Sallie Mae Bundle

How Does Sallie Mae Shape the Future of Education?

Sallie Mae, a titan in the education finance sector, has evolved significantly since its inception. From a government-sponsored entity to a leading private financial services company, its journey reflects the changing landscape of Sallie Mae SWOT Analysis. This evolution has positioned Sallie Mae as a key player in providing

Understanding how Sallie Mae operates is crucial for anyone navigating the complexities of

What Are the Key Operations Driving Sallie Mae’s Success?

The core operations of the company revolve around originating, servicing, and collecting private education loans. It also offers various financial products to support education savings. The primary value proposition is providing accessible and flexible financing options for students and families to cover higher education costs, especially when federal aid isn't sufficient.

Its main offerings include different private student loan options, often tailored to specific academic needs or credit profiles, and savings accounts designed for educational expenses. The company serves a broad customer segment, from undergraduate and graduate students to their parents and guardians. The company's operations are supported by a robust technological infrastructure for loan origination, servicing, and collection.

Operationally, the company employs technology for loan origination, including application processing, credit assessment, and fund disbursement. Servicing involves managing loan accounts, processing payments, and providing customer support. Collection activities are crucial for timely loan repayment, which is vital for the company's financial health. Sophisticated data analytics are used for risk assessment and personalized customer engagement. The company partners with colleges and universities, integrating its financial solutions into their student aid processes, which acts as a significant distribution channel.

This involves processing applications, assessing creditworthiness, and disbursing funds. The company uses a technology-driven approach to streamline the application process. This ensures efficiency and accuracy in evaluating potential borrowers and their eligibility for Sallie Mae loans.

This includes managing loan accounts, processing payments, and providing customer support throughout the loan lifecycle. The company offers various loan payment options and resources to help borrowers manage their student loans effectively. Customer service plays a key role in assisting borrowers with their loan repayment.

The company employs strategies to ensure timely loan repayment. This is essential for maintaining the financial health of the company. The collection process includes various methods to recover outstanding loan balances.

Offers a range of private student loans and savings accounts for educational expenses. Provides resources and tools to help students and families plan and manage their educational finances. The company aims to offer comprehensive financial solutions for higher education.

The company distinguishes itself by offering a variety of loan products with different repayment options and terms. It also provides resources for financial literacy. These factors contribute to a streamlined application process and dedicated support, helping students and families navigate the complexities of education financing. For more details, you can also read about the Marketing Strategy of Sallie Mae.

- Streamlined application process.

- Flexible repayment plans.

- Dedicated customer support.

- Financial literacy resources.

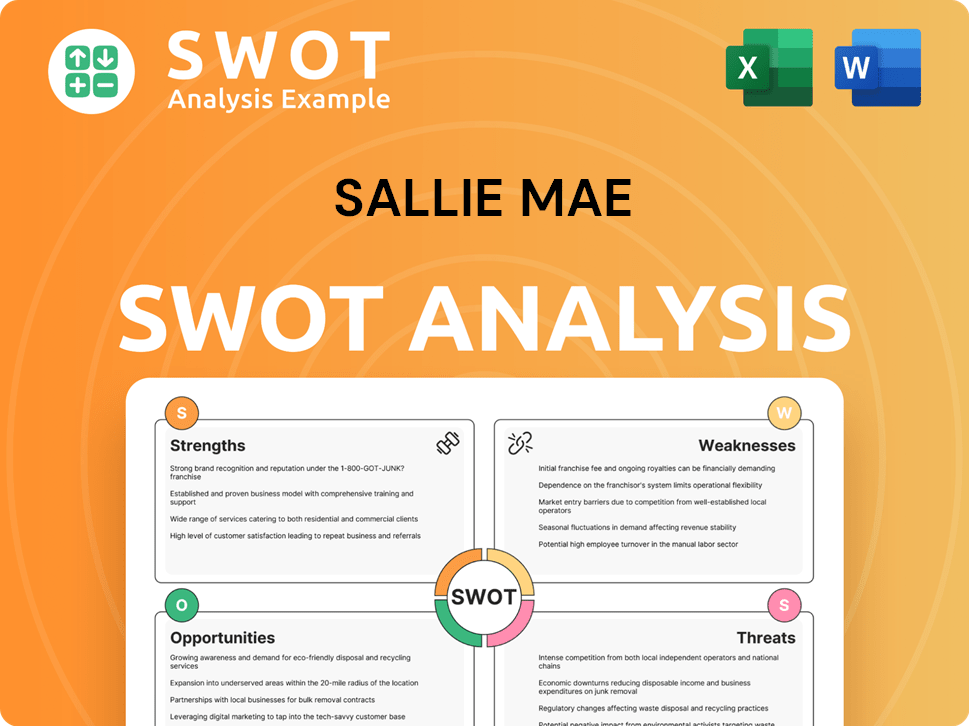

Sallie Mae SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Sallie Mae Make Money?

The primary revenue source for Sallie Mae comes from its private education loan portfolio. The company primarily generates income through the interest earned on these Sallie Mae loans. This revenue stream is a key indicator of the company's financial health and its ability to serve its borrowers.

In addition to interest income, Sallie Mae also generates revenue from other sources, although these typically contribute a smaller portion to the overall revenue. This includes fees associated with loan origination or servicing, and income from deposit products such as savings accounts and certificates of deposit.

The company's monetization strategy focuses on attracting and retaining borrowers through competitive interest rates and flexible loan terms, while effectively managing its cost of funds. Sallie Mae also employs cross-selling strategies by offering savings products to its loan customers, aiming to capture a larger share of their financial needs related to education.

Net interest income for the full year 2024 was $985.4 million, an increase from $945.3 million in 2023. This growth reflects higher average asset yields and an increase in the average balance of its loan portfolio.

The loan portfolio reached $22.6 billion as of December 31, 2024. This represents the total outstanding principal of the private education loans that Sallie Mae manages.

The net interest margin for 2024 was 4.97%. This is a key profitability metric, indicating the difference between the interest income earned and the interest expense paid on the funds used to finance the loans.

Private education loan originations for the full year 2024 totaled $5.3 billion. This demonstrates the company's ability to attract new borrowers and grow its loan portfolio.

Sallie Mae offers deposit products, such as savings accounts and certificates of deposit, which help fund its lending activities. These products also contribute to the company's overall revenue.

The company focuses on attracting and retaining borrowers through competitive interest rates and flexible loan terms. This strategy helps Sallie Mae maintain a strong market position.

Sallie Mae's financial performance is closely tied to its ability to manage its loan portfolio effectively and attract new borrowers. Understanding the competitive landscape is crucial for assessing Sallie Mae's position. You can learn more about the Competitors Landscape of Sallie Mae.

- Interest Income: The primary revenue source, driven by the interest earned on private student loans.

- Loan Originations: Growing the loan portfolio through new originations is a key strategy.

- Net Interest Margin Management: Maintaining a healthy net interest margin is crucial for profitability.

- Cross-Selling: Offering savings products to loan customers to increase the share of their financial needs.

- Competitive Rates and Terms: Attracting and retaining borrowers through favorable loan conditions.

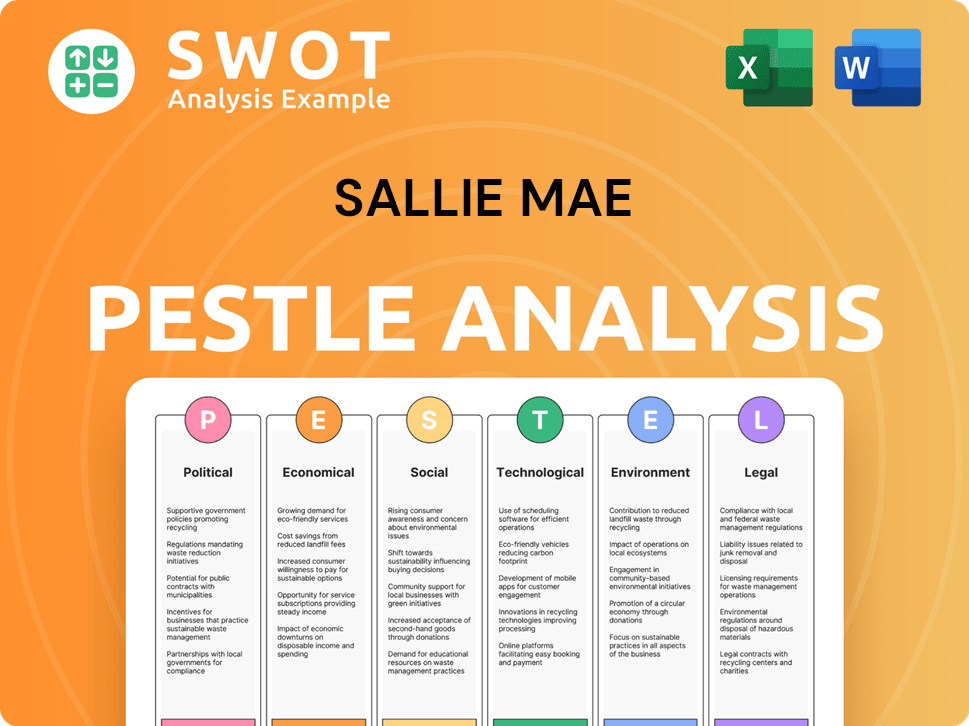

Sallie Mae PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Sallie Mae’s Business Model?

The journey of the company has been marked by significant milestones, most notably its shift from a government-sponsored enterprise to a fully privatized entity in 2004. This transition provided greater operational flexibility, allowing the company to respond more effectively to market demands. A pivotal strategic move was the 2014 spin-off of Navient, which separated the company's legacy federal student loan servicing business from its private education loan origination and servicing operations. This strategic realignment allowed the company to focus solely on its private lending segment.

Operational challenges have included navigating the evolving regulatory landscape within the financial and education sectors, as well as adapting to economic shifts that influence loan demand and repayment rates. The company has had to adjust to changes in interest rate environments and consumer credit trends. The company's competitive advantages stem from its established brand recognition, its extensive experience in private student lending, and its strong relationships with colleges and universities. These relationships provide a direct channel for reaching prospective borrowers.

The company continues to adapt to new trends by emphasizing financial literacy resources for students and families and by offering a variety of loan products designed to meet diverse financial needs, thus sustaining its business model in a competitive market. The company's focus on private student loans and its ability to adapt to market changes have been key to its longevity and success in the education finance sector. Understanding Growth Strategy of Sallie Mae is important to understand its long-term perspective.

Privatization in 2004 provided operational flexibility. The 2014 spin-off of Navient allowed a focus on private education loans. These moves streamlined operations and strategic direction.

Focusing on private student loans, the company streamlined its business model. This allowed for better adaptation to market changes. The company has been able to maintain its position in the market.

Established brand recognition, extensive experience, and strong college relationships are key. Technology enhances application and servicing. Financial literacy resources and diverse loan products support its model.

Navigating regulatory changes and economic shifts is crucial. Adapting to interest rate environments and consumer credit trends is important. The company must stay flexible.

The company has a significant market share in private student loans. The company's loan portfolio includes a diverse range of loan products. It is important to understand the company's financial performance.

- The company's loan portfolio is substantial, with a focus on private student loans.

- The company's interest rates vary based on the borrower's creditworthiness and the loan terms.

- The company offers various loan repayment options, including deferment and forbearance.

- The company provides resources for financial literacy to help borrowers manage their loans.

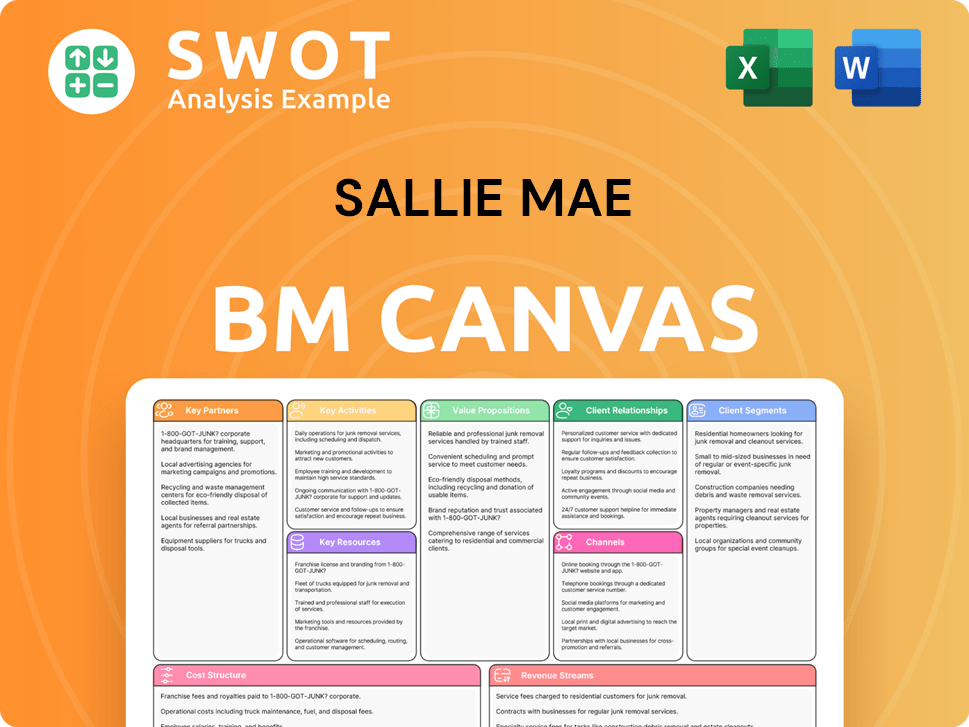

Sallie Mae Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Sallie Mae Positioning Itself for Continued Success?

Sallie Mae holds a prominent position in the private education loan market, competing with traditional banks and specialized lenders. The company has a substantial market share due to its long-standing presence and brand recognition, benefiting from customer loyalty built through its focus on education financing. Its influence primarily resides within the United States, shaping the landscape of higher education funding.

Key risks impacting the company's operations include shifts in interest rates, which affect its net interest margin, and changes in federal education funding policies. Regulatory changes related to consumer lending and student loan practices also pose a continuous risk. The emergence of new competitors or disruptive financial technologies further challenges its market position. For the full year 2024, the company reported a net income of $795 million.

The company is a significant player in the private student loan market, competing with established banks and specialized lenders. Its market share is considerable, underpinned by its long-term presence and brand recognition. Customer loyalty is a key strength, stemming from its focus on education financing and dedicated customer service.

Interest rate fluctuations pose a risk, influencing the net interest margin. Changes in federal funding policies can impact the demand for private Sallie Mae loans. Regulatory changes and competition from new entrants or fintech innovations also present challenges. These factors could affect the company's financial performance.

The company focuses on expanding its private education loan portfolio and enhancing its digital platforms. Strategic initiatives include optimizing loan offerings and expanding partnerships with educational institutions. Investing in technology aims to streamline operations and improve customer engagement. The goal is to sustain profitability by remaining a leading provider of private education funding.

The company reported a net income of $795 million for the full year 2024. The company aims to sustain and expand its profitability by continuing to be a leading provider of private education funding solutions, adapting to market dynamics, and maintaining strong credit quality in its loan portfolio. The company's focus remains on adapting to market dynamics.

The company is focused on several strategic initiatives to maintain and grow its market position. These include optimizing its loan offerings to meet the evolving needs of students and families. Expanding partnerships with educational institutions is another key focus, alongside investments in technology to streamline operations and enhance customer engagement.

- Optimizing loan offerings

- Expanding partnerships with educational institutions

- Investing in technology for streamlined operations

- Enhancing customer engagement

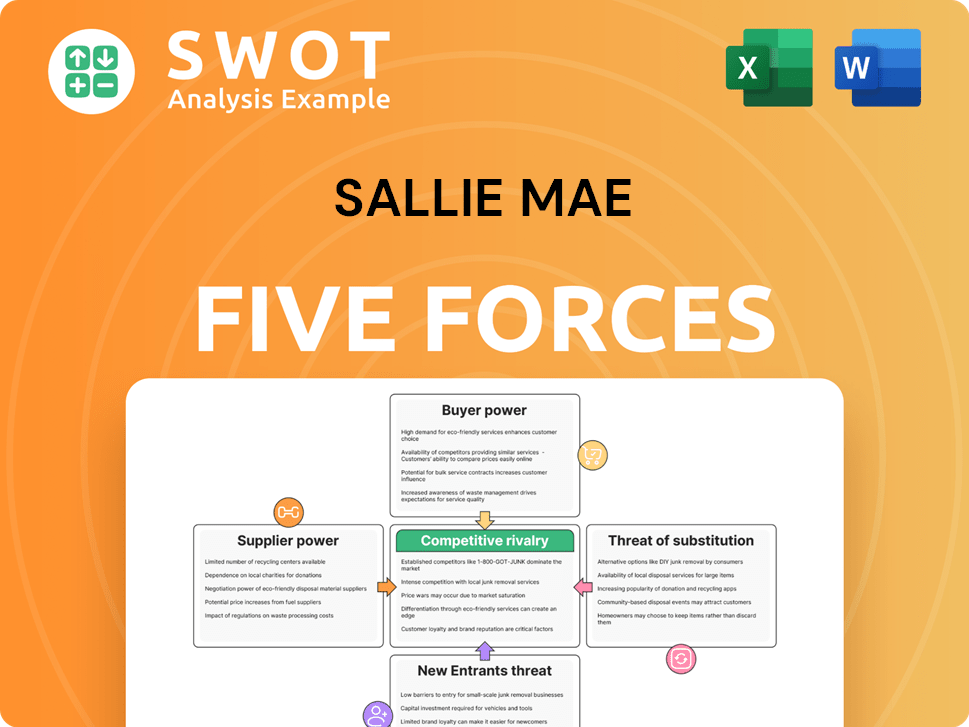

Sallie Mae Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sallie Mae Company?

- What is Competitive Landscape of Sallie Mae Company?

- What is Growth Strategy and Future Prospects of Sallie Mae Company?

- What is Sales and Marketing Strategy of Sallie Mae Company?

- What is Brief History of Sallie Mae Company?

- Who Owns Sallie Mae Company?

- What is Customer Demographics and Target Market of Sallie Mae Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.