WTW Bundle

How Will WTW Navigate the Future of Risk and Consulting?

WTW, a global powerhouse in advisory, broking, and solutions, is charting a course for sustained success. This comprehensive WTW SWOT Analysis will explore the company's dynamic growth strategy, examining how it adapts to evolving industry challenges. We'll delve into WTW's future prospects, offering insights into its strategic initiatives and market positioning.

From its roots in 1828, WTW has evolved into a global leader, serving a vast clientele. This detailed WTW company analysis will dissect its business strategy, focusing on its ability to drive financial performance and shareholder value. Understanding WTW's growth strategy in the consulting sector and its future prospects in the global market is crucial for investors and stakeholders alike.

How Is WTW Expanding Its Reach?

The company, formerly known as Willis Towers Watson, is actively pursuing an ambitious expansion strategy. This strategy is designed to fuel long-term growth and enhance its market position. The focus is on both organic growth and strategic mergers and acquisitions (M&A), reflecting a proactive approach to capitalize on emerging opportunities.

Following the completion of its 'Grow, Simplify and Transform' strategic priorities, the company is now concentrating on accelerating performance and optimizing its portfolio. A significant portion of this strategy involves pursuing M&A opportunities, particularly smaller acquisitions that can be integrated into existing operations. This move is supported by strong financial results in 2024.

The company plans to allocate approximately $1.5 billion annually for share repurchases and M&A activities in 2025, subject to market conditions. This financial commitment underscores its confidence in its ability to create value through strategic investments and expansion.

The company is actively looking for M&A opportunities, especially smaller acquisitions that can be integrated into existing operations. This strategy is supported by a significant financial commitment, with approximately $1.5 billion earmarked annually for share repurchases and M&A activities in 2025. This approach aims to expand capabilities and enhance shareholder value.

The company is reinforcing its core businesses and expanding its global footprint. The Health, Wealth, and Career (HWC) segment saw a 3% growth in the fourth quarter of 2024, driven by strong performance in the health business. The Risk & Broking (R&B) segment reported 7% organic revenue growth, supported by client retention and new business generation.

The company is re-entering the treaty reinsurance broking market through a joint venture with Bain Capital. This strategic move aims to strengthen its position in the insurance sector. These initiatives demonstrate the company's commitment to expanding its services and product lines.

The company launched a dedicated technology industry practice in Australia and New Zealand in September 2024. This practice advises regional technology companies on emerging risks, particularly in insurance. This expansion highlights the company's focus on high-demand areas and consulting services.

The company's expansion initiatives are multifaceted, targeting both organic growth and strategic acquisitions. The focus on M&A, particularly smaller deals, is a key part of the WTW growth strategy. The financial commitment of $1.5 billion annually for share repurchases and M&A activities in 2025 shows the company's confidence in its WTW future prospects. The re-entry into the treaty reinsurance market and the launch of a technology industry practice in Australia and New Zealand are examples of how the company is expanding its services and product lines. For a deeper dive into the company's target market, read more about the Target Market of WTW.

The company's expansion strategy includes M&A, a focus on core businesses, and global reach. The Risk & Broking segment's 7% organic revenue growth and the Health, Wealth, and Career segment's growth demonstrate the success of these initiatives. The dedication to innovation and new ventures is a key part of the WTW company analysis.

- Strategic M&A to enhance capabilities.

- Focus on core businesses and global expansion.

- Re-entry into the treaty reinsurance market.

- Launch of a technology industry practice.

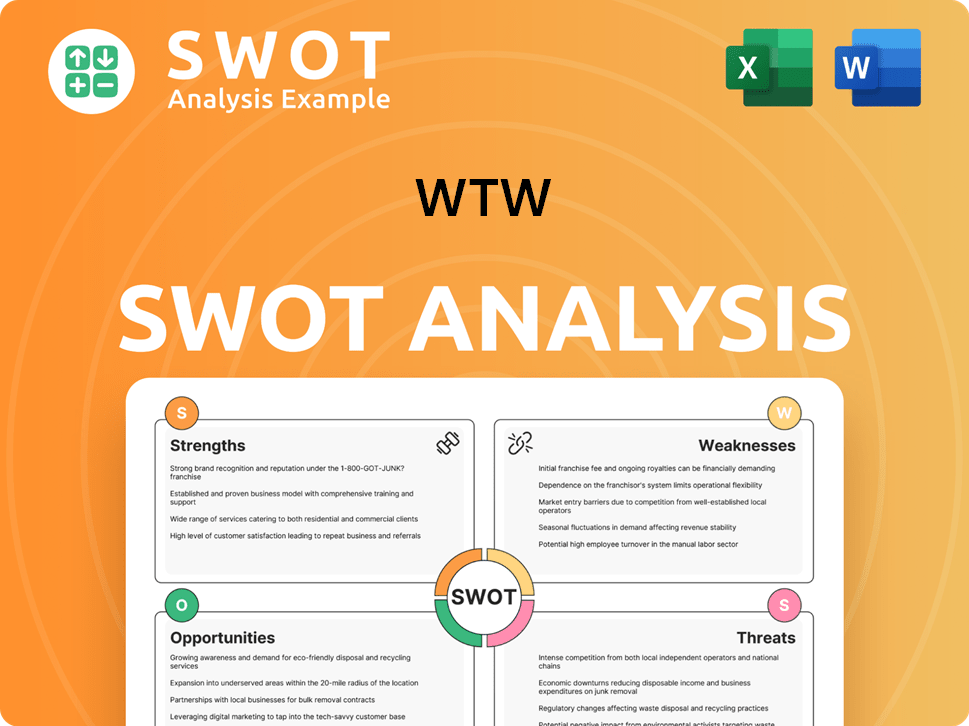

WTW SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does WTW Invest in Innovation?

The innovation and technology strategy of the company is a cornerstone of its growth objectives. This strategy centers on leveraging advanced technologies and digital transformation to improve service offerings and operational efficiency. The company's focus is on strategic investments in technology and talent to drive performance and deliver innovative solutions for its clients, which is a key aspect of the WTW growth strategy.

A significant portion of the company's technological focus addresses the increasing complexities of cyber risk and digital threats. The company is actively involved in guiding clients through these challenges, likely through its advanced analytics and risk management tools. The company's proactive approach to leveraging technology for risk assessment and mitigation is evident in its building of an emerging risk framework.

The company's commitment to technological advancement is evident in its strategic investments. For instance, in the Risk & Broking segment, investments in talent and technology contributed to a robust 10% organic growth in the third quarter of 2024. This demonstrates the direct impact of technology on the company's financial performance and its ability to deliver value to clients, which is a key aspect of the WTW financial performance.

The 2025 Global Supply Chain Risk Survey, conducted in November 2024, highlights cybersecurity and supplier contract vulnerabilities as critical concerns. This leads companies to prioritize digital transformation and data availability to improve transparency and decision-making across supply chain networks. This shows the importance of addressing cybersecurity and digital threats.

The 2024/2025 Global Directors' and Officers' Survey Report indicates that AI is not yet a primary concern for directors and officers, but cybersecurity and data loss remain high priorities. The company is actively advising on the implications of new legal reforms around data and AI risk management. This highlights the company's role in navigating the evolving landscape of data and AI.

The company is building an emerging risk framework that incorporates strategic intelligence tools and early warning indicators. This proactive approach demonstrates its commitment to leveraging technology for risk assessment and mitigation. This framework is designed to help clients anticipate and manage future risks effectively.

Strategic investments in talent and technology have directly contributed to the company's financial performance. The Risk & Broking segment saw a 10% organic growth in the third quarter of 2024 due to these investments. This demonstrates the tangible impact of technology on revenue growth.

The company emphasizes digital transformation and data availability to improve transparency and decision-making across supply chain networks. This focus is a response to the increasing complexities of cyber risk and digital threats. Digital transformation is a core element of the company's business strategy.

The company plays a key role in advising clients on the implications of new legal reforms around data and AI risk management. This advisory capacity extends to helping clients navigate the evolving landscape of digital threats and cybersecurity concerns. The company's expertise is crucial in this area.

The company's technology and innovation strategy is multi-faceted, focusing on enhancing service offerings and operational efficiency. This includes strategic investments in talent and technology, which have directly contributed to the company's strong financial performance, as detailed in the article Revenue Streams & Business Model of WTW.

- Cybersecurity Solutions: Developing advanced analytics and risk management tools to address the increasing complexities of cyber risk and digital threats.

- Data and AI Risk Management: Advising clients on the implications of new legal reforms around data and AI risk management.

- Emerging Risk Framework: Building a framework that incorporates strategic intelligence tools and early warning indicators to proactively assess and mitigate risks.

- Digital Transformation: Promoting digital transformation and data availability to improve transparency and decision-making across supply chain networks.

- Investment in Talent: Strategic investments in talent, particularly in the Risk & Broking segment, which contributed to a 10% organic growth in Q3 2024.

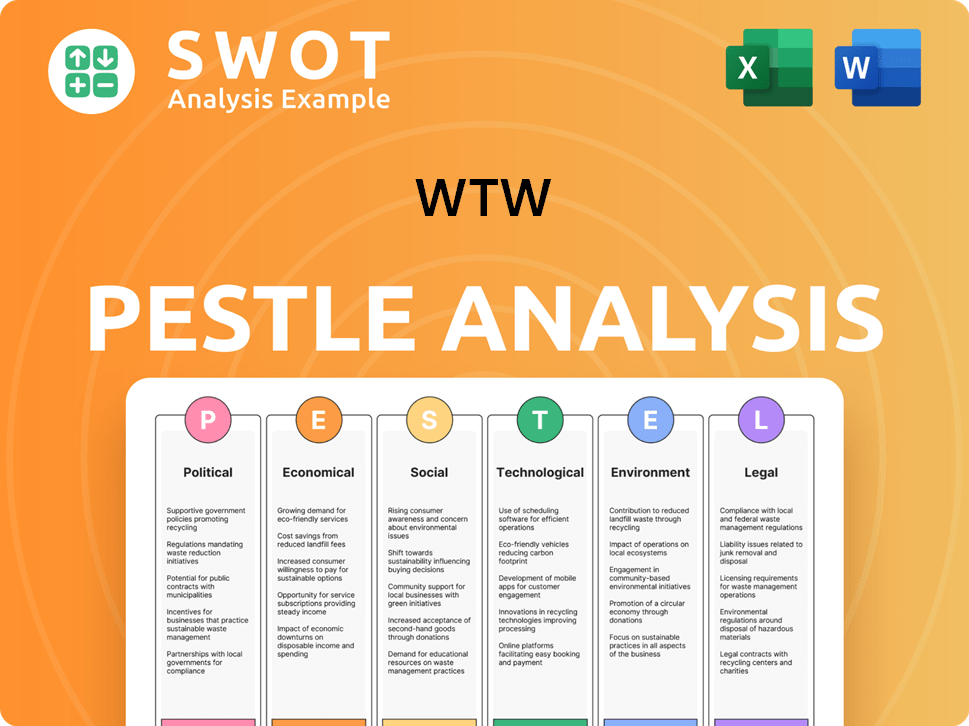

WTW PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is WTW’s Growth Forecast?

The financial outlook for WTW is robust, reflecting strong performance in 2024 and promising projections for the coming years. The company's financial performance showcases a solid foundation for sustained growth. This WTW company analysis reveals a trajectory of strategic financial management and expansion.

WTW concluded 2024 with a 5% organic revenue growth, reaching $9.9 billion for the full year. The adjusted operating margin improved by 190 basis points to 23.9%. Additionally, adjusted diluted earnings per share (EPS) increased by 17% to $16.93. These figures highlight the WTW financial performance and its ability to deliver value.

Looking ahead, WTW anticipates mid-single-digit organic growth in 2025 and continued improvement in adjusted EPS. This growth is supported by strategic initiatives and a focus on operational efficiency. The company's WTW growth strategy is designed to capitalize on market opportunities and enhance its competitive position. For a broader view, consider the Competitors Landscape of WTW.

WTW projects an adjusted operating margin between 23.0% and 23.5% for 2025. The Risk & Broking segment is expected to see approximately 100 basis points of average annual margin expansion over the next three years. This outlook suggests a commitment to profitability and efficiency.

Analysts estimate WTW to report an EPS of $3.25 for Q1 2025. The full fiscal year 2025 non-GAAP EPS is projected at $16.89. For fiscal 2026, earnings are expected to rebound by 13.7% year-over-year to $19.20 per share. These projections indicate positive WTW future prospects.

WTW plans to achieve ongoing free cash flow growth. Share repurchases of approximately $1.5 billion are planned for 2025, subject to market conditions. The free cash flow for the year ended December 31, 2024, was $1.4 billion, an increase of $184 million from the prior year.

Earnings are projected to reach $20.73 in 2026 and $21.55 in 2027. This long-term forecast underscores the company's potential for sustained financial growth. These projections are key indicators of the company's WTW market position and future success.

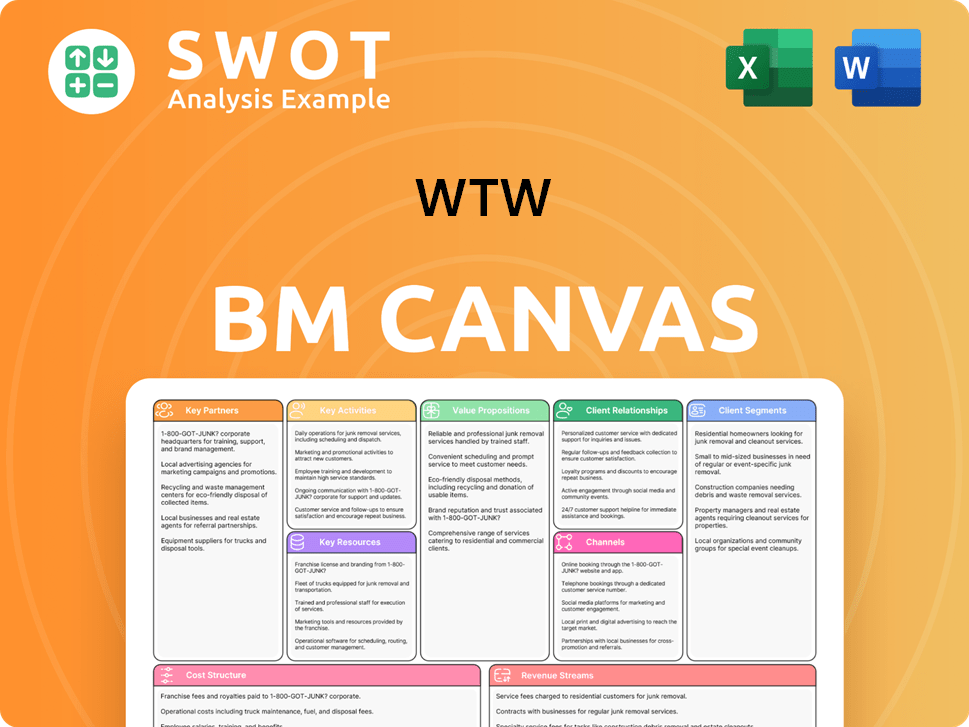

WTW Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow WTW’s Growth?

The path of WTW's growth strategy and future prospects is fraught with potential risks and obstacles, demanding careful navigation. The insurance brokerage industry is highly competitive, and geopolitical issues and regulatory changes pose ongoing threats to WTW's operations.

Supply chain vulnerabilities and cybersecurity risks are also critical areas of concern. These challenges require WTW to proactively manage and adapt to a dynamic risk landscape to ensure its business strategy remains resilient and its financial performance remains strong.

WTW's company analysis reveals that it must continually assess and mitigate these risks to achieve its growth objectives. This involves not only internal strategies but also a keen understanding of the external environment and its market position within the industry.

The insurance brokerage industry is intensely competitive, with numerous players vying for market share. This competition can pressure pricing and margins, potentially impacting WTW's financial performance and its ability to execute its business strategy. Understanding the competitive landscape is crucial for WTW's market position.

Geopolitical instability and regulatory changes present significant risks. The 2024 Thomson Reuters Global Trade Survey Report highlights that regulations and international politics are top concerns for businesses. These factors can disrupt operations and increase compliance costs, affecting WTW's growth strategy in the global market.

Supply chain vulnerabilities are a critical area of risk for WTW. The 2025 Global Supply Chain Risk Survey identifies cybersecurity and supplier contract vulnerabilities as central. Disruptions in the supply chain can lead to operational challenges and financial losses, potentially hindering WTW's business strategy.

Cybersecurity is a major risk factor, with the Global Manufacturing Risk Report 2024/2025 emphasizing this. Cyber threats can lead to data breaches, operational disruptions, and reputational damage, impacting WTW's financial performance and its ability to maintain client trust. This is essential for WTW's future prospects.

Reputational risk remains a significant challenge. The Reputational Risk Readiness Survey 2024/25 indicates that only 11% of respondents have strong capabilities in modeling the financial impact of reputational events. This can undermine WTW's market position and its ability to attract and retain clients.

Emerging risks, such as health and safety, regulatory compliance, and financial performance, are top concerns for directors and officers globally. These risks can impact WTW's operations and financial performance. Addressing these emerging risks is critical for WTW's sustainable growth.

WTW addresses these risks by aligning risk to insurance and utilizing trusted data sources. Investment firms must ensure their vulnerabilities are identified and covered. Proactive risk management is crucial for WTW's Marketing Strategy of WTW and overall success.

Organizations should build an emerging risk framework and integrate it into their business model. This involves fostering a risk-aware culture that proactively identifies and responds to new threats. This approach is essential for WTW's future prospects in the global market.

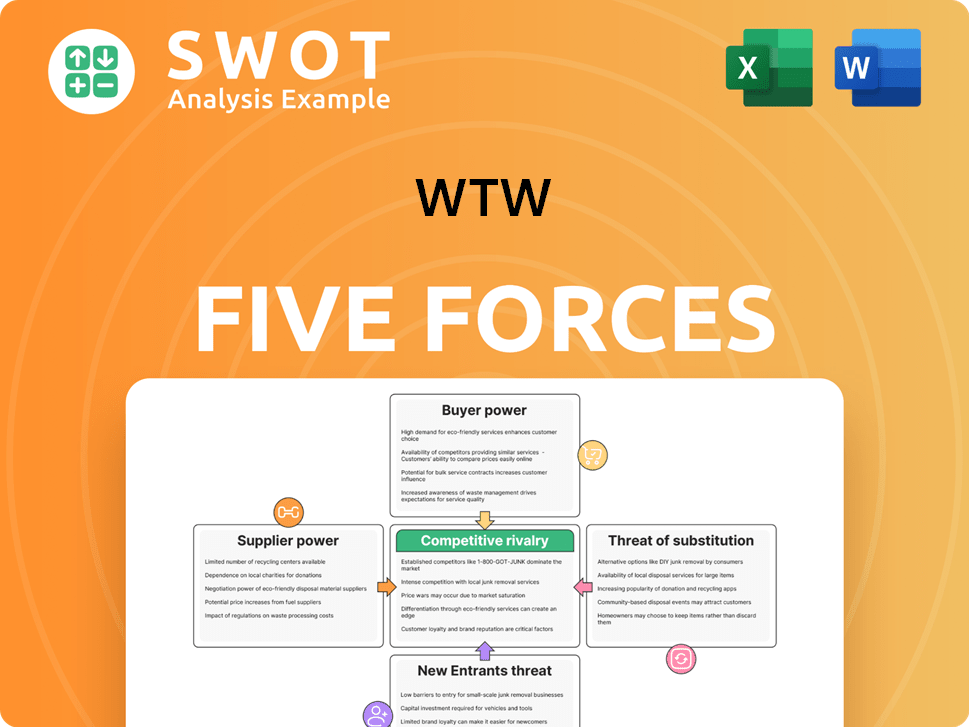

WTW Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.