UniFirst Bundle

Can UniFirst Continue Its Impressive Growth Trajectory?

From a single washing machine to a multi-billion dollar enterprise, UniFirst's journey is a compelling study in strategic growth. This UniFirst SWOT Analysis will reveal how the company, founded in 1936, has become a leader in uniform and facility services, serving hundreds of thousands of customers. We'll explore the key elements of its business model and how it has maintained a strong market position.

This in-depth UniFirst company analysis will dissect the company's current growth initiatives and future prospects, examining its expansion plans and revenue growth drivers. We'll also investigate how UniFirst's financial performance and strategic acquisitions contribute to its long-term growth potential and competitive edge in the uniform rental market. Furthermore, we'll analyze the impact of technology, sustainability efforts, and customer retention strategies on UniFirst's continued success.

How Is UniFirst Expanding Its Reach?

The Marketing Strategy of UniFirst includes a robust expansion strategy focused on both organic growth and strategic acquisitions. This approach is designed to strengthen its market position and capitalize on opportunities within the uniform and facility services industry. The company's commitment to innovation and customer service, coupled with strategic investments, underscores its long-term growth potential.

UniFirst's growth strategy involves expanding its presence across North America, tailoring services to specific market needs and regulatory environments. The company's Core Laundry Operations have shown consistent organic growth, driven by new account sales and improved pricing strategies. UniFirst's Specialty Garments segment has also seen growth, particularly in European and North American nuclear operations. These initiatives are supported by strategic investments in infrastructure and technology to enhance efficiency and service capabilities.

Mergers and acquisitions are also a key part of UniFirst's expansion strategy. The company has made several acquisitions to broaden its service offerings and geographic reach. These acquisitions, along with organic growth initiatives, are designed to drive revenue and market share gains. The company's strategic investments in technology and infrastructure are aimed at improving operational efficiency and customer service.

In the first quarter of fiscal year 2025, Core Laundry organic growth was 1.7%, primarily due to new account sales and pricing efforts. This demonstrates the effectiveness of UniFirst's strategies in attracting and retaining customers.

The Specialty Garments segment experienced growth, with a 2.2% increase in revenue in Q3 2023. This growth is particularly notable in European and North American nuclear operations, indicating successful expansion in specialized markets.

The First Aid segment saw a 10.6% revenue increase, driven by strong growth in its van business. This highlights the company's ability to capitalize on opportunities within the first aid services market.

UniFirst has made strategic acquisitions, including CLEAN Uniform in February 2023 for $300 million, and also Arrow Uniform and McGuire Uniforms, primarily in the Apparel Brands and Facility Management Services sectors across Canada and the United States. These acquisitions support its expansion strategy.

UniFirst is investing nearly $28 million in its Owensboro, Kentucky Distribution and Fulfillment Center. This expansion, which began construction in March 2025, will add 109,000 square feet, bringing the facility's total size to 469,000 square feet. The expansion aims to enhance efficiency and service capabilities.

- Partial occupancy is anticipated by October 2025, with full completion expected by early 2026.

- The facility will incorporate advanced robotics, smart conveyors, and a new Warehouse Management System.

- This investment reflects UniFirst's commitment to better serve its national and local customer base and drive operational excellence.

- The expansion is a key element of UniFirst's long-term growth strategy and future prospects.

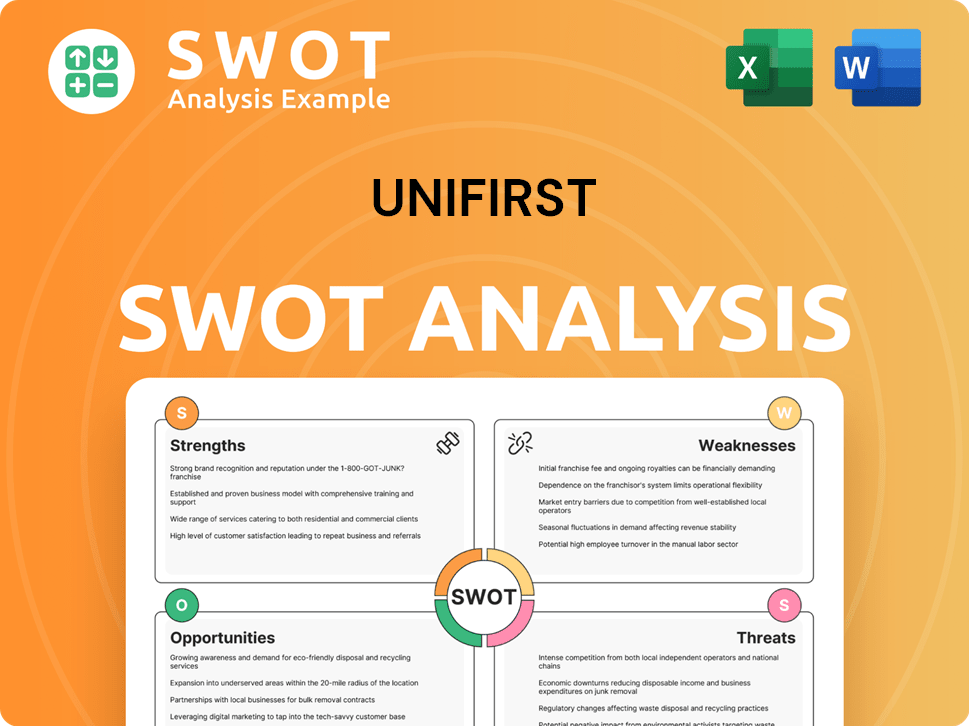

UniFirst SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does UniFirst Invest in Innovation?

The company is actively employing technology and innovation to foster sustained growth and improve its service offerings. This commitment is evident in its substantial investments in technology and infrastructure, which are designed to enhance efficiency and expand service capabilities. The company's strategic focus on innovation is a key driver of its long-term success.

A core aspect of the company's strategy involves significant investments in key initiatives, including customer relationship management (CRM) computer systems and enterprise resource planning (ERP) projects. These initiatives are designed to enhance operational execution and drive future growth. The company's proactive approach to technological advancements supports its competitive edge in the uniform services industry.

The company's digital transformation efforts are also notable, with investments in a cloud-based uniform management platform. This platform covers a significant portion of the company's operations, contributing to improved efficiency and customer experience. These technological advancements are critical for the company's future prospects and market position.

In fiscal year 2024, the company's capital expenditures totaled $143.8 million. These investments included upgrades to laundry facilities and technology enhancements. This investment demonstrates the company's commitment to operational excellence and service quality.

The company is investing in key initiatives such as CRM and ERP systems. Costs associated with these initiatives were approximately $2.5 million in Q1 2025 and $1.9 million in Q2 2025. The full deployment of the ERP system is anticipated by fiscal year 2027.

The company has invested $18.5 million in digital infrastructure for a cloud-based uniform management platform. This system covers 94% of the company's operations. This investment supports improved efficiency and enhances the customer experience.

The company has allocated $42.3 million toward eco-friendly uniform development. This reflects a growing corporate sustainability consciousness. The company's commitment to sustainability is a key aspect of its long-term strategy.

Investment in advanced textile technologies for improved uniform durability has resulted in increased uniform lifespan by 37% compared to previous manufacturing techniques. This focus on quality and durability enhances customer satisfaction.

The new 70,000-square-foot facility in Taylor, Michigan, which opened in May 2024, features advanced textile services technologies and automation. This includes heat reclaiming equipment, high-efficiency HVAC units, and machinery that uses less gas, electricity, water, and detergents. This facility underscores the company's commitment to sustainable practices.

The company's strategic use of technology significantly impacts its operations and market position. These investments are critical for maintaining a competitive edge and driving future growth. For a deeper understanding of the competitive landscape, consider exploring the Competitors Landscape of UniFirst.

- Enhanced operational efficiency through automation and digital platforms.

- Improved customer experience via advanced uniform management systems.

- Sustainable practices through eco-friendly uniform development and efficient facilities.

- Increased uniform lifespan and durability, enhancing customer satisfaction and reducing costs.

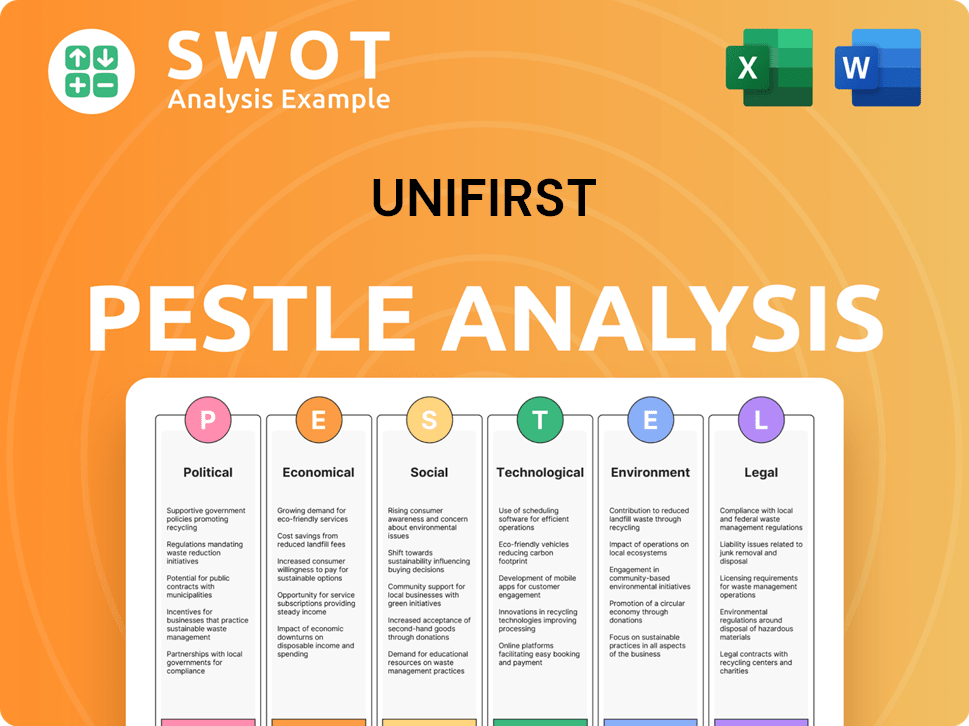

UniFirst PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is UniFirst’s Growth Forecast?

The financial outlook for UniFirst in fiscal year 2025 suggests a trajectory of continued growth, although tempered by certain challenges. The company anticipates revenues to fall within the range of $2.425 billion to $2.440 billion. This projection indicates a steady expansion in their revenue stream, underscoring the effectiveness of their UniFirst growth strategy.

Earnings per share (EPS) are expected to be between $6.79 and $7.19. These forecasts include approximately $16 million in expenses earmarked for their 'Key Initiatives' in fiscal 2025. This investment highlights the company's commitment to innovation and long-term expansion. This focus is crucial for maintaining a strong UniFirst market position.

In the first quarter of fiscal year 2025, UniFirst reported consolidated revenues of $604.9 million, marking a 1.9% increase from the previous year. This positive performance reflects their solid UniFirst business model. Operating income increased by 4.5% to $55.5 million, and net income rose to $43.1 million, or $2.31 per diluted share. Adjusted EBITDA increased by 5.9% to $94 million.

For Q1 2025, consolidated revenues increased by 1.9% to $604.9 million. Operating income rose by 4.5% to $55.5 million, and net income was $43.1 million, or $2.31 per diluted share.

Core Laundry Operations revenue increased by 1.7% to $532.7 million, with an improved operating margin of 8.1%. This segment remains a crucial driver of UniFirst's revenue growth.

In the second quarter of fiscal year 2025, consolidated revenues increased 1.9% to $602.2 million. Operating income increased by 11.7% to $31.2 million. Net income for the quarter increased by 19.6% to $24.5 million, or $1.31 per diluted share.

UniFirst has a strong balance sheet with $201 million in cash and no long-term debt as of March 1, 2025, providing financial flexibility for future investments and UniFirst's expansion plans in the next 5 years.

Despite some initial misses in EPS and revenue forecasts during the first two quarters of 2025, the market's positive response suggests confidence in the company's operational strength and future guidance. UniFirst's robust financial position, with $201 million in cash and no long-term debt as of March 1, 2025, offers substantial flexibility for future investments. The company's earnings are projected to increase by 12.58% in the coming year, from $7.71 to $8.68 per share. UniFirst is also focused on its key initiatives, aiming to boost top-line growth to mid-single digits and achieve EBITDA margins in the high teens. Full deployment of technology investments is expected by fiscal 2027. For more insights, check out the Revenue Streams & Business Model of UniFirst.

UniFirst is investing in key initiatives to drive growth. These initiatives are designed to enhance service offerings and improve operational efficiency, contributing to UniFirst's long-term growth potential.

The company is deploying technology investments, with full implementation expected by fiscal 2027. These investments are aimed at improving customer service and streamlining operations, which will also help with how UniFirst uses technology to improve its services.

UniFirst aims to achieve EBITDA margins in the high teens. This target reflects the company's focus on profitability and operational excellence. This will also help with UniFirst's stock forecast and outlook.

With a strong cash position and no long-term debt, UniFirst has significant financial flexibility. This stability allows the company to pursue strategic investments and navigate market fluctuations effectively, supporting UniFirst's recent financial results.

The company is working to drive top-line growth back to mid-single digits. This focus on revenue expansion is critical for sustaining long-term value creation and enhancing UniFirst's future prospects.

Earnings are expected to grow by 12.58% in the next year, from $7.71 to $8.68 per share. This growth underscores the company's potential for delivering strong returns to shareholders and solidifying its UniFirst company analysis.

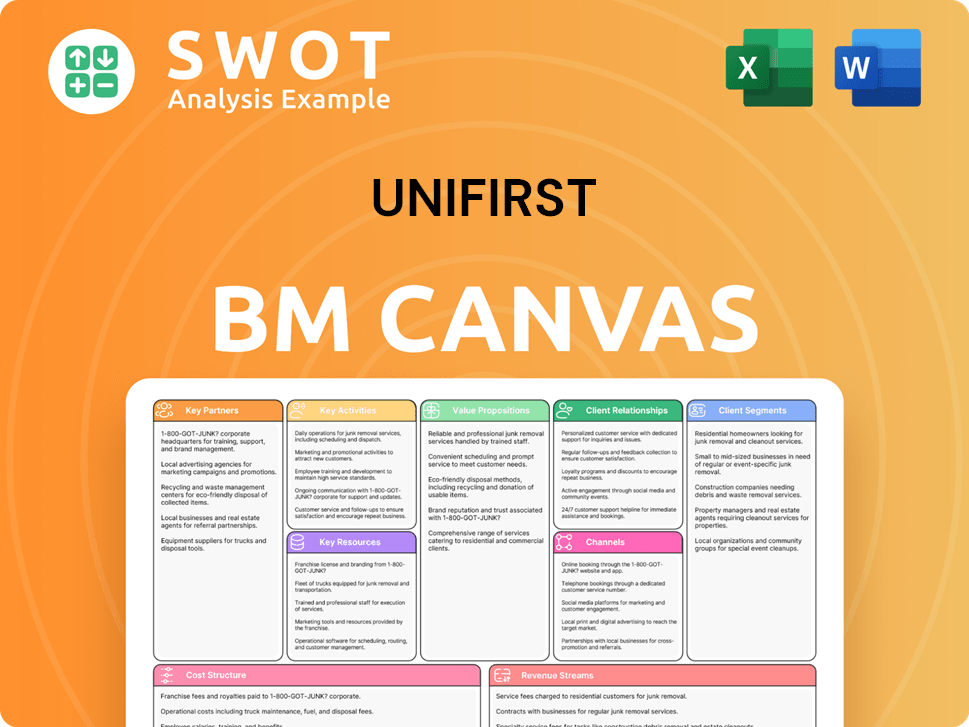

UniFirst Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow UniFirst’s Growth?

Analyzing the potential risks and obstacles is crucial when assessing the UniFirst growth strategy and its future prospects. The company faces a dynamic environment, including competitive pressures, regulatory changes, and technological disruptions. Understanding these challenges is vital for investors and stakeholders to evaluate the UniFirst company analysis and its long-term viability.

The uniform and facility services industry is highly competitive, with major players and smaller businesses vying for market share. This competition can impact customer retention and growth, particularly in a challenging pricing environment. Moreover, external factors, such as supply chain vulnerabilities and broader economic conditions, further complicate the landscape. These factors can potentially affect UniFirst's financial performance.

Regulatory changes and compliance requirements present an ongoing challenge for UniFirst, demanding continuous adaptation. Supply chain vulnerabilities, with a 45% risk of global textile supply chain disruption, and increased logistics costs, with a 6.2% rise, pose operational risks. Furthermore, technological disruption, requiring significant investment, and internal resource constraints, like higher healthcare claims, can also impact profitability. For more background, you can read a Brief History of UniFirst.

UniFirst competes with both large and small companies. The primary methods of competition include product quality, service, and pricing. These factors directly influence the company's ability to maintain and grow its customer base, affecting its market position.

Evolving regulatory frameworks require constant attention and adaptation. UniFirst must stay informed and compliant with changing laws and standards. This necessitates ongoing investment in compliance and risk management to avoid penalties and maintain operational integrity.

Disruptions in the global textile supply chain pose a significant risk. Indicators include a 45% risk of disruption and increased logistics costs. These issues can lead to delays, higher costs, and potentially impact service delivery, affecting UniFirst’s business model.

UniFirst invests in digital transformation, but faces challenges related to technology scaling. Annual technology investments of $37.2 million and a digital transformation budget of 2.1% of total revenue highlight the need for ongoing investment. The technology upgrade cycle is 3-4 years.

Higher healthcare claims expenses and increased selling and administrative costs can impact operating margins. These internal constraints reduce profitability and require effective cost management strategies to maintain financial health and support UniFirst's revenue growth drivers.

Elevated inflation, rising interest rates, and geopolitical conflicts can adversely affect financial performance. These macroeconomic factors can influence customer spending, increase operational costs, and create uncertainty, impacting UniFirst's stock forecast and outlook.

UniFirst focuses on strong customer service. Route sales representatives are supported by local customer service and operations management to address ongoing customer needs. This approach is designed to improve customer satisfaction and retention, which is key to sustaining UniFirst's long-term growth potential.

The company invests in technology and operational improvements, including the full deployment of its ERP system by fiscal 2027. These investments aim to enhance efficiency and improve customer experience, contributing to UniFirst's expansion plans in the next 5 years.

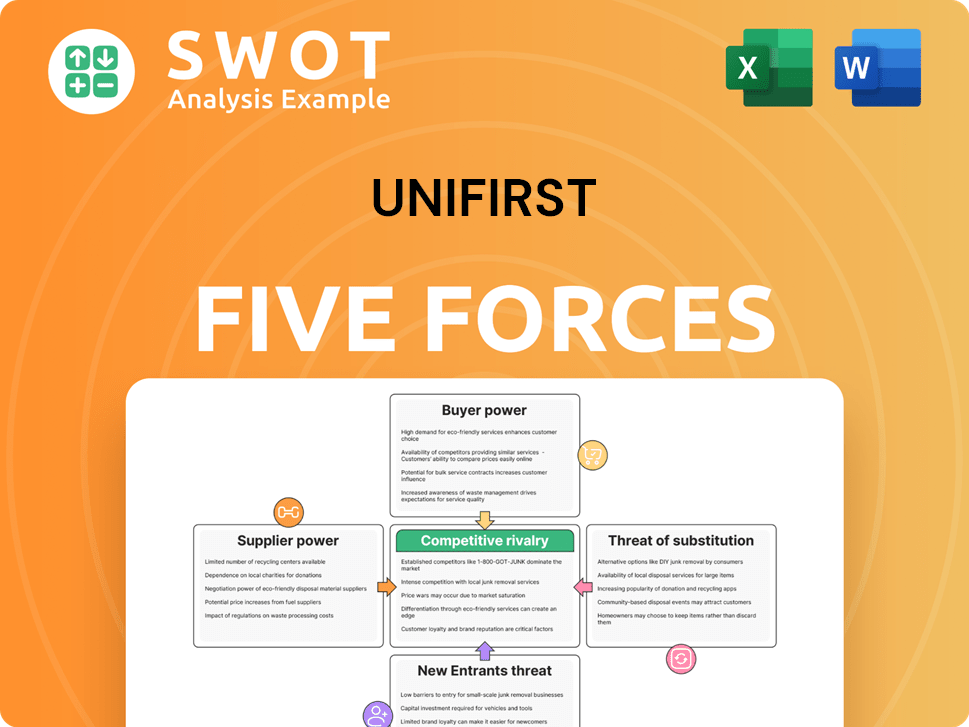

UniFirst Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of UniFirst Company?

- What is Competitive Landscape of UniFirst Company?

- How Does UniFirst Company Work?

- What is Sales and Marketing Strategy of UniFirst Company?

- What is Brief History of UniFirst Company?

- Who Owns UniFirst Company?

- What is Customer Demographics and Target Market of UniFirst Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.