Karex Bundle

How Does Karex Thrive in the Global Condom Market?

Karex Berhad, the world's largest condom manufacturer, is a powerhouse in the sexual wellness and healthcare sector. Producing billions of condoms annually, Karex controls a significant portion of the global market, supplying both its own brands and major players like Durex. But how does this Karex SWOT Analysis reveal the secrets behind its success?

This deep dive into the Karex company will explore its Karex operations, from Karex manufacturing processes to its diverse Karex products portfolio. We'll uncover the strategies that have allowed Karex to maintain its leading position and navigate the ever-changing landscape of the global market. Understanding the Karex business model is crucial for anyone interested in the sexual health industry or considering investment opportunities.

What Are the Key Operations Driving Karex’s Success?

The core operations of the Karex company center around large-scale manufacturing, primarily of sexual wellness and medical products. This includes condoms, personal lubricants, and medical devices, serving a global clientele. The company's value proposition lies in its ability to deliver high-quality products to a diverse market, including governments, NGOs, and retailers across over 130 countries.

Its operational model is characterized by vertical integration, particularly in-house research and development (R&D) and machine fabrication. This approach allows Karex to quickly adapt to market changes and develop new products. The company's manufacturing process, especially for condoms, is a multi-stage process ensuring quality and reliability.

The company's success is built on its robust R&D capabilities and economies of scale, producing approximately 5.5 billion condoms annually. This enables innovation, cost efficiency, and a diverse product range. The strategic shift towards higher-margin products, such as synthetic condoms and personal lubricants, further enhances its profitability.

The condom manufacturing process at Karex involves three main stages: primary production, quality control, and secondary production. This multi-stage process ensures the production of safe and reliable condoms. The extensive quality control stage includes latex, tensile, visual, burst, and pinhole batch testing.

The company's core products include condoms, personal lubricants, Foley balloon catheters, and probe covers. Karex serves a diverse clientele, including governments, NGOs, brand owners, and retailers in over 130 countries. The company strategically shifts towards higher-margin products like synthetic condoms and personal lubricants.

The company's unique operational effectiveness stems from its robust in-house R&D capabilities. This, combined with economies of scale from its large-scale manufacturing (5.5 billion pieces annually), propels innovation and enhances cost efficiency. The ability to fabricate its own machinery provides cost savings and flexibility.

The company's supply chain benefits from its operations in Malaysia and Thailand, two of the top rubber-producing countries. Karex distributes its products globally, with a significant presence in both developed and developing markets. Brief History of Karex provides further insights into its background.

The Karex business model is centered on large-scale manufacturing and global distribution of sexual wellness and medical products. The company's operational efficiency is enhanced through in-house R&D and machine fabrication, enabling rapid adaptation to market demands.

- Vertical integration ensures quality control and cost efficiency.

- Focus on innovation, including new product development and packaging.

- Compliance with international standards like ISO 4074 and WHO specifications.

- Strategic shift towards higher-margin products and segments.

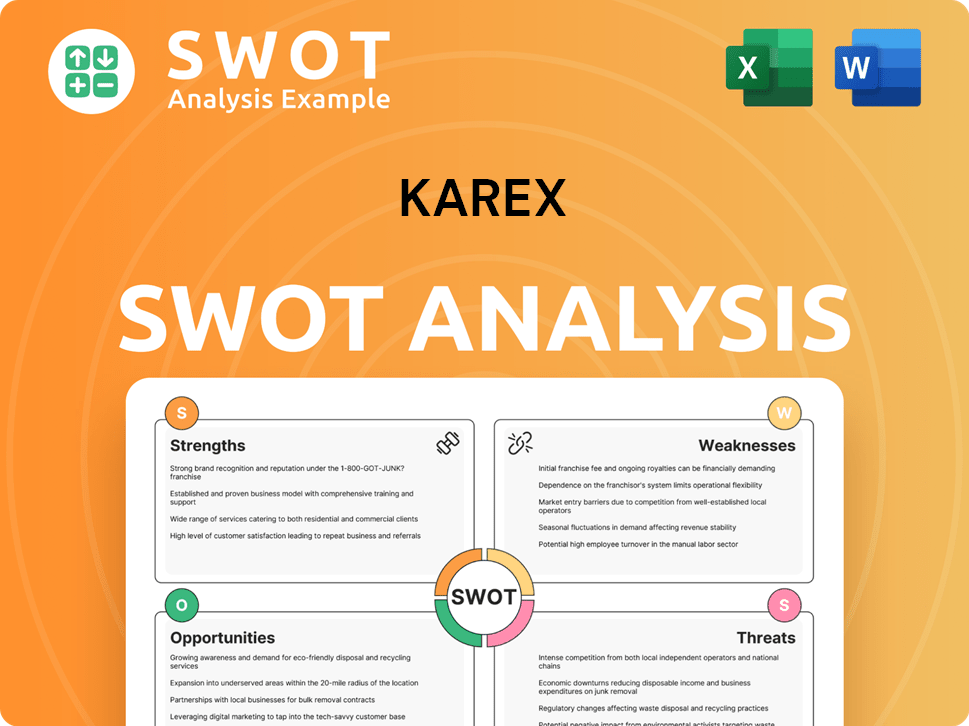

Karex SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Karex Make Money?

The Karex company generates revenue mainly through the sale of sexual wellness and medical products. Its operations are structured around three primary divisions: Sexual Wellness, Medical Products, and Others. The Sexual Wellness segment is the largest, contributing the majority of sales, followed by Medical Products and other miscellaneous segments.

The company's financial strategy is heavily reliant on the sales of its products, particularly condoms and lubricants. Over the years, Karex has strategically expanded its product offerings and distribution channels to maximize revenue and profitability. The company's approach includes both its own branded products and original equipment manufacturer (OEM) agreements.

In FY23, personal lubricants contributed approximately 10% of Karex's revenue, showing substantial growth, especially in the U.S. market. Karex is aiming for the personal lubricants sector to eventually match its condom business in the long term.

The company's main revenue stream is derived from the sale of its sexual wellness and medical products. Its monetization strategies are diverse, including sales of its own brands and OEM agreements. The company is strategically focused on commercial and OBM segments, which offer higher profit margins compared to the tender market. For more details on the Owners & Shareholders of Karex, the company's financial performance is also crucial to understanding its revenue and monetization strategies.

- Sexual Wellness Division: This division is the primary revenue driver, accounting for 91% of sales from FY19 to the present, including condom and lubricant sales.

- Medical Products Division: Contributes approximately 7% of total revenue during the same period.

- Other Segments: Constitutes the remaining 2% of revenue.

- Personal Lubricants: In FY23, personal lubricants contributed roughly 10% of Karex's revenue.

- Commercial and OBM Segments: These segments yield significantly higher gross profit margins (20%-25% for commercial and over 50% for OBM) compared to the tender market (7%-10%).

- FY25 Revenue Forecast: Revenue is forecasted to expand 1.1% year-on-year to RM513.5 million.

- FY26 Revenue Projection: Projected to grow 9.5% year-on-year to RM562.2 million.

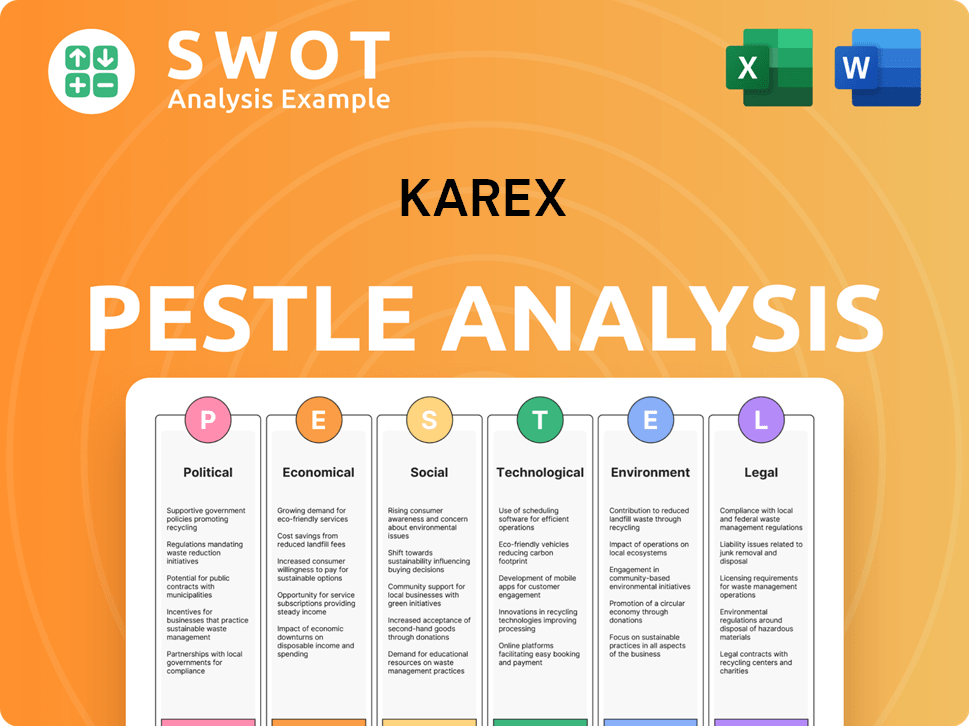

Karex PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Karex’s Business Model?

Established in 1988, the Karex company has become the world's largest condom manufacturer. A significant milestone was its listing on Bursa Malaysia in November 2013. Strategic acquisitions, such as Pasante in 2016, have been crucial for growth, boosting its brand portfolio and market presence. The Karex business has strategically adapted to market changes and challenges, focusing on high-margin segments.

Operational challenges have included competition and rising costs. In response, Karex operations shifted towards higher-margin commercial and OBM segments. This pivot significantly improved profitability, with a gross profit margin of 30.7% in 1QFY24. The company has also strategically reduced reliance on migrant workers, aiming for no foreign workers by 2024.

The company's competitive edge is multifaceted, stemming from its market position and production capacity. With an annual production capacity of around 5.5 billion pieces, Karex holds approximately 20% of the global condom market share. Strong R&D capabilities drive product innovation, including new packaging concepts and a new synthetic condom, enhancing its market position.

The listing on Bursa Malaysia in 2013 was a significant step for the Karex company, solidifying its presence in the global sexual health industry. The acquisition of Pasante in 2016 expanded its brand portfolio, enhancing its market reach. These strategic moves have been pivotal in its growth trajectory.

Shifting focus to higher-margin segments, such as commercial and OBM, was a key strategic decision. This move improved profitability, with gross profit margins significantly increasing. The company also reduced reliance on migrant workers to meet international labor standards and future audit requirements.

Its leading market position, with approximately 20% of the global market share, provides significant economies of scale. Strong in-house R&D capabilities drive product innovation, including the introduction of a new synthetic condom. The company's adherence to international standards also contributes to its advantage.

The company continues to adapt by focusing on premium and top-quality products. This aligns with evolving market trends and changing consumer preferences. By focusing on premium products, the Karex business is well-positioned to capitalize on post-pandemic market recovery.

The Karex company benefits from a strong market position and significant production capacity. Its focus on R&D and adherence to international standards further strengthen its competitive advantage. The company's multi-brand strategy also caters to different market segments.

- Leading Market Share: Approximately 20% of the global condom market.

- Production Capacity: Annual production of around 5.5 billion condoms.

- R&D Focus: Continuous innovation in product development and packaging.

- Brand Strength: Multi-brand strategy, including ONE Condoms and Pasante.

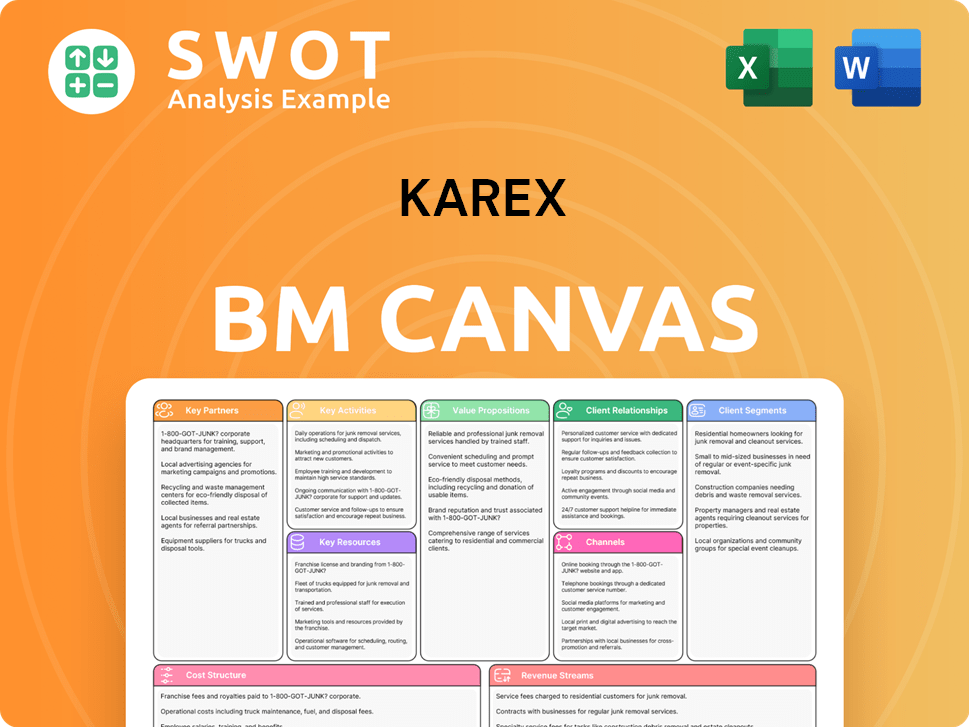

Karex Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Karex Positioning Itself for Continued Success?

The Karex company, a major player in the global condom industry, holds a significant market share, with its operations spanning across numerous countries. It's essential to consider the risks and future prospects for Karex business to understand its position and potential growth.

The Karex company's outlook is also shaped by its strategic initiatives and the dynamic market conditions, including competition and economic factors. The company's commitment to innovation and sustainability further influences its trajectory.

Karex is the world's largest condom manufacturer, holding around 20% of the global market share. Its products are sold in over 130 countries. The company serves governments, NGOs, and retailers, with a strong reputation and diverse product range.

Key risks include potential reductions in government spending on birth control and lower acceptance rates for new products. Competition from lower-priced manufacturers and increased costs due to labor policies are also concerns. US tariff reinstatement risks and currency fluctuations pose additional challenges.

Karex is expanding synthetic condom production, with plans to increase capacity to 400 million pieces by the end of 2025. This expansion is crucial as synthetic condoms offer higher profit margins. The company aims for a 10% GHG reduction by 2035 and is adopting solar PV systems.

The company is focusing on high-margin products and continuous innovation. Medical-grade lubricants accounted for 17% of total sales in 1QFY25. The global condom market is projected to grow at a CAGR of 8%-9% over the next decade, from USD8-9 billion in 2022 to USD19-23 billion by 2032.

The Karex company's success hinges on its ability to manage risks and capitalize on market opportunities. Strategic decisions regarding product development, distribution, and cost management are crucial for maintaining its competitive edge. For more details, you can read about the Growth Strategy of Karex.

- Expansion of synthetic condom production is a key driver for future growth.

- Focus on high-margin products and continuous innovation will enhance profitability.

- Managing risks related to competition, labor costs, and currency fluctuations is essential.

- Sustainability initiatives, such as GHG reduction and solar energy adoption, are important.

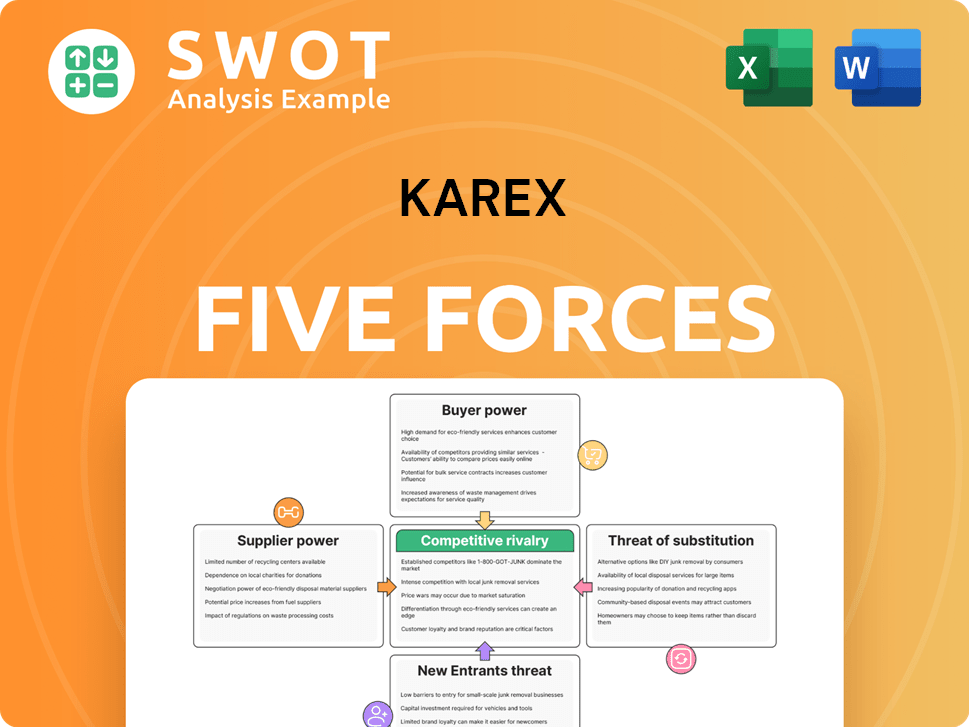

Karex Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Karex Company?

- What is Competitive Landscape of Karex Company?

- What is Growth Strategy and Future Prospects of Karex Company?

- What is Sales and Marketing Strategy of Karex Company?

- What is Brief History of Karex Company?

- Who Owns Karex Company?

- What is Customer Demographics and Target Market of Karex Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.