Nexstar Media Group Bundle

Can Nexstar Media Group Conquer the Future of Media?

Nexstar Media Group, a leading Nexstar Media Group SWOT Analysis, has become a powerhouse in the broadcasting industry. From its humble beginnings, this media company has rapidly expanded, establishing a significant presence across the United States. This analysis dives into Nexstar's strategic journey, exploring its growth strategy and its ambitious vision for the future.

Understanding Nexstar Media Group's future prospects requires a deep dive into its expansion plans and digital media initiatives. Analyzing its financial performance and market share, alongside its competitive landscape, is crucial. This exploration will reveal the challenges and opportunities Nexstar faces as it navigates the evolving media landscape, aiming for sustained revenue growth and a strong future outlook within the local television market.

How Is Nexstar Media Group Expanding Its Reach?

The expansion initiatives of Nexstar Media Group are designed to strengthen its market presence, diversify revenue streams, and adapt to the changing dynamics of the broadcasting industry. These initiatives include strategic mergers and acquisitions, content expansion, and regulatory efforts. The overarching goal is to position the company for sustained growth and profitability in the evolving media landscape.

A key element of Nexstar's growth strategy involves strategic mergers and acquisitions. This approach allows the company to quickly expand its footprint and enter new markets. Nexstar also focuses on expanding its content offerings, particularly in sports programming, to attract a broader audience and increase revenue. Furthermore, the company is actively pursuing deregulation to enhance its competitive position.

Nexstar's strategies are a response to the evolving media landscape, which is increasingly dominated by digital platforms and streaming services. By focusing on acquisitions, content diversification, and regulatory changes, Nexstar aims to enhance its competitive position and create value for its shareholders. The company's focus on local television and digital initiatives aims to capture a larger share of advertising revenue and expand its reach to a wider audience.

Nexstar's acquisition strategy is a cornerstone of its growth strategy. In January 2025, Nexstar acquired WBNX-TV/TV55 in Cleveland, Ohio, establishing a duopoly in the nation's 19th largest television market. This acquisition is part of Nexstar's broader strategy to expand its reach into key demographic areas. The acquisition of WBNX-TV is expected to be accretive to Nexstar's operating results.

Nexstar is actively expanding its content offerings, particularly in sports programming. The company has increased sports programming on The CW by adding Grand Slam Track and AVP matches. Nexstar entered into a partnership with the Texas Rangers to air games across multiple stations. Sports and sports-related programming are expected to constitute approximately 40% of The CW's total programming hours in 2025.

Nexstar is pursuing deregulation as a key initiative in 2025. The company aims to renew distribution contracts representing approximately 60% of its subscriber base. Nexstar believes that deregulation of broadcast ownership rules is crucial to enhance its competitive position. Securing a comprehensive multi-year renewal of their NBC Television Network affiliations in January 2025 is a part of these efforts.

Nexstar aims for The CW Network to achieve profitability by 2026. The company's focus on acquisitions, content diversification, and regulatory changes aims to enhance its competitive position. The company's financial performance will be influenced by its ability to integrate new acquisitions, manage content costs, and adapt to changes in the media industry. For more insights, check out the Owners & Shareholders of Nexstar Media Group.

Nexstar's growth strategy involves a multi-faceted approach to expand its market presence and revenue streams. This includes strategic acquisitions, content diversification, and regulatory initiatives. The company is focused on achieving profitability and enhancing shareholder value in a dynamic media environment.

- Strategic Mergers and Acquisitions: Acquiring stations to expand market reach.

- Content Expansion: Increasing sports programming to attract a broader audience.

- Regulatory Initiatives: Pursuing deregulation to enhance competitiveness.

- Financial Goals: Aiming for The CW Network to achieve profitability by 2026.

Nexstar Media Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Nexstar Media Group Invest in Innovation?

The innovation and technology strategy of Nexstar Media Group is crucial for its sustained growth within the broadcasting industry. The company strategically invests in new technologies and digital platforms to enhance its reach and revenue streams. This approach is designed to meet evolving consumer needs and preferences in the media landscape.

A core element of Nexstar's strategy involves the advancement of ATSC 3.0, also known as NextGen TV. This technology offers improved broadcast capabilities and new opportunities for content delivery. Nexstar's focus on digital transformation, including its local websites and mobile apps, further supports its efforts to engage audiences and monetize content effectively.

Nexstar's approach to innovation is geared towards enhancing its broadcast capabilities and digital offerings. The company's emphasis on local journalism and content production underpins its ability to deliver relevant and engaging content across its platforms. The company's commitment to sustainability is also evident in its efforts to reduce its environmental impact.

Nexstar views ATSC 3.0 as a key driver of future growth. In February 2025, the company announced the creation of EdgeBeam Wireless, LLC, a joint venture to deliver wireless data via ATSC 3.0 across 97% of the U.S. This expansion aims to explore new revenue streams. Nexstar has reached over 50% of U.S. television households with an ATSC 3.0 signal.

Nexstar owns 120 local websites and 284 mobile apps. The company focuses on monetizing digital content and growing its portfolio of digital products and services. NewsNation, Nexstar's national news network, expanded to 24 hours of news programming seven days a week in 2024.

Nexstar has received numerous accolades for its journalistic integrity. In 2025, 28 of its television stations won 52 regional Edward R. Murrow Awards. In 2024, 33 Nexstar-owned and partner TV stations won a total of 100 Regional Emmy Awards.

Nexstar aims to limit its environmental impact. The company replaces tube-based transmission equipment with more energy-efficient solid-state equipment. Studio lighting is upgraded to LED, and a company-wide e-waste recycling program is implemented.

Nexstar's commitment to local journalism and content production is significant. Approximately 6,000 journalists and 1,600 salespeople produce over 316,000 hours of programming annually. This focus supports the delivery of relevant and engaging content.

Nexstar's digital initiatives are crucial for its Growth Strategy. The company is focused on expanding its digital content and audience. This includes apps for NewsNation, The Hill, and other local television station programming.

Nexstar's strategic investments in technology and digital platforms are designed to enhance its market position and drive revenue. The company's focus on ATSC 3.0, digital content, and local news production showcases its commitment to innovation and its ability to adapt to the evolving media landscape. For more insights into the company's mission and values, read Mission, Vision & Core Values of Nexstar Media Group.

Nexstar's technology strategy involves significant investments in digital platforms and broadcast technologies. The company's focus on ATSC 3.0 and digital content expansion is designed to drive future growth and enhance its competitive position within the broadcasting industry.

- ATSC 3.0 Deployment: Expanding the reach of NextGen TV signals to increase revenue opportunities.

- Digital Content Monetization: Improving strategies to generate revenue from digital platforms and content.

- Local News Strategy: Strengthening local news production to engage audiences and increase advertising revenue.

- Sustainability Efforts: Implementing initiatives to reduce environmental impact and improve operational efficiency.

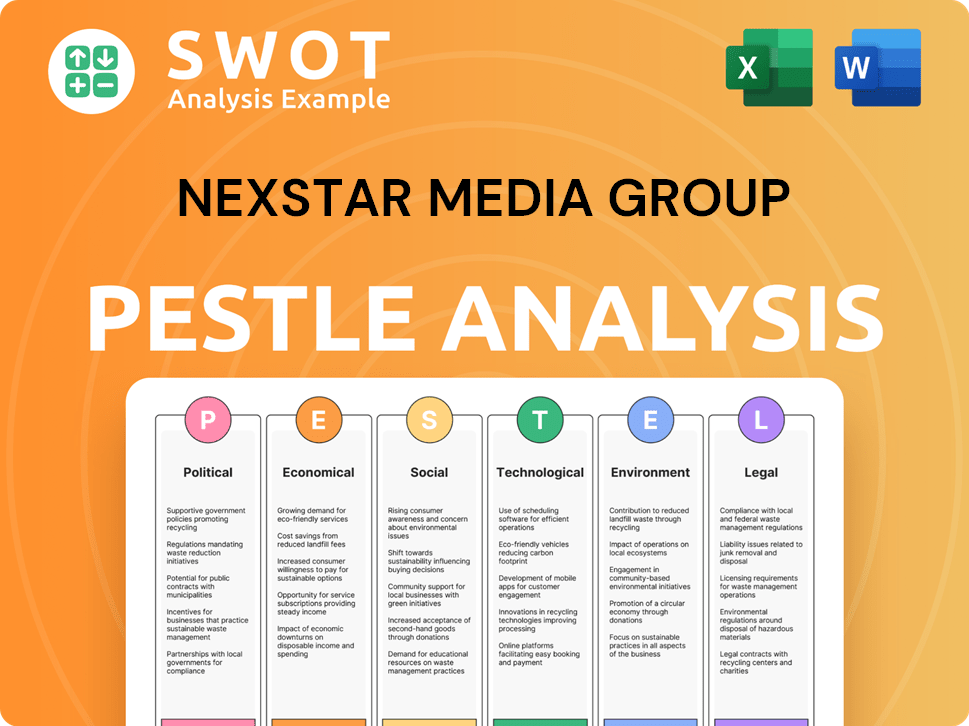

Nexstar Media Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Nexstar Media Group’s Growth Forecast?

The financial outlook for Nexstar Media Group reflects a strategic focus on sustained growth within the broadcasting industry. The media company demonstrated robust performance in 2024, setting a new revenue record. However, the company anticipates a mixed financial trajectory for 2025, with specific challenges and opportunities shaping its future.

Nexstar Media Group's financial strategy is heavily influenced by its revenue streams, including advertising, distribution, and political advertising. The company is navigating the cyclical nature of advertising revenue, particularly the impact of election years. Strategic initiatives, such as the profitability of The CW Network by 2026, are also key to its financial outlook.

For a deeper dive into the company's origins and evolution, you can explore the Brief History of Nexstar Media Group.

Nexstar Media Group achieved record annual revenue of $5.41 billion in 2024, surpassing $5.21 billion in 2022. This growth was driven by increased political advertising and distribution revenue.

Distribution revenue is expected to grow, with a record $762 million in Q1 2025. However, overall distribution revenue is projected to be relatively flat with 2024 levels due to subscriber attrition.

Q1 2025 net revenue was $1.23 billion, a 3.9% decrease year-over-year, mainly due to reduced political advertising. Advertising revenue decreased by 10.2% due to market softness.

Q1 2025 EPS was $3.37, exceeding the forecast of $3.26. Adjusted EBITDA for Q1 2025 was $381 million, down from $452 million in Q1 2024 due to rising content costs.

Nexstar Media Group has provided Adjusted EBITDA guidance for fiscal year 2025 in the range of $1.5 billion to $1.595 billion. The company aims for The CW Network to achieve profitability by 2026.

Nexstar generated $1.2 billion of Adjusted Free Cash Flow in 2024, returning $820 million, or 68%, to shareholders. The company increased its dividend for the twelfth consecutive year. As of December 31, 2024, outstanding debt was $6.5 billion.

Nexstar Media Group's financial performance and future outlook are shaped by several key factors:

- Nexstar Media Group revenue growth in 2024, driven by political advertising and distribution.

- Anticipated flat distribution revenue in 2025, despite record Q1 2025 performance.

- Impact of reduced political advertising on Q1 2025 revenue and advertising revenue.

- Adjusted EBITDA guidance for 2025 and the goal of The CW Network's profitability by 2026.

- Shareholder returns through dividends and share repurchases, and the current debt position.

Nexstar Media Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Nexstar Media Group’s Growth?

The Media Company, faces several risks that could influence its Growth Strategy and Future Prospects in the evolving media market. These challenges range from fluctuating advertising revenue to regulatory uncertainties and operational hurdles. Understanding these potential obstacles is crucial for assessing the company's long-term viability and investment potential.

A key concern is the ongoing decline in advertising revenue, particularly in non-political advertising, which is influenced by economic conditions and competition. The shift towards streaming services and digital platforms further fragments audiences, affecting viewership and advertising income for traditional broadcasters. Political advertising, while lucrative, is cyclical and can cause significant revenue swings, as seen in the first quarter of 2025.

Regulatory changes also pose a significant risk to the Broadcasting Industry. The company is actively advocating for the removal of broadcast ownership restrictions, such as the national television ownership cap and local television ownership rules. Unfavorable regulatory changes could limit the company's ability to pursue further expansion and consolidation.

The company's advertising revenue is subject to economic cycles and competition from digital platforms. Non-political advertising revenue is vulnerable to economic downturns. Political advertising revenue experiences significant fluctuations linked to election cycles, which can be seen in the 2025 data.

Changes in regulations, particularly regarding ownership restrictions, could limit the company's expansion opportunities. The company is actively involved in advocating for the elimination of these restrictions. Unfavorable regulatory outcomes could hinder the company's growth strategies.

The ability to secure favorable terms for distribution and network affiliation agreements is crucial. Increased programming costs, especially for sports content, can compress margins. The company must manage these operational aspects effectively to maintain profitability.

The company's substantial debt load, reported at $6.5 billion as of December 31, 2024, and related interest expenses could limit its financial flexibility. The company's strategy includes allocating a portion of its free cash flow to shareholders. Managing debt is critical for financial health.

The competitive landscape includes streaming services and digital platforms that attract audiences and advertisers. The company must compete effectively in this evolving environment to maintain its market share. The company's ability to adapt to technological advancements is critical.

The company allocates a budget for legal risk management to cover potential content and broadcasting standard disputes. Legal and regulatory compliance is essential for avoiding penalties and maintaining its broadcasting licenses. This includes adherence to evolving standards.

To address these risks, the company focuses on a diversified revenue model, with over 60% of revenue coming from subscription-based streams. Management emphasizes cost management and operational efficiency through restructuring actions. The adoption of ATSC 3.0 and the exploration of new advertising models are also key. For further insight into the company's financial structure, consider the Revenue Streams & Business Model of Nexstar Media Group.

Economic uncertainty and competition from digital platforms continue to impact advertising revenue. Non-political advertising is particularly susceptible to economic downturns. Political advertising revenue fluctuates significantly based on election cycles, as was evident in Q1 2025.

The company is advocating for the elimination of broadcast ownership restrictions. Unfavorable changes in regulations could limit the company's expansion plans. The outcome of regulatory changes will significantly affect the company's Future Prospects.

Securing favorable terms for distribution and network affiliation agreements is essential for revenue. Increased programming costs, particularly for sports content, can lead to margin compression. Effective operational management is crucial for maintaining profitability.

The company's high debt load and related interest expenses could constrain financial flexibility. The company's strategy includes allocating a portion of free cash flow to shareholders through buybacks and dividends, as well as debt reduction. Managing debt is important for financial stability.

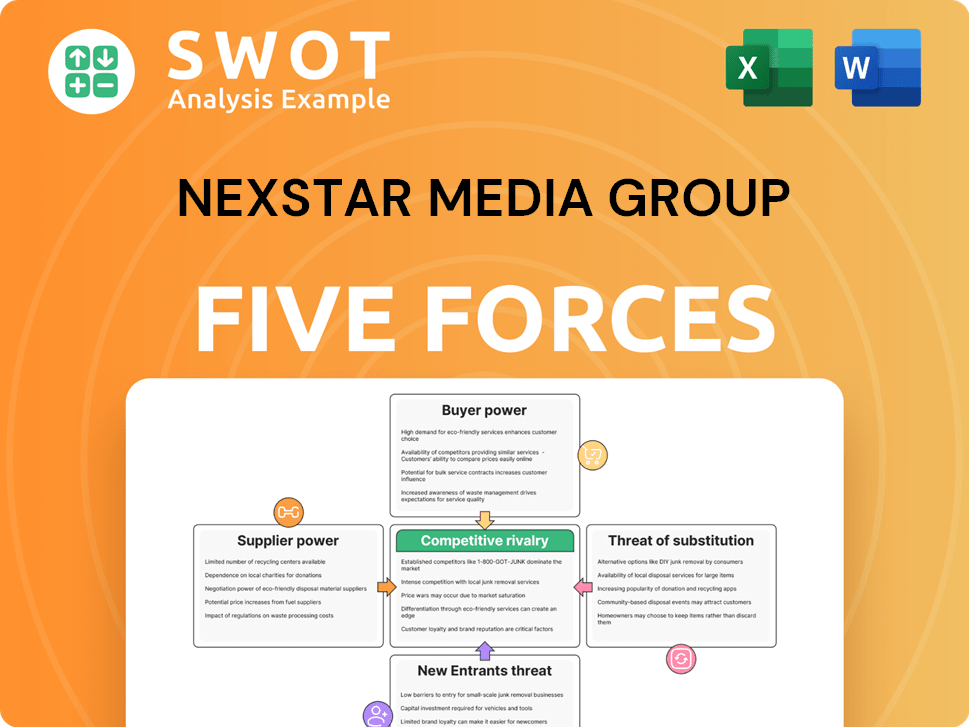

Nexstar Media Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nexstar Media Group Company?

- What is Competitive Landscape of Nexstar Media Group Company?

- How Does Nexstar Media Group Company Work?

- What is Sales and Marketing Strategy of Nexstar Media Group Company?

- What is Brief History of Nexstar Media Group Company?

- Who Owns Nexstar Media Group Company?

- What is Customer Demographics and Target Market of Nexstar Media Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.