Transcontinental Bundle

Can TC Transcontinental Continue Its Ascent?

TC Transcontinental, a North American leader, has significantly reshaped its business, particularly through strategic investments in flexible packaging. Founded in 1976, the company has evolved from its printing roots to become a major player in flexible packaging and publishing. With a focus on expansion and innovation, what does the future hold for this dynamic company?

This exploration delves into the Transcontinental SWOT Analysis, providing a comprehensive look at its growth strategy and future prospects. We will examine how Transcontinental Company is navigating the complexities of business expansion through robust strategic planning and insightful market analysis. Understanding the company's trajectory is crucial for anyone interested in the future of transcontinental logistics and the impact of technology on transcontinental growth.

How Is Transcontinental Expanding Its Reach?

The company, is actively pursuing various expansion initiatives to strengthen its market position. These efforts are primarily focused on the flexible packaging and in-store marketing sectors. The company's strategic investments in these areas are expected to be key drivers of long-term growth, according to recent reports.

In the Packaging Sector, the company anticipates organic growth in adjusted operating earnings before depreciation and amortization for fiscal year 2025 compared to fiscal year 2024. This sector has shown resilience despite facing some challenges. The company is adapting to market dynamics and focusing on areas with strong growth potential.

The Retail Services and Printing Sector is another area of focus for the company. The rollout of raddar™ and the expansion of in-store marketing activities are key initiatives. These developments are expected to contribute to the company's overall growth strategy and future prospects.

The company is investing in the Packaging Sector to drive long-term growth. The focus is on flexible packaging solutions. Despite some challenges, the company anticipates organic growth in adjusted operating earnings for fiscal year 2025.

The company is encouraged by the rollout of raddar™ and growth opportunities in in-store marketing. This sector saw a 6.1% increase in adjusted operating earnings before depreciation and amortization for the first quarter of fiscal 2025. Cost reduction initiatives also play a key role.

The company completed the sale of its industrial packaging operations to Hood Packaging Corporation for C$132.0 million (US$95.0 million) on October 28, 2024. This strategic move allows the company to focus on core growth areas. This is part of the company's strategic planning.

The Retail Services and Printing Sector saw a 6.1% increase in adjusted operating earnings before depreciation and amortization for the first quarter of fiscal 2025. This growth was driven by cost reduction initiatives, a favorable product mix, and increased book printing activities.

These initiatives are part of the company's broader growth strategy, aimed at enhancing its market position and driving long-term value. The company's focus on flexible packaging and in-store marketing reflects its commitment to adapting to market trends and capitalizing on emerging opportunities. For more details on the company's business model, you can read about the Revenue Streams & Business Model of Transcontinental.

The company is strategically expanding its operations in key sectors. This includes a focus on flexible packaging and in-store marketing. These efforts are supported by financial performance and strategic adjustments.

- Anticipated organic growth in adjusted operating earnings for the Packaging Sector in fiscal 2025.

- A 6.1% increase in adjusted operating earnings before depreciation and amortization for the Retail Services and Printing Sector in Q1 fiscal 2025.

- Sale of industrial packaging operations for C$132.0 million (US$95.0 million) in October 2024.

- Focus on the rollout of raddar™ and growth opportunities in in-store marketing.

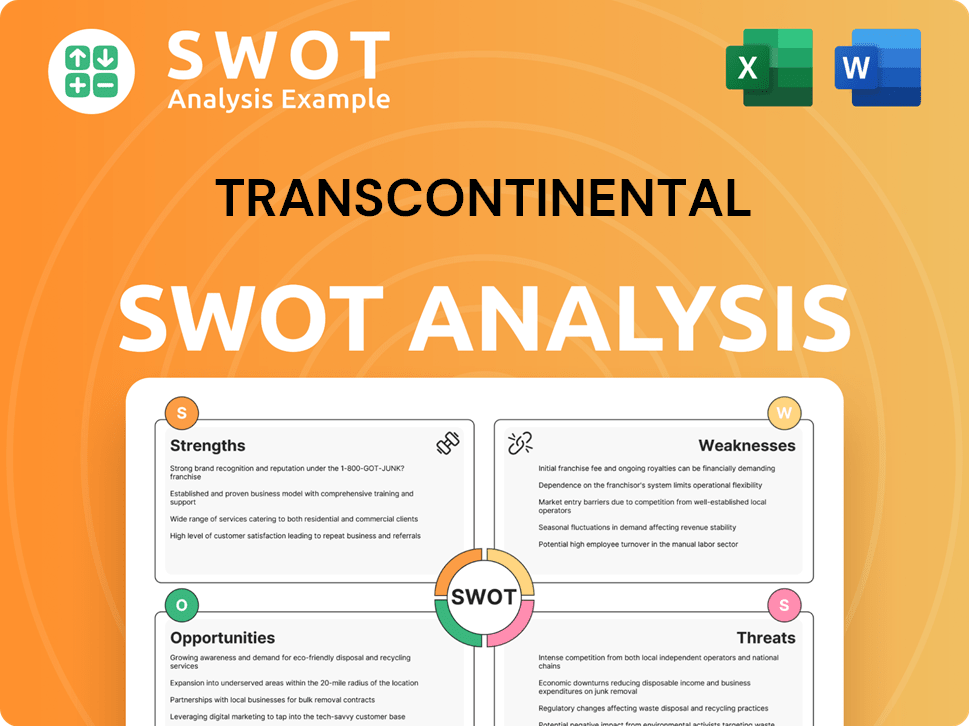

Transcontinental SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Transcontinental Invest in Innovation?

The company's growth strategy heavily relies on innovation and technology, particularly within its packaging and media segments. This approach is crucial for navigating the evolving market landscape and ensuring long-term success. The focus on sustainable solutions and digital transformation highlights a commitment to adapting to future demands and maintaining a competitive edge.

A key element of this strategy involves a strong emphasis on sustainability. The company aims to make all its plastic packaging reusable, recyclable, or compostable by 2025. This ambitious goal drives significant investment in research and development, especially in sustainable film development, showcasing a proactive approach to environmental responsibility.

Furthermore, the integration of technology extends to various areas of the business. In the media segment, the company is exploring the use of artificial intelligence to enhance operations, such as children's book publishing. This demonstrates a forward-thinking approach to leveraging technology for improved efficiency and innovation.

The company's commitment to sustainable packaging is a cornerstone of its innovation strategy. This involves significant investment in research and development to create eco-friendly packaging solutions. This strategy is a direct response to growing consumer and regulatory demands for sustainable products.

Digital transformation is another key area of focus, with investments in areas like artificial intelligence. This includes the adoption of digital technologies to streamline processes and enhance operational efficiency. This strategy is designed to improve customer engagement and create new revenue streams.

The company is actively involved in research and development to create sustainable films. This includes exploring new materials and technologies to improve the environmental profile of its packaging. This ensures that the company remains at the forefront of sustainable packaging innovation.

The company has received numerous awards for its sustainable packaging innovations. These accolades validate the effectiveness of its strategies and enhance its reputation. Recognition from industry peers and organizations boosts the company's credibility.

The company participates in initiatives like the Carbon Disclosure Project and the United Nations Global Compact. This demonstrates a commitment to environmental transparency and responsible business practices. This commitment is crucial for building trust with stakeholders.

The company is exploring the use of artificial intelligence in its media segment, particularly in children's book publishing. This illustrates the company's efforts to leverage technology to enhance its offerings. This strategy is aimed at creating more engaging and interactive content.

The company's commitment to sustainability is reflected in its participation in the Carbon Disclosure Project since 2012 and the United Nations Global Compact since 2020. These initiatives highlight the company's dedication to environmental transparency and responsible business practices. The company's focus on innovation and technology is designed to drive business expansion and secure its future prospects.

The company's technological initiatives are geared towards improving operational efficiency and sustainability. These initiatives are crucial for maintaining a competitive edge in the market and driving growth strategy. The company's focus on innovation is essential for long-term success.

- Sustainable Packaging: Development of reusable, recyclable, and compostable packaging.

- Digital Transformation: Integration of AI and other technologies in various business segments.

- R&D Investments: Continuous research in sustainable materials and processes.

- Media Segment Enhancements: Application of AI in children's book publishing.

- Environmental Initiatives: Participation in Carbon Disclosure Project and UN Global Compact.

For a deeper understanding of the competitive landscape, consider exploring the Competitors Landscape of Transcontinental. This analysis can provide valuable insights into how the company's strategic planning compares to its rivals.

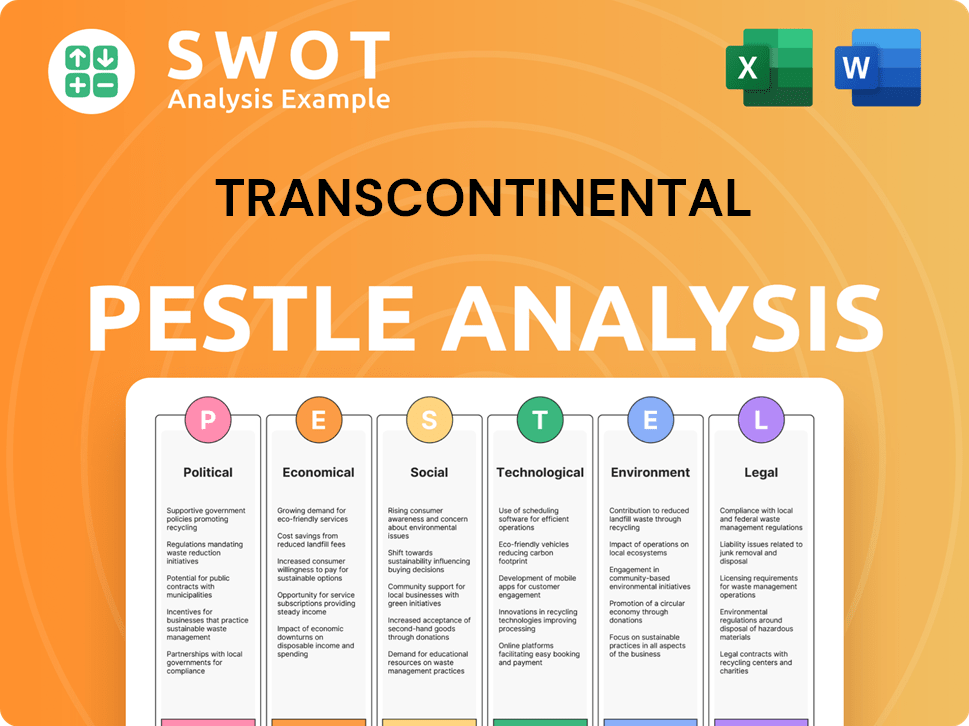

Transcontinental PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Transcontinental’s Growth Forecast?

The financial outlook for TC Transcontinental reflects a period of strategic adjustments and operational efficiency. The company's performance in fiscal year 2024, with revenues of C$2.8 billion and cash flows from operating activities of C$413.7 million, sets a baseline for future developments. The company's growth strategy includes managing its portfolio and enhancing operational performance.

For the first quarter of fiscal 2025, ending January 26, 2025, the company reported revenues of C$643.0 million, operating earnings of C$88.7 million, and net earnings attributable to shareholders of C$55.6 million. Adjusted operating earnings before depreciation and amortization for Q1 2025 increased by 1.5% to C$97.5 million, indicating the impact of cost-reduction initiatives. This demonstrates the company's focus on optimizing its financial performance.

The company's financial strategy involves managing its debt and capital expenditures. The net indebtedness ratio improved to 1.53x as of January 26, 2025, and a special dividend of C$1.00 per share was declared in Q1 2025. Capital expenditures are expected to remain flat at approximately C$120 million in fiscal year 2025, primarily for maintenance and investments in the Media segment. These actions show a commitment to returning value to shareholders while investing in the business.

Morningstar DBRS forecasts a revenue decline towards C$2.7 billion in fiscal year 2025, down from C$2.8 billion in fiscal year 2024. This decline is primarily due to the sale of industrial packaging operations and near-term challenges in medical packaging. However, adjusted EBITDA is expected to remain stable, ranging from C$465 million to C$475 million in fiscal year 2025, compared to C$469 million in fiscal year 2024.

The company is actively managing its debt, having repaid C$200 million of notes maturing in 2025. It also plans to generate up to C$200 million from asset sales in fiscal year 2025, aiming for gross leverage below 2.0x. This strategy supports the company's financial stability and flexibility.

Capital expenditures are planned to be approximately C$120 million in fiscal year 2025, focused on maintenance and investments in the Media segment. The declaration of a special dividend of C$1.00 per share in Q1 2025 reflects the company's commitment to returning value to shareholders. This allocation strategy balances investment in core operations with shareholder returns.

The positive impact of cost reduction initiatives is evident in the 1.5% increase in adjusted operating earnings before depreciation and amortization for Q1 2025. These initiatives are crucial for maintaining profitability and improving operational efficiency. The Owners & Shareholders of Transcontinental should note that this is a key element of the company's growth strategy.

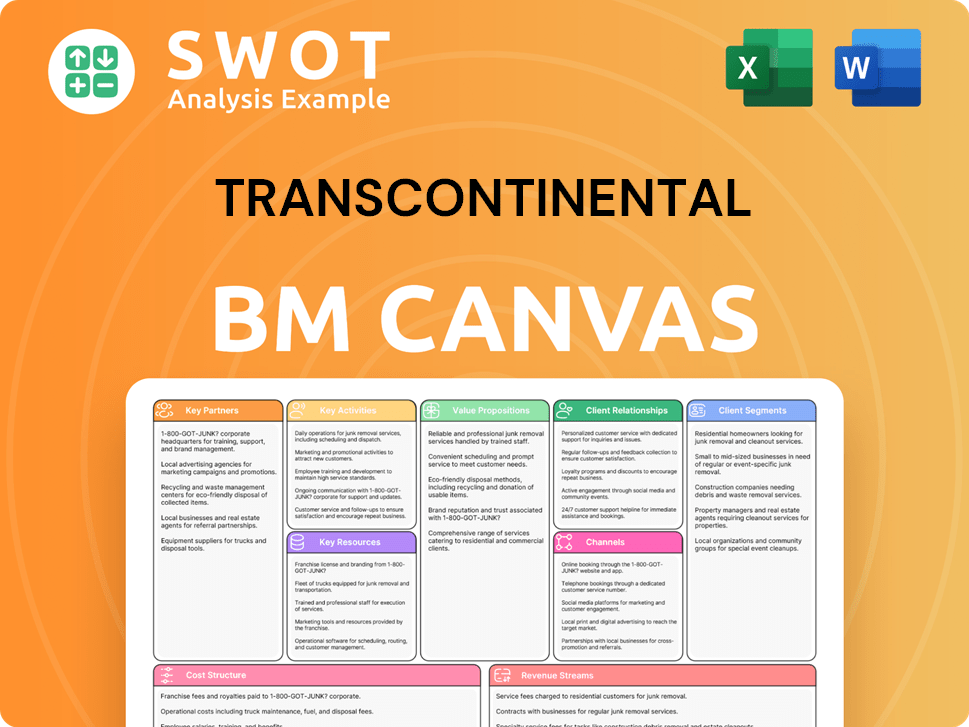

Transcontinental Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Transcontinental’s Growth?

The Transcontinental company faces several potential risks and obstacles that could influence its future growth strategy. The printing sector, where the company is a major player in Canada, is highly competitive and faces the ongoing challenge of a shift towards digital media. The flexible packaging industry, another key area, is also fragmented, with competition based on various factors like quality and price.

Regulatory changes and labor disputes could affect the Retail Services and Printing Sector. Additionally, the company's performance is subject to the development and adoption of digital products. The Packaging Sector, while generally promising, has experienced weaker demand in certain regions. These factors highlight the need for careful strategic planning to navigate the evolving market landscape and ensure sustainable business expansion.

To address these challenges, the company has initiated a program to improve profitability and strengthen its financial position. The goal is to achieve annual recurring savings of approximately C$30 million by the end of fiscal 2024. The company's diversified customer base and product offerings, along with its strong free cash flow generation, are key to managing economic uncertainties and supporting its credit ratings.

The printing industry is highly competitive, with many players vying for market share. Increased pricing pressure and overcapacity within the industry are significant challenges. The shift towards digital media further complicates the landscape, requiring continuous adaptation and innovation to maintain a competitive edge.

The flexible packaging industry also faces fragmentation, with competition based on factors like product features and innovation. Demand fluctuations in specific regions, such as Latin America, can impact financial performance. Managing these market dynamics is crucial for the company's success.

Regulatory changes, particularly those affecting door-to-door distribution, can disrupt operations. Labor disputes, such as those at Canada Post, can also affect the Retail Services and Printing Sector. These operational risks necessitate proactive management and contingency planning.

The company's future performance is influenced by digital product development and adoption. Keeping pace with technological advancements and consumer preferences is essential. Failure to adapt can lead to a loss of market share and reduced profitability.

Economic uncertainties can affect the company's financial performance. The company must manage its credit ratings and maintain strong free cash flow. A diversified customer base and product offerings help mitigate these risks.

Weaker demand in certain markets, such as Latin America and the medical market, can impact the Packaging Sector's performance. The company needs to identify and address these demand fluctuations. Adapting to market-specific challenges is critical for sustained growth.

The company's two-year program to improve profitability and financial position is crucial. This program aims to achieve annual recurring savings of approximately C$30 million by the end of fiscal 2024. The company's strong free cash flow generation supports its ability to manage economic uncertainties.

The printing industry's competitive landscape, with numerous players and overcapacity, presents continuous challenges. The shift to digital media requires ongoing adaptation and investment. The flexible packaging sector's fragmentation demands strategic focus on product features and innovation to maintain competitiveness.

The company's diversified customer base and product offerings support its financial stability. The ability to generate strong free cash flow is essential for managing economic uncertainties. These factors contribute to maintaining credit ratings and supporting future investment trends.

Strategic planning is crucial for navigating the challenges of transcontinental business expansion. Market analysis is essential for identifying growth opportunities and mitigating risks. The company's ability to adapt to regulatory changes and manage labor disputes is also vital for long-term success.

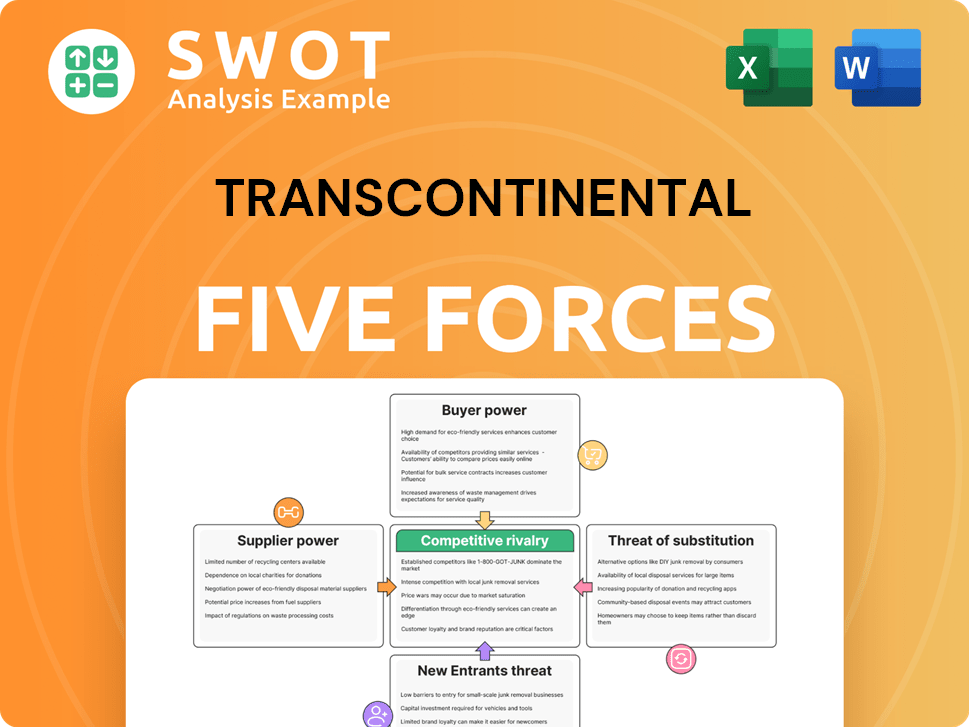

Transcontinental Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Transcontinental Company?

- What is Competitive Landscape of Transcontinental Company?

- How Does Transcontinental Company Work?

- What is Sales and Marketing Strategy of Transcontinental Company?

- What is Brief History of Transcontinental Company?

- Who Owns Transcontinental Company?

- What is Customer Demographics and Target Market of Transcontinental Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.