Iron Mountain Bundle

How Does Iron Mountain Shape the Future of Data and Records?

Iron Mountain Incorporated isn't just a storage company; it's a critical partner for organizations worldwide, managing their vital information and physical assets. From secure offsite storage to cutting-edge data backup and recovery, Iron Mountain services are essential across industries. Its influence is vast, touching everything from healthcare to finance, and its services are vital for regulatory compliance and efficient information lifecycle management.

This deep dive will uncover the inner workings of the Iron Mountain SWOT Analysis, exploring its core offerings, value proposition, and diverse revenue streams. Whether you're an investor seeking to understand its business model, a customer relying on its records management solutions, or an industry observer tracking digital transformation, understanding Iron Mountain is key. Learn about how Iron Mountain company operates, its data storage capabilities, and its impact on the evolving landscape of information governance, including secure document shredding and data protection services.

What Are the Key Operations Driving Iron Mountain’s Success?

The core operations of the company, revolve around providing secure and compliant information management services. This involves safeguarding and optimizing access to critical information assets for a diverse customer base. Their primary offerings include secure storage of physical records, data backup and recovery solutions, secure information destruction, and a growing suite of digital transformation services, including data center and cloud-based solutions.

The company serves a wide array of customer segments, from small businesses to large enterprises across sectors such as healthcare, financial services, legal, and government. They all share a common need for secure and accessible information management. The operational processes underpinning these offerings are extensive and highly specialized, ensuring data integrity and compliance.

The company's value proposition lies in its ability to reduce risk, improve operational efficiency, and ensure adherence to regulatory mandates for its clients. This is achieved through a global footprint, deep expertise in secure information handling, and a strong commitment to compliance. The company's services are designed to meet the evolving needs of businesses in an increasingly digital world, providing comprehensive solutions for information management.

This involves a sophisticated logistics network for transportation and secure facilities equipped with advanced security measures. The company uses meticulous inventory management systems to track and manage physical records. This ensures that documents are stored securely and can be easily accessed when needed.

Data backup and recovery services leverage robust data centers and cloud infrastructure, ensuring data integrity, availability, and rapid recovery in the event of a disaster. This helps businesses protect their critical data from loss or damage. The company's data centers are strategically located to provide optimal performance and security.

Information destruction services adhere to strict security protocols and regulatory requirements, ensuring sensitive data is irreversibly disposed of. The company provides secure shredding and destruction services to protect businesses from data breaches. This service helps clients comply with data privacy regulations.

These initiatives involve developing and deploying technologies for scanning, indexing, and managing digital information, often integrating with existing customer systems. This helps businesses modernize their information management processes. The company offers a range of digital solutions to improve efficiency and accessibility.

The company's operations are characterized by a highly integrated supply chain, encompassing a vast network of facilities, vehicles, and trained personnel. Strategic partnerships with technology providers and industry associations further enhance its service capabilities and market reach. The company's commitment to compliance and security is a core differentiator.

- Global Footprint: A significant presence in numerous countries, providing services worldwide.

- Expertise: Deep knowledge in secure information handling, ensuring data protection.

- Compliance: Adherence to stringent regulatory standards, offering peace of mind to clients.

- Data Centers: State-of-the-art data centers strategically located for optimal performance.

The company's business model is designed to provide comprehensive information management solutions. As highlighted in the Marketing Strategy of Iron Mountain, the company focuses on long-term contracts and recurring revenue streams. The company's diversified service offerings and global presence contribute to its financial stability and growth. In 2024, the company reported revenues of approximately $5.4 billion, demonstrating its strong market position and the ongoing demand for its services. The company's commitment to innovation and customer satisfaction continues to drive its success in the information management industry.

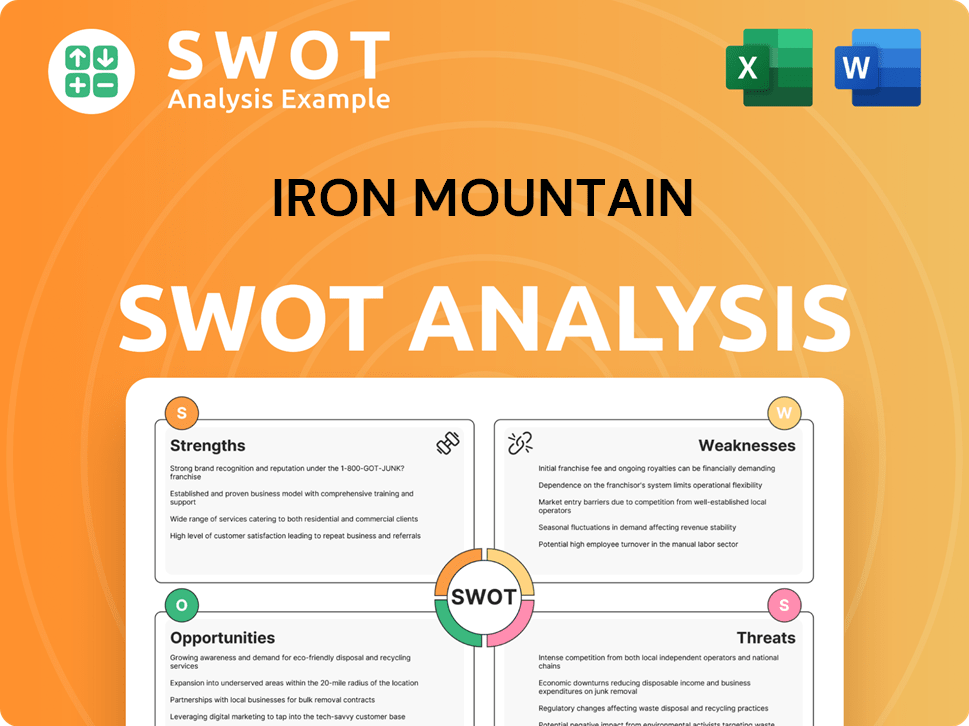

Iron Mountain SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Iron Mountain Make Money?

The revenue streams and monetization strategies of the company are multifaceted, reflecting its comprehensive offerings in information management. The company generates revenue through secure storage, data center and connectivity services, and various information management solutions, including shredding and digital solutions. In 2023, the company reported total revenues of approximately $5.53 billion, showcasing its significant market presence.

The company's storage rental business forms a substantial part of its revenue, benefiting from long-term contracts and high customer retention rates. Service revenue, which includes data management, shredding, and digital solutions, also contributes significantly to the overall financial performance. The company's strategic approach to revenue generation is designed to ensure a stable and recurring income base, driven by its diverse service offerings.

The company employs several monetization strategies to maximize revenue. These include a tiered pricing model for storage services, subscription-based models for digital services, and cross-selling strategies to offer additional services. As of Q1 2024, the company's total revenues were $1.42 billion, a 6% increase year-over-year, with storage revenue up 7% and service revenue up 4%. The company anticipates continued growth in its data center business, with projected revenue growth of 11% in 2024.

The company's revenue model is built on a combination of storage, services, and data center solutions. The storage rental business is a cornerstone, generating a stable income stream through physical and digital storage. The service segment, encompassing data management and digital solutions, leverages subscription models and cross-selling to drive recurring revenue. Understanding the Growth Strategy of Iron Mountain provides additional insights into how the company leverages its diverse service portfolio to drive revenue growth and maintain a strong market position. The company's strategic initiatives are designed to capitalize on the growing demand for secure data management and digital infrastructure, ensuring sustainable financial performance.

- Storage Revenue: In 2023, global storage revenue reached $3.08 billion, including physical and data center co-location services.

- Service Revenue: Service revenue, which includes data management, shredding, and digital solutions, reached $2.45 billion globally in 2023.

- Pricing Models: Tiered pricing for storage and subscription-based models for digital services.

- Cross-Selling: Leveraging existing customer relationships to offer additional services, such as data backup and digital transformation solutions.

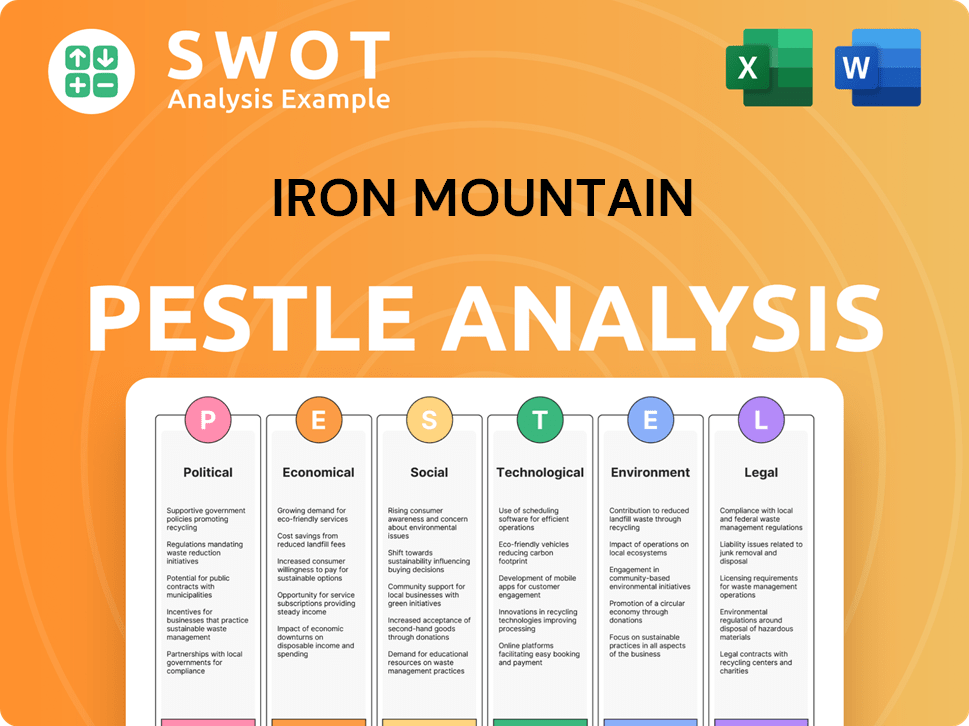

Iron Mountain PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Iron Mountain’s Business Model?

The evolution of the Iron Mountain company has been marked by significant milestones and strategic shifts. Initially focused on physical records storage, the company strategically expanded into digital solutions to meet the changing needs of businesses. This transition highlights its adaptability and foresight in the information management industry.

A key strategic move has been the aggressive expansion into the data center business. This expansion, fueled by acquisitions and new facility developments, positions the company as a major player in the hybrid IT infrastructure market. The company's emphasis on digital transformation solutions, integrating physical and digital information management, further solidifies its position.

Operational challenges have included managing the vast volume and diversity of information assets across its global footprint, as well as navigating complex regulatory landscapes. The company has responded by investing heavily in technology, enhancing its security protocols, and developing specialized compliance expertise.

The company's history includes expanding from physical records management to digital solutions, adapting to the evolving needs of clients. This strategic shift has been crucial for maintaining relevance and growth in the information management sector. The expansion into data centers represents a significant diversification, enhancing its service offerings.

The company has made strategic moves, including acquiring data centers and expanding its digital transformation services. These moves have enhanced its capabilities in data storage and records management. The company's focus on hybrid IT infrastructure positions it well in the market.

The company's competitive advantages include a vast global network, a trusted brand, and a comprehensive service portfolio. These factors enable the company to offer a 'one-stop shop' for information lifecycle management. The company's focus on 'Project Matterhorn' aims to optimize its operating model and enhance efficiency.

The company faces challenges in managing a large volume of information assets and navigating complex regulations. The company addresses these challenges through technology investments and enhanced security protocols. Specialized compliance expertise is crucial for maintaining data security.

The company's competitive advantages include a vast global network, a trusted brand, and a comprehensive service portfolio. These elements enable the company to offer a 'one-stop shop' for information lifecycle management, differentiating it from specialized competitors. The company continues to adapt to new trends by focusing on its 'Project Matterhorn' initiative, aiming to optimize its operating model and enhance efficiency.

-

Global Network: A vast network of secure facilities provides unparalleled reach and economies of scale for

. - Trusted Brand: The brand name, built over decades, instills confidence in clients handling sensitive information.

- Comprehensive Services: A comprehensive service portfolio, encompassing both physical and digital solutions, offers a 'one-stop shop' for information lifecycle management.

- Project Matterhorn: This initiative aims to optimize the operating model and enhance efficiency, further strengthening the competitive edge by improving service delivery and profitability.

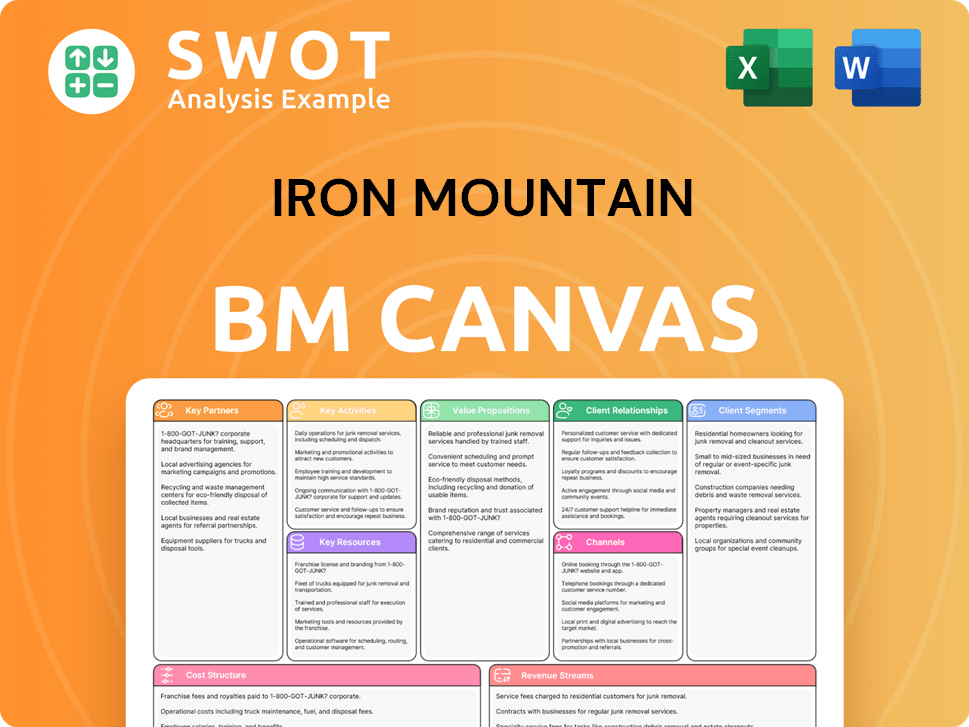

Iron Mountain Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Iron Mountain Positioning Itself for Continued Success?

The Target Market of Iron Mountain, is a leader in the information management sector, holding a significant market share and a strong global presence. Its core business revolves around secure storage and information lifecycle management, serving a wide range of clients across various industries. The company's structure as a Real Estate Investment Trust (REIT) offers investors attractive returns through its real estate holdings and consistent dividend payments.

Despite its strong position, the company faces challenges from regulatory changes, competition from digital storage solutions, and the need to adapt to changing customer preferences. The shift towards digital-first strategies requires ongoing investment in digital transformation solutions to remain relevant. The company's future depends on its ability to innovate and adapt to the evolving data management landscape.

The company is a leading provider of records management and data storage solutions. It has a global footprint, serving a diverse customer base. The company's REIT structure provides a unique advantage in the market.

Regulatory changes, particularly in data privacy, pose ongoing challenges. Increased competition from digital storage providers impacts its market share. Technological advancements and changing customer preferences require continuous adaptation.

The company is focused on expanding its data center business and enhancing its digital transformation services. It is committed to sustainability and environmental responsibility. The increasing volume of global data ensures a continued need for its services.

Investment in data centers is a key strategy for growth. Expanding its global presence and enhancing digital transformation solutions are priorities. The company is leveraging its physical infrastructure to support digital growth.

The company's revenue for 2024 was approximately $5.5 billion, demonstrating its substantial market presence. Its data center business continues to grow, with a focus on expanding capacity and geographic reach. The company's commitment to sustainability includes initiatives to reduce its environmental impact.

- Revenue in 2024 was around $5.5 billion.

- The company is actively expanding its data center capacity.

- Focus on enhancing digital transformation services.

- Continued investment in compliance and data protection services.

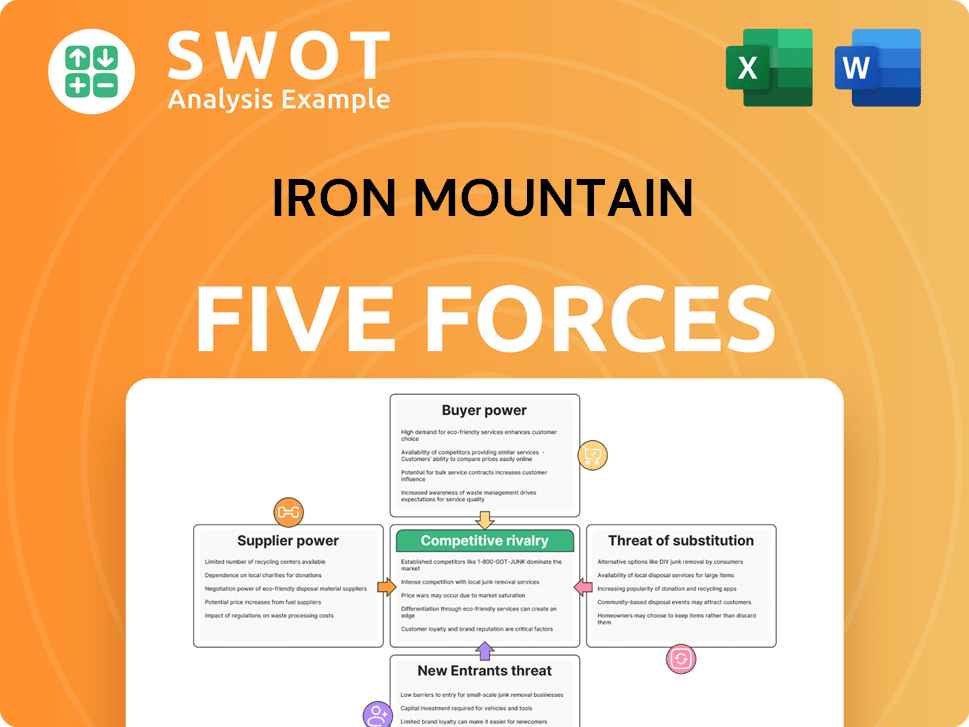

Iron Mountain Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Iron Mountain Company?

- What is Competitive Landscape of Iron Mountain Company?

- What is Growth Strategy and Future Prospects of Iron Mountain Company?

- What is Sales and Marketing Strategy of Iron Mountain Company?

- What is Brief History of Iron Mountain Company?

- Who Owns Iron Mountain Company?

- What is Customer Demographics and Target Market of Iron Mountain Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.