Guardian Pharmacy Bundle

How Does Guardian Pharmacy Company Thrive in the LTC Sector?

Guardian Pharmacy Services is making waves in the long-term care (LTC) pharmacy sector, with a remarkable 20% year-over-year revenue surge in early 2025. This impressive growth, fueled by both organic expansion and strategic acquisitions, highlights the company's significant influence. With the LTC pharmacy market estimated to be worth billions, understanding Guardian Pharmacy's operations is crucial for anyone interested in healthcare investments.

As a leading healthcare provider, Guardian Pharmacy services operates 52 pharmacies across the US, serving nearly 190,000 residents. Its focus on technology-enabled services and medication management positions it as a key player in improving patient care. To gain a deeper understanding of its strategic approach, consider exploring the Guardian Pharmacy SWOT Analysis, which can provide valuable insights into its strengths, weaknesses, opportunities, and threats within the pharmacy benefits landscape. This analysis is particularly useful for those seeking information on Guardian Pharmacy locations, Guardian Pharmacy customer reviews, and the overall efficiency of their medication synchronization programs.

What Are the Key Operations Driving Guardian Pharmacy’s Success?

The core operations of Guardian Pharmacy Services revolve around providing comprehensive pharmacy solutions tailored for long-term care facilities. They focus on delivering high-touch, individualized clinical support, along with drug dispensing and administration services. The goal is to help residents adhere to their medication regimens, reduce care costs, and improve clinical outcomes, managing the entire prescription lifecycle.

Guardian Pharmacy Services leverages a technology-driven platform, including systems like GuardianShield and Guardian Compass, to streamline operations. These systems provide real-time operational dashboards and metrics, enhancing pharmacy efficiencies. This technological integration supports features like electronic Medication Administration Records (eMARs) and advanced dispensing systems, improving accuracy and resident care.

The company's value proposition centers on improving medication adherence, reducing healthcare costs, and enhancing clinical outcomes within long-term care settings. Their services are designed to meet the complex medication needs of residents, ensuring they receive the right medications at the right times. This approach helps facilities manage medication risks effectively.

Guardian Pharmacy services include medication dispensing, medication management, and clinical support tailored to long-term care facilities. They offer services such as medication synchronization and pharmacist consultations. The company also provides specialty pharmacy services.

The company utilizes advanced technology platforms like GuardianShield and Guardian Compass to improve efficiency and accuracy. These technologies support eMARs and advanced dispensing systems. This integration helps in streamlining operations and enhancing resident care.

The company operates a national network of local pharmacies, combining personalized service with national support. This local-autonomy model allows local teams to focus on customer service. The corporate support team handles back-end functions like data analytics and payor relations.

Guardian Pharmacy serves over 325,000 individuals annually, filling approximately 22 million prescriptions. This demonstrates the significant scale of its operations within the long-term care pharmacy market. They are a significant healthcare provider.

Guardian Pharmacy offers a range of value-added services, including medication synchronization and pharmacist consultations. They also provide specialty pharmacy services, catering to specific medication needs. These services enhance medication management and improve patient outcomes.

- Medication Synchronization: Aligning medication refills for convenience.

- Pharmacist Consultations: Providing expert advice on medications.

- Specialty Pharmacy Services: Offering specialized medications.

- Compounding Pharmacy Services: Customizing medications.

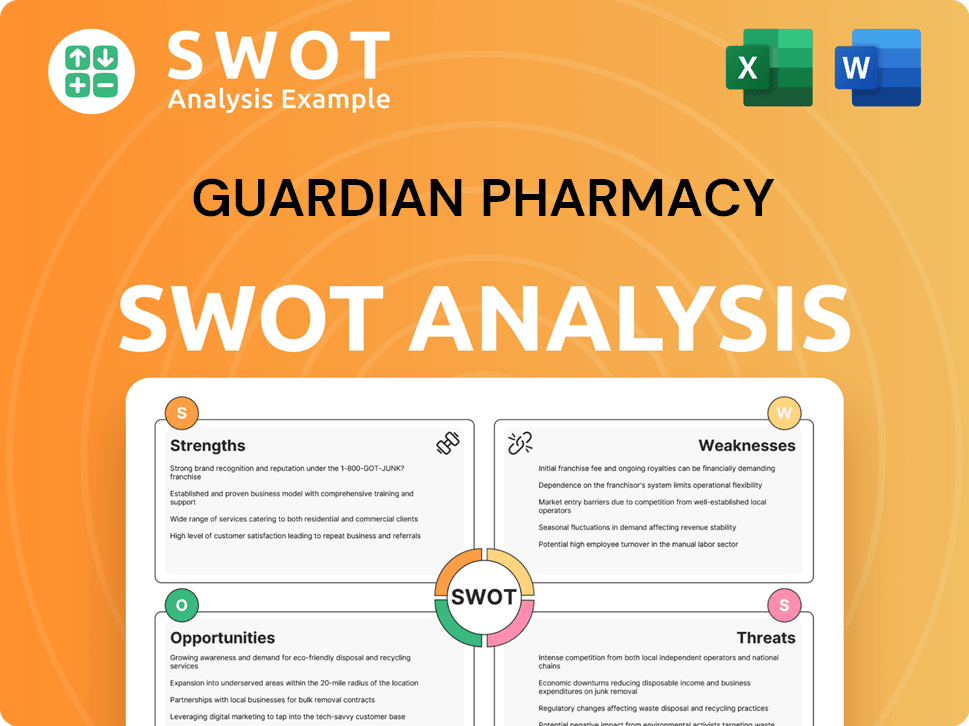

Guardian Pharmacy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Guardian Pharmacy Make Money?

The primary revenue stream for Guardian Pharmacy comes from the sale of pharmaceutical and medical products. This revenue is generated exclusively within the United States. The company's financial performance demonstrates strong growth, reflecting its effective monetization strategies and market position.

As of March 31, 2025, Guardian Pharmacy Services reported a trailing 12-month revenue of approximately $1.28 billion. For the full year ended December 31, 2024, the company's revenue was approximately $1.228 billion, marking a significant year-over-year increase of about 17.4%. In the first quarter of 2025, revenue reached $329.3 million, a 20% increase compared to the same period the previous year. The company projects its full-year 2025 revenue to be in the upper half of its $1.330 billion to $1.350 billion guidance range.

Beyond direct product sales, Guardian Pharmacy leverages its service offerings to generate revenue. This includes medication management, clinical support, and technology solutions. The administration of flu and COVID-19 vaccinations in long-term care facilities has also contributed positively to revenue, establishing a new seasonal trend. The company's adjusted EBITDA for the first quarter of 2025 was $23.4 million, a 16% increase year-over-year. The adjusted EBITDA margin expanded to 7.4% in 2024 from 6.3% in 2023, indicating pricing power and scalability.

Strategic acquisitions play a significant role in expanding Guardian Pharmacy's revenue. Integrating acquired pharmacies, such as Heartland Pharmacy (April 2024) and Freedom Pharmacy (November 2024), has boosted both resident count and revenue. These acquisitions broaden the company's geographic reach and enhance its service offerings, directly impacting its top-line performance.

- The company's focus on medication management helps reduce overall healthcare costs for facilities.

- Clinical support services offered by Guardian Pharmacy add value to its revenue model.

- Technology solutions provided by the company also contribute to its monetization strategies.

- The company offers specialty pharmacy services.

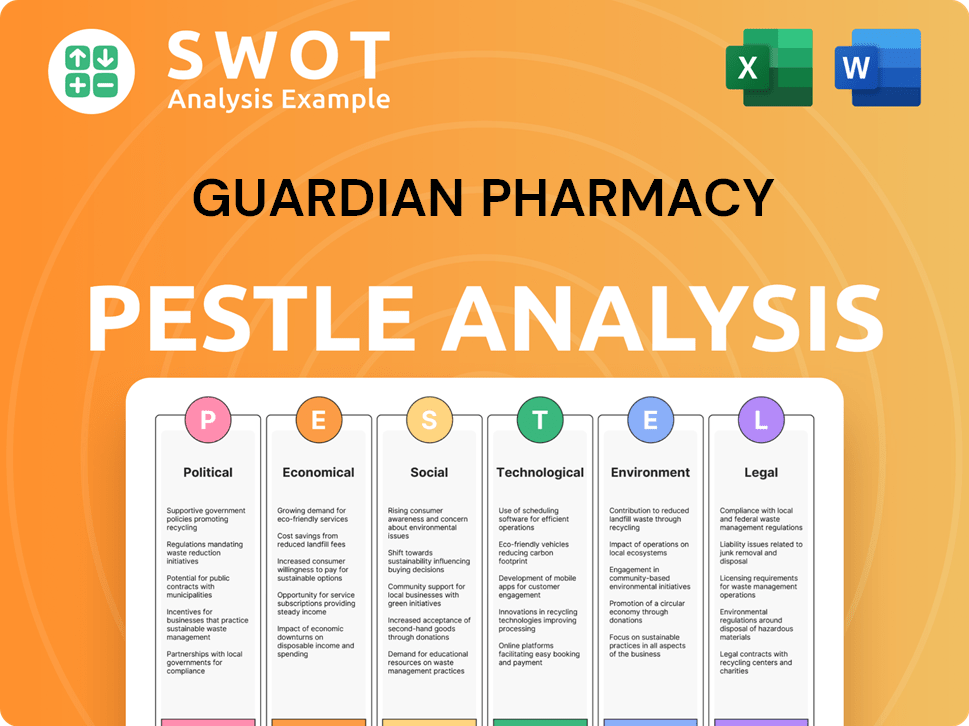

Guardian Pharmacy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Guardian Pharmacy’s Business Model?

Guardian Pharmacy Services has strategically expanded its footprint through a series of acquisitions and organic growth initiatives. These moves have been pivotal in shaping its market position and operational capabilities. The company's focus on technology and operational efficiency has allowed it to navigate industry challenges effectively.

The company's financial health, marked by a strong balance sheet and strategic capital management, supports its continued expansion. This approach demonstrates a commitment to shareholder value and long-term growth within the pharmacy services sector. The company's strategy includes leveraging technology to improve patient care and streamline operations.

The Brief History of Guardian Pharmacy highlights the company's evolution and its commitment to providing quality care. The company's growth trajectory underscores its adaptability and strategic vision in the healthcare market.

Guardian Pharmacy Services has achieved significant milestones, including the acquisition of Heartland Pharmacy in April 2024, expanding its presence across seven western states. The acquisition of Freedom Pharmacy in November 2024 marked its entry into New Jersey. In June 2025, Guardian acquired Mercury Pharmacy Services, further solidifying its presence in the Pacific Northwest.

Strategic moves include expanding its operational footprint through acquisitions and opening new locations. The company opened a new location in Columbus, Ohio, in April 2025, strengthening its presence in Ohio, Kentucky, and West Virginia. Guardian Pharmacy Services focuses on a tech-driven service model to navigate industry challenges.

The company's competitive edge lies in its unique local-autonomy business model, combining personalized local service with national support. It emphasizes technology-enabled services, such as clinical software and vaccine administration systems. This approach helps reduce care costs and improve outcomes.

As of March 31, 2025, Guardian Pharmacy Services had a strong balance sheet with $14.0 million in cash and no long-term debt. The company experienced a 30% surge in adjusted EBITDA in Q4 2024 due to operational efficiencies and seasonal vaccine demand. Strategic capital management, including a non-dilutive public offering in May 2025, supports future growth.

Guardian Pharmacy Services faces challenges such as regulatory headwinds in the long-term care sector and staffing issues. The company navigates these through its tech-driven service model and focus on efficiency. The resident count reached 189,000 across 7,000 LTCFs in 38 states as of March 31, 2025.

- The company continues to adapt to new trends and competitive threats.

- It maintains an active acquisition pipeline and focuses on organic growth.

- The local-autonomy model allows local pharmacies to focus on customer service.

- Corporate teams manage complex functions like data analytics, HR, and IT.

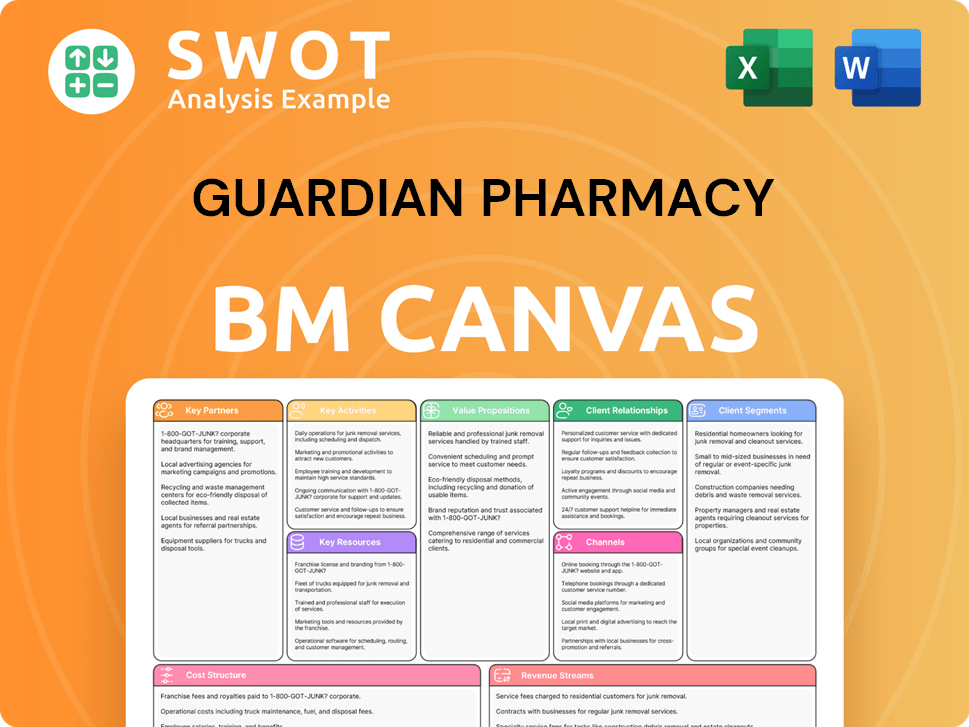

Guardian Pharmacy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Guardian Pharmacy Positioning Itself for Continued Success?

As of March 31, 2025, Guardian Pharmacy Services, a major player in the long-term care (LTC) pharmacy sector, served approximately 189,000 residents across about 7,000 LTC facilities in 38 states. The company holds a significant market share, particularly in assisted living facilities (ALFs) and memory care, where it has approximately 12% of the market. The overall LTC pharmacy market is valued at an estimated $18-$19 billion, with national providers like Guardian Pharmacy company controlling over 90% of the market.

Despite its strong industry position, Guardian Pharmacy faces several risks. These include regulatory changes within the LTC sector, along with challenges in reimbursement policies and staffing. The highly competitive pharmacy services industry requires continuous innovation to maintain its competitive edge. Economic uncertainties could also impact its acquisition plans.

Guardian Pharmacy Services aims to sustain and expand its profitability through strategic initiatives, including an active acquisition pipeline. The company plans to launch new pharmacies in cities like Columbus and Oklahoma City. The full-year 2025 revenue guidance is projected to be between $1.330 billion and $1.350 billion.

The company is targeting an adjusted EBITDA of $97 million to $101 million. Its commitment to technology adoption, personalized medication management, and operational efficiency, along with strategic acquisitions, positions it well to capitalize on the growing demand for LTC pharmacy services driven by an aging population.

Guardian Pharmacy's strong financial position, with no long-term debt and ample liquidity, provides a margin of safety for future endeavors. This financial stability supports its growth strategy. For more details, consider reading about the Growth Strategy of Guardian Pharmacy.

- Focus on acquisitions to expand market presence.

- Investment in technology to improve operational efficiency and medication management.

- Expansion into new geographic markets to capture additional market share.

- Adaptation to regulatory changes and industry trends.

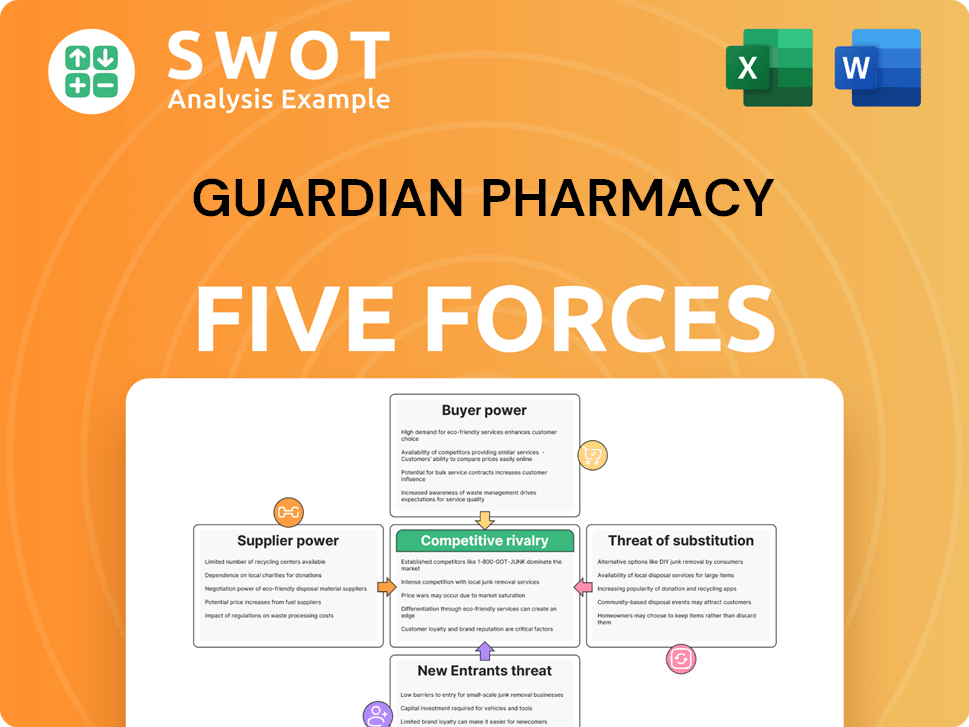

Guardian Pharmacy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Guardian Pharmacy Company?

- What is Competitive Landscape of Guardian Pharmacy Company?

- What is Growth Strategy and Future Prospects of Guardian Pharmacy Company?

- What is Sales and Marketing Strategy of Guardian Pharmacy Company?

- What is Brief History of Guardian Pharmacy Company?

- Who Owns Guardian Pharmacy Company?

- What is Customer Demographics and Target Market of Guardian Pharmacy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.