Transcontinental Bundle

Decoding Transcontinental: How Does This Canadian Giant Thrive?

Transcontinental Inc. isn't just another name; it's a powerhouse in North America's flexible packaging and printing industries, and a significant player in Canadian French-language educational publishing. With revenues reaching C$2.768 billion in fiscal 2023, understanding its inner workings is crucial for anyone interested in the financial landscape. This deep dive explores the Transcontinental SWOT Analysis, its business model, and its strategic positioning.

Exploring Transcontinental's operations reveals a complex yet fascinating interplay of packaging, printing, and publishing, all contributing to its impressive financial performance. The company's success is tied to its ability to navigate global logistics and international trade, managing its supply chain effectively. Analyzing the Transcontinental business model provides valuable insights into how this Canadian company adapts to challenges and seizes opportunities in a competitive market, making it a compelling subject for investors and industry observers alike.

What Are the Key Operations Driving Transcontinental’s Success?

The core of the Transcontinental company lies in its ability to create and deliver value through its flexible packaging, printing, and publishing divisions. This diversified approach allows it to serve a wide array of customer segments, providing tailored solutions that meet specific needs. The company's operational model is designed to integrate design, manufacturing, and distribution, offering end-to-end solutions that enhance product quality and efficiency.

Transcontinental operations are characterized by advanced manufacturing processes, material sourcing, and specialized printing technologies. The flexible packaging segment focuses on innovation, creating solutions for industries such as food, beverage, and industrial goods. Simultaneously, the printing division, as Canada's largest, offers comprehensive services, leveraging extensive press capabilities and distribution networks. This integrated strategy enables the company to respond effectively to market demands and maintain a competitive edge.

The Transcontinental business model emphasizes sustainability and customer-centricity. In flexible packaging, the company focuses on creating sustainable solutions, such as recyclable and compostable films, to meet the growing demand for environmentally friendly products. In printing, the scale and technological investments allow for cost-effective production and broad reach across Canada. These capabilities translate into enhanced product quality, operational efficiency, and a commitment to sustainability, which collectively contribute to its market differentiation and customer loyalty.

The flexible packaging segment focuses on product protection, shelf appeal, and sustainability. It utilizes advanced manufacturing processes and specialized printing technologies. The supply chain emphasizes efficiency and responsiveness to ensure timely delivery of customized solutions.

As Canada's largest printing operation, it offers a comprehensive suite of services. It leverages extensive press capabilities and robust distribution networks. This division supports newspapers, magazines, flyers, and marketing materials.

This segment concentrates on French-language educational materials. It provides valuable content and resources to the education sector in Canada. The operations involve content development, editorial processes, and tailored distribution channels.

The company is committed to sustainable practices in its operations. This includes the development of recyclable and compostable films in the packaging segment. These efforts align with the growing market demand for environmentally friendly products.

The company's value proposition centers on enhanced product quality, operational efficiency, and a commitment to sustainability. These factors contribute to market differentiation and customer loyalty. For a deeper dive into how the company strategizes its market approach, consider reading about the Marketing Strategy of Transcontinental.

- Customer-Centric Solutions: Tailored packaging and printing solutions that meet specific customer needs.

- Operational Excellence: Integrated design, manufacturing, and distribution capabilities for end-to-end solutions.

- Sustainability Focus: Emphasis on eco-friendly materials and practices to meet market demands.

- Market Leadership: As of 2024, the company holds a significant position in the Canadian printing market.

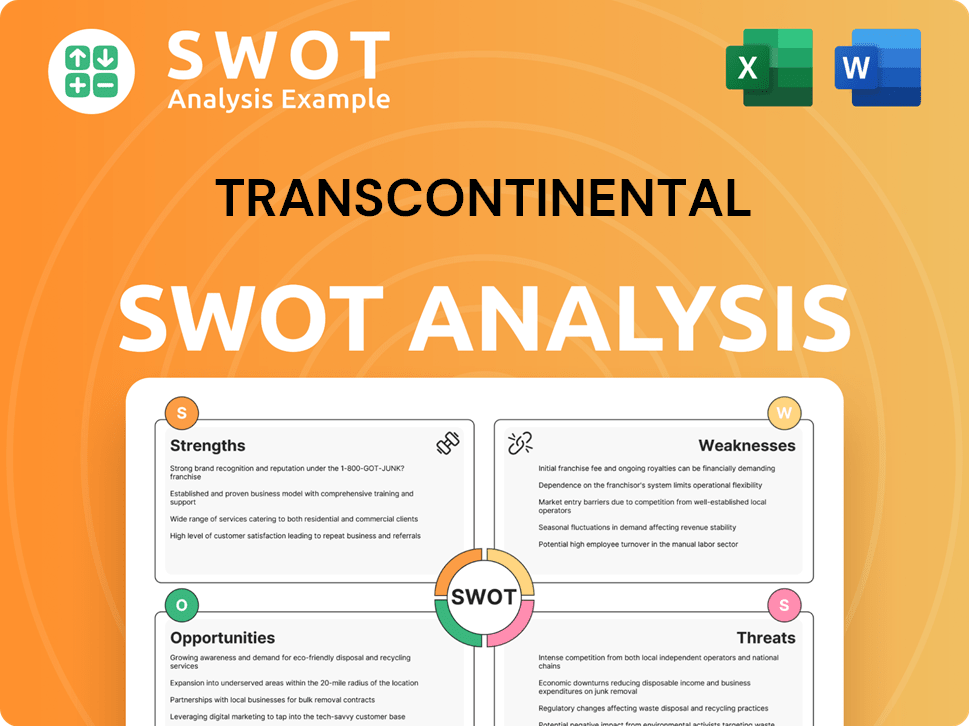

Transcontinental SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Transcontinental Make Money?

The core of the Transcontinental company's financial strategy lies in its diverse revenue streams and how it monetizes them. The company's approach is multifaceted, focusing on flexible packaging, printing, and educational publishing. These segments each contribute differently to the overall financial performance, with flexible packaging being the dominant force.

For fiscal year 2023, the Transcontinental business generated C$2.768 billion in total revenues. Flexible packaging was the largest contributor, bringing in C$1.854 billion, which accounted for approximately 67% of the total revenue. The printing sector contributed C$823.1 million, or about 30%, while the publishing sector added C$90.9 million, representing around 3% of the total.

The company's monetization strategies are tailored to each sector. In flexible packaging, the focus is on direct sales of customized solutions to manufacturers and brands. Printing services are monetized through large-scale contracts, advertising inserts, and direct mail services. Educational publishing generates revenue by selling books and digital resources to educational institutions.

Transcontinental operations have strategically shifted to emphasize higher-growth areas like flexible packaging. This is evident in the company's divestiture of certain printing assets to concentrate on more profitable sectors. The company also explores cross-selling opportunities between its printing and packaging clients to leverage existing customer relationships and expand service offerings.

- The flexible packaging segment's significant revenue share highlights its importance to the company's financial health.

- The printing sector's contribution remains substantial, though the company is strategically adjusting its focus.

- The publishing segment, though smaller, provides a diversified revenue stream.

- The company's strategic moves, such as divesting printing assets, aim to optimize its portfolio and enhance profitability.

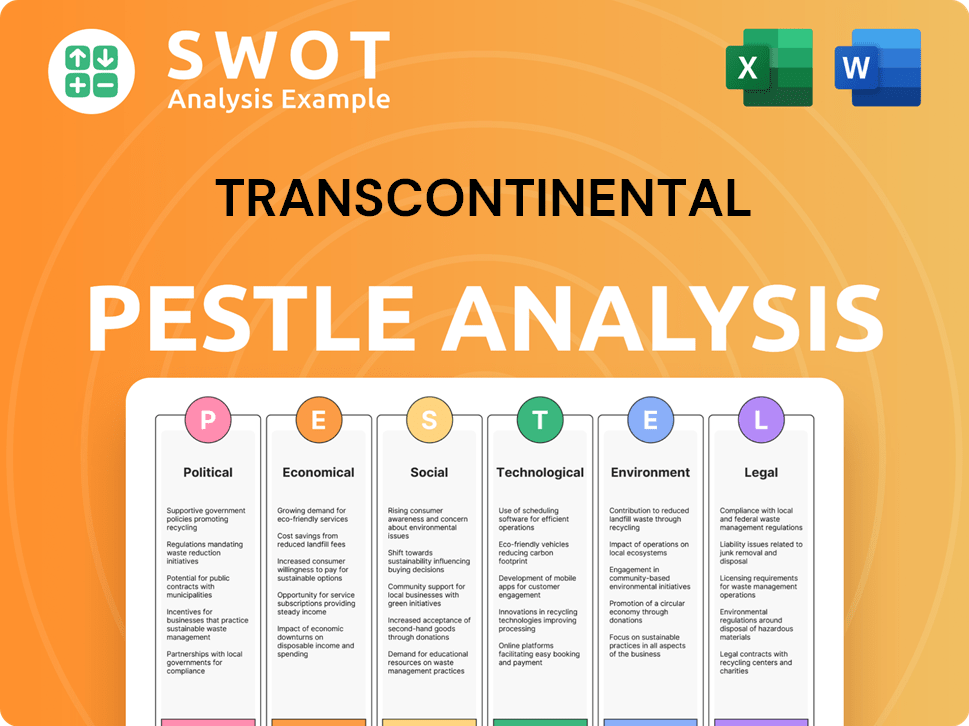

Transcontinental PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Transcontinental’s Business Model?

The evolution of the Transcontinental company has been marked by significant strategic shifts and key milestones. A pivotal move was its expansion into flexible packaging, notably through the acquisition of Coveris Americas in 2018. This strategic decision transformed the company into a leading player in the North American flexible packaging market, diversifying its revenue streams and adapting to changing market demands.

Transcontinental operations have also faced challenges, including fluctuations in raw material costs and shifts in demand within traditional printing segments. The company has responded by focusing on operational efficiencies, investing in advanced technologies, and optimizing its manufacturing footprint. These efforts aim to enhance production capabilities and reduce environmental impact.

Transcontinental business has consistently adapted to market changes. The company's strategic moves have been crucial in shaping its current position. This includes a focus on sustainability and technological advancements to maintain a competitive edge.

The acquisition of Coveris Americas in 2018 was a transformative event, significantly expanding Transcontinental's presence in flexible packaging. This move helped the company to diversify its revenue sources and adapt to the evolving market conditions. This strategic shift was a crucial step in the company's growth strategy.

Transcontinental has focused on operational efficiencies and technological investments to enhance its capabilities and reduce environmental impact. The company has also prioritized innovation in sustainable packaging solutions. Furthermore, it has invested in research and development for sustainable packaging and explored digital solutions.

The company's extensive operational scale and diverse product portfolio give it a competitive advantage. Its commitment to sustainability, through recyclable and compostable packaging, positions it well in the environmentally conscious market. This approach is part of a broader strategy, as detailed in Growth Strategy of Transcontinental.

In 2024, the packaging sector showed resilience, with companies like Transcontinental focusing on sustainable practices. The company's financial performance is closely tied to its ability to manage costs and adapt to market changes. The company's investments in technology and sustainable solutions are expected to drive future growth.

Transcontinental has strategically adapted to market challenges by focusing on operational efficiencies and technological advancements. This includes investments in state-of-the-art equipment to enhance production capabilities and reduce environmental impact. The company's focus on sustainability and innovation is crucial for maintaining its competitive position.

- Focus on operational efficiencies to manage costs.

- Investment in advanced technologies to improve production.

- Innovation in sustainable packaging solutions.

- Exploration of digital solutions in its publishing segment.

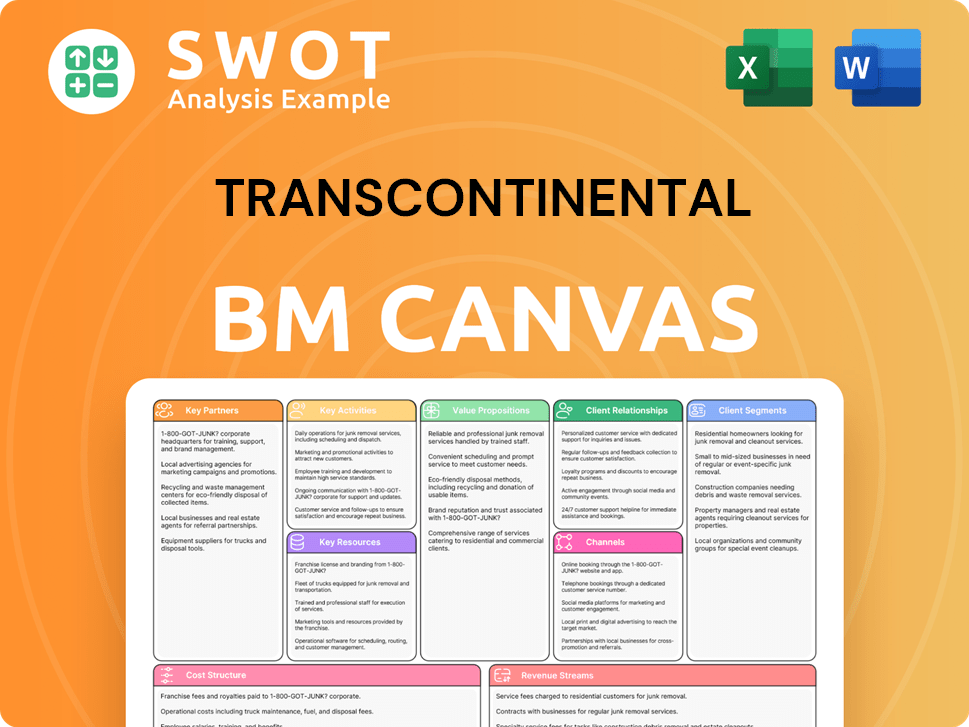

Transcontinental Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Transcontinental Positioning Itself for Continued Success?

The Transcontinental company holds a leading position in the North American flexible packaging market and is the largest printer in Canada. This strong market presence is supported by strategic acquisitions and customer loyalty, especially in its long-standing printing relationships and its growing base of flexible packaging clients. Its operations are primarily focused in Canada and the United States, giving it a solid base for Transcontinental operations.

However, Transcontinental business faces various risks, including fluctuations in raw material prices, particularly resins used in flexible packaging, and ongoing inflation. Competition from other large packaging and printing companies, along with potential technological disruptions, also poses challenges. Regulatory changes concerning environmental standards for packaging could further impact the company, although its focus on sustainable solutions aims to mitigate these risks.

As of the latest reports, the company's market share in flexible packaging has grown significantly due to strategic acquisitions. It is a leading supplier in North America, with a strong presence in Canada and the United States. The company benefits from its established relationships and a growing customer base, showing resilience in the market.

Volatility in raw material prices, especially for resins, is a significant risk. Inflationary pressures and competition from other packaging and printing companies also pose challenges. Regulatory changes related to environmental standards for packaging could impact operations, but the company's sustainable solutions strategy aims to address these concerns.

The company is focused on optimizing its flexible packaging platform and investing in sustainable product innovation. Leadership is committed to operational excellence and portfolio optimization to deliver shareholder value. The emphasis is on flexible packaging as the primary growth driver while maintaining a strong presence in printing and publishing.

The company plans to continue optimizing its flexible packaging platform and invest in innovation for sustainable products. They are also exploring growth opportunities within the flexible packaging segment. Leadership is focused on operational excellence, portfolio optimization, and delivering shareholder value, as highlighted in the Target Market of Transcontinental article.

Recent financial reports show that the company is focused on maintaining profitability through strategic initiatives. The company's ability to manage costs and adapt to market changes is crucial for its financial performance. The company's commitment to sustainability and operational efficiency is key to its long-term success.

- The company is actively managing its supply chain to mitigate risks related to global logistics and international trade.

- Investments in technology and innovation are ongoing to improve operational efficiency and enhance its competitiveness in the market.

- The company's focus on supply chain management is critical to navigating the challenges in the packaging and printing industries.

- The company's expansion strategies involve optimizing its existing operations and exploring new opportunities within the flexible packaging segment.

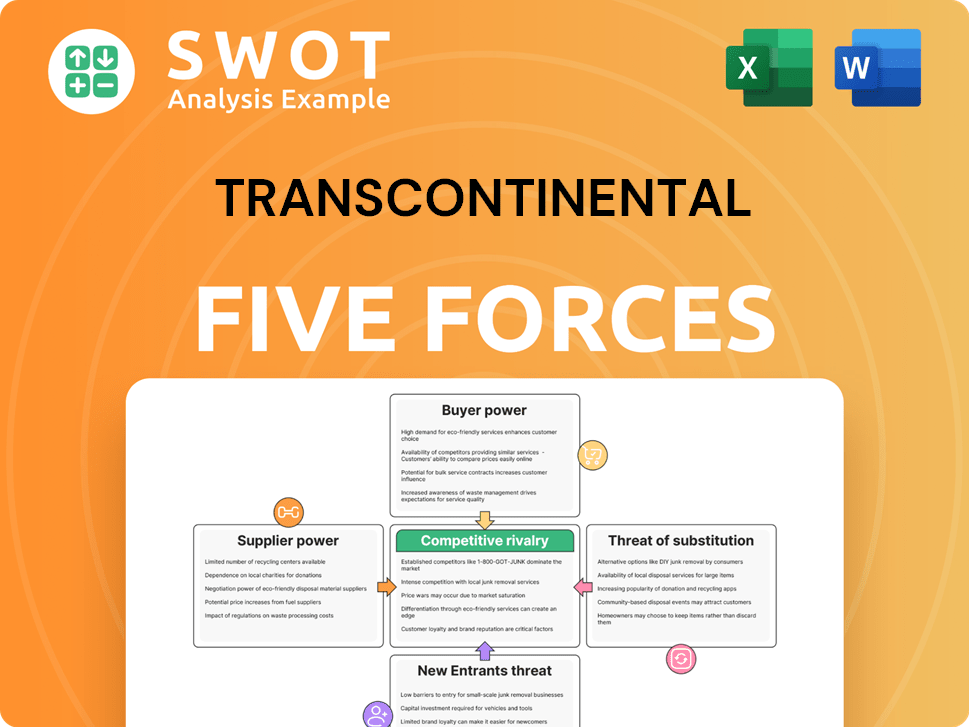

Transcontinental Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Transcontinental Company?

- What is Competitive Landscape of Transcontinental Company?

- What is Growth Strategy and Future Prospects of Transcontinental Company?

- What is Sales and Marketing Strategy of Transcontinental Company?

- What is Brief History of Transcontinental Company?

- Who Owns Transcontinental Company?

- What is Customer Demographics and Target Market of Transcontinental Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.