WTW Bundle

How Does the WTW Company Thrive?

Willis Towers Watson (WTW) stands as a global powerhouse, offering advisory, broking, and solutions across risk, strategy, and people sectors. With $9.9 billion in revenue in 2024, and a robust 5% organic revenue growth, WTW demonstrates significant influence. Despite a net loss in 2024, the company's performance warrants a closer look at its WTW SWOT Analysis.

Understanding the WTW operations and WTW business model is crucial for anyone interested in the financial landscape. WTW company provides essential services, helping clients manage risk and optimize their performance. Examining its core functions, revenue streams, and strategic direction offers insights into its continued success and adaptability in a constantly evolving market. This analysis is particularly relevant given WTW's global presence and comprehensive WTW services and WTW solutions.

What Are the Key Operations Driving WTW’s Success?

The WTW company, formerly known as Willis Towers Watson, creates value by offering data-driven solutions across people, risk, and capital. Their core operations encompass advisory services, broking, and various solutions designed to enhance client resilience, motivate workforces, and maximize performance. The WTW business model focuses on providing tailored advice and solutions to manage complex risks, optimize human capital, and inform financial decisions.

WTW operations are enabled through a combination of advisory services and technology solutions. The company serves a diverse global customer base, operating in over 140 countries and markets. This global presence allows them to offer comprehensive services and solutions tailored to local market needs.

In Q1 2025, the Health, Wealth & Career (HWC) segment saw organic revenue growth driven by solid client retention, new business, and geographic expansion in Health. The Risk & Broking (R&B) segment also experienced organic revenue growth, fueled by increased new business activity and strong client retention globally. WTW's integrated approach to risk, people, and capital allows it to offer comprehensive solutions that address multifaceted client needs.

WTW services include advisory services, broking, and various solutions. These offerings help clients enhance resilience, motivate their workforce, and maximize performance. Their services are designed to meet a wide range of client needs across different industries.

WTW company operates in 140 countries and markets, demonstrating a strong global presence. This extensive reach allows WTW to serve a diverse range of customer segments worldwide. This global footprint enables them to offer localized solutions.

WTW solutions are delivered through a combination of advisory services and technology. They focus on client retention, new business, and geographic expansion. Strategic partnerships play a key role in their operational strategy, enhancing their capabilities and reach.

WTW provides tailored advice and solutions to help organizations manage risks, optimize human capital, and make informed financial decisions. Their integrated approach to risk, people, and capital allows them to offer comprehensive solutions. This approach differentiates them in the market.

WTW engages in strategic partnerships to enhance its service offerings and expand its reach. These collaborations highlight WTW's focus on innovative solutions and expanding its reach. These partnerships are key to their growth strategy.

- Joint venture with Bain Capital to re-enter the treaty reinsurance broking market.

- Partnership with Kayna and Vibrant to enhance third-party vendor cybersecurity insurance compliance.

- Focus on leveraging technology to streamline risk management and insurance distribution.

- These partnerships and innovations are critical for WTW's competitive advantage.

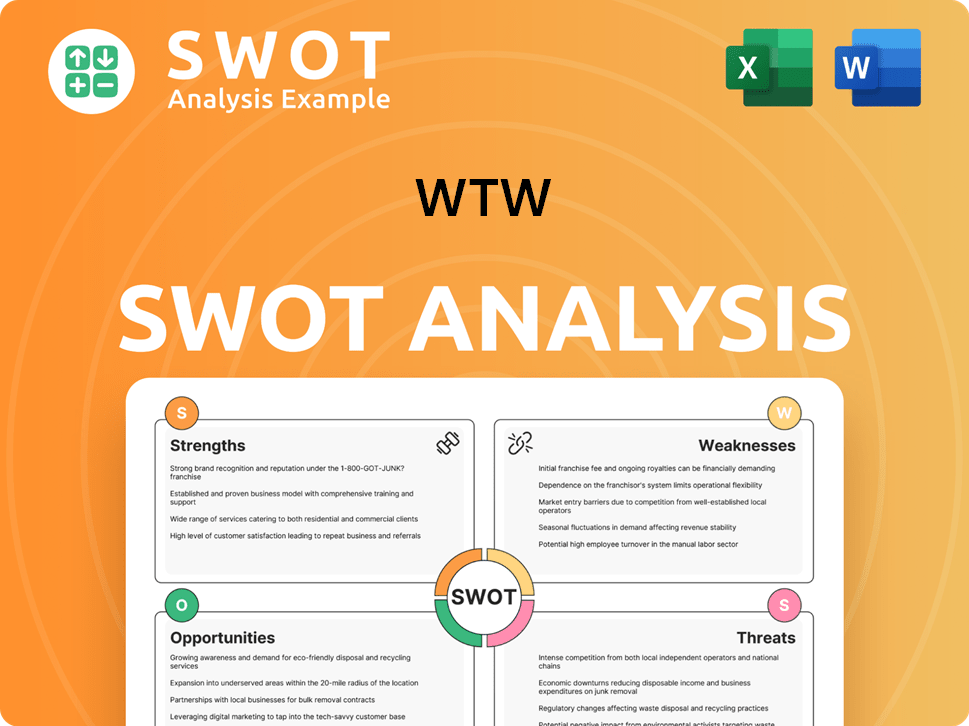

WTW SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does WTW Make Money?

The WTW company generates revenue through a diversified range of services. These include advisory services, broking activities, and various solutions focused on risk, strategy, and people. The WTW business model is centered on providing expertise and solutions across multiple sectors, ensuring a steady flow of income.

For the fiscal year ending December 31, 2024, WTW reported a total revenue of $9.93 billion. This represents a 5% increase compared to the $9.48 billion recorded in the previous year. The organic revenue growth for 2024 was also 5%, indicating solid performance across its core business areas.

The WTW operations are primarily structured around two key segments, each contributing significantly to the company's overall financial performance.

The WTW services are categorized into two main segments, each contributing significantly to overall revenue. These segments are Health, Wealth & Career (HWC) and Risk & Broking (R&B). The company's ability to provide comprehensive solutions across these segments is a key driver of its financial success.

- Health, Wealth & Career (HWC) Segment: This segment generated $5.77 billion in revenue in 2024, marking a 3% increase from the previous year. In Q1 2025, the segment's revenue was $1.17 billion, though it decreased by 13% year-over-year due to the sale of the TRANZACT business. Despite this, the segment achieved 3% organic revenue growth in Q1 2025, driven by strong client retention, new business, and geographic expansion in Health, as well as growth in Retirement work and Investments.

- Risk & Broking (R&B) Segment: The R&B segment contributed $4.04 billion to the total revenue in 2024, representing an 8% year-on-year increase. In Q1 2025, the R&B segment's revenue reached $1.03 billion, reflecting a 5% increase (7% organic growth) compared to the prior year. This growth was fueled by increased new business activity and robust client retention in Corporate Risk & Broking, alongside expansion in the Consulting and Technology practices of Insurance Consulting and Technology.

While WTW reported a net loss of $88 million in 2024 due to impairment charges from the TRANZACT sale, its adjusted diluted earnings per share (EPS) for the full year 2024 was $16.93, up 17% over the prior year. The company's strategic approach to monetization also involves leveraging technology and data. For more information on the target market of WTW, you can read this article: Target Market of WTW.

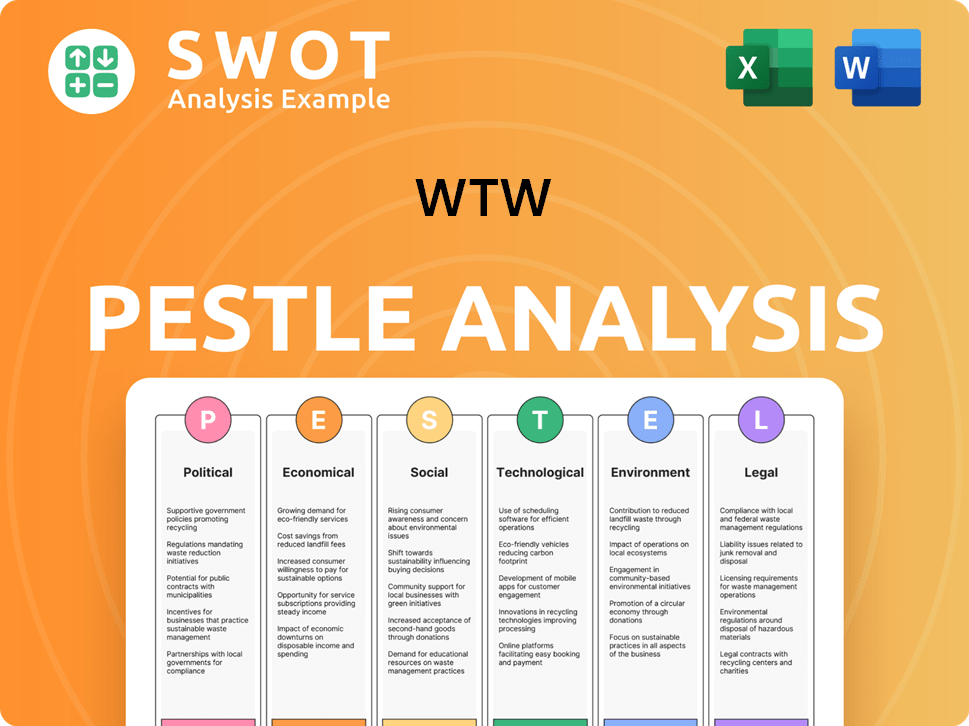

WTW PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped WTW’s Business Model?

Understanding the evolution of the WTW company involves examining its strategic shifts, key milestones, and competitive advantages. These elements collectively shape its WTW operations and financial trajectory. The company has been actively reshaping its portfolio and market approach to enhance its position in the global market.

The WTW business model has been significantly influenced by strategic decisions aimed at streamlining operations and boosting profitability. The 'Grow, Simplify and Transform' strategy, which concluded in 2024, played a crucial role in this transformation. This initiative aimed to make the company more focused, faster-growing, and profitable.

A deep dive into these aspects provides a comprehensive view of how WTW operates and competes in the industry, offering insights into its future prospects.

A significant milestone for WTW was the divestiture of its TRANZACT direct-to-consumer insurance distribution business, completed in January 2025, for $632.4 million. This strategic move, although resulting in over $1 billion in impairment charges and a net loss for 2024, is expected to improve growth, operating margins, and free cash flow starting in 2025.

WTW re-entered the treaty reinsurance broking market through a joint venture with Bain Capital, announced in December 2024. This partnership aims to leverage WTW's global expertise and Bain Capital's experience. Furthermore, the company is focusing on mergers and acquisitions (M&A) as part of its next growth phase, targeting smaller acquisitions that can be integrated into existing operations, particularly in the middle-market segment.

WTW's competitive advantages stem from its brand strength, technology leadership, and extensive global reach. The company's focus on data-driven, insight-led solutions helps it differentiate in the market. It continues to adapt to new trends by investing in technology and AI, with expectations for accelerated AI adoption in the next two years to personalize communications and enhance program delivery.

The company addresses evolving risks, as highlighted in its 2024/25 Global Manufacturing Risk Report, which identified cybersecurity as the biggest risk factor for businesses. WTW's partnerships, such as with Kayna and Vibrant for cybersecurity insurance compliance, demonstrate its proactive approach to addressing market needs and competitive threats. Learn more about the Marketing Strategy of WTW.

The strategic moves, including the divestiture and joint ventures, are designed to improve WTW's financial performance. The sale of TRANZACT, despite the initial financial impact, is expected to streamline operations and improve profitability. The focus on M&A suggests a strategy to expand and integrate new capabilities, enhancing WTW's service offerings.

- The joint venture in reinsurance broking aims to capitalize on emerging market opportunities.

- Investments in technology and AI are expected to drive efficiency and enhance client service.

- Partnerships in areas like cybersecurity insurance compliance highlight a proactive approach to risk management.

- These initiatives collectively position WTW for sustained growth and improved financial results.

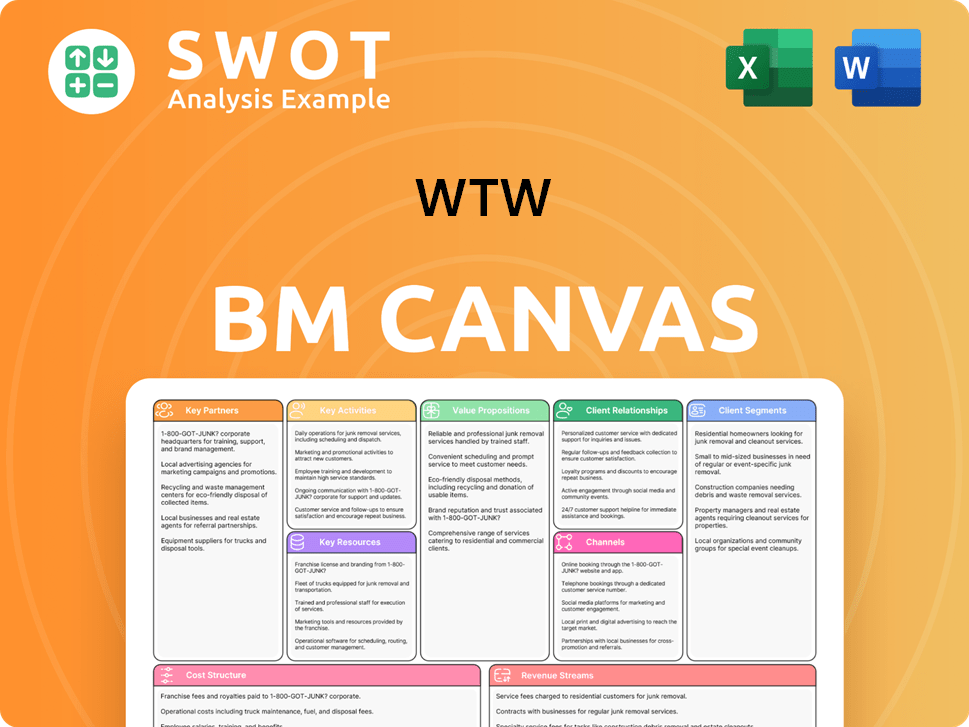

WTW Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is WTW Positioning Itself for Continued Success?

The WTW company maintains a prominent position within the advisory, broking, and solutions sector. As of Q1 2025, WTW's market share was approximately 7.00% relative to its competitors. This strong market presence is supported by its global reach, serving clients in 140 countries and markets, contributing to a diversified revenue base.

Despite its robust industry standing, WTW operations are subject to various risks. These include macroeconomic factors such as inflation, interest rate fluctuations, and geopolitical tensions, which could affect its financial performance. Additionally, a potential decrease in demand for consulting and actuarial services, stagnant insurance pricing, and foreign exchange fluctuations pose further risks to WTW business model.

As of Q1 2025, WTW held a market share of approximately 7.00%. The company operates globally, serving clients in 140 countries. This broad reach supports its diversified revenue streams.

Macroeconomic conditions, including inflation and interest rate changes, pose significant risks to WTW. Decreased demand for consulting services and currency fluctuations also present challenges. The company's Reputational Risk Readiness Survey 2024/25 identified cyber risk and environmental challenges as major threats.

In 2025, WTW aims for mid-single-digit organic revenue growth and continued adjusted EPS improvement. The company plans approximately $1.5 billion in share repurchases in 2025, subject to market conditions. WTW is also focused on strategic investments in total rewards, including employee-facing technology, data, analytics, and AI.

WTW is re-entering the treaty reinsurance market and focusing on M&A opportunities. The company anticipates continued growth in its Health, Wealth & Career segment. The Risk & Broking segment is expected to benefit from strong client retention and new business activity.

For 2025, WTW anticipates mid-single-digit organic revenue growth and plans for approximately $1.5 billion in share repurchases. The company's strategic focus includes geographic expansion and investments in technology to enhance its services.

- The Health, Wealth & Career segment is expected to grow through geographic expansion.

- The Risk & Broking segment should benefit from strong client retention and new business.

- Strategic investments in total rewards, data, and AI are underway.

- The company is actively pursuing M&A opportunities aligned with its strategic priorities.

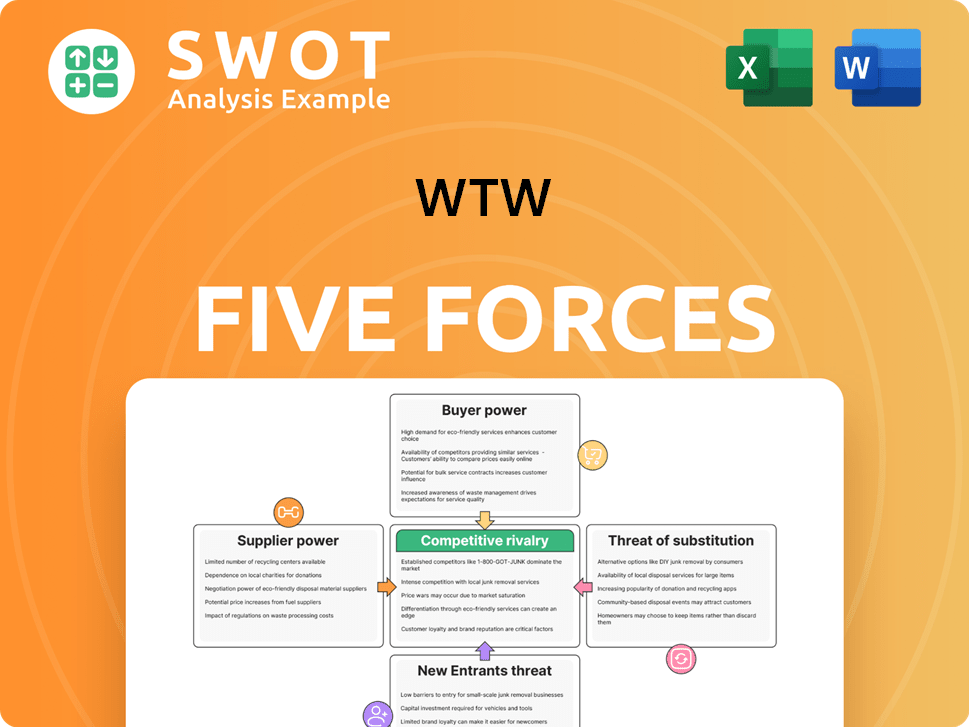

WTW Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of WTW Company?

- What is Competitive Landscape of WTW Company?

- What is Growth Strategy and Future Prospects of WTW Company?

- What is Sales and Marketing Strategy of WTW Company?

- What is Brief History of WTW Company?

- Who Owns WTW Company?

- What is Customer Demographics and Target Market of WTW Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.