Pinnacle Financial Partners Bundle

How is Pinnacle Financial Partners Shaping Its Future?

In an era where financial institutions must constantly adapt, understanding a company's growth strategy is crucial. This analysis delves into Pinnacle Financial Partners, a leading financial services provider, and its approach to navigating the complexities of the modern market. We'll explore how Pinnacle Financial Partners is not just surviving but thriving, focusing on its strategic initiatives and future outlook.

From its inception in 2000, Pinnacle Financial Partners has demonstrated a commitment to strategic planning and sustainable growth. The company's journey, marked by significant expansion and a strong market presence, offers valuable insights into bank performance and effective strategic initiatives. To further understand their position, consider a detailed Pinnacle Financial Partners SWOT Analysis, which provides a comprehensive view of their strengths, weaknesses, opportunities, and threats, crucial for understanding their future prospects and investment opportunities.

How Is Pinnacle Financial Partners Expanding Its Reach?

The growth strategy of Pinnacle Financial Partners is firmly rooted in organic expansion, strategic market entry, and opportunistic team acquisitions. Their primary focus is on the high-growth markets of the Southeastern United States. This region presents significant opportunities for financial services, driven by population and business growth.

Pinnacle's approach involves deepening its presence in established markets like Nashville, Atlanta, and Charlotte, while strategically entering new metropolitan areas. This dual strategy allows for both consolidation in key areas and expansion into promising new markets. The company's success is closely tied to its ability to capitalize on the economic vitality of the Southeast.

A key element of Pinnacle's expansion strategy is its de novo approach, which involves establishing new offices and recruiting experienced banking teams in target markets. This strategy allows the company to build a strong local presence and attract clients who value relationship-based banking, which is a cornerstone of Pinnacle's business model.

Pinnacle establishes new offices and recruits experienced banking teams. This strategy allows the company to build a strong local presence. The de novo strategy is a key component of their expansion plans.

Pinnacle recruits entire teams of experienced bankers from competitors. This brings established client relationships and expertise. Team lifts are a strategic move to quickly expand the client base and market share.

The primary focus is on high-growth markets in the Southeastern United States. This region experiences significant population and business growth. Pinnacle aims to deepen its presence in existing markets.

Pinnacle continuously enhances its service offerings. This includes banking, investment, trust, and insurance services. The goal is to meet the evolving needs of the client base.

Pinnacle's growth strategy involves a blend of organic expansion, strategic market entry, and opportunistic team lifts. The company's focus on the Southeastern United States positions it well for future growth. For a deeper understanding of the competitive landscape, consider reading about the Competitors Landscape of Pinnacle Financial Partners.

- De novo expansion into new markets.

- Recruiting experienced banking teams.

- Continuous enhancement of service offerings.

- Focus on high-growth markets.

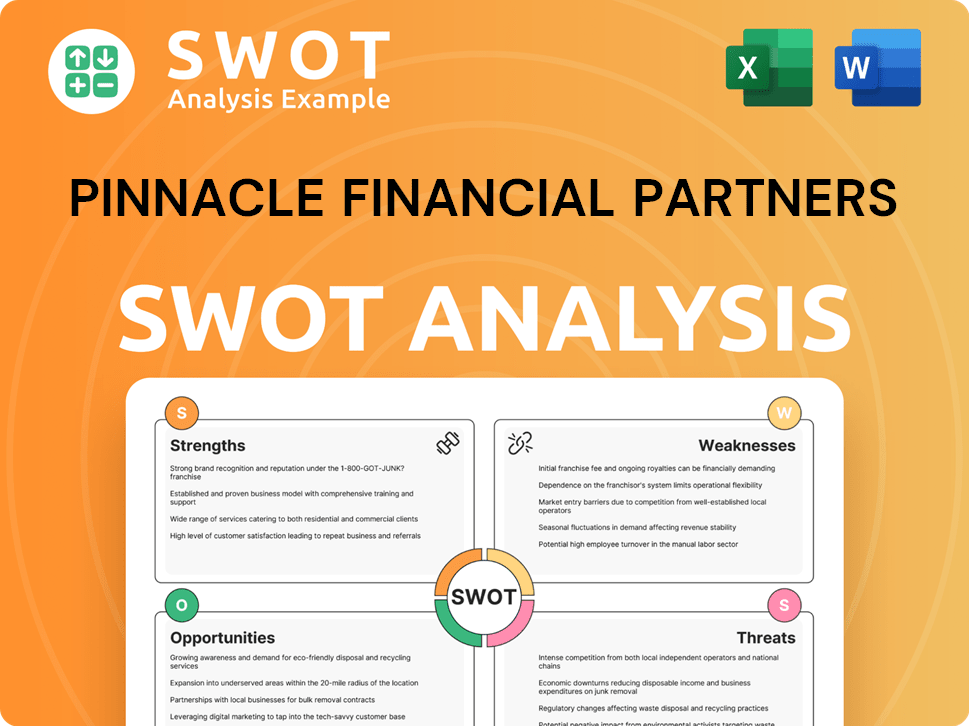

Pinnacle Financial Partners SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Pinnacle Financial Partners Invest in Innovation?

Pinnacle Financial Partners prioritizes technology and innovation to enhance client experiences, improve operational efficiency, and support sustained growth. The company strategically invests in digital transformation to provide seamless and convenient banking services. This approach includes ongoing development of its online and mobile banking platforms, ensuring clients have access to a full range of services from anywhere.

The focus is on user-friendly interfaces and robust security features to build client trust and loyalty. This commitment to technological advancement is crucial for maintaining a competitive edge in the evolving financial services landscape. The company aims to meet the changing needs and preferences of its customers through continuous innovation.

Pinnacle's technology strategy is often centered on integrating advanced tools to support its relationship-based banking model. This involves utilizing data analytics to better understand client needs and deliver personalized advice, a core tenet of Pinnacle's value proposition. While specific details on R&D investments or patents are not typically disclosed for regional banks, Pinnacle's commitment to technology is evident in its continuous efforts to streamline internal processes through automation, which contributes to improved efficiency and allows its associates to focus more on client engagement. The adoption of new digital capabilities aims to enhance the overall client journey, from account opening to complex financial planning, ultimately contributing to client acquisition and retention, and thus, growth objectives.

Pinnacle Financial Partners continually updates its online and mobile banking platforms. These platforms offer a wide range of services, ensuring clients can manage their finances from anywhere. The focus is on user-friendly interfaces and strong security measures to build client trust.

The company uses data analytics to understand client needs and offer personalized advice. This approach supports Pinnacle's relationship-based banking model. Data-driven insights help in delivering tailored financial solutions.

Pinnacle streamlines internal processes through automation. This improves efficiency and allows associates to focus on client engagement. Automation enhances operational effectiveness and supports growth.

New digital capabilities improve the client journey from start to finish. This includes account opening and complex financial planning. Enhanced digital tools aid in client acquisition and retention.

Pinnacle's commitment to technology is evident in its continuous efforts to streamline internal processes through automation, which contributes to improved efficiency and allows its associates to focus more on client engagement. The adoption of new digital capabilities aims to enhance the overall client journey, from account opening to complex financial planning, ultimately contributing to client acquisition and retention, and thus, growth objectives.

Pinnacle prioritizes robust security features to protect client data and build trust. Strong security measures are integrated into all digital platforms. This focus is essential for maintaining client confidence and loyalty.

Pinnacle Financial Partners' Revenue Streams & Business Model of Pinnacle Financial Partners shows that the company's strategic investments in technology are designed to support its growth strategy. These investments are aimed at improving operational efficiency and enhancing the client experience. The company's digital transformation efforts are crucial for maintaining a competitive edge in the financial services sector. These efforts are focused on providing convenient and secure banking services, which are key factors in attracting and retaining customers. The company's focus on technology is directly linked to its long-term goals.

Pinnacle's technology strategy encompasses several key initiatives aimed at enhancing its services and operational efficiency. These initiatives support the company's overall growth strategy.

- Digital Banking Platforms: Continuous updates and enhancements to online and mobile banking platforms.

- Data Analytics: Utilizing data analytics to understand client needs and provide personalized financial advice.

- Automation: Streamlining internal processes through automation to improve efficiency and reduce costs.

- Cybersecurity: Implementing robust security measures to protect client data and maintain trust.

- Integration of Advanced Tools: Integrating new tools to support the relationship-based banking model.

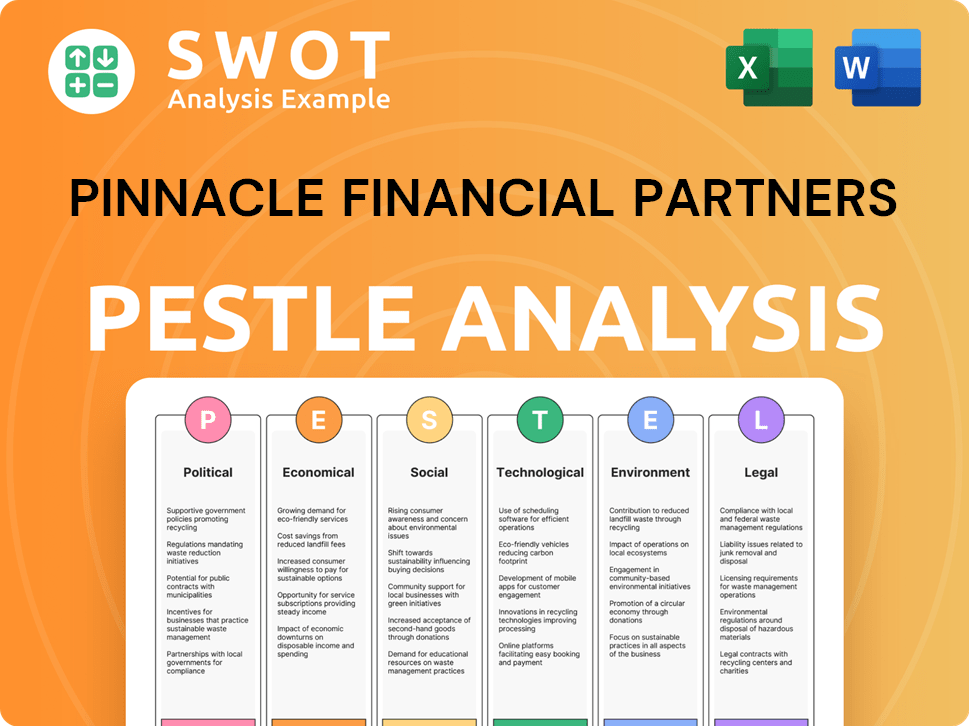

Pinnacle Financial Partners PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Pinnacle Financial Partners’s Growth Forecast?

The financial outlook for Pinnacle Financial Partners is robust, underpinned by consistent growth in key financial metrics. The company's performance in the financial services sector reflects a strategic approach to expansion and market penetration. This positive trajectory is supported by a strong presence in the Southeast, where the company has been actively pursuing growth opportunities.

As of March 31, 2024, Pinnacle Financial Partners reported total assets of $48.97 billion, demonstrating its substantial scale and market position. Deposits reached $37.03 billion, and loans totaled $35.32 billion, indicating a healthy balance sheet and active lending operations. These figures are indicative of the company's ability to attract and manage significant financial resources, which is crucial for sustainable growth.

The company's financial health is further evidenced by its net income and earnings per share. For the first quarter of 2024, Pinnacle reported net income of $150.1 million, translating to diluted earnings per share of $1.99. This performance builds on a successful 2023, where the company achieved diluted earnings per share of $6.97. The net interest margin for the first quarter of 2024 stood at 3.03%, reflecting efficient management of interest-earning assets and interest-bearing liabilities.

Pinnacle Financial Partners' financial performance showcases its ability to generate consistent profits and manage its assets effectively. The company's strategic planning and focus on customer relationships have contributed to its robust financial results. These factors position the company favorably for future growth and expansion within the financial services industry.

Key financial metrics, such as total assets, deposits, and loans, underscore the company's significant presence in the market. Total assets reached $48.97 billion, deposits were at $37.03 billion, and loans totaled $35.32 billion as of March 31, 2024. These figures highlight the company's financial strength and its ability to support its growth strategy.

Analyst forecasts generally anticipate continued positive performance for Pinnacle Financial Partners. These projections are based on expectations of sustained revenue growth, driven by the company's expansion initiatives and its strong market presence in the Southeast. The company's focus on relationship banking and attracting high-value clients is expected to support its profitability.

Pinnacle Financial Partners aims to maintain healthy profit margins and continues to invest in its human capital and technology to support future expansion. These strategic initiatives are designed to enhance its competitive advantage and drive long-term sustainable growth. For more insights into the company's approach, consider exploring the Marketing Strategy of Pinnacle Financial Partners.

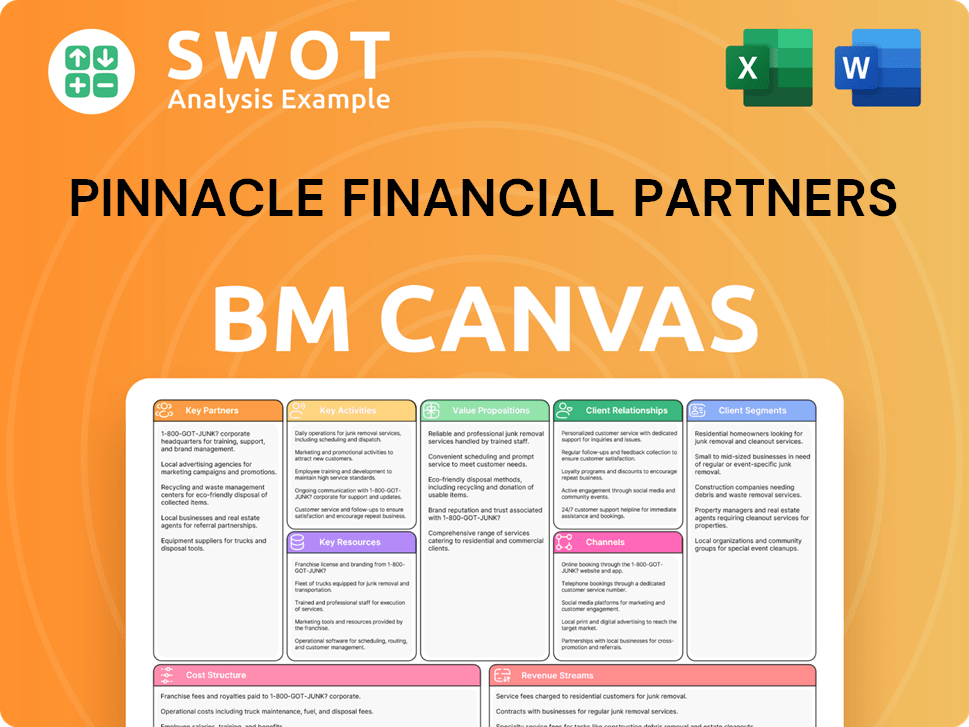

Pinnacle Financial Partners Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Pinnacle Financial Partners’s Growth?

The Growth Strategy and Future Prospects of Pinnacle Financial Partners are subject to several potential risks and obstacles. These challenges include intense competition within the Financial Services industry and the need to navigate evolving regulatory landscapes. Furthermore, the company must adapt to rapid technological advancements and economic fluctuations, all of which can impact its Bank Performance.

Pinnacle Financial Partners faces significant market competition from larger national banks and agile fintech firms, especially in the Southeastern U.S., where it operates. Regulatory changes, including capital requirements and compliance mandates, present ongoing challenges that require constant adaptation and investment. Additionally, the company must continuously invest in technology to remain competitive amidst rapid innovation in areas like artificial intelligence and data analytics.

Economic downturns or regional slowdowns in the Southeast could adversely affect loan demand and credit quality, influencing overall financial performance. Pinnacle Financial Partners addresses these risks through a diversified approach, offering a broad range of financial products and services. They also maintain a robust credit risk management framework and focus on personalized client relationships to mitigate price-driven competition. For more information, you can check out Owners & Shareholders of Pinnacle Financial Partners.

Intense competition from national banks and fintech companies can pressure pricing and client acquisition. This demands continuous innovation and strategic adjustments to maintain Pinnacle Financial Partners' market share.

Evolving banking regulations, capital requirements, and compliance mandates can increase operational costs. This requires constant adaptation and investment in compliance infrastructure to ensure Strategic Planning remains effective.

Rapid innovation in areas like AI and blockchain could create new competitive pressures. Pinnacle Financial Partners must invest in technology to stay competitive and meet evolving customer expectations.

Economic slowdowns in the Southeast could impact loan demand and credit quality. This requires proactive risk management and careful monitoring of Financial Performance Analysis metrics.

Potential cyber threats and data security breaches necessitate continuous investment in robust cybersecurity measures. Protecting client information and maintaining trust are critical for Future Prospects.

Changes in interest rates can affect profitability and asset values. Pinnacle Financial Partners must manage interest rate risk effectively to maintain financial stability.

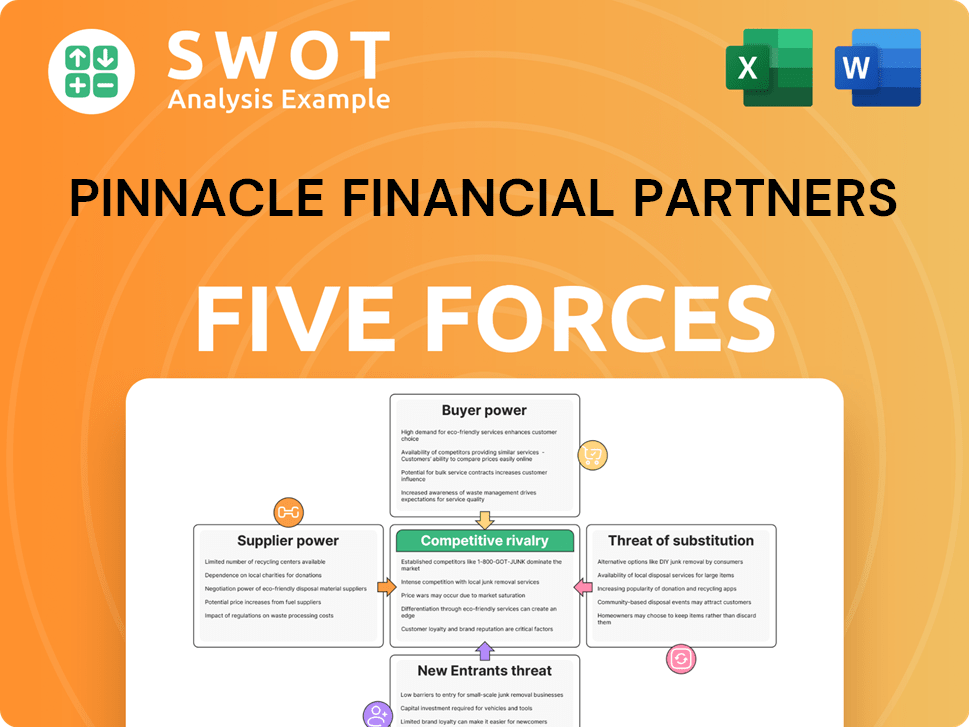

Pinnacle Financial Partners Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Pinnacle Financial Partners Company?

- What is Competitive Landscape of Pinnacle Financial Partners Company?

- How Does Pinnacle Financial Partners Company Work?

- What is Sales and Marketing Strategy of Pinnacle Financial Partners Company?

- What is Brief History of Pinnacle Financial Partners Company?

- Who Owns Pinnacle Financial Partners Company?

- What is Customer Demographics and Target Market of Pinnacle Financial Partners Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.