VTEX Bundle

How Does VTEX Power the Future of E-commerce?

VTEX, a leading SaaS digital commerce platform, is reshaping the e-commerce landscape for enterprise brands and retailers. With a strong Q1 2025 performance, including a significant increase in Gross Merchandise Volume, VTEX demonstrates its ability to thrive in a competitive market. This article provides an in-depth look at how the VTEX platform operates, its key features, and its impact on the global e-commerce sector.

From its robust order management system to its comprehensive digital commerce solutions, VTEX offers a suite of tools designed to streamline operations. Understanding VTEX SWOT Analysis can provide deeper insights into its competitive advantages and strategic positioning. Whether you're exploring VTEX vs Shopify comparison or seeking a VTEX platform implementation guide, this analysis offers valuable perspectives on this dynamic e-commerce platform.

What Are the Key Operations Driving VTEX’s Success?

The core of VTEX's operations revolves around its comprehensive, Software-as-a-Service (SaaS) digital commerce platform, designed for enterprise-level brands and retailers. The VTEX platform offers solutions for B2C, B2B, and marketplace commerce. This enables clients to establish online stores, manage orders across various channels, and create marketplaces for third-party vendors.

VTEX delivers value by providing a scalable and reliable cloud infrastructure. The company continuously invests in Research & Development (R&D) to enhance the platform with frequent updates and new features, including advanced AI capabilities. This focus allows businesses to customize their e-commerce presence without sacrificing core functionalities.

VTEX serves a diverse range of customer segments, including manufacturing, retail, and distribution, with a strong focus on large, digitally mature businesses. Notable customers include Carrefour, Colgate, Sony, Stanley Black & Decker, and Whirlpool. The platform's flexibility and composable architecture allow for faster time to market, improved margins, and reduced complexity.

The VTEX platform offers a wide array of features, including order management, inventory control, and customer relationship management. It supports multiple currencies, languages, and payment gateways, catering to global operations. The platform's API-driven architecture ensures seamless integration with other business systems.

VTEX offers a composable and complete e-commerce solution, providing businesses with the flexibility to customize their online stores. This approach results in faster time to market, improved operational efficiency, and enhanced customer experiences. The platform's scalability supports business growth and global expansion.

VTEX continuously invests in R&D, integrating advanced AI capabilities and expanding its ecosystem of implementation partners. The company's focus on innovation ensures that the VTEX e-commerce platform remains at the forefront of digital commerce solutions. Recent acquisitions, such as Weni, highlight VTEX's commitment to enhancing its offerings.

Several brands have achieved significant results using VTEX. For instance, ASICS saw a 135% increase in orders during live shopping events. An enterprise multinational fashion retailer in Ireland improved sales efficiency by integrating inventory from over 100 stores. These examples demonstrate the platform's effectiveness in driving business growth.

VTEX's operational model is built on a robust cloud infrastructure, ensuring scalability and reliability across different geographies. The company's go-to-market strategy involves a strong ecosystem of implementation partners and technology alliances. This approach allows VTEX to extend its reach and capabilities, providing comprehensive digital commerce solutions.

- Continuous investment in R&D to fuel platform innovation.

- Strategic partnerships for expanding AI and conversational commerce capabilities.

- Emphasis on a strong ecosystem of implementation partners.

- Focus on providing a composable, API-driven architecture.

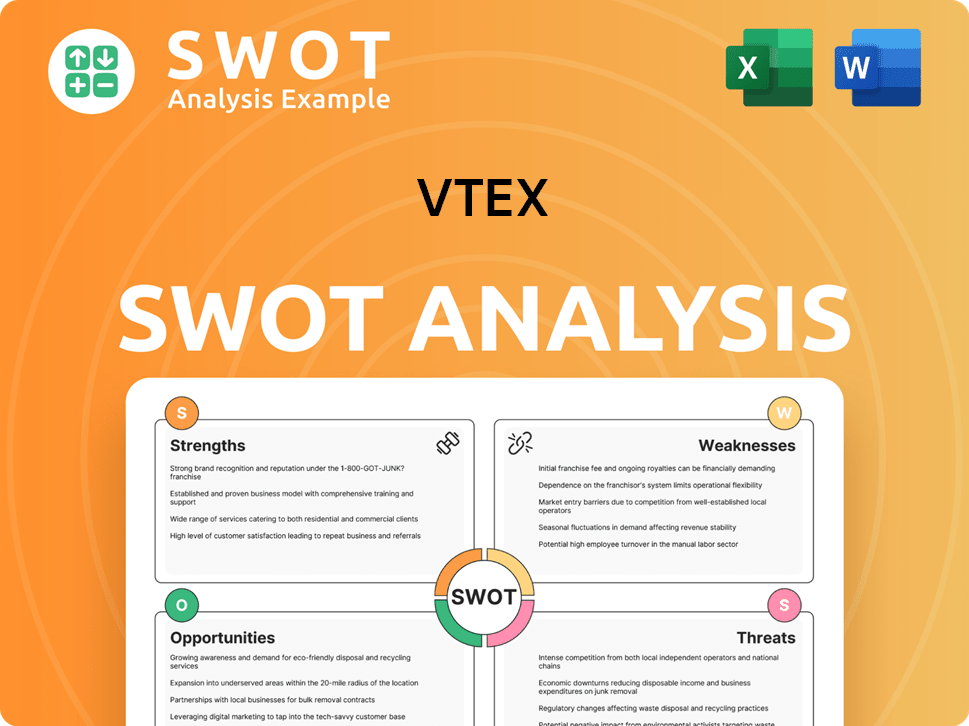

VTEX SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does VTEX Make Money?

The core revenue model for the VTEX platform is subscription-based, heavily influenced by the Gross Merchandise Volume (GMV) processed by its clients. This Software-as-a-Service (SaaS) approach provides a predictable revenue stream, with a significant portion tied to the success of the merchants using the VTEX e-commerce platform.

Monetization strategies include a suite of integrated solutions and tiered pricing models, enhancing revenue generation. The company is expanding its offerings to include B2C, B2B, and retail media solutions, which are designed to provide more value to customers and drive additional revenue streams.

In the first quarter of 2025, subscription revenue accounted for 97.1% of VTEX's total revenue, reaching US$52.6 million. This signifies the importance of subscriptions to the company's financial health. For a deeper dive into the company's strategic direction, consider reading about the Growth Strategy of VTEX.

The company's revenue streams are primarily driven by subscription fees, with a focus on expanding its service offerings. The consistent growth in subscription revenue indicates strong customer retention and the effectiveness of its monetization strategies. The expansion into retail media and other integrated solutions is expected to further diversify revenue sources.

- In Q1 2025, total revenue reached US$54.2 million, a year-over-year increase.

- Subscription revenue for the full year 2024 was US$217.7 million, representing 96% of total revenue.

- The number of customers paying over US$250,000 per year increased by 23% in 2024.

- Net revenue retention was 104% in FX-neutral for 2024, demonstrating strong customer loyalty.

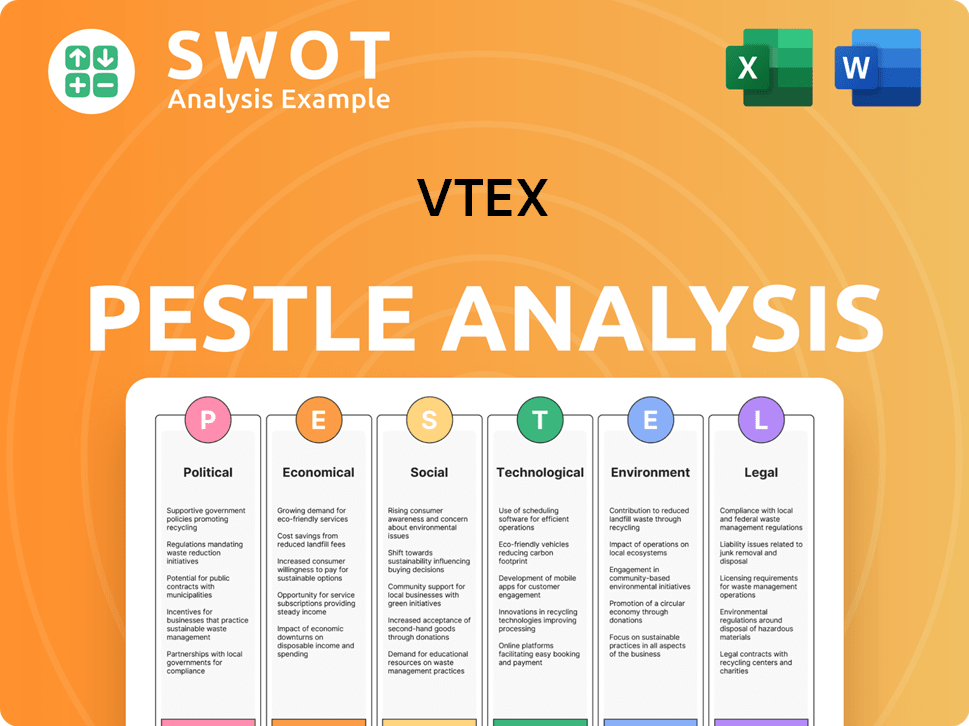

VTEX PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped VTEX’s Business Model?

The journey of VTEX has been marked by significant achievements and strategic shifts, shaping its operational and financial trajectory. A critical early success was securing Walmart as a client in Brazil, which was a key step in expanding its global retail solutions. The company's transition to a scalable, multitenant SaaS model further solidified its position as a leading e-commerce platform.

In 2021, VTEX's listing on the NYSE was a pivotal moment, raising approximately US$361 million in gross proceeds. This financial boost fueled growth and enhanced the company's global visibility. Recent strategic moves, including acquisitions and investments, highlight VTEX's evolution from a single-product platform to an integrated suite of solutions, expanding its capabilities in AI and conversational commerce.

Despite facing challenges such as currency volatility and market fluctuations, VTEX has maintained strong sales momentum, particularly in signing new enterprise customers worldwide. The company's consistent annual revenue churn, remaining stable in the mid-single digit percentage range, underscores strong customer satisfaction and a competitive edge in the market.

VTEX's success includes pivotal moments such as winning the Walmart RFP in Brazil, marking a significant step in scaling global retail solutions. The company transitioned to a scalable, multitenant SaaS model, establishing itself as a cutting-edge e-commerce platform. In 2021, VTEX went public on the NYSE, raising approximately US$361 million.

Strategic investments and acquisitions have been central to VTEX's growth strategy. The company invested in Synerise and acquired Weni in August 2024 for US$3.0 million, enhancing its AI and conversational commerce capabilities. In January 2025, VTEX acquired Newtail for US$4.1 million, expanding its retail media solutions. These moves show VTEX's transformation into an integrated solutions provider.

VTEX's competitive advantage lies in its composable and complete platform, offering a blend of out-of-the-box features with a modular, API-based architecture. This allows businesses to customize their e-commerce presence without compromising core functionalities. The company has a strong market leadership position in Latin America and is expanding globally, particularly in the US and Europe.

VTEX's commitment to customer success is evident in its recognition as the Customers' Choice in the 2025 Gartner® Voice of the Customer for Digital Commerce report for the second consecutive year, with 98% of VTEX customers reportedly recommending the platform. VTEX continues to adapt to new trends, with a strong focus on AI, data management, and B2B offerings.

VTEX's composable and complete platform offers a unique blend of out-of-the-box features with the flexibility of a modular, API-based architecture, allowing businesses to customize their e-commerce presence. VTEX is a leader in Latin America and is expanding globally, particularly in the US and Europe. The company is also adapting to new trends and technology shifts, including a strong focus on AI and data management.

- VTEX's strong customer satisfaction is reflected in its low annual revenue churn, remaining stable in the mid-single digit percentage range.

- The company's global expansion strategy is supported by its strong market position in Latin America and increasing momentum in contract signings in the US and Europe.

- For more insights, explore the Competitors Landscape of VTEX.

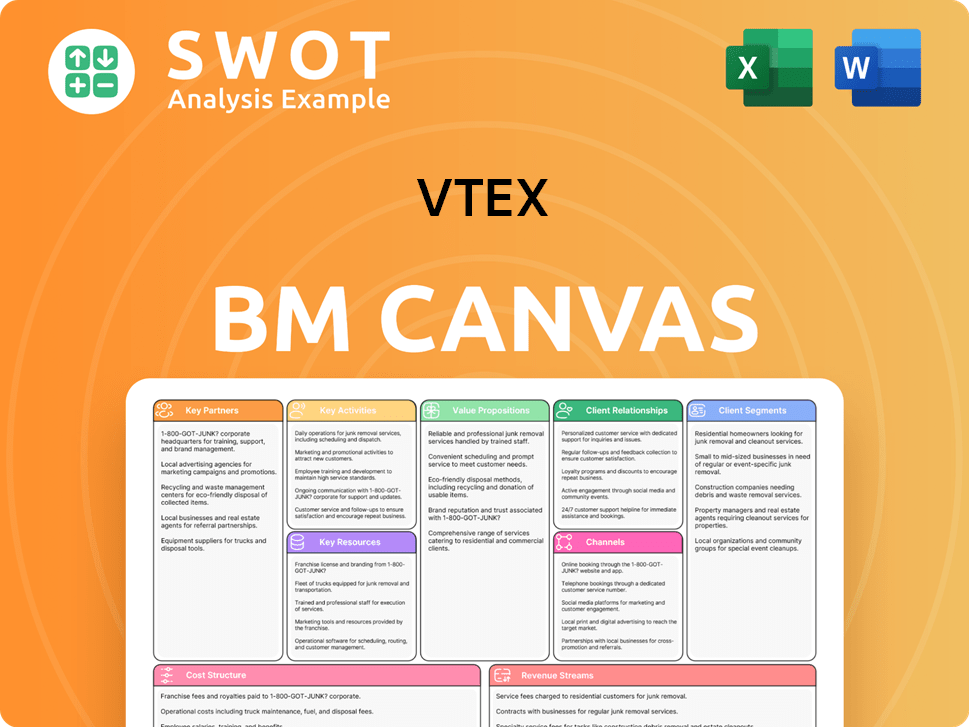

VTEX Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is VTEX Positioning Itself for Continued Success?

As of early 2025, the company holds a solid position in the global digital commerce platform market, with a strong presence in Latin America, while actively pursuing growth in North America and Europe. The VTEX platform supports 3.4 thousand active online stores across 43 countries as of December 31, 2024. This positions it as a significant player in the e-commerce landscape.

However, the company faces challenges. The digital commerce space is fiercely competitive, and regulatory shifts in key markets could disrupt growth. Technological advancements and changing consumer preferences also present ongoing challenges. Understanding the risks and opportunities is crucial for stakeholders evaluating the company's potential.

The company is recognized for its composable and complete commerce platform, trusted by 2.4 thousand global B2C and B2B customers. Its market share in the global e-commerce platform market is estimated to be around 2-4%, with a strong presence in Latin America. The company's customer loyalty is reflected in its low annual revenue churn, which remains stable in the mid-single digit percentage range.

Regulatory shifts in Brazil, its core market, could disrupt growth. The digital commerce space is intensely competitive, featuring established giants like Salesforce Commerce Cloud and Adobe Commerce, as well as nimble specialists. Technological disruption and evolving consumer preferences also pose continuous challenges.

The company's future hinges on continued platform innovation, expansion into the B2B sector, and successfully capturing larger enterprise clients. Strategic initiatives include refining solutions for greater interoperability and ensuring the suite helps businesses grow profitably. For the full year 2025, the company is targeting FX neutral year-over-year revenue growth of 14.0% to 17.0%, implying a range of US$238 million to US$244 million.

The company is transitioning from merely enabling commerce to actively executing business outcomes, aiming to simplify commerce for even the most complex organizations. The company plans to sustain and expand its ability to make money through continued investment in AI-powered solutions, such as intelligent agents that can autonomously execute operational workflows. The company also aims for non-GAAP operating income and free cash flow margins in the mid-teens.

The company's ability to navigate the competitive landscape and regulatory changes will be crucial. Successfully expanding into the B2B sector and attracting larger enterprise clients are key growth drivers. The company is confident in its ability to capitalize on market opportunities by empowering customers to digitally transform their commerce operations and outperform the market. For more detailed insights, consider reading about the Growth Strategy of VTEX.

- Continued platform innovation is essential.

- Expansion into the B2B sector is a key focus.

- Successfully capturing larger enterprise clients is a priority.

- AI-powered solutions will drive operational efficiency.

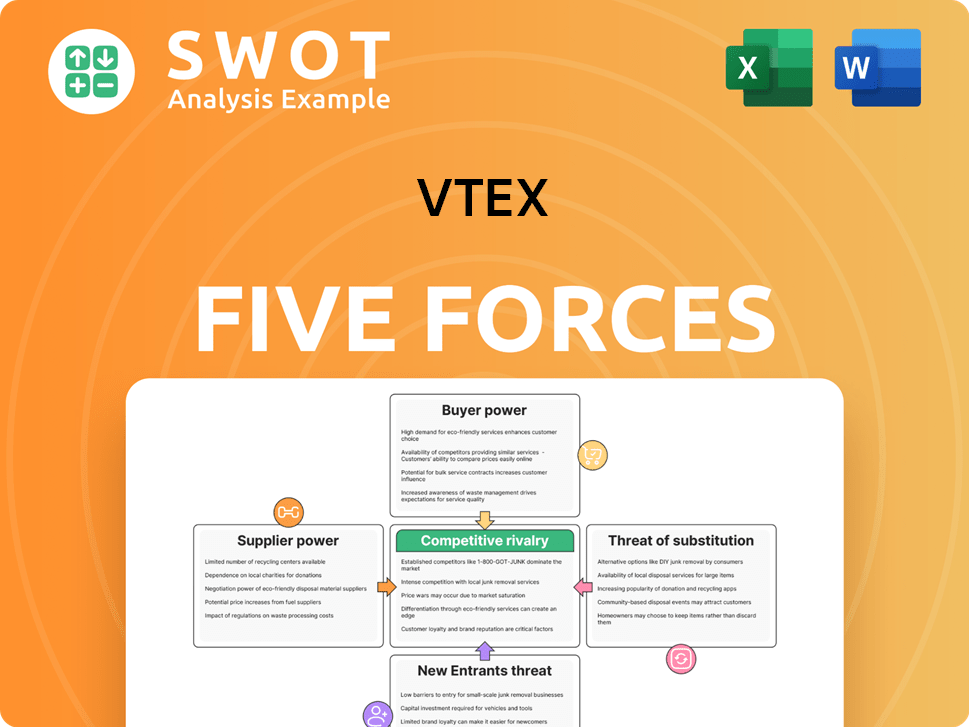

VTEX Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of VTEX Company?

- What is Competitive Landscape of VTEX Company?

- What is Growth Strategy and Future Prospects of VTEX Company?

- What is Sales and Marketing Strategy of VTEX Company?

- What is Brief History of VTEX Company?

- Who Owns VTEX Company?

- What is Customer Demographics and Target Market of VTEX Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.