Credicorp Bundle

How is Credicorp Dominating the Financial Landscape?

Credicorp, a financial powerhouse based in Peru, has masterfully navigated the evolving financial services sector. Its recent success, particularly with its digital payment platform Yape, showcases a remarkable shift in its go-to-market approach. This transformation, coupled with impressive financial results, warrants a closer look at its sales and marketing strategies.

This analysis will explore Credicorp's Credicorp SWOT Analysis, dissecting its sales and marketing approach, including its digital marketing initiatives and customer acquisition strategies. We'll examine its brand positioning strategy and key marketing campaign examples, providing actionable insights for investors and business strategists alike. Understanding Credicorp's Credicorp sales strategy and Credicorp marketing strategy is crucial for grasping its continued success in a competitive market.

How Does Credicorp Reach Its Customers?

The sales strategy of Credicorp involves a mix of online and offline channels to reach its wide customer base. Traditional channels, such as physical branches of its subsidiaries like BCP and Mibanco, have been crucial for serving individuals and businesses. These branches and direct sales teams support the direct acquisition and servicing of customers for banking, insurance, and investment products, which is a key aspect of the Credicorp sales strategy.

Credicorp's marketing strategy has evolved significantly with a strong emphasis on digital adoption and omnichannel integration. Digital channels have seen substantial growth in transactions. By the end of 2024, a significant portion of financial product sales in BCP's Retail Banking were conducted through digital channels, highlighting the company's shift towards digital platforms. This transformation aims to enhance customer engagement and improve operational efficiency across its core businesses, demonstrating the company's commitment to adapting to changing market dynamics.

The company also utilizes wholesale distribution and partner retail arrangements, especially in its insurance and pension fund businesses, to broaden its reach. The use of these varied channels allows Credicorp to cater to different customer segments and offer a wide range of financial products and services. This multi-channel approach is a core element of Credicorp's business model and its approach to the Credicorp sales and marketing approach.

Digital channels have experienced exponential transaction growth. Monetary transactions through digital channels at BCP grew by 116.5%, and non-monetary transactions increased by 87.8%. This rapid growth demonstrates the increasing importance of digital platforms in Credicorp's operations.

The mobile payment application, Yape, is a key digital channel, with over 13.7 million monthly active users by the end of 2024, and a goal of 16.5 million by 2026. Yape's transaction volume nearly doubled in 2024, and it has expanded paid assets to 1.8 million users, becoming Peru's fifth-largest e-commerce player.

Credicorp's investment in digital initiatives extends to neobanks, such as Tenpo in Chile, which is expected to become the country's first digital bank in 2025 and already serves over 750,000 users. This expansion into neobanks shows Credicorp's commitment to innovation and its ability to adapt to the evolving financial landscape.

Key partnerships, such as the collaboration with Falabella in Embedded Insurance, further contribute to growth and market share by expanding offerings through commercial partnerships. This approach allows Credicorp to leverage its ecosystem and reach a wider audience, supporting its market expansion strategies.

Credicorp's digital strategy focuses on enhancing customer engagement and operational efficiency. The company invests heavily in technology within its core businesses and disruptive initiatives to maintain a competitive advantage. This includes the development and expansion of digital platforms like Yape and investments in neobanks like Tenpo.

- Yape has become a leading digital wallet in Peru and Bolivia, with significant user growth and transaction volumes.

- Digital channels account for a growing share of financial product sales, indicating a shift towards online platforms.

- Partnerships like the one with Falabella expand offerings and market reach through commercial collaborations.

- Tenpo in Chile is expected to become the country's first digital bank, further expanding Credicorp's digital footprint.

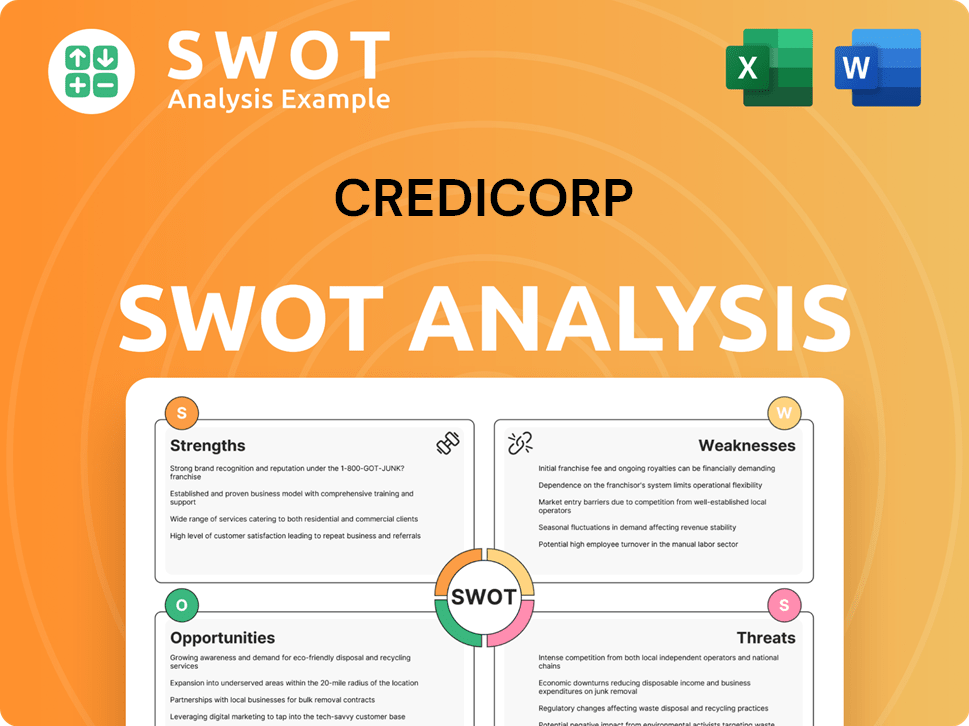

Credicorp SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Credicorp Use?

The marketing tactics employed by Credicorp are multifaceted, designed to build brand awareness, generate leads, and drive sales across its diverse financial services. A strong emphasis is placed on digital channels, leveraging various online strategies to reach and engage its target audience. Their approach combines digital initiatives with traditional media to maximize reach and impact.

Digital marketing is at the forefront of Credicorp's strategy, with significant investments in digital channels and disruptive initiatives. Content marketing, search engine optimization (SEO), paid advertising, email marketing, and social media platforms are crucial for reaching and engaging their target audience. Data-driven marketing is also a key focus, emphasizing customer segmentation and personalization to provide tailored financial solutions.

The company's commitment to innovation is evident in its goal to generate 10% of its risk-adjusted revenues from new business models by 2026. This demonstrates a strong focus on leveraging data and technology for new revenue streams and enhancing its market position. This approach is crucial for their overall Credicorp sales strategy.

Digital channels are central to Credicorp's marketing efforts. They utilize content marketing, SEO, paid advertising, email marketing, and social media extensively.

The success of Yape, with over 13.7 million monthly active users by the end of 2024, highlights the effectiveness of their digital outreach. The app's expansion through new functionalities has driven significant transaction volumes.

Traditional media, such as TV, radio, and print, likely still play a role in broader brand awareness campaigns. This helps in reaching segments of the population less integrated digitally.

Credicorp focuses on customer segmentation and personalization. This approach aims to provide tailored financial solutions, enhancing customer engagement and satisfaction.

Technology platforms and analytics tools are integral to their marketing efforts. Credicorp continuously invests in technology to strengthen its core businesses and develop disruptive initiatives.

Strategic updates in 2024 highlighted their disciplined approach to innovation. This includes leveraging platforms like Monroquera to link insurance to digital channels and enabling Yape to become a digital insurance distributor.

Credicorp's Credicorp marketing strategy involves a blend of digital and traditional tactics to achieve its goals. The company focuses on innovation and leveraging technology to enhance its market position and customer engagement. They aim to optimize their Credicorp business model through data-driven decisions.

- Digital Marketing: Content marketing, SEO, paid advertising, email marketing, and social media.

- Customer Segmentation: Personalizing financial solutions based on customer needs.

- Innovation: Developing new business models to generate revenue streams.

- Technology Integration: Utilizing platforms and analytics tools to enhance marketing efforts.

- Traditional Media: Employing TV, radio, and print for broader brand awareness.

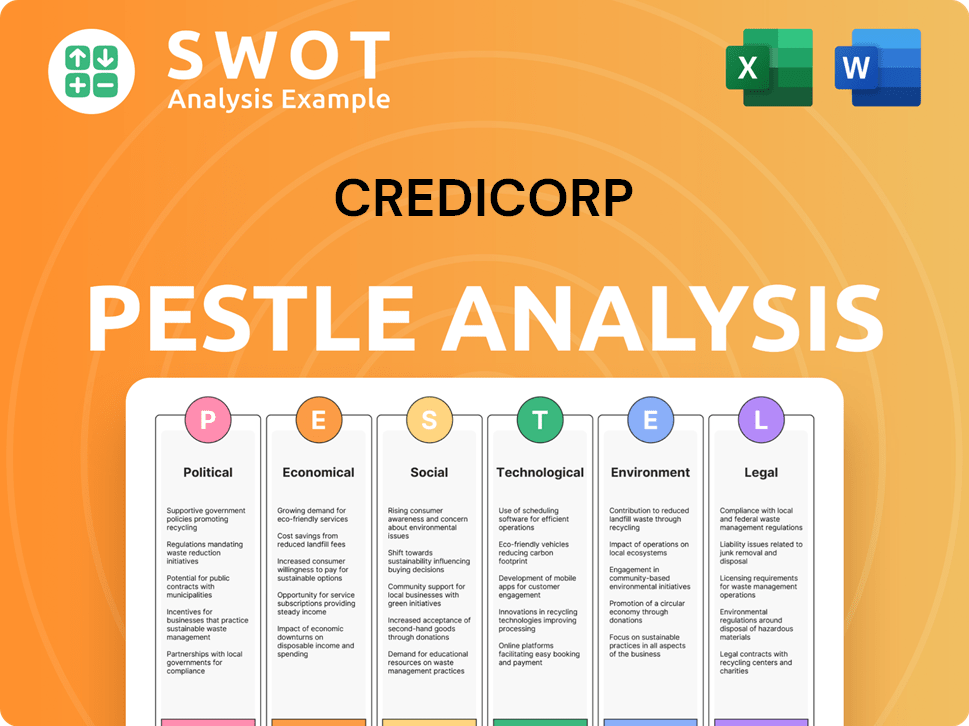

Credicorp PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Credicorp Positioned in the Market?

Credicorp's brand positioning centers on being a leading financial services holding company, primarily in Peru and across Latin America. This strategy emphasizes innovation, reliability, and a commitment to improving lives. The company differentiates itself through a diversified business portfolio, including universal banking, microfinance, insurance, pension funds, and investment management. This approach is key to its Credicorp sales strategy.

The core message focuses on contributing to the sustainable and inclusive development of the countries where it operates. This brand identity is built on trust, a long history, and a forward-looking approach driven by digital transformation. Credicorp aims to be perceived as both a traditional pillar of the financial system and a modern, adaptable entity. This also influences its Credicorp marketing strategy.

Credicorp's commitment to financial inclusion is a significant part of its brand appeal. For example, BCP and Yape have successfully included 5.7 million people in the financial system since 2020. Mibanco Peru achieved banking access for over 58,000 people in 2024, with 62% being women. This focus on inclusion strengthens its appeal to a broad demographic, including underserved populations, which is critical for its Credicorp strategy.

Credicorp maintains brand consistency across its subsidiaries and touchpoints, reinforcing a unified image. This ensures a cohesive brand experience for customers across all its financial services. This is crucial for effective Credicorp financial services.

The company's sustainability strategy, updated in 2024, integrates environmental and social considerations into its business model. This proactive role in driving change aligns with its purpose of 'contributing to improving lives by driving the changes that our countries need.' This approach is key to Credicorp business model.

Credicorp continuously invests in technology and disruptive initiatives to maintain a competitive advantage. This responsiveness to shifts in consumer sentiment and competitive threats is crucial. This is a key part of its Credicorp market analysis.

The brand appeals to its target audience through trust, established history, and a forward-looking approach. This positions the brand as both a traditional pillar of the financial system and a modern, adaptable entity. To learn more about the company, check out the Brief History of Credicorp.

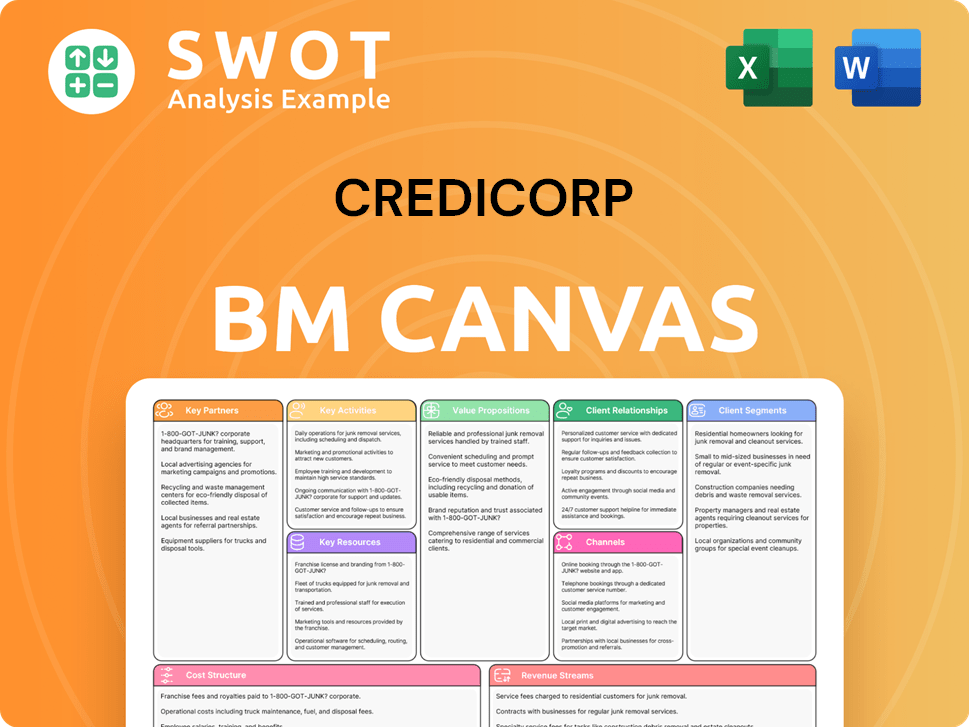

Credicorp Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Credicorp’s Most Notable Campaigns?

The Credicorp sales strategy and marketing strategy are heavily influenced by its digital transformation efforts. This includes significant campaigns focused on its digital payment platform, Yape, and strategic initiatives aimed at fostering innovation. These efforts are designed to drive customer engagement, expand market reach, and generate new revenue streams. The company's approach combines digital platforms, strategic partnerships, and a focus on customer experience to achieve its objectives. For a deeper dive into the competitive environment, consider exploring the Competitors Landscape of Credicorp.

A key aspect of Credicorp's marketing strategy involves targeted campaigns to promote its services. These campaigns often leverage digital channels, strategic alliances, and a focus on customer needs to drive adoption and engagement. By emphasizing ease of use, accessibility, and a wide range of transaction options, Credicorp aims to attract and retain a broad customer base. This approach is supported by investments in technology and a commitment to improving customer experience, leading to measurable results.

Another important component of Credicorp's strategy is its emphasis on collaboration and strategic alliances. Partnerships with other companies, such as the one with Falabella in Embedded Insurance, extend Credicorp's reach and integrate its financial services into broader consumer ecosystems. These collaborations boost brand visibility and credibility, contributing to increased customer engagement and market penetration. All these efforts contribute to the overall success of Credicorp's business model.

The primary objective for Yape was to achieve profitability, which it successfully did in May 2024, ahead of schedule. This campaign focused on ease of use and accessibility. Digital platforms, social media, and in-app promotions were key channels.

Credicorp has a disciplined approach to innovation to foster new business models. The goal is to derive 10% of risk-adjusted revenues from new models by 2026. Key examples include Yape and Tenpo, a Chilean neobank.

Pacifico Seguros expanded offerings through commercial partnerships. The alliance with Falabella in Embedded Insurance contributed to a two-percentage-point increase in their Net Promoter Score (NPS) over the year. These collaborations boost brand visibility.

Credicorp's record net income in 2024 was S/5,501 million. Yape had over 13.7 million monthly active users by the end of 2024. The company aims for 16.5 million active users and S/600 billion in annual transactions by 2026.

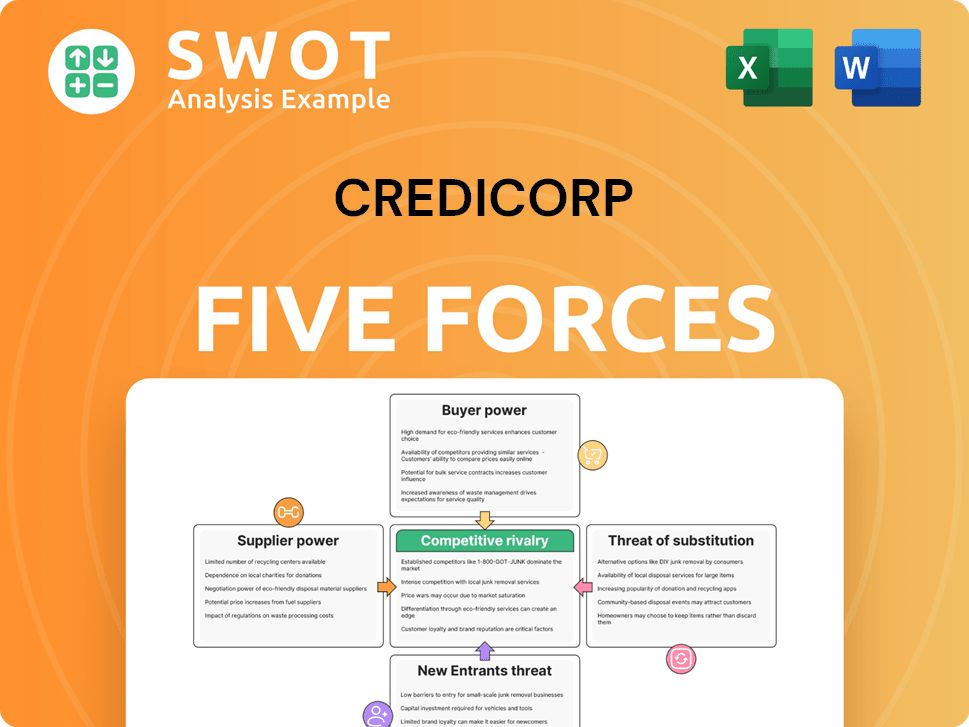

Credicorp Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Credicorp Company?

- What is Competitive Landscape of Credicorp Company?

- What is Growth Strategy and Future Prospects of Credicorp Company?

- How Does Credicorp Company Work?

- What is Brief History of Credicorp Company?

- Who Owns Credicorp Company?

- What is Customer Demographics and Target Market of Credicorp Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.