Audacy Bundle

How is Audacy Navigating the Future of Audio?

Audacy, a major media company, recently emerged from Chapter 11 bankruptcy, shedding significant debt and signaling a fresh start. This strategic restructuring has positioned the company for growth in the dynamic audio market. Understanding the inner workings of Audacy SWOT Analysis is now more crucial than ever.

With a focus on digital transformation, Audacy, a leading Audacy radio broadcasting company, is aiming to counter challenges in traditional advertising. The company's diverse portfolio, including Audacy radio stations and a growing digital platform, highlights its commitment to reaching a vast audience. This in-depth exploration will delve into how Audacy company operates, examining its revenue streams and strategic initiatives, to provide a comprehensive understanding of its position within the audio industry, including its financial performance and future outlook.

What Are the Key Operations Driving Audacy’s Success?

The Audacy company operates as a multi-platform audio content and entertainment provider, serving a wide range of listeners and advertisers. Its core business revolves around its extensive network of radio stations, digital platforms, and content production capabilities. The company generates value by offering diverse audio content, including news, sports, music, and podcasts, through various channels like broadcast radio, online streaming, and its proprietary app.

The value proposition of Audacy is centered on its broad reach and the delivery of premium audio content. This includes a significant presence in sports audio, with a leading position in local all-sports stations and a substantial sports podcast network. Additionally, the company provides digital marketing and advertising solutions, enabling businesses to connect with targeted audiences. Audacy continually invests in its digital infrastructure and strategic partnerships to enhance its offerings and competitive edge.

The company's operations are unique due to its combination of a strong broadcast radio presence and a scaled digital offering. This includes a focus on content genres like news and sports. Investments in talent, content, and ad tech aim to drive growth. The core capabilities translate into benefits for customers through trusted local news, sports coverage, and diverse music and podcast offerings. Advertisers benefit from highly engaged audiences and precise targeting capabilities. To learn more about the company's past, you can read the Brief History of Audacy.

Audacy operates a vast network of over 220 local radio brands across 45 of the largest U.S. markets. These stations provide a mix of news, sports, and music content. This extensive reach allows Audacy to serve a broad audience and offer diverse programming options.

The company has made significant investments in digital capabilities, including its audio streaming platform and podcasting. The Audacy radio app is a direct-to-consumer streaming platform. Audacy also boasts one of the country's largest podcast studios.

Audacy holds a leading position in sports audio, with 40 leading local all-sports stations. It also runs the #1 Sports Podcast Network with over 600 titles. The company is the flagship home of 37 professional sports teams and the exclusive audio sales partner for Major League Baseball.

Audacy provides digital marketing and advertising solutions to businesses. Through strategic partnerships, like the one with Experian, Audacy enhances its addressable audience targeting. This allows advertisers to reach specific audiences with greater accuracy.

Audacy's operational effectiveness stems from its ability to combine a strong broadcast presence with a scaled digital offering. This integrated approach allows for content distribution across multiple platforms, enhancing audience reach and engagement. Continuous investment in talent, content, and technology further strengthens its competitive position.

- Extensive Radio Network: Over 220 radio stations across major U.S. markets.

- Digital Innovation: Focus on streaming and podcasting through the Audacy app.

- Sports Dominance: Leading position in sports audio with numerous stations and partnerships.

- Advertising Solutions: Precise audience targeting and digital marketing services.

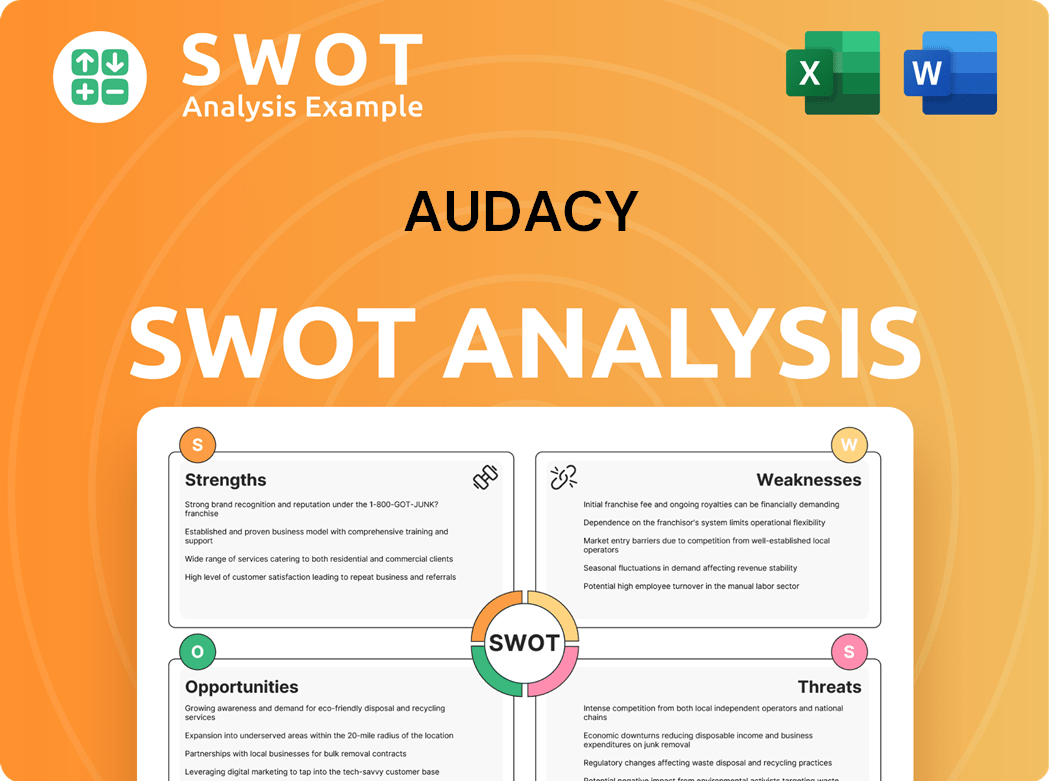

Audacy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Audacy Make Money?

The Audacy company generates revenue through a variety of streams, with broadcast radio advertising historically serving as its main source. The Audacy business model is evolving to adapt to changing media consumption habits. The company is actively expanding its digital offerings to complement its traditional radio broadcasting revenue.

In 2023, Audacy reported net revenue of $1.17 billion, a 7% decrease from $1.25 billion in 2022. The main revenue streams include local AM/FM advertising and national advertising.

While broadcast radio advertising remains a significant part of the revenue, it is facing a decline due to competition from online advertising. Digital offerings are becoming increasingly important, contributing about 23% of total revenue. The company is enhancing its digital monetization and programmatic capabilities to boost financial results.

Broadcast radio advertising is a primary revenue source for Audacy radio. Revenue comes from local and national advertising spots. Spot revenue is projected to decline annually.

Digital revenue streams include embedded advertisements in podcasts and production fees for podcast creation. Targeted advertising on platforms like audacy.com and the Audacy app also contribute. Digital revenues increased by 10% in the first quarter of 2024.

Other revenue sources include network compensation, sponsorships, and event revenues. These streams help diversify the company's income. Audacy leverages its content leadership to attract advertisers.

Audacy focuses on expanding its digital monetization and programmatic capabilities. The company is working with Experian to enhance audience targeting. This collaboration aims to deliver more relevant content and precise advertising solutions.

To learn more about the company's strategic approach, consider reading about the Marketing Strategy of Audacy.

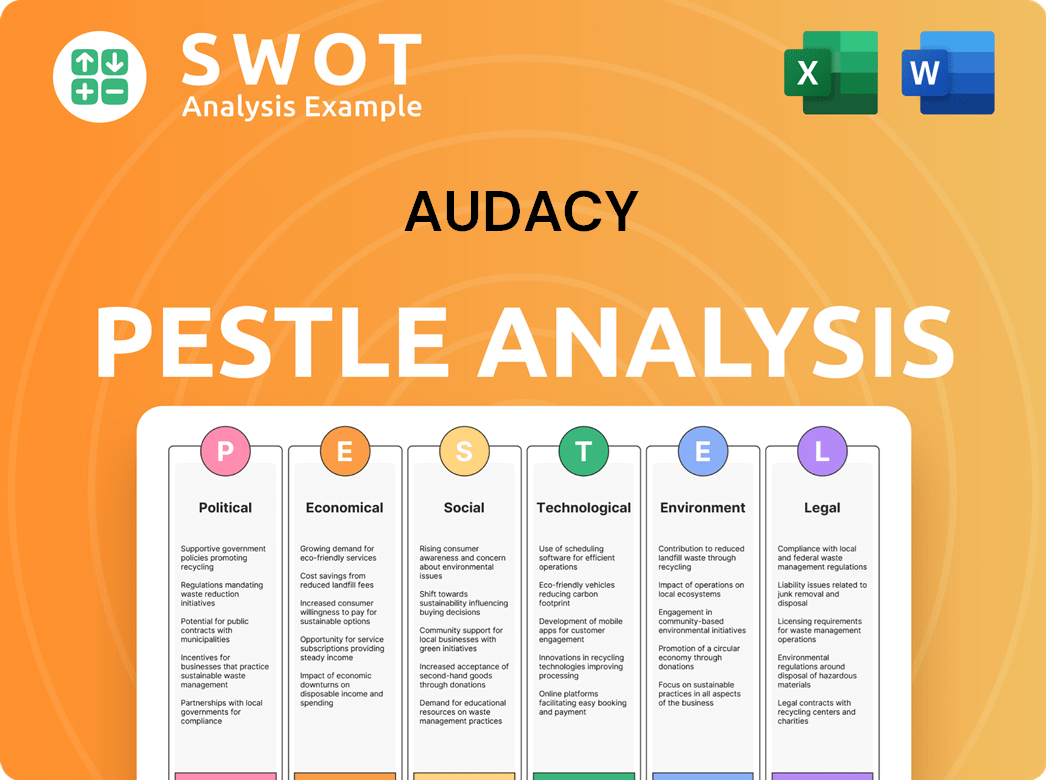

Audacy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Audacy’s Business Model?

The Audacy company has navigated significant shifts, with key milestones shaping its current operational and financial landscape. A crucial turning point was its emergence from Chapter 11 bankruptcy in late 2024, a move that reshaped its financial structure. This restructuring was pivotal for the Audacy company's recovery, providing the flexibility to invest in future growth areas.

Operationally, Audacy has adapted to the evolving media landscape, particularly the challenges in broadcast radio advertising. The company has strategically invested in its digital capabilities, including its audio streaming platform and podcasting, to drive future growth. The leadership changes in early 2025, with Kelli Turner as President and CEO, signal a focus on leveraging internal expertise for revenue and innovation.

Audacy's competitive advantages are rooted in its multi-platform audio leadership, extensive radio portfolio, and premium content, especially in sports and news. The company's strategic moves and financial restructuring have positioned it to capitalize on these strengths and adapt to the changing media environment. Understanding the history of Audacy company helps to understand its current position in the market.

The emergence from Chapter 11 bankruptcy in late 2024 was a pivotal event, reducing debt and providing financial flexibility. This restructuring decreased its debt by approximately 80%, from $1.9 billion to $350 million. These changes allowed the company to invest in new technologies and content.

Audacy has invested in its digital capabilities, including its audio streaming platform and podcasting. The company consolidated and rebranded its podcast division in 2024. Executive leadership changes in early 2025, including the appointment of Kelli Turner as CEO, reflect a focus on internal expertise.

Audacy has a strong position in multi-platform audio, with over 220 local radio brands. The company is the exclusive audio sales partner of Major League Baseball. Audacy has shown consistent ratings share growth in key demographics, including its 8th consecutive quarter of year-over-year broadcast and digital ratings share growth in the A25-54 demographic as of Q1 2024.

Audacy is investing in AI solutions for content delivery and personalized ad campaigns. 88% of marketers expect AI to have a serious impact on their business by mid-2025. This focus on AI shows the company’s commitment to innovation and staying ahead in the media industry.

The financial restructuring post-bankruptcy provided Audacy with a stronger foundation for future growth. The company's strategic investments in digital platforms and content creation aim to offset the decline in traditional radio advertising. Understanding the company's ownership structure can provide further context, as explored in Owners & Shareholders of Audacy.

- Debt reduction from $1.9 billion to $350 million.

- Focus on digital audio streaming and podcasting.

- Leadership changes to drive revenue and innovation.

- Consistent ratings share growth in key demographics.

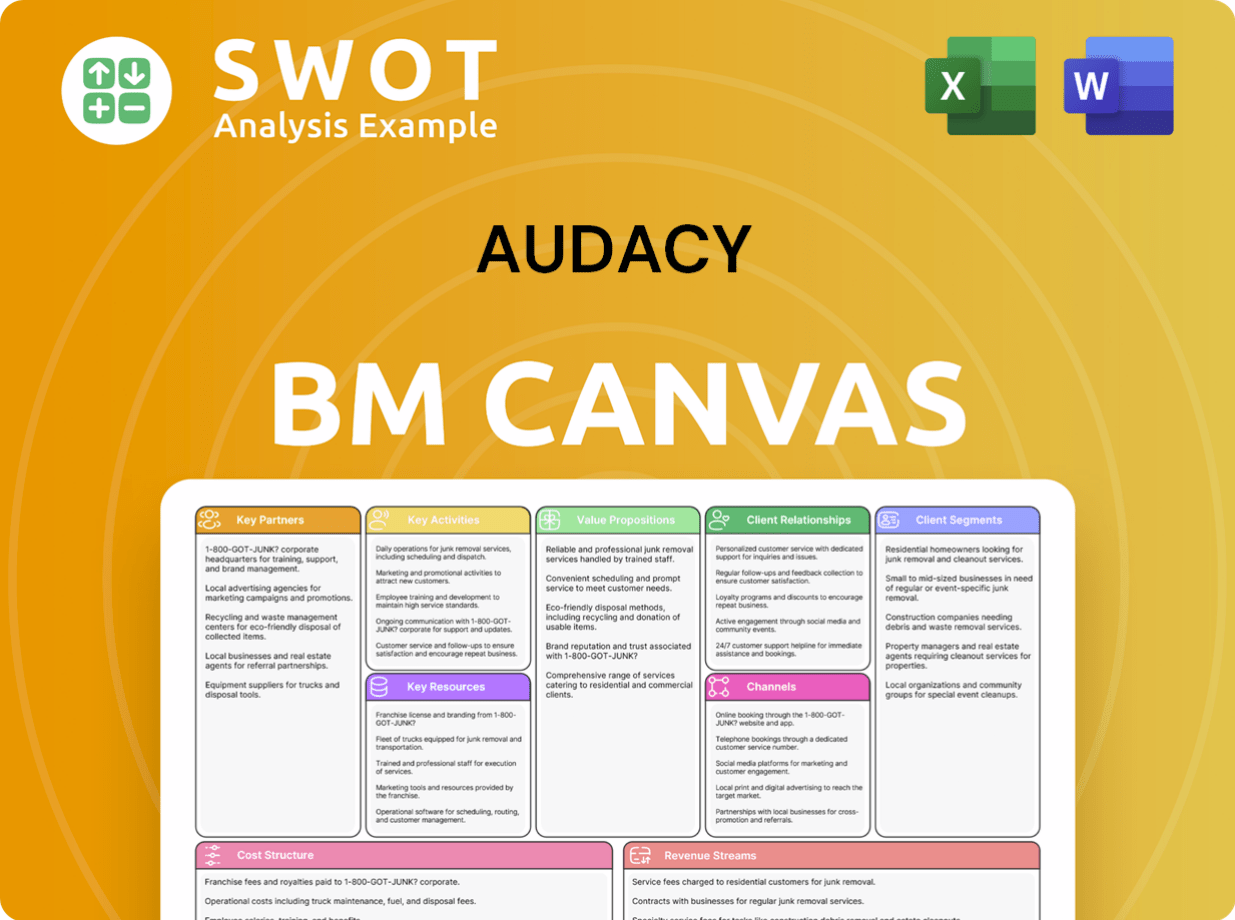

Audacy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Audacy Positioning Itself for Continued Success?

Audacy, a significant player in the media industry, holds a strong position as one of the largest radio broadcasting groups in the United States. Reaching approximately 200 million consumers monthly, the company has a leading presence in many of the largest U.S. markets. Its strength lies in its all-news and all-sports radio platforms, which have demonstrated high listener loyalty and advertising impact.

However, despite its market position, Audacy faces several risks. The company is heavily reliant on broadcast radio advertising revenue, which is experiencing a decline due to competition from online advertising. Additionally, the company must navigate intense competition from digital audio platforms and potential regulatory changes that could impact its operations. Audacy's future growth hinges on its ability to expand its digital offerings and increase digital revenue.

Audacy is a leading radio broadcasting company, with a strong presence in the U.S. market. It has a leading presence in 45 of the largest U.S. markets. The company is particularly strong in all-news and all-sports radio platforms, which helps to maintain high listener loyalty.

The primary risk for Audacy is its dependence on broadcast radio advertising, which is declining. Competition from digital platforms like Spotify and iHeartMedia also poses a risk. Regulatory changes, such as those impacting ownership limits, could affect the company's operations.

Audacy's future depends on expanding its digital products and accelerating digital revenue growth. The company is investing in digital capabilities, including its audio streaming platform and podcasting. It aims to leverage its premium content, particularly in sports audio, and its strong balance sheet to drive digital transformation.

Audacy focuses on multi-platform audio, digital innovation, and premium content. The company is committed to investing in high-quality content to engage audiences and provide solutions for partners. Recent layoffs in early 2025 were part of efforts to streamline resources for a strong future post-bankruptcy.

Audacy's financial health and strategic direction are crucial for investors and stakeholders. The company is working to offset declines in traditional radio revenue by boosting its digital offerings and exploring new revenue streams. A look at the Competitors Landscape of Audacy can provide further insights.

- Audacy is focused on digital transformation, including podcasting and live audio content.

- The company aims to capitalize on its leadership in the dynamic audio market.

- Audacy plans to expand its revenue by focusing on multi-platform audio and premium content.

- The company is investing in high-quality content to engage audiences.

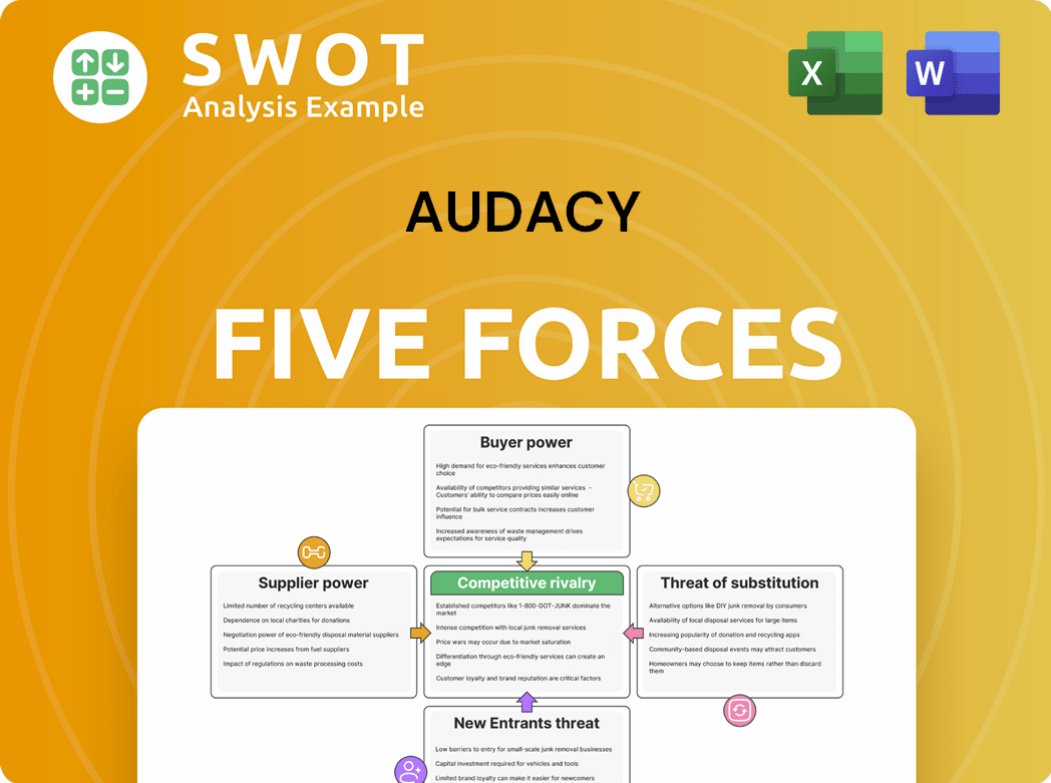

Audacy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Audacy Company?

- What is Competitive Landscape of Audacy Company?

- What is Growth Strategy and Future Prospects of Audacy Company?

- What is Sales and Marketing Strategy of Audacy Company?

- What is Brief History of Audacy Company?

- Who Owns Audacy Company?

- What is Customer Demographics and Target Market of Audacy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.