NEC Bundle

Can NEC Corporation Maintain Its Momentum?

NEC's strategic acquisition of Avaloq in 2020 signaled a bold move into digital finance, but what does the future hold for this tech giant? From its origins in 1899, NEC has consistently adapted, evolving from a telecommunications equipment provider to a global IT leader. This NEC SWOT Analysis provides a deeper look into the company.

This in-depth NEC company analysis will explore NEC's growth strategy, examining how it plans to capitalize on its market position and drive technology innovation. We'll delve into NEC's future prospects, considering its expansion into new markets and its approach to digital transformation. Understanding NEC's business model and its response to market changes is crucial for assessing its long-term growth strategy and financial performance and outlook.

How Is NEC Expanding Its Reach?

The expansion initiatives of NEC are crucial for its NEC growth strategy and future success. The company is actively pursuing strategies to broaden its market presence and diversify its revenue streams. This includes both organic growth through new product offerings and inorganic growth through mergers and acquisitions, all aimed at enhancing its competitive position.

A core element of NEC's strategy is global expansion, focusing on key areas such as public safety, digital government, and digital finance. NEC leverages its strong portfolio in these domains to capitalize on global demand. This strategic direction is supported by investments in research and development and partnerships to drive innovation and market penetration.

The company aims to achieve sustained growth by entering new geographical markets and expanding its offerings in existing ones. NEC is working to increase its revenue and market share through strategic initiatives.

NEC is focusing on expanding its global footprint, particularly in areas like public safety, digital government, and digital finance. This involves targeting new geographical markets and strengthening its presence in existing ones. The company's goal is to leverage its existing strengths and technologies to meet the growing global demand for these solutions.

Mergers and acquisitions (M&A) are a key part of NEC's growth strategy. The acquisition of Avaloq, for instance, significantly bolstered its digital finance solutions. These strategic moves are designed to enhance NEC's capabilities, expand its market share, and accelerate its growth in key sectors.

NEC is expanding its 5G solutions globally, capitalizing on the increasing demand for high-speed, reliable connectivity. This includes developing open 5G network solutions and partnering with telecommunications providers. These efforts are designed to drive innovation and accelerate the deployment of 5G technology worldwide.

NEC aims to achieve a consolidated operating profit of 250.0 billion yen by fiscal year 2025. This financial target reflects the company's commitment to sustainable growth. The company is focused on strategic investments and operational efficiencies to achieve this goal.

NEC's NEC future prospects are closely tied to its ability to execute these expansion initiatives effectively. The company's focus on technology innovation, strategic partnerships, and market diversification positions it well for future growth. The company's commitment to these strategic initiatives is further detailed in Mission, Vision & Core Values of NEC.

NEC's expansion strategy focuses on global reach, strategic acquisitions, and 5G solutions. These initiatives are designed to drive growth in key markets and enhance its competitive advantage. The company aims to increase its revenue and market share through strategic investments.

- Expansion into new geographical markets.

- Strategic mergers and acquisitions to enhance capabilities.

- Development and deployment of 5G solutions globally.

- Focus on public safety, digital government, and digital finance.

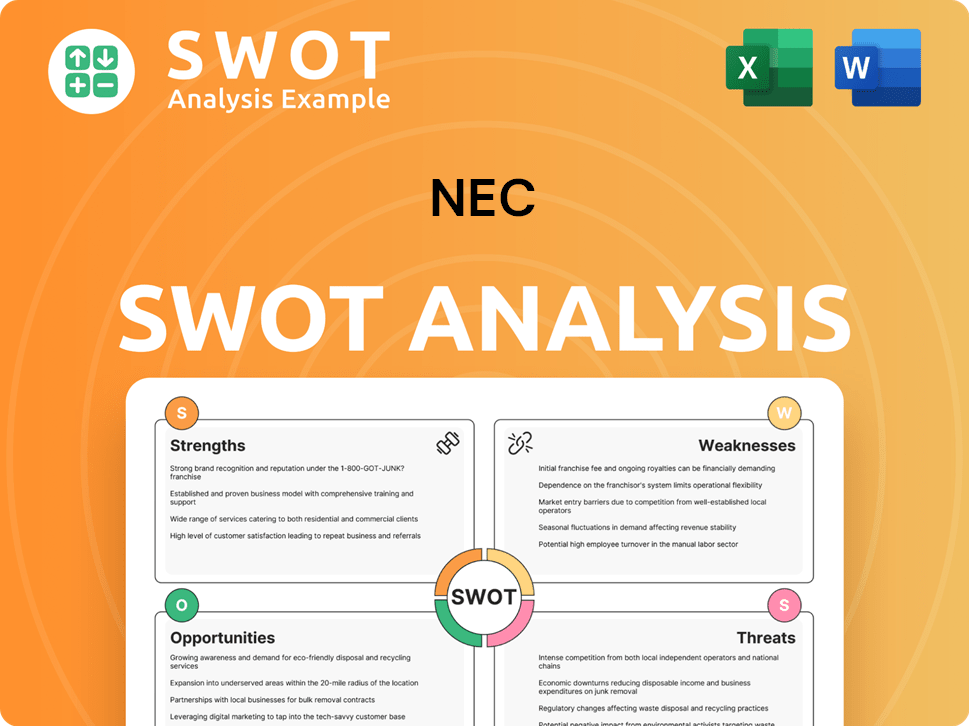

NEC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does NEC Invest in Innovation?

The NEC growth strategy is deeply rooted in technological innovation, positioning the company to capitalize on emerging market trends. This approach is crucial for navigating the dynamic landscape of the tech industry and ensuring sustained growth. The company’s focus on key areas like AI, IoT, and sustainability underscores its commitment to future-proofing its business model.

The company's approach involves a blend of in-house R&D and strategic partnerships, which allows it to rapidly adapt to market changes. This strategy is designed to enhance its market position and drive expansion into new markets. By focusing on digital transformation, NEC aims to create innovative solutions that meet evolving customer needs.

NEC's commitment to innovation is evident in its substantial investment in research and development. This investment is crucial for maintaining a competitive edge and driving the NEC future prospects forward. The company's strategic initiatives are designed to leverage its technological capabilities to secure its leadership in various sectors.

NEC consistently invests a significant portion of its revenue into research and development to foster innovation. These investments are critical for staying ahead in the rapidly evolving tech industry. The company's R&D efforts are focused on creating cutting-edge solutions and technologies.

Digital transformation is a core element of NEC's strategy, with a focus on leveraging AI, IoT, and other advanced technologies. This transformation allows NEC to develop innovative products and services. The company aims to enhance its operational efficiency and customer experience through digital initiatives.

NEC is committed to sustainability, developing environmentally friendly technologies and solutions. These initiatives support a sustainable society and align with global environmental goals. The company integrates sustainability into its business practices and product development.

NEC actively forms strategic partnerships and collaborations to enhance its innovation capabilities. These collaborations help the company access new technologies and markets. Partnerships are crucial for accelerating growth and expanding its reach.

Key focus areas for NEC include biometric authentication, network orchestration, and advanced analytics. These areas are critical for driving growth and maintaining a competitive edge. The company's expertise in these areas contributes to its leadership in various technological sectors.

NEC is actively expanding into new markets by leveraging its technological advancements and solutions. This expansion strategy is designed to increase revenue and diversify its business portfolio. The company aims to capitalize on global opportunities and strengthen its market presence.

NEC’s technology strategy is designed to drive innovation and secure its future in a competitive market. The company's focus on digital transformation, AI, and IoT is key to its long-term growth. NEC’s initiatives are supported by strategic partnerships and significant investments in R&D.

- Artificial Intelligence (AI): NEC develops and deploys AI-powered solutions for facial recognition, public safety, and smart city initiatives. These solutions enhance security and improve operational efficiency.

- Internet of Things (IoT): NEC leverages IoT technologies to create smart solutions for various industries, including infrastructure and healthcare. IoT solutions improve connectivity and data analysis.

- Sustainability: The company focuses on developing environmentally friendly technologies and solutions. These initiatives support a sustainable society and align with global environmental goals.

- 5G Technology: NEC is actively involved in 5G technology development, contributing to advancements in network infrastructure and services. 5G enhances connectivity and supports new applications.

- Biometric Authentication: NEC's expertise in biometric authentication provides secure and reliable identity verification solutions. These solutions are used in various applications, including access control and security systems.

- Network Orchestration: The company's network orchestration capabilities enable efficient management and optimization of network resources. This improves network performance and reduces operational costs.

- Advanced Analytics: NEC utilizes advanced analytics to derive insights from data, supporting better decision-making and improved operational outcomes. This capability enhances the value of its solutions and services.

For a deeper understanding of how NEC navigates the competitive landscape, consider exploring the Competitors Landscape of NEC. This analysis provides valuable insights into the company's strategic positioning and competitive advantages.

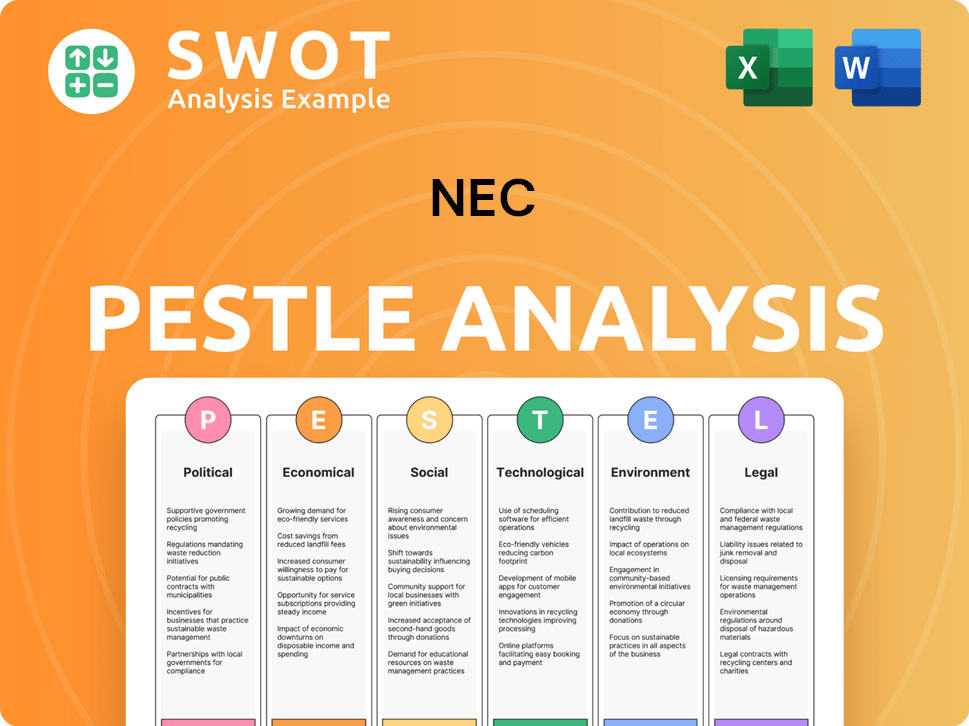

NEC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is NEC’s Growth Forecast?

The financial outlook for NEC Corporation appears positive, driven by strategic growth initiatives and a focus on high-growth areas. The company's projections for the fiscal year ending March 31, 2025, indicate continued financial growth. This growth is built upon the foundation of its performance in the previous fiscal year, demonstrating a consistent upward financial trajectory.

NEC's strategy includes prioritizing investments in its growth businesses, particularly in public safety, digital government, and digital finance. This approach aims to significantly increase profitability. The company's focus on expanding its global business and enhancing its service offerings is expected to drive sustained revenue growth and improved profit margins in the coming years.

For the fiscal year ending March 31, 2025, NEC anticipates consolidated revenue of 3,500.0 billion yen and a consolidated operating profit of 250.0 billion yen. This follows a successful fiscal year 2024, where the company reported consolidated revenue of 3,381.8 billion yen and an operating profit of 188.0 billion yen. These figures highlight the company's ongoing financial progress and strategic direction.

The NEC growth strategy focuses on expanding its global business and enhancing service offerings. This strategy is designed to drive sustained revenue growth. The company aims to improve profit margins in the coming years through these initiatives.

NEC is prioritizing investments in high-growth areas. These areas include public safety, digital government, and digital finance. These investments are crucial for achieving a significant increase in profitability.

In fiscal year 2024, NEC reported consolidated revenue of 3,381.8 billion yen. The operating profit for the same period was 188.0 billion yen. This performance serves as a baseline for future growth and strategic planning.

NEC aims to achieve sustained revenue growth and improved profit margins. This reinforces its long-term financial goals. The company's focus on strategic investments supports these objectives.

NEC's NEC future prospects are closely tied to its strategic initiatives. The company is focused on expanding its global presence and enhancing its service offerings. These initiatives are designed to drive revenue growth and improve profit margins.

- Prioritizing investments in growth businesses.

- Focusing on public safety, digital government, and digital finance.

- Expanding global business operations.

- Enhancing service offerings to increase profitability.

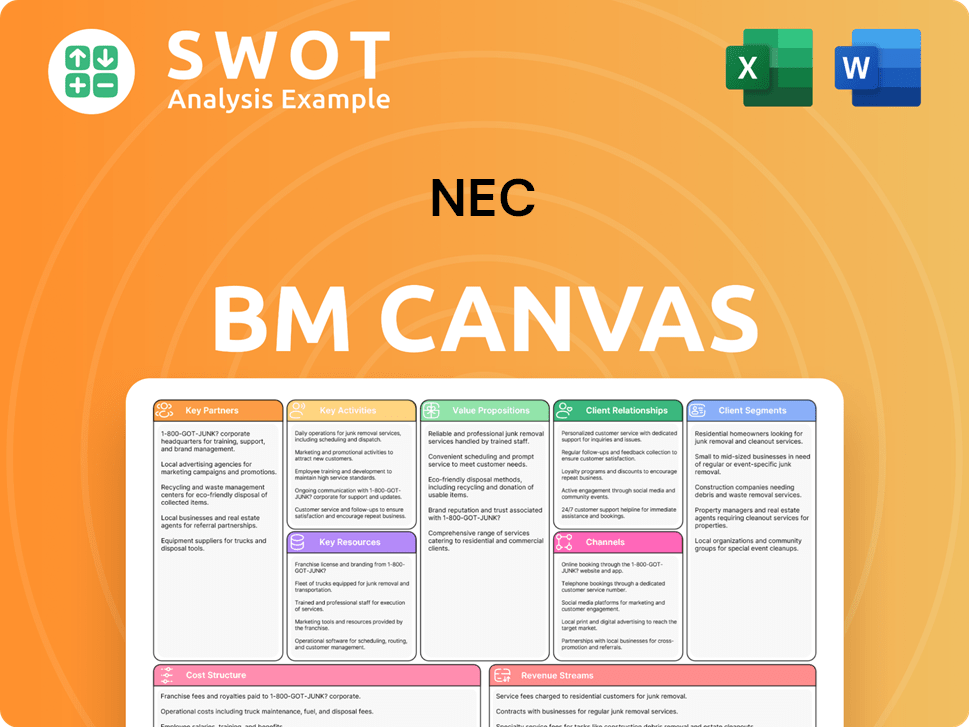

NEC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow NEC’s Growth?

The path to growth for NEC is fraught with potential risks and obstacles. Intense competition within the IT and electronics sectors demands continuous innovation and differentiation, which is crucial for maintaining its market position. Navigating regulatory changes, especially concerning data privacy and cybersecurity, presents ongoing challenges that could impact operations and market access. Understanding these challenges is vital for a thorough NEC company analysis.

Supply chain disruptions, amplified by global events, pose a significant threat to production and delivery. The rapid pace of technological advancement necessitates consistent investment in research and development to avoid obsolescence. Securing and retaining top talent in specialized fields like AI and cybersecurity is also a key internal challenge. To understand the NEC business model, it's essential to consider these factors.

NEC addresses these challenges through a diversified business portfolio and robust risk management. The company has shown resilience in the face of economic downturns and technological shifts. This adaptability is crucial for sustaining its growth trajectory and realizing its NEC future prospects. For a deeper dive, consider reading about the Marketing Strategy of NEC.

The IT and electronics markets are highly competitive, requiring constant innovation. Competitors include global giants and emerging players, intensifying the pressure on NEC's market position. To thrive, NEC must continually enhance its technology innovation and adapt to evolving customer needs.

Changes in data privacy laws, cybersecurity regulations, and international trade policies can significantly affect NEC. Compliance costs and potential market access restrictions pose risks. Proactive adaptation and strategic planning are essential to navigate these regulatory hurdles.

Global events and natural disasters can disrupt supply chains, affecting production and delivery. NEC must build resilient supply chains and diversify its sources to mitigate these risks. This is crucial for maintaining operational efficiency and meeting customer demands.

The rapid pace of technological change requires continuous investment in R&D. Failure to innovate could lead to obsolescence and loss of market share. NEC must stay ahead of the curve in areas like 5G technology and AI to remain competitive.

Attracting and retaining top talent in specialized fields is a challenge. Competition for skilled professionals in AI and cybersecurity is intense. NEC needs to invest in employee development and create an attractive work environment.

Economic downturns can impact demand for NEC's products and services. Diversification and financial resilience are key to weathering these economic cycles. NEC's ability to adapt and innovate has been demonstrated in past downturns.

NEC's strategy includes diversifying its business portfolio across various sectors. This helps to mitigate risks associated with any single market. Robust risk management frameworks are essential for identifying and addressing potential threats to the company's operations and financial stability. This approach supports NEC's long-term growth strategy.

NEC's ability to adapt to market changes and embrace technology innovation is critical. Continuous investment in R&D and a focus on emerging technologies, such as AI, are vital. This adaptability supports NEC's expansion into new markets and ensures its competitive advantage in the industry.

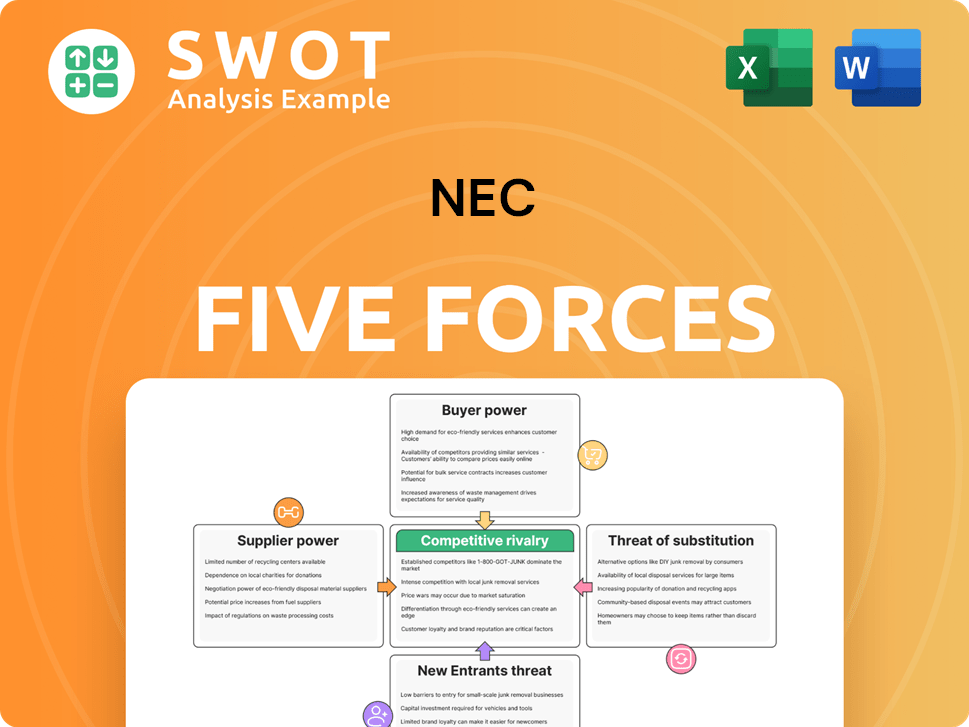

NEC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.