Halliburton Bundle

What Makes Halliburton a Global Energy Powerhouse?

Halliburton, a titan in the Halliburton SWOT Analysis, stands as a pivotal force in the energy industry, shaping the future of oil and gas exploration and production. With a rich history dating back to 1919, the Halliburton company has evolved into a global leader, offering cutting-edge technologies and comprehensive services. Understanding the Halliburton operations is key to grasping its impact on the sector and its potential for continued growth.

From its extensive global footprint spanning over 70 countries to its diverse workforce, Halliburton continues to innovate and adapt to meet the evolving demands of the energy industry. Its ability to provide crucial oilfield services and its strategic positioning are essential for anyone seeking to understand the complexities of the energy market. This comprehensive overview will delve into How does Halliburton make money, its Halliburton company structure, and its role in the industry, providing valuable insights for investors and industry professionals alike.

What Are the Key Operations Driving Halliburton’s Success?

The Halliburton company creates value by offering a broad range of products and services throughout the lifecycle of oil and gas reservoirs. Its core operations are divided into two main segments: Completion and Production, and Drilling and Evaluation. These segments provide essential services and technologies designed to maximize hydrocarbon recovery and optimize well performance, playing a key role in the energy industry.

The Completion and Production segment focuses on enhancing well performance, including cementing, completion tools, and production enhancement. The Drilling and Evaluation segment provides advanced solutions for drilling, wellbore placement, and reservoir modeling. Halliburton operations also include integrated project management and consulting services, providing end-to-end solutions for its clients, which helps them to boost their profits.

Operational processes at Halliburton involve a complex interplay of technology development, manufacturing, logistics, and on-site service delivery. The company invests heavily in research and development (R&D), with facilities globally focused on enhancing oil recovery, digital solutions, and environmental sustainability. For example, the company has developed over 50 digital platforms and software solutions for oil and gas operations, including real-time drilling optimization platforms and predictive maintenance systems. The company's supply chain and distribution networks are extensive, supporting operations in over 70 countries.

Halliburton's emphasis on technological innovation is a key differentiator. The company continually invests in R&D to stay at the forefront of the industry, developing advanced solutions to improve efficiency and reduce costs for its clients. This commitment to technology helps Halliburton maintain a competitive edge in the oil and gas sector.

Digital platforms and software solutions are central to Halliburton's operations. These digital tools enable real-time drilling optimization and predictive maintenance, improving operational efficiency. The focus on digital solutions is a critical aspect of Halliburton's strategy to enhance its service offerings.

Halliburton offers end-to-end solutions through its integrated project management and consulting services. This approach allows the company to provide comprehensive support to its clients, from initial planning to final execution. This integrated model ensures that clients receive seamless and coordinated services.

The core capabilities of Halliburton translate into significant benefits for its customers. These include enhanced efficiency, improved productivity, reduced costs, and minimized environmental impact. These benefits contribute to maximizing asset value for its clients, making Halliburton a valuable partner in the oilfield services sector.

Halliburton's success is driven by its commitment to technological leadership and digital transformation. The iCruise® intelligent rotary steerable system (RSS) and LOGIX™ automation and remote operations platform are examples of technologies that reduce well time and improve well construction consistency and performance. Halliburton's focus on solutions like its ZEUS IQ autonomous fracturing systems and Octiv Auto Frac systems aims to optimize reservoir performance without human intervention, leading to significant efficiency improvements.

- iCruise® intelligent rotary steerable system (RSS)

- LOGIX™ automation and remote operations platform

- ZEUS IQ autonomous fracturing systems

- Octiv Auto Frac systems

Halliburton SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Halliburton Make Money?

The Halliburton company generates revenue primarily through its two main operating segments: Completion and Production, and Drilling and Evaluation. These segments provide a comprehensive suite of services and products to the oil and gas industry. The company's monetization strategies are centered around service contracts and long-term project engagements, with charges varying based on project complexity and scale.

Halliburton's approach includes leveraging digital platforms and integrated services to reduce client costs and secure recurring revenue. This strategy positions Halliburton as a single-service provider, enhancing its market position. The company's financial performance and strategic direction are crucial for understanding its operations within the energy industry.

In the first quarter of 2025, the Completion and Production segment reported revenue of $3.1 billion, while the Drilling and Evaluation segment generated $2.3 billion. For the full year 2024, Halliburton's total revenue was $22.944 billion, a slight decline of 0.32% from 2023. The company anticipates a low-single-digit contraction in revenue for 2025, with growth expected to resume in 2026.

In Q1 2025, Completion and Production contributed $3.1 billion, while Drilling and Evaluation generated $2.3 billion. These figures highlight the importance of each segment. This breakdown is crucial for understanding Halliburton's operations.

Halliburton uses service contracts and long-term project engagements. The company's charges are determined by the complexity and scale of each project. This approach ensures revenue generation based on the scope of services provided.

The company's DecisionSpace 365 software and turnkey project management models aim to reduce client costs. This strategy helps secure recurring revenue by positioning Halliburton as a single-service provider. This approach is a key part of the Halliburton company structure.

International revenue in Q1 2025 was $3.2 billion, a 2% decrease year-over-year. Latin America decreased by 19% due to lower activity in Mexico. Europe/Africa increased by 6% due to activity in Norway and Namibia.

North America revenue in Q1 2025 was $2.2 billion, a 12% decrease compared to Q1 2024. This decline was influenced by lower stimulation activity in US Land. Understanding these trends is important for investors.

Halliburton anticipates a low-single-digit contraction in revenue for 2025. Growth is expected to resume in 2026. For more insights, read about the Growth Strategy of Halliburton.

Halliburton's financial performance in 2024 and early 2025 reflects strategic adjustments and market dynamics. The company's ability to adapt to fluctuating market conditions is a key factor in its long-term success. Here's a summary:

- 2024 Total Revenue: $22.944 billion, a slight decrease from 2023.

- Q1 2025 Completion and Production Revenue: $3.1 billion.

- Q1 2025 Drilling and Evaluation Revenue: $2.3 billion.

- Q1 2025 International Revenue: $3.2 billion, a 2% decrease year-over-year.

- Q1 2025 North America Revenue: $2.2 billion, a 12% decrease year-over-year.

Halliburton PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Halliburton’s Business Model?

The evolution of the Halliburton company has been marked by significant strategic moves and operational adaptations. A key shift in its structure was the realignment of its services into two main divisions: Completion and Production, and Drilling and Evaluation. This restructuring continues to define its operational framework. The company's commitment to innovation is evident through its consistent investment in research and development, which totaled approximately $800 million in 2022, leading to advancements in oil recovery and digital solutions.

Recent achievements highlight Halliburton's technological prowess, including the world's first closed-loop, autonomous fracturing operation. This demonstrates its dedication to pioneering technologies. Furthermore, the strategic decision to dual-list its common stock on the NYSE Texas underscores its presence in crucial energy hubs. These moves reflect Halliburton’s ongoing efforts to optimize its operations and strengthen its market position.

Halliburton operations have faced various market challenges. The fourth quarter of 2024 saw a 9% decrease in North American revenue due to reduced activity. The first quarter of 2025 continued this trend, with a 12% decline in North American revenue and a 19% decrease in Latin American revenue, primarily due to slowdowns in Mexico. The company has responded by focusing on international growth, with international revenue increasing by 2.4% in Q4 2024 and 6% in Europe/Africa in Q1 2025, partially offsetting the North American downturn.

Halliburton realigned its service offerings into two divisions: Completion and Production, and Drilling and Evaluation. The company invested approximately $800 million in research and development in 2022. It announced a dual listing of its common stock on NYSE Texas.

The company is focusing on international growth to offset revenue declines in North America. Halliburton is investing in efficiency-enhancing and low-carbon solutions. Prioritizing capital discipline and strong free cash flow generation remains a key strategy.

Halliburton has brand strength, technological leadership, and an extensive global footprint. Advanced technologies like iCruise® and LOGIX™ provide a competitive edge in drilling operations. Digital transformation, including cloud-based services and AI solutions, enhances efficiency.

Q4 2024 saw a 9% decline in North American revenue. Q1 2025 showed a 12% decrease in North American revenue and a 19% decrease in Latin American revenue. International revenue increased by 2.4% in Q4 2024 and 6% in Europe/Africa in Q1 2025.

Halliburton's competitive advantages are rooted in its strong brand, technological leadership, and global presence. Its advanced technologies, such as the iCruise® and LOGIX™ platforms, provide a significant edge in drilling operations. The company's commitment to digital transformation, including cloud-based digital services and AI solutions like ZEUS IQ, enhances its efficiency and competitive standing. For more information about the Halliburton, you can read more about the Target Market of Halliburton.

- Brand Strength: Well-recognized and trusted within the oil and gas industry.

- Technological Leadership: Continuous innovation in drilling and completion technologies.

- Global Footprint: Operations in over 70 countries, providing extensive reach.

- Digital Transformation: Leveraging digital solutions to improve efficiency and services.

Halliburton Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Halliburton Positioning Itself for Continued Success?

Halliburton holds a prominent position in the oilfield services sector, ranking as the world's second-largest company in this industry. Its operations span over 70 countries, demonstrating a significant global footprint. This extensive reach, coupled with strong ties to major oil producers, supports its market share and customer loyalty. However, the company's revenue heavily relies on North America, which accounted for more than 40% of its revenue in 2024, posing a risk due to fluctuating drilling activity and pricing pressures in the region.

Several factors could impact Halliburton's performance. These include regulatory changes, technological advancements, and shifting consumer preferences toward lower-carbon energy solutions. Trade policies and tariffs also present potential challenges to profitability. Despite these challenges, the company is strategically focused on profitable international growth, maximizing value in North America, improving capital efficiency, and accelerating digital and automation initiatives.

Halliburton is a leading player in the oil and gas industry. It is the second-largest oil service company globally. The company's international presence and strong customer relationships are key strengths.

Key risks include regulatory changes and technological disruption. The shift towards lower-carbon energy solutions poses a challenge. Trade policies and tariffs could also affect profitability.

Halliburton is investing in digital transformation and AI solutions. The company expects revenue contraction in 2025. Growth is anticipated to resume in 2026.

The company plans to generate solid free cash flow in 2025. Halliburton is committed to returning at least $1.6 billion to shareholders. This includes buybacks and dividends.

Halliburton is focused on technology differentiation and digital adoption. The company aims to improve capital efficiency to sustain and expand its profitability. For more insights, consider reading about Owners & Shareholders of Halliburton.

- Deliver profitable international growth.

- Maximize value in North America.

- Improve capital efficiency.

- Advance a sustainable energy future.

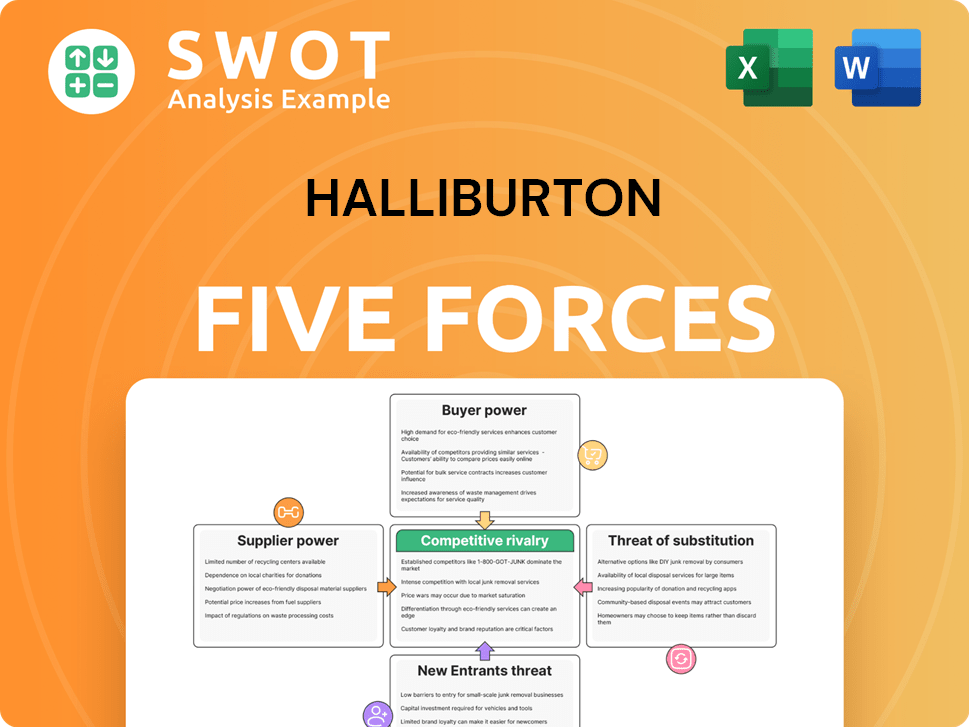

Halliburton Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Halliburton Company?

- What is Competitive Landscape of Halliburton Company?

- What is Growth Strategy and Future Prospects of Halliburton Company?

- What is Sales and Marketing Strategy of Halliburton Company?

- What is Brief History of Halliburton Company?

- Who Owns Halliburton Company?

- What is Customer Demographics and Target Market of Halliburton Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.