Walmart Bundle

How Does Walmart Stay on Top?

Walmart, a retail behemoth, consistently leads the global market, boasting impressive financial figures and an extensive reach. In fiscal year 2024, Walmart's revenue surged to $648.1 billion, a testament to its enduring economic power. This article dives into the core of Walmart SWOT Analysis, exploring the strategies behind its success.

Understanding how Walmart works is crucial for anyone interested in the retail industry. This exploration will dissect Walmart's business model, from its complex supply chain and diverse store formats to its e-commerce operations and global presence. We'll examine Walmart's pricing strategy, its impact on small businesses, and its future plans, providing a comprehensive look at this retail giant's operations and competitive advantages.

What Are the Key Operations Driving Walmart’s Success?

The core of how operates centers on providing customers with 'everyday low prices' and a convenient shopping experience. This is achieved through a vast and integrated retail ecosystem. The company offers a wide array of products and services, catering to various customer segments across its different store formats and e-commerce platforms.

Its operational processes are highly sophisticated and deeply integrated. The sourcing strategy leverages immense buying power to secure favorable terms from suppliers globally, ensuring competitive pricing. The supply chain is a cornerstone of its efficiency, characterized by a highly optimized distribution network. Technology plays a crucial role, with investments in automation, data analytics, and artificial intelligence to optimize everything from inventory forecasting to personalized customer experiences.

Sales channels include its extensive physical store footprint, which continues to be a primary driver of sales, complemented by a robust e-commerce presence that offers online ordering, in-store pickup, and home delivery options. Customer service is integrated across these channels, aiming for a seamless shopping journey. Understanding Marketing Strategy of Walmart helps to grasp the company's approach.

The value proposition focuses on 'everyday low prices' and a convenient shopping experience. This is delivered through a vast retail ecosystem, including stores and e-commerce platforms. It provides a wide range of products, from groceries to general merchandise, appealing to diverse customer segments.

Walmart's operations are marked by a sophisticated, integrated approach. The company uses its buying power to secure favorable terms from suppliers. Its supply chain is highly optimized, and technology plays a crucial role in everything from inventory to customer experience.

Sales channels include its extensive physical store network and a robust e-commerce presence. E-commerce offers online ordering, in-store pickup, and home delivery. Customer service is integrated across all channels, ensuring a seamless shopping journey.

The company's operations are distinguished by their scale and efficiency. Cross-docking minimizes storage time, reducing costs. Strategic partnerships with suppliers ensure a steady supply of goods. Integration of physical and digital platforms enhances customer loyalty.

Walmart's operational success is driven by its efficient supply chain and strategic use of technology. These capabilities translate into lower prices, wide product selection, and convenient access for customers.

- $611.3 billion in revenue for fiscal year 2024.

- Over 10,500 stores and clubs under 46 banners in 19 countries.

- Approximately 210 million customers and members visit Walmart stores and clubs each week.

- E-commerce sales continue to grow, with a focus on expanding fulfillment capabilities.

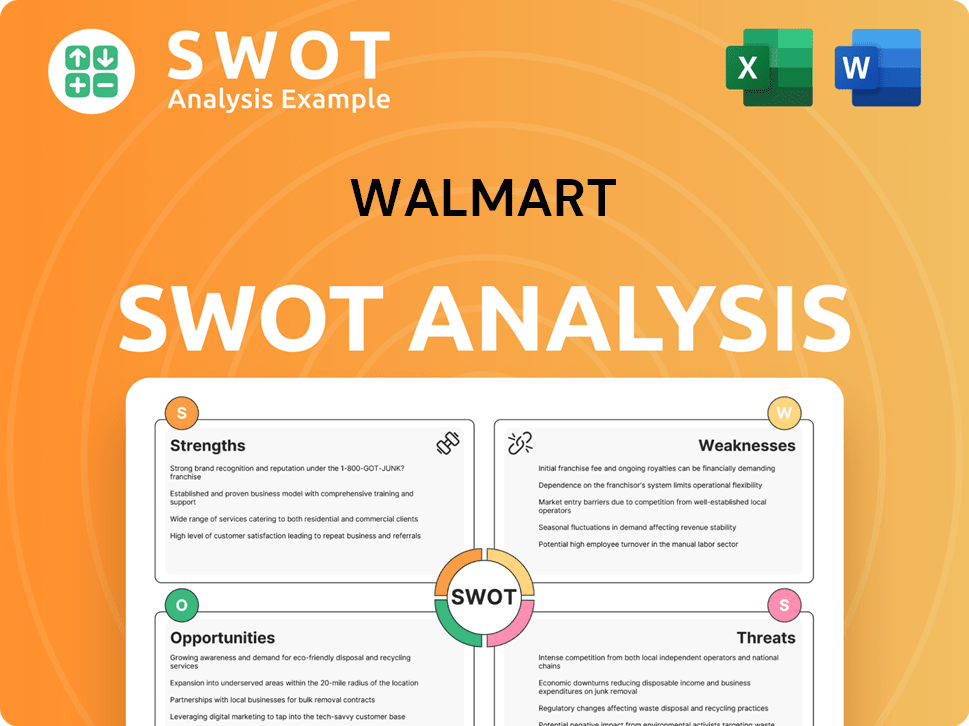

Walmart SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Walmart Make Money?

Understanding how Walmart generates revenue offers insight into its massive scale and market dominance. The company's financial success is rooted in a multifaceted approach, primarily driven by product sales across a variety of retail channels and e-commerce platforms. This strategy is complemented by diverse monetization methods that enhance profitability and customer engagement.

The core of Walmart operations involves the sale of goods. This includes groceries, general merchandise, health and wellness products, and other consumer items. For the fiscal year 2024, the company reported total revenues of $648.1 billion, with net sales contributing the bulk of this figure. The U.S. segment, encompassing Walmart U.S. and Sam's Club, significantly boosted sales, with Walmart U.S. net sales increasing by 5.3% and Sam's Club by 3.9%.

Beyond direct sales, Walmart business model incorporates several strategies to diversify its income. Advertising, particularly through Walmart Connect, is a notable area. This platform allows brands to advertise to Walmart's extensive customer base both online and in-store, leveraging the company's customer data. Walmart Connect generated $3.4 billion in global advertising income in fiscal year 2024, a 28% increase, showing the growing importance of this revenue stream.

Several key strategies contribute to how Walmart works financially. The Walmart+ membership program offers benefits like free shipping and fuel discounts, creating a recurring revenue stream and enhancing customer loyalty. Financial services, including money transfers and bill payments, also contribute, albeit on a smaller scale. Walmart has also expanded into healthcare services through Walmart Health, providing primary care and other services, representing an emerging revenue source. These strategies reflect Walmart's focus on leveraging its customer data and physical presence to create additional value-added services, moving beyond traditional retail sales.

- Product Sales: The primary revenue source, including groceries, general merchandise, and health products.

- Advertising: Walmart Connect, its retail media business, generated $3.4 billion in 2024.

- Walmart+: A subscription service driving recurring revenue and customer loyalty.

- Financial Services: Money transfers and bill payment services.

- Healthcare: Walmart Health provides healthcare services, creating a new revenue stream.

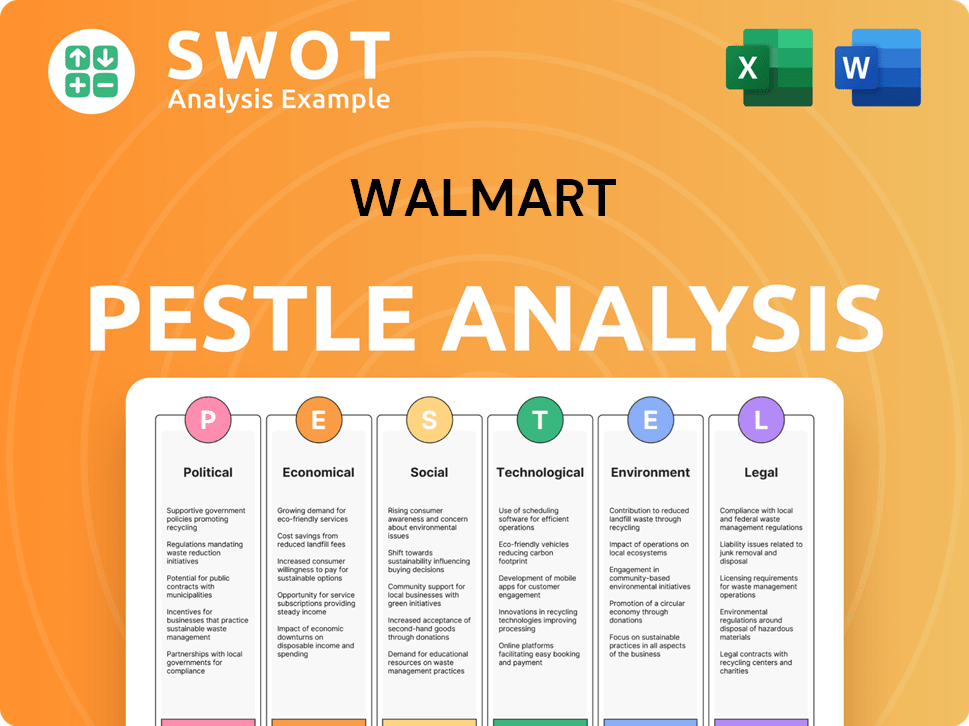

Walmart PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Walmart’s Business Model?

The story of Walmart is one of remarkable growth and adaptation, marked by key milestones and strategic decisions that have shaped its dominance in the retail industry. From its humble beginnings, the company has consistently evolved, embracing new technologies and consumer trends to maintain its competitive edge. Understanding the evolution of Walmart operations is essential for anyone interested in the retail landscape.

A cornerstone of Walmart's success has been its unwavering commitment to providing 'everyday low prices,' a strategy that revolutionized the retail sector. This focus, coupled with early investments in logistics and supply chain management, allowed the company to achieve unparalleled cost advantages. More recently, Walmart has made significant strides in e-commerce and omnichannel capabilities, reflecting its commitment to meeting the changing needs of consumers.

Walmart's journey also involves navigating operational challenges and adapting to shifts in consumer behavior. The company's ability to diversify its sourcing and increase inventory levels during supply chain disruptions demonstrates its resilience. Moreover, Walmart continues to address regulatory hurdles and public scrutiny, focusing on sustainability and employee benefits to maintain its position as a retail leader. If you are interested in learning more about the competitive environment, check out the Competitors Landscape of Walmart.

Walmart's history includes several pivotal moments. The introduction of 'everyday low prices' was a game-changer. Early adoption of advanced logistics and supply chain systems provided a significant cost advantage. Expansion into supercenters broadened its appeal and market share.

Recent strategic moves include aggressive investment in e-commerce. The acquisition of Jet.com in 2016 boosted online growth. Significant investments in online grocery pickup and delivery services were crucial during the pandemic. The launch of Walmart+ in 2020 aimed to increase customer loyalty.

Walmart's competitive advantages are multifaceted. Its economies of scale allow for favorable supplier terms and lower costs. Its brand strength is built on decades of consumer trust. Its extensive physical footprint offers advantages for in-store and omnichannel fulfillment.

Walmart continues to adapt to new trends. It invests in technology, expands e-commerce offerings, and explores new retail formats. The company's focus is on convenience and personalized shopping experiences. Walmart's global presence includes thousands of stores worldwide.

Walmart's competitive advantages are significant, contributing to its continued success in the retail sector. The company's unmatched economies of scale allow for lower operational costs and favorable supplier terms. Its extensive physical footprint, coupled with a strong brand reputation, provides a distinct edge in both in-store and online retail.

- Economies of Scale: Walmart's size allows it to negotiate lower prices with suppliers, reducing costs.

- Brand Strength: Decades of consumer trust in its value proposition.

- Extensive Physical Footprint: Thousands of stores provide convenience for customers and support omnichannel fulfillment.

- Technological Leadership: Investments in data analytics and supply chain optimization enhance efficiency.

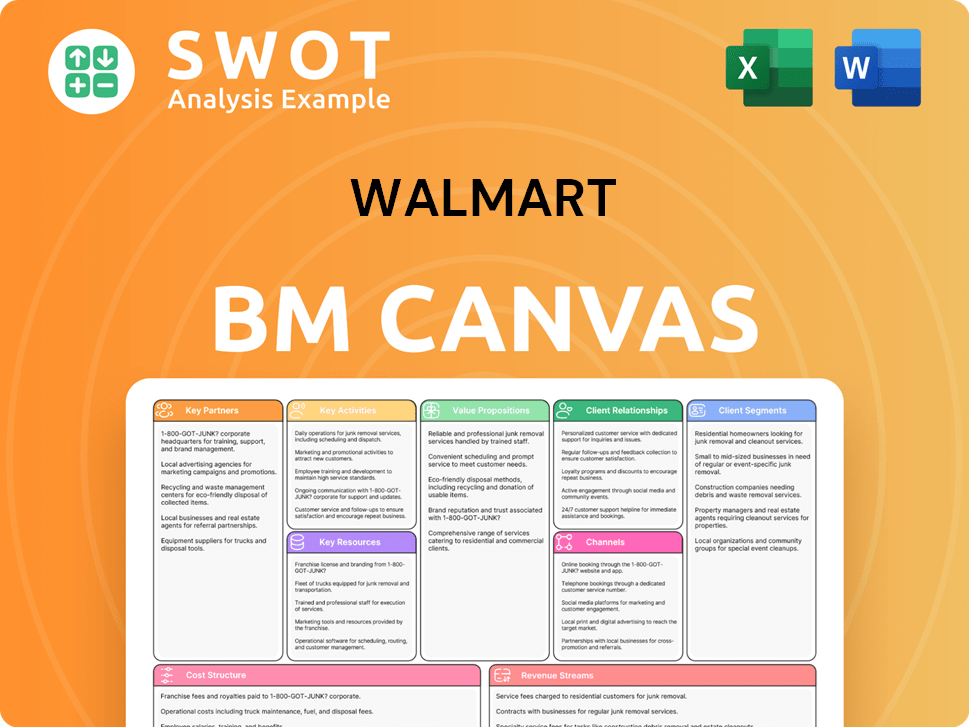

Walmart Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Walmart Positioning Itself for Continued Success?

In the realm of global retail, the company stands as a dominant force, consistently holding the title of the world's largest company by revenue. Its substantial market share in the U.S. grocery sector, coupled with an extensive store network, provides unparalleled reach and convenience. Customer loyalty is reinforced through its 'everyday low prices' strategy and the expansion of its omnichannel offerings, such as Walmart+.

Despite its strong market position, the company faces several risks. Intense competition from traditional and e-commerce retailers, technological disruption, regulatory changes, and shifting consumer preferences pose significant challenges. Economic downturns and inflationary pressures could also impact consumer spending, affecting sales and profitability. To maintain its competitive edge, the company must adapt and innovate.

The company is the world's largest retailer, with a significant presence in the U.S. grocery market. Its vast store network and "everyday low prices" strategy contribute to high customer loyalty. The company's global operations span across numerous countries, with its primary focus in the United States.

Competition from traditional and e-commerce retailers, technological disruption, and regulatory changes are key risks. Shifting consumer preferences and economic downturns also pose challenges. The company must continuously adapt to maintain its market share and profitability.

The company is investing heavily in e-commerce and expanding its higher-margin businesses. It is exploring new technologies like drone delivery and warehouse automation. The company's future depends on its ability to adapt to the dynamic retail landscape and leverage technological advancements.

Focus on e-commerce integration, expansion of high-margin businesses, and technological advancements. The company aims to enhance its delivery infrastructure and leverage stores as fulfillment centers. Continuous innovation and data utilization are key to serving customers effectively.

The company continues to invest in its e-commerce capabilities, aiming for seamless integration of online and offline experiences. This includes the expansion of last-mile delivery options and leveraging its stores as fulfillment centers. The company is also focused on growing higher-margin businesses like advertising and healthcare services, diversifying its revenue streams beyond traditional retail sales. The company is also exploring new technologies, such as drone delivery and automation in its warehouses, to improve efficiency and enhance the customer experience.

- E-commerce Expansion: Investing heavily in online platforms and delivery infrastructure.

- Diversification: Growing higher-margin businesses like advertising and healthcare.

- Technological Advancements: Exploring drone delivery and warehouse automation.

- Customer-Centric Approach: Prioritizing innovation, sustainability, and data utilization.

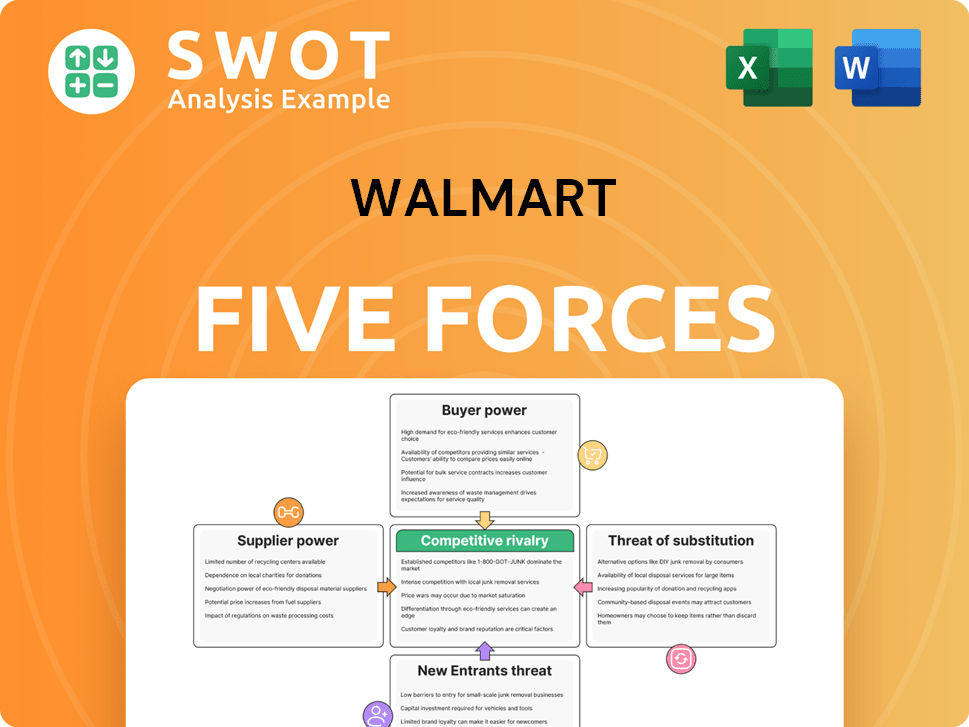

Walmart Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Walmart Company?

- What is Competitive Landscape of Walmart Company?

- What is Growth Strategy and Future Prospects of Walmart Company?

- What is Sales and Marketing Strategy of Walmart Company?

- What is Brief History of Walmart Company?

- Who Owns Walmart Company?

- What is Customer Demographics and Target Market of Walmart Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.