UCP, Inc. Bundle

Can UCP, Inc. Continue Building a Strong Future?

In the dynamic world of real estate, understanding a company's UCP, Inc. SWOT Analysis is crucial for investors and strategists alike. UCP, Inc. has carved a unique space with its community-focused development approach. But how does this translate into a viable Growth Strategy and what are the Future Prospects for this player in a competitive market?

This Company Analysis delves into UCP, Inc.'s approach, examining its commitment to building more than just structures. We'll explore the Business Development strategies that underpin its success and analyze how the company is positioning itself for long-term growth. Furthermore, we will dissect the company's Strategic Planning to understand the challenges and opportunities that lie ahead, including potential expansion plans and revenue projections.

How Is UCP, Inc. Expanding Its Reach?

The expansion initiatives of UCP, Inc. are focused on deepening its presence in the real estate development and construction sectors. The company's strategic approach likely involves identifying underserved or high-growth areas, potentially entering new metropolitan statistical areas (MSAs) or expanding within existing ones. This strategic planning is driven by factors such as population growth and favorable regulatory environments.

UCP, Inc. is likely to maintain its focus on a diverse range of projects, including residential, commercial, and mixed-use developments. Diversifying its portfolio across these segments helps mitigate risks associated with market fluctuations. Increased emphasis on mixed-use developments could be a key strategy to create vibrant, self-sustaining communities and attract a broader tenant base. These strategic goals and objectives are pursued to access new customer segments and diversify revenue streams.

Partnership strategies are crucial for UCP, Inc.'s expansion. Collaborating with local governments, community organizations, and other developers can facilitate access to prime development sites and streamline regulatory processes. The company's commitment to quality construction and community-focused design suggests a pipeline of projects aimed at sustainable growth. This includes exploring new business models to adapt to changing market demands and capitalize on emerging opportunities. For a detailed look at the company's revenue streams, consider reading Revenue Streams & Business Model of UCP, Inc..

UCP, Inc. likely targets specific MSAs based on growth potential and regulatory environments. This may involve entering new markets or expanding within existing ones. The company's approach to business development is driven by market analysis and strategic planning.

The company focuses on a range of projects, including residential, commercial, and mixed-use developments. Diversification helps mitigate risks and access new customer segments. Mixed-use developments are a key strategy for creating self-sustaining communities.

Collaboration with local governments and other developers is crucial. These partnerships streamline regulatory processes and ensure projects align with community needs. This approach supports sustainable growth and explores new business models.

UCP, Inc. adapts to changing market demands through new business models. The company capitalizes on emerging opportunities, such as build-to-rent communities. Industry trends influence the company's strategic goals and objectives.

UCP, Inc.'s growth strategy involves targeted market entry and diversified project types. The company aims to expand its presence in the real estate development and construction sector, focusing on underserved or high-growth areas. This strategic planning is essential for future prospects.

- Targeted Market Entry: Focusing on specific MSAs with high growth potential.

- Product Diversification: Including residential, commercial, and mixed-use developments.

- Partnership Strategies: Collaborating with local entities for project success.

- Adaptation to Market Demands: Exploring new business models like build-to-rent communities.

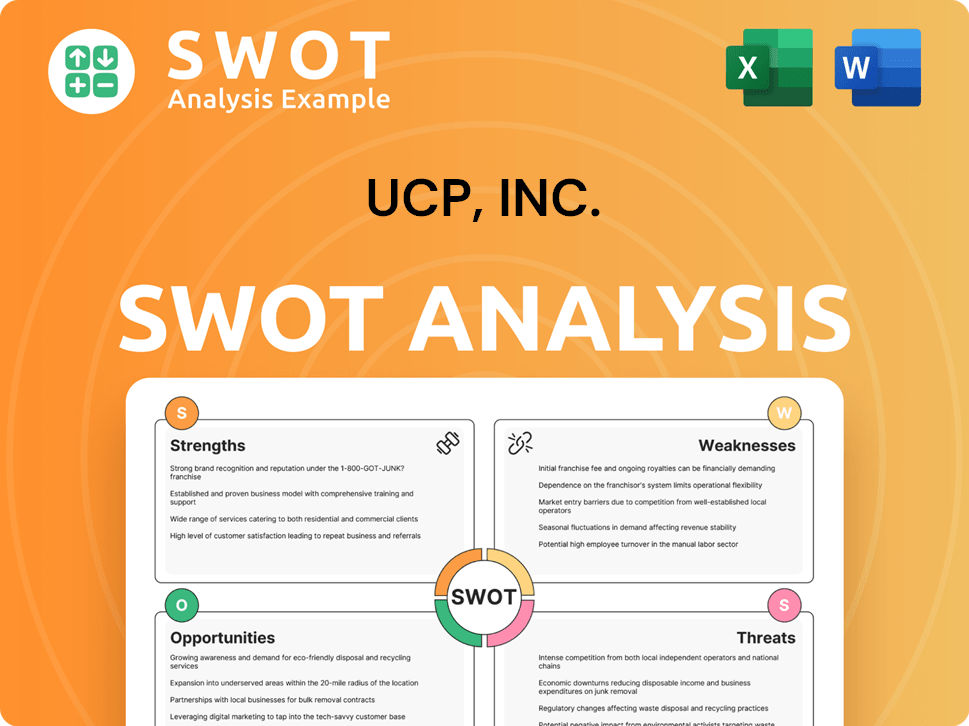

UCP, Inc. SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does UCP, Inc. Invest in Innovation?

The company, UCP, Inc., utilizes innovation and technology to enhance its development and construction processes. This approach aims for sustained growth and improved project outcomes. While specific details on their R&D investments or in-house development teams are not publicly available, the real estate and construction industry is increasingly adopting digital transformation strategies.

This suggests UCP, Inc. is likely investing in technologies to improve efficiency, reduce costs, and enhance the quality of its projects. The company's focus on innovation likely includes integrating advanced software for project management, building information modeling (BIM), and virtual reality (VR) for design visualization. These tools enable better collaboration, minimize errors, and allow for more efficient planning and execution of complex developments.

Automation in construction, such as prefabrication or modular construction techniques, could also be a focus, leading to faster build times and consistent quality. Furthermore, UCP, Inc. is likely exploring the use of cutting-edge technologies like artificial intelligence (AI) for predictive analytics in site selection or market demand forecasting, and the Internet of Things (IoT) for smart building features that enhance resident experience and operational efficiency.

Digital transformation in construction involves the adoption of digital technologies to improve efficiency, reduce costs, and enhance project outcomes. This includes the use of BIM, VR, and AI.

Building Information Modeling (BIM) allows for better collaboration, minimizes errors, and allows for more efficient planning and execution of complex developments. BIM adoption is growing, with a projected market size of $11.7 billion by 2025.

Automation includes prefabrication and modular construction techniques, leading to faster build times and consistent quality. The global modular construction market is expected to reach $157.1 billion by 2030.

AI is used for predictive analytics in site selection and market demand forecasting. The AI in construction market is projected to reach $2.7 billion by 2027.

The Internet of Things (IoT) is used for smart building features that enhance resident experience and operational efficiency. The global smart building market is expected to reach $108.7 billion by 2027.

Sustainability initiatives involve incorporating green building materials, energy-efficient designs, and renewable energy solutions. The green building market is expected to reach $492.8 billion by 2027.

Sustainability initiatives are also a key driver of innovation in the industry, and UCP, Inc. is probably incorporating green building materials, energy-efficient designs, and renewable energy solutions into its projects. These technological and sustainable advancements contribute directly to growth objectives by creating more attractive, efficient, and environmentally responsible properties, which in turn can command higher market value and attract discerning buyers or tenants. For a deeper dive into the company's target market, consider reading about the Target Market of UCP, Inc.. While specific patents or industry awards for UCP, Inc. are not publicly cited, their commitment to quality construction and community-focused design implies an ongoing effort to adopt best practices and innovative solutions within the industry.

UCP, Inc. likely focuses on several key areas to drive growth through innovation and technology. These include digital transformation, BIM, automation, AI, IoT, and sustainability.

- Digital Transformation: Implementing digital technologies to improve efficiency.

- BIM: Using Building Information Modeling for better project management.

- Automation: Employing prefabrication and modular construction.

- AI: Utilizing artificial intelligence for predictive analytics.

- IoT: Integrating the Internet of Things for smart building features.

- Sustainability: Incorporating green building materials and renewable energy.

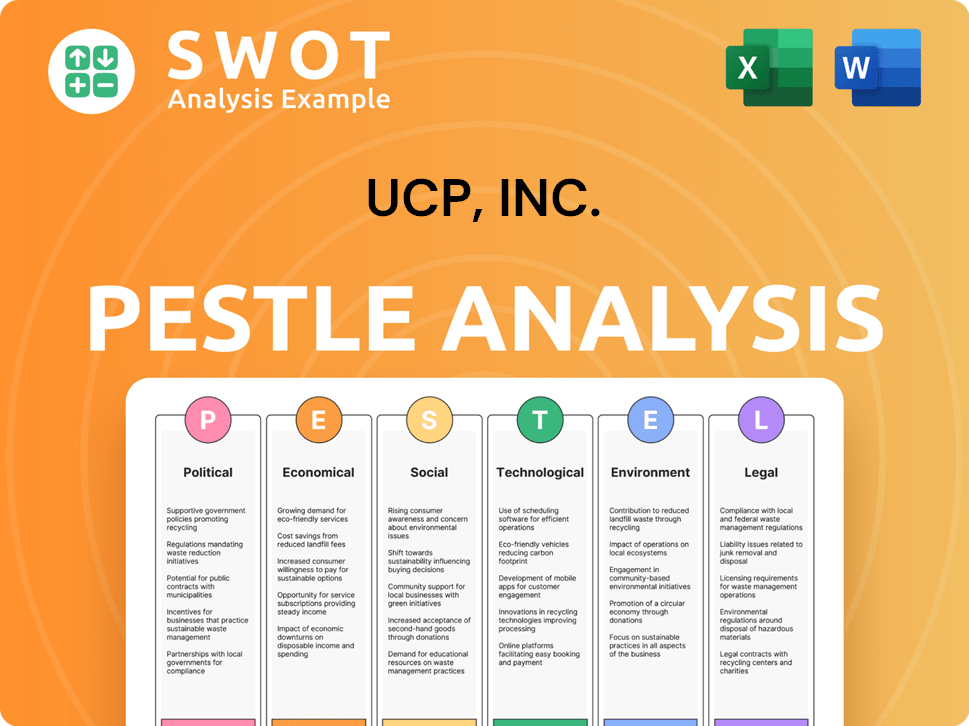

UCP, Inc. PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is UCP, Inc.’s Growth Forecast?

Analyzing the financial outlook for UCP, Inc. requires a deep dive into its revenue targets, profit margins, and investment strategies. However, specific data for 2024-2025 isn't publicly available. This lack of information makes it challenging to provide precise financial projections or compare them to industry benchmarks. Therefore, the following analysis relies on the company's stated strategic focus and industry trends.

Given the emphasis on quality construction and community-focused design, UCP, Inc. likely aims for sustainable profitability. This approach suggests a business model geared towards long-term asset appreciation rather than solely high-volume operations. Investment strategies probably involve acquiring prime development sites and funding construction projects. The company might also invest in new technologies or sustainable building practices to boost project value and align with industry trends.

The financial strategies of UCP, Inc. are presumed to align with its goal of creating lasting value for residents and stakeholders. This focus implies strong project returns and a healthy balance sheet, which supports ongoing expansion and innovation. For a broader understanding, you might want to check out the Competitors Landscape of UCP, Inc.

Without specific data, projecting revenue is difficult. However, the real estate sector's performance in 2024 and 2025 will significantly influence revenue. Factors include interest rates, construction costs, and demand for housing. Industry analysts forecast moderate growth in the housing market, which could positively impact UCP, Inc.'s revenue if it aligns with market trends.

Profit margins in real estate development can vary widely. They depend on project costs, market conditions, and the efficiency of operations. The company's focus on quality and community-focused projects might allow for premium pricing, potentially leading to higher profit margins. However, rising construction costs could squeeze margins, especially in 2024-2025.

Investment levels are critical for UCP, Inc.'s growth strategy. These investments likely include land acquisition, construction costs, and potential investments in sustainable building practices. The scale of these investments will depend on the company's expansion plans and the number of projects underway. Capital raises or funding rounds are common in the real estate sector to support these investments.

UCP, Inc.'s long-term financial goals probably include creating lasting value for stakeholders. This would involve generating strong project returns and maintaining a healthy balance sheet. The company's strategic goals and objectives likely encompass expanding its project portfolio, increasing market share, and potentially diversifying into new markets. These goals contribute to the company's future prospects.

Real estate development often relies on diverse funding sources. These include debt financing, equity investments, and potentially government incentives. Changes in financial strategy might involve optimizing debt-to-equity ratios or exploring alternative financing structures to support growth. Strategic divestitures of non-core assets could also fuel new developments.

External factors significantly influence UCP, Inc.'s financial performance. These include interest rates, inflation, and overall economic growth. Rising interest rates can increase borrowing costs, affecting project profitability. Inflation can drive up construction costs, impacting profit margins. Economic downturns may reduce demand for new housing, potentially affecting the company's expansion plans.

Effective risk management is crucial for UCP, Inc.'s financial stability. This involves mitigating risks associated with construction delays, cost overruns, and market fluctuations. Diversifying its project portfolio across different locations and property types can help spread risk. Strong financial controls and prudent financial planning are also essential.

The competitive landscape also affects UCP, Inc.'s financial outlook. Competition from other real estate developers can impact pricing and market share. Differentiating its projects through quality construction, community-focused design, and sustainability practices can give UCP, Inc. a competitive advantage. Understanding the competitive landscape is key to strategic planning.

UCP, Inc.'s growth strategy likely involves expanding its project portfolio and increasing its market share. This could include acquiring new land for development, entering new markets, or diversifying its project offerings. Strategic partnerships and joint ventures could also accelerate growth. The success of the company's growth strategy significantly impacts its future prospects.

A financial performance review would assess UCP, Inc.'s revenue, profitability, and cash flow. Key metrics include revenue growth, gross profit margin, net profit margin, and return on investment. Analyzing these metrics provides insights into the company's financial health and its ability to achieve its strategic goals. A strong financial performance review is essential for long-term investment potential.

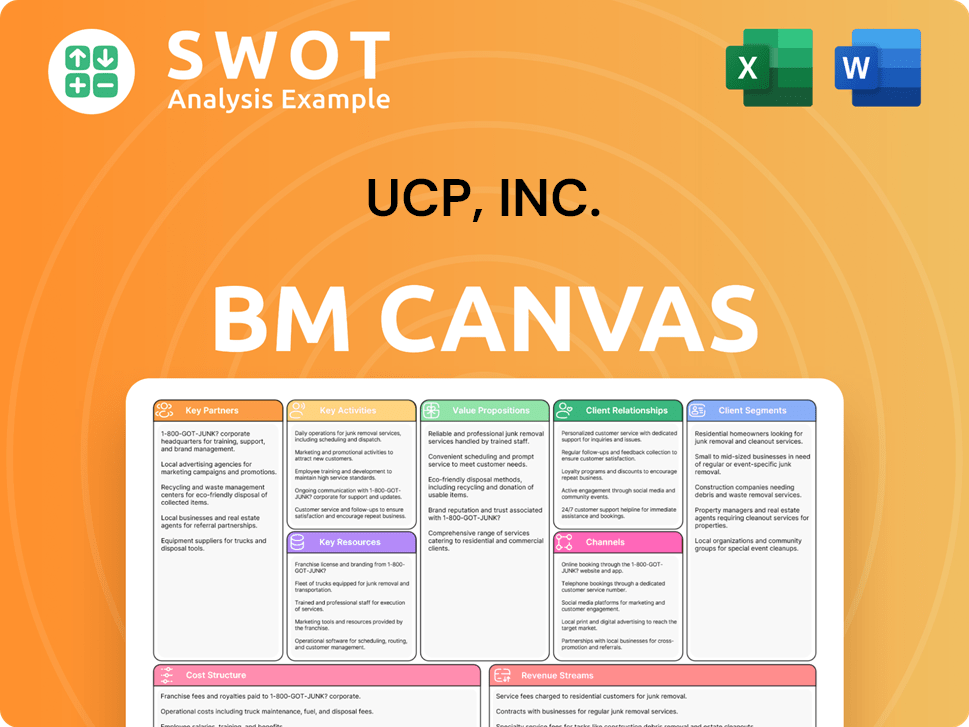

UCP, Inc. Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow UCP, Inc.’s Growth?

The real estate development and construction sector presents a complex landscape of potential risks and obstacles for companies like UCP, Inc. Understanding these challenges is crucial for a comprehensive Company Analysis. These obstacles can significantly impact the Growth Strategy and Future Prospects of UCP, Inc.

Market competition, regulatory changes, and supply chain issues are among the primary concerns. Furthermore, internal resource constraints and economic downturns can also pose significant challenges. To navigate these hurdles, UCP, Inc. must implement robust risk management strategies and adapt to evolving market dynamics.

The competitive landscape in the real estate industry is intense, with numerous players vying for projects and resources. Changes in zoning, environmental regulations, and building codes can introduce delays and increase costs, impacting project feasibility. Supply chain disruptions, exacerbated by global events, lead to material shortages and price fluctuations, affecting project timelines and budgets. These factors directly influence UCP, Inc.’s ability to execute its Business Development plans effectively.

Numerous established and emerging competitors vie for land, projects, and skilled labor. This competition can affect UCP Inc. market share analysis and profitability. The level of competition influences UCP Inc. competitive landscape.

Changes in zoning, environmental protection, and building codes can cause delays and increase project costs. Compliance with new regulations may affect UCP Inc. strategic goals and objectives. These changes directly influence UCP Inc. expansion plans.

Global events can lead to material shortages and price volatility, impacting project timelines and budgets. These vulnerabilities can directly affect UCP Inc. financial performance review. Managing supply chain risks is crucial for Strategic Planning.

Failure to adapt to new construction methods and digital tools adopted by competitors poses a risk. Staying updated with UCP Inc. industry trends is essential. This area could provide UCP Inc. future growth opportunities.

Shortages of experienced project managers, skilled labor, or capital can limit expansion. Efficient resource management is a key factor. This can be a significant challenge for UCP Inc. leadership and management.

Economic downturns, rising interest rates, and shifts in consumer demand can affect project viability. These risks influence UCP Inc. revenue projections. Such external risks are important for UCP Inc. SWOT analysis.

UCP, Inc. likely employs diversification across residential, commercial, and mixed-use projects to mitigate risks. The company might conduct thorough due diligence and contract negotiations. Proactive management of project schedules and budgets is also essential.

Increasing climate-related regulations and shifts towards remote work impact commercial real estate demand. Adaptability and strategic foresight are crucial for long-term success. These factors are critical for UCP Inc. long-term investment potential.

For more detailed insights into the company's structure and ownership, consider exploring the information available on Owners & Shareholders of UCP, Inc.. This information can provide additional context for understanding the company's strategic direction and risk management approaches. Furthermore, understanding these risks is critical for anyone considering How to invest in UCP Inc. stock.

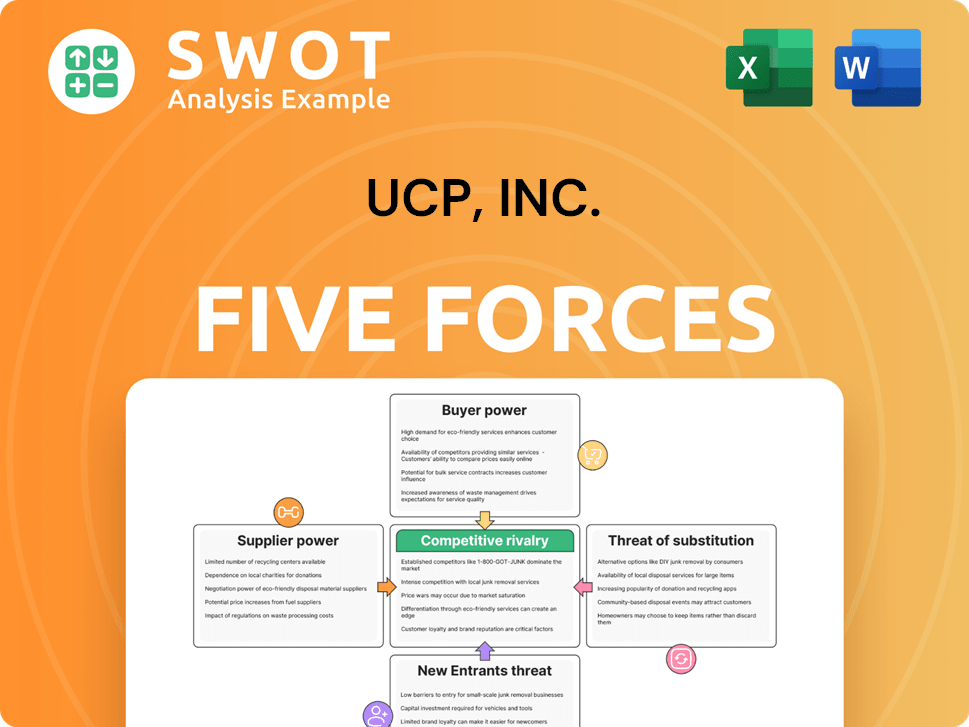

UCP, Inc. Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of UCP, Inc. Company?

- What is Competitive Landscape of UCP, Inc. Company?

- How Does UCP, Inc. Company Work?

- What is Sales and Marketing Strategy of UCP, Inc. Company?

- What is Brief History of UCP, Inc. Company?

- Who Owns UCP, Inc. Company?

- What is Customer Demographics and Target Market of UCP, Inc. Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.