Waters Bundle

How is Waters Corporation Shaping the Future of Science?

Waters Corporation is making waves with its strategic acquisition of Wyatt Technology, a move set to redefine its position in the life sciences sector. This bold step, valued at $1.36 billion, is a testament to Waters' commitment to innovation and expansion, particularly in the burgeoning biopharmaceutical market. From its humble beginnings, Waters has evolved into a global leader, and this acquisition marks a significant chapter in its ongoing growth story.

The acquisition of Wyatt Technology is just one facet of Waters' Waters SWOT Analysis, a comprehensive strategy designed to capitalize on the evolving water technology market. The company's focus on innovation in water technology, coupled with its commitment to environmental sustainability, positions it for substantial long-term growth potential. This strategic direction underscores Waters' dedication to not only enhancing its financial performance but also making a positive impact on clean water access and the overall water treatment industry.

How Is Waters Expanding Its Reach?

The Mission, Vision & Core Values of Waters Corporation is actively pursuing several expansion initiatives to drive future growth. These initiatives focus on strategic acquisitions, new market penetration, and product portfolio diversification. This approach is designed to strengthen the company's position in the water technology market and enhance its long-term growth potential.

A key element of Waters' expansion strategy involves strategic acquisitions. For example, the planned acquisition of Wyatt Technology is set to significantly broaden its presence, particularly in the biopharmaceutical market. This move aligns with Waters' goal to enhance its offerings in high-growth areas and cater to a wider range of customers involved in drug discovery and development. These efforts are crucial for the company's financial performance and overall market share analysis.

Furthermore, Waters is committed to expanding its geographical footprint, especially in emerging markets. This expansion aims to access new customer bases and diversify revenue streams, contributing to the company's revenue growth forecast. The focus on emerging markets is a key component of Waters' strategic planning and business model, ensuring sustained growth within the water treatment industry.

Waters' acquisition strategy is a key driver of its growth. The acquisition of Wyatt Technology is a prime example, expanding its reach in the biopharmaceutical sector. This approach allows Waters to integrate new technologies and capabilities, enhancing its competitive landscape.

Expanding into emerging markets is a priority for Waters. This strategy aims to tap into new customer bases and diversify revenue streams. By focusing on these markets, Waters strengthens its long-term growth potential and impact on clean water access.

Waters continuously launches new products and services to meet evolving customer needs. Innovations like the Xevo TQ Absolute mass spectrometer and the ACQUITY Premier System enhance sensitivity and ease of use. This diversification helps maintain a competitive edge and capture new market share.

Collaborations with academic institutions and other technology providers are crucial. These partnerships facilitate the co-development of cutting-edge solutions. They also enable the integration of new capabilities into existing platforms, driving innovation in water technology.

Waters' expansion initiatives are designed to drive growth and enhance its market position. These include strategic acquisitions, new market penetration, product portfolio diversification, and strategic partnerships. These initiatives support the company's financial performance and sustainability initiatives.

- Acquisitions: Acquiring companies like Wyatt Technology to expand market reach.

- Market Expansion: Penetrating emerging markets to diversify revenue streams.

- Product Innovation: Launching new products like the Xevo TQ Absolute mass spectrometer.

- Strategic Alliances: Collaborating with academic and technology partners.

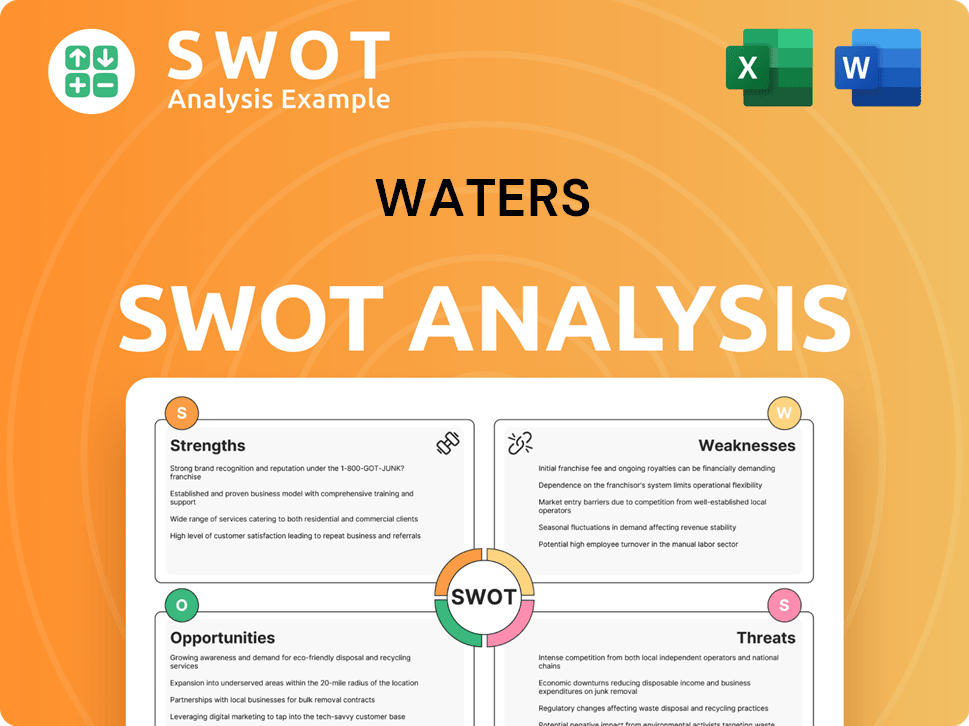

Waters SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Waters Invest in Innovation?

Waters Corporation's innovation and technology strategy is a cornerstone of its growth, focusing on cutting-edge analytical solutions and significant investments in research and development (R&D). This strategy is crucial for maintaining a competitive edge in the water technology market, addressing complex scientific challenges, and meeting the evolving needs of its diverse customer base. The company's commitment to innovation is evident in its continuous efforts to develop advanced analytical instruments, software, and consumables.

The company's approach integrates automation and data analytics to improve laboratory efficiency and data quality. Waters is also exploring the application of artificial intelligence (AI) and machine learning (ML) to enhance instrument performance, predictive maintenance, and data interpretation. This focus on digital transformation and data-driven solutions is essential for streamlining laboratory workflows and enabling seamless data management.

Waters' sustainability initiatives are also a key part of its innovation strategy, with a focus on developing greener analytical methods to reduce solvent consumption and waste. This commitment to environmental sustainability aligns with the growing demand for eco-friendly solutions in the water treatment industry and reflects the company's broader strategic goals.

Waters Corporation invested approximately $180 million in research and development (R&D) in 2023. This significant investment underscores the company's commitment to developing next-generation technologies. This financial commitment is vital for driving innovation and maintaining a competitive edge.

The company focuses on in-house development of advanced analytical instruments, software, and consumables. The Xevo TQ Absolute mass spectrometer is an example of Waters' drive for high-performance solutions. These instruments offer enhanced sensitivity and reproducibility critical for pharmaceutical and life science applications.

Waters is integrating automation and data analytics into its platforms to improve laboratory efficiency and data quality. The Empower Chromatography Data System (CDS) is crucial in streamlining laboratory workflows. This digital transformation enhances data management and operational efficiency.

The company explores the application of artificial intelligence (AI) and machine learning (ML) to enhance instrument performance. This includes predictive maintenance and data interpretation. The goal is to deliver more intelligent and autonomous laboratory solutions.

Waters is committed to sustainability by developing greener analytical methods. These methods reduce solvent consumption and waste. This aligns with the growing demand for environmentally friendly solutions.

The company has received industry recognition for its technological advancements. This underscores its leadership in analytical innovation. These efforts maintain its competitive advantage.

Waters' innovation strategy is multifaceted, focusing on several key areas to drive growth and maintain its market position. These include continuous investment in R&D, strategic collaborations, and the development of cutting-edge analytical solutions. The company's focus on digital transformation and sustainability further enhances its competitive advantage. For more details, you can read about the Marketing Strategy of Waters.

- R&D Investment: Waters allocates significant resources to R&D, with expenditures reaching approximately $180 million in 2023. This investment fuels the development of next-generation technologies and advanced analytical instruments.

- Advanced Instruments: The company focuses on in-house development of advanced analytical instruments, software, and consumables. The Xevo TQ Absolute mass spectrometer exemplifies this focus, offering enhanced sensitivity and reproducibility.

- Digital Transformation: Waters integrates automation and data analytics into its platforms to improve laboratory efficiency and data quality. Informatics solutions like Empower CDS streamline workflows and enable seamless data management.

- AI and Machine Learning: The company explores AI and ML to enhance instrument performance, predictive maintenance, and data interpretation. This aims to deliver more intelligent and autonomous laboratory solutions.

- Sustainability Initiatives: Waters is committed to developing greener analytical methods that reduce solvent consumption and waste. This aligns with the growing demand for sustainable practices in the water treatment industry.

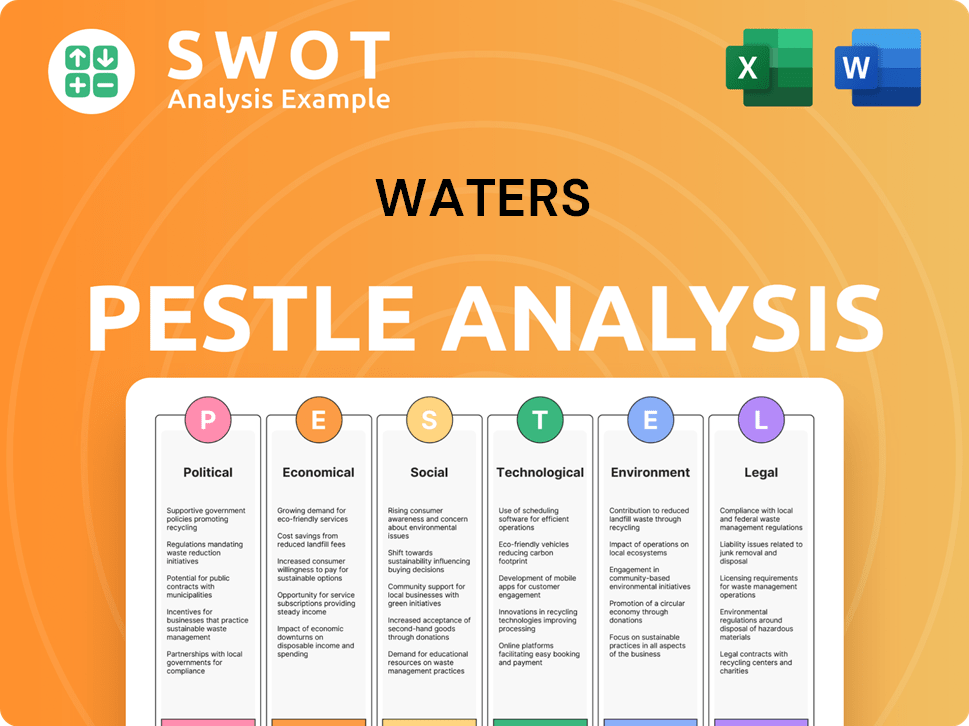

Waters PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Waters’s Growth Forecast?

The financial outlook for Waters Corporation reflects a strategy focused on sustained growth, driven by strategic investments and expansion within key markets. The company anticipates continued demand for its analytical instruments and services, particularly in the pharmaceutical and life sciences sectors. This positive outlook is supported by a robust balance sheet and consistent cash flow, providing a solid foundation for navigating economic fluctuations.

For the full year 2024, Waters projects net sales growth between 2% and 4% on a constant currency basis. The company's adjusted earnings per share are expected to be in the range of $12.70 to $12.90. These projections demonstrate confidence in the company's ability to maintain and expand its market position. The company's financial strategy involves strategic acquisitions, investments in R&D, and shareholder returns.

In the first quarter of 2024, Waters reported net sales of $602 million, although this represented a slight decrease of 2% on a constant currency basis compared to the previous year. The company anticipates a rebound in the latter half of 2024, fueled by new product introductions and the integration of acquisitions like Wyatt Technology. This indicates a proactive approach to addressing market dynamics and leveraging opportunities for future growth.

Waters maintains healthy profit margins, with an adjusted operating margin of 29.8% in the first quarter of 2024. This reflects efficient cost management and strong operational performance. The company's focus on innovation and market diversification supports its long-term financial goals.

Waters' financial strategy includes prudent capital allocation, balancing investments in R&D, strategic acquisitions, and shareholder returns. This approach supports sustainable revenue growth and profitability expansion. The company's commitment to innovation and strategic planning is evident in its approach to capital allocation.

Despite recent currency headwinds and market softness, Waters' robust financial position supports its growth initiatives. The company's strategic planning involves adapting to market changes and capitalizing on opportunities. Brief History of Waters provides more context on the company's evolution and strategic decisions.

Key drivers for Waters' growth include new product introductions and strategic acquisitions. These initiatives are designed to enhance the company's portfolio and expand its market presence. Waters’s focus on innovation in water technology is a key element of its growth strategy.

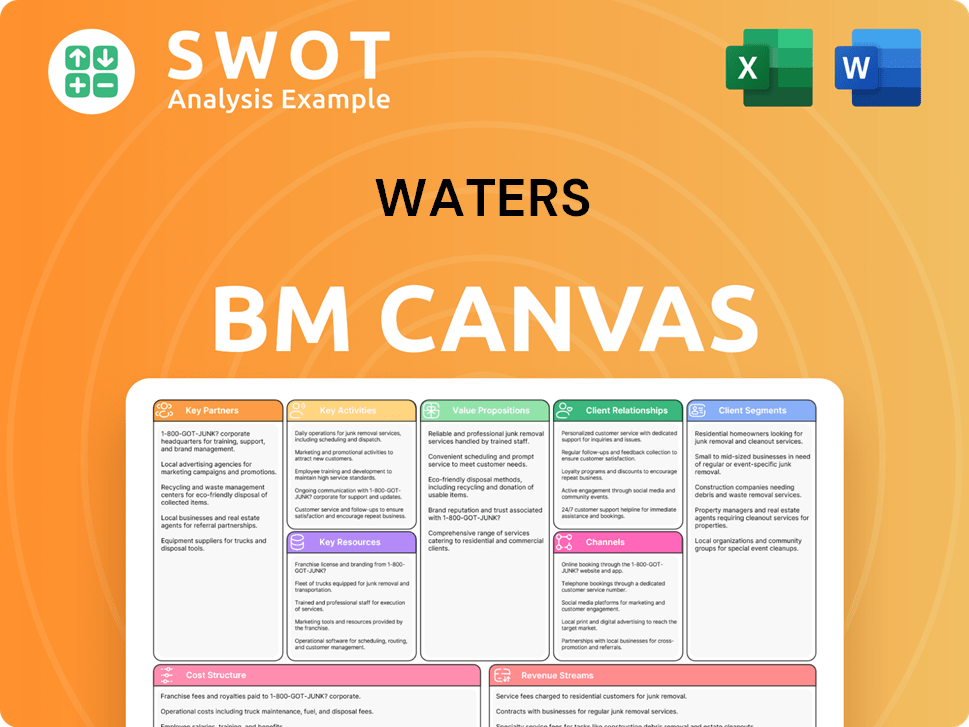

Waters Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Waters’s Growth?

The path of the Waters Corporation to achieving its growth strategy and realizing its future prospects is fraught with potential risks and obstacles. The analytical instrumentation market is highly competitive, demanding continuous innovation and differentiation to maintain its leadership position. Evolving regulatory landscapes, particularly in the pharmaceutical and life science sectors, can influence product development cycles and market access, requiring swift adaptation.

Supply chain disruptions, a persistent threat in recent years, could lead to manufacturing delays, increased costs, and product availability issues. Technological disruptions from emerging analytical techniques pose a challenge to the existing product portfolio, necessitating sustained investment in research and development (R&D) and strategic acquisitions. Internal resource constraints, such as attracting and retaining top scientific and engineering talent, also present significant challenges.

The acquisition of Wyatt Technology, while a growth opportunity, introduces integration risks, which require careful management to achieve expected synergies and avoid operational disruptions. Addressing these challenges requires robust risk management frameworks, scenario planning, and a focus on building a resilient and adaptable organizational structure. The company must navigate these complexities to ensure its long-term growth potential.

The Waters Company competitive landscape includes major players vying for market share in the analytical instrumentation sector. Continuous innovation and differentiation are crucial for maintaining a competitive edge. Competitors' advancements and pricing strategies can significantly impact Waters' market position and Waters Company market share analysis.

Regulatory changes, especially in the pharmaceutical and life science industries, can affect product development and market access. Stricter regulations on laboratory practices or data integrity can necessitate significant investments. Waters must swiftly adapt to new compliance standards to avoid delays and maintain market access.

Supply chain disruptions pose a continuous threat, potentially causing manufacturing delays and increased costs. These disruptions can also impact product availability, affecting revenue and customer satisfaction. Waters mitigates these risks through diversified supplier networks and strategic inventory management.

Emerging analytical techniques and novel research methodologies could challenge Waters' existing product portfolio. Sustained investment in R&D and strategic acquisitions is crucial to stay ahead. Waters needs to anticipate and adapt to technological advancements to maintain its competitive advantage and foster innovation in water technology.

Attracting and retaining top scientific and engineering talent is crucial for driving innovation. Competition for skilled professionals can be intense. Waters must offer competitive compensation, benefits, and career development opportunities to secure and retain key talent. This is essential for Waters Company new product development.

The acquisition of Wyatt Technology presents integration risks, requiring careful management to realize expected synergies. Operational disruptions and cultural clashes can hinder the integration process. Successful integration is crucial for achieving the anticipated benefits and avoiding negative impacts on Waters Company financial performance.

Waters employs robust risk management frameworks and scenario planning to address potential challenges. Diversifying supplier networks helps mitigate supply chain risks, while strategic acquisitions support technological advancements. Furthermore, the company focuses on building a resilient and adaptable organizational structure. Effective Waters Company strategic planning is essential.

Regulatory changes, such as stricter standards for data integrity, can necessitate significant investments. Waters must adapt quickly to maintain compliance and market access. For example, the implementation of new software or instrument redesigns might be required. These adaptations can affect Waters Company revenue growth forecast.

Emerging analytical techniques pose a challenge to existing product portfolios. Waters needs to invest in R&D and strategic acquisitions to stay competitive. This includes exploring new technologies and methodologies to meet evolving customer needs. The focus on innovation is critical for Waters Company long-term growth potential.

Attracting and retaining top talent is crucial for driving innovation and growth. Waters must offer competitive compensation and benefits to secure skilled professionals. Effective talent management is essential for maintaining a strong workforce. This supports the company's ability to execute its Waters Company expansion strategies.

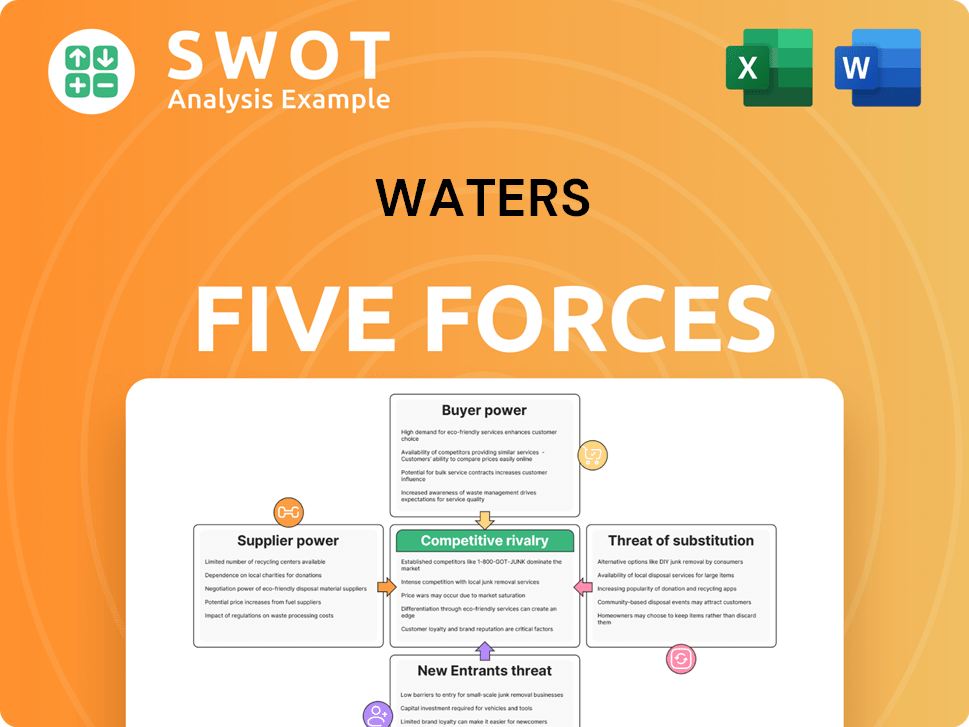

Waters Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Waters Company?

- What is Competitive Landscape of Waters Company?

- How Does Waters Company Work?

- What is Sales and Marketing Strategy of Waters Company?

- What is Brief History of Waters Company?

- Who Owns Waters Company?

- What is Customer Demographics and Target Market of Waters Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.