Cintas Bundle

Unveiling the Inner Workings of Cintas: How Does This Business Powerhouse Operate?

Cintas Corporation, a titan in the business services sector, has a market capitalization of approximately $72.9 billion as of early June 2025. This company provides essential services that are critical to the daily operations of businesses across North America. From corporate identity uniform programs to facility services and safety products, Cintas has solidified its position as a leader. Understanding the Cintas business model is key.

This exploration will provide a deep dive into the core operations of the Cintas company, examining its strategies for value creation and its diverse revenue streams. We'll analyze the strategic moves that have shaped its competitive edge, its industry standing, and the potential risks it faces. For those interested in a deeper dive, consider the Cintas SWOT Analysis to understand its strengths, weaknesses, opportunities, and threats. This analysis is crucial for anyone looking to understand the Cintas services and its future outlook.

What Are the Key Operations Driving Cintas’s Success?

The Cintas company creates value by offering a wide range of services designed to improve the image, safety, and cleanliness of businesses. It provides services like uniform rental and sales, facility services, first aid and safety products, fire protection, and document management. These Cintas services are tailored for various business sizes and industries, including healthcare, hospitality, manufacturing, and retail.

The operational model of Cintas business is highly integrated and efficient. For uniforms, the company handles the entire lifecycle, from design to delivery. This includes a sophisticated logistics network for timely pick-up and delivery. Facility services involve regular maintenance and supply replenishment, while the first aid and safety division stocks and services first aid cabinets. Fire protection services include inspection and maintenance of fire suppression systems, and document management offers secure shredding and data protection.

Cintas uses a route-based service model, ensuring consistent customer interactions and efficient service delivery. This approach fosters strong customer relationships and provides a recurring revenue base. The company's core capabilities lead to benefits such as improved corporate image, enhanced workplace safety, regulatory compliance, and operational efficiencies, setting it apart in a competitive market. If you're interested in learning more about the company's strategic approach, you can read about the Growth Strategy of Cintas.

Cintas products and services include uniform rental and sales, facility services, first aid and safety products, fire protection services, and document management. These offerings are designed to meet the diverse needs of businesses across various sectors. The company focuses on providing comprehensive solutions that enhance both safety and operational efficiency for its clients.

Cintas operates with a highly integrated and efficient model, particularly in uniform services, where it manages the entire lifecycle. The company's logistics network ensures timely pick-up and delivery. Facility services and safety programs are delivered through a route-based service model, promoting consistent customer interactions.

Customers benefit from improved corporate image, enhanced workplace safety, and regulatory compliance. Cintas also provides operational efficiencies through its services. The company's focus on customer satisfaction and service quality has contributed to its strong market position and financial performance.

In fiscal year 2024, Cintas reported revenues of approximately $8.8 billion, demonstrating continued growth and market strength. Its consistent financial performance reflects the effectiveness of its business model and the demand for its services. The company's profitability and revenue growth are indicators of its operational efficiency and customer retention rates.

Cintas distinguishes itself through its route-based service model, which fosters strong customer relationships and ensures efficient service delivery. The company's integrated approach to managing its services, from uniform design to facility maintenance, provides a comprehensive solution for businesses. This model allows for consistent, scheduled customer interactions and efficient delivery of multiple services.

- Route-based service model ensures consistent interactions.

- Integrated service offerings enhance customer convenience.

- Focus on customer satisfaction and service quality.

- Strong financial performance and market position.

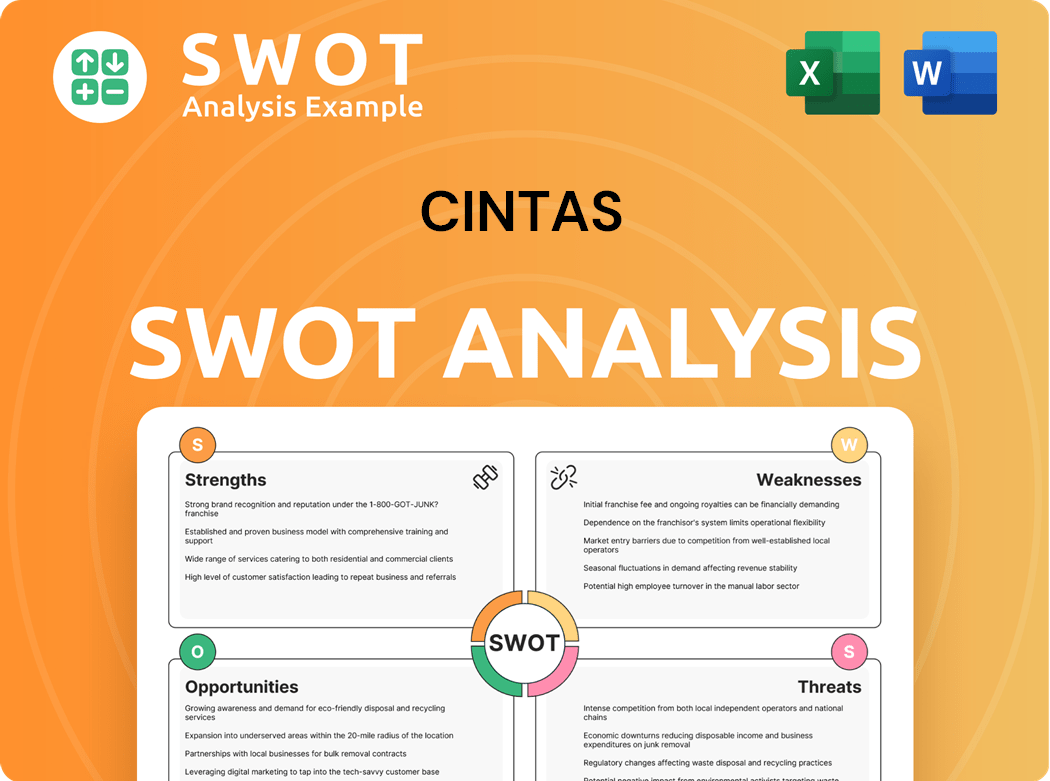

Cintas SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Cintas Make Money?

Cintas, a leading provider of corporate identity uniform programs, facility services, and first aid and safety products, generates revenue through a combination of service contracts and product sales. The company's business model is built on recurring revenue streams, primarily from its uniform rental and facility services segments. This approach ensures a steady income flow, making Cintas a financially stable company.

The company's revenue streams are diversified across several service areas, including uniform rental and facility services, first aid and safety services, and fire protection services. Cintas's financial success is reflected in its revenue figures, with a reported total revenue of $8.86 billion in fiscal year 2024, marking a significant increase from the previous year. This growth demonstrates the effectiveness of Cintas's revenue strategies and its ability to adapt to market demands.

Cintas's monetization strategies are designed to maximize customer lifetime value and ensure a consistent revenue flow. The company employs subscription-based models, bundled services, and cross-selling techniques to enhance customer relationships and increase revenue. These strategies, combined with continuous innovation and strategic acquisitions, have positioned Cintas as a leader in its industry. If you want to know more about the company's rivals, you can read about the Competitors Landscape of Cintas.

The Uniform Rental and Facility Services segment is the largest contributor to revenue, accounting for approximately 79% of total revenue. This segment involves the rental, cleaning, and delivery of uniforms, along with entrance mats and restroom supplies. The First Aid and Safety Services segment contributes around 11% of total revenue, including the sale and servicing of first aid products, safety equipment, and safety training. Fire Protection Services, which includes inspection, maintenance, and sales of fire extinguishers and suppression systems, accounts for approximately 9% of revenue.

- Subscription-Based Model: Customers typically sign multi-year service agreements for uniform rental and facility services, ensuring predictable recurring revenue.

- Bundled Services: Offering various combinations of services to provide comprehensive solutions and increase customer retention.

- Tiered Pricing: Using different pricing structures for various service levels or product volumes.

- Cross-Selling: Leveraging existing customer relationships to introduce additional services, such as fire protection or first aid supplies.

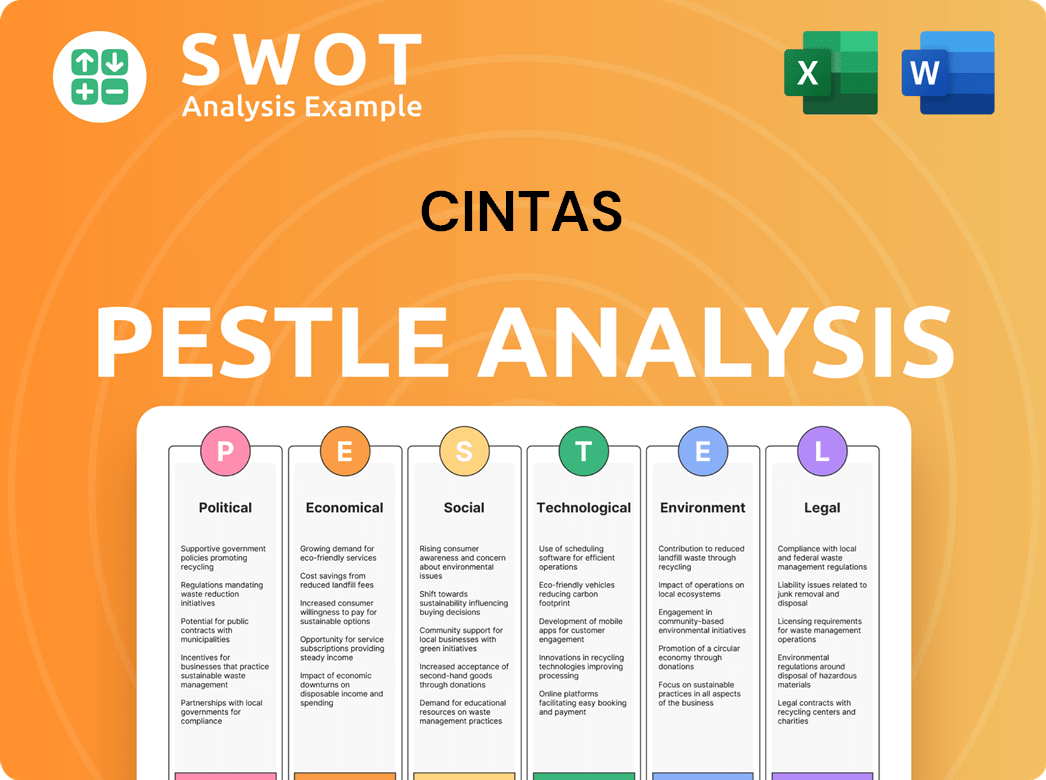

Cintas PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Cintas’s Business Model?

The Cintas company has a history marked by significant growth and strategic initiatives. Its journey includes key milestones, such as consistent organic expansion and strategic acquisitions. These moves have been instrumental in broadening its geographic presence and service offerings. For instance, the acquisition of G&K Services in 2017 was a pivotal decision that significantly boosted its uniform rental business and market share.

Operationally, Cintas has consistently invested in its service infrastructure. This includes advanced laundering technologies and logistics optimization. These investments have enhanced efficiency and service quality. Challenges faced by the company have included managing supply chain disruptions and adapting to evolving regulatory environments. Cintas has responded by diversifying its supplier base and optimizing inventory management.

The company's competitive advantages are multifaceted. Its strong brand recognition and reputation for reliability are significant assets. Furthermore, Cintas benefits from substantial economies of scale, allowing it to operate efficiently across a vast network of service centers. Its integrated service model provides a 'one-stop shop' for businesses, creating customer stickiness. The route-based service delivery model is a core competitive edge, fostering frequent customer interaction.

Key milestones include consistent organic growth and strategic acquisitions. The acquisition of G&K Services in 2017 was a pivotal move. These actions have significantly expanded its uniform rental business and market share. The company's growth is a testament to its effective strategies.

Strategic moves involve continuous investment in service infrastructure. This includes advanced laundering technologies and logistics optimization. These investments have enhanced efficiency and service quality. The company also focuses on adapting to evolving regulatory environments.

The competitive edge includes strong brand recognition and economies of scale. The integrated service model provides a 'one-stop shop' for businesses. The route-based service delivery model fosters frequent customer interaction. The company leverages technology for route optimization and customer relationship management.

In fiscal year 2024, Cintas reported revenue of approximately $8.8 billion. The company's net income for the same period was around $1.3 billion. This financial performance reflects its strong market position and effective operational strategies. These figures highlight the company's financial health.

The company's competitive advantages include a strong brand and reputation. Cintas benefits from substantial economies of scale. Its integrated service model creates customer loyalty. The route-based service delivery model is a core competitive edge. For more insights, consider reading about the Target Market of Cintas.

- Strong Brand Recognition: A well-established reputation for reliability and quality.

- Economies of Scale: Efficient operations across a vast network of service centers.

- Integrated Service Model: A 'one-stop shop' approach for businesses.

- Route-Based Service Delivery: Frequent customer interaction and efficient cross-selling.

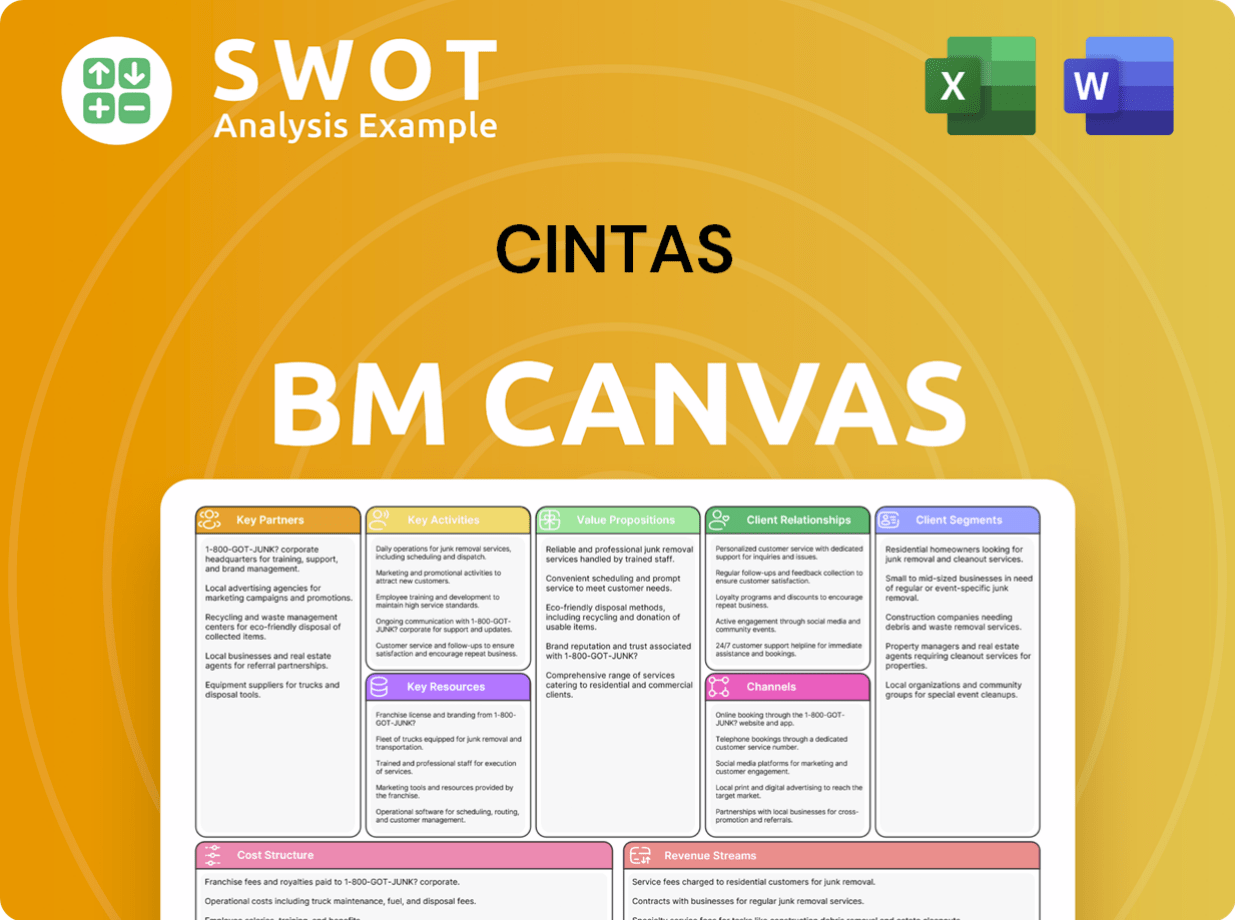

Cintas Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Cintas Positioning Itself for Continued Success?

The Cintas company holds a strong position in the specialized business services sector, especially across North America. It's recognized as a leading provider of uniform rental and facility services, with a significant market share in the U.S. Its extensive customer base and high retention rates highlight its strong market presence and customer loyalty. The company's global operations are predominantly focused in North America, where it leverages its extensive network of service centers and robust infrastructure.

Despite its robust market position, the Cintas business faces several challenges. These include regulatory changes, competition from new entrants, and the impact of economic downturns. Technological advancements also present both opportunities and risks, requiring the company to adapt to innovations in areas like facility management and safety solutions. Cintas is actively pursuing strategic initiatives to sustain and expand its market leadership, focusing on technology, new service offerings, and potential acquisitions.

Cintas is a leading player in the uniform rental and facility services market, particularly in North America. It boasts a substantial market share, often cited as the largest in the U.S. Its success is built on a large customer base and high customer retention, demonstrating strong customer loyalty and market presence. The company strategically uses its wide service network to maintain its position.

Cintas faces risks from regulatory changes, increased competition, and economic downturns. Technological disruption also poses a challenge, requiring the company to adapt quickly. The emergence of new competitors and shifts in consumer preferences could affect demand for its services. Additionally, the company must navigate labor and environmental regulations.

The future for Cintas appears positive, focusing on leveraging its integrated service model. The company is committed to customer service, operational efficiency, and sustainable growth. Cintas aims to sustain its ability to make money by continuous innovation, process optimization, and exploring new markets. This reinforces its position as a key partner for businesses.

Cintas is investing in technology to enhance operational efficiency and customer experience. It is exploring new service offerings to meet evolving market demands. Furthermore, the company is considering strategic acquisitions to expand its footprint or capabilities. Leadership emphasizes customer service excellence and sustainable growth.

Recent financial data indicates Cintas's strong performance. In fiscal year 2024, the company reported revenues of approximately $8.8 billion, demonstrating consistent growth. This growth is supported by a high customer retention rate, often exceeding 90%, and strategic investments in technology and service expansion. For instance, in Q3 2024, Cintas saw a revenue increase of 10.7%. The company's ability to maintain and grow its customer base, combined with its focus on operational efficiency, positions it well for future success. To learn more about the company's history, read the Brief History of Cintas.

- The uniform rental segment remains a significant revenue driver.

- Facility services are experiencing steady growth.

- Investments in technology are enhancing service delivery.

- Acquisitions are part of the growth strategy.

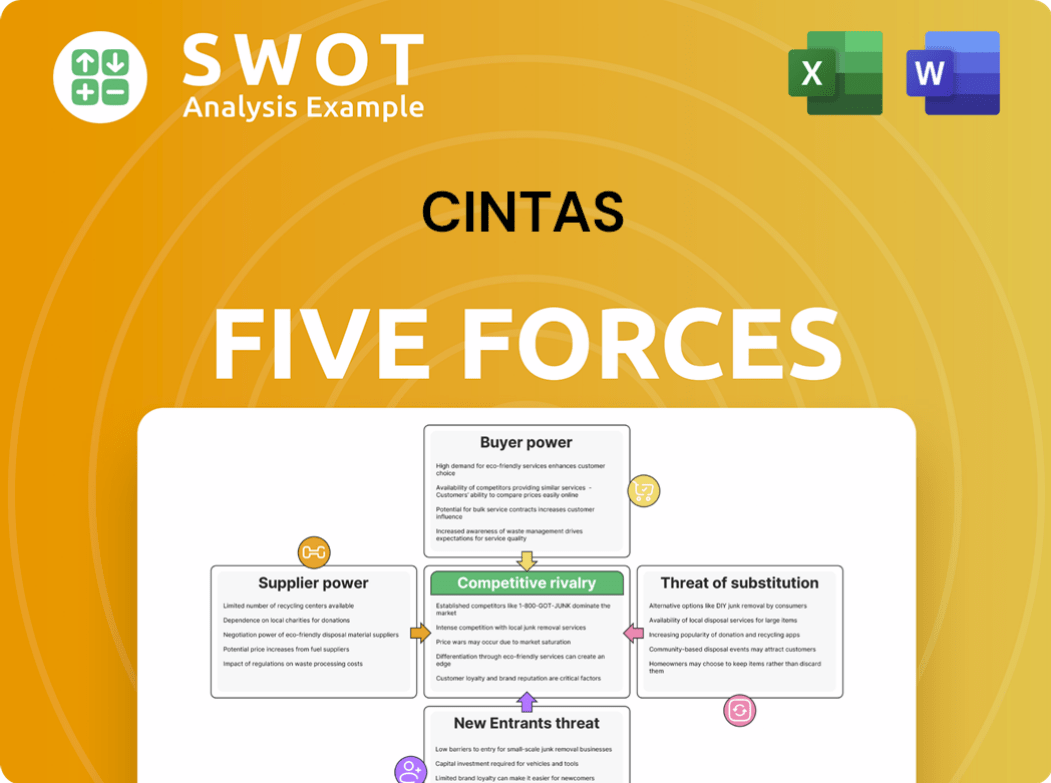

Cintas Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Cintas Company?

- What is Competitive Landscape of Cintas Company?

- What is Growth Strategy and Future Prospects of Cintas Company?

- What is Sales and Marketing Strategy of Cintas Company?

- What is Brief History of Cintas Company?

- Who Owns Cintas Company?

- What is Customer Demographics and Target Market of Cintas Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.