Denali Therapeutics Bundle

How Does Denali Therapeutics Navigate the Complex World of Biotech?

Denali Therapeutics, a prominent biotech company, is on a mission to revolutionize the treatment of neurodegenerative diseases. With a focus on therapies that can cross the blood-brain barrier, Denali is tackling conditions like Alzheimer's and Parkinson's. Their innovative approach, utilizing antibodies and small molecules, sets them apart in the challenging field of drug development.

Understanding the inner workings of the Denali Therapeutics SWOT Analysis is crucial for anyone interested in the biotech sector. From its drug discovery process to its clinical trials updates, this company's journey offers valuable insights. Investors and industry observers alike are keen to understand how Denali Therapeutics generates revenue and its future prospects in the face of fierce competition. Analyzing the Denali Therapeutics stock and its management team is key to understanding its potential.

What Are the Key Operations Driving Denali Therapeutics’s Success?

Denali Therapeutics focuses on discovering and developing transformative therapies for neurodegenerative diseases. Their value proposition centers on creating treatments that target specific disease mechanisms while effectively crossing the blood-brain barrier (BBB). This capability is critical for addressing conditions like Alzheimer's, Parkinson's, and ALS, which represent significant unmet medical needs. The company aims to serve patient populations suffering from these debilitating diseases and the broader medical community seeking advanced treatment options.

The operational processes at Denali Therapeutics company are deeply rooted in cutting-edge scientific research and rigorous clinical development. This includes extensive preclinical research to identify and validate novel drug targets, followed by the design and synthesis of various therapeutic modalities, including small molecules, antibodies, and protein therapeutics. A key differentiator is their proprietary Transport Vehicle (TV) technology, designed to enhance the delivery of therapeutics across the BBB, thereby increasing drug exposure in the brain.

Denali Therapeutics stock is influenced by these operational and strategic factors. The company's supply chain involves sourcing specialized reagents, materials for drug synthesis, and clinical trial supplies. Denali often engages in strategic partnerships with other pharmaceutical companies for co-development, co-commercialization, and licensing agreements, which expand their research capabilities, provide additional funding, and facilitate broader market access. Their distribution networks are primarily through these partnerships once a therapy reaches commercialization, leveraging established pharmaceutical sales and marketing channels. The uniqueness of Denali's operations lies in its specialized focus on BBB penetration and its diverse therapeutic modalities, which collectively aim to overcome historical challenges in treating neurodegenerative diseases, ultimately translating into the potential for more effective patient benefits.

The company's operational success hinges on its ability to navigate the complexities of drug development. Their focus on the BBB is a significant competitive advantage in the biotech industry, particularly within the realm of drug development.

- Research and Development: Extensive preclinical research to identify and validate drug targets.

- Therapeutic Modalities: Development of small molecules, antibodies, and protein therapeutics.

- BBB Technology: Proprietary Transport Vehicle (TV) technology for enhanced drug delivery.

- Partnerships: Strategic collaborations for co-development and market access.

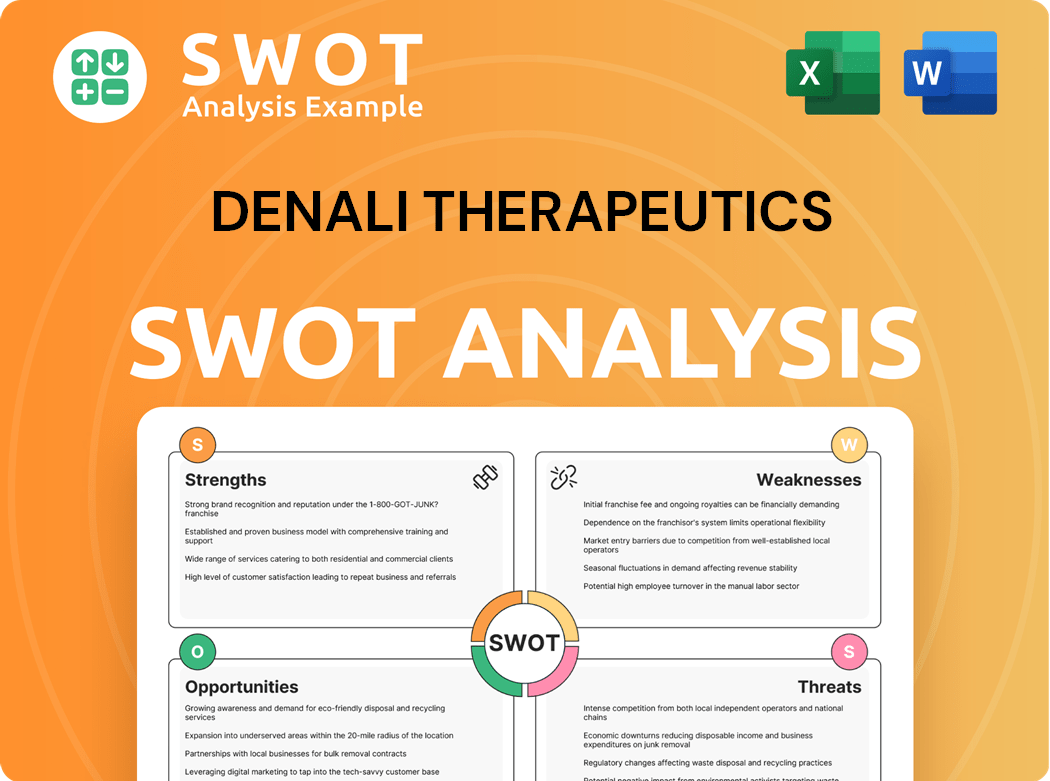

Denali Therapeutics SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Denali Therapeutics Make Money?

The revenue streams for Denali Therapeutics primarily stem from collaborations, licensing fees, and milestone payments. As a biotech company focused on drug development for neurodegenerative diseases, direct product sales are not yet a primary source of income, given its pipeline candidates are still in clinical trials.

In Q1 2024, Denali reported a total revenue of $37.5 million, mainly from collaboration revenues. This represents a decrease compared to the $64.4 million reported in Q1 2023, which was influenced by the timing of milestone achievements from partnerships.

A significant portion of Denali's monetization strategy revolves around partnerships with larger pharmaceutical companies. These collaborations provide upfront payments, research funding, and success-based milestone payments. Key partnerships include collaborations with Sanofi and Takeda.

Denali's revenue model is heavily reliant on strategic partnerships and the successful progression of its drug candidates through clinical trials. This approach allows the company to fund its extensive R&D efforts and validate its technology platforms, such as its Transport Vehicle (TV) technology.

- Collaboration Agreements: Upfront payments and research funding from partners.

- Milestone Payments: Payments triggered by achieving specific development, regulatory, or commercial goals.

- Licensing Fees and Royalties: Future revenue from product sales and royalties upon successful commercialization of partnered products.

- Partnerships: Collaborations with companies like Sanofi and Takeda provide non-dilutive capital and validate the company's scientific approach.

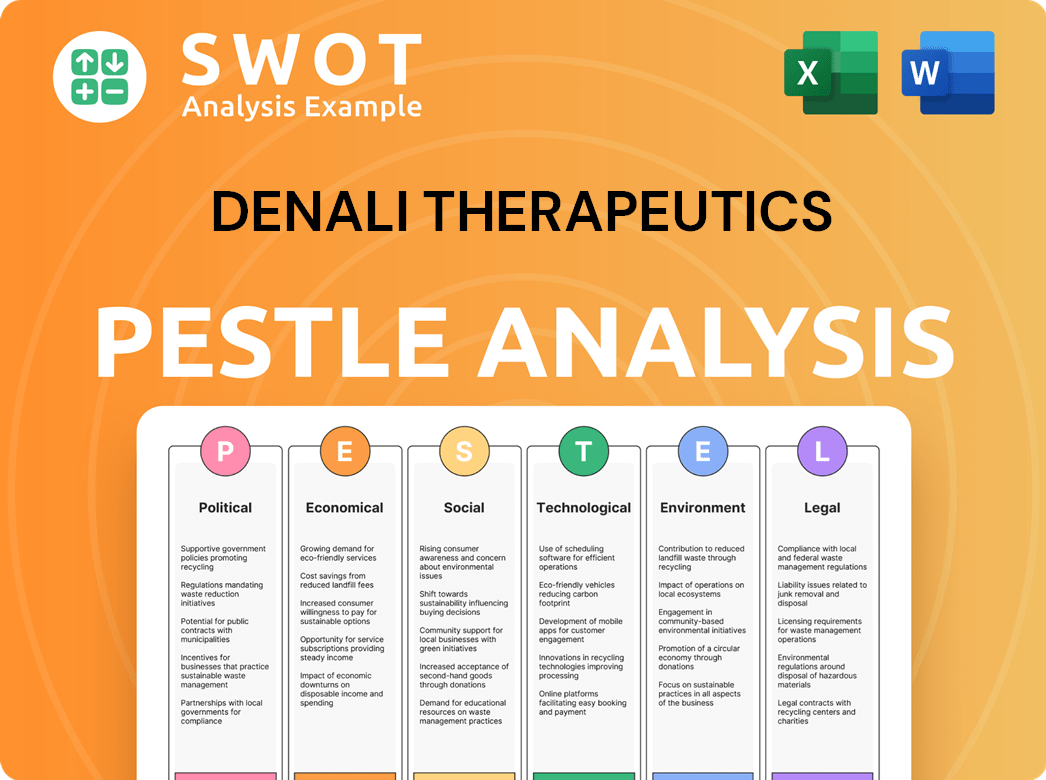

Denali Therapeutics PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Denali Therapeutics’s Business Model?

The journey of Denali Therapeutics has been marked by significant milestones and strategic maneuvers. The company, a prominent player in the biotech company sector, has focused on developing treatments for neurodegenerative diseases. Their progress in clinical trials for various pipeline drugs, including those targeting Parkinson's disease and Alzheimer's disease, highlights their commitment to innovation and scientific advancement.

Strategic moves have been crucial for shaping the company's trajectory. Partnerships have played a vital role in supporting drug development and sharing risks, while the focus on proprietary Transport Vehicle (TV) technology has set them apart. This technology aims to improve drug delivery to the brain, addressing a key challenge in treating neurological disorders. These moves reflect a proactive approach to navigating the complex landscape of drug development.

The competitive edge of Denali Therapeutics is rooted in its scientific expertise and innovative technologies. Their deep understanding of neurodegenerative biology and drug discovery, combined with the potential of their TV technology, positions them favorably in the market. Their ability to adapt to new trends and leverage cutting-edge research is crucial for maintaining a leading position in a rapidly evolving scientific landscape.

Denali Therapeutics has achieved several key milestones, including the initiation of clinical trials for various pipeline candidates. The advancement of programs like the LRRK2 inhibitor for Parkinson's and RIPK1 inhibitor for Alzheimer's and ALS into later stages of clinical development is significant. The ongoing Phase 2 study of DNL788 (SAR443820) for ALS is a notable development.

Strategic partnerships are a key aspect of Denali's operational strategy, providing financial support and risk-sharing in drug development. The company's focus on its proprietary Transport Vehicle (TV) technology is a strategic move to enhance drug delivery to the brain. These moves underscore a proactive approach to navigating the complexities of drug development.

Denali's competitive advantage lies in its deep scientific expertise in neurodegenerative biology and drug discovery. The proprietary Transport Vehicle (TV) technology provides a unique advantage in treating neurological disorders. Adapting to new trends and leveraging cutting-edge research further strengthens their market position.

As of Q1 2024, Denali Therapeutics reported a cash position of approximately $1.1 billion, providing a financial runway to support ongoing research and development activities. The company's revenue model is primarily driven by collaborations and milestone payments. The company's market capitalization fluctuates, reflecting investor sentiment and clinical trial outcomes. Recent stock price analysis indicates volatility influenced by clinical trial updates and broader market trends.

Denali faces challenges common to the biotech industry, including high drug development costs, lengthy timelines, and clinical trial risks. The company mitigates these challenges through strategic partnerships and by focusing on its proprietary Transport Vehicle (TV) technology.

- High costs and lengthy timelines in drug development.

- Inherent risks of clinical trial failures.

- Intense regulatory scrutiny.

- Strategic partnerships to share risks and provide financial support.

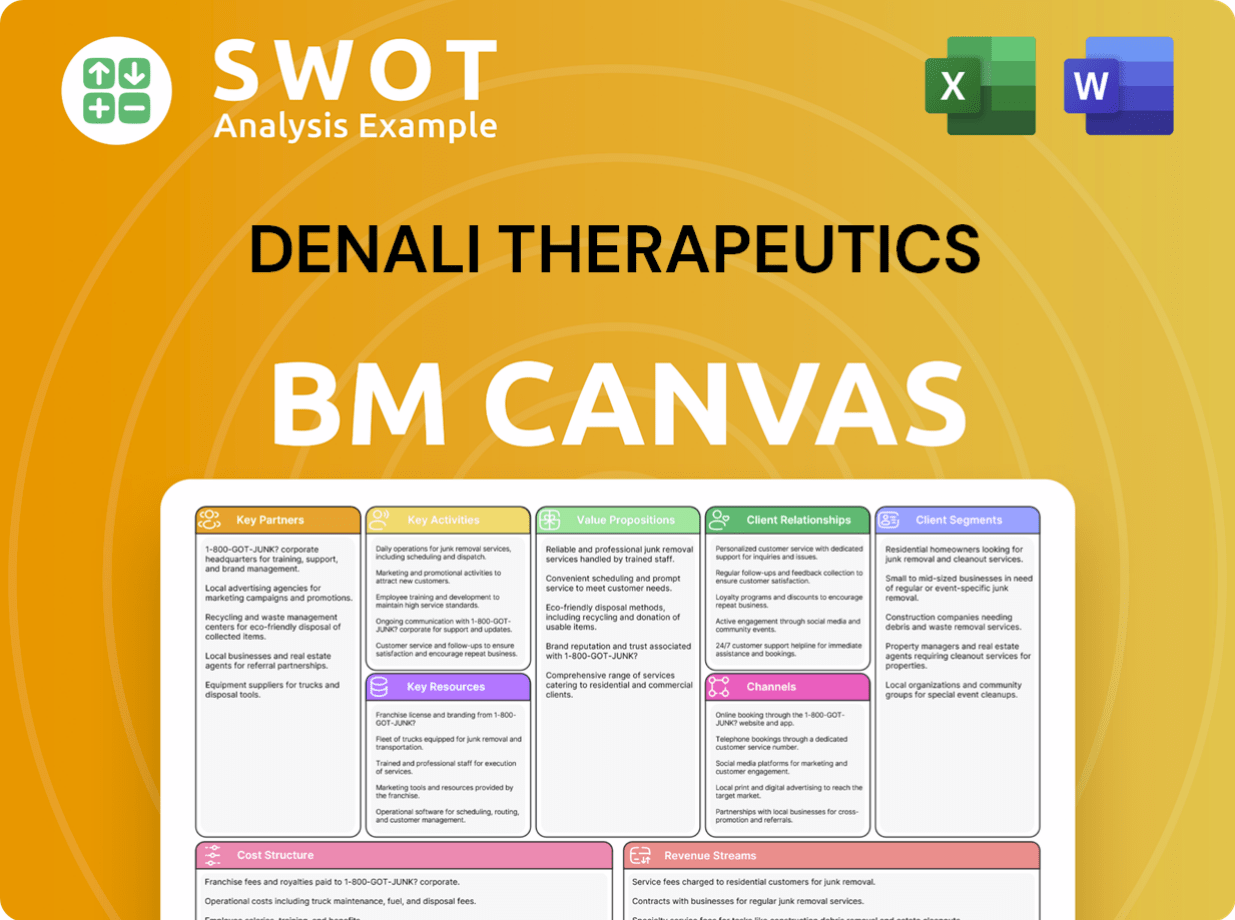

Denali Therapeutics Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Denali Therapeutics Positioning Itself for Continued Success?

The Denali Therapeutics company is positioned within the biotechnology sector, specifically targeting neurodegenerative diseases. They stand out through their innovative approaches, particularly their blood-brain barrier (BBB) penetration technology, aiming to develop treatments for conditions like Alzheimer's and Parkinson's. Their competitive landscape includes both established pharmaceutical giants and other biotech firms focused on similar therapeutic areas. Strategic partnerships with major players like Sanofi and Takeda highlight their strong scientific standing and the value of their pipeline.

Key risks for Denali Therapeutics include the high failure rate of clinical trials in neurodegenerative diseases. Regulatory hurdles from agencies such as the FDA also pose significant risks, potentially delaying product development. Additionally, the entry of new competitors with alternative technologies and the capital-intensive nature of drug development, affecting their ability to raise capital, are also critical factors. The company's success hinges on its ability to navigate these challenges while advancing its pipeline and securing necessary funding.

As a Biotech company, Denali Therapeutics focuses on neurodegenerative diseases. They are recognized for their innovative BBB penetration technology. Strategic partnerships with major pharmaceutical companies underscore their standing.

High failure rates in clinical trials are a significant risk. Regulatory hurdles and approvals can cause delays. Competition and the need for continuous funding also pose challenges for Denali Therapeutics stock.

Denali Therapeutics' strategy includes advancing its drug pipeline and expanding its technology. They aim to explore new targets and modalities. Successful product launches would unlock significant royalty streams and potential direct sales.

The company is focused on clinical development and strategic partnerships. Continued investment in research and development is crucial. Maintaining a competitive edge is essential for achieving long-term goals.

In 2024, the biotechnology sector saw significant investment, with companies like Denali Therapeutics seeking to capitalize on this trend. The company's R&D spending is a key indicator of its commitment to innovation. Strategic collaborations with companies like Takeda are critical for advancing their pipeline.

- Denali Therapeutics' research and development expenses are substantial, reflecting the capital-intensive nature of drug development.

- Partnerships are crucial for accessing resources and expertise, accelerating the drug discovery process.

- The success of clinical trials is vital for the company's future prospects and will influence Denali Therapeutics stock.

- Market analysis indicates a growing demand for treatments for neurodegenerative diseases.

Denali Therapeutics Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Denali Therapeutics Company?

- What is Competitive Landscape of Denali Therapeutics Company?

- What is Growth Strategy and Future Prospects of Denali Therapeutics Company?

- What is Sales and Marketing Strategy of Denali Therapeutics Company?

- What is Brief History of Denali Therapeutics Company?

- Who Owns Denali Therapeutics Company?

- What is Customer Demographics and Target Market of Denali Therapeutics Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.