UniFirst Bundle

Unveiling UniFirst: How Does It Thrive?

UniFirst company stands as a cornerstone in the uniform and facility services sector, boasting impressive financial figures, including $602.2 million in Q2 fiscal 2025 revenue. With a robust market presence across the United States, Canada, and Europe, UniFirst provides essential workplace solutions. But how does this industry giant actually operate and maintain its leading position?

This exploration delves into the operational mechanics of UniFirst SWOT Analysis, examining its value proposition, diverse revenue streams, and strategic initiatives. Understanding how UniFirst services its clients with options like UniFirst uniform rental and other offerings is key to grasping its market dominance. We'll also investigate its competitive advantages and what the future holds for this significant player in the business-to-business landscape, including insights on UniFirst careers and other relevant topics.

What Are the Key Operations Driving UniFirst’s Success?

The core of the UniFirst company revolves around providing comprehensive uniform and facility services. This includes a wide range of offerings, from standard workwear to specialized protective clothing, catering to diverse industry needs. Their approach is designed to be a one-stop solution for businesses looking to maintain a professional image and ensure workplace safety and hygiene.

UniFirst's value proposition centers on delivering convenience, quality, and reliability. They offer flexible service models, including rental, lease, and direct purchase options, to meet various customer preferences. The company manages the entire process, from design and manufacturing to delivery, cleaning, and maintenance, allowing customers to focus on their core business operations.

The operational model of UniFirst is built on an extensive network and integrated processes. This includes a vast distribution network with over 270 service locations and partnerships with more than 300,000 customer locations. Their operations are supported by five ISO-9001-certified manufacturing facilities, ensuring quality control from production to service delivery.

UniFirst provides a wide variety of uniforms, including specialized garments for industries like healthcare and manufacturing. Their services extend to facility solutions, such as floor mats and restroom supplies. These services are delivered through flexible programs, including rental and direct purchase.

The company operates an extensive network of service locations and manufacturing facilities. They manage the entire supply chain, from production to delivery and maintenance. This integrated approach allows UniFirst to maintain high standards of quality and efficiency in their services.

UniFirst's full-service model reduces administrative burdens for businesses. It ensures compliance with safety and hygiene standards. They provide a consistent professional appearance for the workforce, enhancing brand image.

UniFirst outfits over 2 million workers daily, demonstrating its significant scale. The company's focus on quality and customer service has led to strong customer retention rates. Their comprehensive approach has made them a key player in the uniform and facility services market.

UniFirst's operational model is characterized by its integrated approach, encompassing manufacturing, distribution, and service delivery. This ensures quality control and efficiency across all aspects of their business. They focus on providing comprehensive solutions that meet the diverse needs of their customers.

- Extensive Network: Over 270 service locations and partnerships with more than 300,000 customer locations.

- Manufacturing: Five ISO-9001-certified manufacturing facilities producing branded workwear and protective clothing.

- Full-Service Model: Includes design, manufacturing, rental, cleaning, and maintenance services.

- Customer Focus: Provides flexible service programs to meet diverse customer needs.

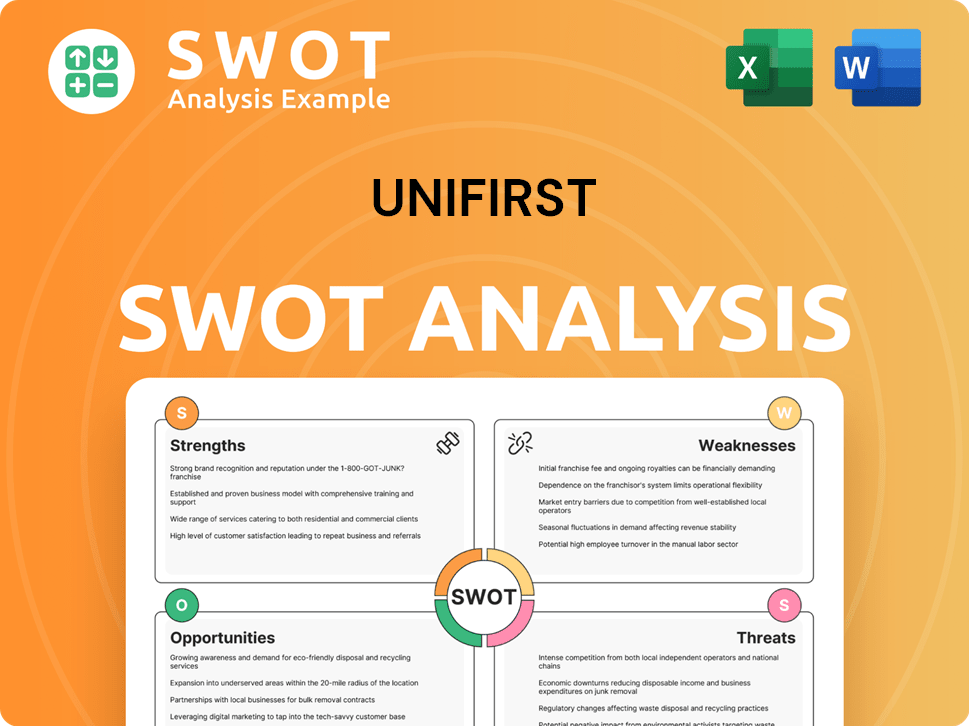

UniFirst SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does UniFirst Make Money?

The UniFirst company generates revenue by providing comprehensive uniform and facility services. These services include options for rental, lease, and direct purchase of uniforms, protective clothing, and facility service products. The company's financial performance is driven by its ability to meet diverse customer needs through a range of service offerings.

In the second quarter of fiscal 2025, UniFirst reported consolidated revenues of $602.2 million, reflecting a 1.9% increase from the prior year. For the full fiscal year 2024, consolidated revenues reached $2.427 billion, marking an 8.7% increase. These figures highlight the company's consistent revenue growth and market presence.

The primary revenue stream for UniFirst comes from its Core Laundry Operations, which generated $530.4 million in the second quarter of fiscal 2025, a 1.5% increase. The Specialty Garments segment, including nuclear decontamination and cleanroom operations, also contributes significantly. In Q2 fiscal 2025, this segment's revenues were $44.4 million, up 2.2%. The First Aid segment saw its Q1 fiscal 2025 revenue increase to $26.2 million, up 5.4%.

UniFirst employs several monetization strategies to maximize revenue and customer satisfaction. These include bundling services that combine uniform rental, cleaning, and facility maintenance, offering tiered pricing structures based on service volume and type. The company also invests in 'Key Initiatives' such as customer relationship management (CRM) and enterprise resource planning (ERP) systems, costing approximately $1.9 million in Q2 fiscal 2025, to enhance operational efficiency and customer engagement. For more information on the company's financial performance, you can read about Owners & Shareholders of UniFirst.

- Core Laundry Operations represent the largest revenue source.

- Specialty Garments and First Aid segments contribute to revenue diversification.

- Tiered pricing and bundled services enhance revenue generation.

- Investments in technology and customer relationship management drive growth.

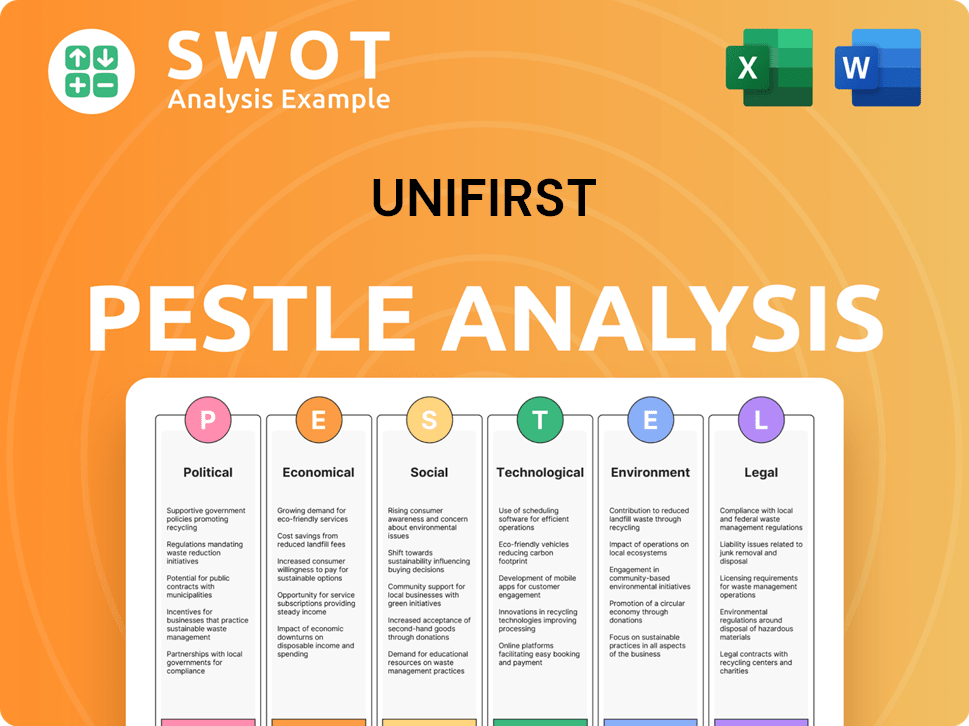

UniFirst PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped UniFirst’s Business Model?

The UniFirst company has navigated several key milestones and strategic moves that have shaped its operational and financial performance. A significant ongoing strategic move involves investments in 'Key Initiatives,' particularly customer relationship management (CRM) and enterprise resource planning (ERP) projects. These initiatives aim to enhance operational efficiency and customer relationship management, which are crucial for long-term growth.

In early 2025, UniFirst addressed a notable market event by rejecting an unsolicited acquisition proposal from Cintas Corporation. This decision, backed by major shareholders, underscored the company's confidence in its standalone value and organic growth potential. This strategic stance reflects the company's commitment to its independent trajectory and the value it sees in its current operational model.

UniFirst's competitive advantages stem from its extensive operational scale, robust brand presence, and integrated service model. The company's dedication to quality is evident through its five ISO-9001-certified manufacturing facilities. Furthermore, its focus on customer service and continuous improvement, as highlighted in its ESG report, differentiates it in the market. To understand more about the company's origins, you can read a brief history of UniFirst.

UniFirst is investing in CRM and ERP projects to improve operational efficiency. These initiatives cost approximately $1.9 million in Q2 fiscal 2025 and $11.8 million in fiscal year 2024. These investments are designed to support mid-single-digit growth and increase EBITDA margins into the high teens.

UniFirst operates over 270 service locations, serving more than 300,000 customer locations. The company outfits over 2 million workers daily. Its extensive operational scale and strong brand contribute to its competitive advantage in the UniFirst uniform and UniFirst rental market.

UniFirst emphasizes customer service and continuous improvement. The company's ESG report highlights efforts in energy management, waste reduction, and workplace safety. This focus helps differentiate UniFirst services in the market.

UniFirst adapts to new trends and competitive threats through internal growth and transformation. The company invests in people and technology. It addresses challenges like pricing pressures and customer retention to maintain its market position.

UniFirst benefits from its operational scale, brand strength, and integrated service model. The company's commitment to quality is supported by its ISO-9001 certifications. UniFirst is focused on internal growth, technological advancements, and addressing market challenges.

- Extensive service network with over 270 locations.

- Serves more than 300,000 customer locations.

- Outfits over 2 million workers daily.

- Focus on ESG initiatives for sustainability and customer service.

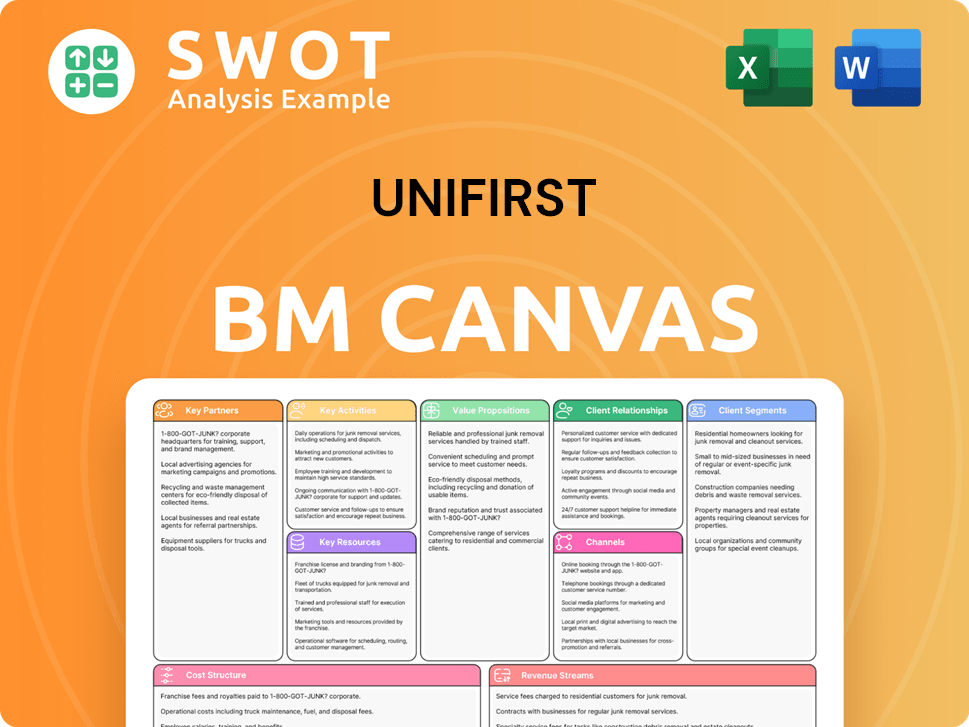

UniFirst Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is UniFirst Positioning Itself for Continued Success?

The UniFirst company holds a prominent position in the North American uniform and facility services sector. It competes with major players like Cintas Corporation and Aramark. With over 270 service locations and the capacity to serve more than 300,000 customer locations daily, providing uniforms for over 2 million workers, UniFirst demonstrates a significant market reach.

Despite its strong market presence, UniFirst faces various risks. These include competitive pricing pressures in a moderate growth environment, potential cost impacts from tariff uncertainties, and execution risks linked to its ongoing technology and ERP investments. Macroeconomic factors such as higher inflation and interest rates could also affect operating margins, and a slight weakening in the existing customer base might impact revenue stability. Furthermore, the company acknowledges uncertainties related to environmental liabilities and potential legal contingencies.

UniFirst is a leading provider of uniform and facility services in North America, competing with major companies. The company’s extensive network and customer base highlight its strong market presence and ability to serve a large number of clients. You can learn more about the Competitors Landscape of UniFirst.

The company faces challenges such as competitive pricing, potential tariff impacts, and execution risks from technology investments. Macroeconomic factors and customer base fluctuations also pose risks. Environmental liabilities and legal contingencies add further uncertainties.

UniFirst plans to continue investing in its CRM and ERP systems, with an estimated cost of $16 million for fiscal year 2025. The company projects fiscal year 2025 revenue to be between $2.425 billion and $2.440 billion. The company is looking to grow in the mid-single digits.

For fiscal year 2025, diluted earnings per share (EPS) are projected to range from $6.79 to $7.19. In the second quarter of fiscal 2025, consolidated revenues increased by 1.9% to $602.2 million. The company aims to increase EBITDA margins into the high teens.

UniFirst is focused on long-term growth and operational enhancements. The company is committed to increasing its EBITDA margins and improving customer satisfaction. These initiatives are designed to drive sustainable profitability and market leadership.

- Continued investment in CRM and ERP systems.

- Focus on driving growth to mid-single digits and beyond.

- Aiming to increase EBITDA margins into the high teens.

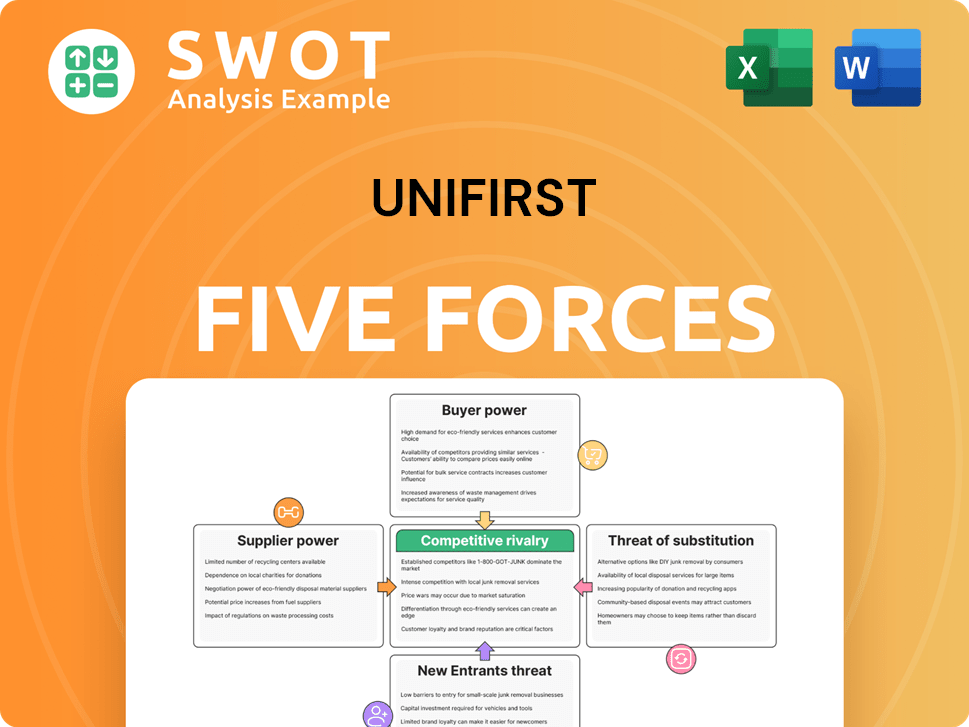

UniFirst Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of UniFirst Company?

- What is Competitive Landscape of UniFirst Company?

- What is Growth Strategy and Future Prospects of UniFirst Company?

- What is Sales and Marketing Strategy of UniFirst Company?

- What is Brief History of UniFirst Company?

- Who Owns UniFirst Company?

- What is Customer Demographics and Target Market of UniFirst Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.