Valeo Bundle

Can Valeo Navigate the Future of Mobility Successfully?

Valeo, a leading automotive supplier, is at the heart of the automotive industry's transformation, focusing on cleaner, safer, and smarter mobility solutions. Founded in 1923, the company has evolved significantly, now operating globally with a vast network of plants and R&D centers. Its strategic focus on innovation positions it to capitalize on the rapid changes in the automotive sector, including the rise of electric vehicles and advanced driver-assistance systems.

This Valeo SWOT Analysis will delve into the company's strategic initiatives and future outlook. With the 'Move Up' strategic plan concluding in 2025, understanding Valeo's growth strategy and its ability to adapt to market dynamics is crucial. This comprehensive Valeo company analysis will explore its financial performance, market share, and long-term growth projections within the evolving automotive landscape, including the impact of the global chip shortage and its investments in research and development.

How Is Valeo Expanding Its Reach?

The Marketing Strategy of Valeo is significantly influenced by its expansion initiatives, which are a cornerstone of its growth strategy. These initiatives encompass entering new markets, launching innovative products, and fostering strategic partnerships to solidify its position as a leading automotive supplier. Valeo's focus on these areas is designed to capitalize on the evolving automotive landscape, particularly in the realms of electrification and advanced driver-assistance systems (ADAS).

Valeo's strategic repositioning of its customer portfolio is evident in its strong focus on the Asian market, especially China. This shift is reflected in the fact that approximately 50% of original equipment sales in Q1 2025 and 60% of order intake in full-year 2024 were attributed to automakers in China, excluding joint ventures. This demonstrates a proactive approach to tap into the growth potential of the Asian market.

Product expansion at Valeo is heavily geared towards electrification and ADAS, which are considered vital for the transformation of mobility. The POWER Division, despite some regional setbacks, saw strong sales momentum in its high-voltage electric powertrain business. The company is also focused on the reinvention of the interior experience and lighting technologies, aiming to be a leader in these areas.

Valeo's expansion in Asia is a key component of its growth strategy. The company has outpaced automotive production growth in Asia (excluding China) by 3 percentage points. This growth is driven by strong sales momentum in the POWER Division for high-voltage electric powertrains in India and thermal systems in South Korea.

Valeo is investing heavily in electrification and ADAS. The company showcased its latest innovations, including software-defined vehicle expertise and enhanced driver experiences, at CES 2025. These innovations are designed to meet the growing demand for advanced automotive technologies.

Strategic partnerships are crucial for Valeo's expansion and future prospects. The company is collaborating with major automakers like Volkswagen Group and Mobileye to enhance driver assistance systems to Level 2+ in future Volkswagen vehicles produced on the MQB platform. Additionally, Valeo is engaged in partnerships with companies like ZutaCore, having launched commercial production of Heat Reuse Units (HRU) compatible with ZutaCore's Two-Phase Direct-to-Chip Liquid Cooling.

- Valeo announced an investment of over $500 million over the next four years in Mexico to expand its presence in electromobility and assisted/autonomous driving sectors.

- This investment includes the inauguration of the Valeo Mobility Technical Center (VMTC) in Querétaro.

- A dual education program with local universities to develop talent in software development, embedded systems, electronics, mechanics, and cybersecurity.

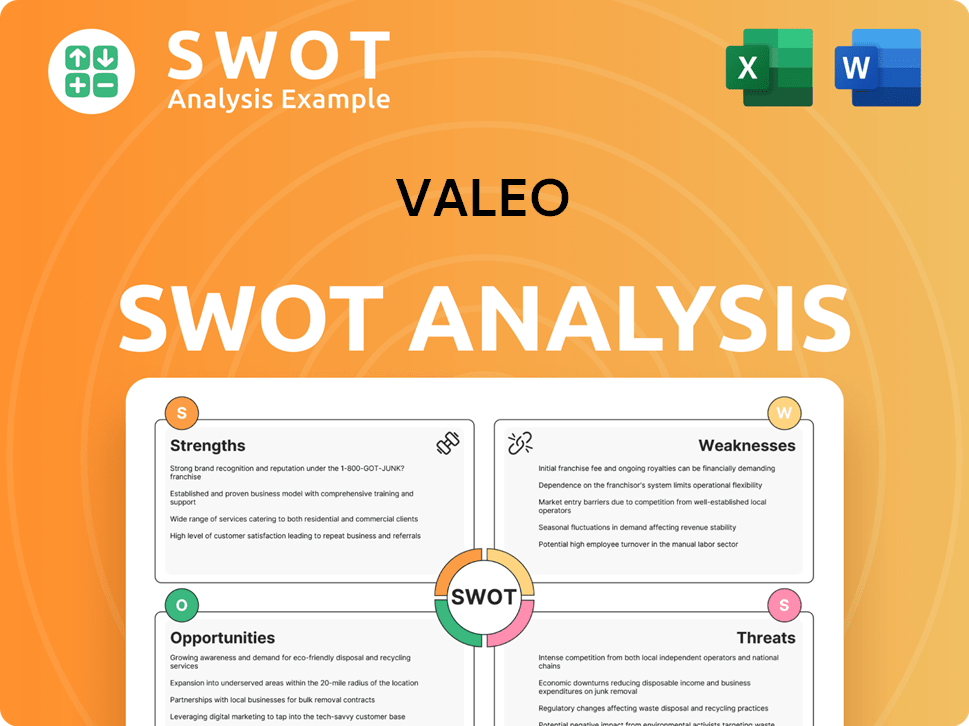

Valeo SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Valeo Invest in Innovation?

The Valeo growth strategy is deeply intertwined with its commitment to innovation and technological advancement. This approach is a cornerstone of the company's plans for the future, focusing on key areas such as electrification, driving assistance systems, and the reinvention of the interior experience. The company's consistent investment in research and development, with over 10% of sales allocated to these efforts, highlights its dedication to staying at the forefront of automotive technology.

Valeo's future prospects are significantly influenced by its strategic initiatives in the rapidly evolving automotive industry. The company is actively involved in digital transformation, particularly in the realm of software-defined vehicles (SDVs), recognizing the increasing importance of software in modern vehicles. This focus allows Valeo to position itself as a key partner for both automakers and technology companies, driving its growth in a competitive market.

Valeo's market share and financial performance are directly linked to its ability to innovate and adapt to changing industry trends. The company's investments in cutting-edge technologies, such as autonomous driving systems and sustainable solutions, are designed to meet the evolving needs of the automotive industry. This proactive stance is crucial for maintaining and expanding its market position in the long term, as detailed in a comprehensive Competitors Landscape of Valeo.

Valeo consistently reinvests a substantial portion of its sales into R&D. Over 10% of sales are allocated to these efforts, demonstrating a strong commitment to technological advancement.

Valeo is focusing on software-defined vehicles (SDVs). The company views software as increasingly critical in vehicles, positioning itself as a key partner for automakers and tech companies.

Valeo is a leader in cutting-edge technologies for autonomous driving, notably with its Valeo LiDAR ScalaTM. This technology is integrated into passenger cars globally, enabling Level 3 autonomous driving.

Valeo is involved in the circular economy, presenting the industry's first remanufactured video camera with Stellantis. They also showcased remanufactured high-voltage inverters with The Future is Neutral (Renault and Suez).

Valeo's Shenzhen plant was recognized as a 'Global Lighthouse Factory' in January 2025 for its manufacturing excellence, further highlighting its leadership in advanced production.

Valeo is committed to CO2 emissions reduction across its product portfolio, with solutions for all types of vehicles, including ICE, BEV, PHEV, and EVs.

Valeo's strategic initiatives are focused on several key areas, including software-defined vehicles, autonomous driving, and sustainability. These initiatives are critical for the company's long-term growth projections and its ability to respond to industry trends.

- Valeo AssistXR: New software solutions, powered by Amazon Web Services, for improved vehicle performance and enhanced driver experiences.

- Valeo LiDAR SCALA™: Enabling Level 3 autonomous driving, demonstrated in a Mercedes-Benz EQS capable of driving up to 95 kph in Germany.

- Circular Economy: Industry's first remanufactured video camera with Stellantis, reducing natural resource consumption by up to 99%.

- Shenzhen Plant: Recognized as a 'Global Lighthouse Factory' in January 2025 for manufacturing excellence.

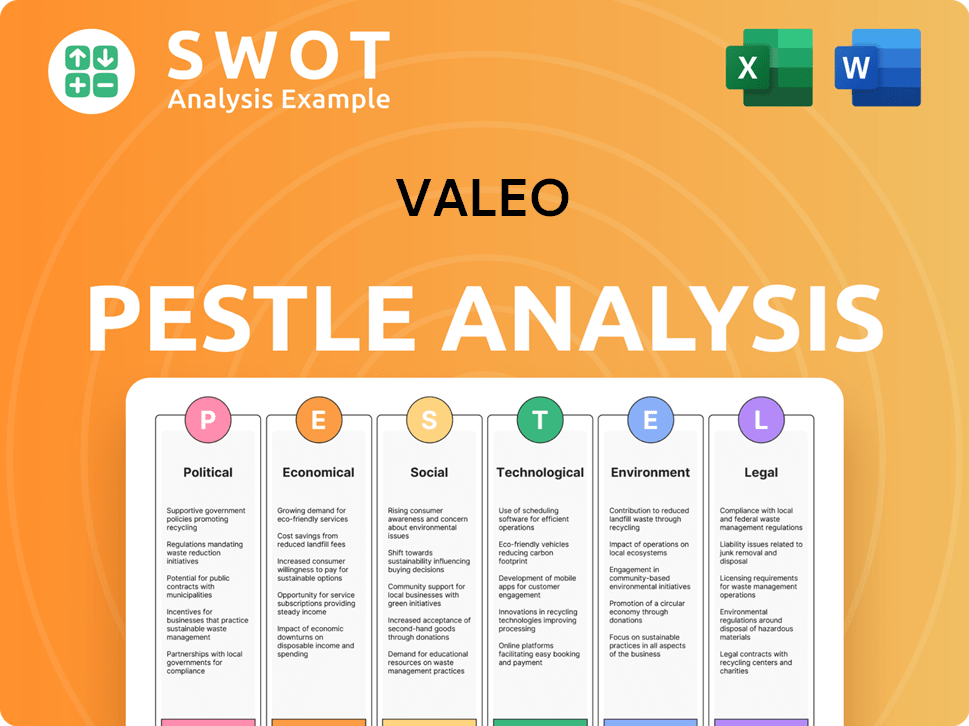

Valeo PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Valeo’s Growth Forecast?

The financial outlook for Valeo in 2025 shows a commitment to enhancing profitability and cash generation. This builds on the company's solid performance in 2024, where it met its financial objectives. The company's strategic initiatives are designed to drive sustainable growth and strengthen its position in the automotive market. This is a key part of the Valeo growth strategy.

In 2024, Valeo reported sales of 21,492 million euros, with a slight decrease of 0.5% on a like-for-like basis compared to 2023. Despite this, the company achieved its profitability and cash generation goals, with an EBITDA margin of 13.3% of sales, totaling 2,863 million euros. This performance sets a positive foundation for the company's Valeo future prospects.

Looking at the Valeo company analysis, the company is focused on cost reduction and strategic investments. Valeo's 'Move Up' plan, ending in 2025, is a critical part of the company's financial strategy, aiming to reduce costs and improve profitability.

Valeo's 2024 financial performance included sales of 21,492 million euros. The EBITDA margin reached 13.3%, with an EBITDA of 2,863 million euros. Free cash flow stood at 481 million euros after restructuring costs.

For 2025, Valeo targets sales between 21.5 billion euros and 22.5 billion euros. The company anticipates an EBITDA margin between 13.5% and 14.5%, and an operating margin between 4.5% and 5.5%. Free cash flow is projected between 700 million euros and 800 million euros before one-off restructuring costs.

Valeo is accelerating restructuring plans to reduce administrative and selling costs. The company aims to cut investments in property, plant, and equipment, as well as intangible assets. These measures are expected to generate 150 million euros in savings in 2025, with annual savings reaching 300 million euros from 2026.

Analysts predict Valeo's revenue to grow by 3.5% per annum on average over the next three years. The company's stock has shown a 25% year-to-date return as of February 28, 2025, reflecting strong financial health. For more details, see this Revenue Streams & Business Model of Valeo.

Valeo's financial health is evident in its consistent profitability and cash flow generation. The company's strategic focus on cost reduction and innovation supports its long-term growth.

- EBITDA Margin: Aiming for 13.5% to 14.5% in 2025.

- Free Cash Flow: Projected between 700 million euros and 800 million euros before restructuring costs in 2025.

- Sales Growth: Anticipated revenue growth driven by strategic initiatives and market demand.

- Stock Performance: Demonstrating strong returns and investor confidence.

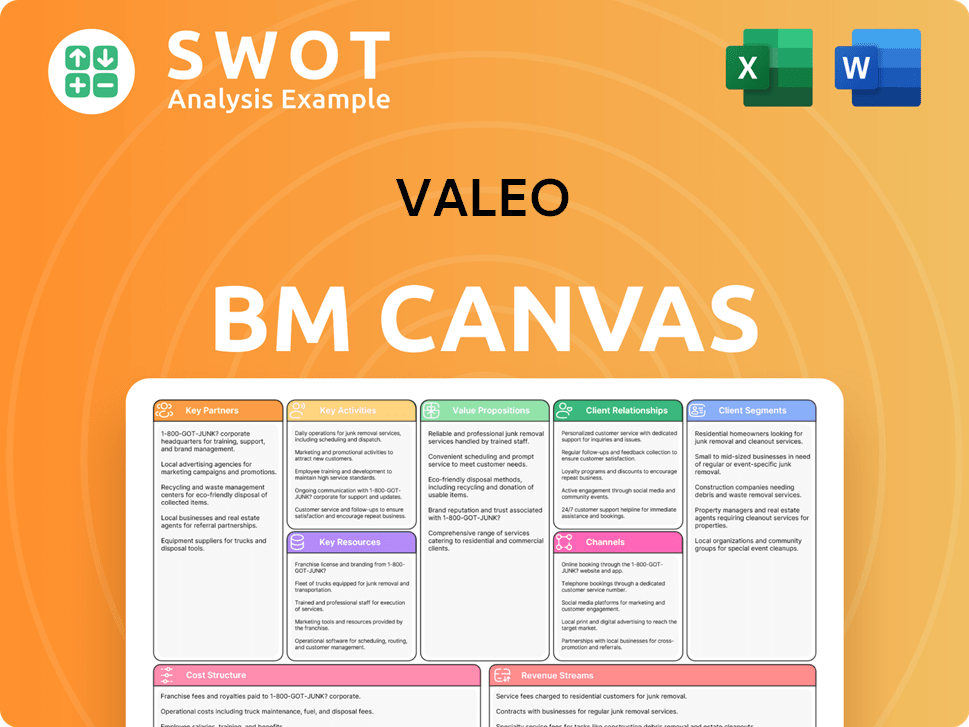

Valeo Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Valeo’s Growth?

The Valeo growth strategy faces several potential risks and obstacles, primarily stemming from the dynamic and uncertain automotive industry. These challenges include slower-than-expected growth in the electric vehicle (EV) market and overall automotive production volumes, particularly in key regions. This has led to adjustments in sales objectives and strategic initiatives for expansion.

Market competition and geopolitical conditions also pose significant threats, requiring continuous innovation and adaptation to maintain market share. Additionally, supply chain vulnerabilities, internal resource constraints, and the rapid pace of technological disruption in the automotive sector present ongoing challenges.

The company's ability to navigate these risks will be crucial for its Valeo future prospects and long-term growth. Strategic initiatives, such as cost management and repositioning its customer portfolio, are essential for mitigating these impacts and ensuring Valeo's financial performance.

Slower-than-expected growth in the electric vehicle (EV) market and overall automotive production volumes, especially in China and Europe, impacts Valeo's market share. This forces the company to revise its sales targets and adapt its growth strategy.

The automotive supplier sector is highly competitive, requiring continuous innovation and adaptation to maintain its market position. This necessitates significant investment in research and development to stay ahead of competitors.

Geopolitical conditions and trade restrictions, including tariffs, pose a threat to Valeo's growth strategy. The company focuses on mitigating the impact of tariffs by reviewing its supply chain and aiming for 100% tariff cost recovery.

Supply chain vulnerabilities and internal resource constraints, such as the need for continuous cost adjustment measures, are also critical. These factors can affect production and profitability.

The rapid pace of innovation in areas like autonomous driving and software-defined vehicles requires continuous adaptation and significant investment. This includes addressing increasing cyber risks due to a larger digital attack surface.

Valeo's 'Move Up' restructuring program, aimed at generating savings, involves one-off restructuring costs. These costs are anticipated to be around 300 million euros over the 2024-2025 period.

To address these challenges, Valeo has implemented several strategic adjustments. These include revising its sales guidance for 2025 to a range of 21.5 billion to 22.5 billion euros, down from a previous estimate of approximately 27.5 billion euros. The company also focuses on rigorous cost management and strategic repositioning.

The 'Move Up' restructuring program aims to reduce administrative and selling costs by approximately 5% and investments in property, plant, and equipment by about 15% in the first half of 2025 compared to 2024. These measures are crucial for improving Valeo's financial performance.

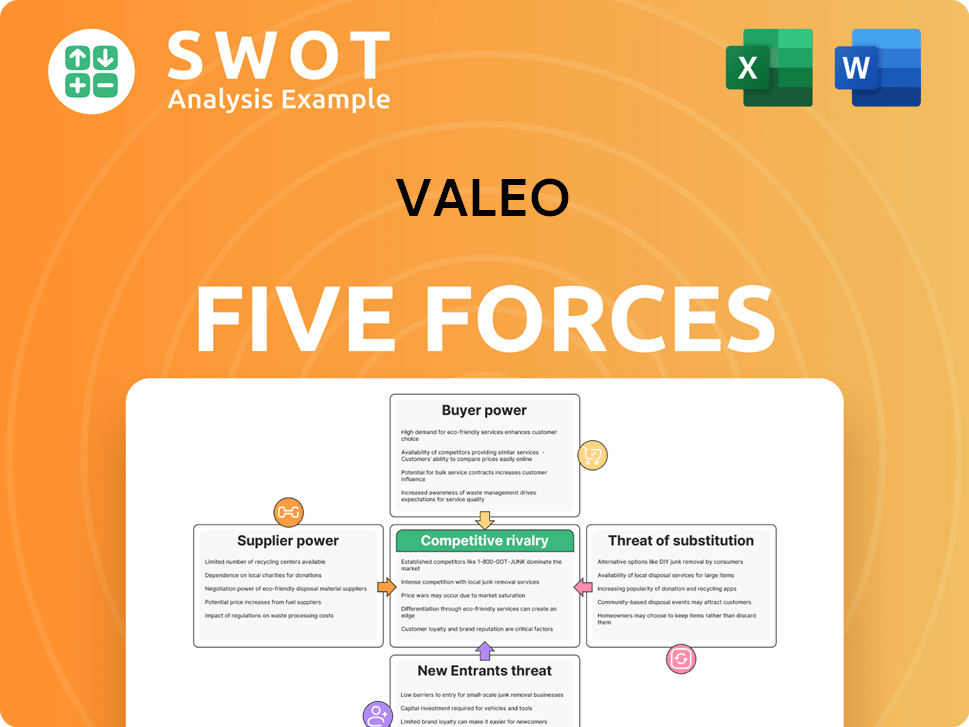

Valeo Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Valeo Company?

- What is Competitive Landscape of Valeo Company?

- How Does Valeo Company Work?

- What is Sales and Marketing Strategy of Valeo Company?

- What is Brief History of Valeo Company?

- Who Owns Valeo Company?

- What is Customer Demographics and Target Market of Valeo Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.