Signet Jewelers Bundle

Can Signet Jewelers Reclaim Its Sparkle?

Signet Jewelers, the global leader in diamond jewelry retail, is undergoing a significant transformation. With a new 'Grow Brand Love' strategy, the company is pivoting to cultivate deeper customer connections, moving beyond transactional sales. This strategic shift, announced in early 2025, is a crucial step in navigating the evolving retail landscape and securing its future.

Founded in 1950, Signet Jewelers has a long history, evolving from a single store to a portfolio of approximately 2,700 locations, including brands like Kay Jewelers and Zales. Despite recent challenges, including a 6% revenue decline in Q4 Fiscal 2025, the company's focus on merchandise average unit retail growth and lab-grown diamonds sales shows a commitment to innovation. To further understand its position, consider a detailed Signet Jewelers SWOT Analysis, which will provide key insights into its strengths, weaknesses, opportunities, and threats within the Jewelry Retail Market.

How Is Signet Jewelers Expanding Its Reach?

The expansion initiatives of Signet Jewelers are central to its growth strategy, focusing on strategic market entry, product diversification, and optimizing its retail footprint. The company aims to enhance its market share in core categories like bridal and gold, while expanding into adjacent segments such as self-purchase and gifting. This strategy involves incorporating more design-led products to meet evolving consumer preferences, aligning with the 'Grow Brand Love' initiative.

Signet's growth strategy includes a significant realignment of its real estate portfolio. The company plans to invest between $160 million and $180 million in capital expenditures for Fiscal Year 2025. This investment will facilitate the opening of 20 to 30 new stores and the renovation of nearly 300 existing locations, with a focus on key brands like Kay, Jared, and Diamonds Direct.

A notable aspect of this strategy is the shift from traditional mall locations to off-mall sites. Signet recognizes that over 30% of its North American revenue still comes from malls, a format experiencing declining foot traffic. For instance, Kay Jewelers is implementing a 'hometown market strategy' by moving ten stores from malls to off-mall locations and opening ten new Kay stores, alongside renovating 200 others. This shift is intended to establish Kay as a local jewelry store in smaller markets where malls are struggling.

Signet is actively repositioning its retail locations to adapt to changing consumer behaviors and market trends. This includes a strategic shift from traditional mall locations to off-mall sites. The company's investment in new stores and renovations indicates its commitment to maintaining a strong physical presence.

The company is expanding its service offerings, including jewelry and watch repair. This expansion includes the acquisition of Service Jewelry & Repair, Inc. (SJR) in Fiscal 2024. The company also transitioned its Blue Nile Seattle fulfillment center into a new enterprise-wide repair facility, Signet Services Washington.

The expansion initiatives are designed to drive future growth and enhance Signet's market position. These efforts involve strategic market entry, product diversification, and optimizing the retail footprint. These initiatives are part of a broader strategy to increase market share and cater to evolving consumer demands.

- Strategic Market Entry: Opening new stores and entering new markets to expand its customer base.

- Product Diversification: Expanding into new product categories like self-purchase and gifting.

- Real Estate Optimization: Repositioning stores from malls to off-mall locations and renovating existing stores.

- Service Expansion: Strengthening its service offerings, including jewelry and watch repair.

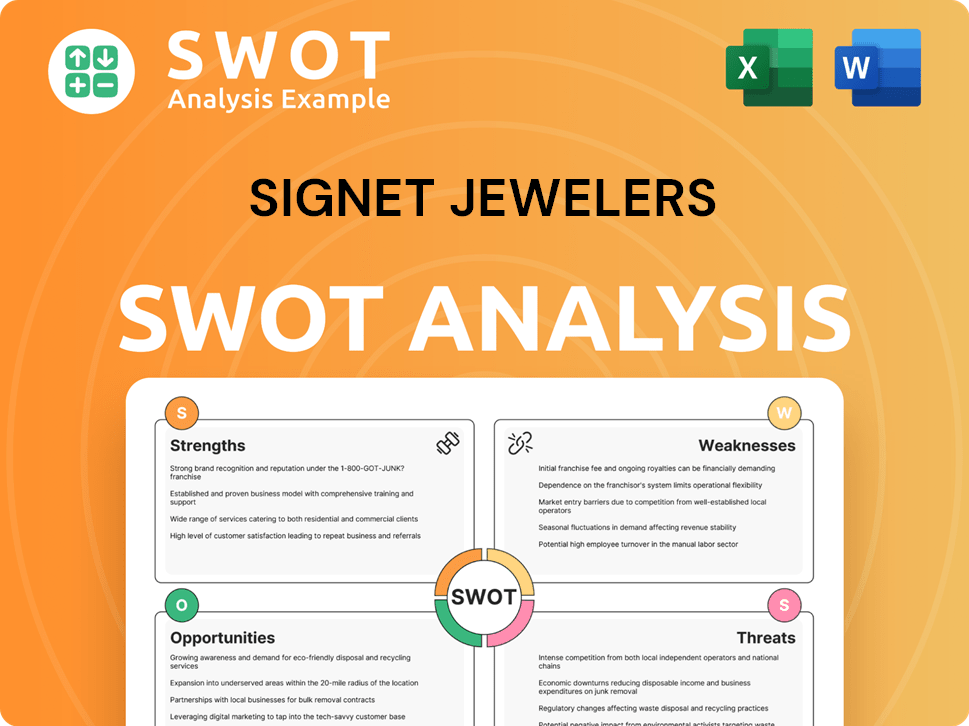

Signet Jewelers SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Signet Jewelers Invest in Innovation?

The company is heavily investing in technology and innovation to drive sustained growth, with a clear focus on digital transformation. This includes leveraging data and exploring cutting-edge technologies to enhance customer experiences and streamline operations. The goal is to position itself as a leader in the evolving jewelry retail market.

Digital innovation and capabilities are integral to the future of jewelry retail for the company. This is evident in its strategic investments in areas like artificial intelligence (AI) and machine learning (ML), which are being integrated into various parts of the business. These advancements aim to improve efficiency, personalize customer interactions, and create a more seamless shopping experience.

In Fiscal Year 2024, the company began utilizing its customer data platform to create more personalized shopping experiences and highly targeted marketing campaigns. The company's digital acceleration has been a key focus, with e-commerce penetration growing significantly from 5% to 20% between 2019 and 2024. This growth demonstrates the effectiveness of its digital strategies and the increasing importance of online channels in the jewelry retail market.

The company plans to invest between $40 million and $50 million in digital and technology to enhance consumer and team member experiences. This investment includes connected commerce capabilities, reflecting the company's commitment to providing a seamless omnichannel experience.

AI and ML are being integrated into inventory distribution and flexible fulfillment processes. In Fiscal Year 2025, the company plans approximately $150 million to $180 million in new cost savings initiatives that leverage technology, including AI, demonstrating the company's commitment to operational efficiency.

The company is focused on introducing consumer-driven services, including personalization, and expanding existing services like Extended Service Plans. This focus on customer service and personalization is a key component of its growth strategy.

Lab-grown diamond sales surged by 40% in Fiscal 2025, contributing to a more premium product mix and increasing market penetration by five percentage points. This growth highlights the company's ability to adapt to changing consumer preferences and capitalize on emerging market trends.

The company is committed to sustainability, with efforts to increase recycled content in packaging. Paper-based packaging increased from 41% to 79%, and plastic-based packaging from 32% to 85% in 2024. This demonstrates its commitment to environmental responsibility.

Through its 'Reclaim, Reuse, Re-Sparkle' program, the company recovered 61,094 carats of diamonds and $20 million in metal. It also customized and repaired 3.7 million pieces of jewelry, showcasing its commitment to circular economy practices.

The company's innovation strategy encompasses several key areas, including digital transformation, AI and ML integration, and sustainable practices. These initiatives are designed to drive growth, enhance customer experiences, and improve operational efficiency. For more insights, you can read about the Revenue Streams & Business Model of Signet Jewelers.

- Digital Transformation: Significant investment in e-commerce and omnichannel capabilities, with e-commerce penetration growing from 5% to 20% between 2019 and 2024.

- AI and ML: Implementation of AI and ML in inventory distribution, flexible fulfillment, and customer data platforms to create personalized shopping experiences and targeted marketing.

- Product Innovation: Strong growth in lab-grown diamond sales, up 40% in Fiscal 2025, and introduction of consumer-driven services like personalization.

- Sustainability: Efforts to increase recycled content in packaging and the 'Reclaim, Reuse, Re-Sparkle' program.

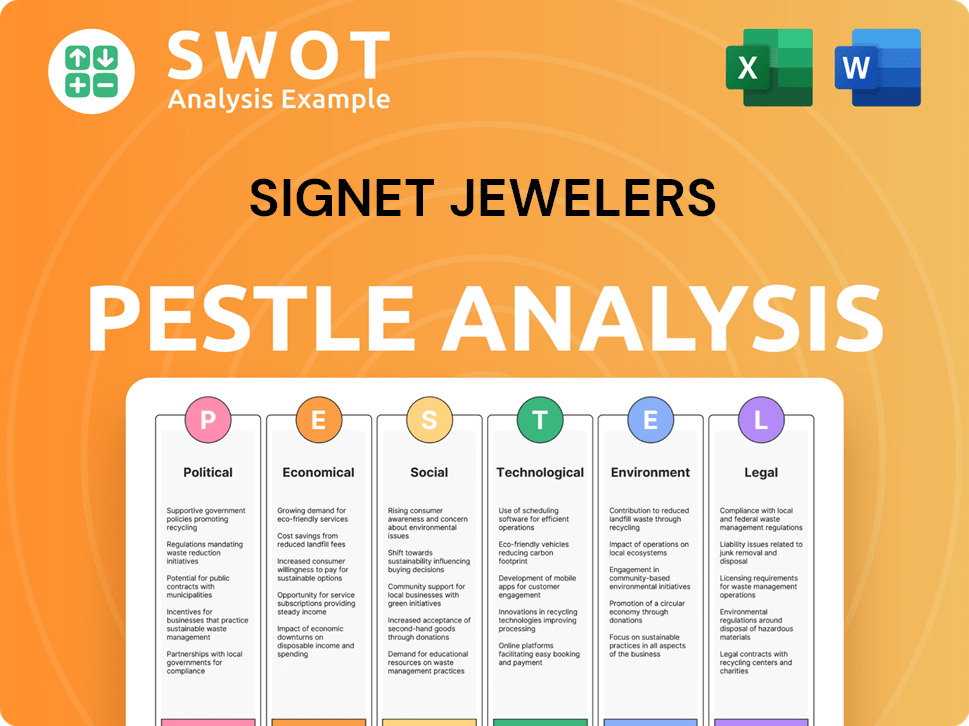

Signet Jewelers PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Signet Jewelers’s Growth Forecast?

The financial outlook for Signet Jewelers, a key player in the Jewelry Retail Market, anticipates a measured approach for Fiscal Year 2025. The company projects total sales to be between $6.53 billion and $6.80 billion. This forecast reflects the current economic environment and the company's strategic initiatives to navigate the market.

Same-store sales are expected to fluctuate, with projections ranging from a decrease of 2.5% to an increase of 1.5%. The company is also focusing on cost-saving measures and operational efficiencies to maintain profitability. These efforts are crucial for sustaining Signet Jewelers' Financial Performance amidst market uncertainties.

Signet Jewelers' Business Model is evolving to adapt to changing consumer behaviors and market dynamics. The company anticipates an adjusted operating income of $420 million to $510 million and an EPS range of $7.31 to $9.10 for Fiscal Year 2025. These projections are based on the company's strategic priorities and its ability to execute its plans effectively.

Signet anticipates total sales between $6.53 billion and $6.80 billion.

Same-store sales are expected to range from a decrease of 2.5% to an increase of 1.5%.

The company projects an adjusted operating income of $420 million to $510 million.

EPS is expected to be in the range of $7.31 to $9.10 for Fiscal Year 2025.

In Q4 Fiscal 2025, Signet reported total sales of $2.35 billion, a 6% year-over-year decrease. Despite this, the company demonstrated strong investor confidence, as evidenced by a 23.25% surge in stock price. For the full Fiscal Year 2025, sales reached $6.7 billion, a 6.5% decrease compared to the previous year, with same-store sales declining by 3.4%. This performance highlights the challenges and opportunities within the current Jewelry Retail Market.

Signet generated over $400 million in free cash flow in Fiscal 2025, marking its fifth consecutive year of strong cash conversion. This financial strength supports the company's strategic initiatives.

The company returned approximately $1 billion to shareholders in Fiscal Year 2025 through share repurchases and convertible preferred redemptions. This resulted in a nearly 20% reduction in diluted share count.

Signet is implementing significant cost savings initiatives, with approximately $150 million to $180 million in new cost savings anticipated for Fiscal Year 2025. This includes leveraging technology and sourcing efficiencies.

Management aims to achieve an annualized $100 million benefit in Selling, General, and Administrative (SG&A) expenses through reorganization efforts, including a 30% reduction in senior leadership.

The company's capital allocation priorities include organic growth and returning excess cash to shareholders, while maintaining a conservative balance sheet. This approach supports long-term value creation.

Fiscal 2025 engagement incidents are expected to increase by 5% to 10% compared to Fiscal 2024, indicating a gradual recovery in engagement rates in the U.S.

Signet Jewelers' Financial Performance is influenced by various factors, including consumer spending, economic conditions, and strategic initiatives. The company's ability to manage costs and adapt to market changes is crucial for its future success.

- Total Sales (Fiscal 2025): $6.7 billion

- Same-Store Sales Decline (Fiscal 2025): 3.4%

- Free Cash Flow (Fiscal 2025): Over $400 million

- Shareholder Returns (Fiscal 2025): Approximately $1 billion

For a deeper understanding of the company's target market, consider exploring the Target Market of Signet Jewelers.

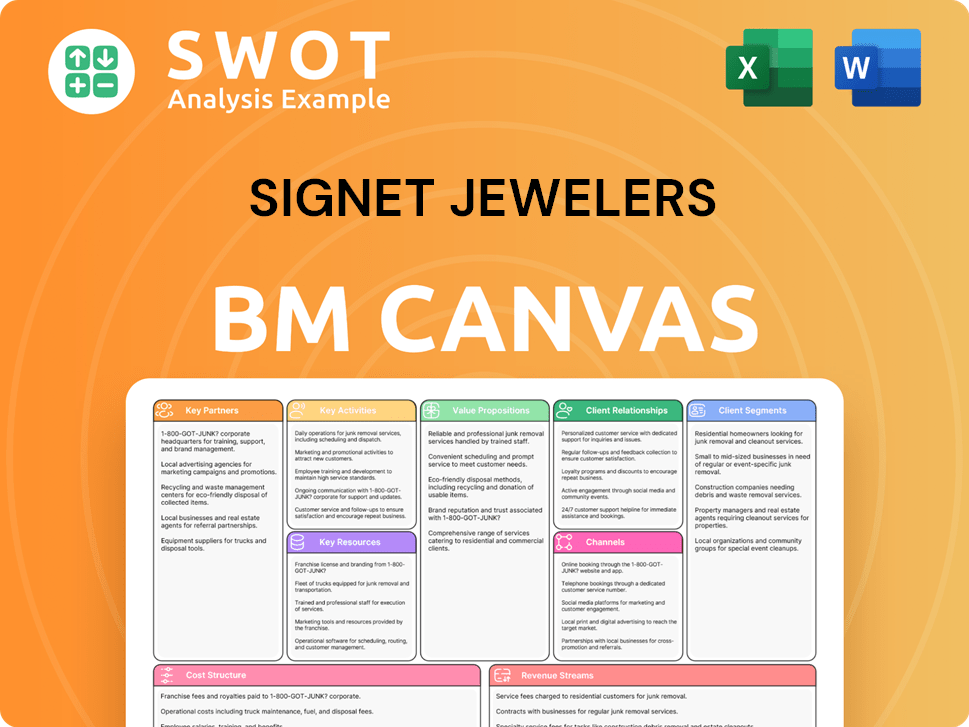

Signet Jewelers Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Signet Jewelers’s Growth?

The path forward for Signet Jewelers, while promising, is fraught with potential pitfalls. The jewelry retail market is highly competitive, and the company faces several strategic and operational risks that could hinder its Signet Jewelers Growth Strategy. Understanding these challenges is crucial for assessing the company's future prospects and overall Signet Jewelers Company Analysis.

One of the primary challenges for Signet is the ongoing decline in same-store sales, coupled with the potential for market saturation, especially in the U.S. jewelry market. Macroeconomic conditions, such as inflation and consumer spending habits, also present significant headwinds. These factors directly impact Signet Jewelers Financial Performance and its ability to achieve its financial goals.

Another significant risk stems from digital integration issues, particularly with its Blue Nile and James Allen subsidiaries. Operational and integration challenges have led to fulfillment issues, impacting same-store sales. The company anticipates a negative impact on sales due to these integration issues in Fiscal 2025. Furthermore, competition and heavy discounting strategies by competitors add to the complexity of the situation.

Signet experienced a revenue decline of 6% in Q4 Fiscal 2025. Full-year sales decreased to $7.17 billion in Fiscal 2024 from $7.84 billion in Fiscal 2023. This highlights the impact of market saturation and declining same-store sales on Signet Jewelers' financial health and future prospects.

Operational and integration issues with digital banners negatively affected fulfillment. Signet expects a 1.5% to 2.0% negative impact on sales from these digital integration issues in Fiscal 2025. These issues are a key factor in evaluating Signet Jewelers' digital transformation initiatives.

The bridal jewelry segment accounts for approximately half of Signet's merchandise sales. Fluctuations in engagement rates can significantly impact financial performance. While a three-year recovery in U.S. engagement rates is anticipated, any slower-than-expected recovery could negatively affect the company.

Mall-based locations still contribute a significant portion of revenue (30-35% in North America). Declining foot traffic in malls poses a risk. Signet plans to close approximately 150 underperforming stores and relocate nearly 200 other stores to off-mall locations over the next few years.

Balancing natural and lab-grown diamond strategies presents a challenge. The company must navigate consumer preferences and market dynamics to maximize profitability. This is vital for Signet Jewelers' expansion plans and strategies.

The jewelry retail market is highly competitive, with rivals often employing heavy discounting. This intense competition requires Signet to continuously innovate and differentiate its offerings to retain market share. Understanding the Signet Jewelers competitive landscape analysis is crucial for long-term success.

Signet is actively addressing these risks through a brand-focused approach designed to foster customer loyalty and differentiate its offerings. The company is also implementing reorganization and cost-saving measures, including a 30% reduction in senior leadership and centralizing core capabilities to improve efficiency. Further insights into the company's mission, vision, and values can be found in this article: Mission, Vision & Core Values of Signet Jewelers.

Despite the challenges, Signet is focused on driving organic growth through marketing personalization, new product offerings, and expanding its service business. This strategy aims to strengthen the Signet Jewelers Business Model and improve its Signet Jewelers stock price forecast. The company is also working on customer acquisition strategies.

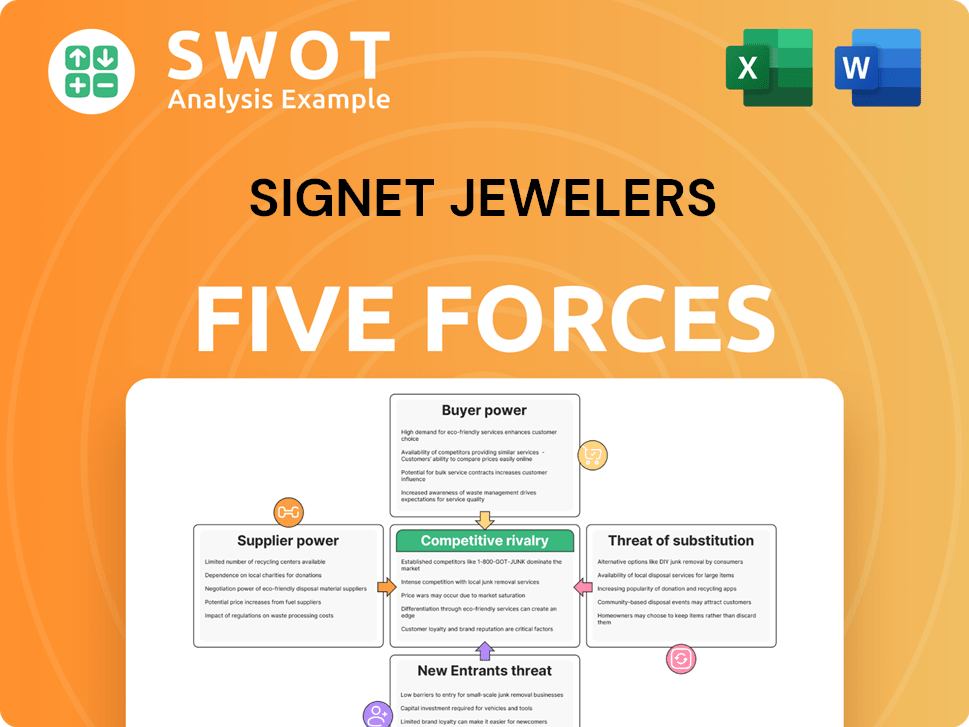

Signet Jewelers Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Signet Jewelers Company?

- What is Competitive Landscape of Signet Jewelers Company?

- How Does Signet Jewelers Company Work?

- What is Sales and Marketing Strategy of Signet Jewelers Company?

- What is Brief History of Signet Jewelers Company?

- Who Owns Signet Jewelers Company?

- What is Customer Demographics and Target Market of Signet Jewelers Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.