Organon Bundle

How Does Organon Thrive in the Healthcare Market?

Organon, a global healthcare leader, emerged from Merck in 2021 with a laser focus on women's health, making waves in the pharmaceutical landscape. This strategic spin-off allowed Organon pharmaceuticals to concentrate on addressing critical, often-overlooked healthcare needs. Understanding Organon's operations is crucial for anyone looking to navigate the complexities of the healthcare sector.

This exploration into the Organon SWOT Analysis will dissect Organon's business model, revealing how it generates revenue and navigates the competitive market. We'll examine its diverse portfolio of Organon products, its commitment to innovation, and its impact on the pharmaceutical industry. Whether you're tracking Organon stock, considering Organon careers, or simply curious about the company's mission, this analysis offers valuable insights.

What Are the Key Operations Driving Organon’s Success?

The Organon company creates value by focusing on prescription medicines and products, especially in women's health. The company operates through two main segments: Women's Health and Established Brands, plus a Biosimilars segment. This structure allows Organon to concentrate resources and expertise on specific areas, driving innovation and improving patient outcomes. This focused approach is a key part of its operational strategy.

The Organon pharmaceuticals business model relies on a multifaceted approach. This includes research and development (R&D), manufacturing, distribution, and commercialization. The company leverages its existing portfolio and actively engages in R&D, often through collaborations and acquisitions, to enhance its product pipeline. The operational efficiency is enhanced by a strong supply chain and distribution networks, which are critical for delivering products globally.

Organon's value proposition centers on addressing unmet needs in women's healthcare. This includes offering a broad range of choices and potentially improving health outcomes. Its dedicated focus on women's health allows for specialized expertise and tailored approaches to product development, marketing, and patient support, which is a key differentiator in the pharmaceutical industry. This focus is further explored in Growth Strategy of Organon.

This segment offers a range of products focused on contraception, fertility, and other conditions specific to women. The company is committed to expanding its portfolio in this area. The Women's Health segment is a core part of Organon's identity and strategy.

This segment includes a diverse portfolio of off-patent medicines across various therapeutic areas. It provides a stable revenue base for the company. These established brands help to ensure financial stability and support ongoing investments.

This segment focuses on developing and commercializing biosimilar versions of complex biologic drugs. The goal is to increase patient access to critical therapies. Biosimilars play a crucial role in expanding treatment options and reducing healthcare costs.

Organon's operational processes include R&D, manufacturing, distribution, and commercialization. These processes are designed to ensure efficient product development and delivery. The company uses both internal and contract manufacturing organizations (CMOs) to maintain a robust supply chain.

Organon's operations are designed to support its core mission of improving women's health and providing access to essential medicines. The company's commitment to innovation and patient care drives its strategic decisions. In 2024, Organon reported revenues of approximately $6.3 billion.

- Focus on Women's Health: Dedicated to addressing unmet needs in women's healthcare.

- R&D Investments: Actively engaged in research and development to enhance its product pipeline.

- Global Distribution: Leveraging a vast network to deliver products to healthcare providers and patients worldwide.

- Strategic Partnerships: Collaborations with distributors and pharmacies to expand market reach.

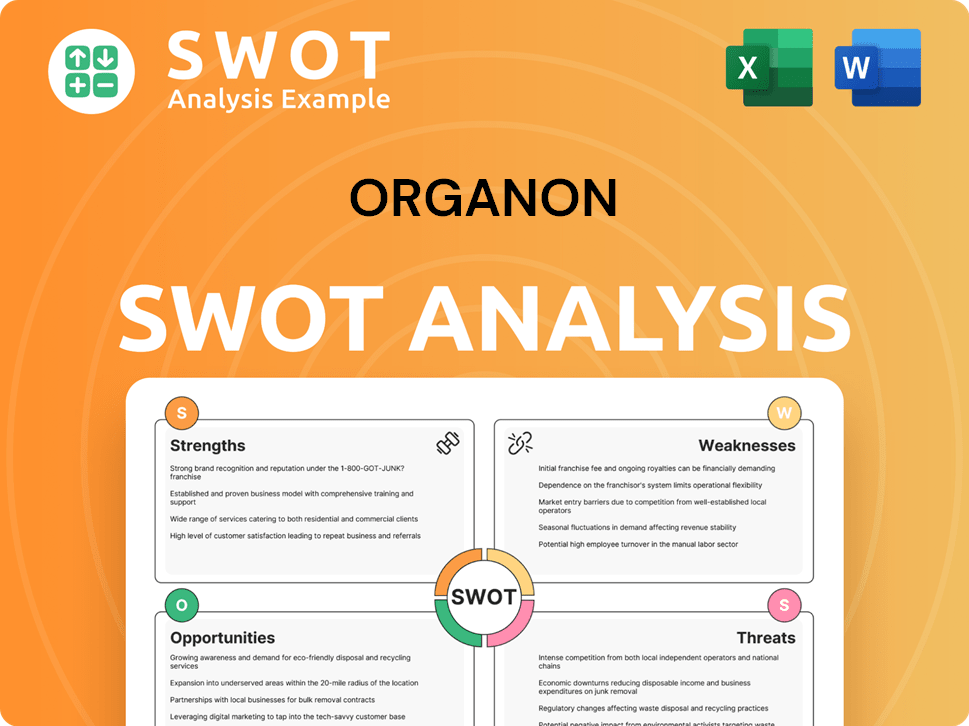

Organon SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Organon Make Money?

The Organon company, a global healthcare firm, generates revenue through the sale of pharmaceutical products across its Women's Health, Established Brands, and Biosimilars segments. This revenue model is supported by strategic monetization strategies, including product sales, pricing variations, and strategic partnerships. In 2023, Organon reported worldwide net revenues of $6.21 billion, demonstrating its significant presence in the pharmaceutical market.

The primary revenue stream for Organon pharmaceuticals comes from product sales, with key products like Nexplanon in Women's Health and a wide array of mature medicines in the Established Brands segment. The Biosimilars segment contributes through the commercialization of biosimilar drugs, which offer more affordable alternatives to complex biologics. These diverse revenue streams highlight Organon's multifaceted approach to generating income within the healthcare sector.

Monetization strategies at Organon are primarily based on the traditional pharmaceutical model, with prescription drug sales as the core. Pricing strategies are tailored to each market and product, considering therapeutic value, competition, and local healthcare policies. Licensing agreements and partnerships also contribute to revenue, diversifying income sources. For more insights, consider reading about the Growth Strategy of Organon.

Product sales, particularly in Women's Health and Established Brands, form the core of Organon's revenue. The company uses a variety of monetization strategies to maximize its revenue potential and market reach.

- Product Sales: Dominant revenue source, including contraceptives, fertility treatments, and established medicines.

- Pricing Strategies: Pricing varies based on market, product value, competition, and healthcare policies.

- Licensing and Partnerships: Agreements contribute through upfront payments, milestones, and royalties.

- Segment Performance (2023): Women's Health generated $1.76 billion, Established Brands $3.68 billion, and Biosimilars $777 million.

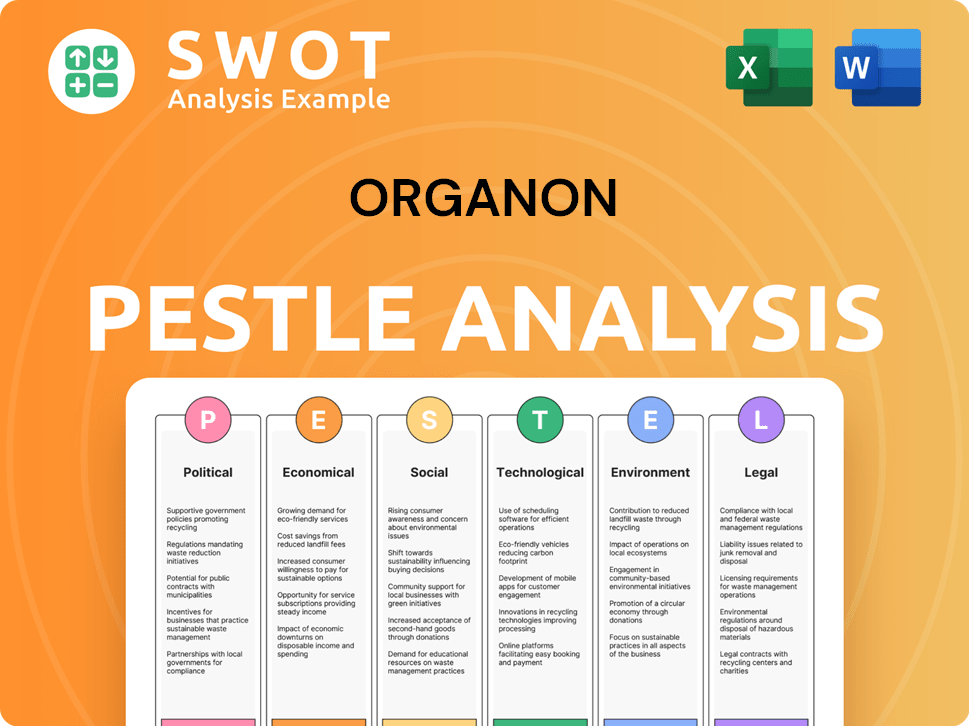

Organon PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Organon’s Business Model?

The journey of the Organon company has been marked by significant milestones and strategic shifts since its spin-off. A pivotal moment was its separation from Merck in June 2021, establishing it as a standalone, publicly traded entity. This move allowed Organon pharmaceuticals to concentrate on its core mission of women's health.

A key strategic focus has been business development, particularly within the women's health sector. The acquisition of Alydia Health in 2022 boosted its maternal health portfolio, and collaborations, such as the one with Daré Bioscience, have reinforced its commitment to addressing unmet needs. This focus is reflected in its diverse product offerings, which include established brands and innovative therapies.

Operational challenges have included establishing a new global supply chain and commercial infrastructure. The company has also faced industry-wide hurdles like intense competition and regulatory changes. Organon has responded by leveraging its global footprint and investing in digital health solutions to enhance patient engagement.

The spin-off from Merck in June 2021 was a major milestone, allowing Organon to operate independently. The acquisition of Alydia Health in 2022 expanded its maternal health offerings. These moves have shaped the company's focus on women's health.

Business development, particularly in women's health, has been a key strategic move. Collaborations and acquisitions, such as the one with Daré Bioscience, have been crucial. These moves support its dedication to addressing unmet needs in women's health.

Strong brand recognition, inherited from Merck, provides a solid foundation. The dedicated focus on women's health allows for targeted R&D. A diverse portfolio of established brands provides a stable revenue base.

Establishing a new global supply chain and commercial infrastructure post-spin was a challenge. The company also faced intense competition and regulatory pressures. Investment in digital health solutions has been a key response.

The competitive advantages of Organon include strong brand recognition and economies of scale. Its focus on women's health allows for a deeper understanding of the market. The company's diverse portfolio provides a stable revenue base.

- Strong Brand Recognition: Inherited from its legacy as part of Merck.

- Economies of Scale: Benefits from global reach in manufacturing and distribution.

- Focus on Women's Health: Allows for targeted R&D and effective commercialization.

- Diverse Portfolio: Provides a stable revenue base for reinvestment.

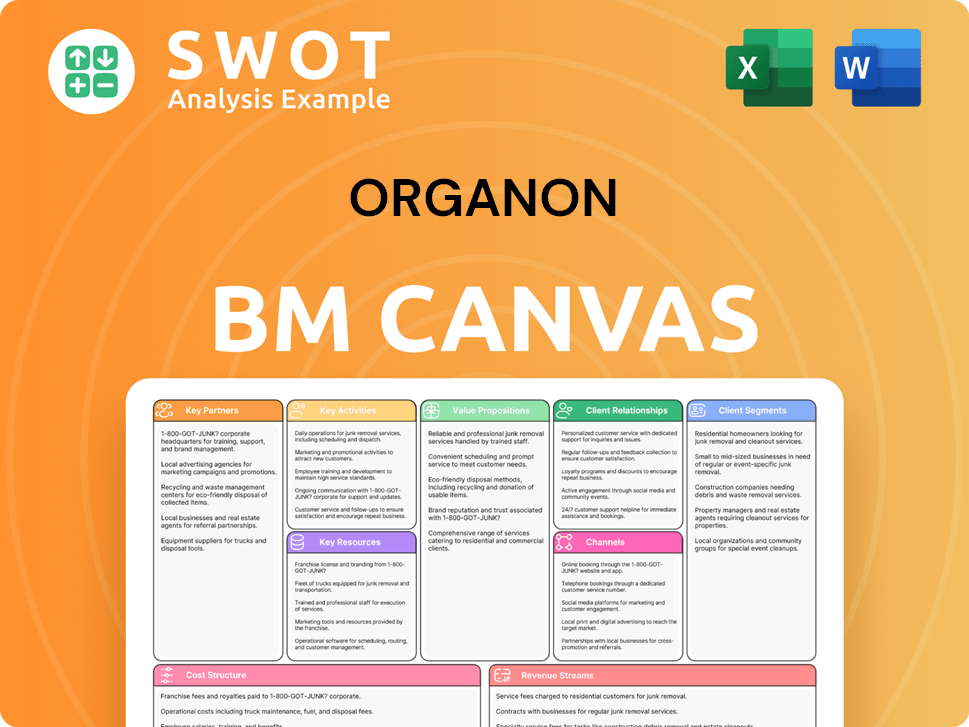

Organon Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Organon Positioning Itself for Continued Success?

The Organon company holds a significant position in the global healthcare industry, particularly within women's health. Its focused approach gives it a competitive edge, especially in areas like contraception and fertility. The company's global reach, extending to over 140 markets, strengthens its industry standing.

However, the Organon company faces risks like regulatory changes, competition, and technological advancements. Economic downturns and supply chain disruptions can also affect its manufacturing and revenue. Despite these challenges, the company aims to expand its women's health pipeline and capitalize on the growing demand for women's healthcare solutions.

The Organon company is a key player in women's health, with a strong presence in contraception and fertility. It competes with larger pharmaceutical companies but benefits from its specialized focus. The company leverages its established products and global reach to maintain a competitive edge.

The Organon company faces risks from regulatory changes, new competitors, and technological disruptions. Economic factors and supply chain issues also pose challenges. These risks require the company to adapt and innovate to maintain its market position.

The future for Organon involves expanding its women's health pipeline through R&D and strategic partnerships. The company aims to address unmet needs and leverage its brands for growth. It also plans to invest in its core business and capitalize on the global demand for women's healthcare.

In 2024, Organon reported total revenue of approximately $6.3 billion. The company's focus on women's health contributed significantly to this revenue. These figures demonstrate the company's financial strength and its ability to generate revenue in the healthcare market.

The Organon company is focused on expanding its women's health pipeline. This includes internal R&D efforts and strategic business development. The company aims to address unmet needs and leverage its established brands.

- Investing in core women's health franchises.

- Pursuing targeted acquisitions and partnerships.

- Optimizing operational efficiency.

- Capitalizing on the growing global demand for women's healthcare solutions.

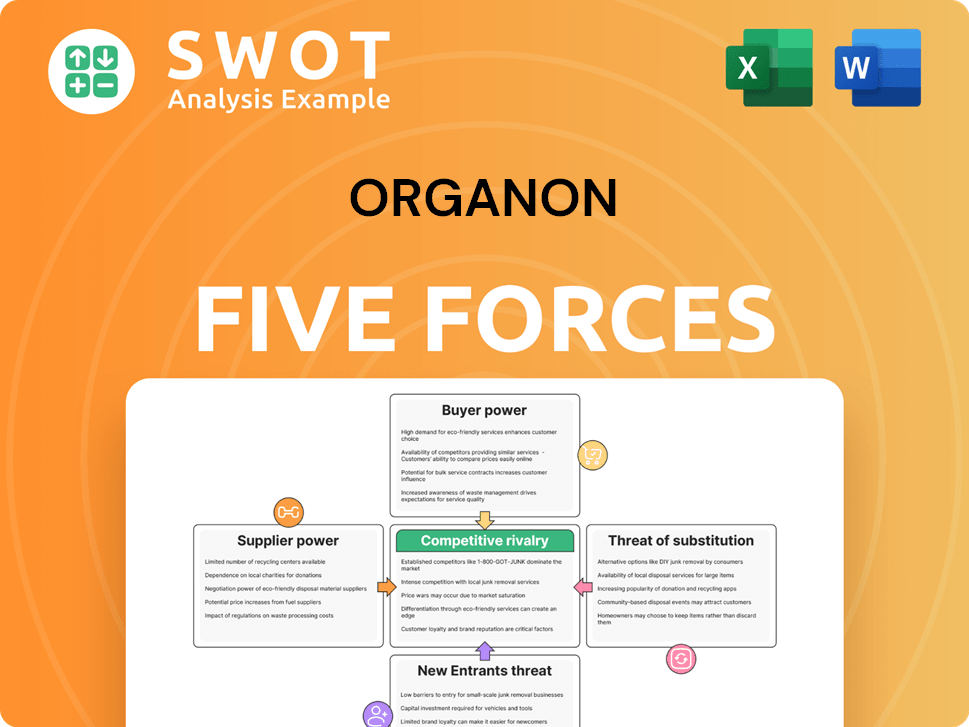

Organon Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Organon Company?

- What is Competitive Landscape of Organon Company?

- What is Growth Strategy and Future Prospects of Organon Company?

- What is Sales and Marketing Strategy of Organon Company?

- What is Brief History of Organon Company?

- Who Owns Organon Company?

- What is Customer Demographics and Target Market of Organon Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.