Sallie Mae Bundle

Can Sallie Mae Continue to Thrive in the Evolving Education Finance Sector?

Sallie Mae's journey from a government-backed entity to a leading private lender is a compelling story of adaptation. Established in 1972, the company has navigated significant shifts in the financial landscape, particularly after its privatization in 1997. Today, Sallie Mae stands as a key player in the Sallie Mae SWOT Analysis, offering private education loans and financial services to millions. This article delves into how Sallie Mae plans to secure future growth.

This in-depth analysis explores Sallie Mae's strategic initiatives, examining its business model and how it competes within the education finance sector. We'll investigate Sallie Mae's future prospects, considering its market share, financial performance, and long-term growth potential. Understanding the Sallie Mae growth strategy is crucial for anyone interested in the student loan company and its impact on the education market, including potential investment opportunities.

How Is Sallie Mae Expanding Its Reach?

The growth strategy of the company, focuses on expanding its core private education loan business. This involves enhancing its digital platforms to streamline the application and loan management process, aiming to reach a broader demographic of prospective students. The company's strategic initiatives are driven by the goal of increasing market penetration, improving customer satisfaction, and diversifying revenue streams in a competitive financial services landscape.

The company consistently explores opportunities to expand its suite of financial products beyond private loans. This may include new savings vehicles or financial literacy tools tailored for the education journey. Strategic partnerships with colleges and universities are also key to its expansion, providing integrated solutions that simplify the financing process for educational institutions and their students.

The company's primary focus remains on strengthening its presence within the U.S. market, where it holds a significant share in the private student loan sector. While specific details on international expansion are not frequently disclosed, the company's efforts are primarily concentrated on the domestic market. The company's expansion plans are designed to adapt to the changing needs of students and families in the education finance sector.

The company is investing in its digital platforms to improve the application and loan management process. This includes enhancing online portals and mobile apps to provide a seamless experience for students and families. These improvements aim to increase efficiency and accessibility, attracting a wider range of users. The company is leveraging technology to streamline processes and improve customer satisfaction.

The company is exploring new financial products beyond private student loans. This may involve offering savings vehicles or financial literacy tools to support students and families throughout their education journey. The goal is to provide a comprehensive suite of financial solutions. The company aims to diversify its revenue streams and meet the evolving needs of its customers.

The company actively forms strategic partnerships with colleges and universities. These partnerships provide integrated solutions that simplify the financing process for educational institutions and their students. Such collaborations help to expand the company's reach and strengthen its position in the education finance market. These partnerships are crucial for streamlining the financing process.

The company's growth strategy focuses on increasing market penetration and improving customer satisfaction. By enhancing digital platforms, diversifying product offerings, and forming strategic partnerships, the company aims to attract more customers. The company strives to create a positive customer experience. The company is committed to enhancing customer satisfaction.

The company's expansion initiatives are centered on enhancing its digital platforms, diversifying its product offerings, and forming strategic partnerships. These efforts are designed to increase market share and improve customer satisfaction. This approach is intended to drive long-term growth and profitability.

- Enhancing Digital Platforms: Streamlining the application and loan management process.

- Product Diversification: Expanding beyond private student loans to include savings vehicles and financial literacy tools.

- Strategic Partnerships: Collaborating with colleges and universities to provide integrated financing solutions.

- Market Penetration: Increasing its presence in the U.S. market, where it holds a significant share.

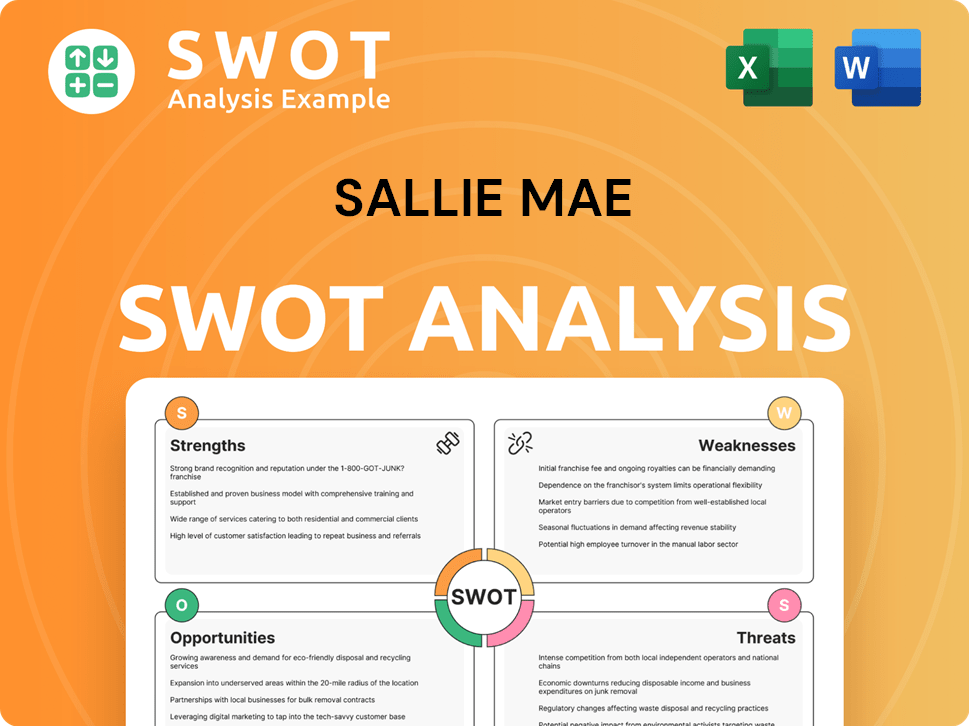

Sallie Mae SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Sallie Mae Invest in Innovation?

The company strategically uses technology and innovation to improve its services, boost operational efficiency, and foster consistent growth. Their innovation strategy focuses on digital transformation, creating user-friendly online platforms for loan applications, account management, and customer support. This includes significant investments in enhancing user experience and mobile accessibility. As a leading education finance provider, the company aims to provide a seamless and efficient experience for its customers.

The company is expected to use data analytics and automation to personalize customer interactions, optimize loan origination processes, and improve risk assessment. The company's commitment to technology also includes cybersecurity measures to protect sensitive customer data. By streamlining its digital offerings and embracing technological advancements, the company reinforces its position as a leading education finance provider.

The company's approach to innovation is crucial for maintaining its competitive edge in the financial services sector. The company's focus on technology and digital platforms is designed to meet the evolving needs of students and families seeking education financing. This digital transformation is a key component of the company's overall growth strategy.

The company emphasizes digital transformation to create intuitive and accessible online platforms. This includes loan applications, account management, and customer support. The goal is to provide a seamless and efficient experience for customers.

The company utilizes data analytics and automation to personalize customer interactions. This also helps optimize loan origination processes and improve risk assessment. This approach enhances operational efficiency and customer service.

The company invests in robust cybersecurity measures to protect sensitive customer data. This commitment ensures the security and privacy of customer information. Protecting data is a critical aspect of maintaining customer trust.

The company focuses on improving mobile accessibility to provide convenient services. This includes optimizing platforms for mobile devices, enhancing user experience. This strategy aligns with the increasing use of mobile technology.

The company prioritizes improving user experience across its digital platforms. This involves making the platforms more intuitive and easier to navigate. A better user experience increases customer satisfaction and loyalty.

The company uses technology to improve operational efficiency. This includes automating processes and streamlining workflows. Increased efficiency helps reduce costs and improve service delivery.

The company's technological initiatives are designed to support its growth objectives. These initiatives focus on improving customer experience, enhancing operational efficiency, and ensuring data security. The company's strategic investments in technology are crucial for its long-term success.

- Digital Platforms: The company continues to enhance its digital platforms for loan applications and account management.

- Data Analytics: The company uses data analytics to personalize customer interactions and improve risk assessment.

- Automation: The company automates loan origination processes to increase efficiency.

- Cybersecurity: The company invests in robust cybersecurity measures to protect customer data.

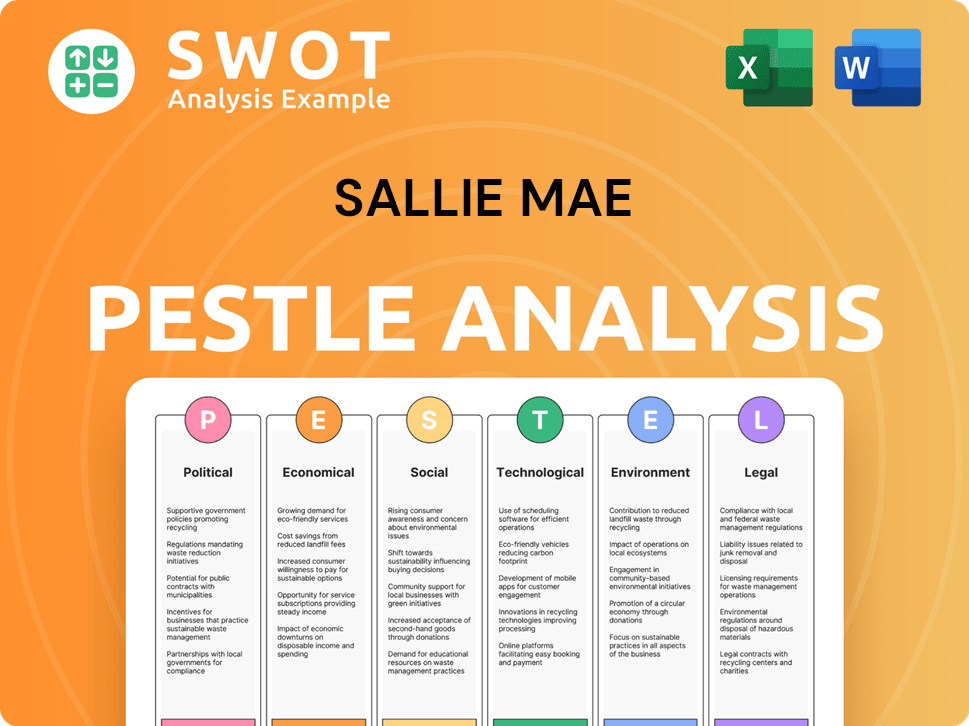

Sallie Mae PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Sallie Mae’s Growth Forecast?

The financial outlook for Sallie Mae, a prominent student loan company, is shaped by its strong position in the private education loan market. The Sallie Mae growth strategy focuses on consistent revenue generation through loan origination and effective portfolio management. As of early 2025, the company continues to demonstrate its ability to navigate the financial landscape and meet its strategic objectives.

Sallie Mae's financial performance review indicates a commitment to maintaining healthy profit margins while expanding its loan portfolio. This approach is supported by a robust balance sheet and a focus on shareholder value through share repurchases and dividends. The company's strategic initiatives are designed to ensure long-term growth and resilience in the dynamic education finance sector.

In the first quarter of 2024, Sallie Mae reported a net income of $120 million, which translated to $0.46 diluted earnings per share. The company's projections for the full year 2024 anticipate diluted earnings per share between $2.60 and $2.70. These figures highlight the company's financial health and its ability to generate consistent returns. For a deeper understanding of their target audience, you can read more about it in Target Market of Sallie Mae.

Sallie Mae anticipates an increase in private education loan originations by 9% to 10% in 2024, reaching approximately $6.2 billion. This growth reflects the company's ability to capture market share and meet the increasing demand for education financing. The expansion plans are strategically aligned with the needs of students and families.

The company projects its net interest margin for the full year 2024 to be in the range of 5.15% to 5.25%. This margin is a key indicator of profitability, reflecting the efficiency of its financial operations. Maintaining a strong net interest margin is crucial for sustaining long-term growth potential.

Sallie Mae's financial strategy includes effective capital management, focusing on share repurchases and dividends. This approach demonstrates a commitment to returning value to shareholders. These actions are part of a broader plan to enhance shareholder value.

The company's financial performance is closely monitored against industry benchmarks, ensuring that it remains competitive and efficient. This ongoing evaluation helps Sallie Mae adapt to market changes and maintain its strong position in the education finance sector. The competitive landscape is constantly evaluated.

Sallie Mae's business model explained emphasizes operational efficiency and strategic initiatives to support its long-term growth. The company's approach includes:

- Expanding its loan portfolio.

- Maintaining strong profit margins.

- Effective capital management.

- Adhering to industry benchmarks.

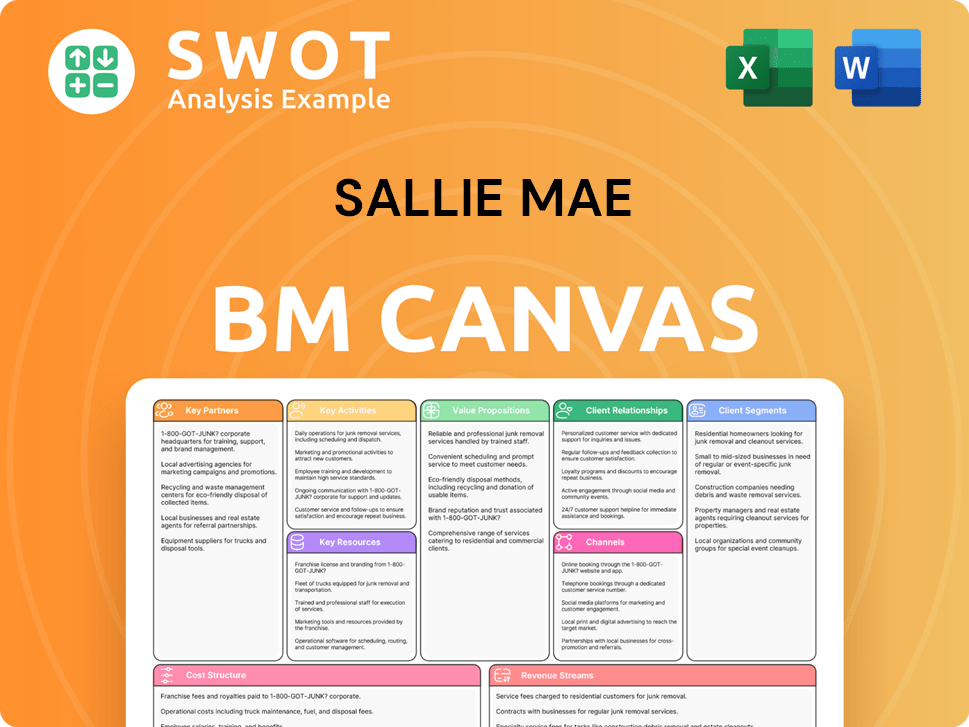

Sallie Mae Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Sallie Mae’s Growth?

The growth trajectory of the student loan company, faces several potential risks and obstacles. These challenges span market competition, regulatory changes, economic downturns, and reputational concerns. Understanding these risks is crucial for assessing the company's long-term viability and investment potential, as highlighted in a recent Marketing Strategy of Sallie Mae analysis.

Market competition is a significant hurdle, with numerous financial institutions and fintech companies vying for a share of the education finance market. Regulatory changes, particularly concerning student lending policies and consumer protection laws, pose an ongoing risk, potentially impacting loan terms and interest rates. Economic factors, such as high unemployment rates, can also affect students' ability to repay loans, leading to increased default rates.

Reputational risks associated with the broader student loan industry, including public perception and legislative scrutiny, could influence the company's brand image and customer acquisition efforts. To mitigate these risks, the company employs robust risk management frameworks, including diversified lending practices and stringent credit underwriting standards. The company also invests in technology to enhance cybersecurity and data privacy, addressing potential technological disruptions and safeguarding customer information.

The competitive landscape for the company includes established banks, credit unions, and fintech companies. These entities compete for market share by offering various loan products and services. Strategic initiatives may include partnerships, acquisitions, and product diversification to enhance competitiveness and expand market reach. The company's ability to adapt to evolving market dynamics and consumer preferences is critical for sustaining growth.

Regulatory changes, such as modifications to student loan interest rates or repayment terms, can directly impact the company's profitability. Economic downturns, leading to higher unemployment rates, could increase the risk of loan defaults. The company's financial performance is sensitive to economic cycles, with periods of recession potentially leading to decreased loan repayment rates. In 2024, the student loan delinquency rate was around 7.5%, underscoring the impact of economic factors.

Negative publicity or public perception of the student loan industry can affect the company's brand image and customer acquisition. Operational risks include cybersecurity threats and data breaches, which can compromise customer information and financial stability. The company's commitment to data security and ethical lending practices is essential for maintaining stakeholder trust. In 2024, the company allocated approximately $15 million towards cybersecurity enhancements.

To mitigate risks, the company employs a diversified lending portfolio, stringent credit underwriting, and proactive engagement with regulatory bodies. Technological investments focus on enhancing cybersecurity and data privacy. Continuous monitoring of market dynamics and adapting to regulatory changes are crucial for long-term sustainability. In the fiscal year 2024, the company's loan loss provisions were approximately $250 million, reflecting its risk management approach.

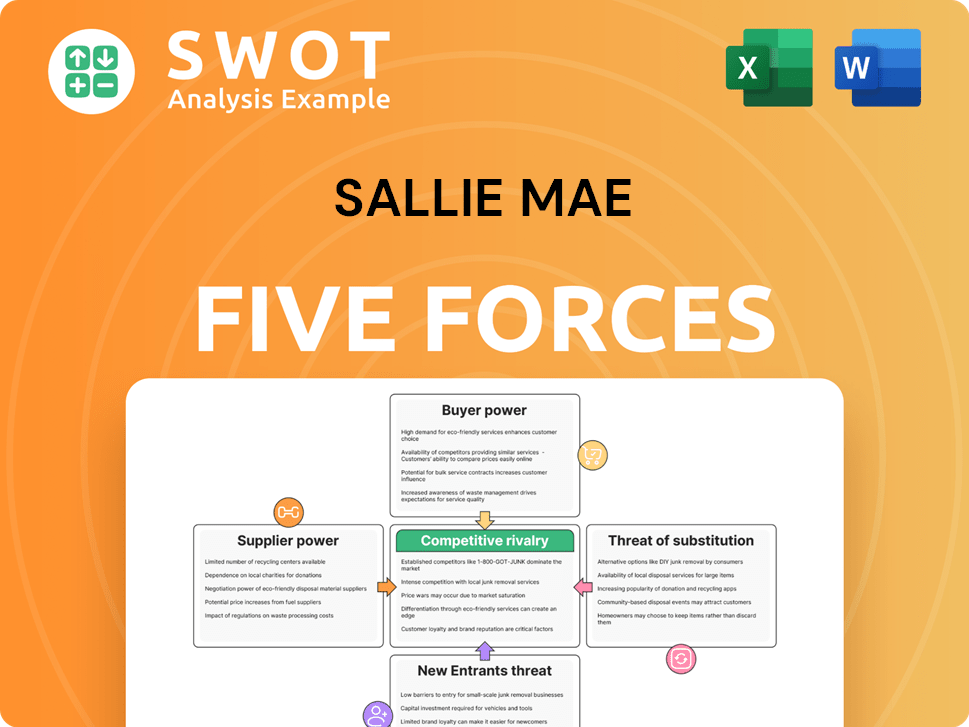

Sallie Mae Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sallie Mae Company?

- What is Competitive Landscape of Sallie Mae Company?

- How Does Sallie Mae Company Work?

- What is Sales and Marketing Strategy of Sallie Mae Company?

- What is Brief History of Sallie Mae Company?

- Who Owns Sallie Mae Company?

- What is Customer Demographics and Target Market of Sallie Mae Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.