NEC Bundle

How Well Do You Really Know NEC Company?

NEC Corporation, a titan in the global IT and electronics arena, is a critical player in today's digital transformation. With over 125 years of experience, NEC has consistently adapted to the ever-changing technological landscape. In fiscal year 2024, NEC reported impressive revenues, highlighting its significant market presence and enduring influence.

To truly understand NEC SWOT Analysis, one must delve into how NEC works. This exploration will reveal the inner workings of NEC business, including its diverse range of NEC products and cutting-edge NEC technology. Examining NEC Corporation's structure, services, and financial performance offers invaluable insights into its innovative approach and future plans.

What Are the Key Operations Driving NEC’s Success?

The core operations of the NEC company center around creating and delivering value through IT and network solutions. These solutions serve a diverse global customer base, including businesses, governments, and individuals. The company operates through two main segments: IT Services and Social Infrastructure, which allows it to address a wide range of needs.

NEC's value proposition focuses on enhancing productivity, improving efficiency, and bolstering security for its customers. This is achieved through continuous investment in research and development, leveraging its global presence, and fostering strategic partnerships. NEC's deep industry expertise enables it to tailor solutions, making it a competitive player in the market.

The company's operational processes are supported by a strong emphasis on innovation and customer-centric solutions. This approach allows NEC to maintain a competitive edge and meet the evolving demands of its diverse customer base. This focus is reflected in its financial performance and strategic initiatives.

Provides system integration services, including system construction and consulting. Offers maintenance, support, outsourcing, and cloud services. Delivers system equipment and software solutions.

Focuses on network infrastructure products like core network equipment and mobile base stations. Provides software and services for telecommunications carriers. Offers system integration and support in aerospace and defense.

NEC's operational success is driven by its commitment to innovation and customer satisfaction. The company's focus on security and industry-specific solutions differentiates it in the market.

- Research and Development: Continuous investment in R&D fuels the development of innovative products.

- Global Presence: NEC leverages its global network for effective distribution and service delivery.

- Strategic Partnerships: Collaborations enhance its ability to meet diverse customer needs.

- Industry Expertise: Tailored solutions are provided to meet specific industry requirements.

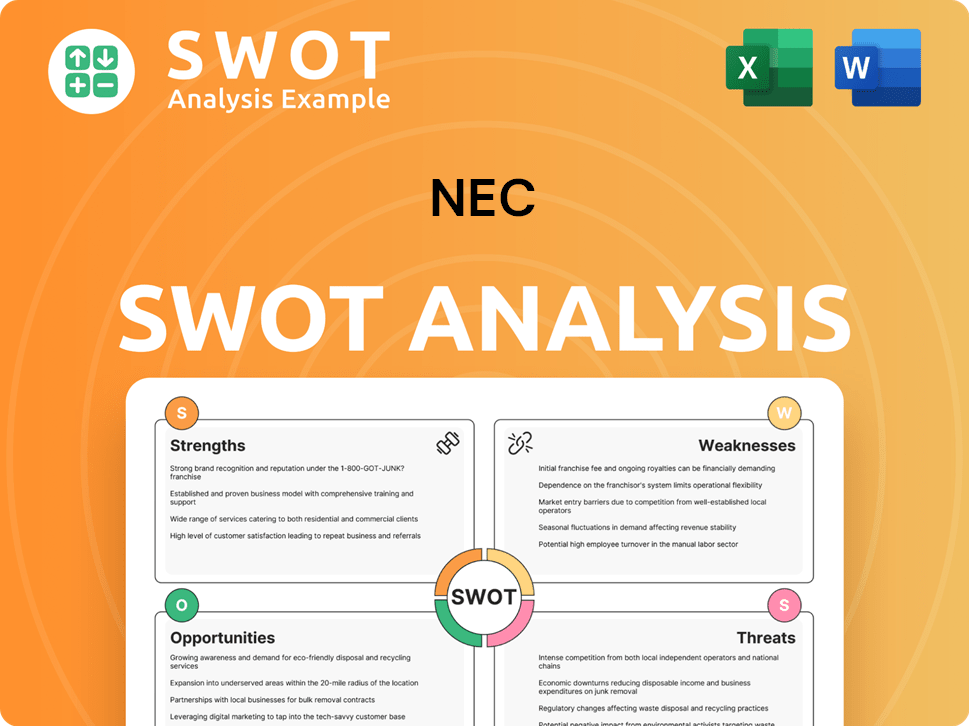

NEC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does NEC Make Money?

The revenue streams and monetization strategies of the NEC company are multifaceted, primarily revolving around its IT Services and Social Infrastructure segments. In the fiscal year ending March 31, 2025, the NEC company reported an annual revenue of 3.42 trillion JPY. This financial performance underscores the company's robust market presence and its ability to generate substantial income from its diverse business operations.

NEC's financial health is further demonstrated by its profit figures. For the nine-month period of 2024, the company's profit surged by 110% to 71.6 billion yen. This significant increase was largely driven by strong performances in domestic IT services and ANS. For the full fiscal year 2025, NEC anticipates revenues of 3.41 trillion yen, reflecting continued confidence in its business model and market position.

The company's revenue model is built on a variety of sources, including IT solutions, system integration projects, maintenance contracts, and cloud services. NEC also generates revenue from the sale of telecommunications equipment, software, and electronic devices. This diversified approach helps to mitigate risks and ensures a steady flow of income.

NEC's primary revenue streams are diverse, reflecting its broad range of products and services. The company is actively shifting towards a Software-as-a-Service (SaaS) model, which is expected to improve profitability. Strategic partnerships and mergers and acquisitions further enhance revenue diversification and market reach. For more insights into the company's structure, consider reading about the Owners & Shareholders of NEC.

- IT Solutions and Services: Sales of IT solutions, system integration projects, and cloud services form a significant portion of revenue.

- Telecommunications Equipment: Sales of telecommunications equipment and software to carriers contribute to the revenue stream.

- Electronic Devices: Revenue is also generated from the sale of electronic devices.

- SaaS Transition: NEC aims to increase the proportion of software under the SaaS model to 80% or higher by the end of fiscal year 2026.

- Strategic Partnerships: Collaborations, such as the one with Sumitomo Corporation for the CropScope agricultural ICT platform, expand market reach.

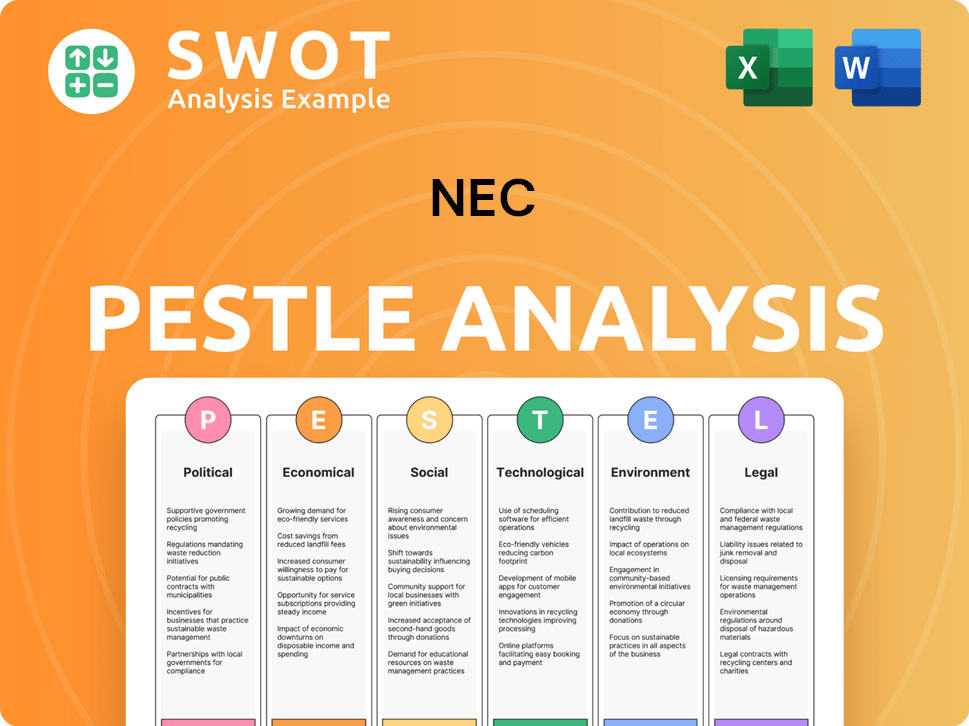

NEC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped NEC’s Business Model?

The operational and financial trajectory of the NEC company has been significantly shaped by key milestones and strategic maneuvers. A recent highlight is the company's robust financial performance in the first nine months of 2024. This period saw a remarkable surge in profit, increasing by 110%, which led to an uplifted outlook for fiscal year 2025. This success was largely driven by strong performance in domestic IT services.

Strategically, the NEC company is focused on its Mid-term Management Plan 2025. This plan emphasizes accelerating global growth and transforming domestic businesses through technology. The financial strategy prioritizes long-term profit maximization. The company has set ambitious targets to improve its operating profit ratio from 8% to 13% by optimizing across industries using digital transformation (DX).

The NEC business has been actively adapting to challenges. One of the challenges is the cautious business environment. The company prioritizes profitability in its base businesses while focusing on growth in areas like digital governments, digital finance, 5G, and future growth businesses. The company has actively addressed challenges like human resource demand, achieving its goal of securing over 10,000 DX specialists by the end of fiscal 2024.

The company's recent financial performance, particularly the 110% profit surge in the first nine months of 2024, is a significant milestone. This performance has led to an improved outlook for fiscal year 2025. The achievement of securing over 10,000 DX specialists by the end of fiscal 2024 is another key milestone, demonstrating a strong commitment to technological advancement.

The Mid-term Management Plan 2025 is a core strategic move, focusing on global growth and domestic business transformation. The company is targeting an improved operating profit ratio, aiming to increase it from 8% to 13%. Strategic partnerships, such as those with IFS and Sumitomo Corporation, are also pivotal in expanding its market reach and service offerings.

Technological innovation, with continuous investment in research and development, is a key competitive advantage for the NEC company. Its global presence allows it to tap into diverse markets. Deep industry expertise enables tailored solutions. Security is a critical differentiator in the digital world.

The company's financial performance in the first nine months of 2024 showed a profit surge of 110%. The focus on improving the operating profit ratio from 8% to 13% by optimizing across industries using digital transformation (DX) is a key financial strategy. These financial metrics underscore the company's commitment to sustainable growth and profitability.

The NEC company leverages digital transformation, AI, and IoT to enhance its products and services. The company's focus on digital governments, digital finance, 5G, and future growth businesses is a strategic move to stay relevant. The company continues to adapt to new trends.

- Focus on digital transformation (DX) to optimize across industries.

- Leveraging AI and IoT to enhance products and services.

- Strategic partnerships to expand market reach and service offerings.

- Prioritizing profitability in base businesses while focusing on growth areas.

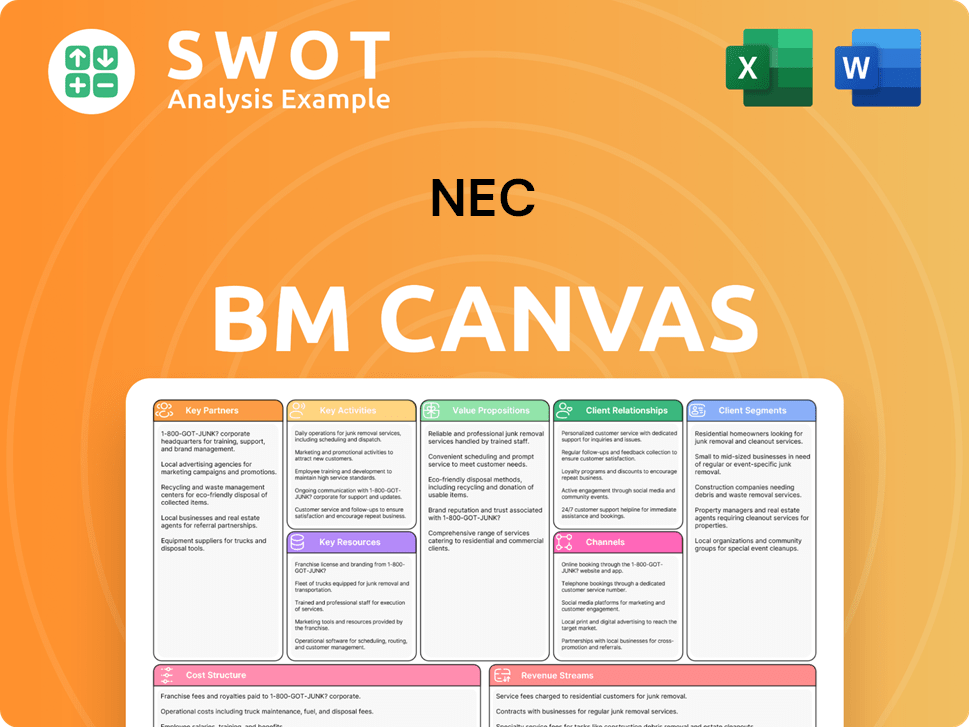

NEC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is NEC Positioning Itself for Continued Success?

The NEC Corporation holds a strong position in the technology sector, recognized as a global leader in integrating IT and network technologies. NEC company has a significant global reach, serving a diverse customer base across numerous countries. This allows it to adapt to local market dynamics. Key competitors include Fujitsu, IBM, and Cisco. While specific market share figures for all its diverse offerings are not readily available, NEC's long history of innovation and commitment to customer satisfaction have helped it maintain a competitive edge.

Despite its strong position, NEC faces several risks and headwinds. These include increasing competition in the rapidly evolving technology sector and the need to continuously adapt to rapid technological advancements. Macroeconomic uncertainties and geopolitical risks can also impact its operations and revenue. Additionally, the NEC company needs to manage the complexities of expanding synergies with its international acquisitions.

NEC Corporation is a global leader in integrating IT and network technologies, serving diverse markets worldwide. It competes with major players like Fujitsu, IBM, and Cisco. The company's long-standing commitment to innovation and customer satisfaction has helped it maintain a competitive edge within the industry.

NEC faces risks such as increased competition and the need for continuous technological adaptation. Macroeconomic uncertainties and geopolitical risks also pose challenges. Furthermore, managing the complexities of international acquisitions is crucial for sustained growth and profitability.

NEC's future is shaped by its Mid-term Management Plan 2025, focusing on global expansion and domestic business transformation. The company aims to grow in areas like digital governments, 5G, and core DX. Strategic initiatives include expanding its SaaS business model and increasing offshore development.

NEC is focused on sustainable growth and aims to achieve carbon neutrality by 2040, as outlined in its 2024 ESG Databook. The company plans to expand its SaaS business, aiming for it to account for 80% or more of its software revenue by the end of fiscal 2026. Increasing offshore development is also a key strategy to improve efficiency.

The Mid-term Management Plan 2025 guides NEC's strategic direction, emphasizing global expansion and domestic business transformation. This plan aims to foster growth in emerging sectors such as digital finance and 5G. The company is investing in disruptive technologies to maintain its competitive edge and drive future innovation. For more detailed insights into NEC's strategic approach, you can read about the Growth Strategy of NEC.

- Focus on digital government solutions.

- Expansion in digital finance and 5G technologies.

- Investment in core DX (Digital Transformation).

- Sustainable growth through carbon neutrality by 2040.

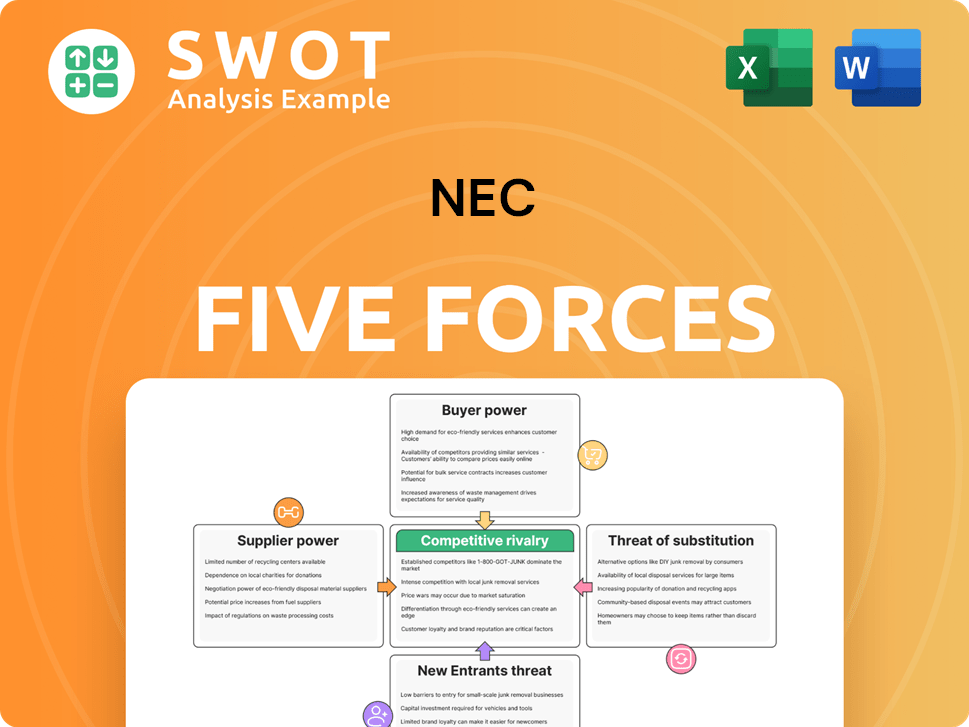

NEC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of NEC Company?

- What is Competitive Landscape of NEC Company?

- What is Growth Strategy and Future Prospects of NEC Company?

- What is Sales and Marketing Strategy of NEC Company?

- What is Brief History of NEC Company?

- Who Owns NEC Company?

- What is Customer Demographics and Target Market of NEC Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.