Simply Good Foods Bundle

Can Simply Good Foods Continue Its Nutritional Snacking Dominance?

Discover the Simply Good Foods SWOT Analysis and unlock the secrets behind the nutritional food company's remarkable journey. From its inception in 2017, Simply Good Foods has redefined the snacking landscape with its focus on better-for-you options. But what does the future hold for this industry leader?

This in-depth analysis explores the growth strategy of Simply Good Foods, examining its future prospects within the competitive market. We'll dissect its business strategy, analyze its market position, and investigate how the company plans to navigate the evolving consumer trends. Understanding the Simply Good Foods company growth strategy is crucial for anyone interested in the future of Simply Good Foods stock and its overall Simply Good Foods company future outlook.

How Is Simply Good Foods Expanding Its Reach?

The Growth strategy of Simply Good Foods centers around several key expansion initiatives designed to boost future performance. These initiatives focus on new product launches, wider distribution networks, and strategic acquisitions to broaden its market presence. This approach is critical for a Nutritional food company aiming to capture a larger share of the health-conscious consumer market.

A core element of Simply Good Foods's strategy involves expanding its product offerings. This is achieved through both internal innovation and external acquisitions. The company is actively seeking to diversify its portfolio and cater to evolving consumer preferences within the nutritional snacking sector. This strategy is supported by detailed Market analysis to identify growth opportunities and consumer trends.

A significant move in this direction was the acquisition of Only What You Need, Inc. (OWYN) on June 13, 2024. This strategic acquisition brought plant-based protein products into the Simply Good Foods portfolio, a move that significantly broadened its market reach and product offerings. OWYN's addition is a key part of the Business strategy to diversify revenue streams and attract new customer segments.

The acquisition of Only What You Need, Inc. (OWYN) on June 13, 2024, expanded Simply Good Foods' product line. OWYN's plant-based protein offerings contributed significantly to the company's sales. This strategic move broadened Simply Good Foods' market presence.

OWYN contributed $32.3 million to net sales in Q1 2025 and $33.8 million in Q2 2025. The company anticipates OWYN's net sales to be between $140 million and $150 million for fiscal year 2025. This highlights the acquisition's positive financial impact.

Simply Good Foods focuses on organic growth, particularly for its Quest brand. This involves increasing distribution and brand awareness. The company is actively adding new retail locations to boost sales.

New product launches are a key component of Simply Good Foods' strategy. The Quest 'Overload' bar, expected in February 2025, aims to improve market trends. Addressing past capacity constraints for Quest chips is also a priority.

Beyond acquisitions, Simply Good Foods is focused on organic growth through increased distribution and product innovation, especially for its Quest brand. The company is actively adding new retail locations and enhancing brand awareness. For instance, Quest's retail takeaway grew by approximately 13% in the second quarter of fiscal year 2025. The company is addressing past capacity constraints for Quest chips, expecting retail inventory levels to normalize by the end of the first quarter of fiscal year 2025, which should support solid growth. New product launches, like the Quest 'Overload' bar expected in February 2025, are also key to improving market trends. While international organic net sales for Simply Good Foods declined by $2.1 million to $6.4 million in Q2 2025, the overall strategy emphasizes leveraging its diversified portfolio to lead the nutritional snacking movement. For more insights, you can refer to this article on Simply Good Foods's financial performance and future outlook here.

Simply Good Foods is focused on expanding through acquisitions, product innovation, and distribution. The acquisition of OWYN broadened its product portfolio, adding plant-based protein options. The company is also focused on organic growth through its Quest brand.

- Acquisition of OWYN to expand product offerings.

- Increased distribution and brand awareness for Quest.

- New product launches, such as the Quest 'Overload' bar.

- Addressing capacity constraints to support growth.

Simply Good Foods SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Simply Good Foods Invest in Innovation?

The company, a nutritional food company, focuses on innovation to meet the evolving consumer demands for high-protein, low-sugar, and low-carb foods. This strategy is crucial for its growth strategy and future prospects. The company's strategic focus involves investments in innovation and marketing across its brands, particularly Quest.

Simply Good Foods aims to capitalize on consumer trends and expand its market penetration. The company's ability to maintain strong retail takeaway for its brands, even with challenges in specific product lines, suggests that its product development is resonating with consumers. This approach is centered on responding directly to market trends and consumer preferences in the nutritional snacking category.

The company's commitment to innovation is evident through continuous product launches and reformulation efforts, particularly for Atkins. The revitalization plans for the Atkins brand include focusing on packaging and reformulation, alongside optimizing brand investments. This approach is designed to meet the needs of health-conscious consumers.

Quest brand is a significant driver of innovation, with new products like the 'Bake Shop' platform performing well. The 'Overload' bar launched in February 2025, demonstrating the company's commitment to expanding its product line. This strategy directly addresses the need for new and exciting options in the market.

The Atkins brand is undergoing revitalization with a focus on packaging and reformulation. This includes optimizing brand investments to better meet consumer expectations. This ensures the brand remains relevant and competitive in the market.

The company's innovation strategy is closely aligned with market trends, particularly the demand for high-protein, low-sugar, and low-carb foods. This focus helps the company maintain its competitive edge. This is crucial for long-term success.

Simply Good Foods prioritizes understanding and responding to consumer preferences in the nutritional snacking category. This consumer-centric approach drives product development and marketing strategies. This ensures products resonate with the target audience.

While specific details on R&D investments and collaborations are not extensively disclosed, the continuous product launches indicate a commitment to innovation. This includes both in-house development and potential partnerships. This supports the company's growth.

The company's ability to maintain strong retail takeaway for its brands, even with challenges, suggests that its product development is effective. This indicates a strong alignment with consumer needs. This is a key indicator of success.

Simply Good Foods' innovation strategy is a critical component of its business strategy, supporting its market analysis and future prospects. The company's focus on new product development, brand revitalization, and responsiveness to consumer trends positions it well for continued growth. For a deeper dive into the company's financial structure, consider exploring the Revenue Streams & Business Model of Simply Good Foods.

- Product Line Expansion: Continuous launches and reformulations, especially with Quest, are key.

- Brand Investments: Optimizing investments in brands like Atkins to drive growth.

- Consumer Focus: Prioritizing consumer preferences for high-protein, low-sugar, and low-carb options.

- Market Adaptation: Adapting to evolving consumer demands and market trends.

Simply Good Foods PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Simply Good Foods’s Growth Forecast?

The financial outlook for Simply Good Foods for fiscal year 2025 indicates a positive trajectory, with the company anticipating continued growth. This growth is supported by strategic acquisitions and a focus on organic sales expansion. Understanding the financial health of the company is crucial for assessing its Brief History of Simply Good Foods and future prospects.

For fiscal year 2025, the company projects net sales to increase by 8.5% to 10.5%. This includes contributions from the OWYN acquisition, with projected net sales between $140 million and $150 million. Organic net sales growth is primarily expected to be driven by volume, reflecting the effectiveness of the company's growth strategy.

Adjusted EBITDA is expected to increase by 4% to 6% in fiscal year 2025. This growth is planned despite an anticipated decline in gross margin of approximately 200 basis points compared to fiscal year 2024, mainly due to higher input costs in the second half of the year and preliminary estimates of costs related to recently announced tariffs. However, the company's focus on productivity and cost-saving initiatives will partially offset these pressures.

Net sales reached $341.3 million, a 10.6% increase year-over-year.

Net income was $38.1 million.

Adjusted EBITDA was $70.1 million, up 13.1% year-over-year.

Net sales increased 15.2% to $359.7 million.

Net income was $36.7 million.

Adjusted EBITDA was $68.0 million.

The company demonstrates financial strength with a strong cash position.

- Cash on hand at the end of the second quarter of fiscal year 2025 was $103.7 million.

- The company has repaid $190.0 million of its term loan since the OWYN acquisition.

- Net debt to trailing 12-month Adjusted EBITDA ratio was 0.7x as of March 1, 2025.

Simply Good Foods Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Simply Good Foods’s Growth?

The Simply Good Foods Company faces several potential risks that could impact its growth strategy and overall performance. These challenges span market competition, cost pressures, and evolving consumer preferences. Understanding these risks is crucial for assessing the future prospects of the company and its ability to maintain its position in the nutritional food market.

Market competition is a significant obstacle, given the numerous players in the health and nutrition segment. The company's reliance on specific suppliers and potential shifts in consumer tastes also pose challenges. Addressing these risks requires strategic adaptation and proactive measures to ensure sustainable growth.

The company anticipates input cost inflation in fiscal year 2025, with headwinds increasing in the second half of the year. This could compress gross margins, with an expected decline of approximately 200 basis points in fiscal year 2025 compared to fiscal year 2024. Supply chain vulnerabilities, with about 65% of key ingredient sourcing dependent on three primary suppliers, also pose a risk.

The nutritional food company operates in a highly competitive market. The presence of numerous key players in the health and nutrition segment intensifies the pressure on the company to innovate and maintain its market share. This competitive landscape affects the business strategy and requires continuous adaptation.

Rising raw material and ingredient costs pose a significant financial risk. Input cost inflation is expected to impact the company, potentially compressing gross margins. The company's financial performance is sensitive to fluctuations in these costs, which could affect its profitability and financial performance.

The company's dependence on a limited number of suppliers for key ingredients creates supply chain vulnerabilities. Disruptions in the supply chain could significantly impact production and product availability. This highlights the importance of a robust supply chain management strategy.

Evolving consumer preferences and dietary trends require continuous adaptation of product offerings. While the company focuses on high-protein, low-sugar, and low-carb products, shifts in consumer tastes could necessitate further innovation and investment. Staying ahead of these trends is vital for long-term success.

Changes in food labeling and nutritional standards can lead to increased compliance costs. The company must adapt its operations to meet new regulatory requirements. These changes can impact the company's marketing strategy and product development processes.

The decline in Atkins retail takeaway, which was off about 10% in the second quarter of fiscal year 2025, presents a challenge. Distribution issues for the Atkins brand have also impacted sales. The company’s efforts to revitalize the brand will need to overcome these obstacles.

The company addresses these risks through strategic initiatives. Diversification, such as the OWYN acquisition, is one approach to broadening its product portfolio. Innovation and marketing investments are also crucial for maintaining a competitive edge. These initiatives support the company’s long term strategy.

Understanding the Simply Good Foods market share analysis is essential for assessing its competitive position. The company's ability to maintain and grow its market share depends on its response to market challenges and its ability to meet evolving consumer demands. This requires a detailed market analysis.

The future of Simply Good Foods stock and the overall Simply Good Foods company future outlook depend on how effectively the company manages these risks. The ability to adapt to market changes, control costs, and maintain a strong brand presence will be critical. For further insights, consider reading about Owners & Shareholders of Simply Good Foods.

Simply Good Foods product line expansion and Simply Good Foods new product development are key strategies to address changing consumer preferences. Investments in research and development and the introduction of innovative products are crucial for sustainable growth. These efforts are vital to remain competitive in the Simply Good Foods competitive landscape.

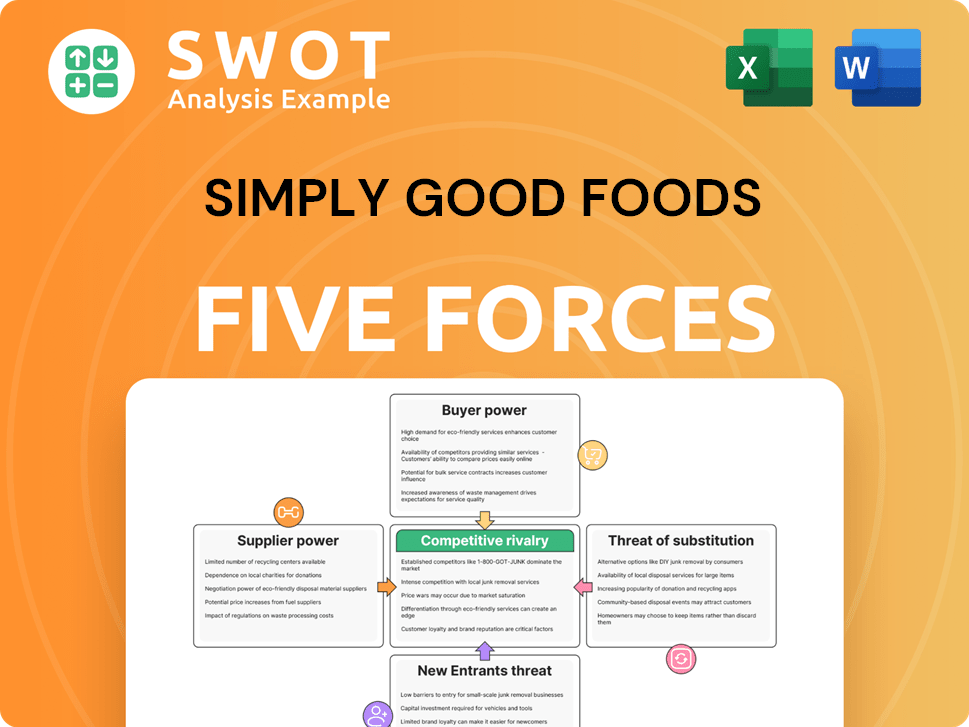

Simply Good Foods Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Simply Good Foods Company?

- What is Competitive Landscape of Simply Good Foods Company?

- How Does Simply Good Foods Company Work?

- What is Sales and Marketing Strategy of Simply Good Foods Company?

- What is Brief History of Simply Good Foods Company?

- Who Owns Simply Good Foods Company?

- What is Customer Demographics and Target Market of Simply Good Foods Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.