Petroplus Holdings AG Bundle

What Went Wrong at Petroplus Holdings AG?

Petroplus Holdings AG, once a major player in the Oil Refining industry, offers a stark lesson in the importance of a sound Growth Strategy. From its ambitious beginnings, the company's journey to insolvency highlights the volatile nature of the Energy Sector. This analysis explores the critical factors that led to its downfall, providing valuable insights for understanding the Future Prospects of similar businesses.

While Petroplus Holdings AG itself is in liquidation, understanding its demise offers crucial lessons for today's investors and business strategists. We will examine the elements of a successful Growth Strategy within the Oil Refining sector, including how to analyze Petroplus Holdings AG SWOT Analysis. This exploration will help you understand the impact of oil prices and other industry trends on Financial Performance and long-term outlook.

How Is Petroplus Holdings AG Expanding Its Reach?

Given that Petroplus Holdings AG is in liquidation, direct expansion initiatives are not applicable. However, considering the context of the oil refining industry, this section will explore potential expansion strategies that could have been considered historically.

Expansion initiatives within the oil refining sector typically involve strategies to increase capacity, enter new markets, or diversify product offerings. These strategies aim to enhance profitability and market share. The following are examples of such initiatives, providing a framework for understanding how a company like Petroplus might have pursued growth.

For a company like Petroplus, expansion could have involved acquiring additional refining assets to increase processing capacity or gain access to new geographical markets. This could include purchasing existing refineries or constructing new ones in regions with growing demand for refined products.

Acquiring existing refineries would increase processing capacity. This could lead to higher revenues by increasing the volume of refined products sold. The acquisition of refineries can also provide access to new geographical markets, diversifying the company's revenue streams.

Diversifying into specialty chemicals or biofuels could broaden the revenue base. This reduces the risk associated with fluctuating oil prices. Investing in these areas could offer higher profit margins compared to traditional petroleum products.

Forming partnerships with other energy companies can share investment costs. Joint ventures can leverage complementary expertise, particularly in international markets. This approach is beneficial in regions where establishing a new presence is complex.

Expanding into retail distribution networks or direct sales to industrial consumers could increase control over the value chain. This strategy can lead to higher profit margins by capturing more of the consumer dollar. It also allows for diversification away from reliance on wholesale markets.

In 2024, the global refining capacity is estimated to be around 100 million barrels per day. The expansion into downstream activities would be pursued to access new customer segments, diversify revenue streams away from reliance on wholesale markets, and stay ahead of evolving energy demands and regulatory changes. The oil refining sector is constantly evolving, with a focus on sustainability and efficiency. Refiners are investing in technologies to reduce emissions and improve operational efficiency. These initiatives are crucial for long-term competitiveness.

These expansion strategies aim to enhance refining capacity, diversify product offerings, and enter new markets. Strategic acquisitions and partnerships are essential for growth. Diversification into downstream activities provides greater control over the value chain.

- Acquiring existing refineries to increase capacity.

- Diversifying into specialty chemicals and biofuels.

- Forming partnerships and joint ventures.

- Expanding into retail distribution networks.

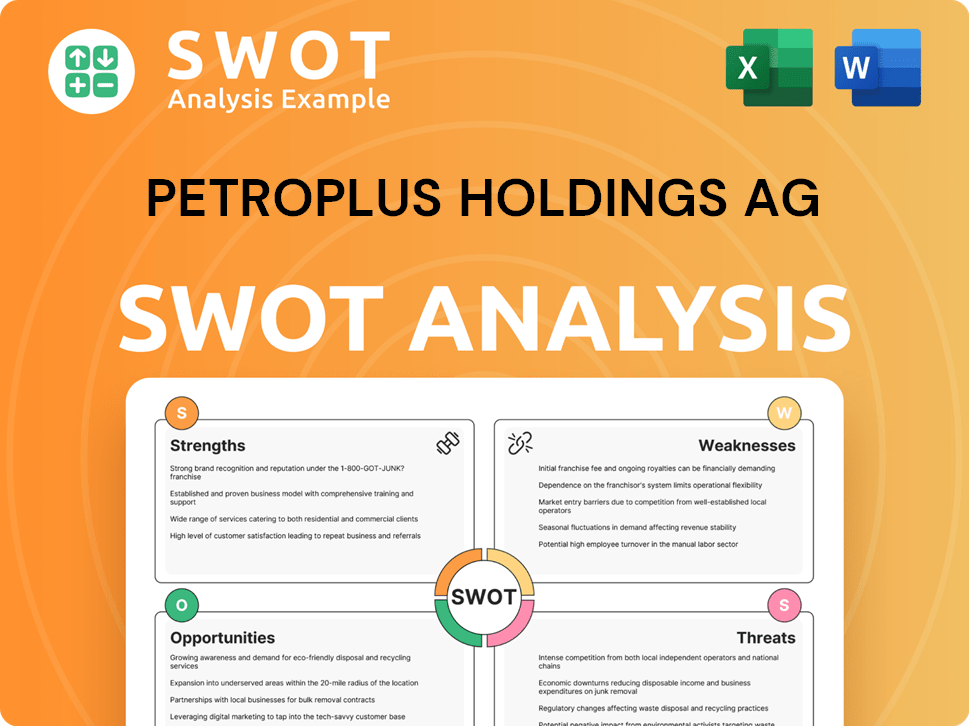

Petroplus Holdings AG SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Petroplus Holdings AG Invest in Innovation?

For a company in the oil refining sector, even if it is no longer operational like Petroplus Holdings AG, a robust innovation and technology strategy is vital for staying competitive and fostering growth. This strategy historically would involve significant investments in research and development (R&D) to enhance refining efficiency, reduce operational expenses, and produce cleaner fuels. These efforts are crucial for addressing the evolving demands of the energy sector.

The core of such a strategy would revolve around improving refining processes. This could include advances in catalyst technology to optimize crude oil conversion rates, which directly impacts the yield of high-value products. Digital transformation would also be key, incorporating automation and advanced analytics across all refining operations. Such technological integrations are designed to improve financial performance.

Sustainability initiatives are increasingly central to innovation in the refining industry, a focus that would have been critical for Petroplus Holdings AG. This involves developing processes to reduce greenhouse gas emissions, investing in carbon capture technologies, and exploring the production of lower-carbon fuels. These moves are essential for long-term growth and adapting to industry trends.

Historically, significant R&D investments would have been crucial for Petroplus Holdings AG. These investments would focus on improving refining efficiency and reducing operational costs. Such investments are a key component of a robust growth strategy.

Digital transformation would have played a pivotal role, with automation and advanced analytics implemented across refining operations. This includes predictive maintenance systems and real-time data analysis for energy optimization. The goal is to enhance supply chain logistics and improve financial performance.

The use of cutting-edge technologies like AI would have been applied to optimize crude feedstock selection and blending. This would lead to more efficient processing and improved product quality. These advancements support the company's strategic goals.

IoT sensors would provide granular data on equipment performance, enabling proactive adjustments and preventing costly disruptions. This would contribute to operational efficiency and cost savings. These technologies are important for the future prospects of the company.

Sustainability initiatives are increasingly central to innovation in the refining industry. This involves developing processes to reduce greenhouse gas emissions and investing in carbon capture technologies. These are key for long-term success.

Collaboration with external innovators, including startups and academic institutions, would accelerate the development and adoption of new technologies. Patents related to novel refining processes or sustainable fuel production would demonstrate leadership in innovation. This helps to create competitive advantages.

For Petroplus Holdings AG, the focus would have been on several key areas to drive growth and maintain a competitive edge. These strategies are crucial for navigating the challenges and opportunities within the energy sector. The company's Mission, Vision & Core Values of Petroplus Holdings AG would have guided these efforts.

- Catalyst Technology: Investing in advanced catalysts to improve crude oil conversion rates and product yields.

- Digitalization: Implementing automation, advanced analytics, and AI to optimize operations and supply chains.

- Sustainability: Developing and adopting technologies to reduce emissions and produce cleaner fuels.

- Collaboration: Partnering with external innovators to accelerate technology development.

- Patents: Securing patents for novel refining processes to create competitive advantages.

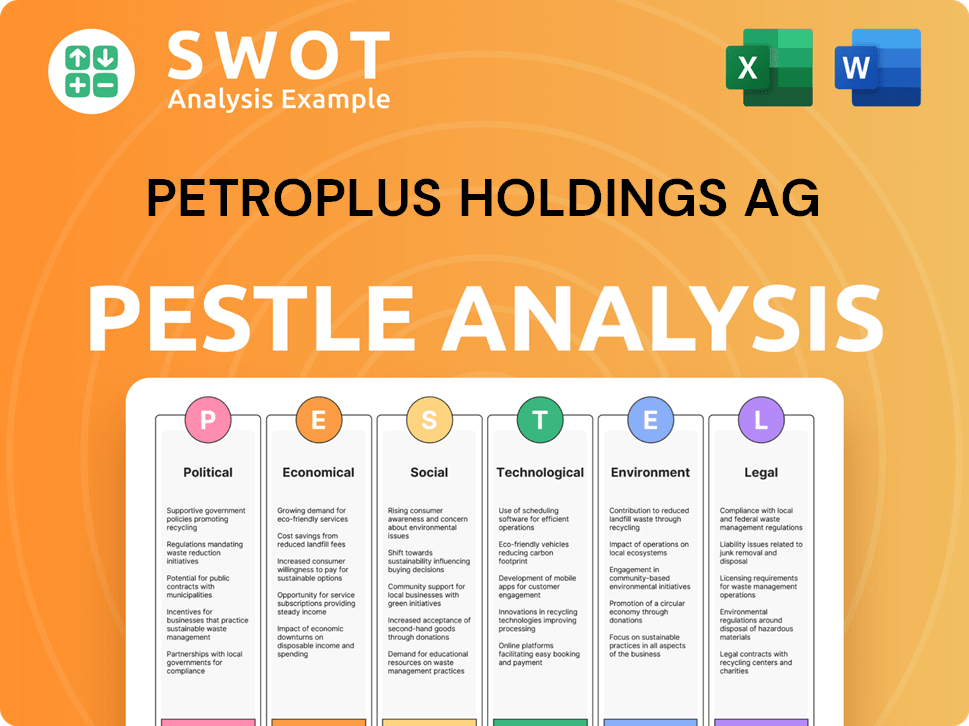

Petroplus Holdings AG PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Petroplus Holdings AG’s Growth Forecast?

Given that Petroplus Holdings AG is in liquidation, the concept of a forward-looking financial outlook is nonexistent. The company is no longer operating, and therefore, does not have revenue targets, profit margin projections, or investment plans. The focus is on the liquidation process, which involves asset sales and settling debts, not on future financial performance or growth strategies.

Historically, in the oil refining sector, a positive financial outlook for a company like Petroplus would have been characterized by several factors. These include stable or increasing revenues, healthy profit margins driven by efficient operations and favorable crack spreads, and strategic investments in capacity upgrades or diversification projects. The financial narrative would emphasize sustainable profitability, efficient capital allocation, and resilience to market volatility.

Prior to its insolvency, Petroplus's financial performance would have been heavily influenced by global oil prices, refining margins, and the demand for refined products in its key markets. A robust financial outlook would have included clear guidance on capital expenditure plans, a strong balance sheet, and access to capital for future investments. However, with the company's current status, these considerations are no longer applicable.

Before its collapse, Petroplus's financial health was subject to the volatile nature of the oil market. The company's performance was significantly impacted by fluctuations in crude oil prices and refining margins. These factors directly influenced revenue, profitability, and overall financial stability. In the years leading up to its insolvency, the company faced challenges in maintaining consistent financial results due to these market dynamics.

Key financial metrics for a refining company like Petroplus would include revenue, cost of goods sold (COGS), gross profit, operating expenses, and net income. Profit margins, such as gross margin and net margin, would be critical indicators of operational efficiency and profitability. Furthermore, metrics like EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and cash flow from operations would be crucial for assessing the company's ability to generate cash and service its debt.

The price of crude oil and refining margins are the two most critical external factors influencing the financial performance of a refining company. High crude oil prices can increase the cost of raw materials, while favorable refining margins (the difference between the price of refined products and the cost of crude oil) can boost profitability. The ability to manage these factors effectively is essential for maintaining a positive financial outlook. In 2024 and 2025, these factors continue to be highly volatile, impacting the industry.

Capital expenditure (CAPEX) is a significant aspect of the financial outlook for an oil refining company. Investments in maintenance, upgrades, and expansion of refining capacity are essential for maintaining operational efficiency and competitiveness. A company with a strong financial outlook would have a clear CAPEX plan, supported by a robust balance sheet and access to capital. Without these investments, the company's long-term viability is at risk.

Debt levels and financial strategy are crucial components of a refining company's financial outlook. High debt levels can increase financial risk and limit flexibility. A sound financial strategy would involve managing debt levels, optimizing capital structure, and ensuring access to capital for future investments. Debt restructuring or equity financing may be undertaken to support growth plans or navigate challenging market conditions. The goal is to maintain financial stability and resilience.

Comparing financial ambitions to historical performance and industry benchmarks is crucial for assessing the viability of growth strategies. For instance, a company might aim to achieve profit margins above the industry average by leveraging technological efficiencies or superior market positioning. Understanding the competitive landscape and the performance of peers is essential for evaluating a company's financial outlook. This analysis helps in setting realistic targets and identifying areas for improvement.

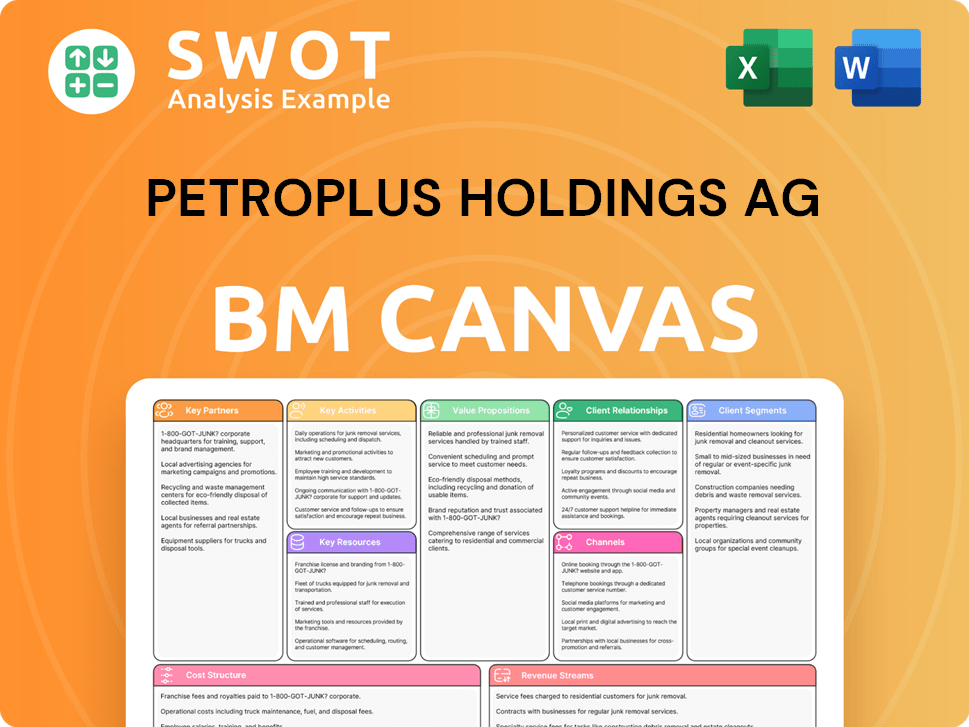

Petroplus Holdings AG Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Petroplus Holdings AG’s Growth?

Understanding the potential risks and obstacles is crucial for any company in the oil refining sector, even one like Petroplus Holdings AG that is no longer operational. These risks can significantly impact a company's growth strategy and future prospects. Several factors, from market competition to regulatory changes, can pose substantial challenges.

The refining industry faces numerous hurdles, including overcapacity and intense price wars. Furthermore, evolving environmental regulations necessitate costly investments, particularly in cleaner technologies. Supply chain disruptions and volatile crude oil prices also present significant risks. These challenges directly affect the financial performance of companies in the energy sector.

Technological advancements and internal resource constraints add further complexity. Adapting to new refining processes and the emergence of alternative fuels are critical. Shortages of skilled labor or insufficient capital for modernization can also hinder growth. This multifaceted risk landscape demands careful consideration for long-term success.

Intense competition, characterized by overcapacity in refining, can lead to price wars, impacting profit margins. The competitive landscape requires constant strategic adaptation. Companies need to differentiate themselves to maintain a competitive edge.

Evolving environmental regulations, such as those promoting decarbonization, necessitate significant investments. Compliance costs can be substantial, potentially affecting financial performance. The industry must adapt to stay competitive.

Disruptions in crude oil supply due to geopolitical instability, natural disasters, or transportation issues pose a risk. Companies must manage these vulnerabilities effectively. Diversifying crude oil sources is a key strategy.

Fluctuations in crude oil prices and refined product demand can severely impact profitability. Hedging strategies and robust risk management are crucial. The ability to adapt to market changes is essential.

Failure to adapt to new refining processes or alternative fuels can diminish demand. Innovation and investment in new technologies are vital. Staying ahead of industry trends is a necessity.

Shortages of skilled labor or insufficient capital for modernization can hinder growth. Strategic workforce planning and investment in infrastructure are critical. Effective resource allocation is key.

Management in the refining industry typically addresses these risks through several strategies. Diversification of crude oil sources and product offerings helps mitigate supply chain risks. Robust risk management frameworks, including hedging strategies, protect against price volatility. Scenario planning prepares for various market conditions. For example, a company might invest in diverse crude grades to reduce reliance on a single source. To understand the financial health of such companies, one can analyze Revenue Streams & Business Model of Petroplus Holdings AG.

Diversifying crude oil sources reduces reliance on single suppliers, mitigating supply chain risks. This approach enhances the stability of operations. Diversification also extends to product offerings, such as biofuels, to adapt to changing market demands.

Implementing robust risk management frameworks is essential. Hedging strategies help mitigate price volatility. Scenario planning prepares for various market conditions, allowing for proactive responses. Risk management ensures financial stability.

Investing in new technologies is vital for adapting to evolving refining processes. This includes exploring alternative fuels and cleaner production methods. Technological advancements are essential for staying competitive.

Forming strategic partnerships can provide access to new markets and technologies. Collaborations can enhance refining capacity and efficiency. Partnerships help in navigating challenges and exploiting opportunities.

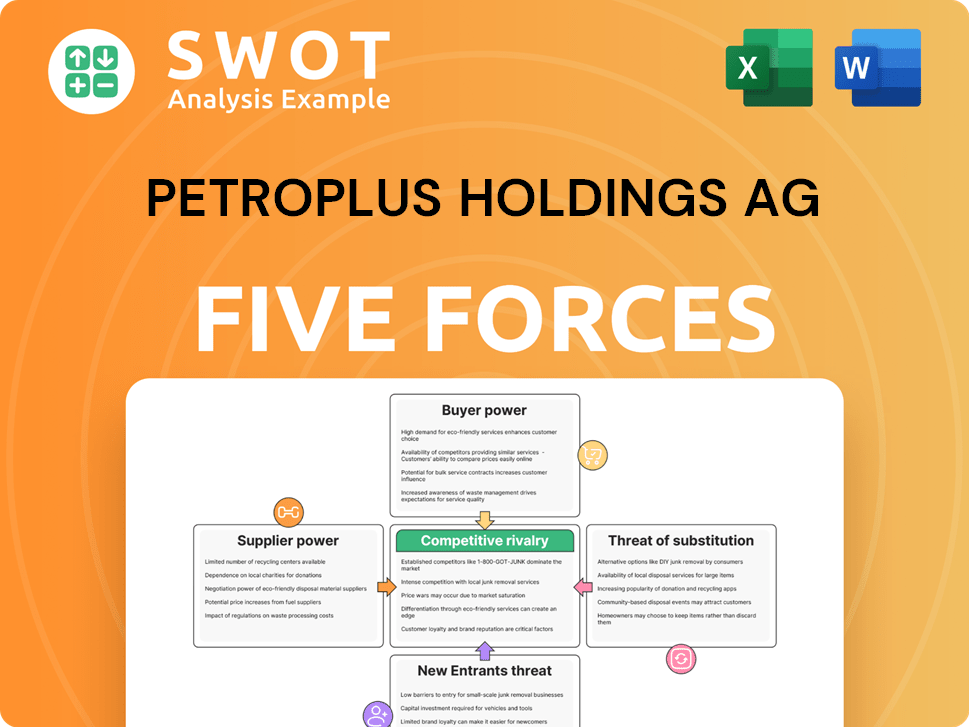

Petroplus Holdings AG Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Petroplus Holdings AG Company?

- What is Competitive Landscape of Petroplus Holdings AG Company?

- How Does Petroplus Holdings AG Company Work?

- What is Sales and Marketing Strategy of Petroplus Holdings AG Company?

- What is Brief History of Petroplus Holdings AG Company?

- Who Owns Petroplus Holdings AG Company?

- What is Customer Demographics and Target Market of Petroplus Holdings AG Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.