Thryv Bundle

Can Thryv Conquer the SME Market?

Thryv Holdings, Inc. has rapidly evolved from its roots in the digital transformation of Dex Media, emerging as a key player in the small business software sector. Its strategic shift toward an end-to-end customer experience platform has significantly reshaped its trajectory, making it a compelling case study in Thryv SWOT Analysis. This comprehensive platform provides essential tools for marketing automation, CRM, and payment processing, all integrated into a single, user-friendly interface.

Understanding the Thryv growth strategy is crucial for assessing its Thryv future prospects, especially considering its Thryv company analysis. The company's integrated approach offers a distinct competitive edge, setting it apart from fragmented solutions and positioning it favorably in the market. This analysis will explore Thryv's business solutions, market position, and financial performance to provide actionable insights for investors and stakeholders.

How Is Thryv Expanding Its Reach?

The expansion initiatives of the company are primarily focused on deepening its market penetration within the small and medium-sized enterprise (SME) segment. This involves enhancing its existing platform with new features and integrations, thereby increasing its value proposition to current and prospective clients. This strategy aims to solidify its market position and drive sustainable growth.

Geographically, the company has shown a commitment to international expansion, particularly in English-speaking markets. The acquisition of Sensis in Australia in 2021 was a significant step in this direction, providing a strong foothold in the Australian SME market. The company's focus on international markets is driven by the opportunity to access new customer bases and diversify revenue streams, reducing reliance on any single market.

Product pipeline development is another critical component of the company's expansion strategy. The company continuously invests in developing new modules and functionalities for its platform, aiming to provide a more comprehensive solution that can address virtually every aspect of a small business's operations. These initiatives are pursued to not only attract new customers but also to increase customer retention by providing an indispensable tool that evolves with their business needs. For more information about the revenue streams and business model, check out the article: Revenue Streams & Business Model of Thryv.

The company consistently updates its platform with new features, such as enhanced payment processing and marketing automation tools. These enhancements broaden its appeal to a wider range of businesses. This approach supports its Thryv growth strategy by making the platform more versatile and valuable.

The acquisition of Sensis in Australia in 2021 provided a significant foothold in the Australian SME market. This move allows the company to leverage Sensis's established relationships and local expertise. Further expansion into other regions with similar small business landscapes is planned.

Continuous investment in new modules and functionalities is a key part of the strategy. The goal is to offer a comprehensive solution that addresses all aspects of a small business's operations. This includes exploring new business models and partnerships.

These initiatives aim to attract new customers and increase retention. Providing an indispensable tool that evolves with business needs is crucial. The company focuses on strategies that enhance customer lifetime value.

The company's expansion strategy involves enhancing its platform and expanding geographically, particularly in English-speaking markets. This includes continuous product development and exploring new business models. These strategies are designed to boost its market position and future prospects.

- Platform Enhancements: Regularly updating the platform with new features and integrations.

- Geographic Expansion: Focusing on international markets, such as Australia, to diversify revenue streams.

- Product Development: Investing in new modules and functionalities to provide a comprehensive solution.

- Strategic Partnerships: Exploring partnerships to reach more SMEs efficiently.

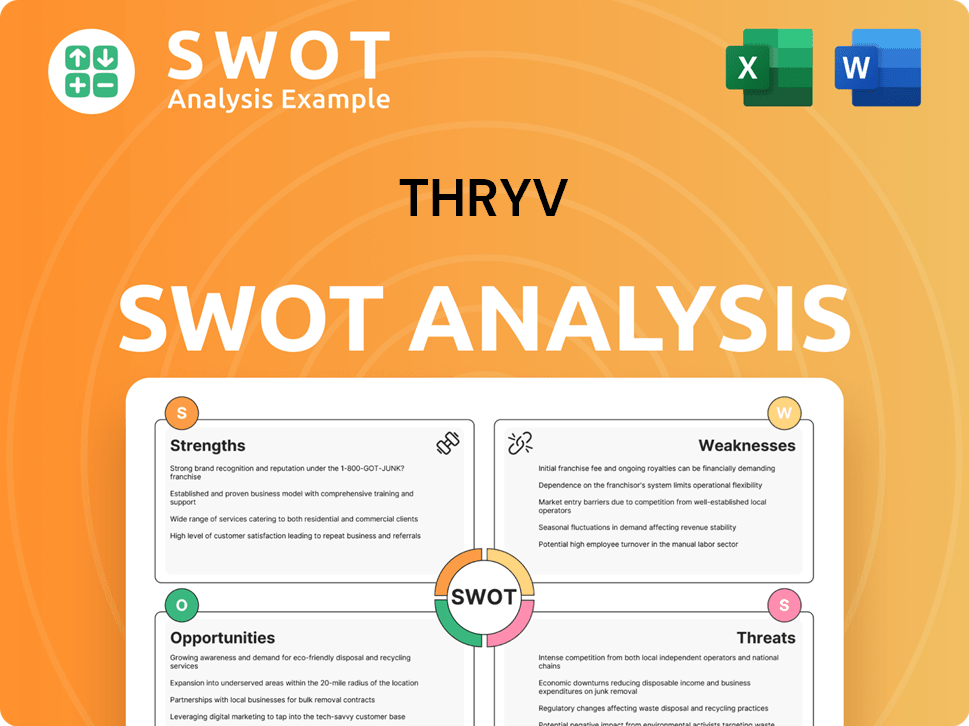

Thryv SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Thryv Invest in Innovation?

The innovation and technology strategy is a cornerstone of the company's growth, focusing on enhancing its platform and delivering value to small businesses. The company invests heavily in research and development (R&D) to improve existing offerings and introduce new features. This includes in-house development and strategic collaborations to integrate specialized functionalities and explore emerging technologies. This approach is critical for the company's future prospects.

The company is committed to digital transformation and automation for its SME clients. The platform automates tasks like appointment scheduling, customer communication, and payment reminders. This frees up small business owners to focus on core operations. The company is exploring technologies like Artificial Intelligence (AI) and machine learning (ML) to provide personalized marketing insights and predictive analytics.

The focus on a unified platform for customer experience management demonstrates its leadership in innovation within the SME software space. By consolidating various business functions into a single, intuitive interface, the company simplifies technology adoption for small businesses, a critical factor for their success. The continuous evolution of its platform and its growing user base serve as indicators of its technological prowess and its ability to deliver innovative solutions that contribute directly to its growth objectives. A deeper understanding of the Target Market of Thryv can further illuminate the impact of these technological advancements.

The company allocates a significant portion of its resources to R&D, which is essential for maintaining its competitive edge. This investment allows the company to continuously improve its existing platform and develop new features that meet the evolving needs of small businesses.

The company is actively integrating AI and ML technologies to enhance its platform's capabilities. These technologies provide personalized marketing insights, intelligent customer support, and predictive analytics, which can significantly improve the efficiency and effectiveness of small business operations.

The company's unified platform approach simplifies technology adoption for small businesses. By consolidating various business functions into a single interface, the company reduces complexity and improves user experience, which is crucial for driving adoption and customer satisfaction.

The platform's automation features streamline routine tasks such as appointment scheduling, customer communication, and payment reminders. This automation frees up small business owners to focus on core operations and strategic initiatives, enhancing overall productivity.

The company engages in strategic collaborations to integrate specialized functionalities and explore emerging technologies. These partnerships allow the company to leverage external expertise and accelerate innovation, ensuring it stays at the forefront of technological advancements.

The company prioritizes customer experience management, which is a key differentiator in the SME software space. By providing a comprehensive and user-friendly platform, the company enhances customer satisfaction and fosters long-term loyalty, contributing to sustainable growth.

The company's technology strategy focuses on providing a unified platform that integrates various business functions. This approach simplifies technology adoption for small businesses, a critical factor in their success. The continuous evolution of its platform and its growing user base serve as indicators of its technological prowess and its ability to deliver innovative solutions that contribute directly to its growth objectives.

- Automation Tools: These tools streamline tasks like appointment scheduling and payment reminders, saving time for small business owners.

- AI-Powered Insights: AI provides personalized marketing insights and predictive analytics, helping businesses make data-driven decisions.

- Unified Platform: Consolidating various business functions into a single interface simplifies technology adoption and improves user experience.

- R&D Investments: Continuous investment in R&D ensures the platform remains competitive and meets the evolving needs of small businesses.

- Strategic Partnerships: Collaborations with external innovators allow the company to integrate specialized functionalities and explore emerging technologies.

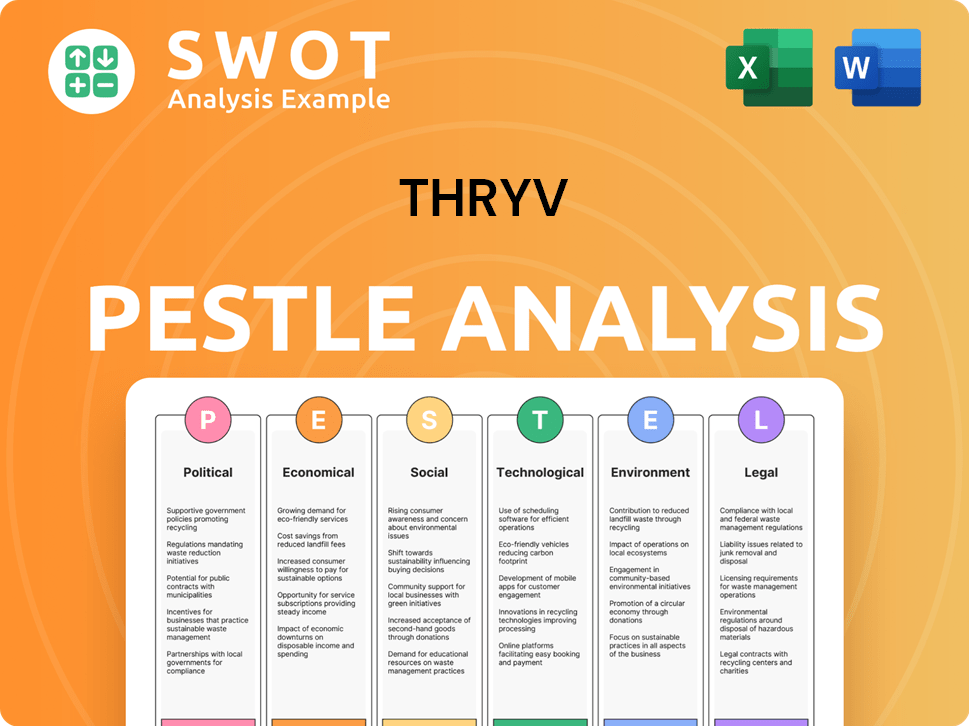

Thryv PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Thryv’s Growth Forecast?

The financial outlook for the company is closely tied to its growth strategy, with consistent strong performance and optimistic future targets. The company has demonstrated a solid history of revenue growth, driven by an expanding subscriber base and increased adoption of its integrated platform. This growth is a key indicator of the success of its business model.

The company's focus on high-margin software services contributes to healthy profit margins, which are crucial for reinvesting in R&D and expansion initiatives. Looking ahead to 2024 and beyond, the company has provided guidance that anticipates continued revenue growth. Analysts' forecasts generally align with the company's positive trajectory, often citing the growing demand for digital solutions among small businesses as a key driver.

The company's investment levels are strategically allocated to product development, sales and marketing, and potential acquisitions that align with its growth objectives. The company's financial strategy also involves optimizing its capital structure to support these growth initiatives, including exploring funding rounds or capital raises if necessary to accelerate expansion. To understand more about the company's approach, you can examine the Marketing Strategy of Thryv.

The company has shown consistent revenue growth, driven by an expanding subscriber base. This growth highlights the effectiveness of its business model and market strategy. Strong revenue performance is critical for sustaining operations and fueling further expansion.

The company's focus on high-margin software services contributes to healthy profit margins. These margins are essential for reinvesting in research and development, sales and marketing, and potential acquisitions. Healthy margins ensure financial stability and support long-term growth.

The company has provided guidance that anticipates continued revenue growth in 2024 and beyond. Analysts' forecasts support this positive trajectory, driven by the increasing demand for digital solutions among small businesses. Continued revenue growth is crucial for the company's long-term success.

The company strategically allocates investments to product development, sales and marketing, and potential acquisitions. These investments align with its growth objectives and are essential for expanding market reach. Strategic investments are key to driving innovation and market share growth.

The company's financial performance is marked by strong subscriber growth and recurring revenue, outperforming many industry benchmarks. This performance indicates the effectiveness of its strategic plans and its ability to capture market share. The company's financial health is supported by a compelling value proposition for SMEs and disciplined financial management.

- Recurring Revenue: A significant portion of the company's revenue comes from recurring sources, providing stability.

- Subscriber Growth: The company's ability to attract and retain subscribers is a key indicator of its success.

- Profit Margins: Healthy margins enable reinvestment in growth and innovation.

- Strategic Investments: Investments in product development and marketing drive expansion.

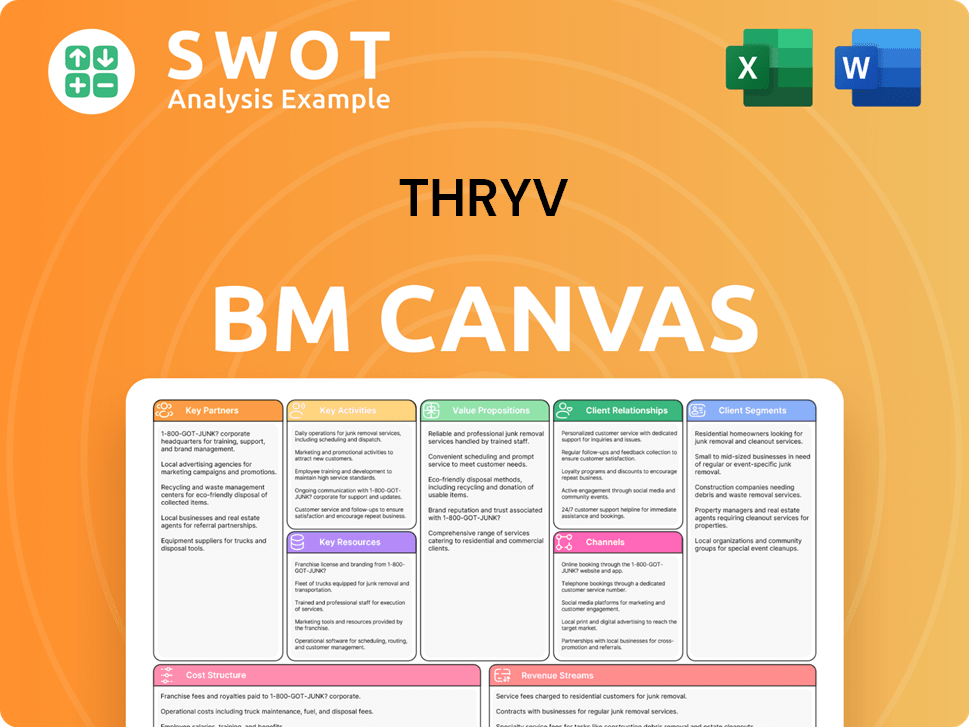

Thryv Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Thryv’s Growth?

Analyzing the Thryv company analysis reveals several potential risks that could influence its Thryv future prospects. These challenges range from market competition to regulatory hurdles, each requiring strategic mitigation. Understanding these obstacles is crucial for assessing the long-term viability of Thryv's growth strategy.

One primary concern is the intense competition within the SME market. Numerous technology providers offer specialized solutions, potentially fragmenting the market and putting pressure on pricing. Moreover, the rapid evolution of technology poses a constant threat of disruption. The company must continually innovate to maintain its competitive edge.

Regulatory changes, especially concerning data privacy and online commerce, also present significant challenges. Compliance with evolving regulations like GDPR or CCPA is critical, as are internal resource constraints, such as the ability to attract and retain top talent. These factors require proactive management and strategic planning.

The SME market is crowded with competitors offering various digital solutions. This competitive landscape can lead to pricing pressures and the need for increased marketing spend. The company's all-in-one platform approach is a key differentiator, aiming to reduce the need for small businesses to manage multiple software solutions.

Evolving regulations regarding data privacy and online commerce pose a constant challenge. Compliance with regulations like GDPR and CCPA is crucial. The company invests in robust data security measures and a dedicated legal and compliance team to adapt to new regulatory landscapes.

The software industry is subject to rapid technological advancements. New technologies or business models could render existing solutions less competitive. Continuous R&D and integrating cutting-edge technologies like AI and machine learning are vital to staying ahead.

Attracting and retaining top talent in a competitive tech labor market is crucial. The company fosters a strong company culture, offers competitive compensation packages, and invests in employee development. This helps mitigate the risk of talent shortages.

Reliance on third-party cloud providers or payment processors can create vulnerabilities. Diversifying partnerships and maintaining strong relationships with key vendors are essential. This ensures business continuity and reduces dependency on any single provider.

Economic downturns can affect small businesses, impacting the demand for the company's services. The company's management assesses and prepares for these risks through a comprehensive risk management framework, scenario planning, and maintaining a diversified product portfolio and geographic footprint.

The company's all-in-one platform strategy helps to reduce the need for small businesses to manage multiple disparate software solutions, which helps to mitigate the risk of market competition. Continuous innovation in R&D, including AI and machine learning, is essential for staying competitive. Robust data security measures and a dedicated legal team are vital for regulatory compliance.

Intense competition might lead to pricing pressures or the need for increased marketing spending, impacting profit margins. Compliance costs related to data privacy and security regulations can also affect financial performance. Maintaining strong financial health is crucial for weathering economic cycles and supporting long-term growth.

For further insights into the company's performance and strategic direction, consider exploring Owners & Shareholders of Thryv.

Thryv Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Thryv Company?

- What is Competitive Landscape of Thryv Company?

- How Does Thryv Company Work?

- What is Sales and Marketing Strategy of Thryv Company?

- What is Brief History of Thryv Company?

- Who Owns Thryv Company?

- What is Customer Demographics and Target Market of Thryv Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.