QCR Holdings Bundle

Unlocking the Potential of QCR Holdings: How Does It Thrive?

QCR Holdings, Inc. (NASDAQ: QCRH) isn't just another player in the financial game; it's a regional powerhouse with a proven track record. Achieving a record net income of $113.9 million in 2024, QCR Holdings demonstrates its robust financial performance and strategic prowess. This deep dive explores the inner workings of QCR Holdings, revealing how it generates value in the competitive financial services landscape.

With $9.2 billion in assets as of March 31, 2025, including $6.8 billion in loans and $7.3 billion in deposits, QCR Holdings Inc. continues to expand its footprint across the Midwest. Understanding the QCR Holdings business model is key for investors looking at QCR Holdings SWOT Analysis, customers seeking reliable banking partners, and anyone interested in the QCR financial services sector. This analysis will dissect the company's operations, revenue streams, and strategic moves, offering a comprehensive QCR Holdings company overview.

What Are the Key Operations Driving QCR Holdings’s Success?

QCR Holdings Company creates value through its multi-bank holding structure. It operates via wholly-owned subsidiary banks, including Quad City Bank & Trust, Cedar Rapids Bank & Trust, Community State Bank, and Guaranty Bank. These banks focus on communities across Iowa, Illinois, and Missouri, offering a variety of financial products and services.

The core offerings of QCR Holdings include deposit accounts, various loan products (commercial and consumer), and trust and asset management services. The operational model emphasizes local charter autonomy for its subsidiary banks. This allows each bank to be responsive to local needs, fostering strong relationships and attracting both clients and experienced bankers.

This localized approach is supported by efficient centralized group operations. QCR Holdings also engages in commercial leasing through m2 Equipment Finance, LLC. This subsidiary, based in Waukesha, Wisconsin, focuses on direct financing lease contracts and equipment financing agreements. This structure helps QCR Holdings provide tailored financial solutions and differentiate itself in the market.

QCR Holdings uses a relationship-driven model, emphasizing local charter autonomy for its subsidiary banks. This approach allows each bank to be agile and responsive to the specific needs of its local client base. This fosters strong relationships and attracts both clients and experienced bankers, contributing to consistent growth.

The company engages in commercial leasing through m2 Equipment Finance, LLC, based in Waukesha, Wisconsin. This subsidiary focuses on direct financing lease contracts and equipment financing agreements. This adds another dimension to QCR Holdings' financial services offerings.

QCR Holdings has demonstrated robust core deposit growth. In the first quarter of 2025, the company experienced a 20% annualized increase. This operational effectiveness translates into customer benefits through tailored financial solutions and market differentiation.

Customers benefit from tailored financial solutions and a strong community banking experience backed by the capabilities of a larger holding company. This unique approach has enabled QCR Holdings to attract high-quality clients and bankers. To understand more about the company's target market, read this article: Target Market of QCR Holdings.

QCR Holdings combines the personalized service of a small community bank with the innovative products and services of larger institutions. This 'best of both worlds' approach is a key differentiator. The company's operational uniqueness contributes to consistent growth and strong financial performance.

- Focus on local charter autonomy for subsidiary banks.

- Offers a wide array of financial products and services.

- Engages in commercial leasing through m2 Equipment Finance, LLC.

- Demonstrated robust core deposit growth in 2025.

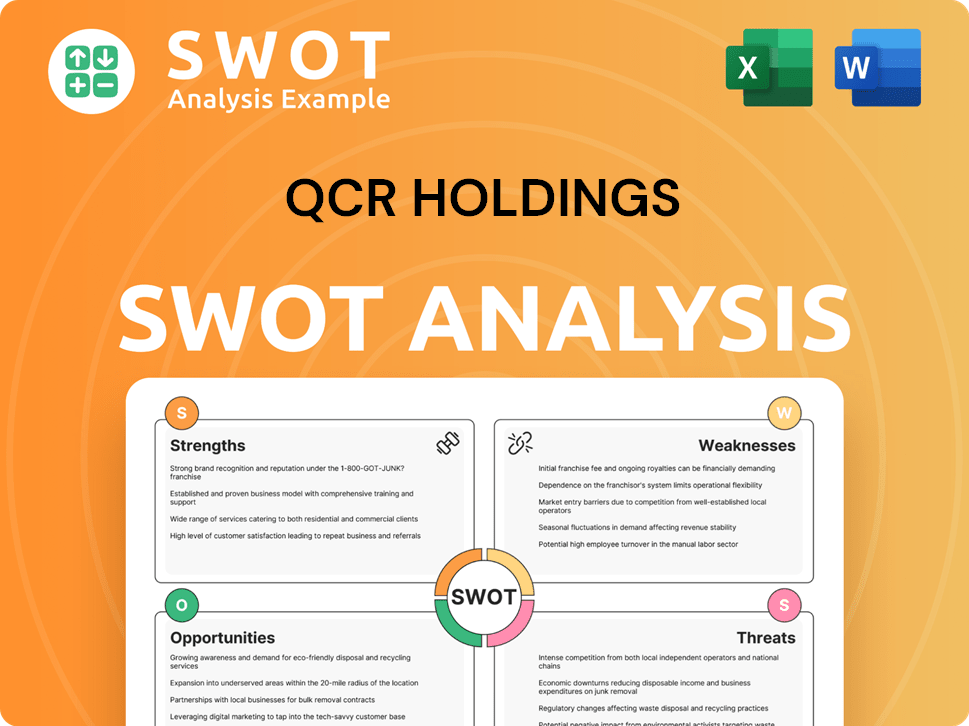

QCR Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does QCR Holdings Make Money?

The revenue streams and monetization strategies of QCR Holdings Company are multifaceted, designed to maximize profitability and shareholder value. The company leverages a diversified approach that includes interest income from lending and leasing, along with significant noninterest income from wealth management and capital markets activities. For the full year 2024, the company demonstrated strong financial health, reporting a record net income.

QCR Holdings Inc. focuses on a relationship-driven model, utilizing its local charter autonomy to tailor solutions by market. This approach attracts both bankers and clients, enabling competitive offerings against larger national and regional banks. The company aims to grow fee income by at least 6% annually, further diversifying its earnings power. This strategic focus on diverse revenue streams, particularly noninterest income, contributes to its upper quartile performance compared to industry peers.

As of March 31, 2025, QCR Holdings' trailing 12-month revenue was $333 million, reflecting a robust financial performance. The company's total revenue for the full fiscal year 2024 reached $337.7 million, underscoring its strong market position and effective revenue generation strategies. This financial success is a testament to the company's strategic focus on diverse revenue streams and its ability to adapt to market dynamics.

QCR Holdings generates revenue through several key streams, each contributing significantly to its overall financial performance. These streams include net interest income, wealth management, capital markets, and other noninterest income. The diversification of these revenue sources allows the company to maintain financial stability and capitalize on various market opportunities.

- Net Interest Income: This is the primary revenue source, derived from the difference between interest earned on loans and investments and interest paid on deposits and borrowed funds. For the first quarter of 2025, net interest income totaled $60.0 million. The adjusted net interest margin (NIM) on a tax-equivalent yield (TEY) basis expanded to 3.41% in Q1 2025.

- Wealth Management Revenue: This stream comes from trust and asset management services. The wealth management business demonstrated strong growth, with a 14% annualized revenue increase in the first quarter of 2025. As of March 31, 2024, the company had $5.8 billion in Wealth Management Assets Under Management (AUM), growing to $6.3 billion by December 31, 2024.

- Capital Markets Revenue: QCR Holdings generates revenue from its capital markets activities, which include swap fees generated through its Low-Income Housing Tax Credit (LIHTC) lending program. This segment contributed significantly, with $20.6 million in revenue in the fourth quarter of 2024.

- Other Noninterest Income: This category encompasses various fees and service charges. Noninterest income for the first quarter of 2025 was $16.9 million.

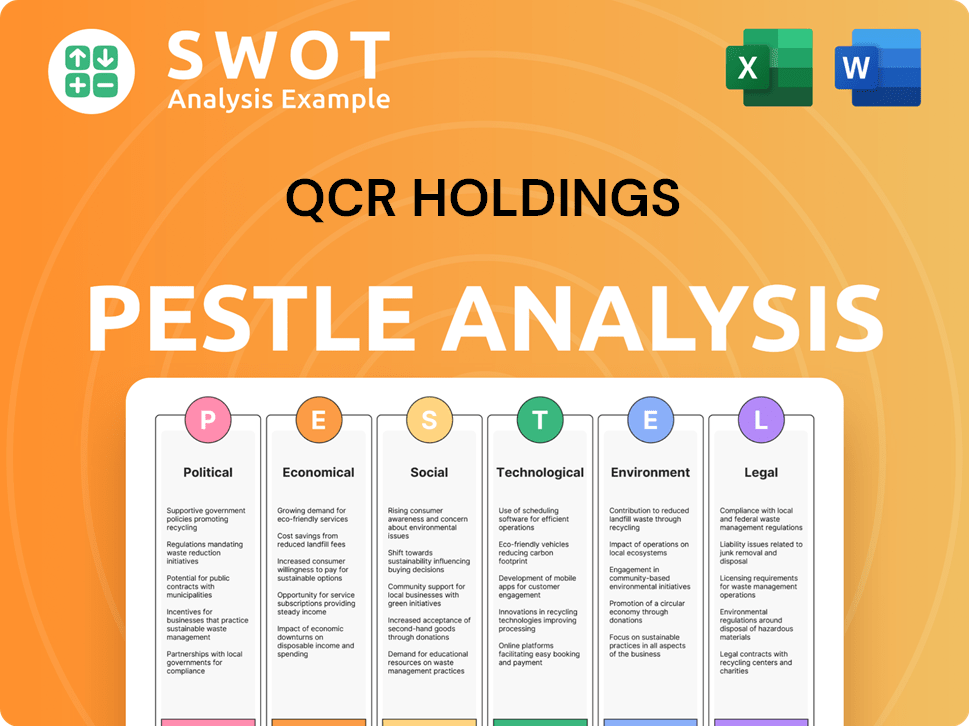

QCR Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped QCR Holdings’s Business Model?

Established in 1993, QCR Holdings has charted a course marked by strategic milestones and significant moves. These actions have been instrumental in shaping its operational framework and financial outcomes. A core element of its growth strategy involves strategic acquisitions, which have consistently expanded its regional footprint and service offerings.

The company has adeptly navigated various operational and market challenges, including adapting to fluctuating interest rates and managing credit quality. For instance, in the fourth quarter of 2024, QCR Holdings recorded a provision for credit losses of $5.2 million, reflecting adjustments to the credit environment. Despite these hurdles, the company has maintained a robust credit culture.

QCR Holdings' competitive advantages stem from a combination of factors that set it apart in the financial services sector. These elements contribute to its ability to attract clients and maintain a strong market position.

QCR Holdings' strategic acquisitions, such as the 2022 purchase of Guaranty Federal Bancshares, demonstrate its commitment to growth. The merger of Guaranty Bank with Springfield First Community Bank, acquired in 2018, showcases a pattern of expansion. These moves have broadened its regional presence and enhanced its service offerings.

The company has focused on adapting to changing interest rates and managing credit quality. In Q4 2024, a $5.2 million provision for credit losses was recorded due to loan growth and increased criticized loan balances. These actions reflect its proactive approach to navigating economic shifts. QCR Holdings maintains a disciplined credit culture.

QCR Holdings' competitive edge is built on its relationship-driven model and local autonomy. This approach allows subsidiary banks to be agile and responsive. Diversified revenue streams, particularly from Capital Markets and Wealth Management, enhance profitability. Consistent financial performance, such as a 15.4% Adjusted Net Income CAGR from 2019 to Q1 2024, supports its market position.

QCR Holdings continuously adapts to new trends and competitive threats. Strategic initiatives include enhancing liquidity and reducing funding costs. This adaptability, combined with a strong business model, allows QCR Holdings to maintain its competitive edge.

The company's competitive advantages are multifaceted, contributing to its sustained success and market position. These advantages include a relationship-driven model and diversified revenue sources.

- Relationship-Driven Model and Local Autonomy: This model enables subsidiary banks to be agile and responsive, attracting top bankers and clients.

- Diversified Revenue Sources: QCR Holdings benefits from diverse fee revenue streams, especially from Capital Markets and Wealth Management.

- Consistent Financial Performance: The company has a history of profitable growth, demonstrated by metrics like a 15.4% Adjusted Net Income CAGR from 2019 to Q1 2024.

- Strategic Market Position: QCR Holdings holds a leading market position in growing mid-sized metro markets across the Midwest.

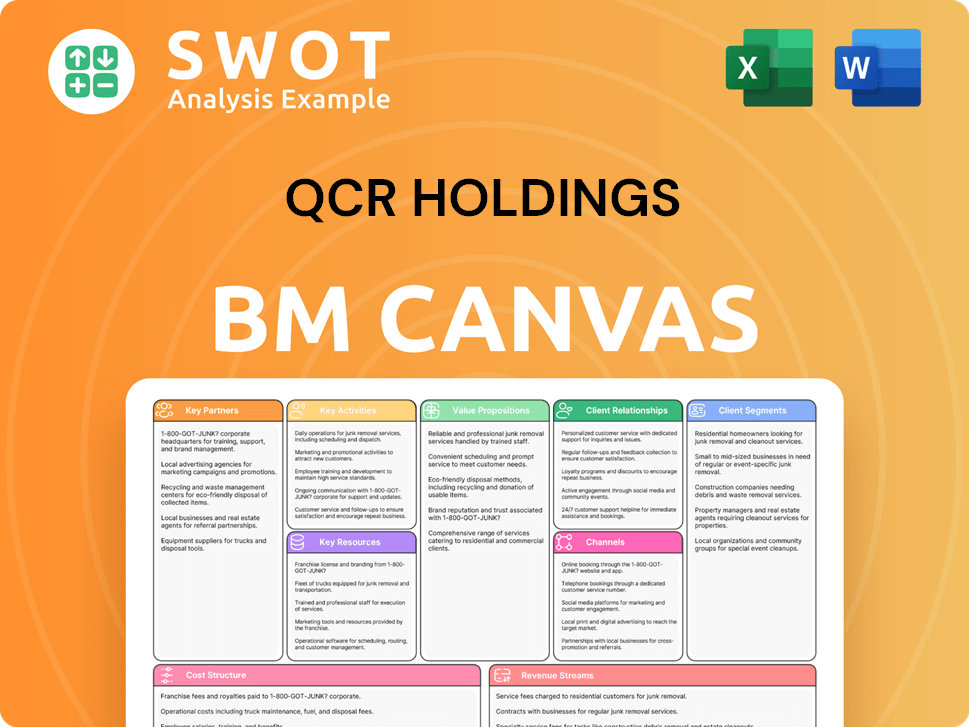

QCR Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is QCR Holdings Positioning Itself for Continued Success?

The QCR Holdings maintains a strong position in the regional banking sector, particularly in Illinois, Iowa, and Missouri. As of March 31, 2025, the company reported assets of $9.2 billion, loans of $6.8 billion, and deposits of $7.3 billion, highlighting its significant presence. Its strategy of customized solutions and a relationship-driven approach allows it to compete effectively.

However, the company faces challenges such as increased competition from traditional banks and non-bank competitors, along with regulatory changes and technological disruptions. Macroeconomic uncertainties, including interest rate fluctuations, also pose risks. For instance, a $9.6 million decrease in accumulated other comprehensive income (AOCI) was seen during the fourth quarter of 2024 due to interest rate changes.

QCR Holdings, or QCR bank, holds a solid market position in the regional banking sector, especially in Illinois, Iowa, and Missouri. The company's focus on relationship-driven banking and local charter autonomy allows it to compete effectively with larger national and regional banks. The company's approach to offering customized solutions by market contributes to customer loyalty.

QCR Holdings faces risks from increased competition from traditional banks and non-bank competitors, such as credit unions and fintech companies. Regulatory changes and technological disruptions also pose challenges. Macroeconomic uncertainties, like interest rate changes, can impact the value of its securities portfolio.

QCR Holdings is focused on sustaining and expanding its revenue generation through strategic initiatives. The company anticipates continued margin expansion and projects an annualized loan growth rate of 4% to 6% for the second quarter of 2025. Wealth management growth is expected to be fueled by strategic investments in specific markets.

Leadership is committed to disciplined expense management, with noninterest expense expected to be between $50 million and $53 million for the next quarter. The company aims to grow loans by 9% per year, funded by core deposits, and increase fee income by at least 6% annually while limiting expense growth to no more than 5%. The focus is also on growing capital and targeting tangible common equity (TCE) in the top quartile of its peer group.

QCR Holdings is aiming for significant growth and financial stability. The company is focused on expanding its revenue through strategic initiatives, anticipating margin expansion, and projecting an annualized loan growth rate of 4% to 6% for the second quarter of 2025.

- Loan growth target of 9% per year.

- Fee income growth of at least 6% annually.

- Expense growth limited to no more than 5%.

- Noninterest expense expected to be between $50 million and $53 million next quarter.

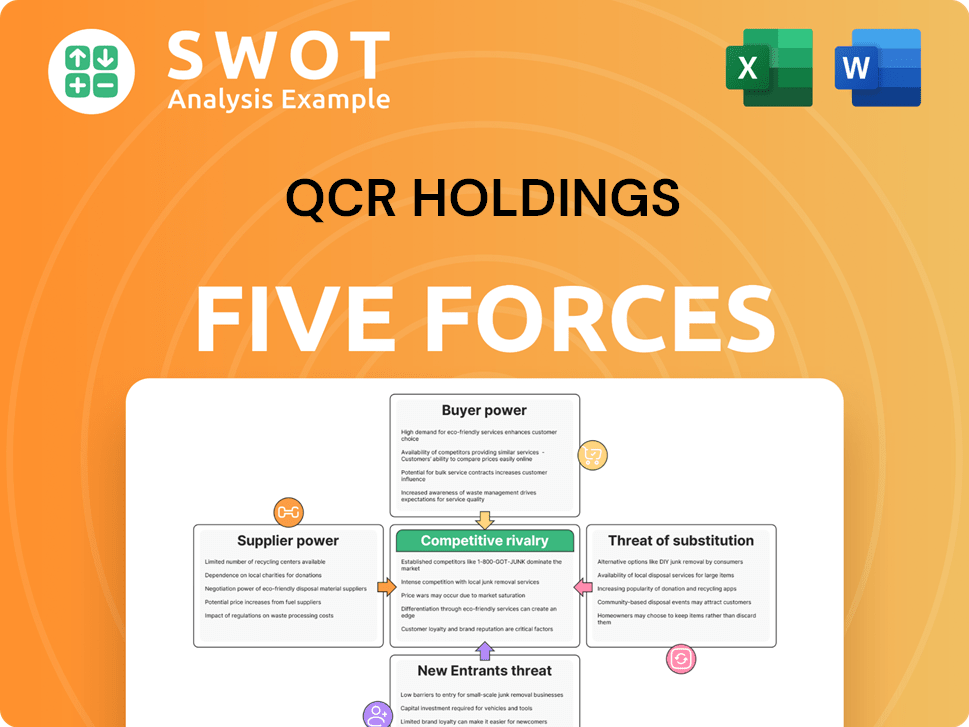

QCR Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of QCR Holdings Company?

- What is Competitive Landscape of QCR Holdings Company?

- What is Growth Strategy and Future Prospects of QCR Holdings Company?

- What is Sales and Marketing Strategy of QCR Holdings Company?

- What is Brief History of QCR Holdings Company?

- Who Owns QCR Holdings Company?

- What is Customer Demographics and Target Market of QCR Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.