Veracyte Bundle

Decoding Veracyte: How Does This Genomic Innovator Operate?

Veracyte, a trailblazer in genomic diagnostics, is transforming healthcare by providing crucial insights for improved patient outcomes. Its innovative Veracyte SWOT Analysis reveals a company at the forefront of precision medicine, offering advanced tests for conditions like thyroid and lung cancer. But how does Veracyte company function, and what drives its success in the competitive diagnostics landscape?

Understanding Veracyte's operations is vital for anyone interested in the future of healthcare and investment opportunities. This exploration will unravel the intricacies of Veracyte tests, from its cutting-edge Veracyte technology to its strategic financial approaches, offering a comprehensive view of a company making a real impact. Whether you're curious about Veracyte products, or how to interpret Veracyte test results, this analysis provides valuable insights.

What Are the Key Operations Driving Veracyte’s Success?

The Veracyte company focuses on developing and commercializing genomic tests to aid in diagnosing and treating various diseases. Their core business revolves around providing crucial insights through advanced genomic testing, specifically targeting areas like thyroid cancer, lung cancer, and idiopathic pulmonary fibrosis. The company's operations are centered on its CLIA-certified laboratories, where patient samples undergo sophisticated analysis using proprietary genomic sequencing and machine learning algorithms.

The value proposition of Veracyte lies in its ability to offer more definitive diagnoses and guide personalized treatment plans. This approach aims to reduce the need for invasive procedures and improve patient outcomes. By leveraging its advanced Veracyte technology, the company strives to enhance patient care and optimize healthcare resource utilization, making it a key player in precision medicine.

The company's core products include genomic tests for thyroid cancer (Afirma), lung cancer (Percepta, Envisia), and idiopathic pulmonary fibrosis (Envisia). These tests serve distinct customer segments: endocrinologists and surgeons for thyroid nodules, pulmonologists for lung nodules and interstitial lung diseases, and oncologists for comprehensive genomic profiling. Veracyte diagnostics help clinicians make more informed decisions, ultimately improving patient care.

The operational processes are centered around CLIA-certified laboratories. Patient samples are received, processed, and analyzed using proprietary genomic sequencing and analysis platforms. This involves a sophisticated workflow from sample accessioning and nucleic acid extraction to RNA sequencing and the application of machine learning algorithms to generate diagnostic results.

The value proposition is the ability to reduce the need for invasive procedures, provide more definitive diagnoses, and guide personalized treatment plans. This leads to improved patient outcomes and reduced healthcare costs. For instance, the Afirma Genomic Sequencing Classifier helps differentiate between benign and malignant thyroid nodules, potentially sparing patients unnecessary surgeries.

The company's tests serve distinct customer segments: endocrinologists and surgeons for thyroid nodules, pulmonologists for lung nodules and interstitial lung diseases, and oncologists for comprehensive genomic profiling. These segments are crucial for the adoption and utilization of Veracyte tests.

The supply chain involves partnerships with healthcare providers for sample collection and logistics, and collaborations with technology providers for its genomic platforms. The distribution network leverages direct sales teams and strategic alliances with medical institutions to ensure broad access to its tests.

What makes Veracyte's operations unique is its focus on developing clinically validated, evidence-based genomic tests that address significant unmet medical needs, coupled with a robust R&D pipeline that continually expands its diagnostic offerings. Its core capabilities translate into customer benefits by offering high-accuracy diagnostic tools that empower clinicians to make more confident and timely decisions, thereby enhancing patient care and optimizing healthcare resource utilization.

- Focus on clinically validated tests.

- Robust R&D pipeline.

- High-accuracy diagnostic tools.

- Empowers clinicians for better decision-making.

For further insights into the financial aspects and ownership structure of the company, you can explore the details provided in Owners & Shareholders of Veracyte. The company's commitment to innovation and its focus on improving patient outcomes position it as a significant player in the precision medicine landscape. As of Q1 2024, Veracyte reported a revenue of $93.8 million, demonstrating continued growth in the market. This growth is supported by the increasing adoption of its tests and the expansion of its product portfolio.

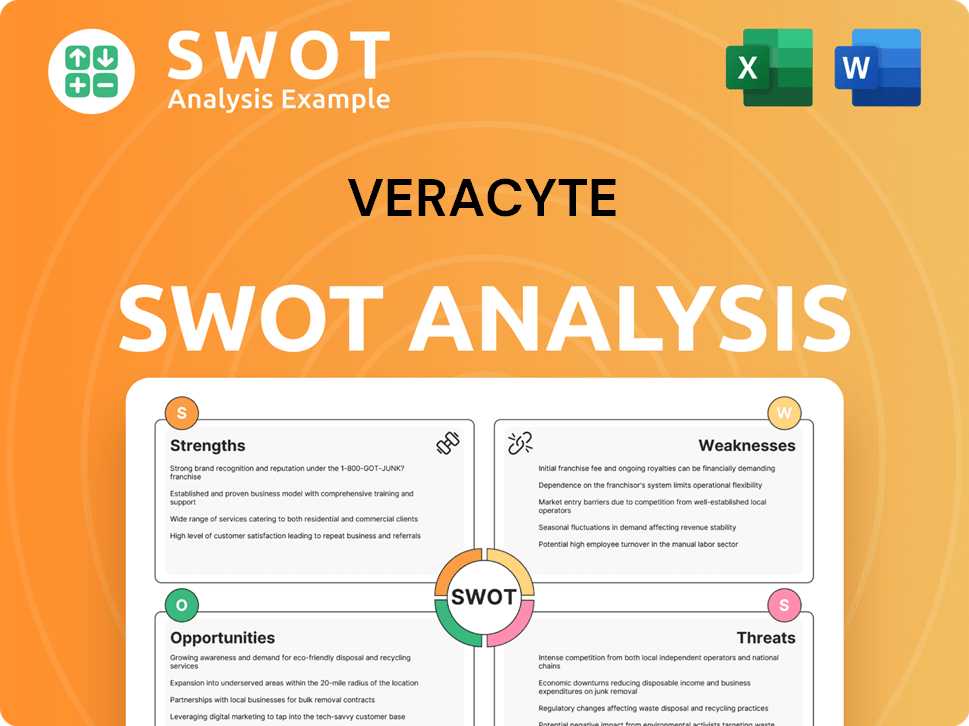

Veracyte SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Veracyte Make Money?

The primary revenue streams for the Veracyte company are derived from the sale of its genomic diagnostic tests. These tests are used to aid in the diagnosis of various diseases, including thyroid nodules and lung cancer. The company's focus on securing broad reimbursement coverage is crucial for driving adoption and revenue growth.

Veracyte diagnostics employs a fee-for-service model. Healthcare providers order the tests, and the company bills insurance providers or patients directly. Strategic acquisitions, like the 2021 purchase of Decipher Biosciences, have broadened its oncology portfolio, adding new genomic tests and diversifying its revenue mix.

Veracyte tests continuously works to expand its test menu and geographic reach. This contributes to the growth and diversification of its revenue streams. The company's approach includes expanding its test offerings and geographic reach to fuel revenue growth.

Veracyte's revenue model focuses on genomic diagnostic tests. The company's revenue is generated through a fee-for-service model. Strategic acquisitions have expanded the company's test offerings.

- Veracyte's revenue comes from selling genomic diagnostic tests, such as Afirma, Percepta, and Envisia.

- The company bills insurance providers or patients directly for the tests.

- Acquisitions, like Decipher Biosciences, have broadened the test portfolio.

- Veracyte aims to expand its test menu and geographic reach to increase revenue.

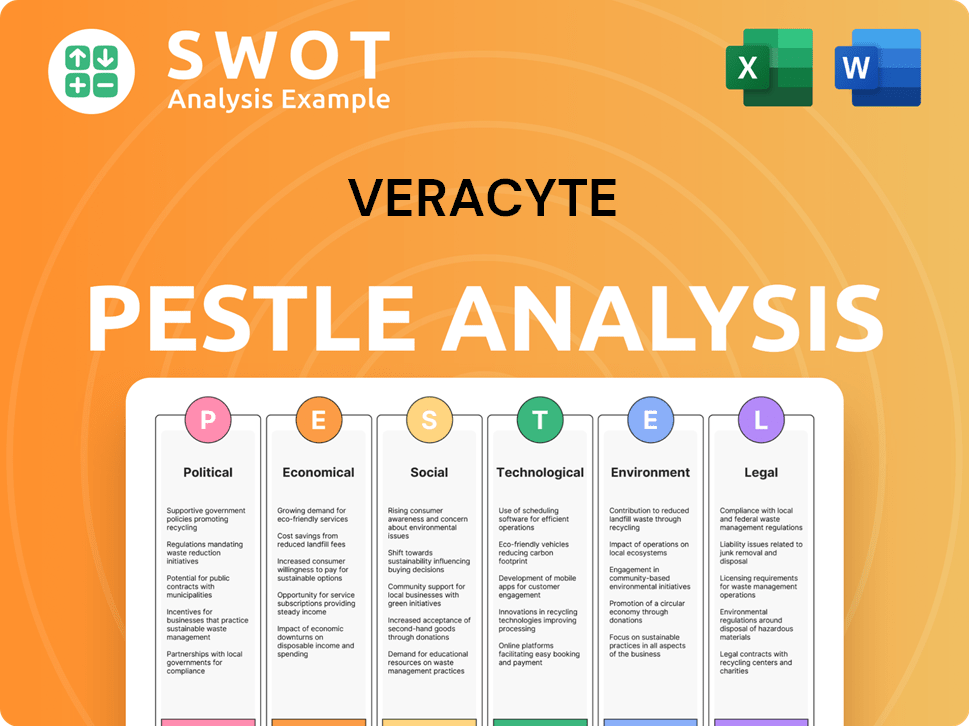

Veracyte PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Veracyte’s Business Model?

The journey of the Veracyte company has been marked by significant milestones, strategic shifts, and a focus on establishing a competitive edge in the genomic diagnostics market. The company's evolution reflects its commitment to innovation and its ability to adapt to the dynamic healthcare landscape. Key decisions and developments have propelled Veracyte forward, influencing its market position and financial performance.

A critical turning point for Veracyte was the commercial launch of its Afirma Genomic Sequencing Classifier. This test revolutionized thyroid nodule diagnosis. The subsequent introduction of Percepta and Envisia classifiers further solidified its presence in lung cancer and interstitial lung disease diagnostics. A major strategic move was the acquisition of Decipher Biosciences in 2021, which expanded Veracyte's oncology portfolio.

Veracyte has faced operational challenges, including securing reimbursement for its tests and navigating regulatory changes. Its response has involved extensive clinical validation studies and proactive engagement with payers. Its competitive advantages include proprietary technology platforms, strong clinical evidence, and a growing intellectual property portfolio. The company continues to invest in research and development to expand its test menu and explore new disease areas.

The launch of the Afirma Genomic Sequencing Classifier was a pivotal moment, significantly impacting thyroid nodule diagnosis. The acquisition of Decipher Biosciences in 2021 expanded the company's oncology portfolio. These milestones have shaped Veracyte's growth and market position.

The acquisition of Decipher Biosciences for approximately $600 million was a strategic move. This expanded Veracyte's oncology portfolio. The company also focuses on securing reimbursement and adapting to regulatory landscapes.

Veracyte's competitive advantages include proprietary technology, strong clinical evidence, and a robust intellectual property portfolio. The brand strength of Afirma provides a barrier to entry. The company continues to invest in R&D to expand its test menu.

In 2023, Veracyte reported a total revenue of $335.9 million. This reflects the impact of strategic acquisitions and the adoption of its tests. The company's financial performance is closely tied to its ability to secure reimbursement and expand its market reach.

Veracyte has addressed challenges by conducting clinical validation studies and engaging with payers to secure reimbursement. The company adapts to new trends by investing in research and development, expanding its test menu, and leveraging advancements in genomics and artificial intelligence. The company's approach to these challenges has been crucial for its sustained growth and market position.

- Clinical Validation: Conducting extensive studies to demonstrate the utility and cost-effectiveness of its tests.

- Reimbursement: Engaging in proactive discussions with payers to secure widespread coverage.

- Innovation: Investing in R&D to expand the test menu and explore new disease areas.

- Technology: Leveraging advancements in genomics and AI to enhance diagnostic capabilities.

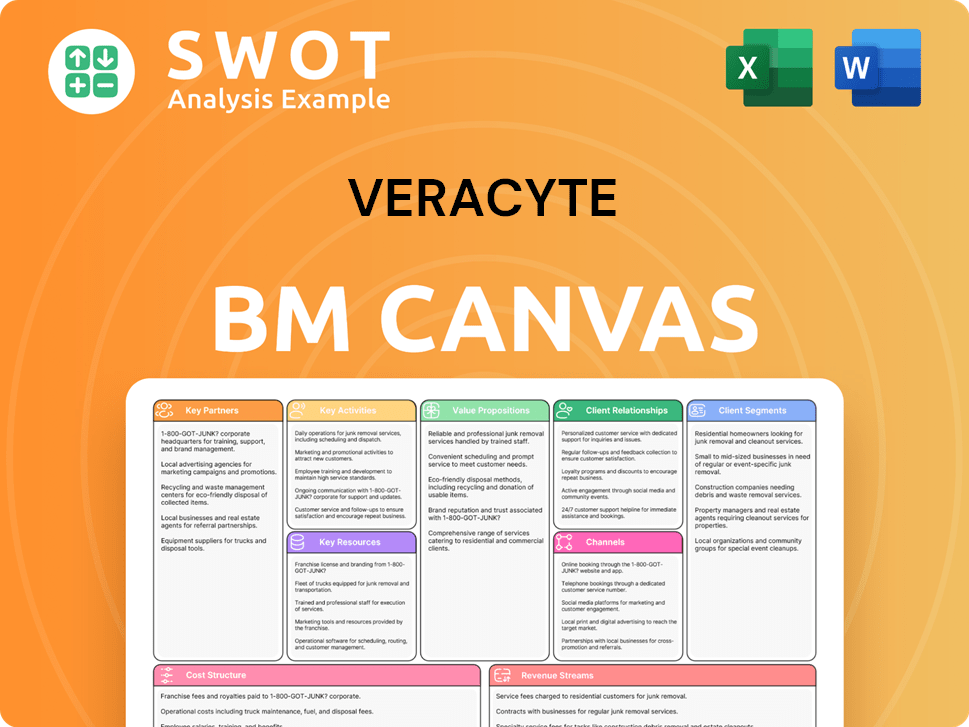

Veracyte Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Veracyte Positioning Itself for Continued Success?

The Veracyte company holds a strong position in the genomic diagnostics industry, particularly in thyroid and lung cancer. The company's Veracyte tests, such as Afirma and Envisia, are widely recognized and used by clinicians. Veracyte has established itself as a leader in providing clinically actionable genomic information, which has fostered significant customer loyalty.

However, Veracyte faces several risks. Regulatory changes, competition, and shifts in healthcare reimbursement policies could impact the company's operations and revenue. The company's financial performance could also be affected by consumer preferences towards alternative diagnostic approaches.

Veracyte's diagnostic tests are well-regarded within the genomic diagnostics market. Their tests provide valuable insights for clinicians, particularly in the areas of thyroid and lung cancer. The company has a growing global presence.

Regulatory changes and competition are significant risks for Veracyte. Healthcare reimbursement policies and shifts in consumer preferences may also impact the company. Technological disruption from emerging diagnostic platforms is another potential challenge.

The company plans to sustain and expand its revenue by investing in research and development. They are also expanding sales and marketing efforts. Strategic partnerships and acquisitions are part of their growth strategy.

Innovation is a key focus, with the company leveraging genomic and AI capabilities. Leadership is committed to improving patient outcomes through precision diagnostics. Veracyte aims to solidify its position in the precision medicine landscape.

Veracyte is focused on expanding its test pipeline and market reach. They are pursuing strategic partnerships to enter new disease areas. The company's innovation roadmap includes developing next-generation diagnostic solutions. For example, in 2024, the company reported a significant increase in test volume, indicating strong market adoption. You can learn more about the Target Market of Veracyte to understand their customer base.

- Continued investment in R&D to broaden the test pipeline.

- Expansion of sales and marketing efforts to drive test adoption.

- Strategic partnerships or acquisitions for market expansion.

- Focus on precision medicine and improving patient outcomes.

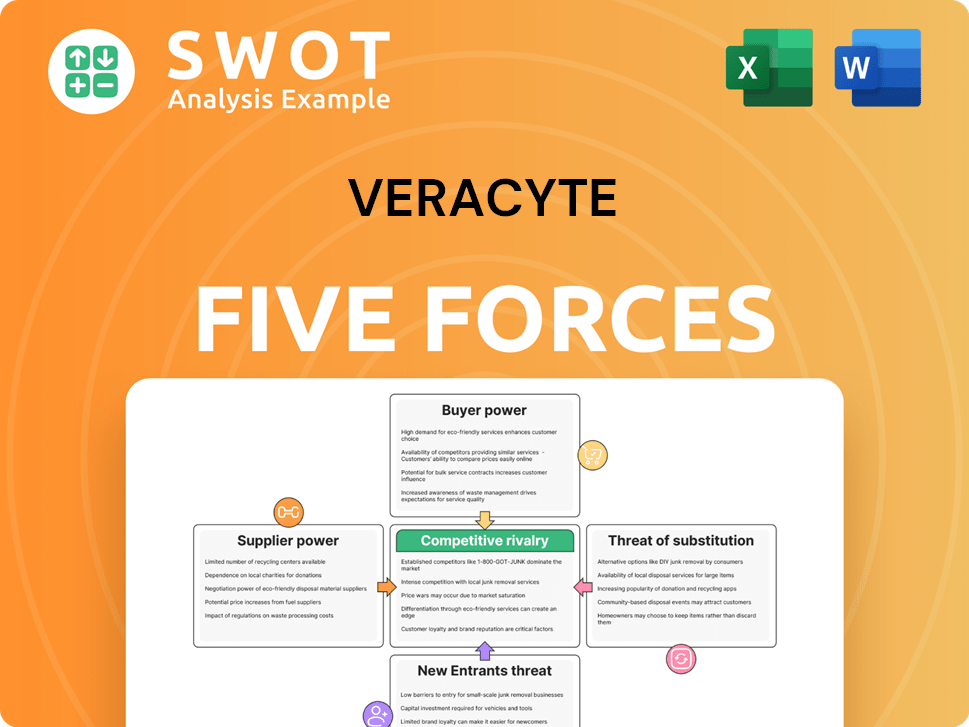

Veracyte Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Veracyte Company?

- What is Competitive Landscape of Veracyte Company?

- What is Growth Strategy and Future Prospects of Veracyte Company?

- What is Sales and Marketing Strategy of Veracyte Company?

- What is Brief History of Veracyte Company?

- Who Owns Veracyte Company?

- What is Customer Demographics and Target Market of Veracyte Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.