United Bank Bundle

Can United Bank Company Continue Its Impressive Ascent?

United Bankshares, Inc. (NASDAQ: UBSI) recently made a significant stride with its merger with Piedmont Bancorp, Inc., expanding its reach into the dynamic Atlanta market. This strategic move, the 34th in its history, is just one example of how United Bank Company is reshaping its profile within the Banking Sector. With a history dating back to 185 years, the company has evolved into a financial powerhouse.

As of March 31, 2025, United Bank Company boasts approximately $33 billion in assets and operates over 240 offices across nine states, showcasing its robust market position and strategic planning capabilities. The United Bank SWOT Analysis provides a detailed look at the company’s strengths, weaknesses, opportunities, and threats, offering a comprehensive understanding of its competitive landscape. This analysis is crucial for understanding the company's Growth Strategy and Future Prospects, especially in the face of evolving technological advancements and the impact of fintech.

How Is United Bank Expanding Its Reach?

The expansion initiatives of the United Bank Company are multifaceted, focusing on both inorganic and organic growth strategies. The company is actively pursuing mergers and acquisitions (M&A) to broaden its market presence and customer base. Simultaneously, it is investing in organic growth through new branch openings and the introduction of innovative products and services.

A significant step in its expansion strategy was the acquisition of Piedmont Bancorp, Inc. This strategic move aimed to strengthen its foothold in high-growth markets, particularly in the Southeast region, and enhance its competitive position within the Banking Sector. The company's focus on both M&A and organic growth demonstrates its commitment to sustainable expansion and long-term value creation.

The company's strategic planning includes a dual approach to growth, combining acquisitions with organic initiatives. This balanced strategy aims to capitalize on market opportunities, enhance customer offerings, and drive financial performance. The company's ability to execute both inorganic and organic growth strategies effectively is crucial for its future prospects.

On January 10, 2025, the company completed its 34th acquisition, Piedmont Bancorp, Inc. This all-stock transaction involved issuing 7.86 million shares. The acquisition added approximately $2.4 billion in assets, $2.1 billion in loans, and $2.1 billion in deposits to its portfolio.

The company plans to open new branches in industrial and residential areas across several governorates. It aims to introduce innovative banking solutions and credit products. The company is focused on supporting small, medium, and micro-enterprises (MSMEs) and promoting financial inclusion.

The company anticipates loan and deposit growth in the low to mid-single digits (annualized) for the full year 2025. It prioritizes a strong core deposit franchise, which is a competitive advantage. Non-interest-bearing deposits represented 26% of total deposits in 2024.

The company's strategic goals and objectives include expanding its market presence and enhancing its product offerings. It aims to leverage its strong core deposit franchise to drive sustainable growth. The company is committed to supporting MSMEs and promoting financial inclusion.

The company's growth strategy involves both acquisitions and organic initiatives to expand its market presence and customer base. The acquisition of Piedmont Bancorp, Inc. is a prime example of its inorganic growth strategy. The company is also focused on introducing innovative banking solutions and credit products to broaden its customer base.

- Strategic M&A to enter new markets and enhance competitive positioning.

- Opening new branches in strategic locations to increase local market presence.

- Introducing innovative banking solutions and credit products to attract new customers.

- Supporting MSMEs and promoting financial inclusion to broaden its customer base.

The company's expansion initiatives are designed to drive sustainable growth and enhance shareholder value. By combining strategic acquisitions with organic growth strategies, the company is positioning itself for long-term success in the competitive financial landscape. For more insights into the company's business model, consider exploring the Revenue Streams & Business Model of United Bank.

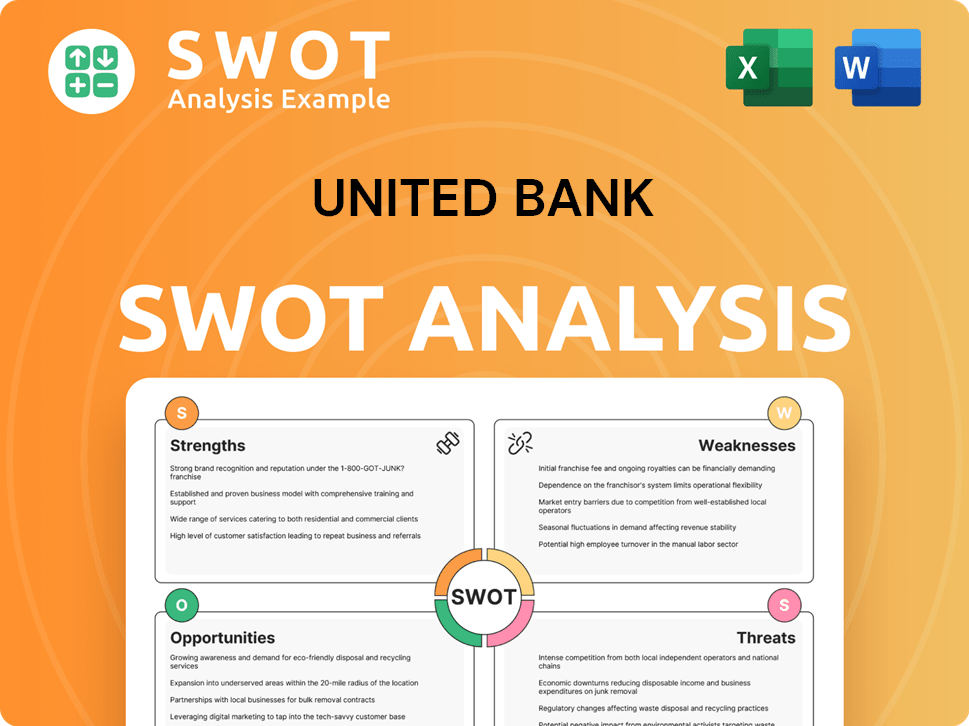

United Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does United Bank Invest in Innovation?

United Bank Company is focusing on innovation and technology to foster sustained growth, with a strong emphasis on digital transformation and enhancing customer experience. This strategic direction is crucial in the rapidly evolving Banking Sector, where technological advancements are key to maintaining a competitive edge. The company plans to invest in financial technology services and launch new digital banking solutions.

The commitment to digital advancement is a response to the broader industry trend. Technology serves as a powerful lever for competitive advantage in the financial sector. This approach is designed to streamline processes and improve the overall customer experience, aligning with the strategic goals and objectives of the company.

While specific details on R&D investments or key patents for United Bank Company are not readily available, the company's strategic roadmap for 2025 emphasizes innovation and digital transformation. For example, United Bank (an entity associated with United Bancorporation of Alabama, Inc.) recently selected Jack Henry to modernize its technology stack.

The modernization of the technology stack is a key component of United Bank Company's Growth Strategy. This includes streamlining processes and enhancing the customer experience, particularly for retail and small business customers. The bank is leveraging advanced technologies to support its expansion plans.

United Bank Company is partnering with technology providers like Jack Henry to implement hosted core processing solutions, commercial loan origination platforms (LoanVantage®), and the Banno Digital Platform™. These partnerships are crucial for technological advancements.

The bank is committed to providing advanced financial services that align with rapid digital changes. This includes a focus on digital payment programs to improve efficiency and transparency in financial transactions. This is a key aspect of United Bank Company's customer acquisition strategies.

The strategic goals include sustainable growth initiatives and enhancing the overall customer experience. This involves a commitment to providing advanced financial services that align with rapid digital changes. These goals are central to the company's strategic planning.

United Bank Company plans to inject new investments into financial technology services. This investment reflects the company's understanding of the impact of fintech on the Banking Sector. This is a part of the long-term investment outlook.

The launch of new digital banking solutions is a key part of the company's strategy. These solutions are designed to meet the evolving needs of customers and improve operational efficiency. This is crucial for the Future Prospects of United Bank Company.

The adoption of advanced technologies, such as Jack Henry's platforms, is central to United Bank Company's strategy. These advancements support various areas of the business, including core processing, loan origination, and digital banking. These initiatives are essential for the company's competitive landscape.

- Hosted core processing solutions provide a robust and scalable infrastructure.

- The commercial loan origination platform (LoanVantage®) streamlines lending processes.

- The Banno Digital Platform™ enhances the digital banking experience.

- Digital payment programs improve efficiency and transparency.

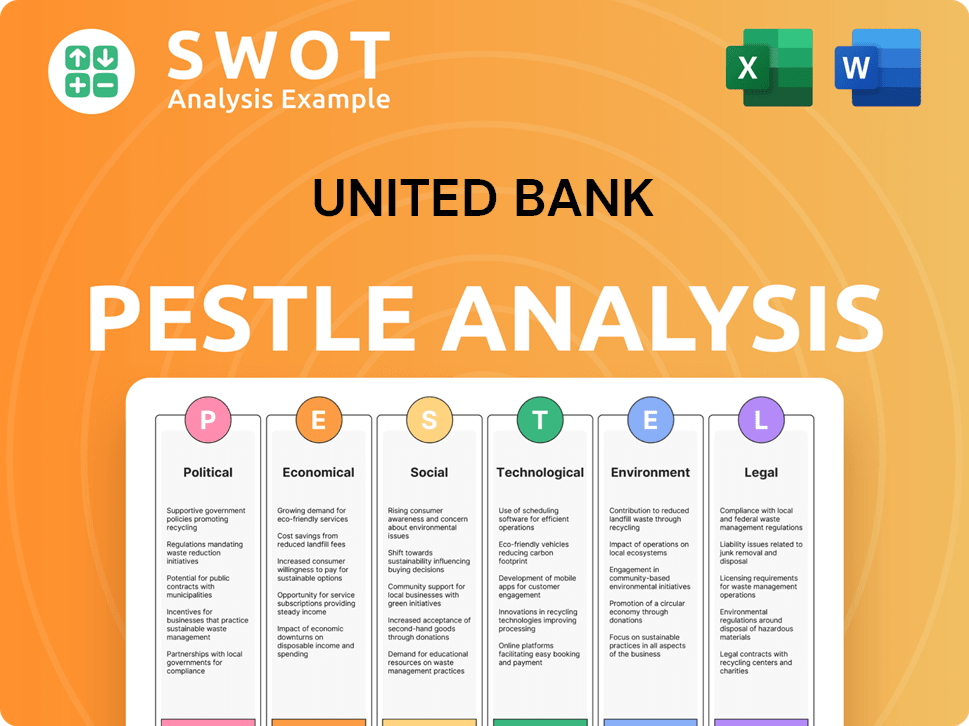

United Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is United Bank’s Growth Forecast?

The financial outlook for United Bank Company showcases a robust performance and promising growth trajectory within the Banking Sector. The institution has demonstrated significant financial strength, which is reflected in its strategic planning and operational results. This performance sets a positive tone for its future prospects, highlighting its potential for sustained expansion and success in the competitive Financial Institution landscape.

In 2024, the company's earnings reached $373.0 million, or $2.75 per diluted share, with a return on average assets of 1.26%. This performance significantly outperformed the peer median. Furthermore, the company's strategic initiatives and financial management have positioned it favorably for continued growth. The company's focus on customer acquisition strategies and technological advancements are key drivers.

Looking at the broader picture, the company's ability to adapt to market dynamics and technological advancements is crucial. The impact of fintech and emerging market strategies are also significant factors. The company's commitment to sustainable growth initiatives and robust risk management strategies further solidify its position.

For the full year 2024, the company reported earnings of $373.0 million, or $2.75 per diluted share. The return on average assets was 1.26%, surpassing the peer median. This performance indicates a strong financial foundation and effective strategic planning.

For the full year 2025, United Bankshares anticipates loan and deposit growth in the low to mid-single digits. Net interest income is projected between $1.050 billion and $1.065 billion. Non-interest income is expected to range from $120 million to $130 million.

In Q1 2025, the company achieved record net interest income of $260.1 million, with a net interest margin of 3.69%. Despite merger-related expenses, net income was $84.3 million, or $0.59 per diluted share. This demonstrates resilience and strategic focus.

The company has consistently increased its dividend for 51 consecutive years, with dividends per share of $1.48 for 2024. Capital ratios remain above regulatory levels. The company resumed its share repurchase program in Q1 2025, buying back approximately 567 thousand shares for $19.8 million.

The company's financial performance is underpinned by several key strategies and metrics that drive its growth. This includes a focus on customer acquisition, risk management, and technological advancements. Owners & Shareholders of United Bank benefit from the company’s focus on strategic planning and financial performance review.

- Strong Earnings and Profitability: Demonstrated by consistent earnings and a high return on assets.

- Dividend Growth: Continuous dividend increases reflect financial stability and shareholder value.

- Capital Adequacy: Capital ratios significantly exceed regulatory requirements, ensuring financial resilience.

- Strategic Investments: Investments in technology and market expansion drive future growth.

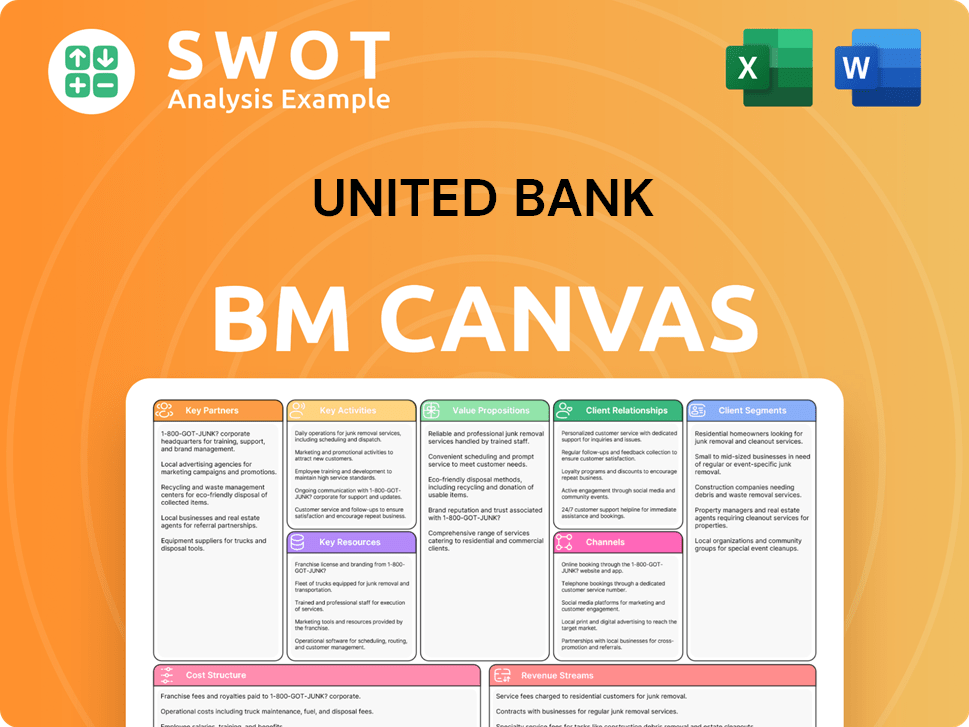

United Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow United Bank’s Growth?

The United Bank Company faces various potential risks and obstacles that could affect its Growth Strategy and future. These challenges are common within the Banking Sector and require careful Strategic Planning. Addressing these risks is crucial for maintaining financial health and achieving long-term Future Prospects.

Market competition and regulatory changes are significant external factors. Rapid technological advancements and cybersecurity threats pose internal operational risks. Effective risk management and adaptation are essential for sustained performance within the Financial Institution landscape.

The recent acquisition of Piedmont Bancorp, Inc. introduced specific financial impacts in Q1 2025. This included merger-related expenses and increased provisions for credit losses. However, management anticipates these costs will be temporary, and the integration will yield future benefits.

Intense competition requires the bank to differentiate its services and maintain competitive pricing. This necessitates continuous innovation and customer-focused strategies. The ability to adapt to changing market dynamics is critical for long-term success in the Banking Sector.

Evolving banking regulations demand costly compliance measures and can limit operational flexibility. Staying compliant with new rules requires significant investment in resources and expertise. Proactive adaptation to regulatory changes is vital for avoiding penalties and maintaining operational efficiency.

The rapid pace of technological advancements requires continuous adaptation to avoid falling behind. Investing in digital transformation and staying ahead of fintech innovations is essential. The company must embrace new technologies to enhance customer experience and improve operational efficiency.

Cybersecurity threats and data breaches pose significant operational risks. Protecting customer data and maintaining system integrity is crucial. Implementing robust cybersecurity measures and regularly updating security protocols are critical for safeguarding the bank's operations.

Supply chain vulnerabilities can affect third-party service providers. Managing these risks requires careful selection and oversight of vendors. Ensuring the resilience of the supply chain is vital for maintaining operational continuity.

The acquisition of Piedmont Bancorp, Inc. led to merger-related expenses, impacting net income. These costs, totaling $30.0 million, included provisions for credit losses. While these expenses are temporary, they affect short-term financial performance.

Despite the challenges, the company's credit quality remains strong, with non-performing loans at 0.29% of total loans. The allowance for loan losses rose to 1.30%, providing a buffer against potential downturns. The loan portfolio is actively managed, with approximately 55% fixed rate and 45% adjustable rate, and about 31% projected to reprice within three months. For more information about the United Bank Company, you can read about the Target Market of United Bank.

The bank is investing in digital transformation to enhance its service offerings and customer experience. This includes developing new digital platforms and improving existing ones. These initiatives are designed to improve operational efficiency and offer competitive services. Continuous investment in technology is essential for future growth.

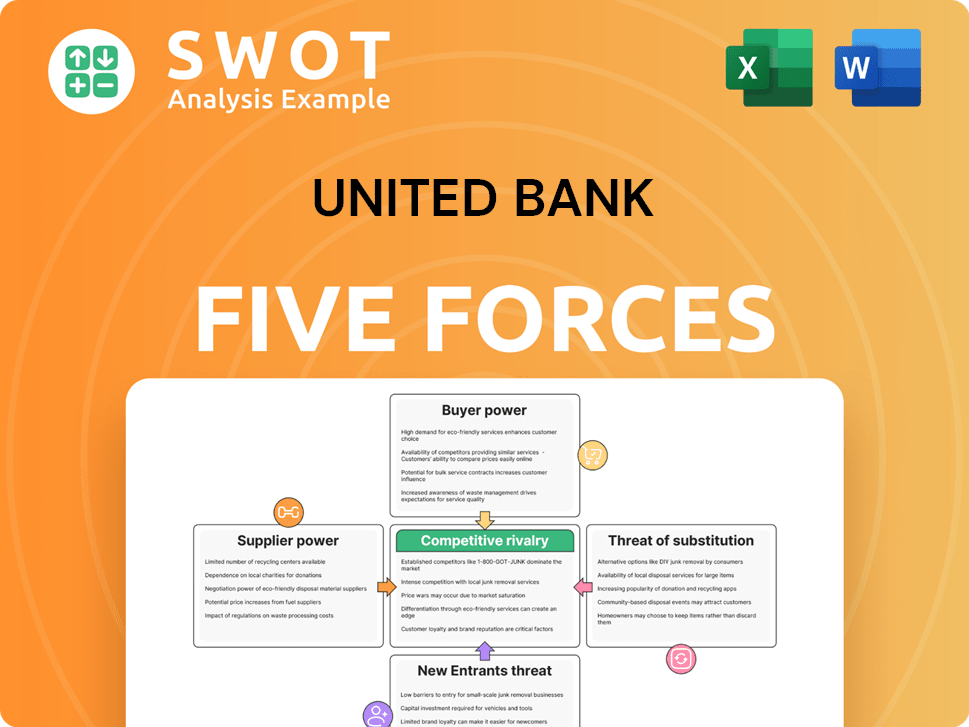

United Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of United Bank Company?

- What is Competitive Landscape of United Bank Company?

- How Does United Bank Company Work?

- What is Sales and Marketing Strategy of United Bank Company?

- What is Brief History of United Bank Company?

- Who Owns United Bank Company?

- What is Customer Demographics and Target Market of United Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.