Walker & Dunlop Bundle

Can Walker & Dunlop Sustain Its Impressive Growth Trajectory?

Explore the dynamic evolution of Walker & Dunlop, a leader in Walker & Dunlop SWOT Analysis and Real Estate Finance, from its humble beginnings to its current status as a commercial real estate finance powerhouse. This analysis dives deep into Walker & Dunlop's strategic initiatives and financial performance, offering a comprehensive overview of its journey and future prospects. Discover how this company has navigated the complexities of the market and positioned itself for continued success.

From its inception, Walker & Dunlop's growth strategy has been marked by strategic diversification and a keen understanding of market dynamics. This in-depth market analysis will examine the firm's expansion plans, including its ambitious 'Drive to '25' plan, and assess its competitive landscape within the Commercial Real Estate sector. We'll also delve into Walker & Dunlop's loan origination and property management services, providing actionable insights for investors and industry professionals alike, considering the company's future outlook and sustainable finance initiatives.

How Is Walker & Dunlop Expanding Its Reach?

The expansion initiatives of Walker & Dunlop are designed to foster growth across multiple dimensions. Their strategy focuses on entering new markets, expanding into fresh product categories, and making strategic acquisitions. These efforts are aimed at diversifying revenue streams and maintaining a strong competitive position within the commercial real estate sector.

A core element of their 'Drive to '25' plan is to increase debt financing and property sales volumes. They also aim to scale their servicing and asset management businesses. This multifaceted approach reflects their commitment to sustainable growth and their ability to adapt to changing market dynamics. This strategy supports their long-term financial performance and market share.

Walker & Dunlop's expansion into new areas includes strategic moves to broaden its service offerings and geographic reach. These initiatives are crucial for maintaining their competitive advantage and driving future financial performance.

Walker & Dunlop expanded its Capital Markets team. They added a hospitality-focused investment sales team. This expansion aims to enhance connectivity beyond the multifamily sector. This move is part of their broader capital markets strategy.

They hired an affordable housing debt financing team. This team builds out their affordable platform. The platform now includes financing, sales, structured equity, and tax credit equity syndication. This expansion demonstrates their commitment to the affordable housing market.

Walker & Dunlop entered international markets. They added a London-based Capital Markets brokerage team. This expansion opens opportunities for new geographies, global investors, and global transactions. The initial focus is on Europe, with potential expansion to other regions.

Walker & Dunlop established new complementary businesses. These include small balance lending, valuation advisory (Apprise), and investment banking (through Zelman & Associates). Apprise won the 'Appraisal Solution of the Year' award in 2023. This diversification strengthens their market position.

Walker & Dunlop's expansion includes significant involvement in affordable housing development. They acted as a financial advisor to secure $400 million in debt and equity capital for over 2,000 affordable housing units on the West Coast, with projects in various planning stages as of August 2024. They also achieved $600 million in financing in the seniors housing sector through Q2 2024, involving 28 assets across 11 states, with an additional $361 million under agreement.

- Consistent ranking as the largest Fannie Mae DUS® lender for six consecutive years.

- A top Freddie Mac and HUD lender, demonstrating strong market leadership.

- Focus on sustainable finance and affordable housing.

- Strategic acquisitions and new business ventures to enhance service offerings.

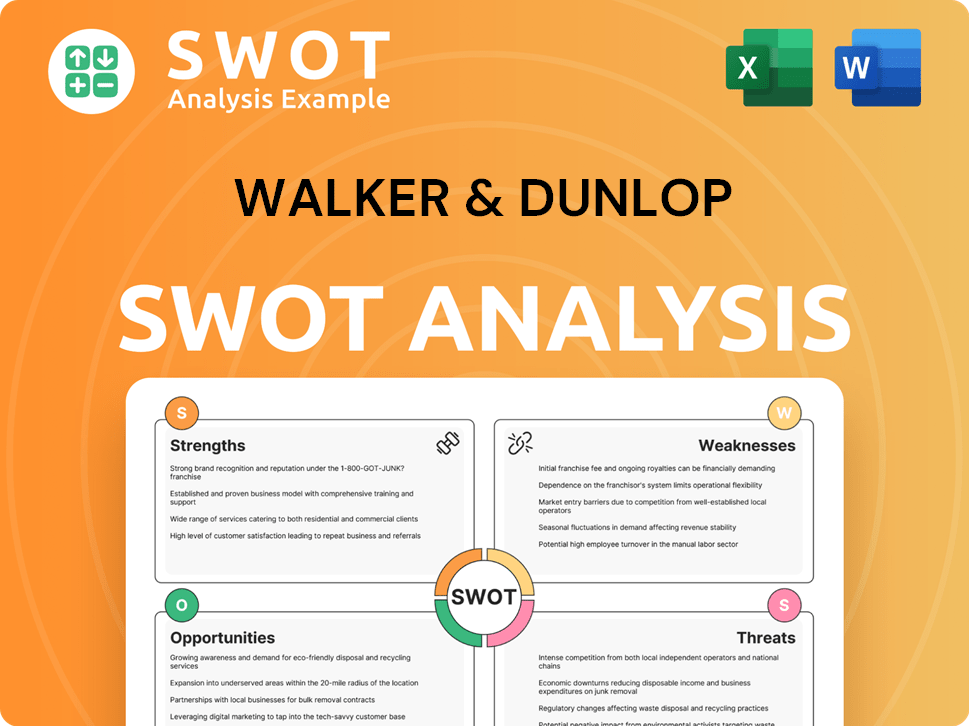

Walker & Dunlop SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Walker & Dunlop Invest in Innovation?

The company's approach to innovation and technology is central to its Growth Strategy and ability to maintain a strong position in the Real Estate Finance sector. By investing in new technologies, the firm aims to drive efficiencies and accelerate future growth. This commitment to technological advancement is a key element of their long-term strategy.

A dedicated in-house technology arm, WDTech, focuses on developing solutions that impact both products and internal processes. This focus on innovation demonstrates the company's commitment to disrupting the traditional Commercial Real Estate industry. This innovative approach is designed to enhance the company's offerings and improve its operational capabilities.

The company is actively integrating artificial intelligence (AI) into its marketing workflow to create customized content and improve marketing performance. This strategic use of AI allows for efficient analysis of campaign results, providing feedback on effective strategies. This data-driven approach supports smarter decision-making and enhances overall Financial Performance.

The company redesigned and migrated its main website to Webflow. This move provides greater control over design and content creation. It also modernizes the digital presence to support future growth.

AI is being used to create customized content quickly. This improves marketing performance by analyzing campaign outcomes. The AI provides insights into effective strategies.

In May 2025, the company launched WDSuite. This new digital experience streamlines the commercial real estate investment lifecycle. It offers tools for investment screening and risk mitigation.

WDSuite provides data-driven insights for informed decisions. It includes hyperlocal market ratings and real-time valuation estimates. The focus is on connected insights to drive smarter decisions.

The company's proprietary multifamily automated valuation model (AVM) boasts industry-leading accuracy. It has a median absolute percentage error rate of less than 6%. This high accuracy supports reliable valuation estimates.

Leadership emphasizes leveraging data to augment business processes. This approach drives smarter decisions across the organization. The focus is on using data to improve overall efficiency.

The company's investment in technology and data-driven solutions is a key part of its Walker & Dunlop strategy. This includes the use of AI, the launch of WDSuite, and a focus on data-driven insights. For more insights into how the company approaches marketing, see the Marketing Strategy of Walker & Dunlop.

The company's technological initiatives include website redesign, AI integration, and the launch of WDSuite. These initiatives are designed to improve operational efficiency and enhance the user experience.

- Website Redesign: Modernizes digital presence for future growth.

- AI Integration: Improves marketing performance through customized content creation and campaign analysis.

- WDSuite: Streamlines the commercial real estate investment lifecycle.

- Data-Driven Insights: Provides hyperlocal market ratings and real-time valuation estimates.

- AVM Accuracy: The AVM has a median absolute percentage error rate of less than 6%.

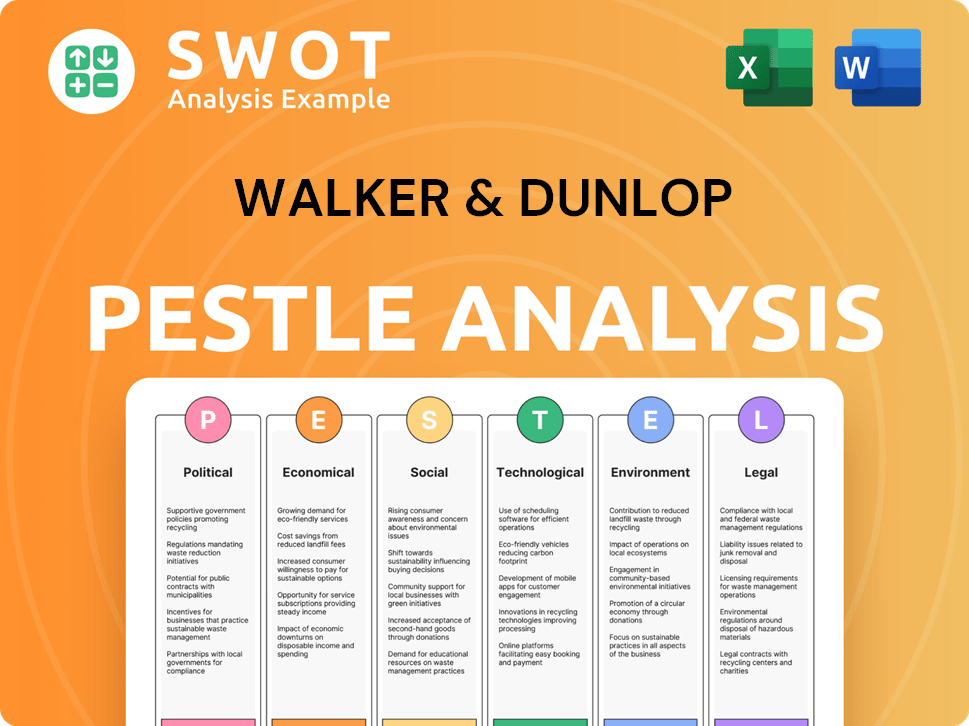

Walker & Dunlop PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Walker & Dunlop’s Growth Forecast?

The financial outlook for Walker & Dunlop in 2025 is centered on sustained growth in key financial metrics, despite current market conditions. The company is actively pursuing its 'Drive to '25' strategic plan, which aims to significantly increase revenues and expand its market presence within the Real Estate Finance sector. This strategy is supported by a focus on increasing transaction volumes and expanding its assets under management.

Walker & Dunlop's performance in 2024 demonstrated resilience and growth. The company achieved a 21% increase in total transaction volume, reaching $40 billion. Revenue grew by 7% to $1.1 billion, and adjusted EBITDA reached a record $329 million, up 9% year-over-year. These results set a positive foundation for future growth.

Looking ahead to 2025, the company projects diluted EPS growth in the high single digits to double digits. The company is focused on achieving its strategic goals, including doubling revenue from $1 billion in 2020 to $2 billion by the end of 2025. This ambitious target is supported by specific volume and asset management targets.

In 2024, Walker & Dunlop saw total transaction volume of $40 billion, a 21% increase from 2023. Total revenues grew by 7% to $1.1 billion. Diluted earnings per share were $3.19.

The 'Drive to '25' plan aims for $2 billion in annual revenues by the end of 2025. This includes targets of over $60 billion in origination volume, over $25 billion in sales volume, and over $10 billion in assets under management.

Q1 2025 saw total transaction volume up 10% year-over-year to $7.0 billion. Revenues were up 4% to $237.4 million. Net income was $2.8 million, or $0.08 per diluted share, down 77% year over year.

The company prioritizes reinvesting in the business for long-term growth. It also returns capital to shareholders through dividends and share repurchases. The dividend was maintained at $0.67 per share for Q2 2025.

Walker & Dunlop's financial performance is crucial for its Growth Strategy. The company's focus on Commercial Real Estate and Multifamily Lending contributes significantly to its revenue streams.

- Loan Origination volumes are a key driver of revenue.

- Market Analysis shows a strong focus on the multifamily sector.

- The company’s Financial Performance is supported by its capital markets activities.

- Expansion Plans are geared towards increasing market share.

For a deeper dive into the Walker & Dunlop and its target market, consider reading about the Target Market of Walker & Dunlop.

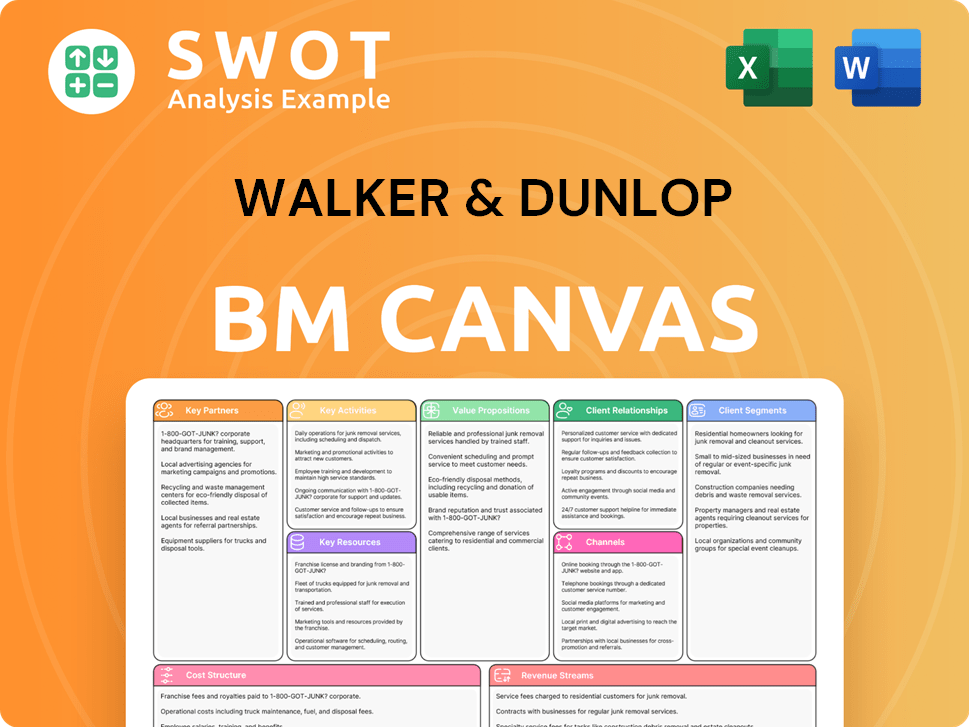

Walker & Dunlop Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Walker & Dunlop’s Growth?

The growth strategy of Walker & Dunlop faces several potential risks and obstacles inherent in the commercial real estate finance sector. These challenges include interest rate volatility, market competition, and regulatory changes. Understanding these risks is crucial for evaluating the company's future outlook and financial performance.

Interest rate fluctuations can significantly impact transaction volumes and market liquidity, affecting Walker & Dunlop's financial results. Market competition adds another layer of complexity, requiring the company to continuously adapt its strategies. Regulatory and legislative changes, particularly those affecting government-sponsored enterprises, could also pose challenges.

Operational risks, such as the ability to retain and attract qualified professionals, are also significant. These factors influence Walker & Dunlop's ability to maintain its loan origination volume and overall market share. Managing credit exposure and navigating potential loan buyback issues are also critical for ensuring long-term profitability. For a comprehensive understanding of its competitors, consider exploring the Competitors Landscape of Walker & Dunlop.

Fluctuations in interest rates directly affect Walker & Dunlop's financial performance. Increased expenses and credit loss provisions in Q1 2025 reflect the impact of changing interest rates and credit cycle dynamics. Variable-rate debt exposes the company to future rate hikes, potentially impacting earnings.

The commercial real estate sector is highly competitive. Walker & Dunlop must compete with other firms for market share. This competitive landscape requires continuous adaptation and innovation to maintain a strong position.

Changes in regulations, particularly those affecting government-sponsored enterprises (GSEs), can significantly impact Walker & Dunlop's operations. Uncertainty surrounding GSE privatization poses risks. Policy risks, such as rent control measures, can also affect property values.

Retaining and attracting loan originators and other professionals is crucial for maintaining production volume. While average production per banker/broker increased in 2024, it remains below pre-pandemic levels. Credit exposure, including rising defaults, can strain profitability.

Rising defaults and unresolved repurchase requests can strain profitability if collateral values decline. As of Q1 2025, the 'at-risk' servicing portfolio expanded to $64.5 billion, with $10.3 billion in Agency loans maturing within the next two years. Defaulted loans rose 72% to $108.5 million.

Walker & Dunlop emphasizes its durable business model and diversified service offerings to navigate challenges. Consistent revenues from Servicing and Asset Management businesses are key. The company continues to invest in its people, brand, and technology.

Walker & Dunlop's Q1 2025 results showed a decline in net income due to increased expenses and credit loss provisions. Lower short-term rates have reduced interest expense, but variable-rate debt leaves earnings vulnerable. The company's ability to manage these financial aspects is critical for its future outlook.

The commercial real estate market is dynamic, with competition and regulatory changes constantly reshaping the landscape. Uncertainty surrounding GSE privatization may impact future operations. Policy risks, such as rent control, can also devalue properties and create barriers for investors.

Maintaining production volume requires retaining and attracting loan originators and other professionals. While average production per banker/broker increased in 2024 to $172 million from $137 million in 2023, it is still below the pre-pandemic average. Credit risk management and potential loan buyback issues pose additional operational hurdles.

Walker & Dunlop mitigates risks through a durable business model and diversified service offerings. Consistent revenues from Servicing and Asset Management businesses support the company during challenging market conditions. Continued investment in people, brand, and technology is also a key strategy.

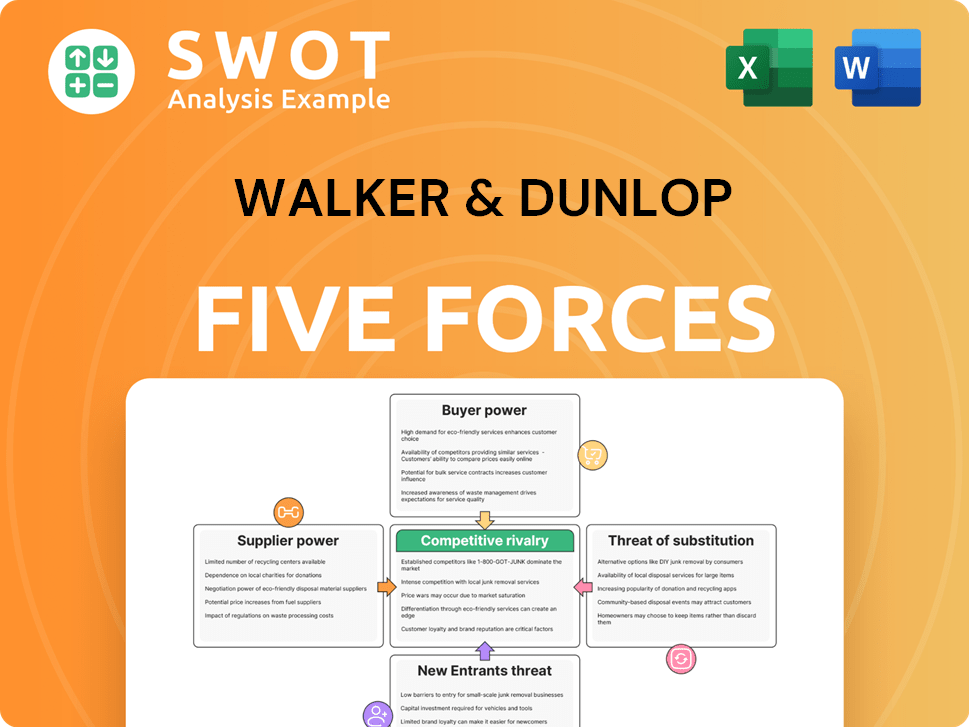

Walker & Dunlop Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Walker & Dunlop Company?

- What is Competitive Landscape of Walker & Dunlop Company?

- How Does Walker & Dunlop Company Work?

- What is Sales and Marketing Strategy of Walker & Dunlop Company?

- What is Brief History of Walker & Dunlop Company?

- Who Owns Walker & Dunlop Company?

- What is Customer Demographics and Target Market of Walker & Dunlop Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.