and data analytics, across its operations. This enhances efficiency, accelerates product development cycles, and improves overall operational performance.

- AI and IoT Integration: Exploring and implementing AI and IoT technologies to optimize manufacturing processes and develop smart materials represents a forward-looking approach. These technologies contribute to improved product quality, reduced costs, and enhanced customer value.

- Sustainability Initiatives: Sustainability is a core focus, with efforts aimed at developing energy-efficient products and eco-friendly manufacturing processes. This approach not only aligns with global environmental goals but also enhances the company's reputation and market position.

- Strategic Partnerships and Collaborations: Morgan Advanced Materials actively engages in strategic partnerships and collaborations with other companies, research institutions, and universities. These collaborations provide access to new technologies, expertise, and markets, fostering innovation and accelerating growth.

For more insights, consider exploring the Mission, Vision & Core Values of Morgan Advanced Materials to understand the company's foundational principles that guide its innovation and strategic direction.

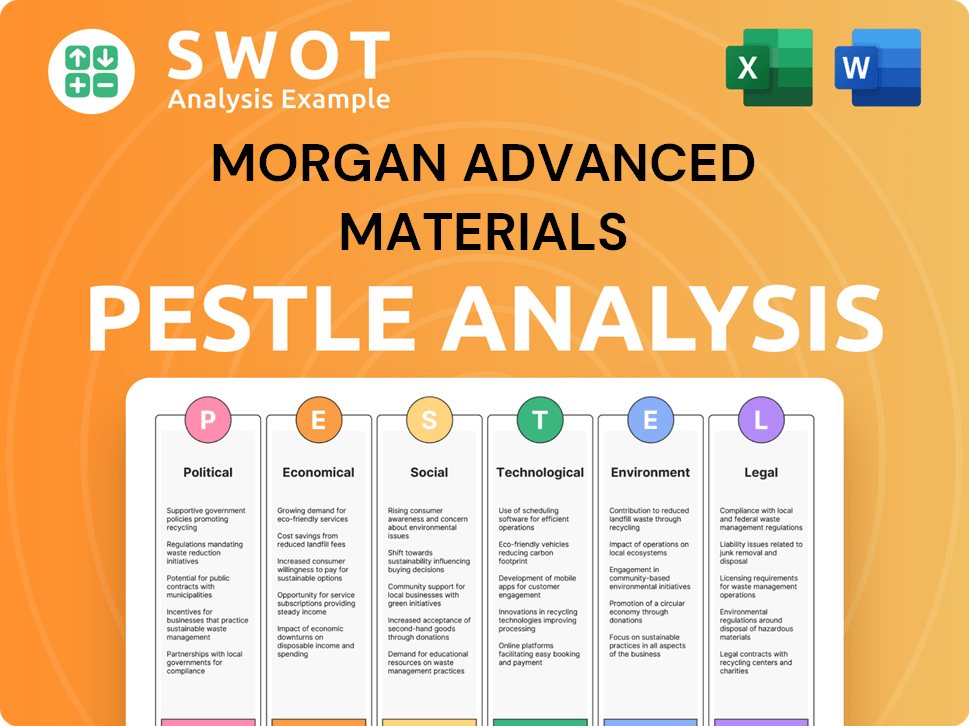

Morgan Advanced Materials PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Morgan Advanced Materials’s Growth Forecast?

The financial outlook for Morgan Advanced Materials is shaped by its strategic initiatives and market positioning, indicating a positive trajectory. The company's performance is driven by the demand for advanced materials in key sectors. Investment levels are expected to remain robust, supporting research and development (R&D), capital expenditures for capacity expansion, and potential acquisitions. This approach is crucial for the company's Growth Strategy.

Recent financial statements and analyst forecasts generally indicate a positive trajectory for Morgan Advanced Materials. For the full year 2024, the company reported an adjusted operating profit of £114.7 million, reflecting a strong performance. The company also announced a proposed final dividend of 5.5 pence per share, bringing the total dividend for 2024 to 8.0 pence per share. This financial performance demonstrates a solid foundation for future growth and supports its Future Prospects.

The company's financial strategy is designed to support its growth ambitions through disciplined capital allocation and a focus on sustainable value creation. Long-term financial goals include expanding market share in high-growth segments and improving operational efficiency to enhance profitability. To understand the competitive environment, consider the Competitors Landscape of Morgan Advanced Materials.

In 2024, the company achieved an adjusted operating profit of £114.7 million, demonstrating strong financial health. This performance is a key indicator of the company's ability to generate profits and manage its operations effectively. The consistent profitability supports the company's strategic initiatives and investment in future growth.

The proposed final dividend of 5.5 pence per share, bringing the total dividend for 2024 to 8.0 pence per share, reflects the company's commitment to returning value to shareholders. This dividend policy indicates financial stability and confidence in future earnings. It also makes the company attractive to investors seeking regular income.

The company's investment strategy focuses on R&D, capital expenditures for capacity expansion, and potential acquisitions. These investments are crucial for driving innovation, increasing production capacity, and expanding market reach. This strategic approach is essential for sustaining long-term growth and competitiveness.

Key growth initiatives include expanding market share in high-growth segments and improving operational efficiency. These initiatives are designed to enhance profitability and create sustainable value. The focus on efficiency and market expansion is critical for achieving long-term financial goals.

The financial outlook for Morgan Advanced Materials is positive, supported by strong financial performance and strategic investments. The company's focus on R&D, capital expenditures, and potential acquisitions is expected to drive future growth.

- Adjusted operating profit of £114.7 million in 2024.

- Total dividend for 2024 of 8.0 pence per share.

- Strategic investments in R&D and capacity expansion.

- Focus on expanding market share and improving operational efficiency.

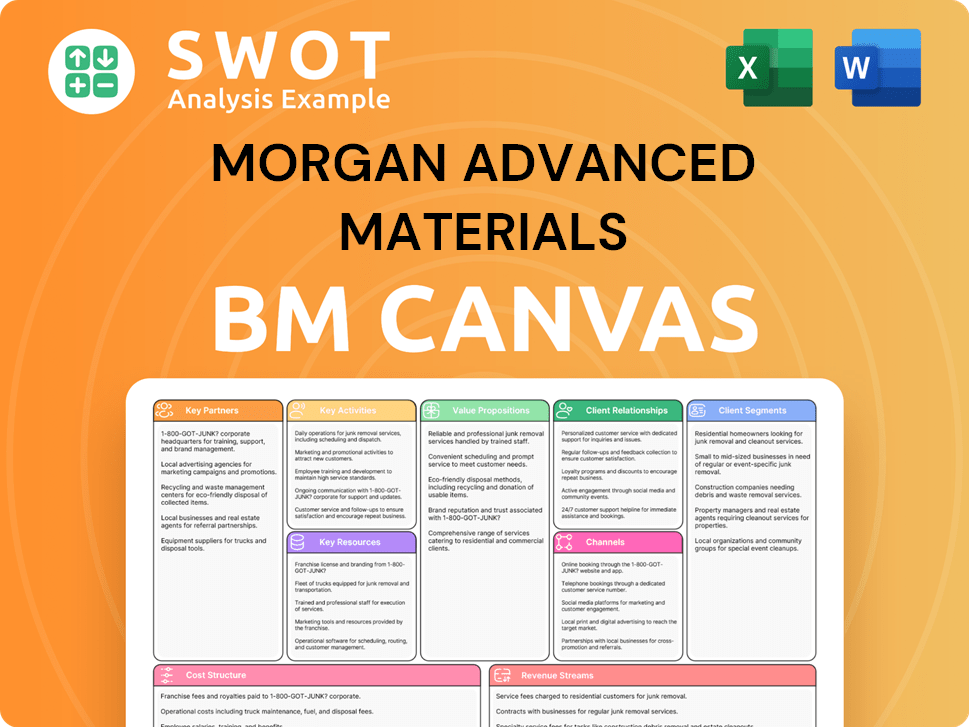

Morgan Advanced Materials Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Morgan Advanced Materials’s Growth?

Several potential risks and obstacles could influence the Morgan Advanced Materials's Growth Strategy and its Future Prospects. These challenges range from competitive pressures to regulatory changes and supply chain disruptions. Understanding these potential hurdles is crucial for investors and stakeholders assessing the company's long-term viability and strategic planning.

The advanced materials sector is dynamic, with constant innovation and evolving customer needs. The company must continually adapt to maintain its competitive edge. Furthermore, external factors such as economic downturns or geopolitical events can create additional uncertainties.

Addressing these risks proactively through diversification, robust risk management, and strategic planning is essential for sustained success.

The Advanced Materials Company operates in a competitive environment with both established and emerging players. Intense competition can lead to pricing pressures and reduced market share. The ability to innovate and differentiate products is critical for maintaining a competitive advantage.

Changes in environmental regulations, trade policies, and industry standards can impact the company. Compliance costs and potential limitations on market access are key considerations. Staying informed and adapting to regulatory shifts is a continuous process.

Disruptions in the supply chain, such as those caused by global events or raw material shortages, can affect production and profitability. Diversifying suppliers and implementing robust supply chain management practices are essential. Recent events have highlighted the importance of supply chain resilience.

Rapid advancements in material science can render existing products obsolete. Continuous investment in research and development and a proactive approach to new technologies are crucial. The company must anticipate and adapt to technological shifts.

Limited access to skilled labor, capital, or specific raw materials can hinder growth. Effective workforce planning, financial management, and strategic partnerships are vital. These constraints can impact expansion plans and innovation.

Economic downturns can reduce demand for advanced materials across various sectors. The company's ability to weather economic cycles depends on its financial stability and market diversification. Business Development strategies must consider economic forecasts.

The company employs several strategies to mitigate these risks, including diversifying its product portfolio and customer base to reduce dependence on any single market segment. It also maintains robust risk management frameworks to identify and address potential threats proactively. Scenario planning is used to anticipate and prepare for various challenges.

The company's history of navigating economic downturns and supply chain disruptions demonstrates its resilience. This adaptability is crucial for long-term success. The ability to quickly adjust to changing market conditions and external shocks is a key strength.

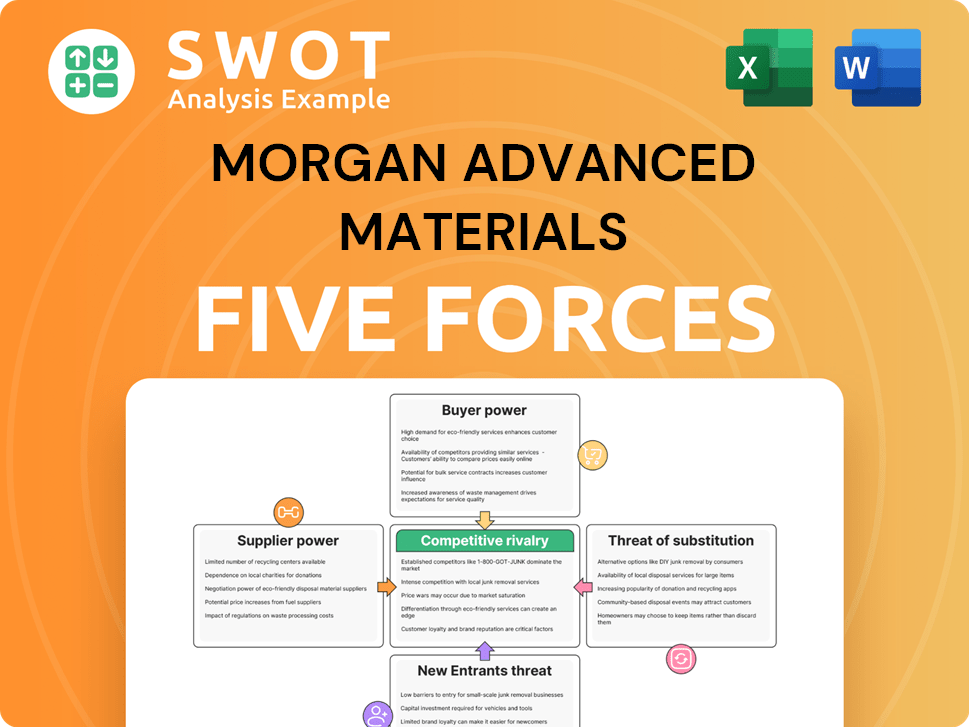

Morgan Advanced Materials Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Morgan Advanced Materials Company?

- What is Competitive Landscape of Morgan Advanced Materials Company?

- How Does Morgan Advanced Materials Company Work?

- What is Sales and Marketing Strategy of Morgan Advanced Materials Company?

- What is Brief History of Morgan Advanced Materials Company?

- Who Owns Morgan Advanced Materials Company?

- What is Customer Demographics and Target Market of Morgan Advanced Materials Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.