Icahn Enterprises Bundle

Decoding Icahn Enterprises: How Does It Thrive?

Ever wondered how a company led by a legendary activist investor navigates the complex world of finance and industry? Icahn Enterprises, spearheaded by Carl Icahn, is a diversified holding company with a unique approach to value creation. This investment company actively shapes the destiny of its subsidiaries across various sectors, from energy to real estate. Understanding the inner workings of Icahn Enterprises is key to grasping its influence.

Icahn Enterprises' distinctive corporate structure and its hands-on approach to managing its portfolio companies set it apart. Its financial performance is closely watched by investors and analysts alike. This in-depth exploration will unravel the Icahn Enterprises SWOT Analysis, shedding light on its strategies, investment philosophy, and the impact of Carl Icahn on its operations. By examining its business model, we can better understand how Icahn Enterprises makes money and its position in the market.

What Are the Key Operations Driving Icahn Enterprises’s Success?

Icahn Enterprises (IEP) operates as an investment company, creating value through an activist approach across various sectors. The core of its strategy involves identifying undervalued assets and underperforming companies, acquiring significant stakes, and actively driving operational and strategic improvements. This hands-on approach is designed to enhance shareholder value by unlocking hidden potential and optimizing performance.

The company's value proposition centers on its ability to generate returns by influencing the strategic direction of its portfolio companies. This includes implementing cost rationalization, pursuing mergers and acquisitions, and undertaking other initiatives aimed at improving operational efficiency and capital allocation. This strategy is applied across diverse segments, including Investment, Energy, Automotive, Food Packaging, Real Estate, and Home Fashion.

Carl Icahn significantly influences Icahn Enterprises' operations and strategic direction. His investment strategy and activist approach are central to the company's value creation model. The company's recent financial performance and strategic moves reflect the ongoing influence of its founder and chairman.

IEP's operations are characterized by a centralized strategic oversight combined with decentralized operational execution within each subsidiary. This involves rigorous due diligence for potential investments and active involvement in the governance of portfolio companies. The company leverages its extensive network and financial acumen to identify and execute opportunities.

The value proposition of Icahn Enterprises lies in its ability to enhance shareholder value through active ownership. This is achieved by identifying undervalued assets, driving operational improvements, and implementing strategic shifts. The goal is to unlock hidden value and improve operational efficiency.

The investment strategy of Icahn Enterprises focuses on identifying opportunities for improvement and value creation within its portfolio companies. This includes active involvement in management and strategic direction, often leading to significant operational overhauls. The hands-on approach aims to translate into direct benefits for shareholders.

Icahn Enterprises' activist investor model differentiates it from traditional private equity firms. By actively seeking to influence management and strategic direction, IEP aims to unlock hidden value and optimize capital structures. This approach leads to market differentiation and long-term value creation.

IEP's operational processes involve a highly centralized strategic oversight coupled with decentralized operational execution within each subsidiary. This includes rigorous due diligence for potential investments and hands-on involvement in the governance of portfolio companies. The company's supply chains and partnerships are highly varied, reflecting its diverse portfolio.

- Active Ownership: IEP actively engages with its portfolio companies.

- Strategic Initiatives: Implementation of cost rationalization, divestitures, or mergers and acquisitions.

- Network and Financial Acumen: Leveraging extensive networks to identify and execute opportunities.

- Diverse Portfolio: Operations span across various segments, including Energy, Automotive, and Real Estate.

Icahn Enterprises SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Icahn Enterprises Make Money?

The core of how Icahn Enterprises, an investment company, generates revenue lies in its diverse portfolio and operational segments. Its financial performance is significantly influenced by the returns from its Investment segment, encompassing capital gains, dividends, and interest. The company's corporate structure allows it to tap into various markets, with each segment contributing to the overall revenue stream.

Beyond its investment arm, Icahn Enterprises derives revenue from several consolidated segments. These include Energy, Automotive, Food Packaging, Real Estate, and Home Fashion, each employing distinct monetization strategies. The performance of these segments, combined with the investment portfolio's returns, determines the company's financial health and its ability to create shareholder value. Marketing Strategy of Icahn Enterprises plays a crucial role in this process.

Understanding the specific revenue contributions from each segment requires examining the latest financial reports, but the Investment segment often plays a pivotal role. For example, in the first quarter of 2024, the Investment segment's performance led to a net loss, highlighting the impact of market conditions and investment strategies on the financial results of Icahn Enterprises.

The Investment segment's performance is a major revenue driver, influenced by market dynamics and investment decisions. Other segments, such as Energy and Automotive, contribute through product sales and services. The company's approach involves strategic acquisitions and operational improvements to enhance profitability and shareholder value.

- Investment Segment: Generates revenue through capital gains, dividends, and interest from its investment portfolio. The performance of this segment is highly volatile and dependent on market conditions and Carl Icahn's investment strategies.

- Energy Segment: Revenue is derived from the refining and marketing of petroleum products.

- Automotive Segment: Revenue comes from parts distribution and services.

- Food Packaging Segment: Sales of food packaging products contribute to revenue.

- Real Estate Segment: Rental income and property sales generate revenue.

- Home Fashion Segment: Sales of home textiles and furnishings contribute to revenue.

Icahn Enterprises PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Icahn Enterprises’s Business Model?

The operational and financial trajectory of Icahn Enterprises has been shaped by key milestones and strategic shifts, often driven by its activist investment approach. The core strategy involves identifying undervalued companies, acquiring significant stakes, and then advocating for changes to unlock value. While specific recent milestones like major product launches across all diversified segments are not singular events for the holding company as a whole, the ongoing strategic moves involve active portfolio management, including potential divestitures or acquisitions that align with its value-creation objectives.

A critical aspect of the Target Market of Icahn Enterprises is its ability to navigate diverse market conditions. The company faces operational and market challenges common to its varied portfolio, such as commodity price fluctuations in the energy sector, supply chain disruptions, or real estate market downturns. Icahn Enterprises typically responds by directly intervening in the governance and management of its subsidiaries to address these challenges, whether through cost-cutting measures, asset sales, or strategic repositioning. For example, in May 2024, it was reported that Icahn Enterprises' board received a letter from its independent directors regarding the company's investment in Xerox, indicating ongoing strategic evaluation of its holdings.

The company's investment strategy is designed to capitalize on market inefficiencies and unlock value within its portfolio companies. This approach often involves a hands-on role in the management and strategic direction of its subsidiaries. The company's financial performance is closely tied to the success of its investments and its ability to execute its strategic initiatives effectively.

Icahn Enterprises' history is marked by significant acquisitions and strategic shifts. The company's evolution is a testament to its adaptability and its ability to identify and capitalize on emerging opportunities in various sectors. The company's strategic moves often involve restructuring, asset sales, and strategic repositioning to maximize shareholder value.

The company's strategic moves are characterized by active portfolio management, including potential divestitures or acquisitions. This involves a continuous evaluation of its holdings and the pursuit of opportunities that align with its value-creation objectives. The company's response typically involves direct intervention in the governance and management of its subsidiaries to navigate challenges.

Icahn Enterprises' competitive advantages are rooted in its unique business model. Carl Icahn's reputation as an activist investor provides a significant edge. Its substantial capital resources allow it to take meaningful stakes in large companies. The diversified portfolio provides insulation from downturns in any single industry.

The company's financial performance is influenced by its investment decisions and market conditions. The company's debt and financial leverage are key factors in assessing its financial health. The company's shareholder information is available through its annual reports and filings.

Icahn Enterprises' competitive advantages are deeply rooted in its unique business model, which includes Carl Icahn's reputation, substantial capital resources, a diversified portfolio, and a hands-on approach to improving operational efficiency. The company's investment strategy is designed to capitalize on market inefficiencies and unlock value within its portfolio companies. The company continues to adapt to new trends by constantly evaluating its portfolio and seeking opportunities in evolving sectors, demonstrating its agility in a dynamic economic landscape.

- Carl Icahn's reputation as an activist investor provides a significant competitive edge, often influencing market perception and corporate behavior.

- Substantial capital resources allow it to take meaningful stakes in large companies and ride out market fluctuations.

- Diversified portfolio provides a degree of insulation from downturns in any single industry.

- Hands-on approach to improving the operational efficiency and strategic direction of its holdings creates intrinsic value that competitors may struggle to replicate through passive investment strategies.

Icahn Enterprises Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Icahn Enterprises Positioning Itself for Continued Success?

Understanding the operational dynamics of Icahn Enterprises involves recognizing its unique position as a holding company with an activist investment strategy. The Icahn Enterprises business model centers around acquiring significant stakes in various companies across diverse sectors, including energy, automotive, and real estate, among others. This approach allows the company to influence corporate strategies and drive value creation through operational improvements and strategic initiatives. The company's structure enables it to maintain a diverse portfolio, spreading risk across different industries.

Icahn Enterprises is not just an investment company; it actively engages in the management of its subsidiaries. This hands-on approach distinguishes it from passive investors, as Carl Icahn and his team often take board seats and push for changes. The company's strategy involves identifying undervalued assets, implementing operational efficiencies, and sometimes pursuing strategic transactions like mergers or spin-offs. This approach is designed to generate returns from both market appreciation and improved operational performance.

Icahn Enterprises operates across multiple sectors, including automotive, energy, and real estate. Its position is defined by its role as a significant shareholder and influencer rather than a direct competitor within specific industries. The company's influence is exerted through its investment activities and strategic oversight. The diversification of its portfolio helps to spread risk, but also makes it complex to manage.

Icahn Enterprises faces regulatory risks, market volatility, and the impact of technological disruption. Changes in regulations, particularly in the energy sector, can affect profitability. Market fluctuations can significantly impact the performance of its investment segment. Technological advancements in sectors like automotive pose challenges and require strategic adaptation. The company's performance is also closely tied to the success of Carl Icahn's investment strategies.

Icahn Enterprises plans to continue its core strategy of active investment and operational improvement. The company will focus on identifying undervalued opportunities and engaging with management teams to drive value appreciation. This includes a commitment to disciplined capital allocation and strategic activism. The company's ability to adapt to changing market conditions and technological advancements will be crucial for its long-term success.

In the first quarter of 2024, Icahn Enterprises reported a net loss attributable to IEP unitholders of $105 million. This performance reflects the inherent volatility of the investment segment and the broader market conditions. The company's financial results can vary significantly depending on the success of its investment strategies and the performance of its subsidiaries. For further insights, consider the Competitors Landscape of Icahn Enterprises.

Icahn Enterprises focuses on portfolio optimization, identifying undervalued opportunities, and active engagement with its holdings. The company consistently seeks to improve the operational efficiency of its subsidiaries. The company's strategy involves disciplined capital allocation and a commitment to long-term value creation.

- Actively managing its diverse portfolio of investments.

- Seeking out opportunities to improve operational performance.

- Implementing strategic initiatives to enhance shareholder value.

- Adapting to changing market conditions and technological advancements.

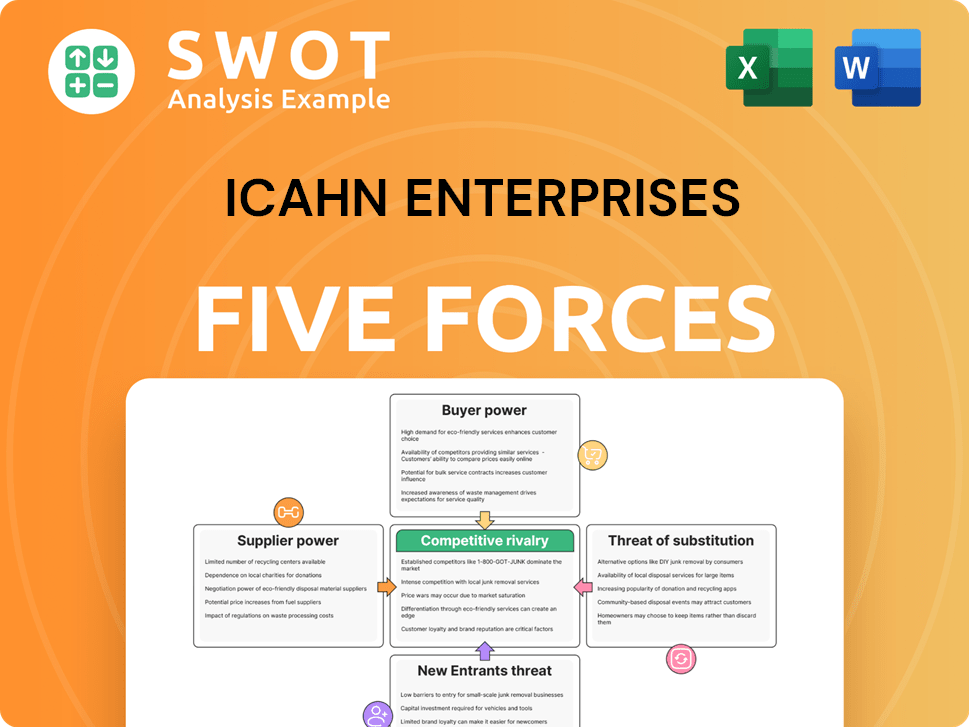

Icahn Enterprises Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Icahn Enterprises Company?

- What is Competitive Landscape of Icahn Enterprises Company?

- What is Growth Strategy and Future Prospects of Icahn Enterprises Company?

- What is Sales and Marketing Strategy of Icahn Enterprises Company?

- What is Brief History of Icahn Enterprises Company?

- Who Owns Icahn Enterprises Company?

- What is Customer Demographics and Target Market of Icahn Enterprises Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.