RingCentral Bundle

Can RingCentral Continue Its Ascent in the Cloud Communication Arena?

RingCentral, a pioneer in the cloud communication space, has strategically navigated the dynamic UCaaS market, transforming from a startup to a global leader. Its 2019 partnership with Avaya was a game-changer, significantly boosting its enterprise presence and solidifying its competitive stance. Founded in 1999, RingCentral's vision of revolutionizing business phone systems has made it a prominent player in the industry.

This exploration of the RingCentral SWOT Analysis will delve into the company's ambitious RingCentral growth strategy and future prospects. We'll examine its expansion plans, innovation, and strategic initiatives designed to sustain its market dominance. Understanding the RingCentral company's trajectory is crucial for anyone looking to understand the cloud communication solutions landscape and the competitive dynamics within the UCaaS market, including its financial performance review and comparison to competitors.

How Is RingCentral Expanding Its Reach?

The RingCentral growth strategy is heavily reliant on ambitious expansion initiatives. These initiatives focus on entering new markets and broadening the product portfolio. A key aspect of this is the continued focus on the enterprise segment, often facilitated through strategic partnerships. These partnerships, like the one with Avaya, allow the company to leverage established customer bases and accelerate market penetration.

Geographical expansion is also a priority, with a focus on strengthening its presence in international markets. This involves tailoring its offerings to meet regional compliance requirements and local market demands. Product innovation remains a core driver of expansion, with the company consistently launching new features and services.

The company aims to continue its double-digit revenue growth. For example, in 2024, the company targeted a revenue increase, as indicated in recent financial reports. This focus on growth is critical for maintaining its position in the dynamic UCaaS market.

Strategic partnerships, such as the one with Avaya, are crucial for accessing enterprise customers. These partnerships help accelerate market penetration and broaden the customer base. This approach allows the company to leverage existing customer relationships and distribution channels, which is a key component of its RingCentral expansion plans.

The company consistently launches new features and services to attract and retain customers. This includes advanced AI-driven communication analytics, enhanced contact center capabilities, and deeper integrations with business applications. These innovations are designed to increase the value proposition for existing customers and diversify revenue streams.

The company is actively expanding its presence in international markets, particularly where cloud communication adoption is growing. This involves adapting offerings to meet regional compliance and local market demands. This strategy is essential for achieving sustained growth and increasing its global footprint.

Recognizing the growing demand for cloud-based customer service solutions, the company is investing in expanding its CCaaS capabilities. This expansion is intended to capture a larger share of the customer service market. This move is a strategic response to market trends and enhances its overall service offerings.

The company's expansion strategy encompasses several key areas, including market entry, product innovation, and geographical expansion. These initiatives are designed to drive revenue growth and increase market share. The company's approach also involves strategic partnerships and investments in emerging technologies.

- Strategic Partnerships: Collaborations with established players to access new markets and customer segments.

- Product Innovation: Continuous development of new features and services, such as AI-driven analytics.

- Geographical Expansion: Targeting international markets with tailored solutions.

- CCaaS Investments: Expanding cloud-based customer service capabilities.

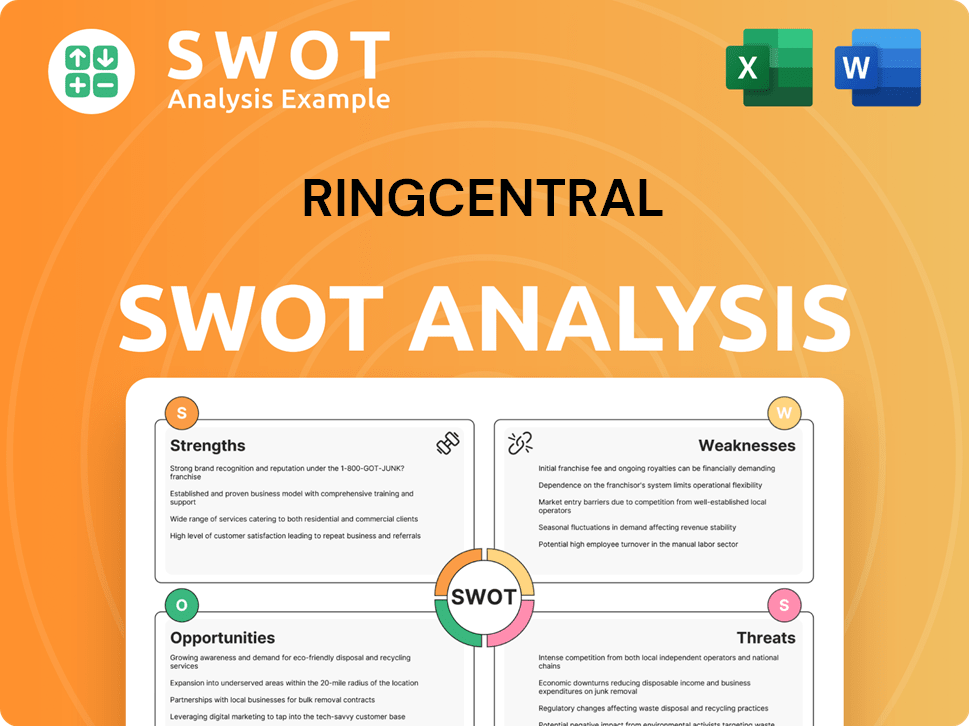

RingCentral SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does RingCentral Invest in Innovation?

The sustained growth of the company is heavily reliant on its technology strategy and dedication to innovation. This involves significant investments in research and development (R&D) to create cutting-edge communication and collaboration tools in-house. The focus is on digital transformation for both its internal operations and its customers, emphasizing automation and seamless integration across its platform.

A key area of innovation is the strategic adoption of artificial intelligence (AI) and machine learning (ML). These technologies are integrated to improve various aspects of the platform, including intelligent virtual assistants, call transcription, sentiment analysis in contact centers, and predictive analytics for network optimization. The goal is to deliver an AI-powered enterprise communications platform, as highlighted in the Q4 2023 earnings call.

The company's approach to innovation also involves strategic collaborations with external innovators and technology partners. This expands its ecosystem and offers more comprehensive solutions. The emphasis on open APIs and platform extensibility allows for seamless integration with a wide array of third-party applications, enhancing its value proposition. Recent advancements include improvements in video conferencing quality, enhanced security features, and the development of new features like Events, designed for the growing virtual events market.

The company consistently invests a substantial portion of its revenue in R&D. For instance, in 2023, the company's R&D expenses were a significant percentage of its total revenue, demonstrating a strong commitment to innovation.

The integration of AI and ML is a core part of the company's strategy. This includes the development of AI-powered features such as intelligent virtual assistants and advanced analytics. These features aim to improve user experience and operational efficiency.

Strategic partnerships are crucial for expanding the company's ecosystem. Collaborations with technology partners allow the company to offer more comprehensive solutions and integrate with a wider range of applications. This enhances the value of its platform.

Open APIs and platform extensibility are key features. These features enable seamless integration with third-party applications. This flexibility is essential for meeting diverse customer needs and enhancing the platform's overall value.

Continuous product innovation is a key driver of growth. Recent advancements include improvements in video conferencing quality, enhanced security features, and new features like Events. These innovations directly support the company's growth objectives.

The company's technology advancements and new features contribute to market expansion. By improving user experience and increasing operational efficiency, the company can attract new customers and expand its addressable market.

The company's technology strategy focuses on continuous innovation to maintain its competitive edge in the cloud communication and UCaaS market. Key areas of advancement include AI-driven features, improved video conferencing, and enhanced security. These advancements are crucial for the company's Brief History of RingCentral and future prospects.

- AI-Powered Features: Development of intelligent virtual assistants, advanced analytics, and sentiment analysis to improve user experience and operational efficiency.

- Video Conferencing Enhancements: Improvements in video quality, reliability, and features to meet the evolving needs of remote work and virtual collaboration.

- Enhanced Security: Strengthening security protocols and features to protect user data and ensure platform integrity, addressing growing concerns about cybersecurity.

- Platform Extensibility: Continued development of open APIs and integrations with third-party applications to provide a flexible and comprehensive communication solution.

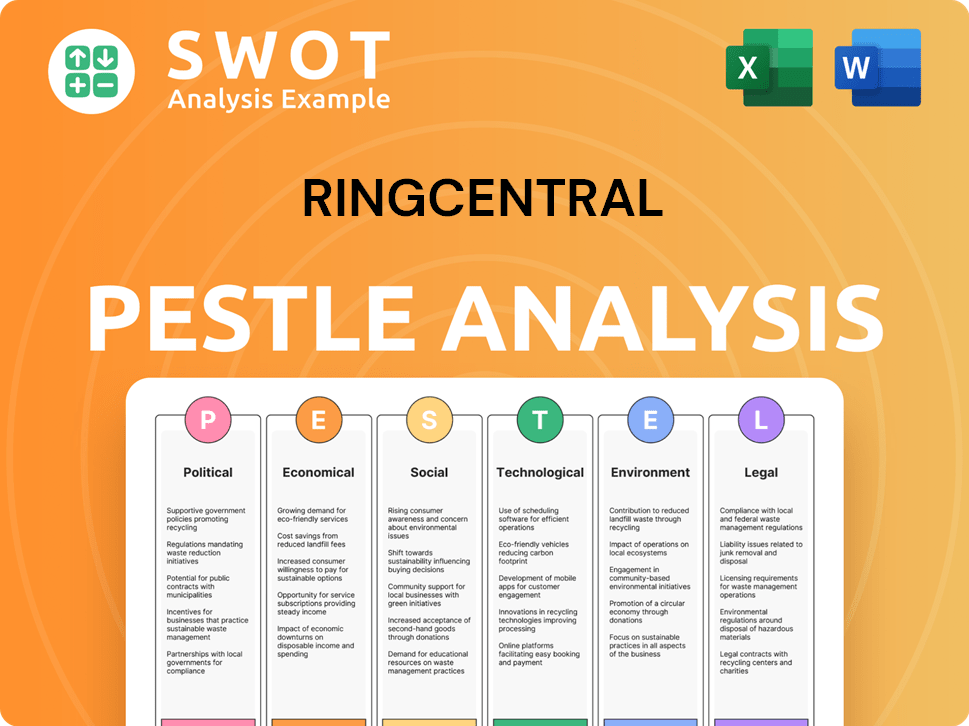

RingCentral PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is RingCentral’s Growth Forecast?

The financial outlook for RingCentral reflects its ambitious growth strategy, with the company anticipating continued revenue expansion and a focus on profitability. The company's projections suggest a strong performance in the cloud communication sector, driven by increasing demand for its Unified Communications as a Service (UCaaS) offerings. This growth is supported by a strategic focus on operational efficiency and prudent capital allocation.

For the full year 2024, RingCentral projects total revenue to be between $2.227 billion and $2.235 billion. This represents a year-over-year growth of approximately 9% to 10%. Subscription revenue, a key driver of this growth, is expected to range from $2.138 billion to $2.146 billion, reflecting an 11% to 12% year-over-year increase. These figures highlight the company's solid position in the UCaaS market and its ability to attract and retain customers.

RingCentral is also focused on improving its profitability. The company anticipates a non-GAAP operating margin of 19.0% to 19.5% for 2024. This focus on profitability, combined with revenue growth, underscores RingCentral's commitment to sustainable financial performance. This financial discipline is crucial as RingCentral navigates the competitive landscape of the business phone systems market.

RingCentral's revenue growth is primarily driven by its subscription services. The company's ability to attract and retain customers is a key factor. Marketing Strategy of RingCentral plays a crucial role in customer acquisition and retention, contributing to the overall growth trajectory.

Improving profitability is a significant focus for RingCentral. The company aims to achieve a non-GAAP operating margin of 19.0% to 19.5% in 2024. This focus on financial discipline is essential for long-term sustainability and success in the UCaaS market.

In 2023, RingCentral reported total revenue of $2.2 billion, an increase of 11% compared to 2022. This historical performance provides a solid foundation for future growth. The company's consistent revenue growth demonstrates its ability to execute its strategic plans.

RingCentral's financial strategy includes prudent capital allocation and a focus on operational efficiency. These measures support the company's growth plans and help maintain a healthy financial position. Efficient operations are crucial in the competitive UCaaS market.

Analyst forecasts generally align with RingCentral's positive outlook, acknowledging the company's strong market position in the UCaaS sector. These forecasts provide external validation of RingCentral's growth potential. The company's strategic direction is well-regarded by industry analysts.

RingCentral's expansion plans include continued investment in its product roadmap and customer acquisition strategies. The company is also exploring partnership opportunities to enhance its market reach. These initiatives are designed to support long-term growth and market share gains.

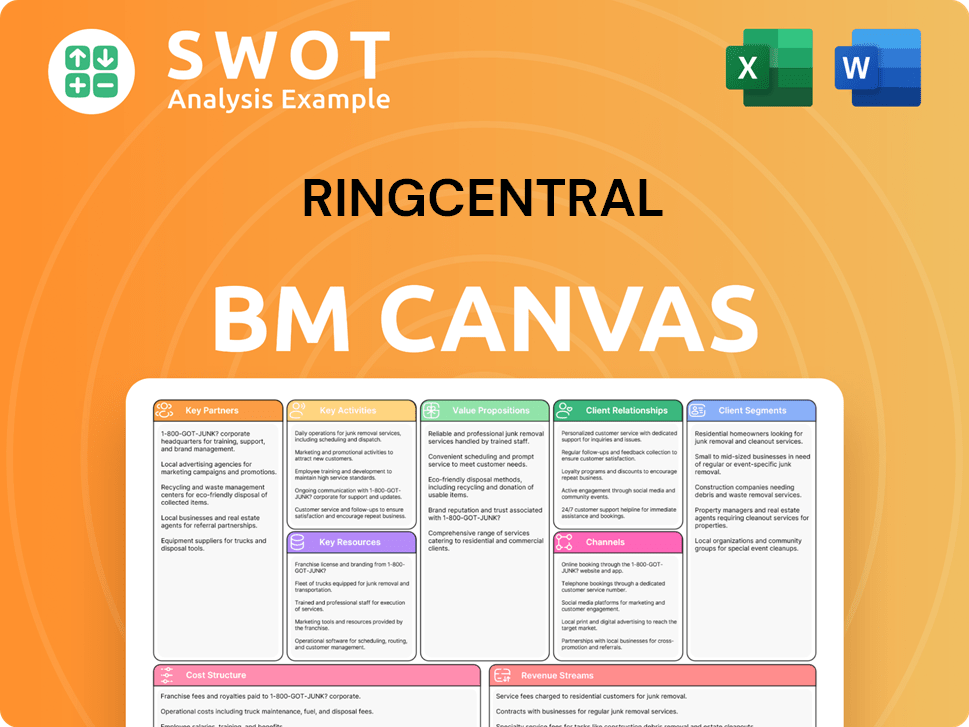

RingCentral Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow RingCentral’s Growth?

The path forward for the company, while promising, is not without its challenges. Several factors could potentially hinder its growth and impact its market position within the cloud communication space. Understanding these risks is crucial for evaluating the company's long-term viability and investment potential.

Intense competition, evolving regulations, and the rapid pace of technological change present significant obstacles. The ability to navigate these challenges effectively will be key to realizing its ambitious growth plans. Furthermore, the company must continuously adapt to maintain its competitive edge and capitalize on emerging opportunities.

One of the primary risks is the highly competitive nature of the cloud communication or UCaaS market. Established players like Microsoft Teams and Zoom, along with other emerging platforms, continually vie for market share. This intense competition can lead to pricing pressures, potentially affecting profit margins. To maintain its position, the company must persistently innovate and differentiate its offerings.

The cloud communication industry is intensely competitive, with numerous players vying for market share. Key competitors include Microsoft Teams and Zoom, which have substantial resources and established customer bases. The company must continuously innovate to stay ahead.

Changes in data privacy and security regulations across different geographic markets pose a significant challenge. The company needs to adapt and comply with these evolving regulations to maintain its global operations. Compliance efforts require dedicated resources and expertise.

The cloud communications industry is subject to rapid technological advancements. The emergence of a disruptive technology from a competitor could potentially shift market dynamics. Staying ahead of the curve requires continuous investment in research and development.

Although less direct for a software company, supply chain issues can affect hardware components for certain solutions. Disruptions in the supply chain or underlying infrastructure could potentially impact service delivery. Diversifying suppliers and building resilient infrastructure are crucial.

Attracting and retaining top talent in a competitive tech labor market is a challenge. Internal resource constraints, such as skilled personnel, can impact the company's ability to innovate and expand. Investing in employee development and fostering a positive work environment is essential.

The increasing complexity of AI ethics and governance presents an emerging risk. As the company deepens AI integration within its platform, it must carefully navigate ethical considerations. This requires robust governance frameworks and responsible AI practices.

To mitigate these risks, the company employs several strategies. It diversifies its customer base and product offerings, implements robust risk management frameworks, and engages in proactive scenario planning. Continuous investment in enhancing security protocols and obtaining relevant certifications is also a key focus. For a deeper understanding of the financial aspects, including potential risks and rewards, consider reading more at Owners & Shareholders of RingCentral.

The UCaaS market is highly competitive, with the company and its rivals constantly vying for market share. Analyzing the competitive landscape is essential for understanding the company's position and growth prospects. Recent data indicates a dynamic shift in market share among key players.

The company's financial performance is crucial for assessing its sustainability and growth potential. A detailed review of revenue growth drivers, profitability, and cash flow provides insights into its financial health. Investors should carefully evaluate these metrics.

The company's expansion plans, including its product roadmap, are critical for future growth. Understanding its customer acquisition strategies and partnership opportunities provides insights into its growth strategy. Recent announcements detail planned expansions.

The company's technology advancements, including its cloud communication solutions, are key to maintaining a competitive edge. Focusing on innovation and integrating the latest technologies, such as AI, is crucial. The company must stay ahead of the curve.

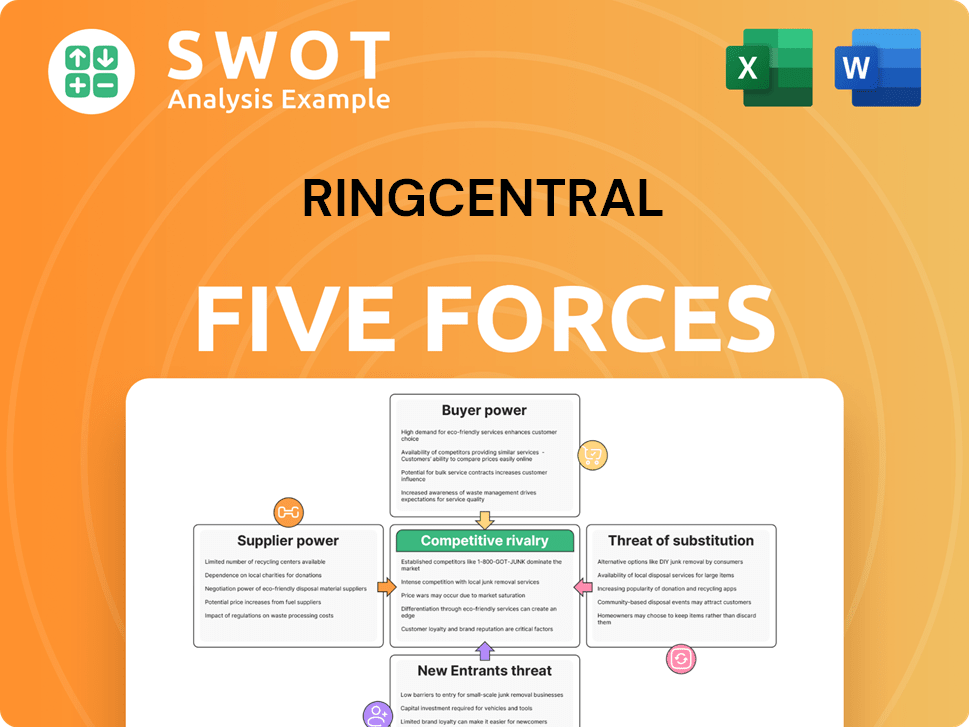

RingCentral Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of RingCentral Company?

- What is Competitive Landscape of RingCentral Company?

- How Does RingCentral Company Work?

- What is Sales and Marketing Strategy of RingCentral Company?

- What is Brief History of RingCentral Company?

- Who Owns RingCentral Company?

- What is Customer Demographics and Target Market of RingCentral Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.