QCR Holdings Bundle

Can QCR Holdings Continue Its Impressive Growth Trajectory?

Founded in 1993, QCR Holdings, Inc. has evolved from a single bank to a regional financial powerhouse, boasting $9.2 billion in assets as of March 2025. This journey, built on a foundation of client relationships, offers a compelling story of strategic growth in the competitive banking sector. But what are the QCR Holdings SWOT Analysis and the company's plans for the future?

This analysis delves into QCR Holdings' ambitious Growth Strategy and explores its Future Prospects, examining how the company plans to navigate the evolving financial landscape. We'll dissect the company's Financial Performance, assess its Investment Portfolio diversification, and analyze its Business Development initiatives. Understanding QCR Holdings' strategic planning process is key to evaluating its long-term growth potential and market share in the banking sector, making it a crucial read for investors and strategists alike.

How Is QCR Holdings Expanding Its Reach?

QCR Holdings' Growth Strategy focuses on strengthening its position within its existing markets. This approach emphasizes organic growth in loans and deposits, supported by a relationship-driven community banking model. The company aims to optimize its capital for future expansion and sustained financial performance.

The company's expansion strategy includes both organic growth and strategic adjustments to its business lines. While acquisitions have been a part of its history, recent moves suggest a more focused approach to core banking services and wealth management. This strategic realignment aims to enhance its capital position and drive future growth.

The company is committed to maintaining a strong regulatory capital position and targeting tangible common equity in the top quartile of its peer group. This is supported by initiatives like securitization and a focus on wealth management and LIHTC lending. The company's strategic plan, known as '9-6-5,' further underlines its disciplined approach to expansion.

QCR Holdings anticipates gross loan growth between 8% and 10% for the full year 2025. This growth is expected to be fueled by new core deposits. The company saw a robust increase of $332.2 million, or 20% annualized, in core deposits in the first quarter of 2025.

In September 2024, the company discontinued offering new loans and leases through its m2 Equipment Finance subsidiary. A significant securitization of approximately $350 million is planned for 2025, which aims to free up capital for new loans and improve its return on assets.

Wealth management revenue grew by 14% annualized in the first quarter of 2025. This diversification, along with a focus on LIHTC lending, demonstrates efforts to access new customer segments and adapt to industry changes.

The company operates 36 locations across Iowa, Missouri, and Illinois. Its '9-6-5' strategic model (9% loan growth, 6% fee income growth, and 5% expense growth) supports its disciplined approach to expansion and financial performance.

The Future Prospects for QCR Holdings are tied to its ability to execute its strategic initiatives, manage its capital effectively, and adapt to changes in the financial services industry. The company's focus on organic growth, strategic realignment, and revenue diversification positions it for sustained financial performance.

- Continued focus on organic loan and deposit growth.

- Strategic use of securitization to free up capital.

- Expansion of wealth management and LIHTC lending.

- Disciplined execution of the '9-6-5' strategic model.

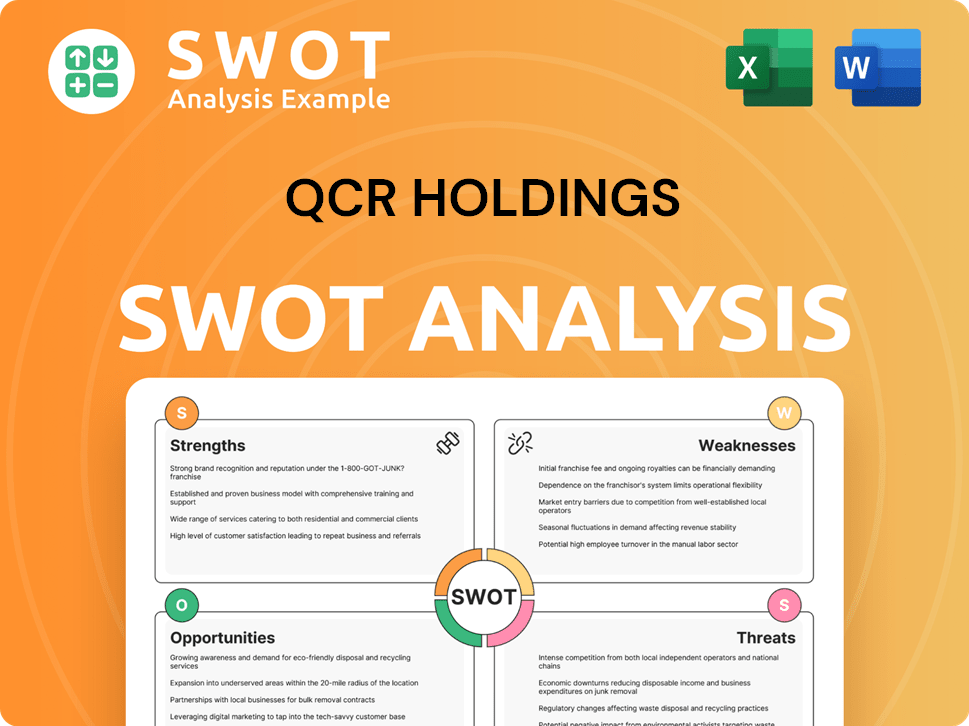

QCR Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does QCR Holdings Invest in Innovation?

The innovation and technology strategy of QCR Holdings is crucial for its sustained growth and future prospects. The company leverages technology to enhance operational efficiency and meet evolving customer demands. This approach is particularly important in the commercial banking sector, where digital transformation is reshaping the landscape.

QCR Holdings focuses on digital banking platforms and strategic technological integration to drive growth. While specific details about extensive R&D investments are not readily available, the company's commitment to technology is evident in its efforts to improve efficiency and customer service. This strategic focus aligns with broader industry trends, such as the adoption of AI to combat fraud and strengthen client relationships.

QCR Holdings' commitment to technology is implicitly tied to its operational efficiency and client-centric model. For instance, in the first quarter of 2025, QCR Holdings demonstrated disciplined expense management, with noninterest expenses decreasing by 13% from the prior quarter, which can be partly attributed to operational efficiencies, potentially driven by technological advancements. Furthermore, the banking industry as a whole is increasingly embracing advanced technologies like AI to combat payment fraud and strengthen client relationships, suggesting that QCR Holdings, as a regional bank, is likely aligning with these broader trends to maintain its competitive edge.

QCR Holdings utilizes digital banking platforms to enhance customer experience and streamline operations. These platforms provide convenient access to banking services, supporting the company's client-centric model. The focus on digital solutions is crucial for attracting and retaining customers in today's competitive market.

The company strategically integrates technology across various aspects of its business. This includes automating processes, improving data analytics, and enhancing cybersecurity measures. Such integration supports operational efficiency and helps the company stay competitive.

Technological advancements contribute to operational efficiency, allowing QCR Holdings to reduce costs and improve service delivery. For example, in Q1 2025, noninterest expenses decreased by 13%, which indicates the impact of technology on cost management. Enhanced efficiency is a key driver of financial performance.

QCR Holdings prioritizes customer needs by offering innovative digital solutions. This customer-centric approach helps the company build strong relationships and increase customer satisfaction. Meeting customer expectations is crucial for long-term growth.

The company is likely aligning with industry trends by embracing advanced technologies like AI. AI can be used to combat payment fraud and enhance client relationships. This proactive approach helps QCR Holdings maintain a competitive edge.

QCR Holdings supports its local community banks through a Group Operations team. This team delivers centralized and efficient operational services. This structure allows individual banks to tailor products and services while benefiting from the resources of a larger institution.

QCR Holdings' strategic focus includes supporting its local community banks with a Group Operations team that delivers centralized and efficient operational services. This structure allows individual banks to tailor products and services to their communities while benefiting from the resources and potentially advanced technological capabilities of a larger financial institution. The company's vision of 'Exceptional people providing extraordinary performance for our clients, shareholders, and communities' and its value of 'Innovation - We embrace change' further underscore its commitment to adapting and evolving through technological means to achieve its growth objectives. To understand the company's roots, consider reading a Brief History of QCR Holdings.

QCR Holdings' technological strategy is multifaceted, focusing on several key areas to drive growth and improve operational efficiency. These initiatives are crucial for maintaining a competitive edge and meeting the evolving needs of customers.

- Digital Banking Platforms: Enhancing mobile and online banking services to provide customers with convenient access to their accounts and financial tools.

- Data Analytics: Utilizing data analytics to gain insights into customer behavior, improve decision-making, and personalize services.

- Automation: Automating various processes to reduce manual effort, improve accuracy, and increase efficiency.

- Cybersecurity: Investing in robust cybersecurity measures to protect customer data and prevent fraud.

- AI Integration: Exploring and implementing AI technologies to enhance customer service, detect fraud, and streamline operations.

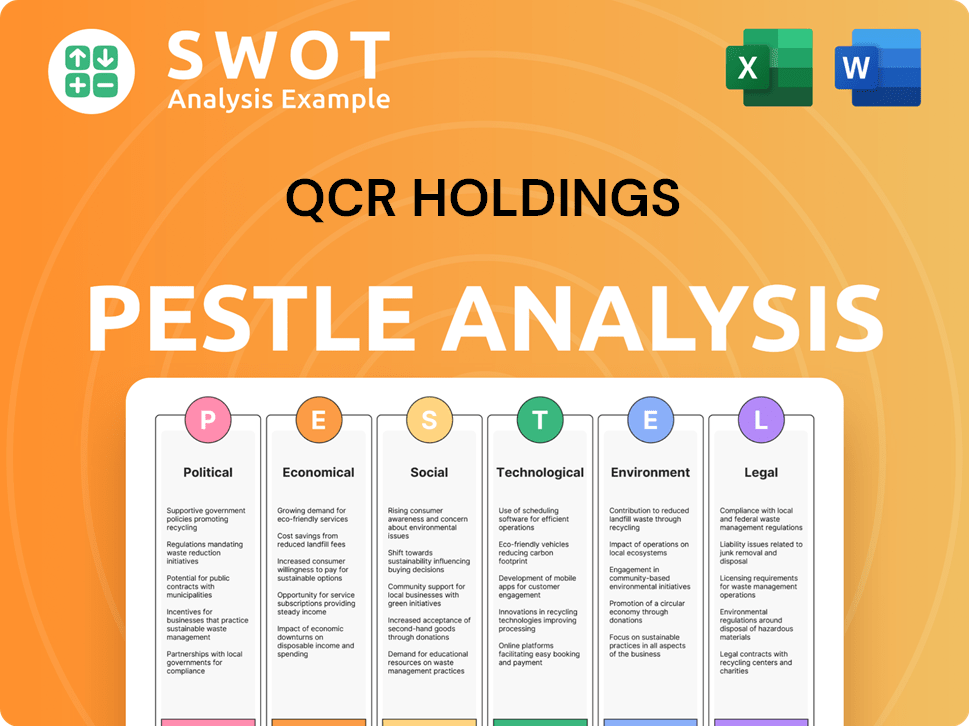

QCR Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is QCR Holdings’s Growth Forecast?

The financial outlook for QCR Holdings is robust, underpinned by strong financial performance and strategic initiatives. The company's ability to maintain and grow its profitability, even amidst macroeconomic challenges, demonstrates effective management and a solid foundation for future growth. Detailed analysis of the company's financial statements reveals key strengths and areas of focus for continued success.

QCR Holdings concluded 2024 with record net income, setting a positive tone for 2025. The company's performance in the first quarter of 2025 further illustrates its financial health and strategic execution. The focus on core deposit growth and effective interest rate management are key drivers of the company's positive financial trajectory.

The company's financial outlook is also supported by positive analyst ratings and growth projections. For a deeper understanding of the company's values, explore Mission, Vision & Core Values of QCR Holdings.

QCR Holdings reported a record net income of $113.9 million, or $6.71 per diluted share, for the year 2024. In Q1 2025, net income was $25.8 million, with diluted earnings per share (EPS) of $1.52. Adjusted net income for Q1 2025 was $26.0 million, and adjusted diluted EPS was $1.53.

Net interest income for Q1 2025 totaled $60.0 million, with a net interest margin (NIM) of 2.95%. The adjusted NIM on a tax-equivalent yield (TEY) basis was 3.41% for Q1 2025, up one basis point from the previous quarter. This indicates effective management of interest income relative to interest expense.

QCR Holdings projects an annualized loan growth rate of 4% to 6% for Q2 2025. The company experienced robust core deposit growth of 20% annualized in Q1 2025, contributing to a solid funding base. This growth allowed for a decrease in brokered deposits and FHLB advances.

As of March 31, 2025, QCR Holdings' Common Equity Tier 1 (CET1) ratio was 10.26%, and total risk-based capital was 14.16%, exceeding regulatory benchmarks. The tangible book value per share increased by $1.43, or 11% annualized, during Q1 2025.

Analysts have a 'Buy' consensus rating for QCRH stock. The average 12-month price target is $82.00, representing a forecasted upside of 26.45% from the current price. This positive outlook reflects confidence in the company's Growth Strategy and Future Prospects.

- The company expects noninterest expense for Q2 2025 to be in the range of $50 to $53 million.

- The decrease in noninterest income in Q1 2025 was primarily due to macroeconomic factors affecting the low-income housing tax credit (LIHTC) lending business.

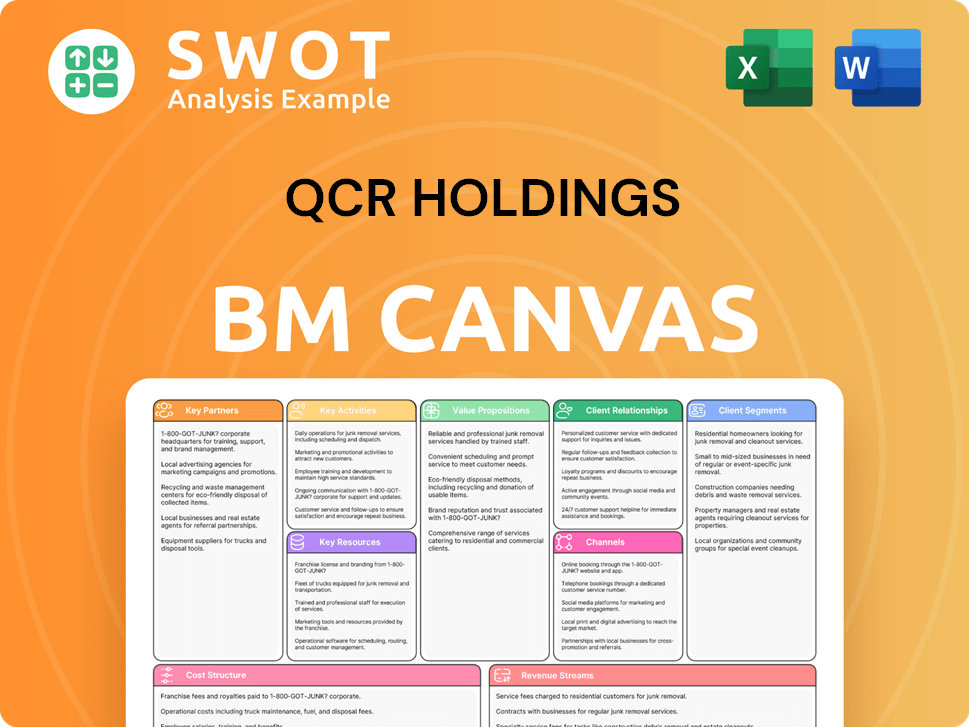

QCR Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow QCR Holdings’s Growth?

The path of QCR Holdings towards its Growth Strategy and realizing its Future Prospects isn't without challenges. Like any financial institution, it faces several risks that could influence its strategic objectives and operational efficiency. These risks range from macroeconomic uncertainties to competitive pressures within the banking sector.

QCR Holdings must navigate a complex landscape to achieve its goals. This involves managing risks associated with a changing economic climate, regulatory shifts, and the evolving credit environment. Understanding these potential obstacles is crucial for investors and stakeholders evaluating the company's long-term viability.

A primary concern for QCR Holdings is macroeconomic uncertainty, which can significantly affect loan growth and revenue from capital markets. For instance, in the first quarter of 2025, the company experienced a decrease in capital markets revenue due to macroeconomic factors influencing noninterest income, particularly from the low-income housing tax credit (LIHTC) lending business.

The banking sector is highly competitive, especially in areas like wealth management and capital markets. This competition can pressure profit margins and market share. QCR Holdings must continuously innovate and differentiate its services to maintain a competitive edge.

Changes in regulations can significantly impact financial institutions. While QCR Holdings has a strong capital base, with a Common Equity Tier 1 (CET1) ratio of 10.26% and total risk-based capital of 14.16% as of March 2025, it must still adapt to evolving regulatory requirements.

The normalization of the credit environment poses a risk, leading to an increase in nonperforming assets (NPAs). As of March 31, 2025, the ratio of NPAs to total assets was 0.53%, a slight increase from the prior quarter. This trend requires careful management to prevent significant financial impact.

Efficient expense management is crucial for maintaining profitability. QCR Holdings demonstrated disciplined expense control, with a 13% decrease in noninterest expense in Q1 2025. This proactive approach helps mitigate financial risks.

Strategic decisions, such as discontinuing new loans and leases through the m2 Equipment Finance subsidiary in September 2024, reflect efforts to consolidate assets and strengthen the balance sheet. These adjustments are critical in navigating economic uncertainties.

Focusing on core deposit growth and a planned $350 million securitization initiative in 2025 are key strategies to enhance liquidity and free up capital. These measures are designed to provide financial flexibility and support QCR Holdings' growth objectives.

QCR Holdings actively manages its risk profile through various strategies. These include disciplined expense management, strategic realignments, and proactive liquidity planning. The company's leadership emphasizes a client-first approach to navigate challenges and deliver industry-leading results. For more insights into the Financial Performance of QCR Holdings, consider reading Revenue Streams & Business Model of QCR Holdings.

Despite the risks, QCR Holdings remains optimistic about the long-term prospects of its markets. The company's ability to adapt to changing conditions and its commitment to strategic initiatives will be critical in achieving its Business Development goals. The company's approach to its Investment Portfolio and its strategic planning will be key factors in its success.

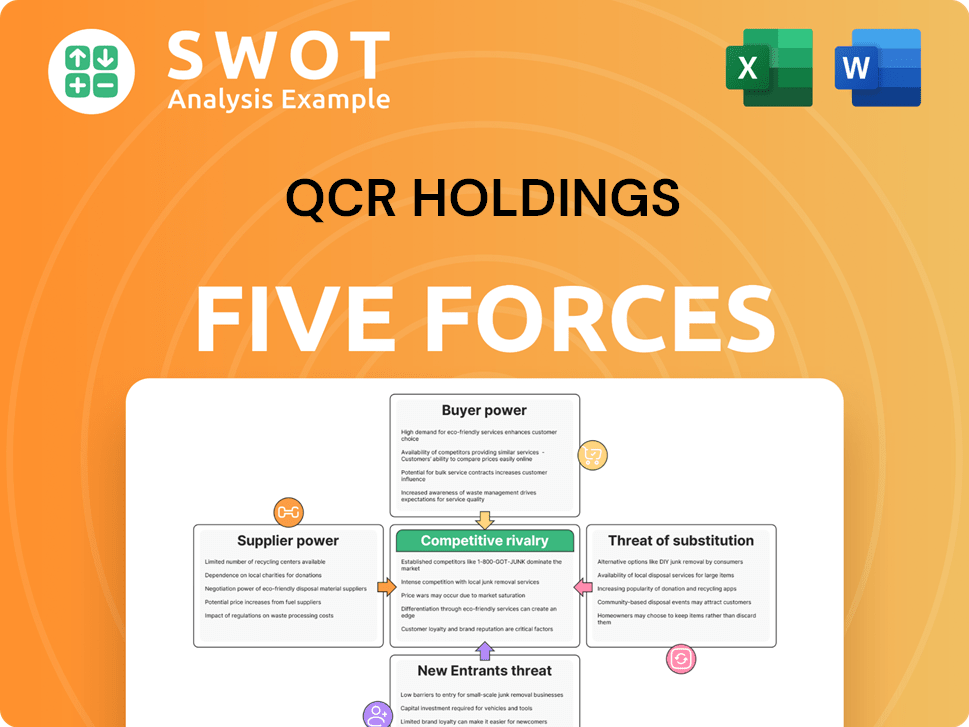

QCR Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of QCR Holdings Company?

- What is Competitive Landscape of QCR Holdings Company?

- How Does QCR Holdings Company Work?

- What is Sales and Marketing Strategy of QCR Holdings Company?

- What is Brief History of QCR Holdings Company?

- Who Owns QCR Holdings Company?

- What is Customer Demographics and Target Market of QCR Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.