Encompass Health Bundle

How Does Encompass Health Thrive in the Healthcare Landscape?

Encompass Health Company, a leading healthcare provider, has demonstrated remarkable growth, concluding 2024 with impressive financial results. With a vast hospital network spanning across the United States, Encompass Health services are vital in the post-acute care sector. Their success offers valuable insights into the evolving healthcare market.

Encompass Health's robust financial performance, including a significant increase in net operating revenue, highlights its strong market position. This Encompass Health SWOT Analysis will provide a comprehensive view of its business model. Understanding how Encompass Health operates, from its rehabilitation centers to its patient care, is crucial for investors and industry observers. This analysis will also explore Encompass Health locations, insurance coverage, and the admission process.

What Are the Key Operations Driving Encompass Health’s Success?

The core operations of the Encompass Health Company revolve around delivering post-acute care services. This includes operating inpatient rehabilitation hospitals and providing home health and hospice services. Their primary focus is on specialized rehabilitative treatment for patients recovering from significant injuries or illnesses.

The value proposition of Encompass Health services lies in offering comprehensive care through an integrated model. This approach combines inpatient rehabilitation with home health and hospice, ensuring a seamless transition for patients. The company's extensive network and specialized care contribute to potentially improved patient outcomes.

In 2024, Encompass Health added 427 beds through new hospitals and expansions, showing their commitment to meeting growing demand. They utilize proprietary technology and data-driven practices, such as the ACT risk model, to improve patient care and operational efficiency. This focus on patient care and efficiency sets them apart in the healthcare provider landscape.

The integrated care model offers a comprehensive continuum of care, which allows for seamless transitions. This model combines inpatient rehabilitation with home health and hospice services. This approach aims to improve patient outcomes through coordinated care.

Their operations are enhanced by proprietary technology and data-driven business practices. They use predictive models and real-time management reporting systems. These systems improve patient care and operational efficiencies.

The company's unique integrated care model and its scale as the largest owner and operator of inpatient rehabilitation hospitals in the U.S. set it apart. This scale provides economies of scale and brand recognition. These factors contribute to its operational effectiveness compared to smaller competitors.

- Integrated care continuum

- Data-driven operational efficiencies

- Scale and brand recognition

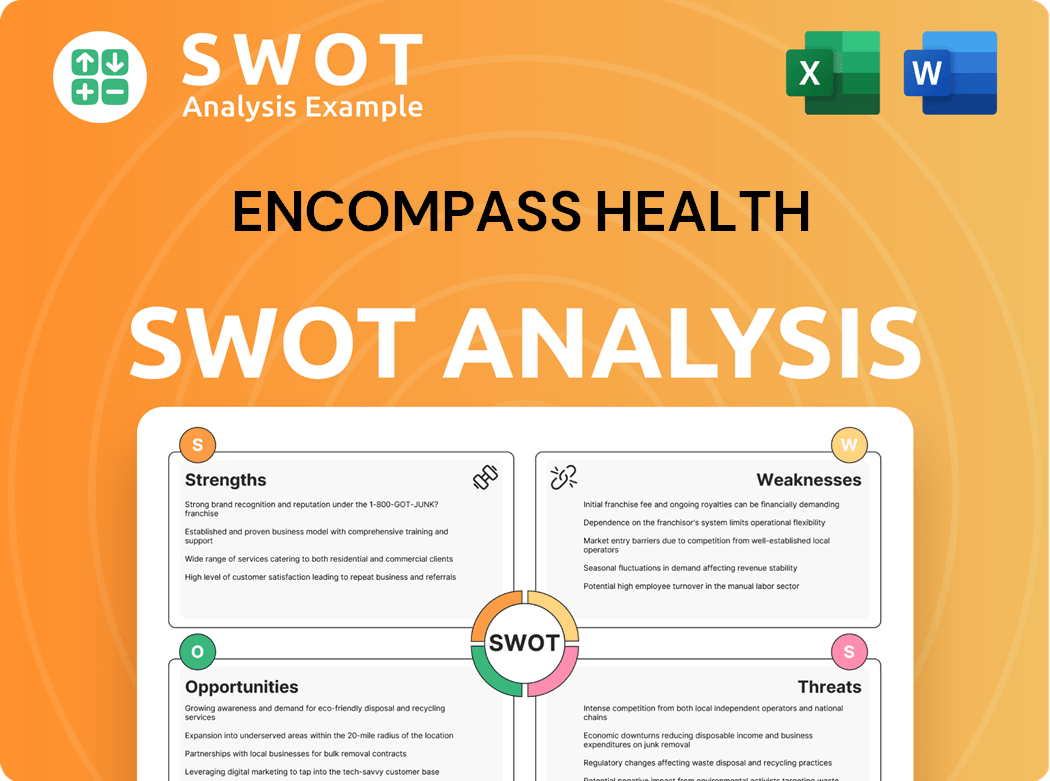

Encompass Health SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Encompass Health Make Money?

The Encompass Health Company derives its revenue primarily from inpatient rehabilitation services. These services make up the bulk of its income, with additional contributions from home health and hospice services. This strategy ensures a diversified revenue stream within the healthcare sector, focusing on specialized care.

In 2024, the company's financial performance showed significant growth across its key segments. The inpatient rehabilitation segment saw substantial revenue increases, and the home health and hospice divisions also contributed positively. The company's ability to expand its services and adapt to market changes has been key to its financial success.

The company's revenue streams are further supported by strategic monetization efforts. These efforts include providing high-quality rehabilitative care, which is reimbursed by various payers, and expanding its inpatient rehabilitation footprint. This approach allows Encompass Health to maintain and grow its revenue streams effectively.

The Encompass Health Company's revenue streams are primarily divided between inpatient rehabilitation and home health/hospice services. The company's financial performance in 2024 and early 2025 demonstrates robust growth across its key segments, reflecting the effectiveness of its strategic initiatives.

- Inpatient Rehabilitation: Net operating revenues increased to $4.25 billion in 2024, a 12.3% increase from $3.78 billion in 2023.

- Home Health and Hospice: Net operating revenues reached $1.12 billion in 2024, up from $1.01 billion in 2023, marking a 10.2% increase.

- Consolidated Revenue: For the full year 2024, consolidated net operating revenues were $5.37 billion, an 11.8% increase compared to $4.79 billion in 2023.

- Q4 2024 Performance: Net operating revenue reached $1.405 billion, a 12.7% increase over Q4 2023, driven by a 7.8% increase in discharges, including 5.8% same-store growth, and a 4.2% increase in net patient revenue per discharge.

- Q1 2025 Performance: Revenue grew by 10.6% to $1.46 billion, driven by a 6.3% rise in total discharges and a 3.9% increase in net revenue per discharge.

The company's monetization strategies focus on delivering high-quality rehabilitative care, which is reimbursed by various payers. This approach ensures a stable revenue stream while maintaining a focus on patient care. The company also strategically expands its services to meet evolving patient needs.

- Payer Mix: Medicare accounted for 65.1% of revenues in 2024, while Medicare Advantage contributed 22.4%.

- Strategic Expansion: The expansion of the inpatient rehabilitation footprint through new hospital openings and service expansions has been a significant contributor to revenue growth.

- Adaptability: The ability to navigate changes in healthcare regulations and adapt to evolving patient needs is crucial for maintaining and growing revenue streams.

For more details on the company's structure and ownership, you can refer to the article about Owners & Shareholders of Encompass Health.

Encompass Health PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Encompass Health’s Business Model?

The success of the Growth Strategy of Encompass Health is evident in its strategic expansion and robust financial performance. The company has consistently increased its capacity and revenue, demonstrating its ability to meet growing demand and maintain a strong market position. This expansion is supported by effective operational management and a focus on providing comprehensive care.

In 2024, Encompass Health expanded its capacity by adding a total of 427 beds through new hospitals and bed additions to existing hospitals. This strategic move highlights the company's commitment to growth and its response to market needs. The company's financial results also reflect its strong performance, with significant increases in revenue and cash flow, showcasing its operational efficiency and financial health.

Encompass Health's competitive advantages are rooted in its market leadership, integrated care model, and operational efficiency. As the largest owner and operator of inpatient rehabilitation hospitals in the U.S., it benefits from economies of scale and strong brand recognition. Its integrated approach, combining inpatient rehabilitation with home health and hospice services, provides a comprehensive continuum of care, differentiating it from competitors.

Encompass Health demonstrated significant growth in 2024, increasing its capacity by adding 427 beds. This expansion included new hospitals and additions to existing facilities. The company's strategic moves also included opening a new hospital in Q1 2025 and planning for more openings throughout the year.

The company's strategic moves include expanding its physical footprint through new hospitals and bed additions. In Q1 2025, Encompass Health opened a new 40-bed hospital and added 25 beds to existing facilities. For the remainder of 2025, it plans to open 7 de novo hospitals and add more beds to existing locations.

Encompass Health's financial results for 2024 showed strong performance, with net operating revenue increasing by 11.9%. Adjusted EBITDA grew by 13.7%, and adjusted free cash flow more than doubled in Q4 2024. The full-year 2024 adjusted free cash flow reached approximately $690 million, a 31.3% increase from 2023.

Encompass Health maintains a competitive edge through its market leadership and integrated care model. As the largest operator of inpatient rehabilitation hospitals, it benefits from economies of scale. The company's focus on markets with favorable demographics and its use of proprietary technology also contribute to its success.

Encompass Health distinguishes itself through several key factors. These include its comprehensive continuum of care, combining inpatient rehabilitation with home health and hospice services. The company also utilizes proprietary technology, including predictive models and real-time management reporting systems, to enhance operational capabilities and patient care.

- Market Leadership: Largest owner and operator of inpatient rehabilitation hospitals in the U.S.

- Integrated Care Model: Provides a comprehensive continuum of care.

- Operational Efficiency: Utilizes proprietary technology for enhanced patient care.

- Strong Clinical Outcomes: Attracts patients and referrals.

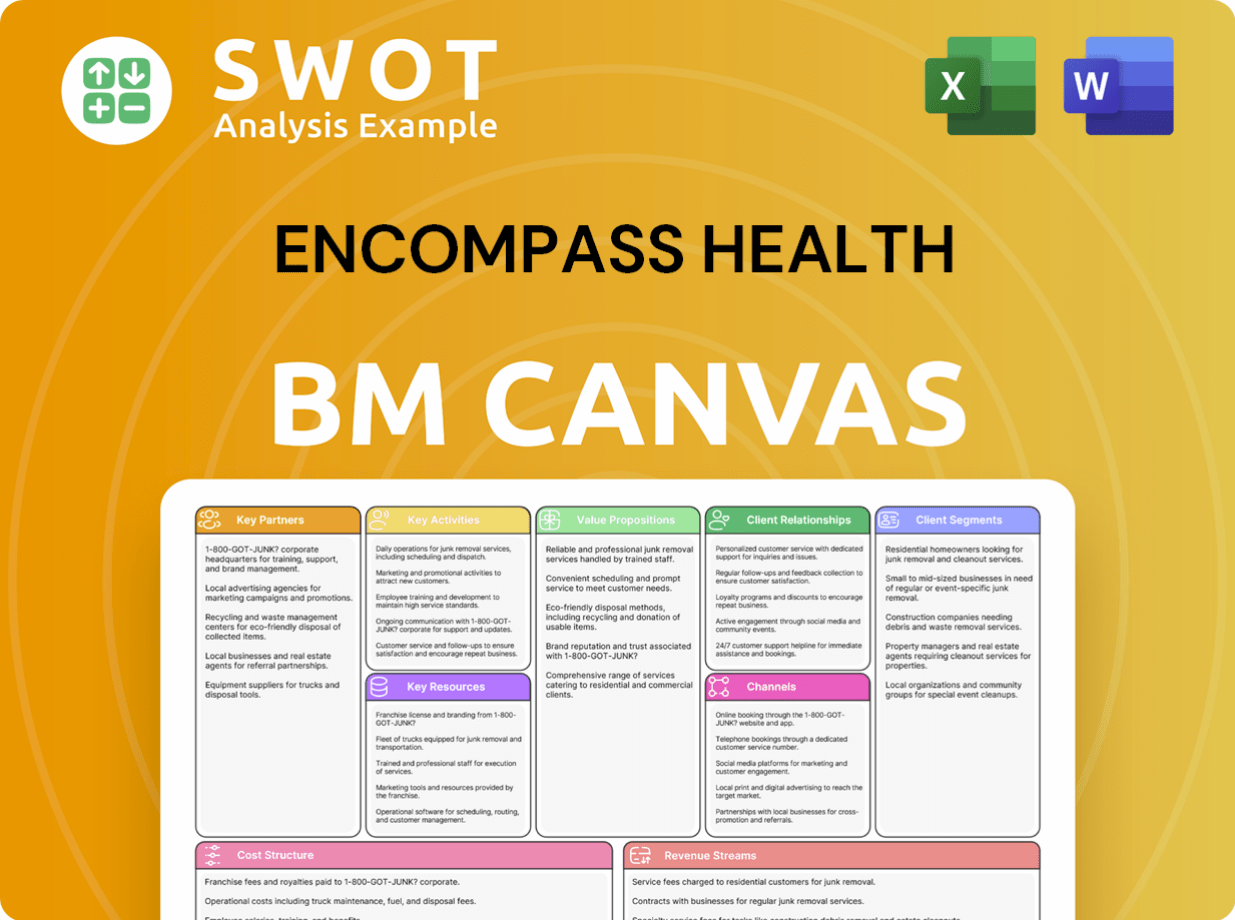

Encompass Health Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Encompass Health Positioning Itself for Continued Success?

Encompass Health, a leading healthcare provider, firmly holds its position as the largest owner and operator of inpatient rehabilitation hospitals in the United States. The company demonstrates strong market confidence, reflected in its market capitalization, which exceeds industry averages. This leadership is supported by impressive financial metrics, including robust revenue growth and high profitability within its Inpatient Rehabilitation Facility (IRF) segment.

Despite its strong market presence, Encompass Health faces various challenges. These include intense competition from other healthcare providers and potential impacts from regulatory changes. Furthermore, managing operational costs, especially labor expenses, remains a key consideration for the company's continued success. For more information about the competitive environment, you can read the Competitors Landscape of Encompass Health.

Encompass Health is the largest owner and operator of inpatient rehabilitation hospitals in the U.S. It has a strong market capitalization, indicating investor confidence. The company's revenue growth of 12.69% as of December 31, 2024, surpasses many peers in the healthcare sector.

The company faces competition from other healthcare providers, including acute-care hospitals and nursing homes. Regulatory changes and shifts in payer mix can also impact financial performance. Managing labor costs, including salaries and benefits, poses an ongoing challenge.

Encompass Health has a positive outlook, supported by strategic initiatives and innovation. The company raised its full-year 2025 guidance, projecting net operating revenue between $5.85 billion and $5.925 billion. They plan to expand through de novo hospitals and joint ventures.

The company's return on equity is at 25%, and the gross profit margin is at 42%. Encompass Health plans to add approximately 120 beds annually in 2026 and 2027. The adjusted EBITDA is expected to be between $1.185 billion and $1.220 billion.

Encompass Health focuses on markets with aging populations and supply-demand imbalances. They plan to continue their growth strategy through de novo expansions and joint ventures. This approach supports their integrated care model and operational expertise.

- Seven new hospitals are planned for 2025.

- Focus on sustained demand for post-acute care services.

- Emphasis on markets with demographic advantages.

- Integrated care model and operational expertise are key strengths.

Encompass Health Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Encompass Health Company?

- What is Competitive Landscape of Encompass Health Company?

- What is Growth Strategy and Future Prospects of Encompass Health Company?

- What is Sales and Marketing Strategy of Encompass Health Company?

- What is Brief History of Encompass Health Company?

- Who Owns Encompass Health Company?

- What is Customer Demographics and Target Market of Encompass Health Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.