Waters Bundle

How Does Waters Corporation Shape the Future of Science?

Waters Corporation, a $16.5 billion giant, is at the forefront of scientific innovation, impacting fields from pharmaceuticals to food safety. This company provides critical tools and expertise, including Waters SWOT Analysis, to a wide range of industries. Understanding Waters' operations is key to grasping its influence and potential for growth.

Waters Company's impact is far-reaching, providing essential Waters instruments like HPLC systems and mass spectrometry solutions for critical applications. From Waters instruments for pharmaceutical analysis to environmental monitoring, Waters' technology ensures quality and drives advancements. This exploration will uncover how Waters Corporation generates revenue and its strategic positioning in the competitive landscape, including its chromatography offerings.

What Are the Key Operations Driving Waters’s Success?

Waters Corporation, often referred to as Waters Company, creates value by designing, manufacturing, selling, and servicing high-value analytical instruments, software, and consumables. They primarily serve customers in the pharmaceutical, life science, biochemical, industrial, food safety, environmental, academic, and government sectors. Their core offerings include liquid chromatography (LC), mass spectrometry (MS), and thermal analysis systems, along with a comprehensive portfolio of chemistries, columns, and software solutions.

These products enable the precise measurement, separation, and identification of chemical compounds, critical for drug discovery, quality control, environmental monitoring, and scientific research. Waters' operational processes are highly specialized and vertically integrated, including advanced manufacturing, rigorous quality control, and a strong focus on research and development to drive innovation. The company's commitment to scientific expertise and robust analytical solutions provides significant market differentiation.

The company's value proposition centers on providing solutions that improve data accuracy, enhance laboratory efficiency, and help customers comply with regulations. This commitment is evident in their customer service, which includes instrument installation, training, technical support, and preventative maintenance. Waters' focus on innovation and customer support has solidified its position in the analytical instruments market.

Waters Company offers HPLC systems, mass spectrometry, and thermal analysis systems. They also provide a range of chemistries, columns, and software. These tools are essential for various applications in different industries.

Their primary customer segments include pharmaceutical companies, life science organizations, and academic institutions. They also serve the food safety, environmental, and government sectors. These diverse segments rely on Waters instruments for their analytical needs.

Waters maintains vertically integrated operations, ensuring high-quality standards. This includes advanced manufacturing, stringent quality control, and a strong focus on R&D. Their commitment to excellence supports their market leadership.

Waters delivers value through improved data accuracy and enhanced laboratory efficiency. They help customers comply with regulations and accelerate product development. This results in significant market differentiation.

Waters Corporation’s operations are characterized by a strong emphasis on innovation and customer support. Their global presence and diverse product offerings cater to a wide range of analytical needs. This approach allows them to maintain a competitive edge in the market.

- Research and Development: Waters invests heavily in R&D, with approximately $300 million spent annually to develop new technologies and improve existing products.

- Global Presence: Waters has a significant global footprint, with sales and service operations in over 35 countries.

- Customer Support: Customer service is a key focus, with extensive training and technical support provided to ensure optimal instrument performance.

- Market Position: Waters holds a leading position in the analytical instruments market, with a market capitalization of approximately $23 billion as of early 2024. Further details can be found in the Owners & Shareholders of Waters article.

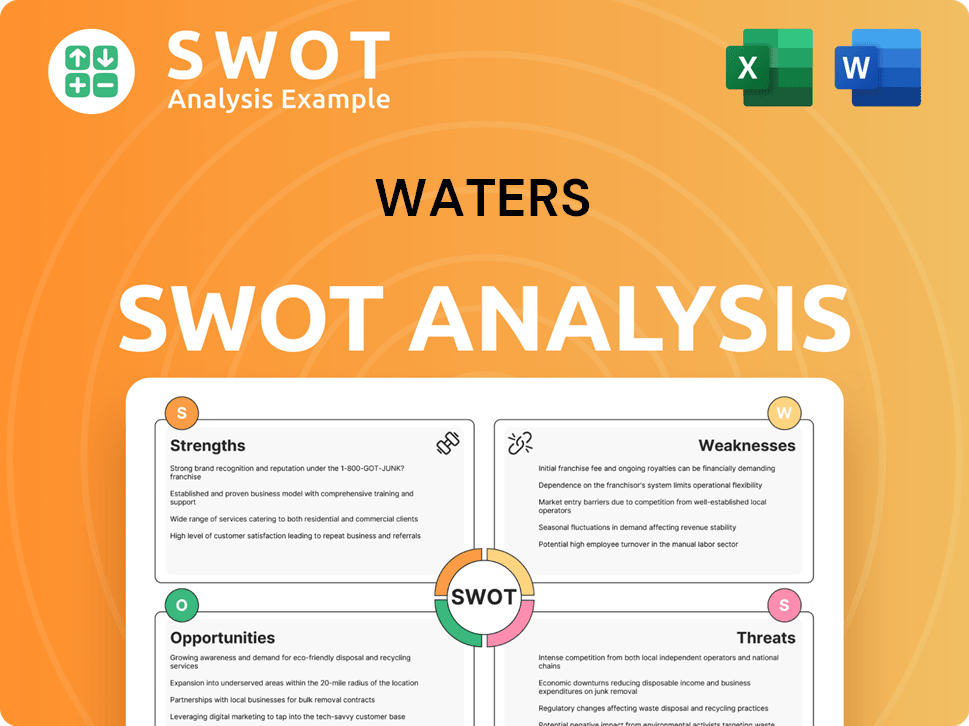

Waters SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Waters Make Money?

Waters Corporation, a global leader in analytical instruments, generates revenue through a diversified approach. The company's financial success hinges on a mix of product sales, recurring revenue streams, and strategic monetization strategies. In 2023, Waters Corporation reported net sales of approximately $2.94 billion, highlighting its significant market presence.

The company's revenue streams are primarily categorized into three key areas: Instruments, Services, and Consumables. This structure allows for a balance between initial sales and ongoing customer relationships. The focus on recurring revenue, particularly from consumables and services, provides financial stability and predictability.

Waters Corporation's monetization strategies include tiered pricing for instruments based on their capabilities and configurations. They also focus on cross-selling consumables and service contracts alongside instrument sales. This approach enhances customer loyalty and provides a steady revenue stream.

The primary revenue streams for Waters Corporation are instruments, consumables, and services. These streams are crucial for the company's financial health. The recurring nature of consumables and services contributes significantly to overall revenue stability.

- Instruments: Instrument sales, including liquid chromatography and mass spectrometry systems, are a major revenue source. In 2023, total instrument sales reached $1.09 billion.

- Consumables: Consumables, such as columns, reagents, and sample preparation products, represent a recurring revenue stream. In 2023, consumables sales totaled $1.07 billion.

- Services: The Services segment, which includes instrument maintenance, repair, validation, and training, contributes to recurring revenue. Service revenue amounted to $775 million in 2023.

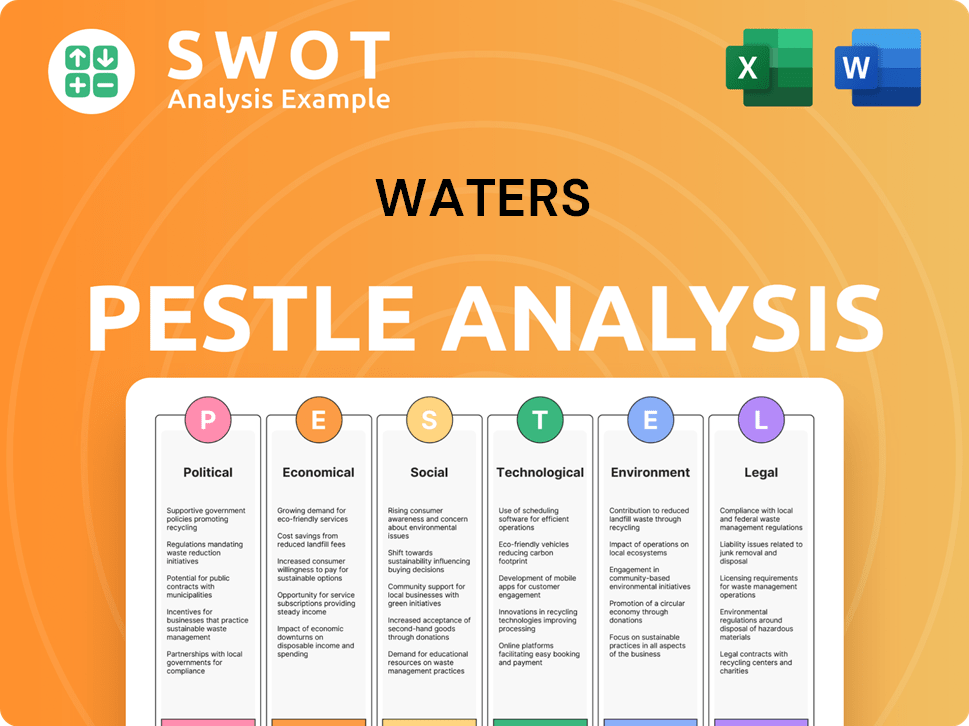

Waters PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Waters’s Business Model?

Waters Corporation has a history marked by significant achievements and strategic shifts that have shaped its operational and financial trajectory. The company's continuous innovation in liquid chromatography and mass spectrometry has been a cornerstone of its success, leading to the development of advanced analytical instruments. Strategic acquisitions, such as the 2023 purchase of Wyatt Technology for approximately $1.36 billion, have broadened its technology portfolio and market reach.

Waters has consistently adapted to challenges and opportunities in the market. Operational hurdles, such as global supply chain disruptions, have been addressed through proactive inventory management and diversification of suppliers. The company has also navigated regulatory complexities, particularly within the pharmaceutical sector, by ensuring continuous compliance and developing validated solutions. These efforts have helped Waters maintain its competitive edge.

The company's competitive advantages are rooted in its strong brand reputation, technological leadership, and extensive patent portfolio. Waters benefits from economies of scale in manufacturing and a global service network that provides unparalleled customer support. Waters continues to adapt to new trends, such as the increasing demand for personalized medicine and biopharmaceutical development, by investing in R&D for solutions tailored to these growing areas. Also, you can read more about the Competitors Landscape of Waters.

Waters has achieved significant milestones, including the introduction of advanced UPLC (Ultra-Performance Liquid Chromatography) systems, which revolutionized separations science. The acquisition of Wyatt Technology in 2023 expanded its offerings in light scattering technology. These developments have enhanced analytical capabilities and addressed evolving scientific needs, reinforcing Waters' position in the market.

Waters has implemented strategic moves such as acquisitions and investments in R&D. These moves have broadened its technology portfolio and market presence. The company focuses on continuous innovation and offers comprehensive, integrated workflows to provide superior value to customers. These strategies help Waters to adapt to new trends and address competitive threats.

Waters maintains a competitive edge through its strong brand reputation, technological leadership, and extensive patent portfolio. The company’s global service network and economies of scale in manufacturing provide unparalleled customer support. Waters' focus on continuous innovation and integrated workflows ensures it remains a leader in the analytical instruments market.

In recent financial reports, Waters has demonstrated consistent revenue growth, driven by demand for its HPLC systems and mass spectrometry solutions. The company's investments in R&D, which accounted for a significant portion of its operating expenses, have supported the development of new products. Waters' strong financial performance reflects its ability to navigate market challenges and capitalize on growth opportunities.

Waters Corporation's success is built on its technological leadership, strong brand reputation, and strategic focus on innovation and customer support. The company leverages its strengths to address market demands and maintain a competitive edge. Waters' ability to adapt to changing market dynamics and invest in R&D is crucial for its continued growth.

- Continuous innovation in HPLC systems and mass spectrometry.

- Strategic acquisitions to expand technology portfolio.

- Strong brand reputation and extensive patent portfolio.

- Global service network and customer support.

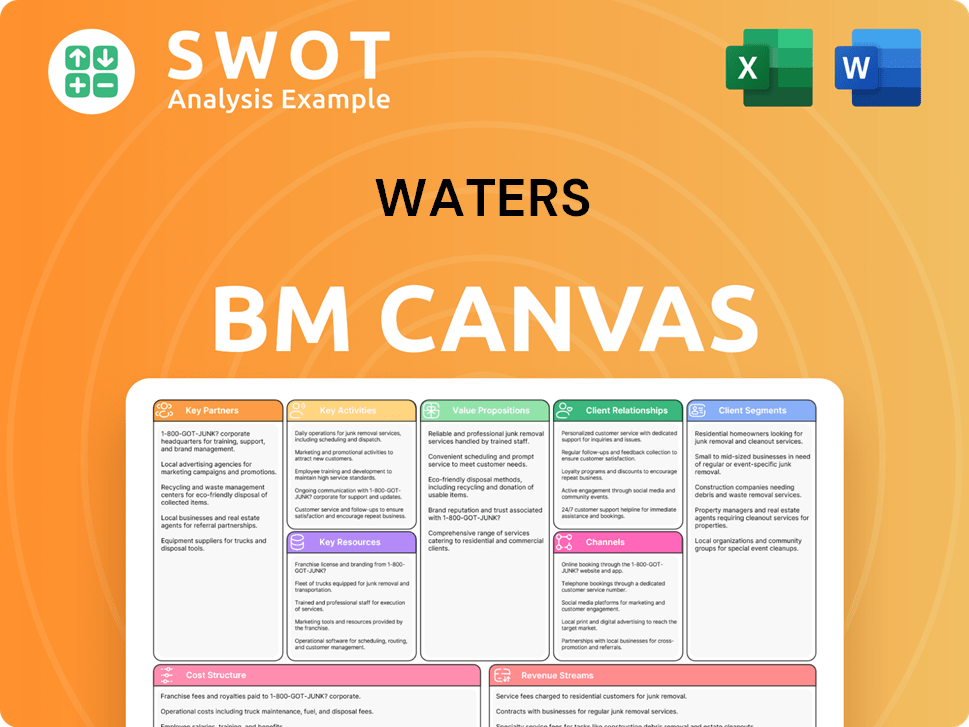

Waters Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Waters Positioning Itself for Continued Success?

Waters Corporation holds a strong position in the analytical instruments market, particularly in the pharmaceutical and life sciences sectors. It is a leading provider of advanced instruments, including HPLC systems and mass spectrometry, crucial for drug discovery and quality control. The company's global reach and strong customer loyalty, driven by its comprehensive support services, further solidify its industry standing.

The future outlook for Waters Corporation involves navigating several key risks and capitalizing on growth opportunities. These include economic uncertainties, intense competition, and technological disruptions. The company is addressing these challenges through strategic initiatives focused on expanding recurring revenue, innovation in R&D, and strategic acquisitions to broaden its market reach. The company is also focusing on digital offerings and best-in-class customer service.

Waters Corporation is a leader in analytical instruments, particularly in the pharmaceutical and life sciences industries. It has a significant market share in HPLC systems and mass spectrometry. Its instruments are critical for laboratory operations, ensuring high customer loyalty.

Economic downturns, intense competition, and rapid technological changes pose risks. Regulatory changes and geopolitical tensions can impact operations. The company must adapt to stay competitive and maintain market access.

The company aims to capitalize on growing demand in emerging scientific fields. It plans to strengthen its digital offerings and enhance customer service. Waters Corporation is focused on sustainable growth and operational excellence.

Waters Corporation is expanding recurring revenue through consumables and services. It is investing in R&D and pursuing acquisitions. The company focuses on data analytics and automation to improve efficiency. Learn more about the Marketing Strategy of Waters.

Waters Corporation has demonstrated consistent financial performance. In recent financial reports, the company has shown growth in both revenue and earnings, indicating a strong market position. The demand for advanced analytical solutions continues to rise, particularly in areas like biopharmaceuticals and environmental testing.

- Waters instruments are essential for pharmaceutical analysis and are used globally.

- The company's focus on innovation, especially in mass spectrometry, is key.

- Strategic acquisitions and partnerships help expand the product portfolio.

- The company's commitment to customer support is crucial for retention.

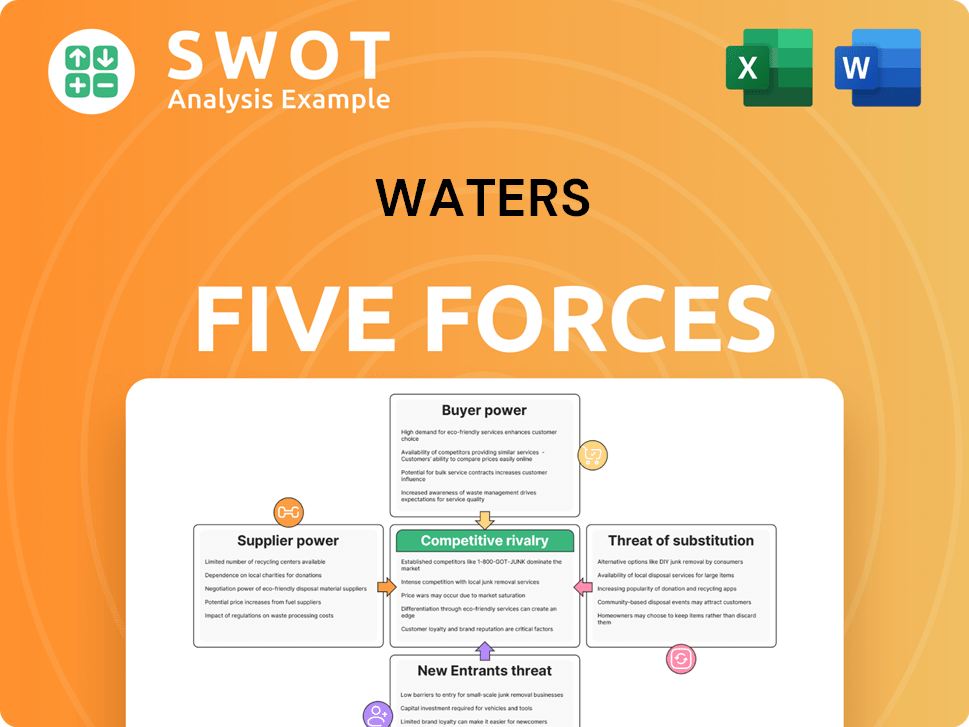

Waters Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Waters Company?

- What is Competitive Landscape of Waters Company?

- What is Growth Strategy and Future Prospects of Waters Company?

- What is Sales and Marketing Strategy of Waters Company?

- What is Brief History of Waters Company?

- Who Owns Waters Company?

- What is Customer Demographics and Target Market of Waters Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.