Econocom Group Bundle

How Does Econocom Group Thrive in the Digital Age?

Econocom Group, a veteran of digital transformation, has been guiding businesses through the complexities of technological evolution for over 50 years. With a robust revenue of €2,744 million in 2024, demonstrating a 3.6% organic increase, Econocom continues to prove its resilience in the dynamic IT services sector. This performance highlights the strength of its diversified business model and its ability to adapt to market changes.

Econocom's influence spans across 16 countries, supported by a workforce of over 8,450 employees, offering a wide array of technology solutions from consulting to managed services. Understanding the Econocom Group SWOT Analysis is essential for investors and stakeholders looking to grasp the company's strategic positioning. This deep dive into the Econocom company will illuminate its operational framework, revenue streams, and strategic initiatives, including its 'One Econocom' plan and the launch of 'Gather', revealing its proactive approach to meeting future market demands and driving growth in the digital workplace.

What Are the Key Operations Driving Econocom Group’s Success?

Econocom Group SE specializes in facilitating digital transformation for large organizations, offering a comprehensive suite of services across various sectors, including retail, media, education, and healthcare. The company's approach is centered on providing end-to-end solutions that encompass the design, financing, and implementation of digital strategies. This integrated model allows the Econocom company to support clients throughout their digital journey, from the initial planning stages to the ongoing management of their technology assets.

The company's business model is structured around three primary activities: Products & Solutions (P&S), Technology Management & Financing (TMF), and Services. These segments work in synergy to deliver value, with P&S focusing on the procurement and management of digital products, TMF providing flexible financing options, and Services offering consulting and integration expertise. This multifaceted approach enables Econocom to meet the diverse needs of its clients, ensuring they can leverage technology to achieve their business objectives effectively. To understand more about its history, you can read Brief History of Econocom Group.

Econocom's core operations are designed to support businesses in their digital transformation efforts. The Products & Solutions segment acts as a one-stop shop, managing the entire lifecycle of digital products, including purchasing, customization, and maintenance. The Technology Management & Financing division offers tailored financing solutions, reflecting the shift from ownership to usage in the IT sector. The Services division provides consulting, infrastructure management, and integration services, ensuring that digital projects are user-oriented and aligned with client goals.

Econocom provides a comprehensive range of digital products and solutions, acting as a single source for acquiring equipment. This includes purchasing, configuration, customization, maintenance, repair, and refurbishment services. This segment ensures clients have access to the latest technology while optimizing the management of their digital assets.

This segment offers flexible financing solutions for managing digital assets, including administrative and financial management. In Q1 2025, this segment experienced substantial growth, reaching €241.0 million, reflecting a 16.7% increase. This growth highlights the increasing demand for usage-based IT solutions.

The Services division focuses on consulting, infrastructure management, application development, digital and systems integration, and managed services. This ensures that digital projects are user-oriented and aligned with client objectives, providing comprehensive support from design to asset recycling.

Econocom’s supply chain and distribution networks are critical for delivering end-to-end solutions. The acquisition of an 80% stake in bb-net, Germany's leading IT refurbishment company, in January 2025, strengthens its commitment to the circular economy.

Econocom distinguishes itself through its integrated approach, covering equipment, services, and financing. This comprehensive support from design to asset recycling sets it apart from competitors. The company's commitment to sustainability and the circular economy is another key differentiator.

- End-to-end solutions for digital transformation.

- Flexible financing options.

- Focus on sustainability and circular economy through refurbishment.

- Comprehensive IT services.

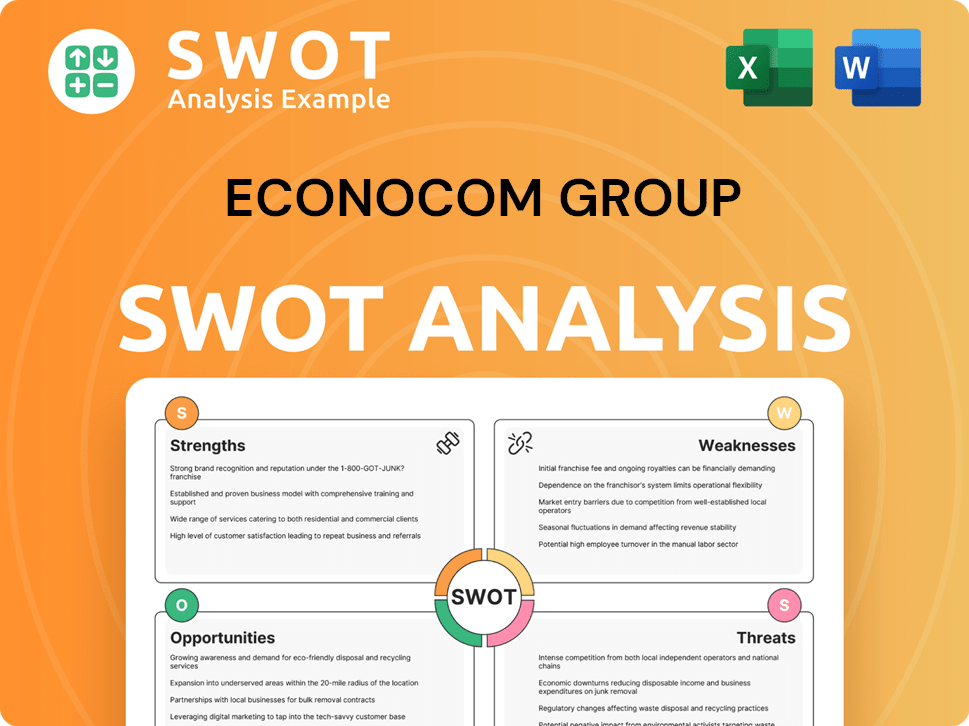

Econocom Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Econocom Group Make Money?

The Econocom Group, a prominent player in the technology solutions sector, generates revenue through a multifaceted approach. This strategy encompasses diverse streams designed to cater to the evolving needs of its clientele. The company's financial performance in 2024 and its strategic initiatives for 2025 underscore its commitment to sustainable growth and innovation in the IT services market.

Econocom Group's revenue streams are primarily segmented into Products & Solutions (P&S), Technology Management & Financing (TMF), and Services. This diversified model allows the company to offer comprehensive digital transformation solutions. The group's ability to integrate equipment, financing, and managed services positions it as a key provider in the digital workplace and beyond.

In 2024, the total revenue for Econocom Group reached €2,744 million, reflecting an organic increase of 3.6% compared to 2023. This growth was driven by strong performances across its various segments, particularly in Technology Management & Financing and Services. The company's strategic focus on both organic and external growth, including acquisitions, is aimed at expanding its revenue sources and achieving its ambitious targets.

The P&S segment focuses on the sale and customization of digital equipment. In 2024, this segment contributed €1,205 million to the total revenue, showing a 0.5% increase. Econocom's strategy involves providing tailored technology solutions to meet specific customer requirements, supporting businesses in their digital transformation journeys.

TMF demonstrated robust growth, with revenue totaling €1,048 million in 2024, a substantial increase of 7.7%. This segment's monetization strategy revolves around flexible financing and leasing solutions for digital assets. In Q1 2025, TMF revenue reached €241.0 million, representing a 16.7% growth, underlining its continued strong performance.

The Services division reported revenue of €491 million in 2024, an increase of 3.1%, with a profitability rate of 5.1%. In Q1 2025, Services revenue grew by 7.0% to €130.5 million. This segment provides managed services and support, enhancing Econocom's end-to-end offerings and supporting its customer base.

Econocom integrates equipment, financing, and managed services to provide end-to-end digital transformation solutions. This approach allows the company to offer comprehensive packages that meet diverse customer needs. The bundled services strategy enhances Econocom's ability to support businesses through their digital transformation efforts.

The acquisition of bb-net in January 2025 expanded Econocom's reach into the refurbished IT market. This move aligns with circular economy principles and offers cost-effective solutions. The 'One Econocom' strategic plan aims to achieve €4 billion in revenues by 2028, with approximately €400 million expected from future acquisitions.

Econocom Group aims to achieve €4 billion in revenues by 2028. This target reflects the company's commitment to both organic growth and strategic external growth. The financial performance of Econocom Group demonstrates its ability to adapt and thrive in the dynamic IT services sector.

Econocom's core monetization strategies are centered around providing comprehensive IT services and solutions. These strategies include:

- Flexible Financing: Offering leasing and financing options for digital assets.

- Bundled Solutions: Integrating equipment, financing, and managed services.

- Strategic Acquisitions: Expanding into new markets and service offerings.

- Managed Services: Providing ongoing support and IT management.

- Focus on the Circular Economy: Entering the refurbished IT market.

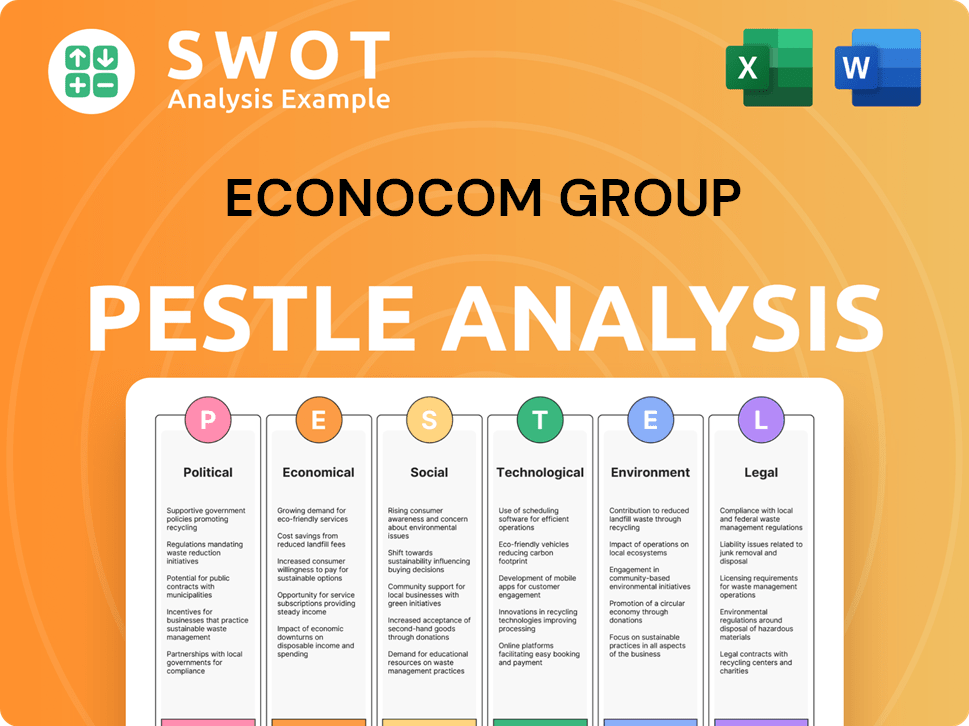

Econocom Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Econocom Group’s Business Model?

The Econocom Group has made several significant moves that have shaped its operations. A key development was the launch of its 'One Econocom' strategic plan in 2024. This plan aims for an average total growth target of 8% per year to reach €4 billion in revenues by 2028.

A strategic move in January 2025 was the acquisition of an 80% stake in bb-net, Germany's leading IT refurbishment company. This acquisition strengthens Econocom's presence in the European circular economy. Another initiative in 2024 was the launch of 'Gather,' a new European brand targeting the audiovisual, unified communications, and information market. To support its growth, Econocom also embarked on a sales force recruitment plan in 2024.

The company's competitive edge lies in its unique, diversified business model that covers the full chain of digital business lines: equipment, services, and financing. This end-to-end approach allows Econocom to provide comprehensive support for digital transformation projects. Its long-standing experience of 50 years in the industry also provides a strong foundation. The company continues to adapt to new trends by focusing on responsible digital practices, including refurbishment and decarbonization initiatives, and preparing for an AI-driven market transformation.

The 'One Econocom' strategic plan launched in 2024 is designed to enhance synergies. The plan aims for an average total growth target of 8% per year. This is to reach €4 billion in revenues by 2028.

In January 2025, Econocom acquired an 80% stake in bb-net. This acquisition strengthens the company's presence in the European circular economy. The launch of 'Gather' in 2024 expanded its market reach.

Econocom's business model covers equipment, services, and financing. This end-to-end approach supports digital transformation. The company has 50 years of experience in the industry.

Econocom's diversified model ensured organic revenue growth in 2024. The company focuses on responsible digital practices, including refurbishment and decarbonization initiatives. Econocom is preparing for an AI-driven market transformation.

Econocom's core strength is its diversified business model. This model covers the full chain of digital business lines. The company has a long-standing experience of 50 years in the industry.

- Comprehensive IT services and solutions.

- Focus on digital transformation.

- Commitment to responsible digital practices.

- Strategic acquisitions to expand market presence.

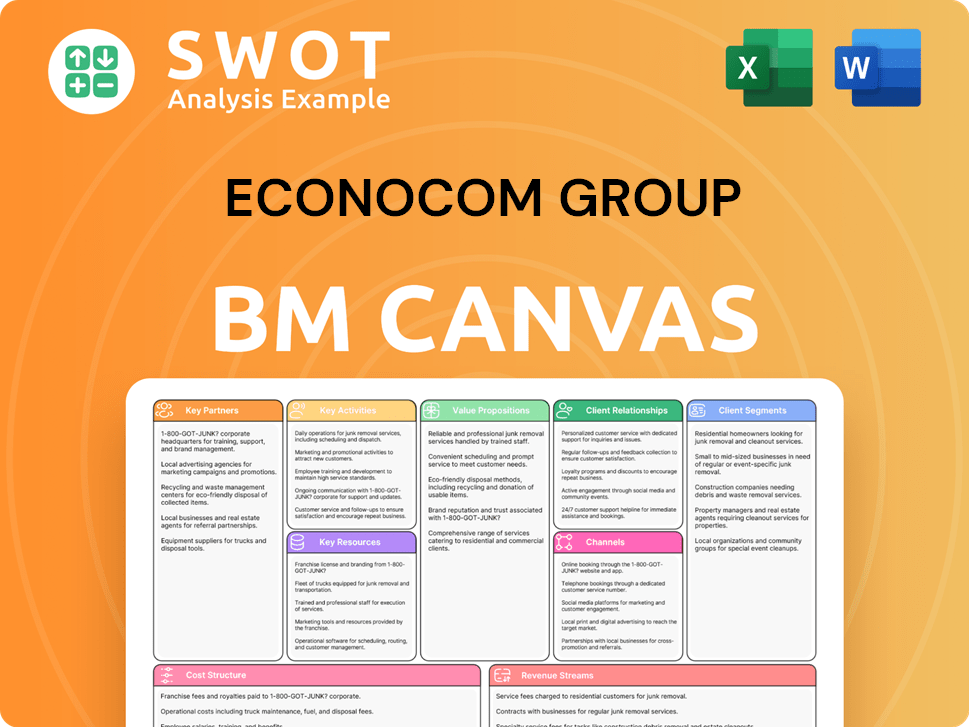

Econocom Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Econocom Group Positioning Itself for Continued Success?

The Econocom Group holds a prominent position within the European digital transformation market. Operating across 16 countries, the company employs over 8,450 people, showcasing its extensive reach and operational capabilities. This positioning is reinforced by its diversified business model, which includes technology management and financing, products and solutions, and services.

Despite its strong market presence, the

Econocom Group is a key player in the European digital transformation market, operating in 16 countries. The company's business model includes technology management, financing, products, solutions, and services. This diversification allows it to maintain a stable operational margin.

The company faces risks such as market saturation in IT distribution and macroeconomic pressures. Integrating acquisitions and adapting to regulatory changes related to AI also present challenges. Furthermore, the company must maintain a competitive edge.

Econocom anticipates growth in 2025, exceeding the 3.6% achieved in 2024. The 'One Econocom' strategic plan (2024-2028) aims for €4 billion in revenues by 2028. The company is expanding its footprint in key European markets and focusing on AI-driven market transformation.

In 2024, Econocom maintained a stable operational margin of 4.0%. The company is listed on Euronext in Brussels and is part of the Tech Leaders, Bel Small, and Family Business indices. The company aims to double its net income by 2028.

Econocom is committed to its Corporate Social Responsibility (CSR) goals. This includes reducing absolute Scope 1 and 2 greenhouse gas emissions by 61.4% by 2028. The company also aims to increase renewable electricity usage to 92% by the same year.

- Expansion in Germany, the Netherlands, the UK, and Spain.

- Focus on AI-driven market transformation.

- Commitment to CSR goals, including emissions reduction and renewable energy usage.

- Anticipated growth in 2025 exceeding 3.6%.

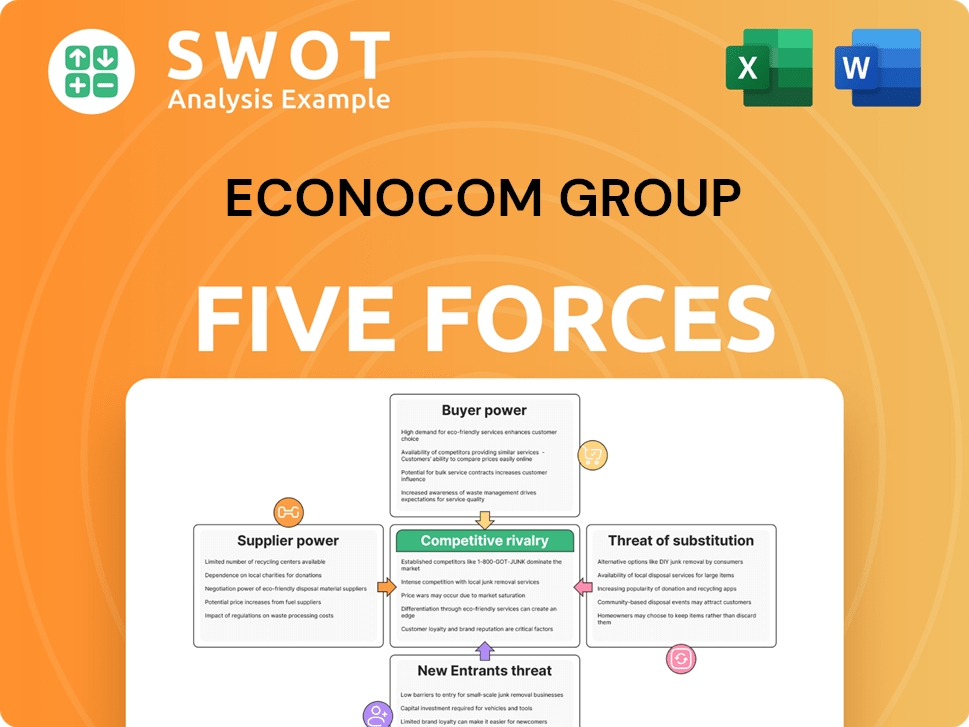

Econocom Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Econocom Group Company?

- What is Competitive Landscape of Econocom Group Company?

- What is Growth Strategy and Future Prospects of Econocom Group Company?

- What is Sales and Marketing Strategy of Econocom Group Company?

- What is Brief History of Econocom Group Company?

- Who Owns Econocom Group Company?

- What is Customer Demographics and Target Market of Econocom Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.