Organon Bundle

Can Organon Revolutionize Women's Healthcare?

Since its 2021 spin-off, Organon has boldly entered the pharmaceutical arena, laser-focused on women's health. This strategic shift has positioned Organon as a pioneering force, addressing critical healthcare disparities globally. With a diverse portfolio and a commitment to innovation, Organon is poised for significant growth.

Organon's Organon SWOT Analysis reveals a company aggressively pursuing its mission, operating in 140 markets with a broad range of products. Understanding the Organon growth strategy and Organon future prospects is crucial for investors and industry watchers alike. This Organon company analysis will delve into its strategic initiatives, financial performance, and the potential impact on the Organon pharmaceuticals landscape, including its Organon market share and innovative Organon business model.

How Is Organon Expanding Its Reach?

The company is actively pursuing several expansion initiatives to drive future business growth, focusing on new markets, product launches, and strategic acquisitions. A key area of expansion is its commitment to women's health, where it seeks to address unmet needs globally. This strategy is a core component of the overall Organon growth strategy.

Organon operates in 140 markets, with a significant presence in fast-growing international markets, including servicing 34 countries in Sub-Saharan Africa. This global footprint helps buffer against regional market fluctuations and provides multiple growth avenues. The company's expansion efforts are designed to enhance its market share and solidify its position in the pharmaceutical industry.

In terms of product expansion, Organon's Women's Health segment saw a 10% increase in revenue as-reported and 12% ex-FX in the first quarter of 2025. Nexplanon, a contraceptive implant, continues to be a critical growth engine, with sales up 14% in constant currency in Q1 2025 and on track to exceed $1 billion in annual sales in 2025. These results are indicative of Organon's strong financial performance analysis.

Organon is expanding its presence in emerging markets to tap into new growth opportunities. The company's focus on women's health is particularly relevant in these regions.

The company is actively launching new products and expanding its existing product lines. Nexplanon is a prime example of a successful product launch driving significant revenue growth.

Organon is pursuing strategic acquisitions to expand its product portfolio and enter new therapeutic areas. The acquisition of Dermavant is a key example of this strategy.

Organon is forming partnerships to enhance its market presence and product offerings. The expanded licensing pact with Lilly is a strategic move to boost revenue.

Organon is expanding into new therapeutic areas through strategic acquisitions, such as Dermavant, and strengthening its biosimilars portfolio. These moves are part of Organon's market expansion strategies.

- In September 2024, Organon acquired Dermavant for up to $1.2 billion, gaining access to Vtama (tapinarof) cream 1%, a non-steroidal topical treatment for plaque psoriasis and atopic dermatitis.

- Vtama is projected to achieve $150 million in annual revenue in 2025, with a potential to grow to $0.5 billion over the next three to five years.

- The FDA approval of Vtama for atopic dermatitis in adults and children as young as two years of age significantly expands its eligible patient population.

- In April 2025, Organon acquired the U.S. regulatory and commercial rights to Tofidence (tocilizumab-bavi) from Biogen.

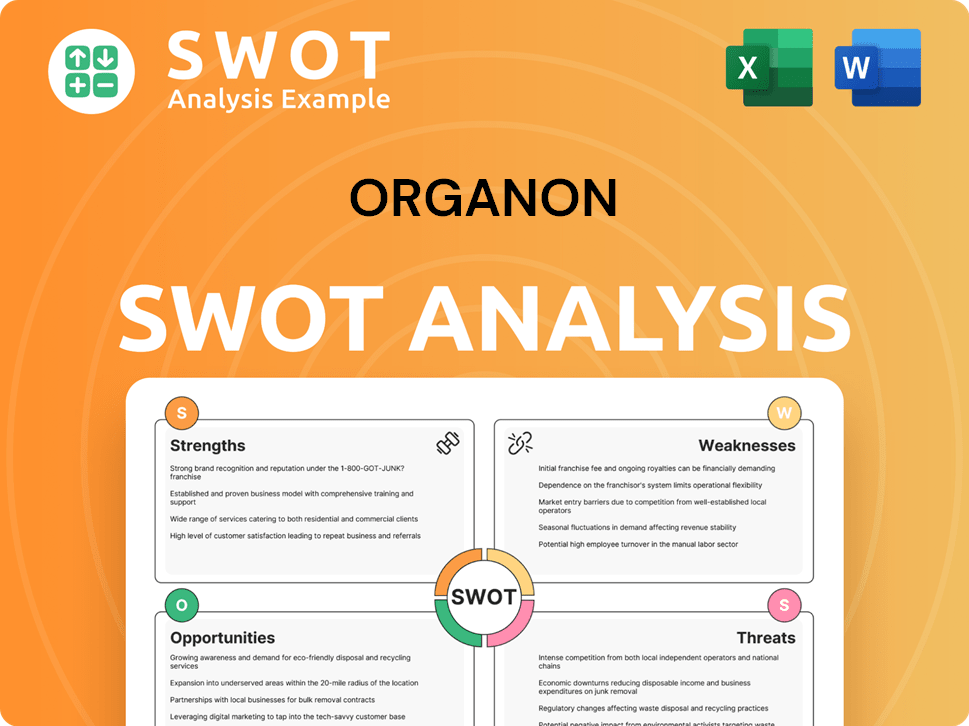

Organon SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Organon Invest in Innovation?

The company's innovation and technology strategy is crucial for its long-term success, focusing on research and development (R&D) and strategic collaborations. This approach is particularly important in the competitive landscape of the pharmaceutical industry, where continuous innovation is essential for maintaining and expanding market share. The company's ability to develop and commercialize novel therapies directly impacts its financial performance and future prospects.

The company's commitment to innovation is evident in its investments in R&D, which are a key component of its growth strategy. By focusing on areas like women's health and biosimilars, the company aims to address unmet medical needs and capitalize on emerging market opportunities. This strategic focus is supported by a robust R&D pipeline and a commitment to bringing new products to market efficiently.

The company leverages its R&D investments to drive future growth opportunities, particularly in women's health and biosimilars. The company's strategic initiatives are designed to enhance its competitive position and deliver value to shareholders. A comprehensive Competitors Landscape of Organon provides further insights into the company's position in the market.

The company's R&D expenditure was approximately 7% of revenue in 2024, excluding acquired in-process research and development (IPR&D). This investment level is expected to remain in the upper single-digit range for 2025, demonstrating a sustained commitment to innovation.

While specific details on cutting-edge technologies like AI or IoT in direct pharmaceutical R&D were not extensively detailed, the company emphasizes a commitment to innovation in its core areas, particularly women's health and biosimilars. This focus aligns with its strategic priorities and market opportunities.

The acquisition of Dermavant in 2024, which brought Vtama into the portfolio, showcases an investment in novel therapies. The company actively pursues opportunities to collaborate with biopharmaceutical partners, leveraging its scale and presence in fast-growing international markets.

The company received recognition from Fortune in 2023 for its work in expanding global access to contraception. It was also recognized by JUST Capital in 2025 as one of America's Most JUST Companies, highlighting its commitment to broader societal impact.

The company's commitment to talent and leadership development is evident through recognitions such as the 'Mentorship Program of the Year' at the 2024 Women Leaders in Pharma Shine Bright Awards for Organon Canada. This supports its long-term growth potential.

'3D Organon' was recognized at the EdTech Awards 2025 for its transformative impact on healthcare education through cutting-edge extended reality (XR) solutions. This indicates a broader trend towards technological advancements in the healthcare training sector.

The company's approach to innovation and technology involves several key strategies aimed at driving growth and maintaining a competitive edge. These strategies include significant R&D investments, strategic acquisitions, and partnerships to expand its product portfolio and market reach. These initiatives support the company's long-term growth potential.

- R&D Investments: Maintaining a consistent level of investment in R&D to support the development of new drugs and therapies.

- Strategic Acquisitions: Acquiring companies and technologies to expand its product offerings and enter new markets.

- Partnerships and Collaborations: Collaborating with biopharmaceutical companies to commercialize products and leverage expertise.

- Focus on Women's Health and Biosimilars: Prioritizing these areas to address unmet medical needs and capitalize on market opportunities.

- Talent Development: Investing in programs to foster talent and leadership within the organization.

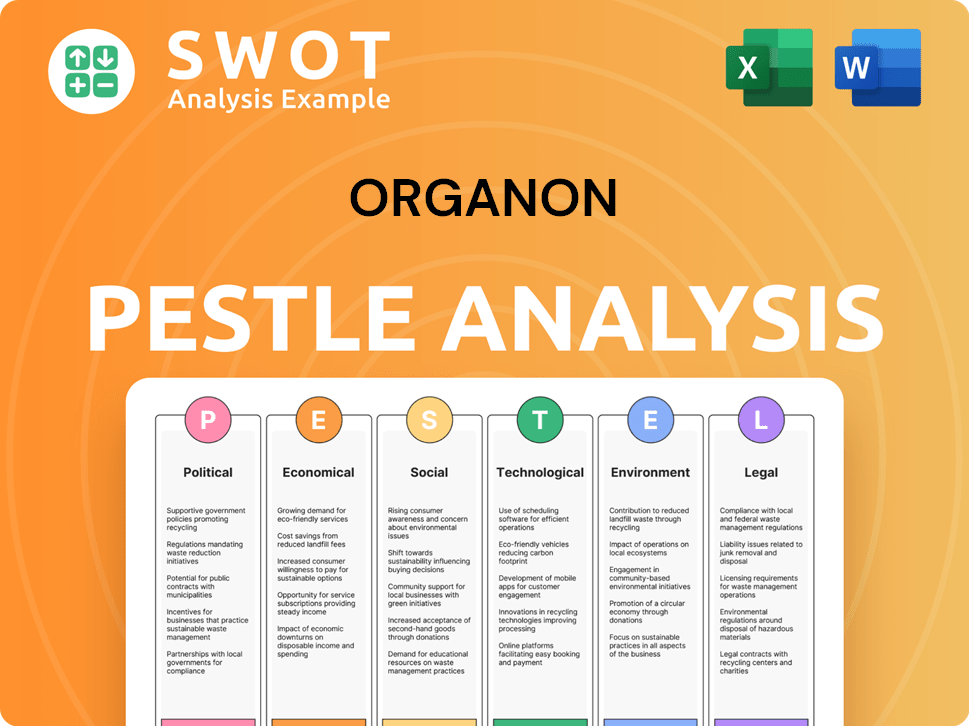

Organon PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Organon’s Growth Forecast?

The financial outlook for Organon in 2025 reveals a strategic approach to navigate both growth opportunities and challenges. The company's Organon growth strategy is focused on balancing expansion in key product areas with the impact of market dynamics. This includes managing the loss of exclusivity (LOE) for certain products while capitalizing on the potential of others.

For the full year 2025, Organon anticipates revenues between $6.125 billion and $6.325 billion. This projection includes a negative impact from foreign exchange, estimated at approximately $200 million. Despite these headwinds, the company is aiming to offset the LOE of certain products with the growth of others. The financial performance analysis will be crucial in assessing the company's progress.

Organon's Organon future prospects are tied to its ability to execute its strategic plan. The company's focus on Women's Health and other key areas is expected to drive revenue. The company's performance in the first quarter of 2025 provides an initial view of its trajectory for the year.

Organon's revenue guidance for 2025 is set between $6.125 billion and $6.325 billion. This range reflects the company's expectations for the year, considering both growth drivers and anticipated challenges. The guidance includes a foreign exchange impact of approximately $200 million.

The company is relying on key products like Nexplanon and Vtama to drive revenue. Nexplanon is on track to achieve at least $1 billion in revenue in 2025, while Vtama is projected to reach $150 million in sales. High-single-digit growth is also expected in the fertility business.

In Q1 2025, Organon reported total revenue of $1.513 billion, down 7% as-reported and 4% ex-FX compared to Q1 2024. Women's Health revenue increased 10% as-reported and 12% ex-FX in Q1 2025. Net income was $87 million, or $0.33 per diluted share.

Non-GAAP Adjusted net income for Q1 2025 was $265 million, or $1.02 per diluted share. The Adjusted EBITDA margin for the full year 2025 is projected to be in the range of 31.0% to 32.0%. The company expects to generate over $900 million of free cash flow before one-time costs in 2025.

Organon has reset its capital allocation priorities, including a revised quarterly dividend of $0.02 per share. The company aims to accelerate progress towards a net leverage ratio below 4.0x by year-end. Net debt edged higher to $8.4 billion in Q1 2025.

Interest expense for full-year 2025 is estimated at $510 million. The non-GAAP tax rate for 2025 is estimated to be in the range of 22.5% to 24.5%. This increase is largely due to the impact of the 15% global minimum tax rate under the OECD's Pillar Two.

The Organon company analysis reveals a pharmaceutical business navigating a dynamic market. The company's strategic initiatives are focused on managing its portfolio and driving growth in key areas. For more insights into the company's origins, you can read the Brief History of Organon.

The company's revenue guidance for 2025 is between $6.125 billion and $6.325 billion. The Organon market share is influenced by the performance of key products like Nexplanon and Vtama. The Women's Health segment is a significant growth driver.

Adjusted EBITDA margin for 2025 is projected to be between 31.0% and 32.0%. Organon expects to generate over $900 million of free cash flow before one-time costs in 2025. The company's Organon business model focuses on sustainable financial performance.

Organon is managing the loss of exclusivity (LOE) of certain products. The company's capital allocation priorities include a revised quarterly dividend of $0.02 per share. The company is focused on deleveraging.

Net debt increased to $8.4 billion in Q1 2025. Interest expense for 2025 is estimated at $510 million. The non-GAAP tax rate for 2025 is expected to be in the range of 22.5% to 24.5%.

The Organon's growth in women's health segment is a key focus. The company is navigating foreign exchange impacts and the loss of exclusivity of certain products. The company's Organon's competitive landscape includes other pharmaceutical companies.

The company's Organon's long-term growth potential relies on the success of key products and strategic initiatives. The company's Organon's market expansion strategies are focused on key areas. Organon's research and development investments will be crucial.

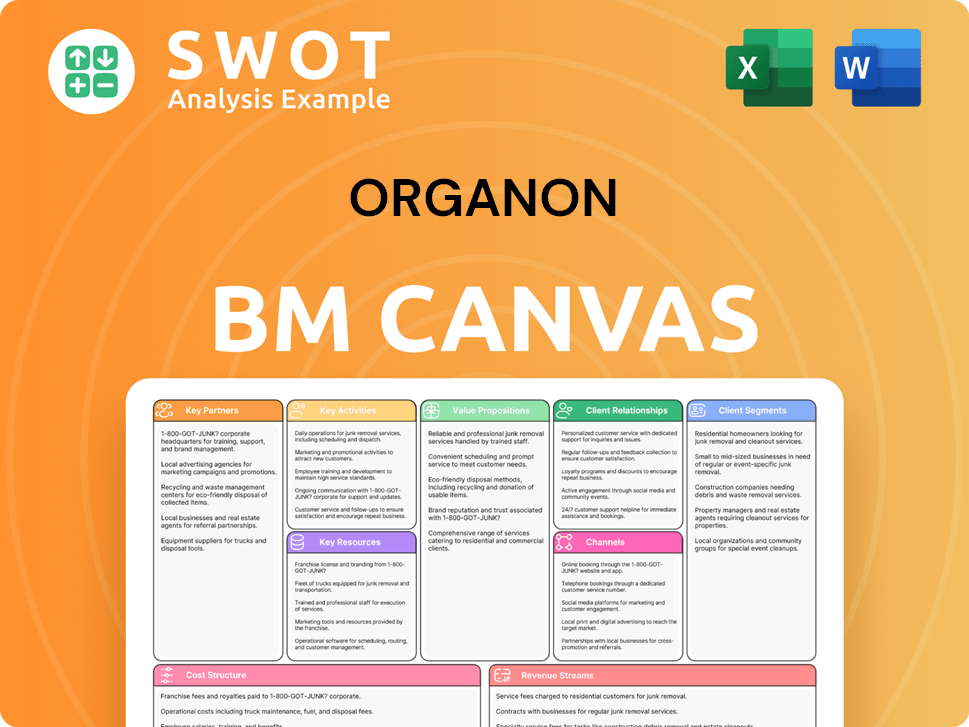

Organon Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Organon’s Growth?

The Organon growth strategy faces several risks and obstacles that could impact its future prospects. These challenges include market competition, patent expirations, regulatory changes, and internal operational shifts. Understanding these potential pitfalls is crucial for assessing the company's long-term performance and making informed investment decisions.

Organon pharmaceuticals is navigating a complex landscape. The loss of exclusivity (LOE) for key products and the rise of biosimilar competition are significant headwinds. Moreover, the company's reliance on emerging markets and the impact of currency fluctuations introduce additional layers of risk.

Internal restructuring and strategic realignments also present challenges. Workforce reductions and changes in the operating model, although aimed at cost savings, can disrupt operations. Recent legal actions and shifts in financial priorities, such as dividend cuts, further complicate the outlook for Organon company analysis.

Organon's market share is threatened by increased competition. Expanded brand and class competition poses a challenge in key markets. The company is actively working to maintain its position amid these competitive pressures.

LOE for products like Atozet in Europe and Japan is a major concern. This has already resulted in a $60 million reduction in sales in Q1 2025. The company is strategizing to mitigate the impact of these losses.

Biosimilar competition is affecting revenue, as seen with Renflexis and Ontruzant. This sector experienced a 17% revenue decline in Q1 2025. Organon's business model must adapt to this competitive environment.

Patent challenges, particularly for Nexplanon, could significantly impact market share. Successful challenges before 2030 could affect profitability. The company is prepared to defend its intellectual property.

Reliance on emerging markets exposes Organon to regulatory and foreign exchange risks. The company anticipates a negative impact of approximately $200 million from foreign currency in 2025. This necessitates careful financial planning.

Workforce reductions and streamlining operations, including layoffs, are ongoing. A recent lawsuit and dividend cut, resulting in a 70% decrease in May 2025, have shaken investor confidence. These internal changes require careful management.

Organon's strategic initiatives involve portfolio diversification. The company is expanding across women's health, biosimilars, and established brands to mitigate individual product risks. This diversification is key to long-term stability.

Deleveraging is a priority, with a target net leverage ratio below 4.0x by the end of 2025. The company is focused on financial discipline to enhance resilience. This helps in managing debt and improving financial health.

Organon's growth in women's health is driven by products like Vtama and Nexplanon. Disciplined cost management is essential to offset revenue headwinds from LOEs. These efforts support the company's future success.

For a deeper understanding of the company's performance, it's beneficial to review a comprehensive analysis of Organon's financial performance analysis. This provides context for the company's challenges and opportunities.

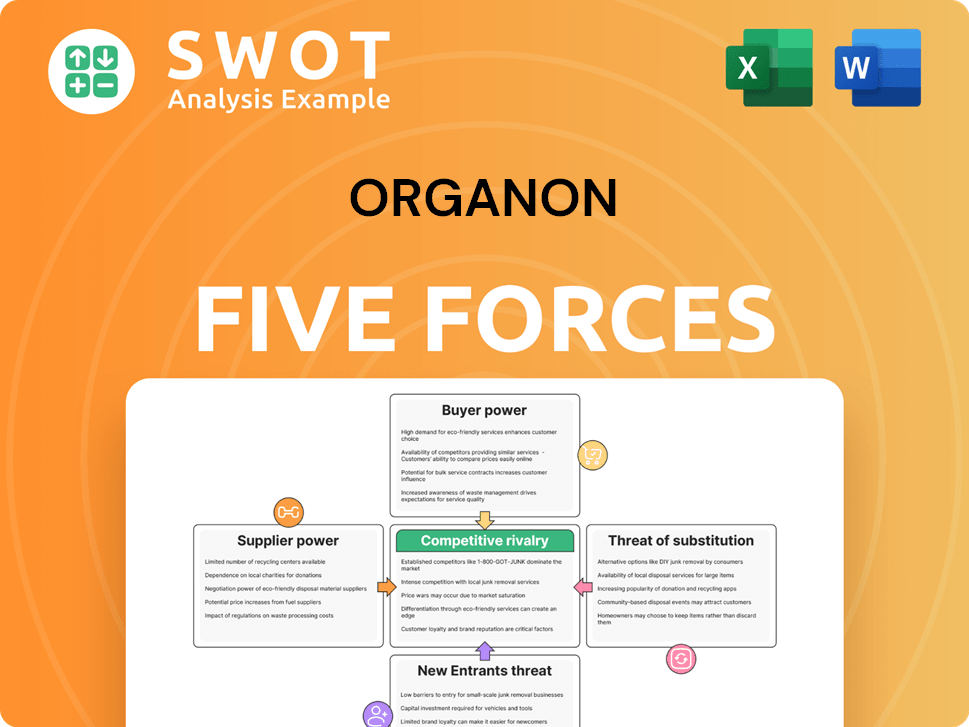

Organon Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Organon Company?

- What is Competitive Landscape of Organon Company?

- How Does Organon Company Work?

- What is Sales and Marketing Strategy of Organon Company?

- What is Brief History of Organon Company?

- Who Owns Organon Company?

- What is Customer Demographics and Target Market of Organon Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.