Nexstar Media Group Bundle

How Does Nexstar Media Group Thrive in Today's Media Landscape?

Nexstar Media Group, a leading media company, isn't just surviving; it's thriving, reporting a staggering $5.41 billion in revenue in 2024. As the largest owner of local television stations in the U.S., Nexstar's influence is undeniable, reaching approximately 70% of U.S. television households. This dominance begs the question: how does this media giant operate, and what drives its impressive financial performance?

This exploration into Nexstar Media Group's Nexstar Media Group SWOT Analysis will uncover its operational strategies, from its extensive network of Television Stations and local news coverage areas to its diverse revenue streams, including advertising revenue and content distribution. We'll examine its competitive advantages within the broadcasting industry and its strategic moves, including television station acquisitions, to understand how Nexstar is positioned for future growth, even amidst the challenges of a rapidly evolving media environment. Understanding the Nexstar Media Group; business model is key.

What Are the Key Operations Driving Nexstar Media Group’s Success?

The core operations of Nexstar Media Group revolve around creating and delivering value through its extensive network of local television stations and national broadcast and digital platforms. The company's strategy focuses on local market leadership combined with national scale, providing a differentiated value proposition for advertisers. This approach allows Nexstar to engage a significant portion of U.S. television households.

Nexstar's value proposition centers on providing local news, sports, and entertainment content. With over 316,000 hours of programming produced annually, the company leverages its local presence and national reach to attract viewers and generate advertising revenue. Strategic partnerships and content diversification further solidify its market position.

The company's operational processes involve significant local journalism, with approximately 6,000 journalists and 1,600 salespeople producing localized content. Nexstar's media properties include affiliations with major networks such as CBS, FOX, NBC, and ABC. Furthermore, Nexstar's ownership stake in TV Food Network and Cooking Channel adds to its diverse portfolio.

Nexstar owns, operates, or provides services to 201 full-power television stations and one AM radio station. These stations are spread across 116 markets in 40 states and the District of Columbia. This extensive reach allows Nexstar to engage approximately 70% of U.S. television households.

Beyond local broadcasting, Nexstar operates national properties like The CW and NewsNation. The CW is America's fifth major broadcast network, with approximately 40% of its programming hours in 2025 dedicated to live sports. Nexstar also holds a 31.3% ownership stake in TV Food Network and Cooking Channel.

Nexstar's operational model emphasizes a blend of local market leadership and national scale, which sets it apart in the broadcasting industry. This strategy is supported by a robust supply chain, content creation, and strategic distribution networks. The company's focus on local news and community engagement is a key component of its success, as highlighted in an article about the Target Market of Nexstar Media Group.

- Content Creation and Acquisition: Nexstar produces and acquires a vast amount of content, including local news, sports, and entertainment.

- Distribution Networks: The company utilizes traditional broadcast, cable, and virtual multichannel video programming distributors (vMVPDs) to deliver content.

- Strategic Partnerships: Agreements, such as the multi-year renewals with CBS Television Network in 42 markets in July 2024, strengthen distribution and content delivery.

- Advertising Revenue: Nexstar generates revenue through advertising sales, leveraging its reach and diverse content offerings.

Nexstar Media Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Nexstar Media Group Make Money?

The revenue model of Nexstar Media Group, a leading media company, is built on a multi-faceted approach. The company generates income primarily through distribution and advertising, with other revenue streams contributing as well. In 2024, the company's total net revenue reached a record of $5.41 billion.

For the first quarter of 2025, Nexstar reported net revenue of $1.23 billion. This financial performance showcases the company's ability to adapt and generate income from various sources. Understanding these revenue streams is essential for evaluating the overall financial health and future prospects of Nexstar.

Nexstar Media Group's business model relies heavily on two primary revenue streams: distribution and advertising. These two sources accounted for the majority of the company's income in 2024. The company also leverages its digital content and audience to generate additional revenue.

Distribution revenue is the largest contributor to Nexstar's income. This includes retransmission consent fees from cable and satellite providers and fees from vMVPDs. In Q1 2025, distribution revenue reached a record $762 million.

Advertising revenue is another significant source of income for Nexstar. This includes local and national advertising, with a portion coming from political advertising. In Q1 2025, advertising revenue was $460 million.

Other revenue streams contribute to the overall financial performance of Nexstar. These include digital content monetization through platforms like NewsNation and The Hill. This segment accounted for 1% of total revenue in 2024.

Distribution revenue, which accounted for 54% of total revenue in 2024, saw growth due to annual rate escalators, contractual increases, and an increase in vMVPD subscribers. This growth offset traditional MVPD subscriber attrition. In Q1 2025, distribution revenue was a record $762 million, showing a slight increase of 0.1% over the comparable prior year quarter.

Advertising revenue, representing 45% of total revenue in 2024, experienced a decrease in Q1 2025, primarily due to a decrease in political advertising. Nexstar had captured approximately $500 million in political advertising revenue in 2024. The decline was mainly due to a significant decrease in political advertising, which fell by $32 million to $6 million, and a $20 million reduction in non-political advertising revenue due to market softness.

The company anticipates continued growth driven by favorable distribution contract renewals, with approximately 60% of its subscriber base up for renewal in 2025. Nexstar also aims to reduce losses at The CW, with a goal of profitability in 2026. To learn more about Nexstar's strategic direction, read about the Growth Strategy of Nexstar Media Group.

Nexstar employs several strategies to monetize its content and audience. These include leveraging its portfolio of television stations and digital platforms. The company focuses on maximizing revenue from distribution agreements and advertising sales.

- Maximizing retransmission consent fees from cable, satellite, and vMVPD providers.

- Generating revenue from local and national advertising, including political advertising.

- Monetizing digital content through platforms like NewsNation and The Hill.

- Focusing on cost management and operational efficiency to improve profitability.

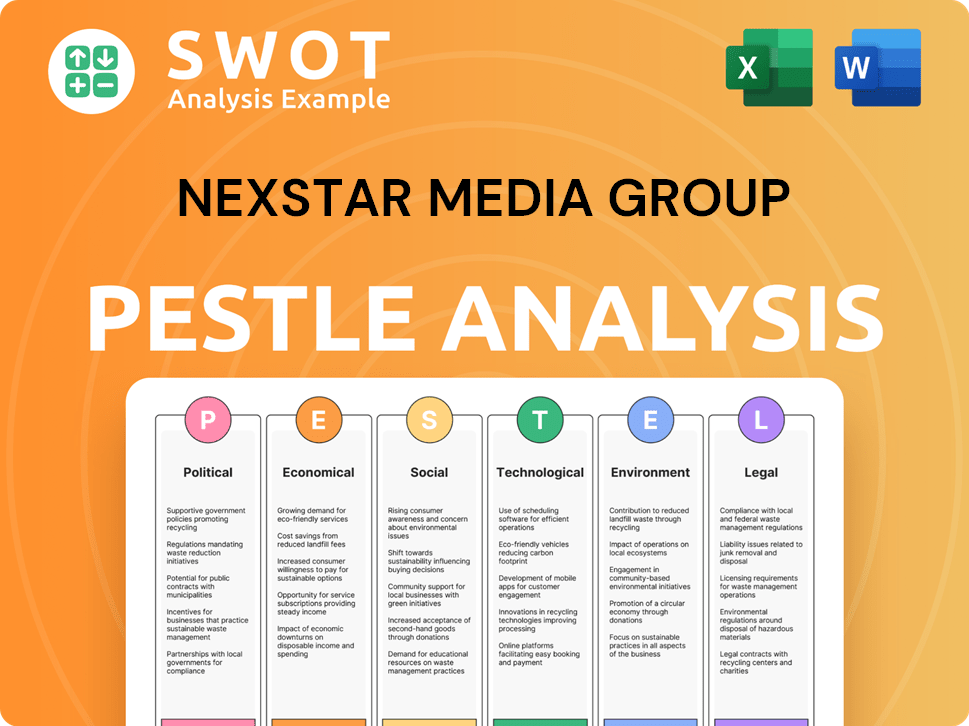

Nexstar Media Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Nexstar Media Group’s Business Model?

The evolution of Nexstar Media Group has been shaped by strategic acquisitions and operational adjustments, positioning it as a significant player in the media industry. A key move was the merger with Tribune Media in 2019, which significantly expanded its reach and market presence. This strategic expansion has allowed Nexstar to build a robust portfolio of television stations and media properties.

Nexstar's strategic initiatives, including the acquisition of The CW Network and investments in new technologies like ATSC 3.0, highlight its commitment to adapting to the changing media landscape. These moves are designed to enhance its revenue streams and maintain its competitive edge. The company's financial strategies and operational adjustments are crucial for its continued growth.

The company faces challenges like the shift from traditional MVPD subscribers to streaming services, and the fluctuations in the advertising market. Nexstar's ability to manage these challenges through diversification and strategic cost management is critical to its long-term success. For a deeper dive into the company's origins, consider reading the Brief History of Nexstar Media Group.

The 2019 merger with Tribune Media was a major milestone, establishing Nexstar as the largest owner of television stations in the U.S. This expanded its reach to 216 stations in 118 markets, covering nearly 39% of U.S. television households. The merger made Nexstar a top broadcast affiliate for Fox and CBS, and a key partner for NBC and ABC.

The acquisition of a 75% stake in The CW Network in 2022 was a strategic move aimed at transforming it into a profitable entity. Nexstar has increased The CW's programming hours by over 40% and introduced significant sports programming. The January 2025 acquisition of WBNX-TV/TV55 in Cleveland, Ohio, further expanded its market presence.

Nexstar's competitive advantages include its scale as the largest local television broadcasting company. Its diversified revenue streams across geography, affiliation, and source also provide resilience. Strategic focus on cost management, evidenced by targeted restructuring actions in Q4 2024, further enhances its competitive edge.

Operational challenges include the decline in traditional MVPD subscribers and a challenging television advertising market. Advertising revenue decreased by 10.2% in Q1 2025, primarily due to reduced political advertising and overall market softness. Nexstar is growing its vMVPD subscribers and securing favorable distribution contract renewals.

Nexstar is actively investing in new technologies like ATSC 3.0, with the creation of EdgeBeam Wireless, LLC in January 2025. This joint venture aims at delivering wireless data across the nation. The company is also focused on increasing The CW's programming hours and introducing sports programming, which is expected to constitute approximately 40% of total programming hours in 2025.

- The company is focused on cost management, with restructuring actions in Q4 2024 to reduce operating expenses.

- Nexstar's scale as the largest local television broadcasting company enables it to achieve results other operators cannot.

- The company's diversified revenue streams across geography, affiliation, and source provide resilience.

Nexstar Media Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Nexstar Media Group Positioning Itself for Continued Success?

As the largest local television broadcasting company in the United States, Nexstar Media Group holds a prominent position, reaching roughly 70% of U.S. television households through its vast network of over 200 stations across 116 markets. This extensive reach provides a strong foundation for customer loyalty and a significant market share. The company extends its national reach through The CW Network and NewsNation.

Despite its strong market position, Nexstar faces several challenges. These include the ongoing decline in traditional multichannel video programming distributor (MVPD) subscribers due to the rise of streaming services. Fluctuations in advertising demand, influenced by economic conditions and the cyclical nature of political advertising, also pose a risk. Furthermore, a substantial debt of $6.5 billion as of March 31, 2025, and potential regulatory changes could impact its operational strategies.

Nexstar is the largest local television broadcasting company in the U.S., with over 200 television stations. Its vast network reaches approximately 70% of U.S. television households, providing a strong market share. Its national reach includes The CW Network and NewsNation.

The company faces risks, including declining MVPD subscribers and fluctuations in advertising revenue. Nexstar also carries significant debt, which was $6.5 billion as of March 31, 2025. Regulatory changes could also impact operations.

Nexstar plans to focus on renewing distribution contracts, with about 60% of its subscriber base up for renewal in 2025. The CW Network is expected to further reduce losses in 2025. The company is preparing for increased political advertising revenue in 2026.

Nexstar is actively pursuing deregulation and exploring M&A opportunities in 2025. ATSC 3.0 technology and the EdgeBeam Wireless joint venture are key for future revenue. The company aims to leverage its balance sheet for acquisitions and return capital to shareholders.

Nexstar is focused on renewing distribution contracts, with approximately 60% of its subscriber base up for renewal in 2025. The company is also working to improve the profitability of The CW Network, expecting further loss reduction in 2025. Furthermore, the company is preparing for the 2026 political cycle, anticipating increased political advertising revenue. For a deeper understanding of Nexstar's competitive environment, you can review the Competitors Landscape of Nexstar Media Group.

- Renewing distribution contracts is a key strategic initiative.

- The CW Network is expected to further reduce losses in 2025.

- Preparing for the 2026 political cycle for increased revenue.

- Focus on M&A opportunities and ATSC 3.0 technology.

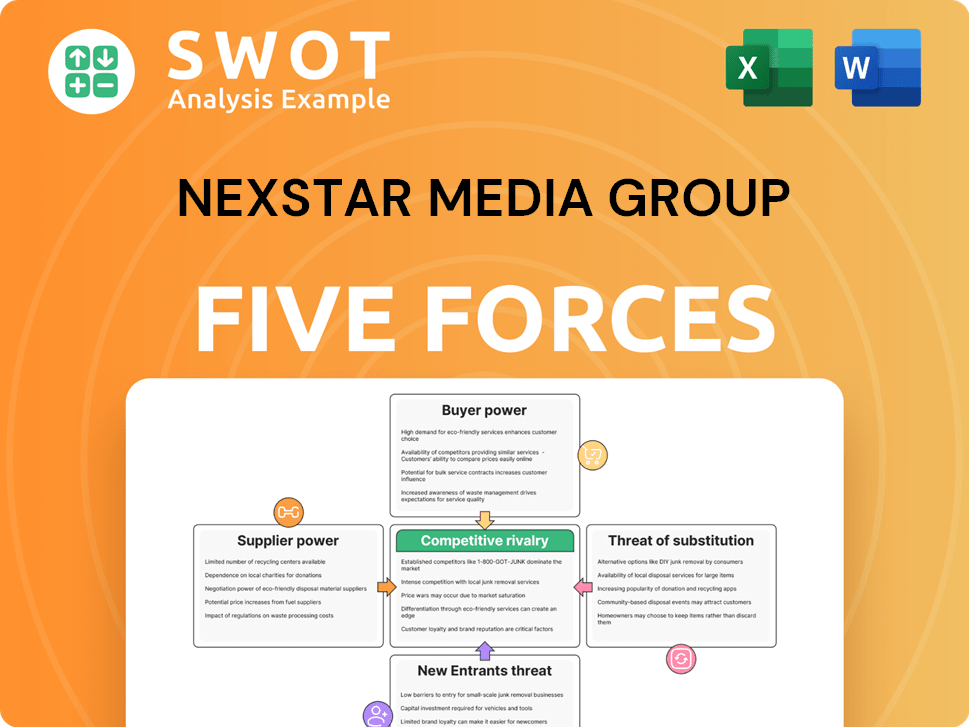

Nexstar Media Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nexstar Media Group Company?

- What is Competitive Landscape of Nexstar Media Group Company?

- What is Growth Strategy and Future Prospects of Nexstar Media Group Company?

- What is Sales and Marketing Strategy of Nexstar Media Group Company?

- What is Brief History of Nexstar Media Group Company?

- Who Owns Nexstar Media Group Company?

- What is Customer Demographics and Target Market of Nexstar Media Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.