United Bank Bundle

How Does United Bank Company Thrive in Today's Market?

United Bankshares, Inc., through its subsidiary United Bank, is a major United Bank SWOT Analysis financial institution with a strong presence in the Mid-Atlantic and Southeastern United States. With a reported net income of $301.7 million for the year ended December 31, 2023, the company showcases its robust profitability. Offering essential commercial and retail banking services, alongside wealth management, United Bank Company plays a crucial role in the regional banking sector.

This deep dive explores the core bank operations that fuel United Bank Company's success. We'll examine its diverse revenue streams, strategic initiatives, and how it provides various banking services. Whether you're curious about account management, online banking features, or the United Bank Company stock price, this analysis provides valuable insights into a key player in the financial landscape.

What Are the Key Operations Driving United Bank’s Success?

As a banking subsidiary of United Bankshares, Inc., United Bank Company provides a wide array of financial services. These services include commercial and retail banking, wealth management, and trust services. They cater to individuals, small to medium-sized businesses, and large corporations.

The core offerings of United Bank Company include deposit accounts, such as checking, savings, and CDs, along with various loan products. These loans cover commercial real estate, commercial and industrial needs, residential mortgages, and consumer loans. Additionally, the bank provides treasury management services for businesses and personal loans, credit cards, and digital banking solutions for individuals.

The bank's operations are multifaceted, with a focus on customer service and technological innovation. Deposit gathering occurs through its extensive branch network and digital platforms. Loan origination involves rigorous credit underwriting. Technology development plays a crucial role in enhancing the customer experience through digital platforms. The company also partners with technology vendors and third-party service providers.

United Bank Company offers a comprehensive suite of banking services to meet diverse financial needs. These services include deposit accounts, loan products, and treasury management solutions. The bank's focus on customer service and technological advancements enhances accessibility and efficiency.

The bank serves a broad range of customers, including individuals, small to medium-sized businesses, and large corporations. This diverse customer base allows the bank to offer tailored financial solutions. Understanding the Target Market of United Bank is key to its success.

Key operational processes include deposit gathering, loan origination, and technology development. Deposit gathering is facilitated through branches and digital platforms. Loan origination involves credit underwriting. Technology enhancements improve customer experience.

United Bank Company's value proposition is rooted in community-focused banking. This approach emphasizes personalized service and local decision-making. The bank's extensive branch network fosters strong customer relationships.

United Bank Company distinguishes itself through its community-focused banking model, emphasizing personalized service and local decision-making. Its extensive branch network fosters strong relationships within the communities it serves. The bank continually invests in digital banking solutions to enhance customer accessibility and efficiency.

- Community-focused banking model.

- Personalized customer service.

- Extensive branch network.

- Investment in digital banking solutions.

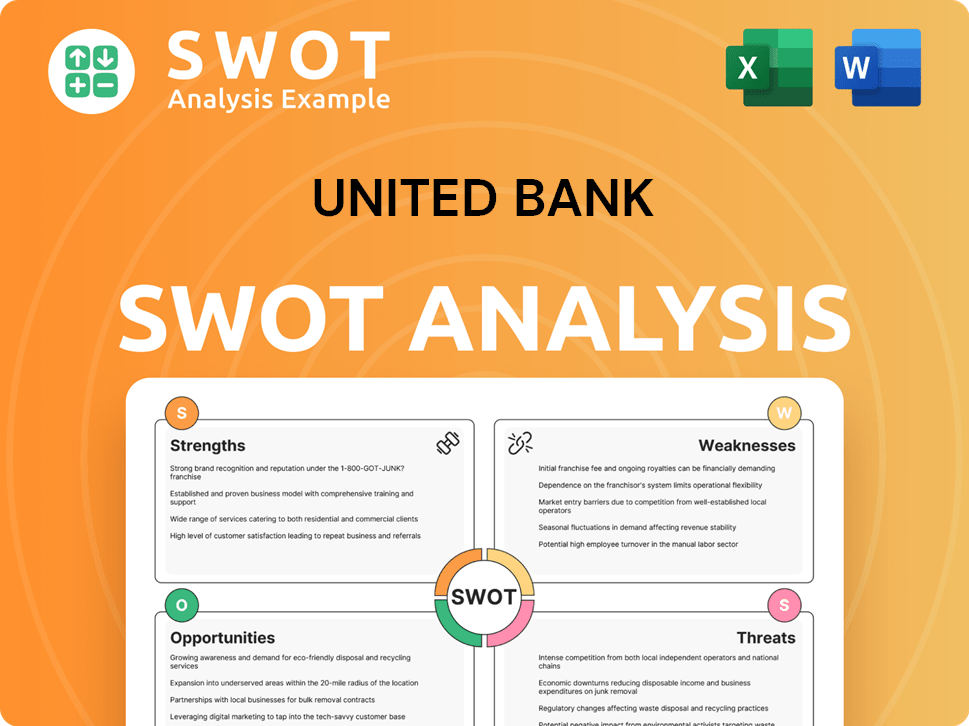

United Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does United Bank Make Money?

The [Company Name] generates revenue through various streams, primarily focusing on interest income and non-interest income. These sources are complemented by wealth management and trust services, creating a diversified revenue model. This approach allows the financial institution to maintain a stable financial position.

Interest income forms the largest part of the revenue, derived from loans and investments. Non-interest income includes fees from various banking services. The company also generates revenue from wealth management and trust services.

The [Company Name]'s revenue streams are designed to provide a stable and diversified financial base. This strategy allows the company to navigate market fluctuations effectively and maintain strong profitability.

The [Company Name]'s revenue model is built around its core banking services. The company's primary revenue streams include interest income, non-interest income, and wealth management services. The financial institution strategically utilizes its diverse service offerings to maximize revenue generation and maintain a strong financial position. Understanding these revenue streams is crucial for evaluating the bank's financial performance and strategic direction.

- Interest Income: The primary source of revenue, driven by interest earned on loans. For the year ended December 31, 2023, net interest income was $846.8 million. This includes commercial real estate, commercial and industrial loans, residential mortgages, and consumer loans. The bank's monetization strategy for loans involves competitive interest rates tailored to borrower risk profiles and market conditions.

- Non-Interest Income: Includes fees and service charges. For the year ended December 31, 2023, non-interest income was $170.1 million. This includes service charges on deposit accounts, fees from ATM and debit card transactions, loan origination fees, and other miscellaneous fees.

- Wealth Management and Trust Services: Offers financial planning, investment management, and trust administration. This segment provides a stable recurring revenue stream based on assets under management and fees for advisory services.

- Strategic Expansion: The company has expanded its revenue sources through acquisitions and organic growth. For instance, the acquisition of Atlantic Union Bankshares Corporation's Community Bank in January 2024 is expected to further diversify its revenue base. This expansion allows for increased opportunities in various markets. For more insights, you can check out the Marketing Strategy of United Bank.

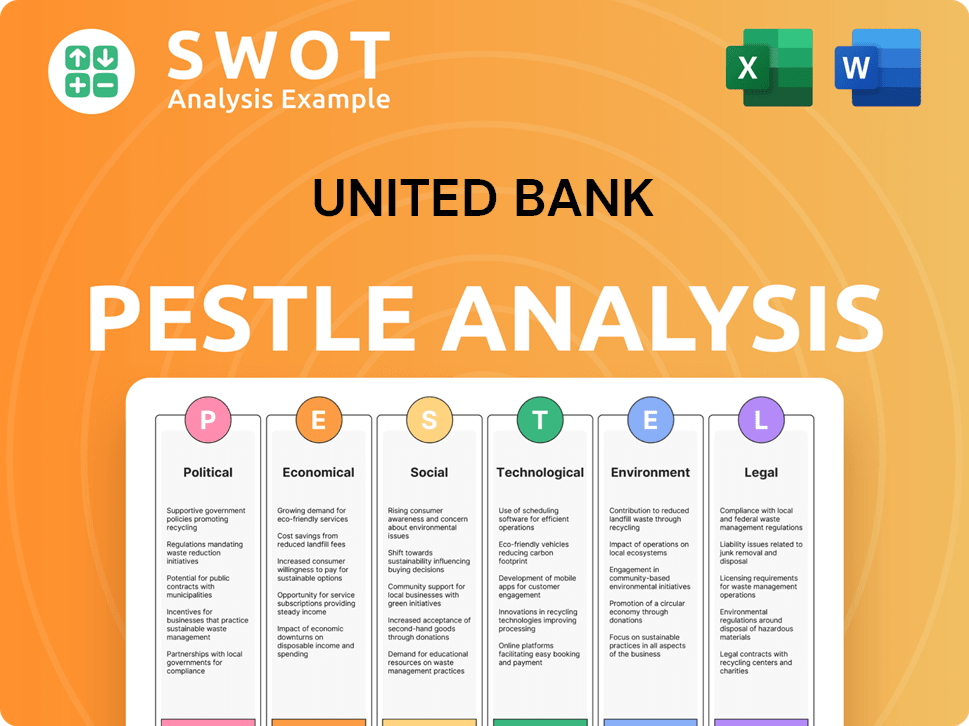

United Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped United Bank’s Business Model?

United Bankshares, Inc. has a rich history marked by significant milestones that have shaped its trajectory. A key strategic move was the acquisition of Atlantic Union Bankshares Corporation's Community Bank in January 2024, which bolstered its market presence. This, along with other strategic mergers and acquisitions, demonstrates the company's proactive approach to growth and its ability to integrate new operations effectively.

The company has adeptly navigated various challenges, including economic downturns and evolving regulatory landscapes. Like many financial institutions, United Bankshares has adapted to interest rate changes and credit cycles. Its ability to respond to these challenges is supported by its strong liquidity position, with total deposits of $27.0 billion as of December 31, 2023. This adaptability is crucial for sustaining robust bank operations and providing consistent banking services.

United Bankshares' competitive advantages are multifaceted, including strong brand strength, economies of scale, and a localized approach to banking. The company's extensive branch network and ongoing technology investments enhance its digital banking capabilities. For more insights, consider exploring the Growth Strategy of United Bank.

The acquisition of Atlantic Union Bankshares Corporation's Community Bank in January 2024 was a pivotal moment. This strategic move significantly expanded the company's footprint. The company's history is filled with strategic mergers and acquisitions that have driven its growth.

Strategic acquisitions have been a cornerstone of United Bankshares' growth strategy. These moves have been instrumental in expanding its market presence and asset base. The company's proactive approach to growth is evident in its ability to integrate new operations efficiently.

United Bankshares benefits from a strong brand, economies of scale, and a localized banking approach. Its extensive branch network and digital banking capabilities provide a competitive edge. The company focuses on digital transformation to meet evolving customer demands.

The company's strong liquidity position, with $27.0 billion in total deposits as of December 31, 2023, underscores its financial health. United Bank Company has consistently adapted to changes in interest rate environments. Prudent risk management and diversified loan portfolios are key strategies.

United Bankshares has demonstrated resilience by navigating economic downturns and regulatory changes. The bank's ability to adapt to changing interest rates and credit cycles is crucial. The company's focus on account management and online banking has enhanced customer service.

- Strong capital ratios support the bank's ability to withstand economic pressures.

- Diversification of the loan portfolio helps mitigate risks.

- Ongoing investments in technology enhance digital banking services.

- Customer loyalty is fostered through a strong brand and community focus.

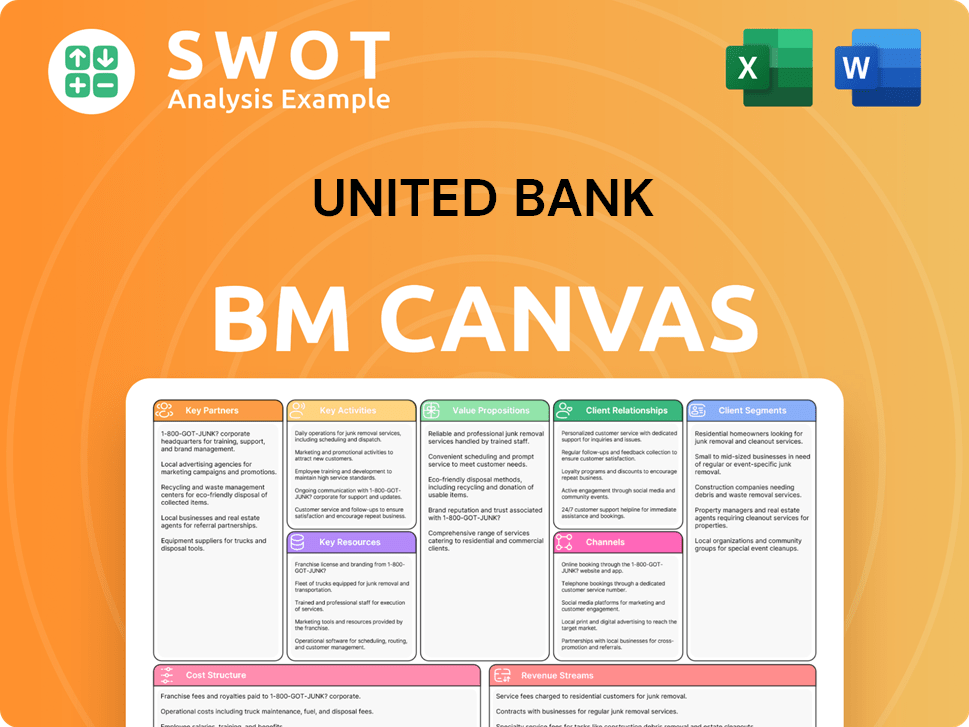

United Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is United Bank Positioning Itself for Continued Success?

United Bankshares, Inc. (UBSI) holds a strong position in the Mid-Atlantic and Southeastern United States, competing with national and community banks. Its extensive branch network and focus on personalized service contribute to customer loyalty. As of December 31, 2023, the company reported assets of $32.4 billion and deposits of $27.0 billion, indicating a significant presence in its operating areas. This financial institution offers various banking services to a diverse customer base.

Several risks could impact UBSI's operations. Changes in interest rates, regulatory shifts, and the emergence of fintech companies pose challenges. Economic downturns could lead to higher loan defaults. For those looking to understand the company's origins, you can read more in the Brief History of United Bank.

UBSI maintains a strong regional presence within the Mid-Atlantic and Southeastern United States. It competes with both large national banks and smaller community banks. The company benefits from a wide branch network and a focus on personalized service.

Key risks include interest rate fluctuations, regulatory changes, and competition from fintech companies. Broader economic downturns could increase loan defaults. These factors could affect the bank operations.

UBSI is focused on organic growth, enhancing digital banking, and strategic acquisitions. The company aims to maintain a strong capital position. By combining traditional strengths with digital innovation, the bank seeks to solidify its market position.

UBSI reported assets of $32.4 billion and deposits of $27.0 billion. This data highlights the financial institution's significant footprint in its operating areas. The company's performance reflects its ongoing strategy to provide banking services.

UBSI's strategic initiatives include expanding its loan and deposit portfolios and enhancing digital banking services. The company is also exploring strategic acquisitions to support growth. These initiatives are designed to improve account management and online banking capabilities.

- Continued organic growth in loan and deposit portfolios.

- Leveraging technology to enhance digital banking services.

- Exploring strategic acquisitions.

- Focus on prudent risk management.

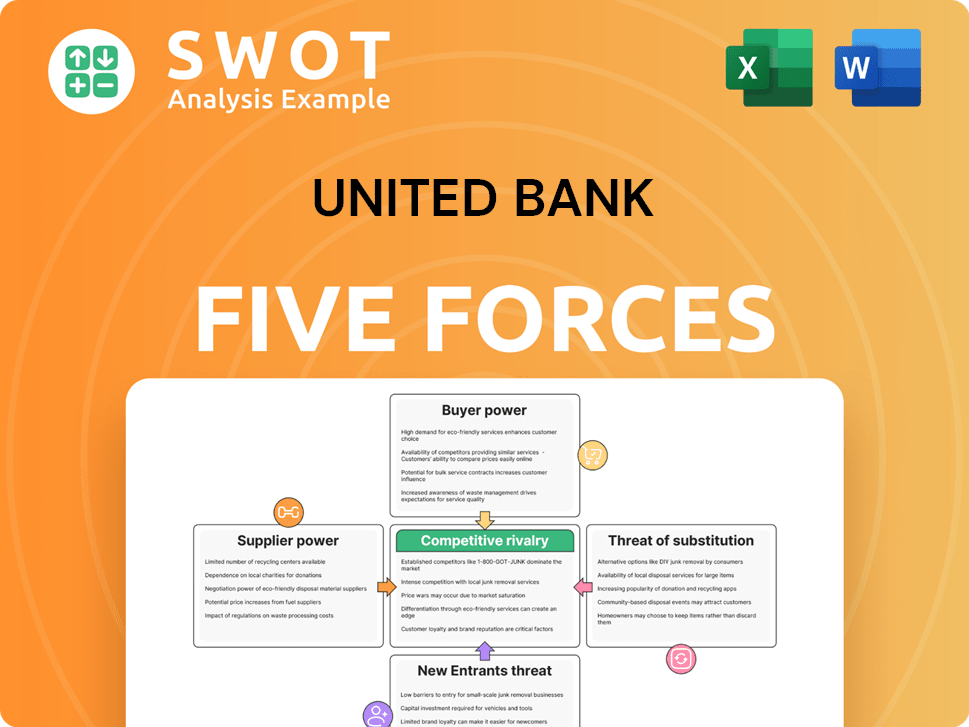

United Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of United Bank Company?

- What is Competitive Landscape of United Bank Company?

- What is Growth Strategy and Future Prospects of United Bank Company?

- What is Sales and Marketing Strategy of United Bank Company?

- What is Brief History of United Bank Company?

- Who Owns United Bank Company?

- What is Customer Demographics and Target Market of United Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.