Petroplus Holdings AG Bundle

How Did Petroplus Holdings AG Navigate the Oil Refining Industry?

Petroplus Holdings AG, once a prominent player in Europe's energy sector, offers a fascinating case study in the volatile world of oil refining. This Petroplus Holdings AG SWOT Analysis will help you understand how this once-dominant energy company operated. Learn about the

Understanding the

What Are the Key Operations Driving Petroplus Holdings AG’s Success?

The core of Petroplus Holdings AG's business revolved around oil refining. This energy company transformed crude oil into various petroleum products, primarily for the European market. These products included diesel, gasoline, heating oil, and aviation fuels, serving diverse customer segments.

Petroplus operations were centered on refining crude oil, a complex process involving sourcing, refining, and distribution. This integrated approach enabled the company to manage the entire value chain, from raw materials to the end product. The company's value proposition was rooted in efficiently converting crude oil into essential fuels, catering to the energy needs of various industries and consumers.

The company's business model involved procuring crude oil from global markets and processing it in its European refineries. The refined products were then distributed through extensive networks across key European countries. Although specific details about partnerships and distribution networks in 2024-2025 are unavailable due to the company's liquidation, its historical operations were characterized by significant refining capacity and established distribution channels. For more details, you can read about the Growth Strategy of Petroplus Holdings AG.

Petroplus operated refineries that processed crude oil to produce a variety of fuels. The refining process involved multiple stages, including distillation, cracking, and blending. The specific processes and technologies used varied depending on the refinery and the desired end products.

The company's value proposition was to provide a reliable supply of essential fuels. This ensured energy security and supported economic activity in the markets it served. The company aimed to meet the energy demands of various industries and consumers.

Petroplus catered to distributors and direct consumers across Europe. These included businesses and individuals who relied on the company's products. The company's focus was on providing a consistent supply of high-quality fuels.

The distribution network included pipelines, storage facilities, and transportation. This network ensured that products reached customers efficiently. The company's logistics were crucial for maintaining its market position.

The company's operations were characterized by large-scale refining and established distribution channels. Petroplus faced challenges, including fluctuations in oil prices and refining margins. The company's financial performance was significantly impacted by these factors.

- Crude Oil Sourcing: Procurement from global markets.

- Refining Processes: Advanced techniques for fuel production.

- Distribution: Extensive networks across Europe.

- Customer Focus: Meeting the energy needs of various sectors.

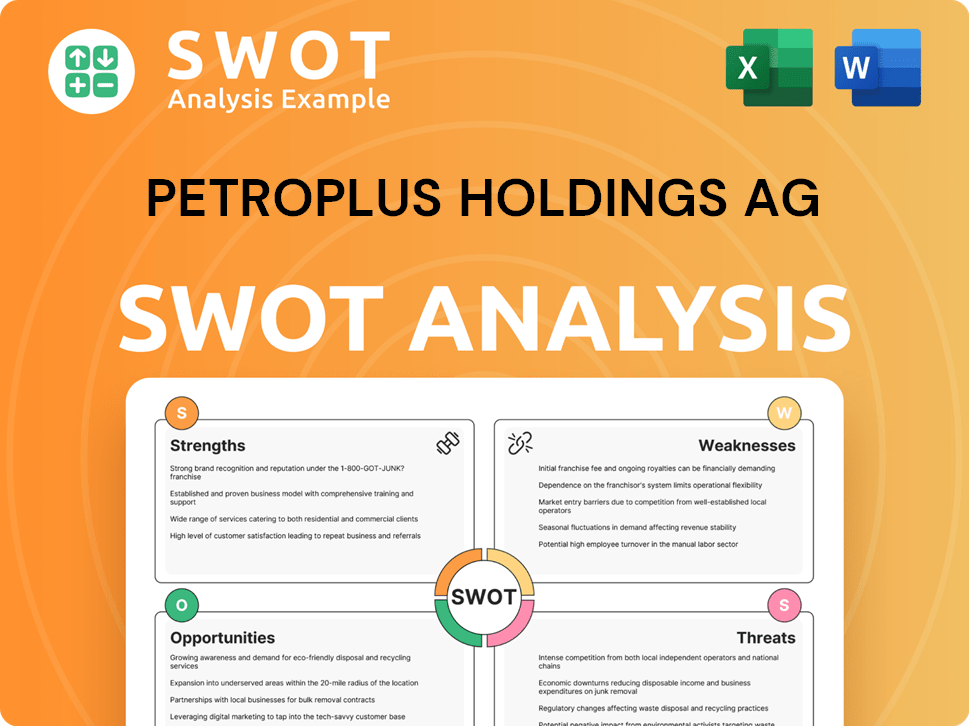

Petroplus Holdings AG SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Petroplus Holdings AG Make Money?

The primary revenue streams for Petroplus Holdings AG, an energy company, were derived from the sale of refined petroleum products. Petroplus operations focused on converting crude oil into marketable products like diesel, gasoline, and heating oil. These products were then sold to a variety of customers, including wholesale distributors and direct end-users.

The company's monetization strategy centered on the 'crack spread,' which is the difference between the cost of crude oil and the market price of the refined products. This spread represented the refining margin, a key indicator of the company's financial performance. The core of Petroplus Holdings AG business model was to purchase crude oil, refine it, and sell the refined products at a profit.

Due to the company's insolvency in 2012, specific financial data for 2024-2025 is unavailable. However, historically, product sales constituted the vast majority of its total revenue. Any additional monetization strategies were generally secondary to the core refining and sales model. The Marketing Strategy of Petroplus Holdings AG would have been influenced by regional demand and prevailing market prices.

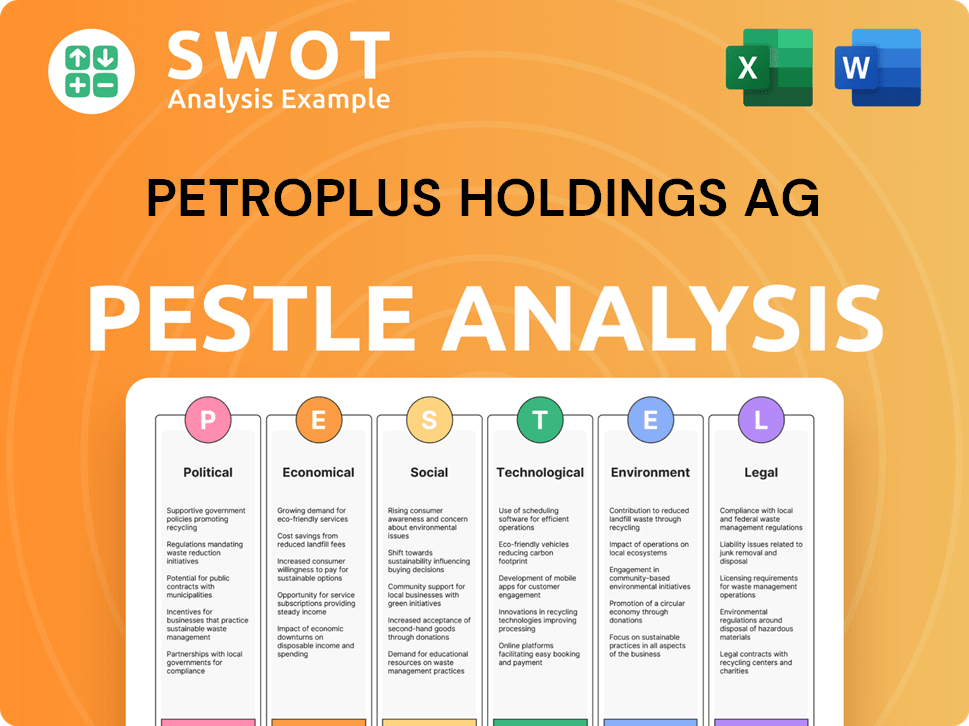

Petroplus Holdings AG PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Petroplus Holdings AG’s Business Model?

The story of Petroplus Holdings AG, a once-prominent energy company, is a study in the complexities of the oil refining industry. The company, which at one point was Europe's largest independent oil refiner, navigated a landscape marked by significant milestones and strategic decisions. Its journey, however, was ultimately cut short by financial challenges, leading to its insolvency in January 2012.

Petroplus's growth strategy centered on acquiring refining assets across Europe. These acquisitions were aimed at expanding its operational footprint and increasing its refining capacity. This approach was key to establishing its competitive edge. The company's strategic moves were designed to capitalize on economies of scale and access key European markets.

Despite its ambitious growth strategy, Petroplus faced considerable operational and market challenges. The company's financial performance was heavily influenced by the volatility of crude oil prices and refining margins. The capital-intensive nature of the oil refining business also posed significant risks. The company's experience serves as a cautionary tale, highlighting the importance of robust risk management and financial resilience in the energy sector. For more information about the competitive environment, you can read about the Competitors Landscape of Petroplus Holdings AG.

Petroplus's history includes significant acquisitions of refinery assets, which expanded its refining capacity. The company's strategic expansions were instrumental in establishing its presence in the European market. These moves were designed to create a robust refining network.

The company focused on expanding its refining capacity through strategic acquisitions. This expansion aimed to benefit from economies of scale. Petroplus sought to position itself strategically near key European markets.

Petroplus's competitive advantage stemmed from its substantial refining capacity. The company's strategic locations near key European markets were beneficial. The company had an established network for product distribution.

The company faced the volatility of crude oil prices and refining margins. Global economic downturns and shifts in demand for petroleum products posed hurdles. The capital-intensive nature of the refining business added to the challenges.

Petroplus's financial performance was significantly impacted by external factors. The company's inability to adapt to changing market conditions led to its downfall. The refining sector's inherent risks were a major factor.

- The company filed for insolvency in January 2012.

- The company's refining capacity was a key aspect of its operations.

- The company's strategic locations were intended to optimize distribution.

- The company's financial difficulties underscore the need for robust risk management.

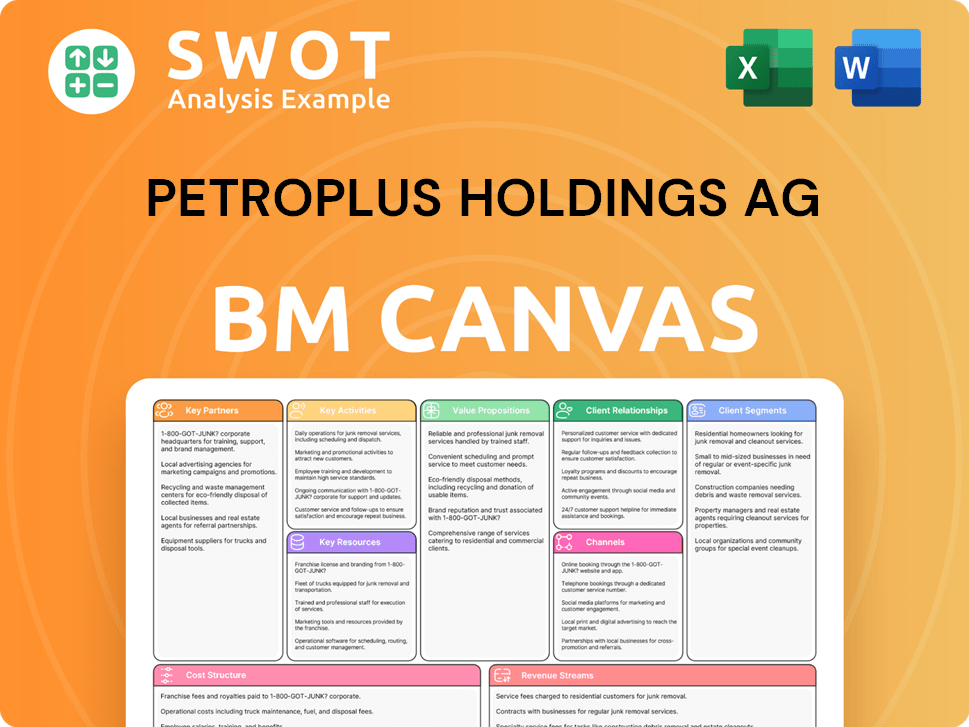

Petroplus Holdings AG Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Petroplus Holdings AG Positioning Itself for Continued Success?

Before its insolvency in 2012, Petroplus Holdings AG held a significant position in the European oil refining market. As the largest independent oil refiner in Europe, its market share was substantial within the independent refining segment. Petroplus operations were crucial for supplying refined products across several major European economies.

The company's global reach was concentrated in Europe, reflecting its operational footprint. Customer loyalty was likely driven by its consistent supply capabilities and established distribution networks. This market position, however, was not enough to overcome the challenges that ultimately led to its bankruptcy.

Petroplus faced substantial risks inherent to the oil refining industry. These included extreme volatility in crude oil prices and refined product prices, leading to fluctuating 'crack spreads' and refining margins. Regulatory changes, particularly those related to environmental standards and emissions, posed ongoing operational and investment challenges.

New competitors, particularly integrated oil majors with greater financial flexibility, presented a competitive threat. Technological disruptions, while perhaps less immediate in the refining sector compared to other industries, could also impact efficiency and environmental compliance. Changing consumer preferences, such as a shift towards electric vehicles or alternative energy sources, represented a long-term risk to demand for traditional petroleum products.

Given the company's liquidation, there are no ongoing strategic initiatives, innovation roadmaps, or leadership statements about its future direction in 2024-2025. The company's trajectory serves as a cautionary tale regarding the significant financial and market risks within the independent oil refining sector. The Brief History of Petroplus Holdings AG provides further context.

The Petroplus case highlights the vulnerability of oil refining businesses to external factors. These include fluctuations in oil prices, regulatory burdens, and competitive pressures. The company's inability to adapt to these challenges ultimately led to its demise. The history underscores the importance of robust financial planning and risk management.

Petroplus's story serves as a stark reminder of the volatility and risks in the oil refining industry. The company's failure underscores the importance of strategic adaptability. The collapse of Petroplus highlights the need for strong financial planning and risk management.

- Market Position: Once a major player in Europe.

- Risks: High oil price volatility and regulatory changes.

- Outlook: No future operations; cautionary tale.

- Financial Performance: The company's financial performance was severely impacted by its inability to manage the risks inherent in the oil refining sector.

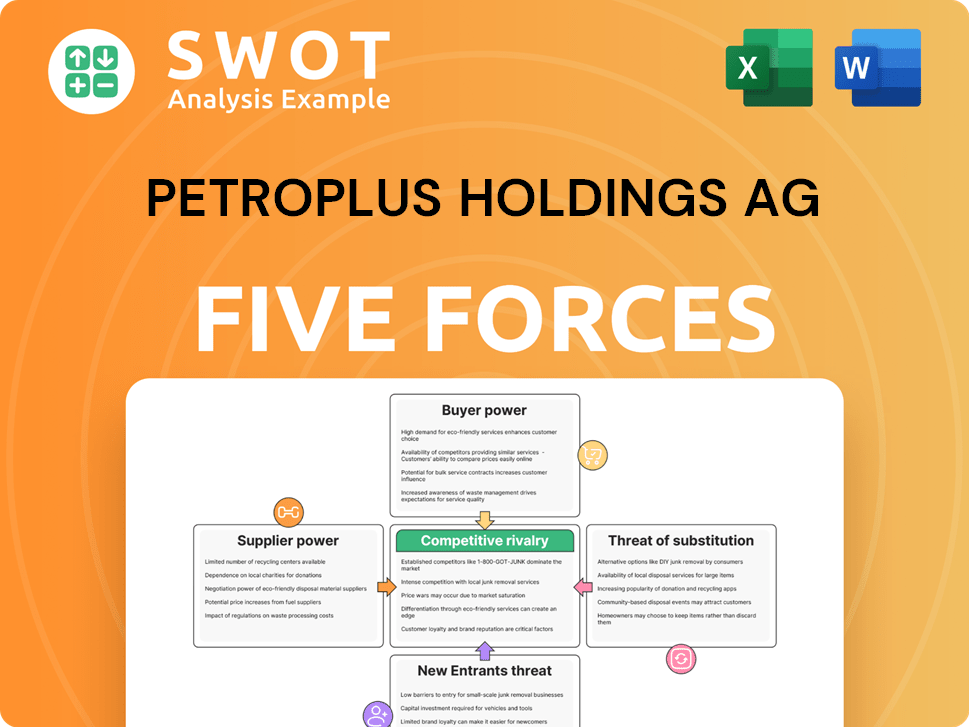

Petroplus Holdings AG Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Petroplus Holdings AG Company?

- What is Competitive Landscape of Petroplus Holdings AG Company?

- What is Growth Strategy and Future Prospects of Petroplus Holdings AG Company?

- What is Sales and Marketing Strategy of Petroplus Holdings AG Company?

- What is Brief History of Petroplus Holdings AG Company?

- Who Owns Petroplus Holdings AG Company?

- What is Customer Demographics and Target Market of Petroplus Holdings AG Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.